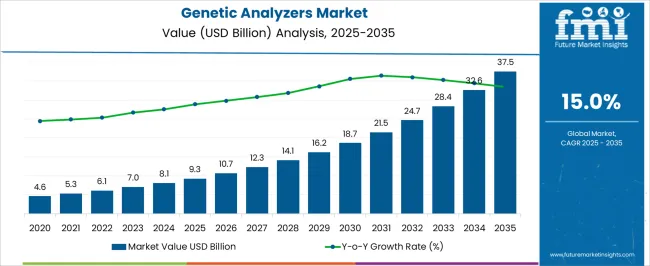

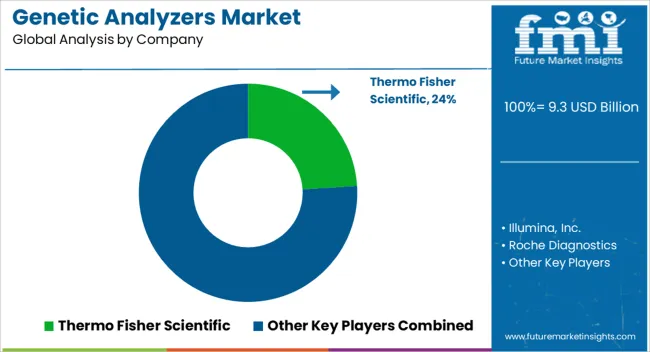

The Genetic Analyzers Market is estimated to be valued at USD 9.3 billion in 2025 and is projected to reach USD 37.5 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| Genetic Analyzers Market Estimated Value in (2025 E) | USD 9.3 billion |

| Genetic Analyzers Market Forecast Value in (2035 F) | USD 37.5 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The Genetic Analyzers market is experiencing strong growth as a result of the increasing demand for precise genetic testing and analysis across research, clinical, and pharmaceutical applications. The market expansion is being driven by advances in next-generation sequencing, personalized medicine initiatives, and the rising focus on genomic research. Automation and software integration in genetic analyzers have enhanced throughput and accuracy, enabling laboratories to handle large sample volumes efficiently.

The growing investment in research and development, coupled with initiatives to accelerate drug discovery and development, is further supporting market growth. In addition, the adoption of advanced reagents and consumables has allowed laboratories to achieve reproducible and reliable results.

The expansion of biotechnology infrastructure, along with the integration of AI and machine learning for data interpretation, is paving the way for future opportunities As the importance of precision medicine and genetic profiling increases, genetic analyzers are expected to remain an essential tool in laboratories, research institutions, and clinical settings, ensuring sustained demand across key end-use industries.

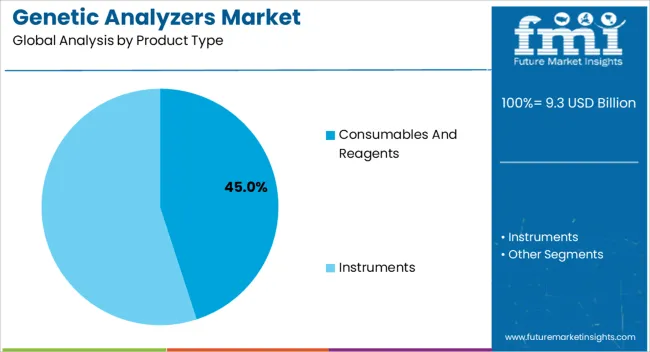

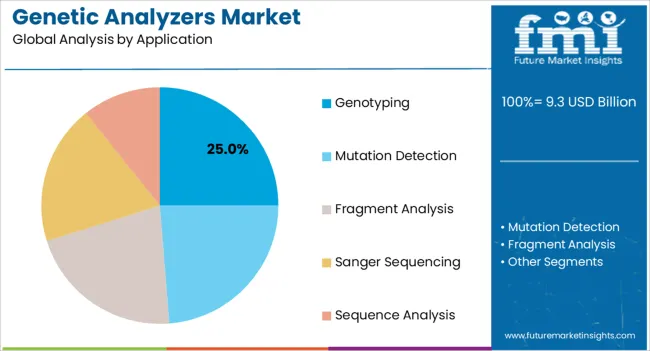

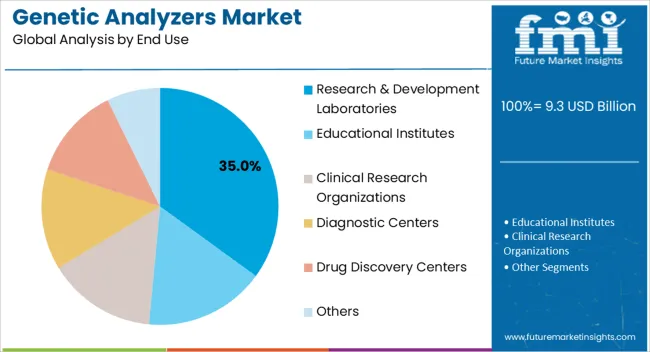

The genetic analyzers market is segmented by product type, application, end use, and geographic regions. By product type, genetic analyzers market is divided into Consumables And Reagents and Instruments. In terms of application, genetic analyzers market is classified into Genotyping, Mutation Detection, Fragment Analysis, Sanger Sequencing, and Sequence Analysis. Based on end use, genetic analyzers market is segmented into Research & Development Laboratories, Educational Institutes, Clinical Research Organizations, Diagnostic Centers, Drug Discovery Centers, and Others. Regionally, the genetic analyzers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Consumables and Reagents product type is projected to account for 45.00% of the Genetic Analyzers market revenue in 2025, making it the leading product type. This growth is being driven by the recurring need for high-quality reagents and consumables that ensure reliable and reproducible genetic analysis. The segment’s adoption has been facilitated by increasing volumes of genomic testing and high-throughput workflows that require frequent replenishment of consumables.

Laboratories are increasingly preferring standardized reagents to minimize variability and improve accuracy, which has further reinforced demand. Moreover, advances in reagent formulations that enhance sensitivity and specificity have supported growth in this segment.

The scalability and flexibility offered by consumables allow genetic analyzers to be applied across multiple applications without major hardware changes As research and clinical laboratories continue to expand their genetic testing capabilities, the consumption of reagents and consumables is expected to remain a critical driver of market revenue, ensuring this segment maintains its leading position.

The Genotyping application segment is expected to hold 25.00% of the Genetic Analyzers market revenue in 2025, positioning it as the dominant application area. This growth is being driven by the increasing use of genotyping for personalized medicine, disease research, and biomarker discovery. Genotyping provides detailed insights into genetic variations, which are essential for identifying disease susceptibility, therapeutic targets, and genetic traits.

The segment has benefited from advancements in high-throughput genetic analyzers that allow rapid processing of multiple samples with high accuracy. Furthermore, the increasing focus on population genetics and large-scale genome projects has reinforced the demand for genotyping applications.

The ability to generate reproducible and high-quality data has made genotyping a preferred choice in research and clinical laboratories As precision medicine continues to expand and the need for individualized treatment strategies grows, the genotyping application segment is expected to sustain its leadership due to its critical role in advancing genetic research and healthcare outcomes.

The Research and Development Laboratories end-use segment is projected to account for 35.00% of the Genetic Analyzers market revenue in 2025, making it the leading end-use industry. This growth is being attributed to the increasing investment in genomic research, drug discovery, and biotechnology innovation. Laboratories in pharmaceutical companies and academic institutions are increasingly adopting genetic analyzers to accelerate research processes, improve data quality, and support high-throughput analysis.

The segment has benefited from the versatility of genetic analyzers that can be applied to multiple research objectives, including functional genomics, biomarker identification, and precision medicine studies. Furthermore, the availability of consumables and reagents that complement analyzers has facilitated seamless workflow integration, improving efficiency and reproducibility.

The need for rapid and accurate data generation in research-intensive environments has reinforced the segment’s growth As global focus on genomics and molecular biology research intensifies, research and development laboratories are expected to continue leading in the adoption of genetic analyzers, ensuring sustained market expansion and innovation in the field.

A significant increase in the number of genetic mapping programs along with technological advancements in sequencing technology are supporting the increasing demand in genetic analyzers. In addition to the growing awareness about genetic disorders, there is also a tendency toward the growth of the genetic disorders market. As a result of rapid adoption of genetic analyzers, medical professionals can now treat abnormalities in a predictable manner.

United States is considered to be a highly lucrative market for genetic analyzers. Several factors are expected to contribute to the growth of gene analyzer applications in these regions, including the diagnosis and screening of rare and fatal disorders in newborns, as well as the estimation of the probability of disease occurrence.

As the market for genetic analyzers continues to grow, there are opportunities for growth owing to rising demands for genetic analyzers to identify genes and to analyze inherited diseases. Genetic analysis can also be applied to the treatment of cancer and to the development of improved diagnostic techniques and new medicines. A significant growth in the use of genetic analyzers is therefore being driven by continuous innovation in genetic analysis.

Parallel to these developments, the genetic mapping program is contributing considerably to the growth of the market for genetic analyzer systems. Players operating in the genetic analyzers market can take advantage of factors such as improving healthcare quality through collaboration, a growing biotech sector in the domestic market, and public and private funding for research in emerging markets to drive their growth. As a result, manufacturers are seeking to develop more authentic clinical data machines for the market.

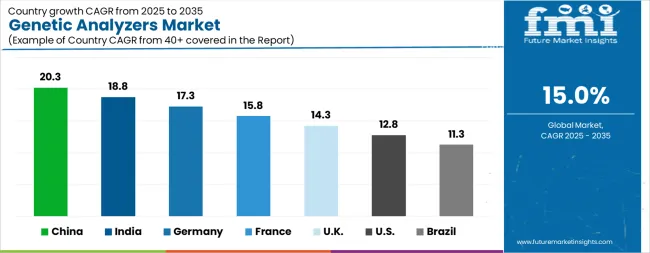

| Country | CAGR |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| France | 15.8% |

| UK | 14.3% |

| USA | 12.8% |

| Brazil | 11.3% |

The Genetic Analyzers Market is expected to register a CAGR of 15.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.3%, followed by India at 18.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.3%, yet still underscores a broadly positive trajectory for the global Genetic Analyzers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.3%. The USA Genetic Analyzers Market is estimated to be valued at USD 3.2 billion in 2025 and is anticipated to reach a valuation of USD 10.7 billion by 2035. Sales are projected to rise at a CAGR of 12.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 447.7 million and USD 275.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Product Type | Consumables And Reagents and Instruments |

| Application | Genotyping, Mutation Detection, Fragment Analysis, Sanger Sequencing, and Sequence Analysis |

| End Use | Research & Development Laboratories, Educational Institutes, Clinical Research Organizations, Diagnostic Centers, Drug Discovery Centers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Illumina, Inc., Roche Diagnostics, Agilent Technologies, Bio-Rad Laboratories, QIAGEN, PerkinElmer, Inc., and Abbott Laboratories |

The global genetic analyzers market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the genetic analyzers market is projected to reach USD 37.5 billion by 2035.

The genetic analyzers market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in genetic analyzers market are consumables and reagents and instruments.

In terms of application, genotyping segment to command 25.0% share in the genetic analyzers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Genetic Cardiomyopathies Market

Genetic Leukemia Detection Testing Market

Cytogenetic Systems Market Size and Share Forecast Outlook 2025 to 2035

Metal Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Power Analyzers Market

Urine Analyzers Market

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Silica Analyzers Market

Albumin Analyzers Market Size and Share Forecast Outlook 2025 to 2035

NMR Fat Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Network Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Mercury Analyzers Market

Process Analyzers Market

Discrete Analyzers Market Growth – Size, Share & Industry Forecast 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Hemostasis Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Bone Morphogenetic Protein Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Medical Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA