The immunochemistry analyzer market exhibits accelerating growth from 2025 to 2035 because of rising exact diagnosis tool need and increasing global disease burden while benefiting from improved automated testing system technology. Accurate antigen detection along with antibody evaluation and biomarker testing serves as essential functions of these clinical laboratory analysers to identify and track diseases at early stages.

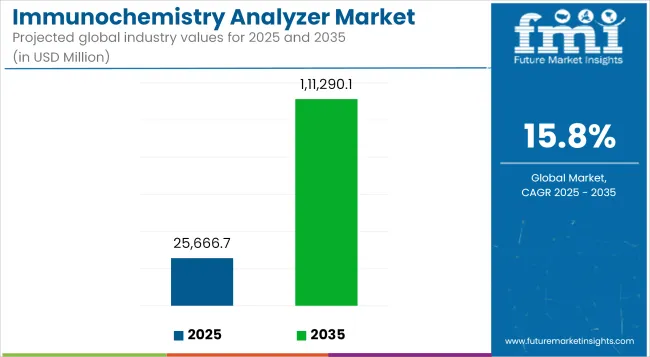

The market value of healthcare rapid diagnostic solutions combined with large-scale screening activities will surge from USD 25,666.7 million in 2025 to USD 111,290.1 million by 2035 with an expected 15.8% Compound Annual Growth Rate (CAGR).

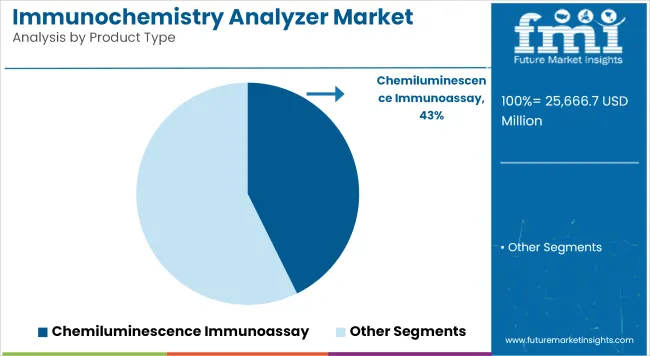

The market gains momentum because laboratories automate their processes while the public becomes more health-conscious and requires quick testing capabilities. The popularity of Chemiluminescence immunoassay (CLIA) systems increases because they combine superior detection capabilities with precise measurement at very low analyte levels.

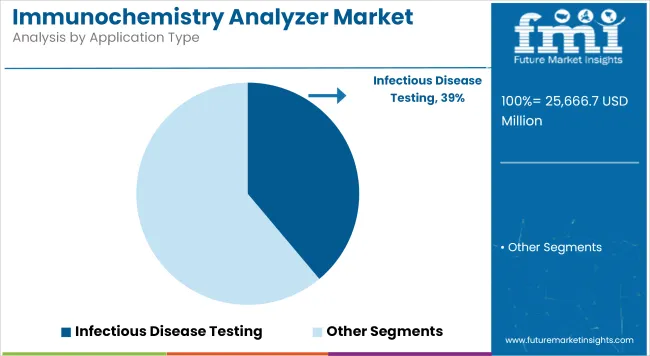

Testing infectious diseases leads application demand which increases because of growing numbers of respiratory infections along with sexually transmitted conditions and diseases spread through vectors. Immunochemistry analysers are being incorporated by laboratories hospitals along with diagnostic centers because they help improve operational efficiency during continuous testing routines for disease detection programs.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 25,666.7 million |

| Industry Value (2035F) | USD 111,290.1 million |

| CAGR (2025 to 2035) | 15.8% |

The immunochemistry analyser market features separate sections for product type and application that impact testing capabilities as well as laboratory processes and medical certainty. The current market preference for CLIA systems stems from their peak performance attributes including elevated specificity levels and quick signal generation combined with reduced background confusion. Applications in laboratories with large sample volumes benefit strongly from this system operation because it provides regular test results with minimal detection thresholds.

The detection of HIV as well as hepatitis and influenza by automatic analysers represents the main area of infectious disease testing through immunochemistry technologies. Global healthcare facilities show increasing necessity for high-speed automated diagnostic solutions through these important marketplace segments.

The immunochemistry analyser market is witnessing significant further expansion, as the global healthcare system is focusing on faster and more accurate diagnostic technologies for routine and complex diseases. The significant contribution of immunochemistry analysers includes biomarker identification, disease progression monitoring, and treatment decision making, spanning a variety of clinical applications.

Chemiluminescence Immunoassay (CLIA) systems to provide superior sensitivity, high throughput, and accurate quantification is the most widely used product type. When looked at as a broader application, infectious disease testing accounts for an ever-increasing proportion of the application profile in use on the rapid and scalable analysers due to global public health efforts and increasing reliance on hospital laboratories. Overall, these segments represent a market increasingly characterized by innovation, automation and an increased demand for laboratory efficiency.

With diagnostic accuracy central to both personalized medicine and pandemic preparedness, CLIA platforms and infectious disease applications remain key drivers of the global immunochemistry analyser market.

Chemiluminescence immunoassays lead the product segment by offering superior sensitivity, speed, and multiplexing capabilities

| Product Type | Market Share (2025) |

|---|---|

| Chemiluminescence Immunoassay | 42.7% |

CLIA product type segment is led by chemiluminescence immunoassays, as they help laboratories attain high sensitivity in detection and faster turnaround time. Instead of a colorimetric detection (like the one above), these analysers use a luminescent chemical reaction in conjunction with either an antigen or an antibody to give significantly better sensitivity compared to classic colorimetric assays.

CLIA systems are preferred by hospitals and diagnostic centres for their high degree of automation, low sample volumes required and wide range of menu of tests available. With the growing need for holistic diagnostic solutions, labs increasingly rely on CLIA platforms for boardroom screening capabilities, such as hormone levels, cardiac markers, tumor antigens and infectious disease tests.

CLIA platforms continue to evolve with integrated robotics, high-throughput capabilities, and intuitive interfaces that make them suitable for use in both high-throughput reference laboratories and smaller scale clinical environments. They help perform multiple tests in parallel and this enhance the workflow thereby mitigating the delay in diagnosis.

CLIA tests are also generally more specific and precise than non-CLIA tests, making them ideal for use in cases where early precise diagnosis is critical. Due to the increasing focus of the healthcare industry on data accuracy and operational efficiency, chemiluminescence immunoassays can be anticipated to become the method of choice for immunochemistry test analysis.

Infectious disease testing dominates the application segment by addressing diagnostic urgency across pathogens and healthcare settings

| Application Type | Market Share (2025) |

|---|---|

| Infectious Disease Testing | 38.9% |

Due to the persistent emphasis within healthcare systems across the globe on the early identification and management of infectious diseases, the infectious disease testing application segment continues to dominate this market. Immunochemistry analysers are pivotal in the identification of various infections, encompassing respiratory viruses, hepatitis, HIV, and sexually transmitted diseases.

The capacities of these systems to quickly process high test volumes with minimal human engagement mean they are irreplaceable in emergency care, urgent care and many outpatient diagnostics and public health laboratories. Immunochemistry analysers facilitate steady test supply during each season of a pandemic and accurate reporting and individualized scalable response throughout healthcare networks.

Outside of hospitals, the proliferation of government programs and diagnostic chains that help influence immunochemistry platforms to assist in community screening, travel health, and epidemiological studies continues. The emergence of antimicrobial resistance, novel zoonotic threats, and pervasive global health inequities highlights the pressing need for accurate infectious disease diagnostics.

Immunochemistry analysers help clinicians to start treatment sooner and reduce the spread of disease, particularly when used in conjunction with centralized lab information systems. As pathogen surveillance and diagnostic accuracy become critical to healthcare strategy, infectious disease testing will remain the most prominent application for immunochemistry analysers globally.

North America is dominating the region for the immunochemistry analyser market due to existing advanced healthcare infrastructure, early adoption of automated diagnostics. CLIA systems are already increasingly integrated into hospitals and public health labs in the USA to monitor infectious diseases and perform routine screenings.

Reimbursement policies that provide support and investments in high-throughput diagnostic platforms are also helping adoption. This, paired with Canada expanding rapid immunoassay-based tests to rural and community clinics, has contributed to regional growth.

Europe shows continuous progress, with national health systems investing in lab modernization as well as disease surveillance. CLIA-based immunochemistry analysers are improving diagnostic response in hospitals and infectious disease centers as Germany, the UK, and France deploy their first generation analysers.

Integrated platforms that simplify sample processing and delivery of results are being used more widely in regional labs. Funding for diagnostic technologies along with EU-wide health preparedness initiatives remain drivers for market expansion.

Asia-Pacific is showing the fastest adoption, driven by increasing disease awareness, improving healthcare access, and government-supported testing initiatives. The deployment of immunochemistry analysers for mass diseased screening is mainly in urban hospitals and diagnostic network in countries such as China, India, Japan, and South Korea.

Higher demand for low-cost, high-sensitivity testing as well as increased investment in public health infrastructure are pushing CLIA systems adoption is expanding across the region’s nascent and developed markets.

High Instrumentation Costs and Workflow Integration Barriers

The market for immunochemistry analysers is still troubled by the high capital investment needed to purchase these devices and the difficulties in integrating them into different laboratory workflows. Procurement and maintenance costs for hospitals and diagnostic centers, particularly in mid-sized and rural hospitals, are painful. And operational friction is generated from the need for trained staff, reagent compatibility and compatibility with existing laboratory information systems (LIS).

These limitations are exacerbated by the variability in assay throughput and platform-specific software limitations in multi-analyser environments. Such limitations hinder adoption in resource-poor settings and prevent wider implementation, as the potential for increased diagnosis in monitoring chronic diseases and managing infectious diseases continues to grow.

Demand for Automation, High-Throughput Testing, and Early Diagnosis

High-throughput diagnostics and automation-driven efficiency are driving the growth of the immunochemistry analyser market as demand for early disease detection continues to increase. Modern analysers offer multiplexing, greater throughput and faster cycle times, and increased sensitivity especially for high-volume testing for oncology, endocrinology, and autoimmune diseases.

Data from LIS, data sharing on the cloud, and analysis with AI help in better clinical decision making. With the advent of personalized medicine, and rising chronic diseases and life-threatening maladies, immunochemistry techniques are becoming indispensable in clinical laboratories. As a result, manufacturers with a focus on compact, modular, and automated analysers are well placed to serve the needs of both large institutions and decentralized diagnostic setups.

The demand for highly sensitive and specific immunoassays has increased from 2020 to 2024 in hospital laboratories and diagnostic chains across the world due to the necessity of accurate biomarker analysis and faster test processing, boosting the immunochemistry analyser market. This is when compact analysers and semi-automated platforms started making inroads into point-of-care settings.

Between 2025 and 2035, the landscape will evolve towards fully integrated systems that allow for real-time diagnostics, with predictive analytics and AI-enabled result interpretation. Immunoassay sensitivity will continually evolve, and modular automation of the testing Jowers will enable flexible testing workflows to tailor workflows to different treatment strategies. Neurology, fertility diagnostics, and infectious disease surveillance are emerging applications that will broaden market scope.

Market Shifts: Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Factor | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with IVD standards and national health regulations. |

| Technological Advancements | Focus on semi-automated analysers and reagent-specific platforms. |

| Sustainability Trends | Low emphasis on device recyclability or reagent waste. |

| Market Competition | Led by global diagnostics OEMs and hospital- centered platforms. |

| Industry Adoption | Common in central labs, reference labs, and hospitals. |

| Consumer Preferences | Preference for accuracy, reliability, and brand trust. |

| Market Growth Drivers | Boosted by chronic disease management and centralized lab demand. |

| Market Factor | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Integration of real-time diagnostics under global data-sharing and AI governance policies. |

| Technological Advancements | Growth in AI-assisted, fully automated, and multiplex immunoassay analysers. |

| Sustainability Trends | Demand for green reagents, energy-efficient systems, and eco-conscious lab operations. |

| Market Competition | Entry of AI-integrated analyser developers and decentralized diagnostic solution providers. |

| Industry Adoption | Expands to mobile clinics, outpatient centers, and home-based testing ecosystems. |

| Consumer Preferences | Shift to faster, AI-driven, and portable systems with minimal user intervention. |

| Market Growth Drivers | Accelerated by personalized healthcare, data-driven diagnostics, and decentralized care models. |

North America accounted for the largest share in the global immunochemistry analyser market owing to the growing adoption of automated diagnostic systems for hospitals, private labs, and research institutions in this region. The continued high burden of chronic and infectious diseases such as cancer and autoimmune diseases drives demand for high-throughput, high-speed results, enabling wide deployment of analysers capable of delivering fast, high-throughput results.

USA manufacturers have mobilized and are designing fully integrated systems with integrated immunoassays, ELISA, and chemiluminescent detection all in small-footprint, easy-to-use platforms. The increasing focus on personalized medicine and diagnostics at the molecular level adds to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 15.5% |

The United Kingdom's immunochemistry analyser market is experiencing rapid growth, supported by NHS initiatives to modernize laboratory testing and adopt advanced clinical diagnostic tools. They are used in early disease detection, drug monitoring and endocrine testing.

UK healthcare providers are preferring analysers with faster turnaround time, less reagent consumption and inbuilt data management capabilities. The centralized laboratory models the country is moving toward are driving an increased demand for high-volume, fully automated platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.3% |

Germany, France, and Italian Region is an established and rapidly growing market in the European Union for immunochemistry analysers. Moreover, countries in the European Union are adopting next-gen analysers for clinical workflows that require reliability, automation, and remote accessibility.

Growing attention towards infectious disease surveillance, oncology biomarkers, and geriatric diagnostics is driving the demand for multiplexed, high-sensitivity platforms. Regulatory frameworks in the EU governing the quality of diagnostic devices and transparency in data and methodology are further influencing the landscape of innovation, competitiveness, and procurement.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 15.8% |

The growth in Japan’s immunochemistry analyser market propelled by the country’s aging population and the increasing focus on early, accurate diagnosis in primary care. Laboratories are also putting in place compact, automated systems that provide repeatable results with less hands-on touch.

Japanese diagnostic manufacturers are also expanding into hybrid systems that enable both immunoassays and molecular detection to be run on a single platform, enabling scalability across both public and private healthcare establishments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 15.2% |

South Korea is one of the fastest growing markets for immunochemistry analysers, with strong healthcare infrastructure, expansion of hospital labs, and increasing investments in life sciences. Both central and point-of-care market adoption are driven by high public awareness and demand for advanced screening technologies.

Other local companies are developing smaller, cartridge-based immunoassay systems that cater to the needs of rapid disease screening, cancer diagnostics, and hormone profiling. Also, government-supporting diagnostic exports and digital health platforms has also expanded the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.3% |

The global immunochemistry analyser market plays a key role in clinical diagnostics, aiding in the detection and quantitation of hormones, proteins, tumor markers, infectious diseases and autoimmune diseases. They use various immunoassay technology including ELISA, CLIA and RIA to provide high-throughput, sensitive, well-validated tests across hospitals, diagnostic labs and research institutions.

These market drivers include rising needs for early disease detection, chronic disease monitoring, and point-of-care diagnostics, as well as technological advancements in automation, multiplexing, and LIS system integration. Major players hedge on assay menu size, TAT, on-chip footprint, compatibility with a laboratory's choice of reagents, and the efficiency of device maintenance.

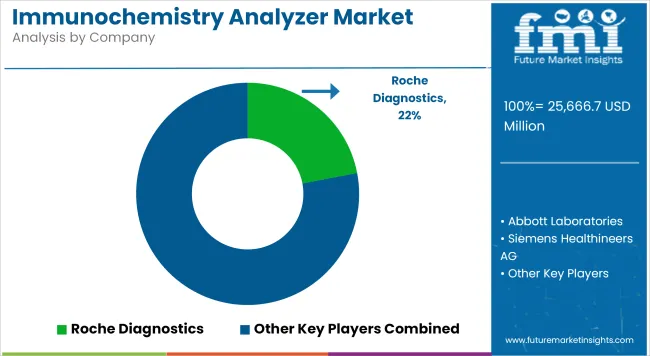

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche Diagnostics | 22-26% |

| Abbott Laboratories | 17-21% |

| Siemens Healthineers AG | 14-18% |

| Beckman Coulter, Inc. (Danaher) | 10-14% |

| bioMérieux SA | 7-11% |

| Ortho Clinical Diagnostics ( QuidelOrtho ) | 6-10% |

| Other Companies (combined) | 15-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche Diagnostics | Launched cobas e 801 analysers with enhanced throughput and consolidated immunoassay testing for high-volume labs in 2025. |

| Abbott Laboratories | Expanded its Alinity i -series with next-generation analysers offering broad assay menus and rapid turnaround in 2024. |

| Siemens Healthineers | Released the Atellica Solution platform with bi-directional automation and immunoassay consolidation for clinical labs in 2025. |

| Beckman Coulter | Introduced the DxI 9000 Access Immunoassay Analyzer featuring predictive maintenance and enhanced auto-sampling in 2024. |

| bioMérieux SA | Rolled out VIDAS 3 compact immunoanalyzers with integrated software and specialty test panels for infectious diseases in 2025. |

| QuidelOrtho (Ortho Clinical) | Released VITROS Immunodiagnostic Systems with no-water operation and integrated calibration features for mid-size labs in 2024. |

Key Company Insights

Roche Diagnostics

Roche dominates the immunochemistry analyser market with its cobas® series, which delivers high-throughput and minimal hands-on time across centralized labs. Its robust test menu covers cardiovascular, oncology, fertility, and infectious markers, backed by industry-leading precision.

Abbott Laboratories

Abbott’s Alinityi-series offers compact, modular immunoassay systems ideal for labs seeking space efficiency and automation. The company emphasizes reduced reagent consumption and faster TAT for high-demand biomarkers and chronic disease panels.

Siemens Healthineers AG

Siemens excels with its Atellica Solution, a scalable immunochemistry platform offering bi-directional automation and cross-discipline integration. Its analysers are known for minimized downtime, AI-enabled diagnostics, and interoperability with existing lab ecosystems.

Beckman Coulter, Inc.

Beckman Coulter provides efficient, user-friendly immunoassay systems tailored for high-volume labs. The DxI 9000 features automated QC, predictive analytics for service intervals, and an intuitive interface, enhancing lab productivity and compliance.

BioMérieux SA

BioMérieux focuses on specialty immunoassay analysers like VIDAS 3, catering to infectious disease testing in decentralized labs. Its strengths lie in reliability, ease of use, and a growing presence in emerging markets and urgent care facilities.

QuidelOrtho (Ortho Clinical Diagnostics)

QuidelOrtho’s VITROS systems offer dry-slide technology and water-free operation, reducing contamination risk and maintenance. Its immunoassay menu includes thyroid, fertility, cardiac, and inflammatory markers, supporting midsize and satellite labs.

Other Key Players (15 to 20% Combined)

Numerous regional and niche diagnostic equipment providers contribute to the immunochemistry analyser market through flexible instrument design, niche assay panels, and affordability for small-to-mid scale labs:

The overall market size for the immunochemistry analyzer market was USD 25,666.7 million in 2025.

The immunochemistry analyzer market is expected to reach USD 111,290.1 million in 2035.

The increasing prevalence of infectious diseases, rising need for high-sensitivity diagnostic tools, and growing adoption of chemiluminescence immunoassays in infectious disease testing fuel the immunochemistry analyzer market during the forecast period.

The top 5 countries driving the development of the immunochemistry analyzer market are the USA, UK, European Union, Japan, and South Korea.

Chemiluminescence immunoassays and infectious disease testing lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017-2032

Table 3: Global Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017-2032

Table 5: Global Market Value (US$ Mn) Forecast by Modality, 2017-2032

Table 6: Global Market Volume (Units) Forecast by Modality, 2017-2032

Table 7: Global Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 8: Global Market Volume (Units) Forecast by Application, 2017-2032

Table 9: Global Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 10: Global Market Volume (Units) Forecast by End User, 2017-2032

Table 11: North America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 12: North America Market Volume (Units) Forecast by Country, 2017-2032

Table 13: North America Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 14: North America Market Volume (Units) Forecast by Product Type, 2017-2032

Table 15: North America Market Value (US$ Mn) Forecast by Modality, 2017-2032

Table 16: North America Market Volume (Units) Forecast by Modality, 2017-2032

Table 17: North America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 18: North America Market Volume (Units) Forecast by Application, 2017-2032

Table 19: North America Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 20: North America Market Volume (Units) Forecast by End User, 2017-2032

Table 21: Latin America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017-2032

Table 23: Latin America Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2017-2032

Table 25: Latin America Market Value (US$ Mn) Forecast by Modality, 2017-2032

Table 26: Latin America Market Volume (Units) Forecast by Modality, 2017-2032

Table 27: Latin America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 28: Latin America Market Volume (Units) Forecast by Application, 2017-2032

Table 29: Latin America Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 30: Latin America Market Volume (Units) Forecast by End User, 2017-2032

Table 31: Europe Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 32: Europe Market Volume (Units) Forecast by Country, 2017-2032

Table 33: Europe Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2017-2032

Table 35: Europe Market Value (US$ Mn) Forecast by Modality, 2017-2032

Table 36: Europe Market Volume (Units) Forecast by Modality, 2017-2032

Table 37: Europe Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 38: Europe Market Volume (Units) Forecast by Application, 2017-2032

Table 39: Europe Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 40: Europe Market Volume (Units) Forecast by End User, 2017-2032

Table 41: East Asia Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 42: East Asia Market Volume (Units) Forecast by Country, 2017-2032

Table 43: East Asia Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 44: East Asia Market Volume (Units) Forecast by Product Type, 2017-2032

Table 45: East Asia Market Value (US$ Mn) Forecast by Modality, 2017-2032

Table 46: East Asia Market Volume (Units) Forecast by Modality, 2017-2032

Table 47: East Asia Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 48: East Asia Market Volume (Units) Forecast by Application, 2017-2032

Table 49: East Asia Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 50: East Asia Market Volume (Units) Forecast by End User, 2017-2032

Table 51: South Asia & Pacific Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 52: South Asia & Pacific Market Volume (Units) Forecast by Country, 2017-2032

Table 53: South Asia & Pacific Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 54: South Asia & Pacific Market Volume (Units) Forecast by Product Type, 2017-2032

Table 55: South Asia & Pacific Market Value (US$ Mn) Forecast by Modality, 2017-2032

Table 56: South Asia & Pacific Market Volume (Units) Forecast by Modality, 2017-2032

Table 57: South Asia & Pacific Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 58: South Asia & Pacific Market Volume (Units) Forecast by Application, 2017-2032

Table 59: South Asia & Pacific Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 60: South Asia & Pacific Market Volume (Units) Forecast by End User, 2017-2032

Table 61: MEA Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 62: MEA Market Volume (Units) Forecast by Country, 2017-2032

Table 63: MEA Market Value (US$ Mn) Forecast by Product Type, 2017-2032

Table 64: MEA Market Volume (Units) Forecast by Product Type, 2017-2032

Table 65: MEA Market Value (US$ Mn) Forecast by Modality, 2017-2032

Table 66: MEA Market Volume (Units) Forecast by Modality, 2017-2032

Table 67: MEA Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 68: MEA Market Volume (Units) Forecast by Application, 2017-2032

Table 69: MEA Market Value (US$ Mn) Forecast by End User, 2017-2032

Table 70: MEA Market Volume (Units) Forecast by End User, 2017-2032

Figure 1: Global Market Value (US$ Mn) by Product Type, 2022-2032

Figure 2: Global Market Value (US$ Mn) by Modality, 2022-2032

Figure 3: Global Market Value (US$ Mn) by Application, 2022-2032

Figure 4: Global Market Value (US$ Mn) by End User, 2022-2032

Figure 5: Global Market Value (US$ Mn) by Region, 2022-2032

Figure 6: Global Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 7: Global Market Volume (Units) Analysis by Region, 2017-2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 10: Global Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2017-2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 14: Global Market Value (US$ Mn) Analysis by Modality, 2017-2032

Figure 15: Global Market Volume (Units) Analysis by Modality, 2017-2032

Figure 16: Global Market Value Share (%) and BPS Analysis by Modality, 2022-2032

Figure 17: Global Market Y-o-Y Growth (%) Projections by Modality, 2022-2032

Figure 18: Global Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 19: Global Market Volume (Units) Analysis by Application, 2017-2032

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 22: Global Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 23: Global Market Volume (Units) Analysis by End User, 2017-2032

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 26: Global Market Attractiveness by Product Type, 2022-2032

Figure 27: Global Market Attractiveness by Modality, 2022-2032

Figure 28: Global Market Attractiveness by Application, 2022-2032

Figure 29: Global Market Attractiveness by End User, 2022-2032

Figure 30: Global Market Attractiveness by Region, 2022-2032

Figure 31: North America Market Value (US$ Mn) by Product Type, 2022-2032

Figure 32: North America Market Value (US$ Mn) by Modality, 2022-2032

Figure 33: North America Market Value (US$ Mn) by Application, 2022-2032

Figure 34: North America Market Value (US$ Mn) by End User, 2022-2032

Figure 35: North America Market Value (US$ Mn) by Country, 2022-2032

Figure 36: North America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 37: North America Market Volume (Units) Analysis by Country, 2017-2032

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 40: North America Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2017-2032

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 44: North America Market Value (US$ Mn) Analysis by Modality, 2017-2032

Figure 45: North America Market Volume (Units) Analysis by Modality, 2017-2032

Figure 46: North America Market Value Share (%) and BPS Analysis by Modality, 2022-2032

Figure 47: North America Market Y-o-Y Growth (%) Projections by Modality, 2022-2032

Figure 48: North America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 49: North America Market Volume (Units) Analysis by Application, 2017-2032

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 52: North America Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 53: North America Market Volume (Units) Analysis by End User, 2017-2032

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 56: North America Market Attractiveness by Product Type, 2022-2032

Figure 57: North America Market Attractiveness by Modality, 2022-2032

Figure 58: North America Market Attractiveness by Application, 2022-2032

Figure 59: North America Market Attractiveness by End User, 2022-2032

Figure 60: North America Market Attractiveness by Country, 2022-2032

Figure 61: Latin America Market Value (US$ Mn) by Product Type, 2022-2032

Figure 62: Latin America Market Value (US$ Mn) by Modality, 2022-2032

Figure 63: Latin America Market Value (US$ Mn) by Application, 2022-2032

Figure 64: Latin America Market Value (US$ Mn) by End User, 2022-2032

Figure 65: Latin America Market Value (US$ Mn) by Country, 2022-2032

Figure 66: Latin America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017-2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 70: Latin America Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2017-2032

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 74: Latin America Market Value (US$ Mn) Analysis by Modality, 2017-2032

Figure 75: Latin America Market Volume (Units) Analysis by Modality, 2017-2032

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Modality, 2022-2032

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Modality, 2022-2032

Figure 78: Latin America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2017-2032

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 82: Latin America Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2017-2032

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 86: Latin America Market Attractiveness by Product Type, 2022-2032

Figure 87: Latin America Market Attractiveness by Modality, 2022-2032

Figure 88: Latin America Market Attractiveness by Application, 2022-2032

Figure 89: Latin America Market Attractiveness by End User, 2022-2032

Figure 90: Latin America Market Attractiveness by Country, 2022-2032

Figure 91: Europe Market Value (US$ Mn) by Product Type, 2022-2032

Figure 92: Europe Market Value (US$ Mn) by Modality, 2022-2032

Figure 93: Europe Market Value (US$ Mn) by Application, 2022-2032

Figure 94: Europe Market Value (US$ Mn) by End User, 2022-2032

Figure 95: Europe Market Value (US$ Mn) by Country, 2022-2032

Figure 96: Europe Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 97: Europe Market Volume (Units) Analysis by Country, 2017-2032

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 100: Europe Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2017-2032

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 104: Europe Market Value (US$ Mn) Analysis by Modality, 2017-2032

Figure 105: Europe Market Volume (Units) Analysis by Modality, 2017-2032

Figure 106: Europe Market Value Share (%) and BPS Analysis by Modality, 2022-2032

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Modality, 2022-2032

Figure 108: Europe Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 109: Europe Market Volume (Units) Analysis by Application, 2017-2032

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 112: Europe Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 113: Europe Market Volume (Units) Analysis by End User, 2017-2032

Figure 114: Europe Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 116: Europe Market Attractiveness by Product Type, 2022-2032

Figure 117: Europe Market Attractiveness by Modality, 2022-2032

Figure 118: Europe Market Attractiveness by Application, 2022-2032

Figure 119: Europe Market Attractiveness by End User, 2022-2032

Figure 120: Europe Market Attractiveness by Country, 2022-2032

Figure 121: East Asia Market Value (US$ Mn) by Product Type, 2022-2032

Figure 122: East Asia Market Value (US$ Mn) by Modality, 2022-2032

Figure 123: East Asia Market Value (US$ Mn) by Application, 2022-2032

Figure 124: East Asia Market Value (US$ Mn) by End User, 2022-2032

Figure 125: East Asia Market Value (US$ Mn) by Country, 2022-2032

Figure 126: East Asia Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 127: East Asia Market Volume (Units) Analysis by Country, 2017-2032

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 130: East Asia Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 131: East Asia Market Volume (Units) Analysis by Product Type, 2017-2032

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 134: East Asia Market Value (US$ Mn) Analysis by Modality, 2017-2032

Figure 135: East Asia Market Volume (Units) Analysis by Modality, 2017-2032

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Modality, 2022-2032

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Modality, 2022-2032

Figure 138: East Asia Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 139: East Asia Market Volume (Units) Analysis by Application, 2017-2032

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 142: East Asia Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 143: East Asia Market Volume (Units) Analysis by End User, 2017-2032

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 146: East Asia Market Attractiveness by Product Type, 2022-2032

Figure 147: East Asia Market Attractiveness by Modality, 2022-2032

Figure 148: East Asia Market Attractiveness by Application, 2022-2032

Figure 149: East Asia Market Attractiveness by End User, 2022-2032

Figure 150: East Asia Market Attractiveness by Country, 2022-2032

Figure 151: South Asia & Pacific Market Value (US$ Mn) by Product Type, 2022-2032

Figure 152: South Asia & Pacific Market Value (US$ Mn) by Modality, 2022-2032

Figure 153: South Asia & Pacific Market Value (US$ Mn) by Application, 2022-2032

Figure 154: South Asia & Pacific Market Value (US$ Mn) by End User, 2022-2032

Figure 155: South Asia & Pacific Market Value (US$ Mn) by Country, 2022-2032

Figure 156: South Asia & Pacific Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 157: South Asia & Pacific Market Volume (Units) Analysis by Country, 2017-2032

Figure 158: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 159: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 160: South Asia & Pacific Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 161: South Asia & Pacific Market Volume (Units) Analysis by Product Type, 2017-2032

Figure 162: South Asia & Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 163: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 164: South Asia & Pacific Market Value (US$ Mn) Analysis by Modality, 2017-2032

Figure 165: South Asia & Pacific Market Volume (Units) Analysis by Modality, 2017-2032

Figure 166: South Asia & Pacific Market Value Share (%) and BPS Analysis by Modality, 2022-2032

Figure 167: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Modality, 2022-2032

Figure 168: South Asia & Pacific Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 169: South Asia & Pacific Market Volume (Units) Analysis by Application, 2017-2032

Figure 170: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 171: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 172: South Asia & Pacific Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 173: South Asia & Pacific Market Volume (Units) Analysis by End User, 2017-2032

Figure 174: South Asia & Pacific Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 175: South Asia & Pacific Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 176: South Asia & Pacific Market Attractiveness by Product Type, 2022-2032

Figure 177: South Asia & Pacific Market Attractiveness by Modality, 2022-2032

Figure 178: South Asia & Pacific Market Attractiveness by Application, 2022-2032

Figure 179: South Asia & Pacific Market Attractiveness by End User, 2022-2032

Figure 180: South Asia & Pacific Market Attractiveness by Country, 2022-2032

Figure 181: MEA Market Value (US$ Mn) by Product Type, 2022-2032

Figure 182: MEA Market Value (US$ Mn) by Modality, 2022-2032

Figure 183: MEA Market Value (US$ Mn) by Application, 2022-2032

Figure 184: MEA Market Value (US$ Mn) by End User, 2022-2032

Figure 185: MEA Market Value (US$ Mn) by Country, 2022-2032

Figure 186: MEA Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 187: MEA Market Volume (Units) Analysis by Country, 2017-2032

Figure 188: MEA Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 190: MEA Market Value (US$ Mn) Analysis by Product Type, 2017-2032

Figure 191: MEA Market Volume (Units) Analysis by Product Type, 2017-2032

Figure 192: MEA Market Value Share (%) and BPS Analysis by Product Type, 2022-2032

Figure 193: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2022-2032

Figure 194: MEA Market Value (US$ Mn) Analysis by Modality, 2017-2032

Figure 195: MEA Market Volume (Units) Analysis by Modality, 2017-2032

Figure 196: MEA Market Value Share (%) and BPS Analysis by Modality, 2022-2032

Figure 197: MEA Market Y-o-Y Growth (%) Projections by Modality, 2022-2032

Figure 198: MEA Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 199: MEA Market Volume (Units) Analysis by Application, 2017-2032

Figure 200: MEA Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 201: MEA Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 202: MEA Market Value (US$ Mn) Analysis by End User, 2017-2032

Figure 203: MEA Market Volume (Units) Analysis by End User, 2017-2032

Figure 204: MEA Market Value Share (%) and BPS Analysis by End User, 2022-2032

Figure 205: MEA Market Y-o-Y Growth (%) Projections by End User, 2022-2032

Figure 206: MEA Market Attractiveness by Product Type, 2022-2032

Figure 207: MEA Market Attractiveness by Modality, 2022-2032

Figure 208: MEA Market Attractiveness by Application, 2022-2032

Figure 209: MEA Market Attractiveness by End User, 2022-2032

Figure 210: MEA Market Attractiveness by Country, 2022-2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immunochemistry Products Market Insights – Growth & Forecast 2025 to 2035

TOC Analyzer Market Size and Share Forecast Outlook 2025 to 2035

ESR Analyzer Market Analysis - Size, Share, and Forecast 2025 to 2035

XRF Analyzer Market Growth – Trends & Forecast 2019-2027

Lens Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fuel Analyzer Market

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Boron Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Power Analyzers Market

Logic Analyzer Market

Urine Analyzers Market

Ozone Analyzer Market

Breath Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Signal Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Grease Analyzer Market Growth - Trends & Forecast 2025 to 2035

Silica Analyzers Market

Genetic Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Albumin Analyzers Market Size and Share Forecast Outlook 2025 to 2035

NMR Fat Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA