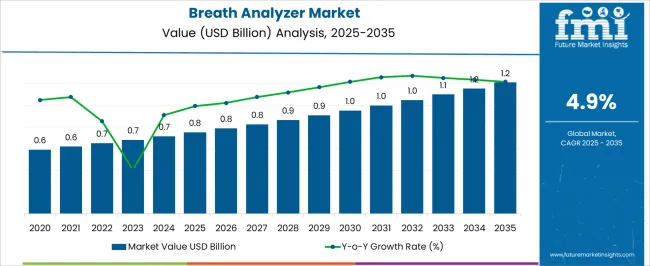

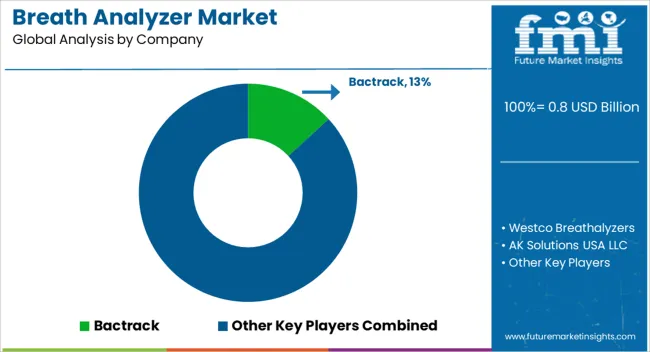

The Breath Analyzer Market is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 1.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Breath Analyzer Market Estimated Value in (2025 E) | USD 0.8 billion |

| Breath Analyzer Market Forecast Value in (2035 F) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The breath analyzer market is experiencing steady expansion, driven by heightened emphasis on public safety, stricter alcohol consumption regulations, and advancements in portable diagnostic technologies. Industry publications and regulatory updates have highlighted growing demand for accurate and rapid testing solutions across transportation, healthcare, and workplace safety.

Technological innovations, particularly in sensor efficiency and miniaturization, have improved the accuracy and reliability of breath analyzers, enhancing their adoption. Rising awareness of alcohol-related road fatalities has led to broader enforcement of roadside testing initiatives, with government agencies and law enforcement departments increasing their procurement of advanced devices.

Healthcare providers have also begun to adopt breath analyzers for non-invasive diagnostics, expanding the scope of applications beyond alcohol detection. Additionally, strategic investments by device manufacturers in user-friendly and connected devices have aligned with global digitalization trends. Looking ahead, market growth is expected to be shaped by increased integration of IoT-enabled breath analyzers, stricter compliance standards across industries, and expanding applications in medical diagnostics and workplace safety monitoring.

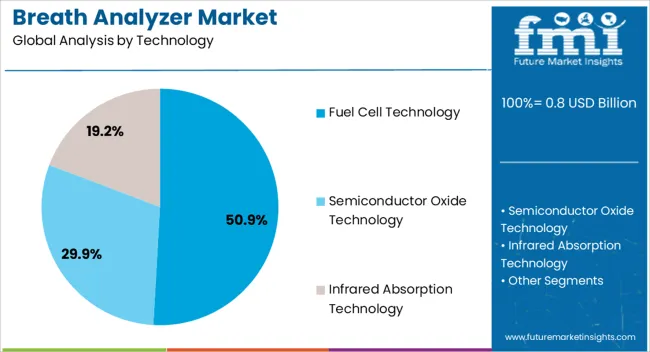

The Fuel Cell Technology segment is projected to contribute 50.9% of the breath analyzer market revenue in 2025, positioning itself as the leading technology. Growth in this segment has been driven by its superior accuracy, sensitivity, and reliability compared to semiconductor-based alternatives. Fuel cell sensors have been preferred by law enforcement and clinical settings for their ability to specifically detect alcohol molecules without interference from other breath compounds, minimizing false positives.

Industry testing standards have consistently validated the precision of fuel cell technology, reinforcing its adoption in official evidential testing scenarios. Moreover, advancements in compact and energy-efficient fuel cell modules have facilitated their integration into portable devices, enhancing field usability.

As regulatory bodies increasingly mandate high-accuracy devices for enforcement and workplace screening, the Fuel Cell Technology segment is expected to retain its dominant share due to its strong performance track record and compliance with evidential testing requirements.

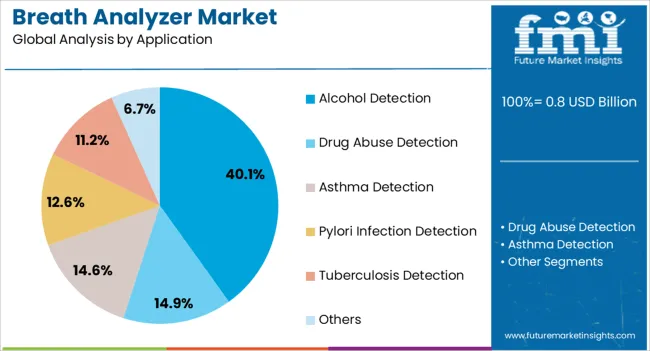

The Alcohol Detection segment is projected to account for 40.1% of the breath analyzer market revenue in 2025, maintaining its position as the leading application. Growth has been supported by the widespread enforcement of alcohol consumption regulations, particularly in road safety and workplace monitoring. Reports from public safety authorities have emphasized alcohol detection as a primary use case for breath analyzers due to its direct role in reducing road accidents and fatalities.

Technological advancements have improved detection accuracy and reduced analysis times, allowing for faster roadside and on-site screenings. Additionally, alcohol detection devices have gained adoption in hospitality and industrial sectors where strict policies require reliable monitoring.

Global initiatives promoting responsible alcohol consumption and stricter penalties for violations have reinforced the demand for alcohol detection solutions. As public health and safety campaigns expand, the Alcohol Detection segment is expected to remain the cornerstone of breath analyzer applications.

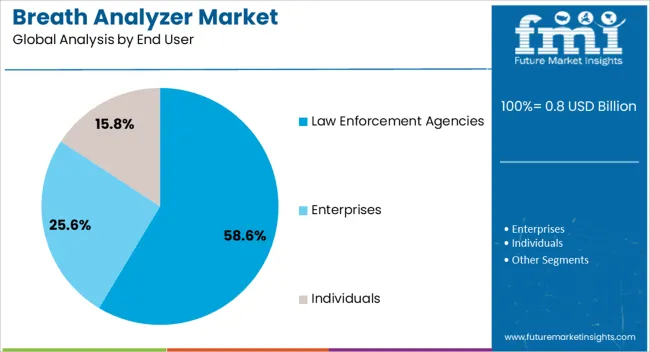

The Law Enforcement Agencies segment is projected to hold 58.6% of the breath analyzer market revenue in 2025, securing its leadership among end users. This segment’s growth has been shaped by rising concerns over impaired driving and the implementation of stricter road safety regulations worldwide. Law enforcement agencies have increasingly relied on portable and evidential breath analyzers to conduct roadside screenings, supported by government funding and procurement programs.

Annual reports and regulatory updates have highlighted expanding adoption of advanced breath analyzers that deliver accurate, legally admissible results. The segment has also benefited from training initiatives that equip officers with user-friendly devices capable of real-time data logging and integration with enforcement databases.

The scalability of breath analyzer deployment in large-scale roadside testing campaigns has further strengthened the segment’s share. As governments continue to prioritize road safety and invest in advanced traffic law enforcement measures, the Law Enforcement Agencies segment is expected to maintain its dominance in the market.

Breath analyzers with fuel cell technology offer highly accurate and fast readings. They provide consistent results over long periods. This quality of theirs makes them the preferred choice among medical professionals and users where accuracy is paramount. The share of fuel cell technology for this sector is set to cover around 50.9% in 2025.

| Attributes | Details |

|---|---|

| Technology | Fuel cell technology |

| Market Share (2025) | 50.9% |

The use of fuel cell technology in analyzers has seen a higher peak due to its application in alcohol testing in various industries. Sectors like transportation, healthcare, and law enforcement have driven the need for these analyzers to ensure safety and compliance with regulations.

Growing awareness of the dangers of drunk driving and personal safety has also augmented the demand for this technology. With advancements in fuel cell technology, the development of portable and handheld breath analyzers for roadside testing and workplace alcohol screening has spurred the breath analyzer market. Its affordable cost has also impacted its sales in varied sectors.

Companies are implementing alcohol screening programs to maintain a safe and healthy ecosystem. Accounting for all these elements, analyzers for alcohol detection are spurring rapidly. This has shown significant growth in the industry. The share for 2025 of alcohol detection applications in the breath analyzer market is set at 40.1%, with rising concerns and government initiatives for the betterment of people.

| Attributes | Details |

|---|---|

| Application | Alcohol Detection |

| Market Share (2025) | 40.1% |

With the rise in alcohol-related accidents, governments and law enforcement agencies worldwide are enforcing strict regulations on alcohol consumption while driving. Thus, the increasing number of traffic accidents caused by drunk driving and drug use has increased the demand for these analyzers.

Below is a table showing the prominence of Asian and American countries in the breath catheters market. India presents a commendable CAGR of 8.2%, and others showing countrywide rules and innovations, making their nascent growth flaunt globally.

South Korea and the United States are emerging economies curating the demand for this device for other applications, too. This distribution and analysis of different regions explain the widespread and principal application of these analyzers.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 8.2% |

| Spain | 7.5% |

| China | 7.1% |

| South Korea | 6.5% |

| United States | 4.1% |

India is among the prominent players in the industrial landscape of healthcare. Increasing alcohol consumption and greater research on the medical application of breathalyzers have fast-paced industrial growth. Major Indian companies with innovative products have great scope for growth opportunities globally. India is set to register a CAGR of 8.2% from 2025 to 2035.

Increasing utilization of these analyzers by government authorities and healthcare sectors on account of the growing number of road accidents in India is another growth factor. Changing lifestyles and the ever-increasing Western influence have a big impact on sales of the breath analyzer industry. The sales of asthma and tuberculosis detection has also spread light on the Indian sectoral growth.

Spain is experiencing significant expansion in this sector due to increasing awareness of the dangers of drunk driving plus increased enforcement of alcohol consumption. The requirement for accurate and reliable breathalyzers for testing has curated its rising trend in Spain. Spain is set to undergo a CAGR of 7.5% through 2035, with several technological companies flourishing globally.

Drägerwerk AG & Co. KGaA is one of the leading Spanish manufacturers offering these analyzers. Development, like analyzers in smartphone applications for convenient usage, spurred the market. Another notable development in Spain is the increasing use of fuel cell sensor technology, which also has enhanced sales of analyzers.

Rising earnings among the population have increased the affordability of personal analyzers in China. The surge in demand for these devices for personal and gifting purposes is also a major factor. Thus, China’s breath analyzer market is set to report a CAGR of 7.10% through 2035.

Key companies in the Chinese breathalyzers industry are BACtrack, Quest Products, Inc., AK GlobalTech Corporation, and Lifeloc Technologies, Inc. They are making technological advancements using artificial intelligence and machine learning.

For example, BACtrack announced the launch of its new breath analyzer model equipped with advanced features like Bluetooth connectivity and smartphone compatibility. This trend towards technologically advanced and user-friendly testers is making China hold a leading position globally.

South Korea has been facing the growing issue of drug abuse among its population. Thus, a push for more stringent drug testing measures like breath analyzers has boomed the South Korean industry. A forecasted CAGR of 6.50% from 2025 to 2035 shows a steady growth trajectory with increasing reliance on breathalyzers widely.

South Korean industry is not limited to the usage of these analyzers for just alcohol detection but for drug abuse and chronic disorders, too. Thus, with applications in various sectors, the market is soaring wide.

The United States holds a record number of alcohol drinkers. The United States breath analyzer market is set to report a CAGR of 4.10% through 2035. Cases of DUIs are also rising in the nation. To curb them, these analyzers have a huge demand in the United States.

The strict government regulation also accounts reflecting a large share of this industry. This sector shows spurred demand owing to the highly developed economy, high product adoption rates, and awareness of road traffic safety in the country.

The breath analyzer industry is fragmented, with a few worldwide competitors and several local, domestic businesses, notably in Europe and Asia Pacific. Affluent population and the emergence of modern culture have raised safety concerns globally. To take into hand the regulation and safety of the population, the research and medical device sectors have collaborated to cover accidental damages.

Manufacturers and major companies are focused on developing more advanced and innovative products in the breath analyzer market for rising demand. The breath analyzer market has curated huge opportunities for new entrants and existing players to shape the multitude of this sector with AI and ML.

Recent Advancements

Drägerwerk AG & Co. KGaA

Dräger, headquartered in Lübeck, Germany, specializes in breathing and protection equipment. They also specialize in gas detection, analysis systems, and non-invasive patient monitoring technologies. Drager is well sound company. They are popular for their high-quality products and commitment to safety and innovation. The top end users of this company are serving hospitals, fire departments, and diving companies.

BACtrack, Inc., Quest Products, Inc.

BACtrack, Inc. specializes in breath alcohol testing devices. They offer accurate and reliable solutions for personal and professional use. Quest Products, Inc. is the market leader in alcohol and drug testing. They provide innovative solutions for consumer safety across various products.

Intoximeter, Inc.

Intoximeters, Inc., headquartered in St. Louis, Missouri, United States of America, with a subsidiary in Totnes, Devon, United Kingdom, is a leading provider of alcohol breath testing instruments. Since 1945, they have been prominent industry players serving law enforcement and occupational health.

Other Prominent players are

The industry is classified into semiconductor oxide, fuel cell, and infrared absorption technology.

The report consists the application of breath analyzer in alcohol detection, drug abuse detection, asthma detection, pylori infection detection, tuberculosis detection, and others.

Key end users in the industry are enterprises, law enforcement agencies, and individuals.

Analysis of the landscape has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe.

The global breath analyzer market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the breath analyzer market is projected to reach USD 1.2 billion by 2035.

The breath analyzer market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in breath analyzer market are fuel cell technology, semiconductor oxide technology and infrared absorption technology.

In terms of application, alcohol detection segment to command 40.1% share in the breath analyzer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breathable Bag Perforators Market Forecast Outlook 2025 to 2035

Breathable Membrane Market Size and Share Forecast Outlook 2025 to 2035

Breather Bags Market Size and Share Forecast Outlook 2025 to 2035

Breathable Tape Market Size and Share Forecast Outlook 2025 to 2035

Breathable Films Market Growth, Trends, Forecast 2025 to 2035

Breathable Lidding Film Packaging Market by Material Type from 2025 to 2035

Market Positioning & Share in the Breathable Films Industry

Competitive Overview of Breathable Lidding Film Packaging Companies

Breathing Circuit Market Report – Growth & Forecast 2024-2034

Breath Samplers Market

Breathing Exercise Devices Market

TOC Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Oil Breather Tank Market Growth - Trends & Forecast 2025 to 2035

ESR Analyzer Market Analysis - Size, Share, and Forecast 2025 to 2035

XRF Analyzer Market Growth – Trends & Forecast 2019-2027

Lens Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fuel Analyzer Market

Nonrebreathing Oxygen Masks Market

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Boron Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA