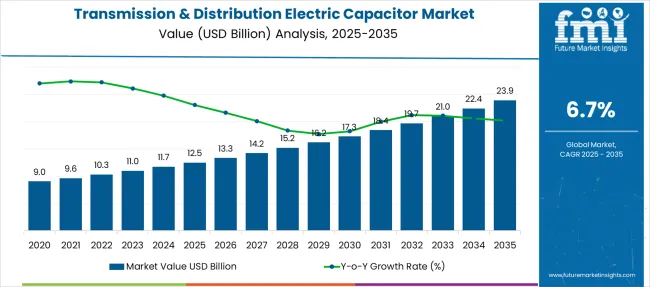

The Transmission & Distribution Electric Capacitor Market is estimated to be valued at USD 12.5 billion in 2025 and is projected to reach USD 23.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. Historical data places the industry at USD 9 billion in 2020, demonstrating consistent incremental growth. Adoption drivers include infrastructure expansion in power networks and reactive power management requirements amid grid modernization. A prominent demand spike occurs beyond 2028, supported by substation reinforcement projects and high-voltage transmission upgrades. Manufacturers are expected to align production toward long-life, low-loss capacitor units integrated with advanced insulation technologies. The operational focus will revolve around reducing system interruptions and optimizing load factors, crucial for smart grid adaptability.

The procurement landscape favors utilities prioritizing performance guarantees alongside lifecycle cost benefits. Growth prospects remain strongest in Asia-Pacific, where electrification intensity drives bulk orders. Strategic moves will include regional assembly units and service-oriented contracts, reinforcing aftermarket opportunities for component replacement cycles.

Growth is linked to grid modernization initiatives, renewable integration, and reactive power compensation, which make capacitors essential for voltage stabilization and efficiency enhancement in high-load networks.

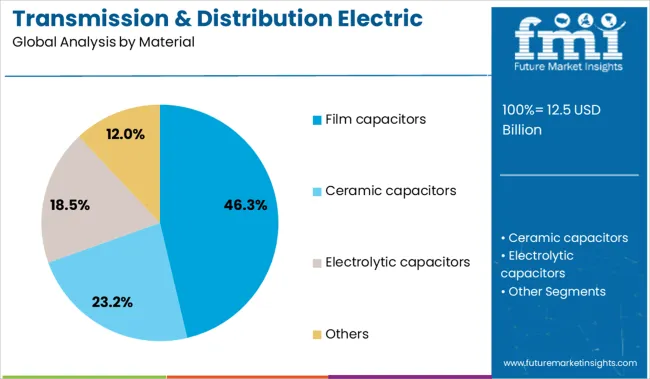

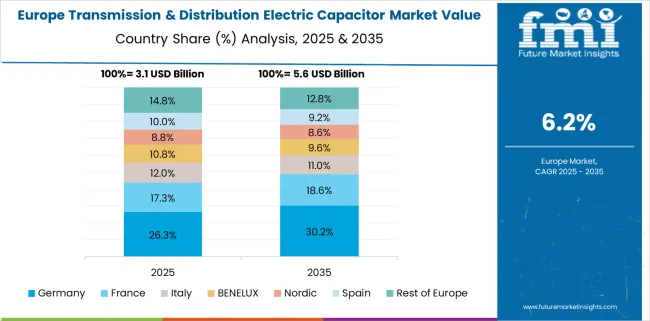

Film capacitors account for 46.3% of the market, primarily due to their superior dielectric properties, long service life, and reliability under fluctuating voltages. Asia-Pacific leads expansion, driven by infrastructure electrification in China and India, alongside substantial renewable energy integration targets. North America follows with grid reinforcement programs addressing aging infrastructure, while Europe focuses on energy efficiency mandates and interconnection projects for cross-border power flow.

The next phase of market evolution will prioritize eco-friendly capacitor designs utilizing low-loss polypropylene films and biodegradable materials. Additionally, the incorporation of IoT-enabled monitoring and condition-based maintenance will become standard as utilities pursue predictive asset management strategies. Strategic opportunities exist for manufacturers offering high-voltage capacitor banks optimized for hybrid grids combining centralized and distributed generation. Cost pressure remains a challenge, reinforcing the need for partnerships with utilities to deliver integrated, life-cycle-optimized capacitor solutions in transmission and distribution networks.

| Metric | Value |

|---|---|

| Transmission & Distribution Electric Capacitor Market Estimated Value in (2025E) | USD 12.5 billion |

| Transmission & Distribution Electric Capacitor Market Forecast Value in (2035F) | USD 23.9 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The transmission and distribution electric capacitor market is progressing steadily as utilities and industries increasingly prioritize grid stability, power quality, and energy efficiency. Adoption is being driven by rising electricity demand, aging infrastructure, and the global transition toward renewable energy integration.

Capacitors are being deployed to improve reactive power compensation, reduce transmission losses, and enhance voltage regulation across distribution networks. The market outlook remains positive as regulatory initiatives favor modernization of grid assets and technological advancements improve capacitor performance and longevity.

Future opportunities are expected to emerge through the integration of smart grid technologies, miniaturization of components, and the expansion of transmission capacity to accommodate distributed generation. Investments by utilities in upgrading and expanding networks are paving the way for sustained demand and innovation in capacitor solutions.

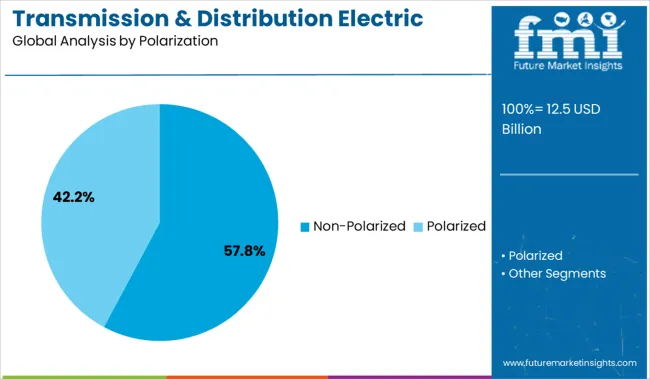

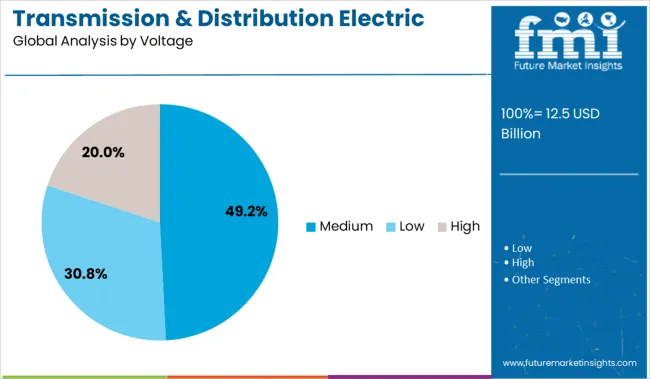

The transmission and distribution electric capacitor market is segmented by material, polarization, voltage, and region. By material, it includes film capacitors, ceramic capacitors, electrolytic capacitors, and others used for energy storage and power quality improvement. In terms of polarization, the segmentation comprises non-polarized and polarized capacitors, catering to different electrical circuit requirements. Based on voltage, the market is categorized into low, medium, and high voltage ranges to support diverse transmission and distribution applications. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

When segmented by material, film capacitors are expected to hold 46.3% of the total market revenue in 2025, establishing themselves as the leading material segment. This position has been reinforced by their superior electrical characteristics, including low loss factor, high dielectric strength, and excellent thermal stability, which are critical for reliable grid operation.

Manufacturers have focused on improving the design and material quality of film capacitors, enabling longer service life and reduced maintenance requirements. Their ability to perform effectively under varying load conditions and their resilience to over-voltage and harsh environments have made them the preferred choice in medium and high-voltage applications.

Furthermore, advancements in metallized films and encapsulation techniques have enhanced the cost-effectiveness and scalability of these capacitors, solidifying their dominant position in the material segment.

Segmented by polarization, non-polarized capacitors are projected to account for 57.8% of the market revenue in 2025, maintaining their leadership in this category. This dominance has been driven by the inherent versatility of non-polarized designs, which allow current flow in both directions, making them suitable for alternating current systems prevalent in transmission and distribution.

Their robust construction and compatibility with high-frequency and high-voltage operations have supported widespread deployment across diverse grid applications. Utilities have increasingly favored non-polarized capacitors due to their durability, low equivalent series resistance, and minimal risk of polarity-related failures.

Continuous improvements in manufacturing processes and material selection have further enhanced their reliability and performance, reinforcing their stronghold in the polarization segment.

When segmented by voltage, the medium voltage category is expected to capture 49.2% of the market revenue in 2025, positioning it as the top voltage segment. This leadership has been supported by the extensive use of medium voltage capacitors in distribution networks, industrial plants, and substations where power factor correction and voltage stabilization are essential.

The medium voltage range offers an optimal balance between capacity and installation cost, making it attractive for utilities managing growing urban and semi-urban electricity demand. As grid expansion projects increasingly focus on strengthening distribution-level infrastructure, medium voltage capacitors have become indispensable for improving network efficiency and reducing losses.

Innovations aimed at enhancing thermal performance and operational safety have further bolstered their adoption, ensuring their continued prominence in the voltage segment.

The transmission and distribution electric capacitor market is advancing as electric utilities address grid reliability, voltage regulation, and power quality challenges. Capacitor banks are being integrated into substations and feeder systems to manage reactive power flow and improve energy efficiency across transmission corridors. Market trends emphasize compact designs, modular configurations, and digitally monitored units that support real-time control. As distributed energy generation and high-load demand increase, capacitor systems are playing a critical role in enabling stable, responsive, and low-loss power networks.

The rising integration of renewable energy into transmission and distribution networks is increasing the requirement for reactive power compensation. Electric capacitors are being implemented to stabilize voltage levels, reduce technical losses, and support real-time grid balancing. These devices contribute to improved power factor correction and energy flow optimization within substation infrastructures. Modern capacitor banks are designed to respond dynamically to load variations, enabling consistent power delivery even under fluctuating generation input. This function is vital in high-voltage transmission environments, where power stability directly influences downstream reliability. Grid modernization initiatives include capacitor installations to improve operational resilience, reduce frequency deviations, and meet international power quality standards. The role of capacitors in reactive power management is strengthening as utilities transition toward automated and digital substation frameworks across key regions.

The transition toward digital energy infrastructure is creating opportunities for smart electric capacitors equipped with condition monitoring, remote control, and predictive diagnostics. These advanced systems enable automated voltage regulation, early fault detection, and optimized maintenance cycles within both transmission and distribution networks. Modular capacitor banks are being adopted to accommodate space constraints and streamline integration into substations and pole-mounted applications. As power systems become more decentralized, intelligent capacitor systems are ensuring network stability and reactive power support across distributed energy resources. Industry regulations emphasizing power quality and asset longevity are accelerating the adoption of sensor-enabled capacitor solutions with SCADA. These developments align electric capacitors with the evolving needs of grid operators focused on control, resilience, and high-performance energy delivery across diversified load zones.

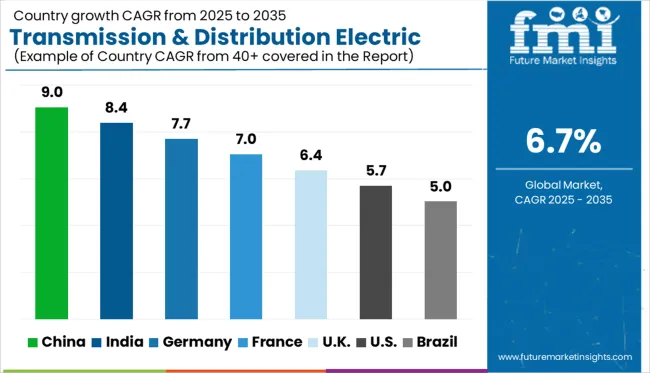

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The transmission & distribution electric capacitor market is projected to expand at a global CAGR of 6.7% from 2025 to 2035, driven by increasing electrification intensity, renewable energy integration, and grid efficiency measures. China leads the momentum with a 9.0% CAGR, powered by ultra-high voltage transmission rollouts and rural electrification plans. India follows with 8.4%, benefiting from feeder-level capacitor integration across emerging load centers. Germany and France are modernizing their mid-voltage grids at 7.7% and 7.0%, respectively, with smart capacitor technologies tailored for renewable-heavy distribution. The United Kingdom, at 6.4%, reflects the gradual modernization of aging substations, driven by offshore wind grid balancing and distributed power demand. These five countries represent strategic benchmarks from a wider 40+ country analysis.

China is projected to record a 9.0% CAGR through 2035, driven by aggressive transmission upgrades and power infrastructure investments. Utility operators are actively expanding ultra-high voltage (UHV) networks, where electric capacitors play a pivotal role in voltage control and grid efficiency. The emphasis on reducing transmission losses and integrating distributed renewable energy into urban and rural grids has increased demand for both shunt and series capacitors. Domestic players benefit from local production incentives and contract awards from State Grid Corporation of China. Modular capacitor banks and compact designs are gaining preference for remote substations and smart city rollouts.

India is expected to grow at 8.4% CAGR, supported by rural electrification mandates, smart metering programs, and distribution loss mitigation efforts. Transmission expansion under schemes like Gati Shakti and Revamped Distribution Sector Scheme (RDSS) enhances capacitor deployment across substations and feeder lines. Capacitor manufacturers are scaling localized production for low-voltage and medium-voltage applications in high-load states. Private transmission firms are also investing in capacitor-based solutions to meet grid code compliance and power factor correction. The push toward decentralized solar integration further drives demand for voltage-stabilizing components in regional grids

Germany is forecast to grow at a CAGR of 7.7%, driven by renewable-heavy grids and the need for grid stabilization during high fluctuation events. Wind-rich northern regions are installing high-voltage capacitor banks to manage phase shifts and reactive loads during peak generation. Utilities prioritize compact capacitor modules that enable voltage control without major substation overhauls. Regulatory emphasis on energy efficiency and power quality compliance strengthens adoption across industrial zones. Product preferences are shifting toward smart capacitors with temperature and performance sensors for predictive maintenance and network monitoring.

France is projected to achieve 7.0% CAGR, influenced by interconnection upgrades, voltage regulation projects, and distributed generation. The transition to low-carbon grids demands capacitor banks in mid-voltage distribution, particularly in regions with photovoltaic feed-in. Regional grid operators prefer plug-and-play capacitor systems with minimal manual commissioning. Manufacturers are offering digital-ready designs compatible with substation automation. Expansion of microgrid projects and energy storage hybrids further increases the role of capacitors in maintaining voltage stability during peak demand or discharge cycles.

The United Kingdom is expected to grow at a CAGR of 6.4%, supported by increasing investments in grid flexibility, aging substation modernization, and inter-island power flow control. Capacitor applications are expanding beyond reactive power compensation into dynamic voltage regulation and frequency control in offshore wind and island grid environments. Utilities are adopting high-performance film capacitors with long life cycles and minimal maintenance. Procurement patterns show preference for modularity, enabling faster deployment in constrained urban and coastal zones. The market is also influenced by policy-led electrification of transport and heating sectors.

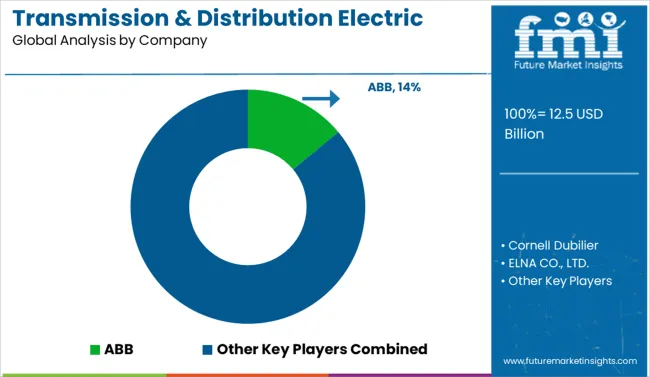

The transmission and distribution electric capacitor industry is led by ABB, holding a 14.0% market share through its dominance in high-voltage power factor correction and grid stability solutions. Siemens and Schneider Electric also operate at grid scale, offering modular capacitor banks integrated with digital monitoring systems. Cornell Dubilier, Vishay Intertechnology, and KEMET Corporation focus on high-performance film and electrolytic capacitors designed for voltage regulation in substations. Asian players like Murata, Panasonic, Samsung Electro-Mechanics, and TDK target compact, durable designs for medium-voltage and industrial applications. Companies such as Havells, ELNA, and Xuansn Capacitor are scaling up presence in cost-sensitive regions. Competitive focus has shifted toward dielectric strength, thermal endurance, and integration with smart grid and renewable-connected transmission infrastructure.

Market participants are investing in IoT-enabled, condition-based maintenance, enhancing asset reliability through predictive diagnostics. They’re developing eco-friendly capacitors, using low-loss polypropylene and biodegradable materials to meet sustainability goals. Companies are establishing regional assembly hubs and offering service-oriented contracts, targeting robust aftermarket support. They're optimizing capacitor design, especially film types, to improve reactive power compensation, voltage stabilization, and integration with renewable or hybrid grids. Expansion efforts are focused on high-growth regions like Asia-Pacific, where electrification demand is surging. Technology platforms now prioritize high-voltage capacitor banks tailored for distributed generation systems to strengthen grid resilience.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.5 Billion |

| Material | Film capacitors, Ceramic capacitors, Electrolytic capacitors, and Others |

| Polarization | Non-Polarized and Polarized |

| Voltage | Medium, Low, and High |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Cornell Dubilier, ELNA CO., LTD., Havells India Ltd., KEMET Corporation, KYOCERA AVX Components Corporation, Murata Manufacturing Co., Ltd., Panasonic Corporation, SAMSUNG ELECTRO-MECHANICS, Schneider Electric, Siemens, TAIYO YUDEN CO., LTD., TDK Corporation, Vishay Intertechnology, Inc., WIMA GmbH & Co. KG, and Xuansn Capacitor |

| Additional Attributes | Dollar sales are segmented by capacitor type, such as shunt, series, and power factor correction units, with dry dielectric capacitors gaining share due to environmental benefits. Demand is growing for smart, digitally monitored, and low-loss solutions. OEMs and CDMOs offer turnkey capacitor modules. Adoption is strongest in Europe and Asia Pacific, driven by grid modernization and renewable integration. |

The global transmission & distribution electric capacitor market is estimated to be valued at USD 12.5 billion in 2025.

The market size for the transmission & distribution electric capacitor market is projected to reach USD 23.9 billion by 2035.

The transmission & distribution electric capacitor market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in transmission & distribution electric capacitor market are film capacitors, ceramic capacitors, electrolytic capacitors and others.

In terms of polarization, non-polarized segment to command 57.8% share in the transmission & distribution electric capacitor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Transmission Fluids Market Trends & Demand 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Transmission Oil Pump Market

Transmission Control Unit Market

EV Transmission System Market Size and Share Forecast Outlook 2025 to 2035

HVDC Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Lines and Towers Market Analysis & Forecast by Product, Conductor, Insulation, Voltage, Current, Application, and Region Through 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Power Transmission Cables Market

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

USA HVDC Transmission Systems Market Insights – Size, Growth & Forecast 2025-2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA