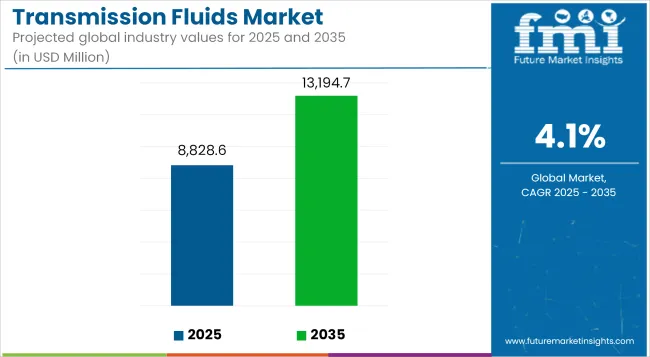

The global transmission fluids market is projected to increase from USD 8,828.6 million in 2025 to USD 13,194.7 million by 2035, growing at a compound annual growth rate (CAGR) of 4.1%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8,828.6 million |

| Industry Value (2035F) | USD 13,194.7 million |

| CAGR (2025 to 2035) | 4.1% |

Market expansion is supported by increased vehicle production, rising demand for fuel-efficient automobiles, and advancements in transmission technologies across both internal combustion.

Transmission fluids continue to serve a vital role in improving transmission system efficiency, thermal stability, and component durability. In vehicles equipped with automatic, dual-clutch, or continuously variable transmissions, high-performance fluids are being formulated to reduce wear, enhance frictional characteristics, and support extended drain intervals.

The rising adoption of electric and hybrid vehicles has created additional demand for fluids compatible with next-generation powertrains, such as e-axles and integrated motor-transmission units. EV-specific transmission fluids are being designed to provide electrical insulation, manage heat in compact drivetrain systems, and resist oxidation under high-voltage operation. OEMs are collaborating with lubricant formulators to tailor products that meet the performance requirements of direct-drive electric systems.

In the broader automotive sector, transmission fluids are being incorporated into advanced drivetrain architectures to support fuel economy mandates and emission reduction targets. Low-viscosity synthetic formulations are being adopted to minimize energy losses in gearboxes and meet stringent efficiency standards. As lightweight materials are introduced into drivetrain assemblies, fluid compatibility and thermal management properties are receiving increased attention.

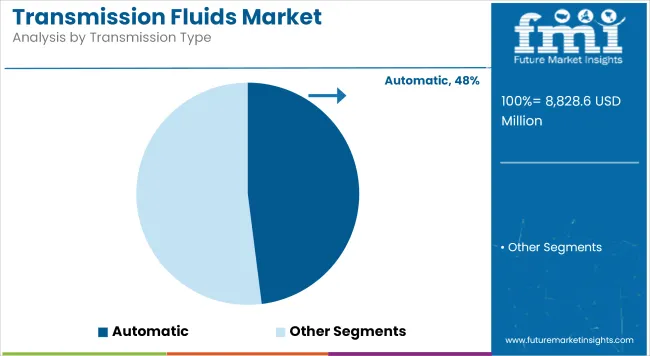

Automatic transmission fluids are anticipated to represent the largest market share due to growing consumer preference for automatic and semi-automatic gear systems. In passenger vehicles and light trucks, demand is supported by comfort expectations and urban traffic conditions that favor automatic transmissions.

The EV transmission fluids segment is expected to expand at a faster pace, reflecting increasing electric vehicle penetration. Formulations for EVs must accommodate unique thermal and electrical requirements, prompting lubricant manufacturers to invest in advanced research and testing protocols.

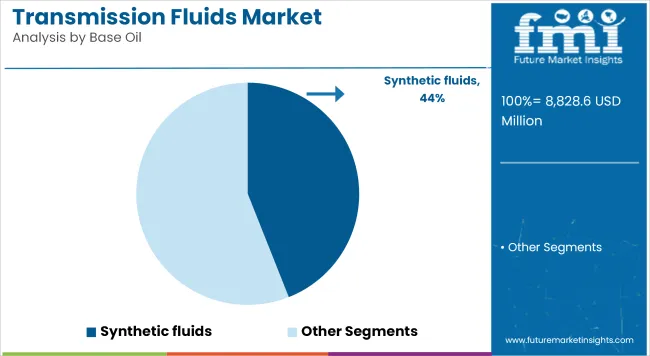

The synthetic segment is projected to account for approximately 44% of the global transmission fluids market share in 2025 and is forecast to grow at a CAGR of 4.3% through 2035. Synthetic transmission fluids offer superior viscosity performance, oxidation resistance, and low-temperature fluidity, which make them suitable for high-load and high-speed conditions. As OEMs increasingly require longer service life and improved fuel economy, synthetic formulations are being adopted across both passenger and commercial vehicle platforms. The growth of electric and hybrid vehicles is also driving development of specialized synthetic fluids that support thermal control and powertrain efficiency.

The automatic transmission segment is estimated to hold approximately 48% of the global transmission fluids market share in 2025 and is projected to grow at a CAGR of 4.2% through 2035. These systems require advanced fluid formulations that provide lubrication, hydraulic pressure, and cooling under varying loads and operating conditions. With increased adoption of multi-speed automatic gearboxes and global preference for driver comfort, automatic transmission vehicles are steadily replacing manual systems across major markets. Technological enhancements such as shift-by-wire and start-stop systems are also contributing to the need for performance-oriented transmission fluids with shear stability and anti-wear properties.

Increasing Complexity of Environmental Regulations

One of the major challenges in the automotive transmission fluids market is the increasing complexity of environmental regulations. With governments and regulatory agencies across the globe implementing increasingly stringent vehicle emissions and fuel efficiency standards, every single player in the industry including those that produce car transmission fluids will have to step up and follow evolving legislation.

Significantly, such regulations usually require a lot of testing and reformulation of products, which consuming and expensive for producers. Moreover, such regulations are frequently region specific, which causes the enterprises to tread a multifaceted landscape of legal compliance in different markets.

This increases operational cost as well as the risk of non-compliance leading to fines or product recalls. From a regulatory perspective, manufacturers will be pushed to innovate continuously in order to remain compliant, while balancing performance and price in product offerings.

Shift Toward Electric Vehicles (EVs)

Another significant challenge is the shift towards electric vehicles (EVs). The automotive industry is undergoing an electrification shift and will no longer dealing with the internal combustion engine (ICE) vehicles needing complex transmission fluids, changing the way lubrication works for electric powertrains. Development for transmission fluid, since electric vehicles usually do not require traditional transmission systems.

This shift puts on fluid manufacturers to adapt by creating new types of fluids better suited for EVs. Electric cars also work in different conditions than ICEs, which means the fluids that work for electric drivetrains are different. While these creates another challenge and opportunity for corporations, companies with substantial business units in legacy transmission fluids face a serious battle to protect their market share.

Growing Demand for Electric Vehicle (EV) Transmission Fluids

A significant opportunity in the automotive transmission fluids market is the growing demand for electric vehicle (EV) transmission fluids. However, with OEMs quickly moving to electric vehicles, there is a drive for fluids to meet the specialized requirements of electric drivetrains. EVs need fluids that improve efficiency while also providing reduced friction and wear in powertrains that work at speed and torque levels significantly higher than those of hydrocarbon engines.

This creates a new opportunity for manufacturers to develop specialized transmission fluids for the electric vehicle market. With the continued expansion of EV adoption, there is tremendous opportunity for companies to create cutting-edge fluid solutions that improve performance, energy efficiency, and life of electric vehicles, helping manufacturers keep pace with the growing demand for this segment.

Advancements in Synthetic Transmission Fluids

Another promising opportunity lies in the continued advancements in synthetic transmission fluids. Reputed quality high-performance fluids are formulated that provide numerous benefits over more conventional polyalolefins and mineral oils which are such as they are more efficient, serves longer service life, and can provide additional protection to components in a vehicle. With an increasing emphasis on fuel efficiency and sustainable environmental practices, the market for advanced synthetic fluids is likely to grow.

These fluids are designed to work better at extreme temperatures and resist friction better than traditional fluids, which results in improved economy and lower emissions. This trend is also an opportunity for the fluid manufacturers to develop new innovative products that can meet the needs of consumers as well as regulatory standards. Advancing performance and sustainability, synthetic transmission fluids are set to emerge as a leading market segment, representing substantial development opportunities for innovators delivering these solutions.

The USA transmission fluids market is driven by a strong automotive and industrial sector. Increased production of vehicles is also expected to drive the demand for high-performance lubricants. Evolution of automatic and hybrid transmission systems in vehicles, the fluid is not only required but also has very low-friction and synthetic fluid. Strict regulatory requirements, especially CAFE fuel economy regulations, are forcing manufacturers to adopt eco-friendly and low-viscosity lubricants.

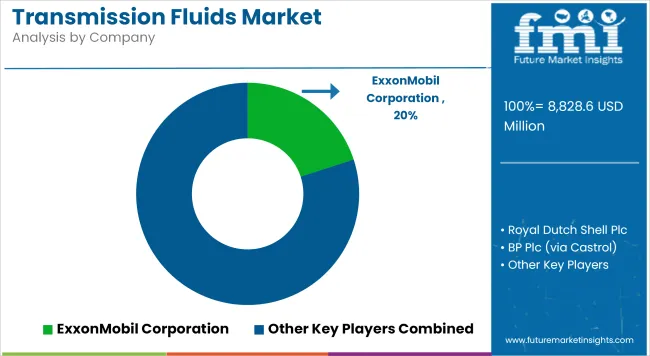

Heavy-duty transmission fluid content in the industrial sector, encompassing industries such as construction and manufacturing. The expanding electric vehicle (EV) market also plays a role in targeting specialized lubricants for e-transmissions and hybrid systems. The lubricant industry's quest for innovation in efficient, high performance transmission fluid. Major players including ExxonMobil, Chevron and Valvoline are funding R&D.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The European Union transmission fluids market is influenced by automotive regulations, technological advancements, and sustainability trends. Carmakers are adopting e-transmission fluids that offer low-energy losses for the transition to electric and hybrid vehicles, influencing lubricant needs. The strict EU emissions regulations, including Euro 7 standards, are triggering a transition to bio-based and low viscosity lubricants.

Countries like Germany, France, and Italy will still be key markets, given their strong presence in automotive manufacturing. The demand for synthetic transmission fluids in heavy machinery is also being driven by industrial automation and smart manufacturing.

Recyclable and biodegradable fluids are already gaining prominence within the European lubricant industry, as it invests in circular economy initiatives. Major oil and lubricant makers like Shell, BP and Total Energies are developing environmentally friendly transmission fluids.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

China's transmission fluids market is the fastest-growing globally, fueled by automotive expansion and rapid industrialization. The EV sector, which some government incentives and local automakers largely drove, has increased demand for EV-compatible transmission fluids. Furthermore, rising vehicle ownership and solid domestic automotive manufacturing presence leads to higher lubricant consumption.

Construction and manufacturing, major segments of the industrial sector, need high-performance transmission fluids for heavy machinery and automation systems. China’s stringent emission regulations are driving the adoption of low-friction and energy-efficient lubricants. Sinopec, PetroChina, and other domestic brands are in a competition against Mobil, Shell, and others for synthetic and environmental lubricant developments. The government’s drive for self-reliance in lubricant production also fuels growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.2% |

Japan’s transmission fluids market is shaped by high-tech automotive advancements and hybrid vehicle dominance. Toyota, Honda, and Nissan spearhead hybrid cars, a growing demand has emerged for specialty low-friction lubricants. Japan’s commitment to fuel efficiency and sustainability is paving the way for bio-based and synthetic fluids, too.

Stringency in vehicle emission laws is also driving the automakers to manufacture ultra-low-viscosity lubricants. Demand for high-end transmission fluids is also driven by the country’s industrial section such as precision machinery and robotics. Japan’s automotive R&D scene is focused on the development of long-life, durable transmission fluids to improve vehicle efficiency. Market research on low-friction and thermal-resistant lubricants from key players such as Idemitsu Kosan, Eneos, and Castrol Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

India’s transmission fluids market is expanding due to growing vehicle ownership, infrastructure projects, and government-led industrial growth. Higher demand for lubricants for automotive production driven by increasing middle class. This trend toward low emission, high performance transmission fluids has been accelerated with the implementation of the BS-VI emission standards.

Government incentives further support India’s electric vehicle (EV) push, generating demand for e-transmission lubricants. The currently booming construction sector additionally aids in industrial-grade lubricants growth. Moreover, foreign investments in the Indian automotive and lubricant sector propel the market rivalry. Leading domestic and multinational corporations such as Indian Oil Corporation, Castrol, and Shell India, Emplon and Jotun in developing synthetic, high-durability, and eco-friendly transmission fluids.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

The transmission fluids market is evolving with a focus on drivetrain electrification and sustainability. OEM strategies aimed at improving fuel efficiency and meeting emissions standards are driving demand for advanced fluids. As regulatory requirements become stricter, companies are developing fluids that offer both high performance and environmental benefits. The integration of fluid performance with digital diagnostics and predictive maintenance is gaining momentum, enabling more precise fluid management and longer component lifecycles.

The global Transmission Fluids Market is projected to reach USD 8,828.6 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.1% over the assessment period.

By 2035, the Transmission Fluids Market is expected to reach USD 13,194.7 million.

The automotive industry represents a substantial and continuously growing consumer base for transmission fluids, with vehicles requiring regular maintenance and fluid changes.

Major companies operating in the Transmission Fluids Market Fuchs Petrolub SE, Valvoline Inc., Phillips 66, Amsoil Inc., Petro-Canada Lubricants, Idemitsu Kosan Co., Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Transmission Oil Pump Market

Transmission Control Unit Market

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA