The global Immunostimulants Market is projected for consistent growth from 2025 to 2035, driven by the increasing prevalence of infectious diseases, cancer, and autoimmune disorders, is expected to maintain healthy growth for the next decade and a half. The health-conscious consumer demands preventive healthcare solutions, and people have gotten interested in immunostimulants, which can strengthen immunity against both infections as well as other diseases.

As cancer immunotherapy and vaccine adjuvants, standardized product development may prompt broad acceptance of immunostimulants. Biotechnology is accelerating, and that, along with the expansion of clinical uses for immunostimulants in therapies for lymphoma or other solid tumours, will advance market application even further.

Availability Improvements in diagnosis, government training programs for medical workers, and expansion at local levels all speak to positive developments in China's healthcare system. Growing government and private sector investments in healthcare infrastructure and research and development are also driving this expansion.

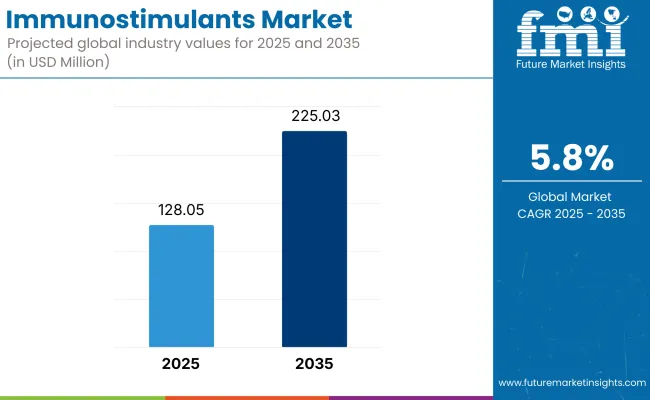

The market is projected to exceed USD 225.03 Million by 2035, expanding at a CAGR of 5.8% during the forecast period.

In North America, the global immunostimulants market leader rests upon a long-established healthcare infrastructure, and its recent increases in cancer incidence, together with strengthened emphasis on advanced immune therapy treatment modalities, hamper the natural adversity of physically modest economies.

From within the region, the United States is the biggest player. Immunostimulant drugs are a hot topic here, as they are now getting closer to market after considerable research and clinical trials.

Government initiatives aimed at prevention, the government's extensive immunization program, and increasingly widespread health awareness among the elderly are all active drivers in this market. In addition, big pharmaceutical companies, in partnership with research institutions, greatly reduce the time required for drug development and stimulate new ideas.

Europe ranks as the world's second-largest market and has seen rapid growth in personalized medicine and immunotherapeutic cancer treatment demand. Countries like Germany, France and the UK are putting substantial effort into pharmaceutical R&D and biotechnological schemes for the next generation of immunostimulants.

The region benefits from regulations that, on the one hand, support immunization campaigns and ensure access to immunotherapy. Europe's growing elderly population and high incidence of chronic diseases have further promoted the market: immune stimulants are an integral part of an all-inclusive health service package.

Asia-Pacific will become the fastest-growing region for immunostimulants. To improve public health care infrastructure, make the benefits of immunotherapy increasingly accepted, and raise health expenditure in countries such as China, India and Japan- all this will contribute toward increasing the rate of growth meanwhile, countries in the region have huge populations of patients, with infectious and chronic diseases on the rise.

Thus, government-led immunization drives and cooperation with global pharmaceutical companies for manufacturing have greatly sped up the adoption of immunostimulants and made Asia-Pacific a main area of market growth for this kind of product.

Challenge

Regulatory and Clinical Validation Challenges

The Immunostimulants market faces obstacles in receiving stringent regulatory approval and must undergo extended clinical trials before it can reach the market. As immunostimulants are often used in conjunction with vaccines or as standalone therapies for immune-compromised patients, the most important thing to prove is that they are safe and effective. Moving through the complex approval processes in different countries means that a product's launch will be delayed and its costs increased.

High R&D Costs and Market Competition

To develop novel Immunostimulants requires a considerable investment in research and development. The competitive scenario, with pharmaceutical giants and emerging biotech firms all vying for market share, puts pressure on companies to innovate quickly, and with huge operational challenges to overcome, achieving scalable production while maintaining the quality and potency of immunostimulants.

Opportunities

Rising Demand for Immune-Boosting Therapies

The expanding global awareness of immune health patterns (especially after being ravaged by COVID) is leading to the demand for immunoostimulants. This is true in a number of different areas such as infectious disease control, oncology and autoimmune disorders. The trend towards preventive health and personalized medicine represents an opportunity for companies to chip away at the medical cake, today aimed ever more precisely towards its intended customer groups.

Technological Advancements in Immunotherapy

Emerging technologies like nanotechnology-based delivery systems and next-generation biologics are driving the innovation of the Immunostimulants Market. Companies that specialize in combination therapies and immune checkpoint modulation, are poised to capture market share. Furthermore, cooperation between research institutions and enterprises speeds up the development of advanced Immunostimulant formulations.

From 2020 to 2024, the Immunostimulants Market expanded rapidly, which was driven by strong interest in Immune Health, coupled with Cancer therapy use (Cancer Immunotherapy) as well as Infectious Disease Management applications. Nevertheless, there are long-standing issues in developing drugs and stiff regulatory requirements which remain an obstacle for development.

Looking ahead to 2025 to 2035, the market is forecast to expand further, with specific impetus being derived from developments in immunotherapy and a move towards precision medicine. The future trends of the market materialize through investment in cutting-edge delivery systems, sustainable production methods and international health initiatives - these factors will all affect the shape of news to come. Future market pioneers will be those who integrate digital health and multi-center real-world data science into their decision-making processes.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stringent regulatory approval processes and regional compliance complexities |

| Market Demand | Demand driven by infectious disease management and oncology applications |

| Industry Adoption | Growth of biologics and adjuvant therapies |

| Supply Chain and Sourcing | Reliance on traditional biopharmaceutical supply chains |

| Market Competition | Competitive landscape led by pharmaceutical giants and biotech firms |

| Market Growth Drivers | Rising awareness of immune health and expanding oncology applications |

| Sustainability and Energy Efficiency | Limited focus on sustainable production methods |

| Integration of Digital Innovations | Early adoption of digital tools for R&D and patient engagement |

| Advancements in Therapy Development | Initial development of monoclonal antibodies and adjuvants |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined regulatory pathways and harmonized international guidelines for immunostimulant approvals |

| Market Demand | Increased use in preventive care, autoimmune disorder management, and combination immunotherapy treatments |

| Industry Adoption | Widespread adoption of nanotechnology-based delivery systems and next-generation immune modulators |

| Supply Chain and Sourcing | Shift towards sustainable sourcing, advanced biomanufacturing techniques, and decentralized production. |

| Market Competition | Intensified competition from startups focusing on innovative immunotherapy and immune-modulating platforms |

| Market Growth Drivers | Surge in demand for personalized medicine, combination therapies, and global immunization programs |

| Sustainability and Energy Efficiency | Integration of eco-friendly manufacturing practices and carbon-neutral production strategies |

| Integration of Digital Innovations | AI-driven drug discovery, digital twin technologies, and remote clinical trial platforms |

| Advancements in Therapy Development | Breakthroughs in cell-based therapies, synthetic biology, and gene-modified immunostimulant platforms |

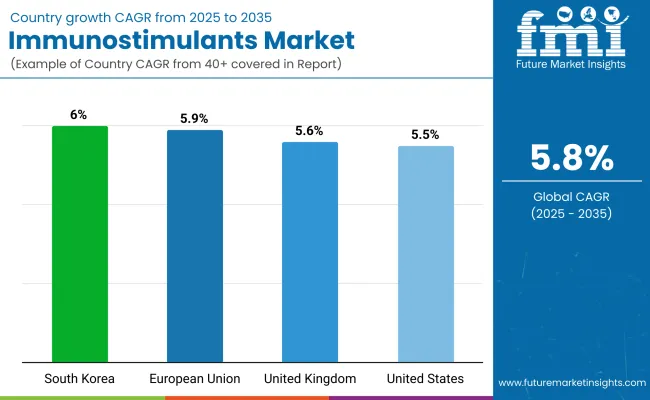

A greater political regard for healthcare prevention and the spread of chronic, infectious diseases drives the growth in the United States immunostimulants market. An increasing outpouring of money for federally sponsored studies and treatment techniques, together with increased public acceptance of immunotherapy as a means to relieve suffering among cancer patients, is also leading to growth. The integration of immunostimulants into cancer treatment protocols and the boom in developmental work on novel therapies continue to encourage market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

The British immunostimulants market is growing as awareness of immune fitness rises, more money is injected into healthcare, and a vigorous pharmaceutical research sector. The government’s immunisation campaigns and initiatives on public health by the National Health and other public health officials are a bonus for immunostimulants usage, particularly in high-risk groups.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.6% |

The European Union’s immunostimulants market benefits from strong government support of immunization programmes and increased investment in biotechnology and pharmaceutical research and development. It is countries such as Germany, France and Italy that are critical contributors, suffering from an aging population and ever greater need to fight infectious diseases using immunostimulant therapy.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.9% |

South Korea’s immunostimulants market is growing as a result of its high level of biotechnology and the big demand for immune-boosting remedies--a demand which has only increased given today’s global health crises. The country’s dedication to innovation and its regulatory okay of new formulations for immunostimulants also both help keep markets moving on.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

Colony Stimulating Factors (CSFs) are the largest part of the everyday immunostimulants market. CSFs are applied a lot in the treatment of neutropenia, especially in cancer patients going through chemotherapy, where immunity suppression is a commonly encountered side effect. These biologics augment the production of neutrophils and thus decrease the danger of infection, making them irreplaceable in an oncological setting.

Granulocyte Colony Stimulating Factors (G-CSFs), e.g., filgrastim and pegfilgrastim, are becoming standard treatments in chemotherapy immune restoration regimens. These biologics help to supplement immune recovery following cancer treatment and expand their usage. Even stem cell mobilization processes and bone marrow transplants are also examples of where CSFs have penetrated to further increase production.

Cancer and autoimmune diseases are increasing, and the spread of biologics in healthcare generally has meant that demand for CSFs throughout the world has risen sharply. New products and biosimilars being introduced continuously in biologic manufacturing processes will further propel the rate of growth this particular category will achieve over the coming years.

Oncology is one of the major segments of the immunostimulants market. There is an increasing global burden of cancer, and the demand for therapies that can improve immune system function. Infections can easily arise in people receiving treatment for all sorts of cancer, particularly those who have reduced immunity because of the treatment (chemotherapy or irradiation).

Immunostimulants, including colony-stimulating factors, interleukins, and interferons, are playing an increasingly important role in bringing the immune system back into a state of readiness and thereby reducing side effects. In cancer immunotherapy, agents such as interferons that stimulate anti-tumour responses are another factor promoting the imposition of immunostimulants in oncology.

Furthermore, as targeted therapies and combination treatments become more popular, demand for immunostimulants as supportive care agents should soar. The overall market for immunostimulants is likely to be further reinforced by an increase in cancer incidence rates, longer living populations and improved diagnosis and treatment of cancer. In this context, it is clear that the most important area of application for these substances lies within oncology.

The development of multiple types of therapy areas and medicine has resulted in an even more pleasant environment for immunotherapists to work. New drugs that restore the body's ability to fight infection are being developed in response to increases in Communicable diseases and other types of disease. This makes the future development of immunotherapeutic agents encouraging on the global pharmaceutical and biotechnology front. Big Pharma is heavily invested in the research and development of new, immune-system support aids.

Market Share Analysis by Key Players & Manufacturers

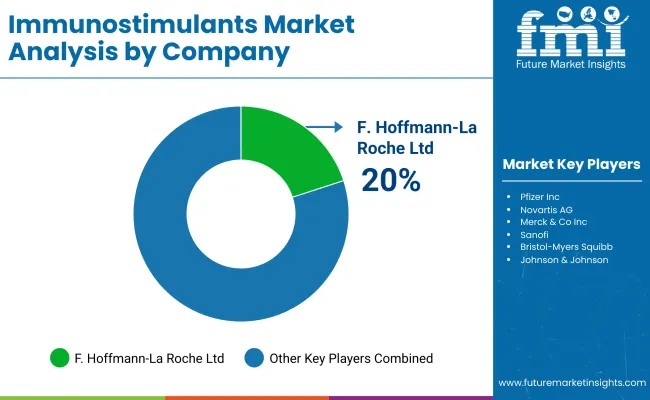

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| F. Hoffmann-La Roche Ltd | 20-25% |

| Pfizer Inc. | 15-20% |

| Novartis AG | 12-16% |

| Merck & Co., Inc. | 8-12% |

| Amgen Inc. | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| F. Hoffmann-La Roche Ltd | Immunostimulant drugs targeting oncology and infectious disease applications. |

| Pfizer Inc. | Advanced immune-boosting therapies, including colony-stimulating factors and cytokines. |

| Novartis AG | A range of immunotherapies, including interferons and vaccines. |

| Merck & Co., Inc. | Immunotherapy agents, biologics, and oncology-focused immunostimulants. |

| Amgen Inc. | Biologic immunostimulants, including granulocyte colony-stimulating factors. |

Key Market Insights

F. Hoffmann-La Roche Ltd (20-25%)

As a leader in the fields of oncology and infectious disease immunotherapies, it offers new immune-modulating drugs worldwide.

Pfizer Inc. (15-20%)

Pfizer is working to launch a strong pipeline of immunity-boosting therapies aimed at both infectious diseases and cancer treatment.

Novartis AG (12-16%)

Novartis concentrates primarily on the development of immunopathology and vaccine research to meet preventative and curative needs equally.

Merck & Co., Inc. (8-12%)

Merck specializes in the production of oncology immune-physiatrics as well its biologics, with particular emphasis on developing programs for cancer immunotherapy.

Amgen Inc. (5-9%)

Amgen's immune-boosting offerings are biologics for the recovery and resilience of the immune system.

Other Key Players (30-40% Combined)

Numerous pharmaceutical and biotech firms contribute to innovation in the immunostimulants market, including:

The overall market size for immunostimulants market was USD 128.05 Million in 2025.

The immunostimulants market is expected to reach USD 225.03 Million in 2035.

The immunostimulants market will be driven by rising cancer incidence, increasing autoimmune disorders, growing vaccine adoption, and expanding applications of colony stimulating factors, interferons, and interleukins in oncology and respiratory treatments.

The top 5 countries which drives the development of immunostimulants market are USA, European Union, Japan, South Korea and UK.

Colony Stimulating Factors demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End-User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End-User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Aquaculture Immunostimulants Market Analysis – Size, Share & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA