The infectious disease diagnostics market is witnessing accelerated growth, driven by the global resurgence of communicable diseases and the rising demand for timely, accurate diagnostic solutions. Medical journals and health organization updates have emphasized the role of early detection in containing outbreaks and improving patient outcomes, prompting healthcare systems to invest in rapid and high-sensitivity diagnostic tools.

Public and private funding for infectious disease research has increased, supporting the development of multiplex assays, portable diagnostics, and integrated testing platforms. Additionally, pandemic preparedness initiatives have strengthened laboratory infrastructure and expanded diagnostic capabilities in both developed and emerging regions.

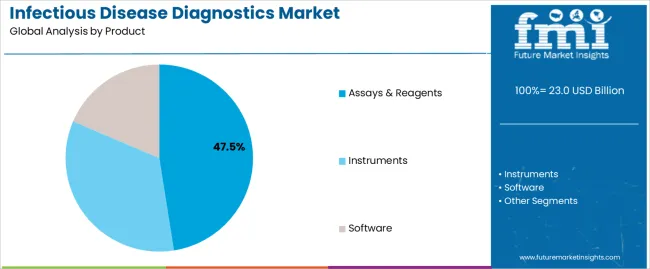

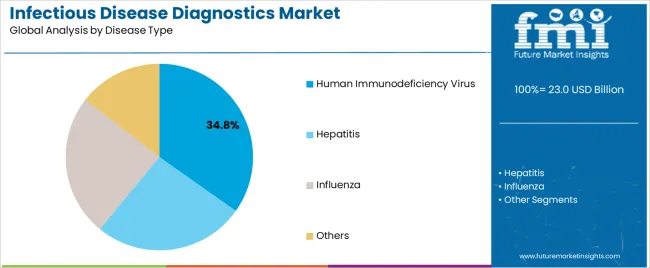

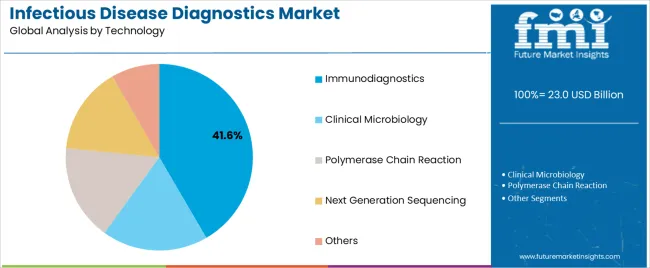

Pharmaceutical company reports and diagnostic equipment manufacturer disclosures have noted rising sales volumes for reagents, assays, and automated instruments. As governments and health agencies prioritize disease surveillance and response, the market is poised for sustained growth. Segmental leadership is expected from Assays & Reagents in product offerings, Human Immunodeficiency Virus (HIV) in disease-specific diagnostics, and Immunodiagnostics in technological application, owing to their established clinical use, market readiness, and adaptability across healthcare settings.

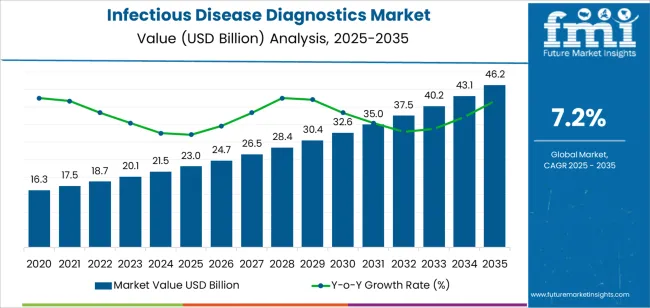

| Metric | Value |

|---|---|

| Infectious Disease Diagnostics Market Estimated Value in (2025 E) | USD 23.0 billion |

| Infectious Disease Diagnostics Market Forecast Value in (2035 F) | USD 46.2 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The market is segmented by Product, Disease Type, and Technology and region. By Product, the market is divided into Assays & Reagents, Instruments, and Software. In terms of Disease Type, the market is classified into Human Immunodeficiency Virus, Hepatitis, Influenza, and Others. Based on Technology, the market is segmented into Immunodiagnostics, Clinical Microbiology, Polymerase Chain Reaction, Next Generation Sequencing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Assays & Reagents segment is projected to account for 47.5% of the infectious disease diagnostics market revenue in 2025, emerging as the leading product category. This growth has been fueled by the high-frequency usage of consumables in diagnostic workflows, especially in centralized laboratories and point-of-care settings.

Clinical demand for rapid, sensitive, and scalable testing solutions has increased reliance on specialized reagents and assay kits that deliver accurate results across a range of pathogens. Product development efforts by diagnostics companies have prioritized ready-to-use, multiplex-capable assay kits, which enhance lab productivity and reduce turnaround times.

Furthermore, global health initiatives aimed at expanding testing access in underserved regions have focused on affordable and easy-to-deploy reagent systems. With infectious disease testing often requiring repeat screening and follow-up diagnostics, the consistent consumption of assays and reagents has supported recurring revenue generation. These factors are expected to secure the continued dominance of this segment in the diagnostic supply chain.

The Human Immunodeficiency Virus (HIV) segment is projected to contribute 34.8% of the market revenue in 2025, holding the leading position in the disease type category. This segment’s growth has been driven by the ongoing global burden of HIV, with millions requiring routine viral load monitoring, early detection, and antiretroviral therapy (ART) initiation.

Public health policies and global funding mechanisms have prioritized universal access to HIV testing, particularly in high-prevalence regions, creating strong demand for reliable diagnostic platforms. International healthcare agencies have reported a surge in the use of combination rapid tests and nucleic acid testing (NAT) for both screening and confirmatory purposes.

Continuous innovation in HIV diagnostics, including the development of self-test kits and digital result interpretation tools, has expanded patient outreach and decentralized testing capabilities. As global efforts persist toward ending the HIV epidemic through early diagnosis and treatment linkage, the HIV segment is expected to maintain its strategic significance within infectious disease diagnostics.

The Immunodiagnostics segment is projected to represent 41.6% of the infectious disease diagnostics market revenue in 2025, retaining its lead in technology adoption. Growth in this segment has been propelled by the widespread use of enzyme-linked immunosorbent assays (ELISA), lateral flow assays, and chemiluminescence-based platforms in the detection of bacterial, viral, and parasitic infections.

Healthcare providers have favored immunodiagnostics for their high specificity, rapid results, and cost-effectiveness, especially in large-scale disease surveillance and screening programs. Diagnostic manufacturers have expanded their immunoassay portfolios with automated platforms that reduce technician dependency and improve throughput in clinical laboratories.

Moreover, immunodiagnostics have been integral in pandemic response strategies, where scalable and accurate serological testing was essential. Technological advances enabling multiplex immunoassays have further enhanced utility across co-infection scenarios and endemic diseases. As global health programs continue emphasizing preventive screening and early detection, immunodiagnostics are expected to remain the foundation of infectious disease testing technologies.

The increasing incidence of infectious diseases such as COVID-19, HIV, tuberculosis, malaria, and influenza has heightened the demand for effective diagnostic tools. This surge is largely due to the global rise in population, increased travel, and urbanization, which facilitate the spread of infections.

Innovations in diagnostic technologies, including molecular diagnostics, polymerase chain reaction (PCR), next-generation sequencing (NGS), and point-of-care (POC) testing, have revolutionized the market. These technologies offer rapid, accurate, and early detection of pathogens, which is crucial for effective disease management and control.

Governments worldwide are investing heavily in healthcare infrastructure and disease surveillance programs. Funding for research and development in infectious disease diagnostics is increasing, driven by the need to prepare for and respond to pandemics and other infectious disease outbreaks.

Public awareness regarding the importance of early detection and diagnosis of infectious diseases is growing. This awareness is supported by healthcare campaigns and educational programs, which emphasize the benefits of early intervention in managing and controlling disease spread.

Rising healthcare expenditure globally is enabling better access to advanced diagnostic tools and services. This is particularly evident in developing countries where improving healthcare infrastructure is a priority, thereby boosting the adoption of infectious disease diagnostics.

Globalization has led to increased travel and trade, contributing to the spread of infectious diseases across borders. This has created a heightened need for robust diagnostic systems to monitor and control outbreaks, especially at ports of entry and among travelers.

The global aging population is more susceptible to infections due to weakened immune systems. As a result, there is a higher demand for diagnostic testing among the elderly, driving market growth.

The emergence of new and re-emerging pathogens, such as the Ebola virus, Zika virus, and most recently, SARS-CoV-2, necessitates the development and deployment of new diagnostic tests. The dynamic nature of pathogens requires continuous innovation in diagnostic approaches.

The increasing preference for point-of-care testing, which provides rapid results and can be conducted outside traditional laboratory settings, is a significant driver. This trend is particularly important in remote and underserved areas where access to centralized laboratories is limited.

The private sector is playing a crucial role in the development of new diagnostic technologies. Pharmaceutical and biotechnology companies are investing in research and development to create more effective and user-friendly diagnostic tools, driven by the lucrative potential of the market.

The infectious disease diagnostics market in the United States benefits from a highly competitive and innovative landscape. A major factor is the robust infrastructure of the Centers for Disease Control and Prevention (CDC), which plays a critical role in disease surveillance and outbreak response.

The United States market is also distinguished by strong collaborations between academic institutions, biotechnology firms, and government agencies, fostering an environment ripe for innovation.

The extensive insurance coverage and reimbursement policies in the United States further encourage advances in rapid infectious disease diagnostics.

Moreover, the presence of large healthcare conglomerates and a mature market for clinical trials allow for the rapid development and deployment of new diagnostic tools. Public awareness campaigns about the importance of diagnostics in disease prevention and management also drive market growth.

China's infectious disease diagnostics market is rapidly expanding, driven by the country's large population and the increasing incidence of infectious diseases such as tuberculosis, hepatitis, and emerging viral infections.

The Chinese government’s proactive approach to healthcare reform and infectious disease control has led to substantial investments in healthcare infrastructure and diagnostic technologies.

The market is characterized by the adoption of advanced diagnostic tools, including molecular diagnostics and rapid testing methods. Public health policies, such as the national tuberculosis control program and extensive screening for infectious diseases, significantly boost market demand. Additionally, China's growing biotechnology sector and the presence of numerous domestic diagnostic companies contribute to the market's dynamism.

The government’s focus on enhancing healthcare access in rural and underserved areas also plays a critical role in promoting the future of point-of-care infectious disease testing and other innovative diagnostic solutions across the country.

In the United Kingdom, the market for infectious disease diagnostics is notably influenced by the centralized healthcare system provided by the National Health Service (NHS).

This centralized system ensures that new diagnostic technologies can be integrated uniformly across the country, leading to widespread and equitable access. The United Kingdom also places a strong emphasis on public health and preventive measures, supported by entities such as Public Health England.

The United Kingdom's participation in international health initiatives and collaborations, especially with the European Centre for Disease Prevention and Control, enhances its diagnostic capabilities.

Additionally, the United Kingdom government’s focus on antimicrobial resistance (AMR) has led to significant investments in diagnostics aimed at identifying resistant strains of pathogens, thus guiding appropriate treatment strategies. The strong regulatory framework in the United Kingdom also ensures the safety and efficacy of diagnostic tests.

PCR tests are renowned for their high sensitivity and specificity, which allows for the accurate detection of even minute quantities of pathogen DNA or RNA. This precision is crucial for diagnosing infections early, often before symptoms appear, leading to timely and effective treatment.

PCR tests provide rapid results compared to traditional culture-based methods, which can take days to yield outcomes. This speed is vital for controlling outbreaks and implementing timely public health interventions. The ability to quickly confirm or rule out infections helps in managing patient care more efficiently and reduces the spread of contagious diseases.

Advancements in PCR technology, such as real-time PCR (qPCR) and digital PCR (dPCR), have further enhanced its capabilities. Real-time PCR provides quantitative data, which is useful for monitoring viral loads in patients, while digital PCR offers even greater precision and sensitivity. These technological improvements have expanded the applications and reliability of PCR tests, driving their adoption in clinical settings.

There is a growing demand for accurate and reliable diagnostic tests due to rising awareness about the importance of early detection and treatment of infectious diseases. PCR tests meet this demand by providing precise and dependable diagnostic results, contributing to their increased use in healthcare settings.

Assays and reagents play a critical role in expanding the test menu for infectious disease diagnostics. Manufacturers are developing multiplex assays capable of detecting multiple pathogens simultaneously, providing comprehensive testing solutions for syndromic panels and respiratory infections. This versatility enhances diagnostic efficiency and streamlines laboratory workflows.

Advancements in assay development allow for customization and tailoring of diagnostic tests to individual patient needs.

Assays and reagents can be optimized for specific pathogens, genetic variations, and antimicrobial resistance markers, supporting personalized medicine approaches. This customization enhances diagnostic accuracy and guides more effective treatment strategies.

Investments in research and development (R&D) are driving innovation in assay technologies and reagent formulations. Manufacturers are investing in novel platforms, such as digital PCR, loop-mediated isothermal amplification (LAMP), and CRISPR-based assays, to enhance sensitivity, specificity, and speed of diagnostics. These advancements expand the market potential and address unmet needs in infectious disease testing.

Leading companies in the infectious disease diagnostics market are employing several strategies to foster growth. These include investing in research and development to innovate new diagnostic technologies expanding their product portfolios to offer a comprehensive range of testing solutions.

In addition, they are forging strategic partnerships and collaborations with other industry players or healthcare institutions, enhancing market presence through mergers and acquisitions, and focusing on geographic expansion to tap into emerging markets.

Additionally, players are prioritizing customer education and support to increase awareness and adoption of their diagnostic products and services, ultimately driving market growth and profitability.

In terms of product, the market encompasses assays & reagents, instruments, and software.

Based on disease types, the market is categorized into hepatitis, human immunodeficiency virus, influenza, and others.

The technology segment comprises immunodiagnostics, clinical microbiology, polymerase chain reaction, and next-generation sequencing.

As per region, the industry is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

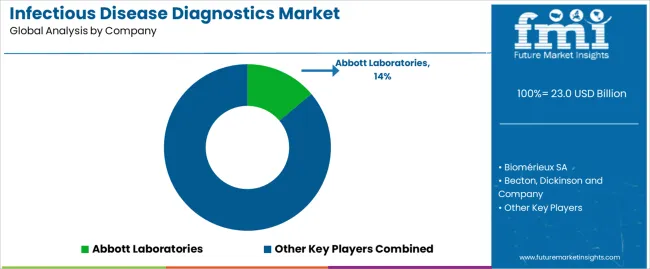

The global infectious disease diagnostics market is estimated to be valued at USD 23.0 billion in 2025.

The market size for the infectious disease diagnostics market is projected to reach USD 46.2 billion by 2035.

The infectious disease diagnostics market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in infectious disease diagnostics market are assays & reagents, instruments and software.

In terms of disease type, human immunodeficiency virus segment to command 34.8% share in the infectious disease diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infectious Disease Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Infectious Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Infectious Enteritis Treatment Market

Veterinary Infectious Disease Therapeutics Market

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Rare Disease Gene Therapy Market

Fabry Disease Market Size and Share Forecast Outlook 2025 to 2035

Byler Disease Market

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Celiac Disease Diagnostics Market Analysis - Size, Share & Forecast 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Crohn’s Disease (CD) Treatment Market Analysis & Forecast by Drug Type, Distribution Channel and Region through 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Zoonotic Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA