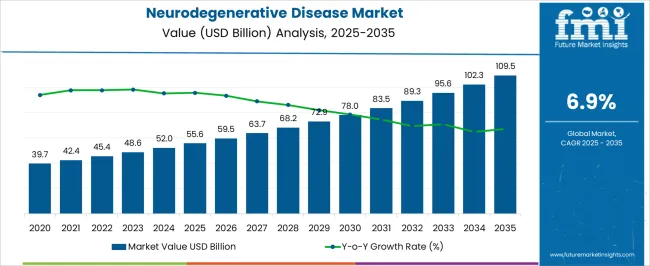

The Neurodegenerative Disease Market is estimated to be valued at USD 55.6 billion in 2025 and is projected to reach USD 109.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Neurodegenerative Disease Market Estimated Value in (2025 E) | USD 55.6 billion |

| Neurodegenerative Disease Market Forecast Value in (2035 F) | USD 109.5 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The neurodegenerative disease market is expanding steadily, influenced by the rising prevalence of disorders such as Alzheimer’s, Parkinson’s, and Huntington’s disease, along with the global increase in the aging population. Clinical publications and health authority reports have underscored the growing disease burden, which has driven greater investments in both symptomatic and disease-modifying therapies.

Pharmaceutical pipelines have advanced significantly, with numerous candidates in late-stage development focusing on slowing disease progression and targeting underlying pathological mechanisms such as protein misfolding and neuronal loss. Government funding initiatives and advocacy group efforts have further accelerated research, while regulatory agencies have facilitated fast-track approvals for innovative therapies.

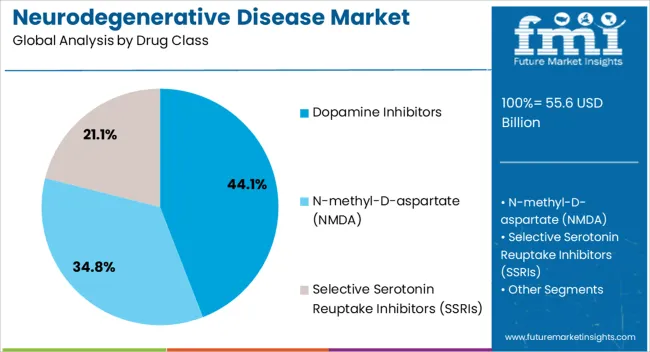

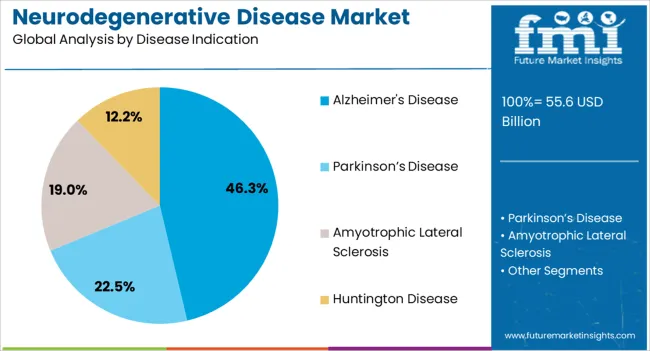

Digital health solutions, including cognitive assessment tools and remote monitoring, are also being integrated into patient care. Future growth is expected to be supported by biomarker-driven clinical trials, increased availability of novel drug delivery systems, and collaborations between biotech firms and research institutions. Segmental strength is currently led by dopamine inhibitors within drug classes and Alzheimer’s disease in disease indication, reflecting both clinical need and ongoing therapeutic advances.

The dopamine inhibitors segment is projected to hold 44.1% of the neurodegenerative disease market revenue in 2025, making it the leading drug class. This dominance has been attributed to their established use in managing motor symptoms associated with disorders such as Parkinson’s disease.

Clinical evidence has demonstrated the effectiveness of dopamine inhibitors in regulating neurotransmission, alleviating tremors, rigidity, and motor fluctuations, thereby improving patient quality of life. The segment’s growth has been supported by continuous development of new formulations designed to minimize side effects and extend therapeutic duration.

Healthcare provider reliance on these therapies has remained strong due to their proven efficacy and familiarity in clinical practice. Furthermore, reimbursement coverage and broad availability have increased patient access across global markets. As research continues to refine dosing strategies and explore combination therapies, dopamine inhibitors are expected to maintain their leadership in the drug class segment.

The Alzheimer’s disease segment is projected to contribute 46.3% of the neurodegenerative disease market revenue in 2025, sustaining its position as the largest disease indication. This segment’s prominence has been driven by the high prevalence of Alzheimer’s globally, which has created substantial demand for both symptomatic and disease-modifying therapies.

Clinical journals have reported an increase in early diagnosis rates supported by biomarker testing and imaging technologies, which has expanded the treatment pool. Pharmaceutical pipelines have concentrated heavily on Alzheimer’s disease, with novel therapies targeting amyloid and tau proteins progressing through regulatory review and approvals.

Patient advocacy groups and national health strategies have also prioritized Alzheimer’s management, channeling resources into awareness campaigns, caregiver support, and improved access to medications. With rising societal and economic impact of Alzheimer’s, this segment has attracted significant attention from both healthcare providers and policymakers. Ongoing therapeutic innovations and increased emphasis on early intervention are expected to sustain the segment’s leading position in the market.

Surge in Prevalence of Neurological Disorders

The escalating incidence of neurological disorders worldwide, propelled by factors like population growth and surge in life expectancy, acts as a significant driver for the neurodegenerative disease sector.

With conditions such as Parkinson's disease, Alzheimer's dementia, and Huntington's disease becoming more prevalent across diverse demographic groups, a growth in demand for innovative therapies, diagnostics, and disease management strategies can be seen.

The trend underscores the urgent need for effective interventions, fueling research and development efforts and stimulating sectorial expansion in the coming years.

Deep-dive into Growth Drivers Positively Increasing Public Awareness

Ongoing efforts by governments, non-governmental organizations, and industry players to raise public awareness about neurodegenerative diseases contribute significantly to industrial growth.

Initiatives such as Parkinson's Disease Awareness Month, Multiple Sclerosis Awareness Month, and collaborative research programs like the Eisai Co. Ltd. and the United Kingdom Dementia Research Institute partnership highlight the importance of research, diagnosis, and treatment advancements.

Educating the public and garnering support for research funding thus stimulates the demand for innovative therapies and diagnostic tools, fostering expansion and advancements in patient care.

Challenges Faced due to Patent Expiry of Neurodegenerative Disease Treatment Products

The neurodegenerative disease industry is poised to encounter challenges as several key patents expire in the upcoming years. The phenomenon will lead to the entry of generic alternatives into the market, resulting in intensified competition and a subsequent decline in prices.

The availability of multiple generics under the same brand name is expected to propel prices further down, diminishing the overall value of the industry despite an increase in drug volume.

The trend thus poses a significant challenge for pharmaceutical companies, impacting the revenue streams and potentially stalling innovation in the neurodegenerative disease treatment sector.

The neurodegenerative disease industry has witnessed moderate growth over the past few years, with a historical CAGR of 5.6% from 2020 to 2025. The growth can be attributed to an aging population, a rise in awareness and diagnosis of neurodegenerative diseases, advancements in medical technology and research, and greater investment in healthcare infrastructure.

Advancements in medical technology and research have expanded our understanding of the underlying mechanisms of the diseases, facilitating the development of targeted therapies. Substantial investments in healthcare infrastructure and research have played a pivotal role in augmenting growth within the industry.

Pharmaceutical companies, research institutions, and government agencies have dedicated resources to developing innovative treatments and therapies, leading to improved patient outcomes and quality of life.

The forecast period from 2025 to 2035, where the industry is poised for even stronger growth, with a projected CAGR of 7%. The upsurge in the ecosystem is propelled by continued advancements in medical research and technology, leading to more effective treatments and therapies for neurodegenerative diseases, as well as the surge in global healthcare expenditure and initiatives aimed at addressing neurological disorders.

The growing prevalence of neurodegenerative diseases due to aging populations worldwide, hence, is expected to fuel industrial expansion during the forecast period further.

The table represents the top five countries ranked by revenue, with India holding the top position.

India dominates the neurodegenerative disease industry through a robust pharmaceutical sector, skilled workforce, and growing research capabilities. India's expertise in drug development, cost-effective manufacturing, and large patient population makes it a key player in producing treatments, conducting clinical trials, and advancing therapies for neurodegenerative disorders globally.

The industry is led significantly by sales of the neurodegenerative disease industry in India, the United Kingdom, and Canada. Asia Pacific region, thus, emerges as a key industry at a global level, followed by Western Europe.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR |

|---|---|

| The United States | 6.9% |

| The United Kingdom | 8.6% |

| Canada | 7.5% |

| China | 7% |

| India | 9.4% |

In the United States, the neurodegenerative disease industry holds a significant position due to the advanced healthcare infrastructure of the country, due to the substantial investment in research and development, and the large patient population.

With renowned academic institutions, pharmaceutical companies, and research organizations, the United States leads in innovation, clinical trials, and the development of novel therapies for conditions like Alzheimer's and Parkinson's.

The United Kingdom boasts a prominent position in the neurodegenerative disease industry, driven by a strong scientific research base, cutting-edge medical facilities, and government support for life sciences.

Government policies on long-term care for patients with neurodegenerative diseases prioritize a holistic approach, encompassing access to specialized healthcare services, community-based support programs, and caregiver respite services.

The United Kingdom’s expertise in genetics, neuroscience, and clinical research positions it as a leader in understanding disease mechanisms and developing targeted treatments for neurodegenerative disorders.

India has emerged as a predominant player in the neurodegenerative disease industry, supported by a thriving pharmaceutical sector, a skilled scientific workforce, and cost-effective manufacturing capabilities.

The ascending prevalence of neurodegenerative diseases is attributed to the rapidly aging population of the country, with a surge in life expectancy and changing demographics exacerbating the burden of conditions such as Alzheimer's and Parkinson's diseases.

The demographic shift, thus, underscores the urgent need for comprehensive healthcare strategies, including early detection programs, specialized geriatric care, and community-based support services, to address the complex needs of older adults affected by neurodegenerative disorders.

With a focus on generic drug production, clinical research, and collaborative partnerships, India contributes significantly to the global supply of neurodegenerative disease treatments and plays an important role in addressing healthcare challenges worldwide.

In the subsequent section, the pivotal segments influencing the neurodegenerative disease market are scrutinized and illustrated through data from research. Growing awareness of the immune system's involvement in neurodegenerative diseases like Alzheimer's is propelling research into immunomodulators.

As populations around the world continue to age, the prevalence of Alzheimer's is expected to rise, highlighting the urgent need for effective treatments and interventions.

| Attribute | Details |

|---|---|

| Drug Class | Immunomodulators |

| Industrial Share in 2025 | 43.4% |

Based on the drug class, the immunomodulators segment is accounted to hold a market share of 43.4% in 2025.

The segment underscores the growing significance of the drug class in the treatment of neurodegenerative diseases. Immunomodulators play an important role in modulating the immune response in conditions like multiple sclerosis, Alzheimer's disease, and Parkinson's disease.

The rise in understanding of the role of inflammation and immune dysregulation in neurodegenerative processes has spurred the development and adoption of immunomodulatory therapies.

The drugs offer the potential to modify disease progression by targeting underlying inflammatory pathways, thereby providing hope for improved outcomes and symptom management in patients.

Ongoing research and development efforts focused on identifying novel immunomodulatory targets and optimizing treatment strategies will further propel the growth of the segment in the coming years.

| Attribute | Details |

|---|---|

| Disease Indication | Alzheimer's Disease |

| Industrial Share in 2025 | 32.2% |

Based on disease indication, the Alzheimer's disease segment is accounted to hold a market share of 32.2% in 2025, reflecting the profound impact of the neurodegenerative disorder on global healthcare systems and society at large.

With the aging population and spike in life expectancy, the prevalence of Alzheimer's disease is on the rise, augmenting the demand for effective treatments and interventions. Despite significant research efforts, therapeutic options for Alzheimer's disease remain limited, presenting a substantial unmet need in the market.

Pharmaceutical companies and research organizations are intensifying the efforts to develop disease-modifying therapies that target underlying pathological mechanisms such as amyloid-beta and tau protein aggregation.

Initiatives aimed at early detection and diagnosis, along with strategies to provide comprehensive care and support for patients and caregivers, are essential for addressing the multifaceted challenges posed by Alzheimer's disease and improving patient outcomes in the years ahead.

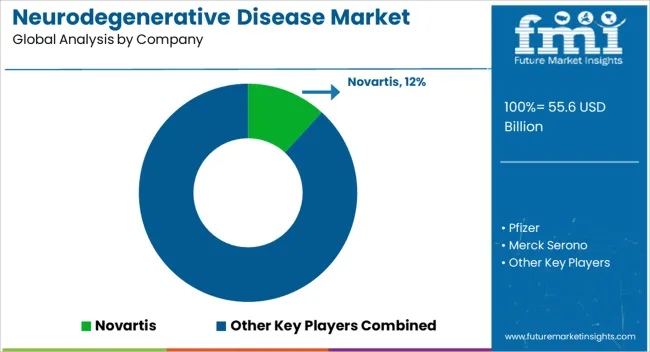

The competitive landscape of the neurodegenerative disease sector showcases a mix of established pharmaceutical giants and innovative startups. While industry leaders dominate with extensive research and development resources and market presence, startups inject dynamism with agile approaches and novel therapies.

The startup ecosystem fosters disruptive innovation, driving competition by introducing groundbreaking treatments and diagnostic tools, challenging traditional market norms, and potentially reshaping the future of neurodegenerative disease management.

Advancements in medical research, personalized medicine approaches, and the integration of digital health solutions shape competition. Regulatory challenges, high research and development costs, and the quest for disease-modifying treatments further influence the competitive dynamics of the rapidly evolving sector.

Recent developments

In 2025, UCB announced a significant milestone in the neurodegenerative disease market with the initiation of a Phase III clinical trial for the investigational therapy targeting progressive supranuclear palsy (PSP). The rare neurodegenerative disorder currently lacks effective treatments, and UCB's therapy aims to address the unmet medical need by potentially providing disease-modifying effects.

In 2025, Sanofi-aventis Groupe collaborated with leading research institutions to accelerate the development of precision medicine approaches for Parkinson's disease. The collaboration aimed to leverage advanced genetic insights and biomarker discoveries to identify subtypes of Parkinson's disease and tailor treatment strategies accordingly, ushering in a new era of personalized care for patients with the debilitating condition.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 55.6 billion |

| Projected Market Valuation in 2035 | USD 109.5 billion |

| Value-based CAGR 2025 to 2035 | 6.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Drug Class, Disease Indication, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Novartis AG; Pfizer Inc.; Merck Serono; Biogen Idec; Teva Pharmaceuticals; UCB; Boehringer Ingelheim; Sanofi S.A; GlaxoSmithKline |

The market is classified into N-methyl-D-aspartate (NMDA), Selective Serotonin Reuptake Inhibitors (SSRIs), Dopamine Inhibitors, and Immunomodulators.

The report consists of key sourcing, such as Parkinson’s Disease, Alzheimer's Disease, Amyotrophic Lateral Sclerosis, and Huntington Disease.

Analysis of the market has been carried out in key countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

The global neurodegenerative disease market is estimated to be valued at USD 55.6 billion in 2025.

The market size for the neurodegenerative disease market is projected to reach USD 109.5 billion by 2035.

The neurodegenerative disease market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in neurodegenerative disease market are dopamine inhibitors, n-methyl-d-aspartate (nmda) and selective serotonin reuptake inhibitors (ssris).

In terms of disease indication, alzheimer's disease segment to command 46.3% share in the neurodegenerative disease market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Neurodegenerative Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Rare Disease Gene Therapy Market

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Fabry Disease Market Size and Share Forecast Outlook 2025 to 2035

Byler Disease Market

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Celiac Disease Diagnostics Market Analysis - Size, Share & Forecast 2025 to 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Crohn’s Disease (CD) Treatment Market Analysis & Forecast by Drug Type, Distribution Channel and Region through 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Zoonotic Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Wilson’s Disease Diagnostics Market Analysis – Size, Share & Forecast 2023-2033

Infectious Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Predictive Disease Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA