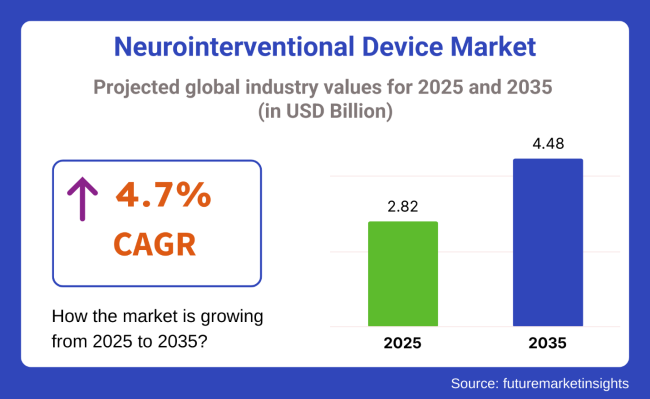

The global neurointerventional devices market is projected to grow steadily from USD 2.82 billion in 2025 to USD 4.48 billion by 2035, representing a CAGR of 4.7%. This growth is underpinned by the increasing prevalence of neurovascular conditions such as ischemic stroke, brain aneurysms, and arteriovenous malformations (AVMs)-conditions that require rapid, precise, and minimally invasive interventions.

The market is also being driven by continued innovation in endovascular imaging, navigation technologies, and surgical delivery systems, which are enhancing procedural efficacy and expanding the pool of eligible patients, particularly among the elderly. As the global population ages, the clinical burden of cerebrovascular diseases is expected to rise, further reinforcing demand for neurointerventional therapies.

Leading medical device manufacturers such as Stryker, Medtronic, Boston Scientific, and Penumbra are spearheading advancements in neurointerventional devices, focusing on improving precision, safety, and outcomes in complex procedures. These companies are investing heavily in R&D to develop technologies that cater to both emergent and elective care.

A notable advancement is the WEB Aneurysm Embolization System, an intrasaccular device used for the treatment of wide-neck bifurcation aneurysms. Carsten Schroeder, President and CEO of MicroVention, Inc. states that with over 10,000 units sold in the United States, WEB advances the treatment of wide-neck bifurcation aneurysms with one intrasaccular device.

We will continue to work side-by-side with leading physicians to transform clinical insights into life-saving technologies. This trend toward collaborative innovation is accelerating the pace of device development and ensuring that novel tools are aligned with evolving clinical needs.

North America dominates the neurointerventional devices market due to advanced healthcare systems, widespread insurance coverage, and strong clinical expertise, with the USA leading in procedure volumes and early diagnoses. In Europe, countries like Germany, the UK, and France drive market growth through public healthcare funding, rising adoption of minimally invasive techniques, and university-industry collaborations that support MDR-compliant innovations.

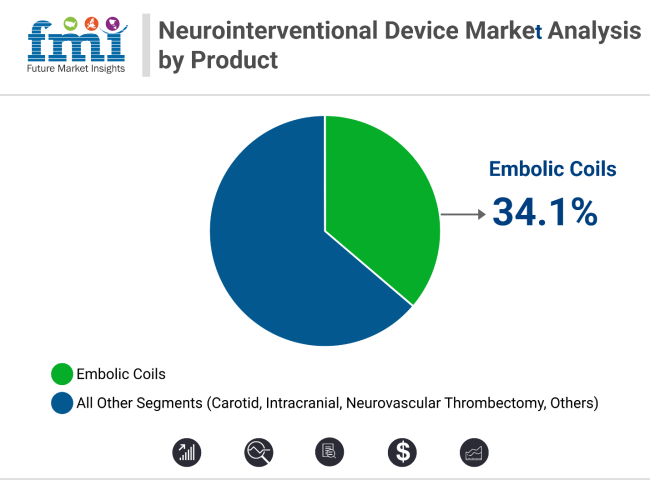

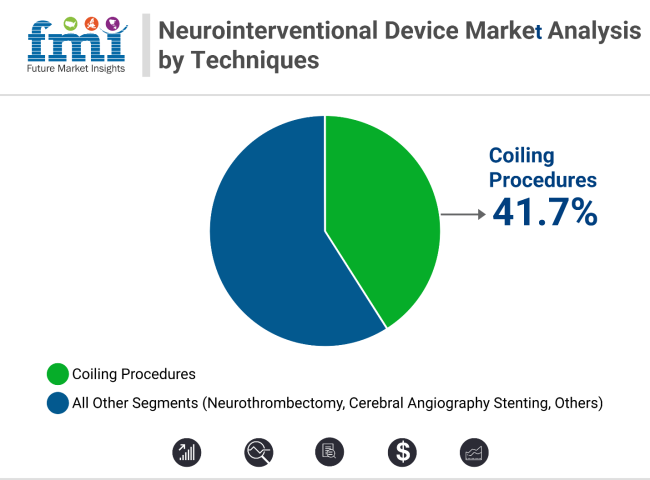

Embolic coils lead the product segment with 34.1% revenue share in 2025, supported by hydrogel-coated and detachable coil innovations. Coiling procedures dominate technique-wise with 41.7% share, aided by adjunctive tools like stent-assisted coiling. Early diagnosis, minimally invasive advantages, and strong clinical data continue to expand both segments across global neurology settings.

In 2025, embolic coils are projected to account for 34.1% of total neurointerventional device revenue, reaffirming their status as a critical tool in the treatment of intracranial aneurysms and arteriovenous malformations (AVMs). These devices are favored due to their ability to provide long-lasting vessel occlusion with a low incidence of retreatment.

Recent innovations have focused on next-generation coil materials, including hydrogel-coated and detachable platinum coils, which enhance procedural accuracy and reduce recurrence. Leading manufacturers such as Medtronic and Stryker are launching coils with improved radiopacity, flexibility, and microcatheter compatibility, allowing for better control and safer navigation through delicate neurovascular anatomy.

The growing use of advanced neuroimaging, including MRI and CT angiography, has led to a significant increase in the detection of unruptured aneurysms, fueling demand for elective coiling procedures. This clinical shift supports the positioning of embolic coils as a scalable, minimally invasive, and reliable solution for diverse neurointerventional needs. As hospitals expand their neurology programs and more physicians gain specialized training, the segment is expected to grow consistently over the next decade.

Coiling procedures are anticipated to represent more than 41.7% of all neurointerventional techniques globally by 2025, reflecting their central role in aneurysm management. These minimally invasive procedures have largely supplanted surgical clipping, particularly for patients with aneurysms in difficult-to-reach anatomical regions or those with significant comorbidities.

The growing prevalence of wide-neck and irregularly shaped aneurysms has led to broader adoption of adjunctive technologies, such as balloon-assisted and stent-assisted coiling, which improve safety and procedural success. High-definition 3D angiography and MRI-based planning have enhanced physicians' ability to diagnose and treat unruptured aneurysms earlier, often in outpatient settings.

Leading device manufacturers are focused on integrating coiling systems with low-profile delivery platforms that are compatible with tortuous vasculature. Additionally, growing volumes of elective neurointerventional procedures are being supported by investments in hybrid cath labs and multidisciplinary stroke teams. As evidence mounts in favor of long-term durability and reduced complication rates, coiling is expected to remain the preferred first-line treatment for intracranial aneurysms through 2035.

The market is expanding due to rising stroke incidence and increased aneurysm detection, driving demand for minimally invasive neurointervention. However, high device costs, complex training, and fragmented regulations remain significant barriers. Advances in imaging and adjunctive technologies present strong growth potential, though inconsistent procurement policies continue to challenge new product entries and equitable device access globally.

Device Cost, Training Needs, and Regulatory Variability Pose Barriers

Despite growing clinical acceptance, the neurointerventional device market faces significant access challenges. Advanced devices such as flow diverters, embolic coils, and stent retrievers are expensive to procure and require highly specialized skills for effective use. Many healthcare facilities, particularly in emerging markets and rural regions, lack both the financial resources and trained personnel to perform these procedures consistently.

In addition, device usage is often restricted by inconsistent reimbursement structures, where neurointerventional procedures are not uniformly covered across public or private insurance schemes. Training requirements are also high, with interventional neurologists and radiologists needing years of education and certification.

This expertise gap, combined with equipment costs, limits adoption outside major urban centers. Regulatory requirements further complicate market entry, as neurovascular implants are subject to high clinical evidence thresholds. Collectively, these barriers slow product uptake and restrict equitable access to lifesaving interventions, especially in underserved populations.

Adjunctive Technologies and Imaging Innovations Create Growth Potential

The convergence of neurointervention and advanced imaging is unlocking new opportunities in precision-guided therapies. High-resolution imaging modalities such as 3D rotational angiography, cone beam CT, and fusion imaging are improving diagnostic clarity and real-time visualization during procedures.

These advancements are increasing operator confidence and enabling the treatment of complex lesions, including wide-neck aneurysms and distal occlusions. Adjunctive technologies like balloon-assisted coiling and stent-assisted techniques are expanding the scope of treatable cases, reducing retreatment rates and improving long-term outcomes. Leading manufacturers are aligning their product portfolios with these imaging advancements, developing devices that offer enhanced visibility, flexibility, and deliverability within tortuous cerebral vasculature.

Materials innovation, including hydrophilic coatings and bioactive surfaces, is improving device integration and navigation. As hospitals seek to improve procedural efficiency and clinical outcomes, demand for neurointerventional devices that are compatible with digital imaging systems is rising. The integration of real-time data, AI-based guidance, and enhanced visualization tools is expected to further differentiate product offerings over the next decade.

Fragmented Procurement Policies and High Regulatory Hurdles Threaten Entry

Procurement systems for neurointerventional devices vary widely across geographies, creating a challenging landscape for manufacturers and distributors. In some countries, bulk procurement by public health systems prioritizes cost over innovation, limiting the introduction of advanced devices with premium pricing. In other regions, decentralized hospital purchasing introduces inconsistency in standards and product availability.

Regulatory clearance is another significant hurdle. Devices such as flow diverters, liquid embolics, and novel stent systems often require multi-phase clinical trials, long evaluation timelines, and region-specific submissions. These processes increase time to market and capital requirements, discouraging smaller firms from entering the field.

Startups and mid-sized players may struggle to meet compliance and evidence standards without strategic alliances, co-marketing agreements, or licensing deals with larger incumbents. As competitive pressures mount and regulatory scrutiny tightens, companies must navigate both pricing constraints and approval complexities to sustain market presence. Harmonization of regulatory frameworks and transparent value-based procurement models will be essential to unlocking new market opportunities.

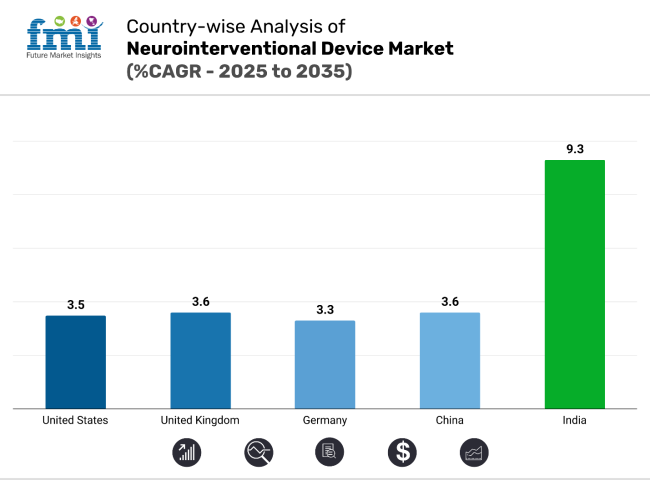

The neurointerventional device market is witnessing diverse growth patterns across key regions. The United States remains a volume-driven, innovation-led market. Germany emphasizes clinical precision, while China is scaling rapidly with domestic production. India leads in CAGR with infrastructure expansion. The U.K. grows steadily through structured NHS initiatives and academic trials supporting next-generation neurovascular technologies.

The United States neurointerventional device market is projected to grow at a CAGR of 3.5% from 2025 to 2035. As one of the most developed healthcare systems globally, the U.S. supports high procedural volumes due to its wide network of certified comprehensive stroke centers and neurointerventional suites.

Advanced reimbursement frameworks-including Medicare and private payers-provide strong financial backing for mechanical thrombectomy and coiling procedures. Leading companies like Medtronic, Stryker, and Penumbra are expanding their portfolios and integrating with outpatient care centers and neurology groups. The preference for minimally invasive treatments, particularly in elderly and high-risk populations, continues to drive the adoption of embolic coils, flow diverters, and stent retrievers.

Regulatory clarity through FDA fast-track approvals and clinical registry participation supports a robust innovation pipeline. Continuous investment in clinical education, live case workshops, and AI-driven imaging platforms strengthens the U.S.’s role as a trendsetter in neurovascular intervention and therapeutic standardization.

The German neurointerventional devices market is projected to expand at a CAGR of 3.3% through 2035, reflecting its established healthcare infrastructure and strict procedural protocols. University hospitals and stroke-specialized centers play a central role in procedural consistency and adoption of flow diverters and coil systems for complex aneurysm cases. German medical societies emphasize evidence-based treatment algorithms, often requiring rigorous case selection and imaging validation prior to intervention.

Regulatory preferences lean toward CE-marked devices backed by peer-reviewed studies. Local procurement is driven by hospital consortia, leading to vendor concentration among well-established players. Academic collaborations foster device trials and innovations, with close partnerships between industry and clinical institutions. Additionally, emphasis on post-market surveillance and real-world evidence supports long-term product reliability.

While market growth is steady rather than explosive, Germany remains a high-value geography due to its patient volume, device standardization, and adherence to stringent performance metrics across all neurovascular procedures.

The neurointerventional devices market in China is forecast to grow at a CAGR of 3.6%, supported by rising healthcare investment and improved access to imaging diagnostics. Government-led health reforms under initiatives like “Healthy China 2030” are expanding stroke care capacity across Tier 2 and Tier 3 cities. National screening programs have increased the detection of aneurysms and arteriovenous malformations (AVMs), resulting in a higher procedural base for coiling and thrombectomy.

Domestic manufacturers such as MicroPort and Wallaby Medical are enhancing market penetration with cost-competitive and increasingly sophisticated devices, especially in coils and stent retrievers. Bulk procurement under China’s centralized Volume-Based Procurement (VBP) policy supports rapid hospital uptake while applying pricing pressure.

Hybrid hospitals with interventional radiology capacity are on the rise, particularly in regional hubs. As reimbursement for neurointervention expands under public schemes, China’s balance of local production strength and rising clinical demand positions it as a globally relevant growth market in the neurovascular space.

India is projected to experience the fastest growth globally, with a CAGR of 9.3% between 2025 and 2035. This surge is driven by increasing urban stroke incidence, improved access to advanced neuroimaging, and the rapid buildout of interventional neurology capacity in private hospital chains.

Metro hospitals are establishing comprehensive neurovascular units, while emerging cities are being equipped through teleradiology and training partnerships. Companies like Meril Life Sciences, Stryker India, and Cerenovus are scaling access to embolic coils, stent retrievers, and liquid embolic agents via tiered pricing and channel partnerships.

Government initiatives under Ayushman Bharat and state-level insurance schemes are beginning to include neurointerventional therapies. Capacity building programs led by academic neurology bodies are training more neurointerventionists and expanding the referral base. With increasing digitalization in diagnostics and a large at-risk population, India presents a robust opportunity for sustained market entry, localization, and volume-driven growth across both public and private healthcare sectors.

The neurointerventional device market in United Kingdom is expected to grow at a CAGR of 3.6% from 2025 to 2035. The National Health Service (NHS) plays a central role in ensuring equitable access to coiling procedures and mechanical thrombectomy for eligible stroke and aneurysm cases. Aneurysm screening programs and integrated stroke care pathways have improved early detection and referral timing.

Institutions such as King’s College Hospital and University College London Hospitals lead multicenter trials for flow diverters, embolic agents, and liquid-based occlusion systems. Procurement under NICE (National Institute for Health and Care Excellence) guidelines emphasizes clinical value and cost-effectiveness, driving adoption of proven technologies.

Companies like Stryker UK, Cerenovus, and Medtronic maintain close collaboration with hospital trusts to pilot next-generation neurovascular devices. The U.K.'s structured clinical governance, high-quality data collection, and focus on reducing stroke-related disability ensures stable, quality-focused growth. With expanding digital tools and AI-supported planning platforms, procedural integration is expected to improve further.

The global neurointerventional devices market is moderately consolidated, with Tier 1 players like Medtronic, Stryker, Penumbra, and Johnson & Johnson’s Cerenovus holding significant global market share. These firms offer complete neurovascular portfolios including embolic coils, stent retrievers, and thrombectomy systems.

Tier 2 firms such as Terumo, Phenox GmbH, and Rapid Medical are focused on specialized innovation such as intrasaccular flow disruption and flexible microcatheters. Companies are prioritizing R&D in bioactive coatings, miniaturization, and hydrophilic materials to improve navigation and procedural success.

Market entry remains restricted by stringent regulatory approvals, clinical data requirements, and capital-intensive trial processes. Consolidation continues, with larger firms acquiring tech-driven startups to expand their therapeutic scope. Pricing pressures in Europe and emerging markets also influence go-to-market strategies and distributor partnerships.

In 2024, Penumbra Inc. launched its REAL Neuro System, a navigation platform enabling real-time image feedback during neurointerventional procedures. The device received CE Mark and U.S. FDA clearance and has been rolled out across selected stroke centers in Europe and the United States.

The platform supports catheter tracking and real-time procedural adjustments, reducing fluoroscopy time and improving safety. With growing demand for advanced imaging integration, this move enhances Penumbra’s positioning in the innovation-driven neurovascular market.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.82 billion |

| Projected Market Size (2035) | USD 4.48 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Embolic Coils, Carotid Stents, Intracranial Stents, Neurovascular Thrombectomy, Embolic Protection Devices, Flow Diverters Devices, Intrasaccular Devices, Liquid Embolic, Balloons, Stent Retrievers |

| Techniques Analyzed (Segment 2) | Neurothrombectomy Procedure, Cerebral Angiography, Stenting, Coiling Procedures, Flow Disruption |

| End Users Analyzed | Hospitals, Ambulatory Surgical Centers, Other End User |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia and Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players Influencing the Neurointerventional Devices Market | Medtronic plc, Stryker Corporation, Penumbra, Inc., Terumo Corporation, MicroVention, Inc. (Terumo Group), Johnson & Johnson (Cerenovus), Balt USA, Phenox GmbH, Rapid Medical, Others |

| Additional Attributes | Rise in ischemic stroke interventions, Demand for minimally invasive neurosurgeries, Expansion of hybrid operating rooms, Growth in mechanical thrombectomy adoption, Technological advances in flow diverters and embolic coils, Surge in neurovascular disorders in aging populations |

By product, the market is segmented into embolic coils, carotid stents, intracranial stents, neurovascular thrombectomy, embolic protection devices, flow diverter devices, intrasaccular devices, liquid embolics, balloons, and stent retrievers.

By technique, the segmentation includes neurothrombectomy procedure, cerebral angiography, stenting, coiling procedures, and flow disruption.

By end use, the market is categorized into hospitals, ambulatory surgical centers, and other end users.

By Region, the market covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa.

The neurointerventional device market is projected to reach USD 2.82 billion in 2025.

The neurointerventional device market is projected to grow to USD 4.48 billion by 2035 at a CAGR of 4.7%.

Embolic coils lead with a 34.1% share, favored for aneurysm and AVM treatment.

Coiling procedures dominate with over 41.7% share, driven by safety and minimally invasive benefits.

India leads with a CAGR of 9.3%, driven by expanding neurodiagnostics and private hospital investment.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Technique, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technique, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Technique, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Technique, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Technique, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Technique, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Technique, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Technique, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Technique, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technique, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Technique, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Technique, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technique, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Technique, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Technique, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technique, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Technique, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Technique, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Technique, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Technique, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Technique, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Technique, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Technique, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Technique, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Technique, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Technique, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Technique, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Technique, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Technique, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Technique, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Technique, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Technique, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Technique, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Technique, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technique, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Technique, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Venous Device Market

Serial Device Servers Market

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Technology Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA