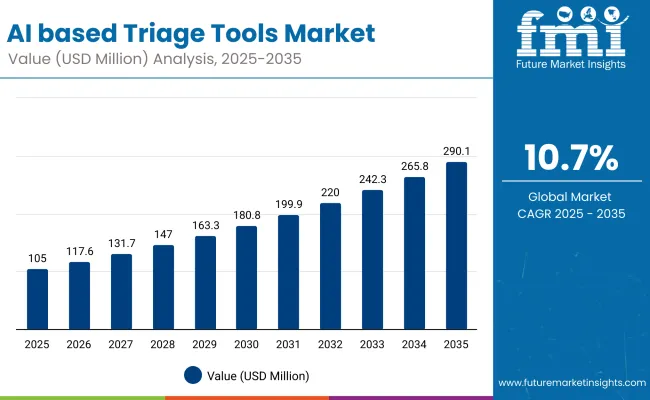

The Global AI based Triage Tools Market has been forecasted to attain a valuation of USD 104.97 million in 2025, rising to USD 290.10 million by 2035, resulting in an incremental gain of USD 185.1 million, which reflects a 36.2% increase over the forecast decade. A compound annual growth rate (CAGR) of 10.7% is expected to be recorded, indicating a rapid expansion trajectory for the global AI based triage tools market.

Global AI based Triage Tools Market Key Takeaways

| Metric | Value |

|---|---|

| Global AI based Triage Tools Market Estimated Value in (2025E) | USD 104.9 million |

| Global AI based Triage Tools Market Forecast Value in (2035F) | USD 290.1 million |

| Forecast CAGR (2025 to 2035) | 10.7 % |

Between 2025 and 2030, AI-based triage tools are expected to see broader adoption across hospitals, diagnostic imaging centers, and specialty clinics, as healthcare providers increasingly rely on AI to streamline patient prioritization, reduce diagnostic delays, and optimize workflow efficiency.

It will grow upto USD 69.5 million in that period from USD 104.9 million in 2025 to USD 174.5 million in 2030. Advances in deep learning algorithms, integration with electronic health records (EHRs), and user-friendly interfaces are making these solutions more accessible, driving adoption even among mid-tier hospitals and outpatient facilities.

Between 2030 and 2035, the market is projected to expand further by USD 115.6 million, fueled by demand from specialized care units, telemedicine platforms, and emergency response systems. Continuous improvements in natural language processing, real-time predictive analytics, and multi-modal imaging integration will define the next generation of AI-based triage tools, enabling faster, more accurate patient risk stratification.

From 2020 to 2024, the global AI based triage tools market, expanded from USD 60.4million to USD 95.7 million, transitioning from early-stage pilot deployments in select hospitals to broader commercial adoption. During this period, technology vendors partnered with healthcare institutions to integrate AI models with hospital IT infrastructure, optimize clinical workflows, and ensure regulatory compliance laying the foundation for widespread adoption of AI-driven patient triage across healthcare systems.

Looking ahead, the AI-based triage ecosystem is expected to evolve with real-time decision support, predictive outcome modeling, and interoperability with other clinical decision-making tools such as diagnostic imaging AI and remote patient monitoring. These innovations aim to reduce clinical workload, enhance patient outcomes, and expand adoption across diverse healthcare settings, positioning AI-based triage tools as a core component of modern healthcare delivery.

The growth of the global AI based triage tools market is reinforced by the unique ability of these solutions to rapidly assess patient risk levels, prioritize care delivery, and optimize healthcare workflows capabilities that conventional triage and manual systems cannot match. By combining advanced algorithms with multimodal data inputs, AI-based triage tools provide real-time insights into patient acuity, enabling faster and more accurate decision-making in high-pressure clinical environments.

Over the last decade, the scope of AI-based triage has expanded beyond experimental pilot projects into mainstream healthcare delivery. Hospitals, emergency departments, and telemedicine providers now rely on these tools to reduce wait times, enhance diagnostic accuracy, and allocate limited resources more effectively. As patient volumes rise and healthcare systems face workforce shortages, AI-driven triage is becoming an indispensable component of digital health infrastructure.

Another factor driving adoption is the integration of triage tools with existing clinical workflows. Vendors are offering turnkey platforms that seamlessly connect with electronic health records (EHRs), imaging systems, and hospital IT networks, minimizing setup complexity and ensuring interoperability. This ease of deployment is accelerating adoption not only in advanced healthcare systems but also in mid-sized hospitals and emerging-market healthcare networks.

Moreover, increasing demand from interdisciplinary domains including emergency medicine, radiology, and telehealth is fostering the development of specialized triage solutions, such as imaging-based AI triage for stroke and cardiac events or symptom-checker integration for remote patient management. These innovations are directly addressing the need for scalable, cost-efficient, and accurate patient assessment across diverse care settings.

Collectively, these clinical and technological drivers are positioning the AI-based triage tools market for sustained expansion, fueled by its critical role in enhancing patient outcomes, improving healthcare efficiency, and supporting the broader transformation toward AI-powered medical ecosystems.

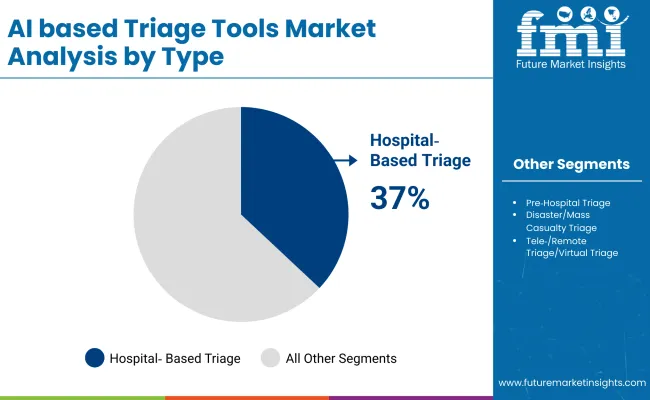

The market is segmented by type, component, deployment, end user, and region.Type includes pre-hospital triage, hospital-based triage, disaster/mass casualty triage, tele-/remote/virtual triage, and others. Component classification covers software, hardware, services, wearables/IoT integration, and others. Based on deployment, the segmentation includes on-premises, cloud-based, web-based, and mobile/app-based.

By end user, the market is segmented into hospitals/emergency departments, ambulatory surgical centers, clinics, telemedicine providers/virtual clinics, and others. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Type | Market Value Share, 2025 |

|---|---|

| Pre hospital Triage | 16.4% |

| Hospital based Triage | 37.0% |

| Disaster/Mass Casualty Triage | 7.0% |

| Tele /Remote Triage/Virtual Triage | 26.0% |

| Others | 13.6% |

Hospital-based triage is projected to lead the type category with a 37.0% market share in 2025, and is expected to maintain this dominance due to its pivotal role in emergency and acute care environments. Unlike pre-hospital or remote triage models, hospital-based systems integrate directly into emergency departments and inpatient workflows allowing providers to prioritize patients based on acuity, resource availability, and treatment urgency with unmatched reliability. These solutions form the foundation of structured patient flow management, ensuring that life-saving interventions are directed to the most critical cases first.

Recent advances in AI-driven algorithms, EHR integration, and predictive analytics have significantly enhanced hospital-based triage capabilities. Modern platforms can automate acuity scoring, streamline admissions, and generate real-time alerts for conditions such as sepsis or cardiac arrest functions that were previously reliant on manual assessment. Moreover, the incorporation of natural language processing and imaging-based decision support allows for faster, more accurate categorization across diverse patient presentations.

A key factor driving this segment’s strength is its institutional adoption at scale. Hospitals worldwide are increasingly implementing standardized triage protocols supported by software platforms that require minimal calibration and training. With the rise of cloud and mobile-compatible solutions, deployment is no longer confined to tertiary centers community hospitals and regional facilities are also rapidly adopting these tools.

As global healthcare systems continue to experience rising patient volumes and resource constraints, hospital-based triage remains indispensable. Its ability to balance patient safety with operational efficiency ensures that it continues to serve as the backbone of modern triage workflows, cementing its position as the dominant model across emergency and inpatient care settings.

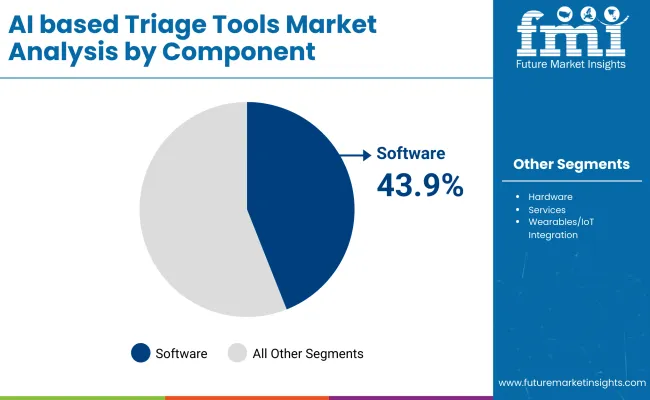

| Component | Market Value Share, 2025 |

|---|---|

| Software | 43.9% |

| Hardware | 24.3% |

| Services | 15.6% |

| Wearables / IoT Integration | 9.2% |

| Others | 7.0% |

Software continues to dominate the component landscape, accounting for 43.9% of total demand in 2025. This segment forms the backbone of AI-enabled triage, driving the core functionalities that allow healthcare providers to rapidly assess, categorize, and prioritize patients across diverse care settings. By embedding advanced algorithms, decision-support frameworks, and interoperability with electronic health records (EHRs), software solutions deliver the intelligence layer that underpins modern triage workflows.

What makes software irreplaceable is its scalability, adaptability, and continual evolution through updates and AI model training. Hospitals, clinics, and telemedicine providers can implement triage software without major hardware overhauls, enabling cost-efficient adoption. Many platforms are cloud-based, making them accessible in both high-resource hospitals and smaller or rural facilities. Over time, these systems accumulate large patient datasets, enhancing predictive accuracy and supporting comparative studies across populations.

Recent improvements in user interfaces, natural language processing, and predictive analytics have further advanced the usability and precision of software-driven triage. Integration with real-time monitoring systems and imaging tools has expanded their scope beyond symptom-checking, making them indispensable in detecting acute conditions such as sepsis, stroke, or cardiac events.

A key driver of this segment’s dominance is the institutional demand for workflow optimization. As healthcare facilities face rising patient volumes and resource strain, software solutions provide automated prioritization, reduce human error, and ensure compliance with standardized triage protocols. Additionally, their modular architecture allows customization for specific clinical environments ranging from emergency departments to virtual clinics.

While hardware, services, and IoT-enabled wearables are gaining ground in complementary roles, software remains the mainstay of the AI triage tools market, largely due to its versatility, accessibility, and central role in enabling data-driven decision-making across the healthcare ecosystem.

The adoption of AI-based triage tools is accelerating across healthcare systems worldwide as technological and clinical advancements converge to improve patient assessment and care delivery. While the market is expanding rapidly, adoption also faces structural challenges tied to infrastructure, data management, and staff readiness.

Rising patient volumes and clinician shortages are boosting adoption of AI based triage toolsThe global healthcare sector is experiencing unprecedented patient demand, driven by aging populations, increasing chronic disease prevalence, and a rising incidence of complex medical conditions. This surge in patient volume has placed significant strain on healthcare providers, contributing to clinician burnout and inefficiencies in patient flow management. AI-based triage tools have emerged as a strategic solution to address these challenges.

By leveraging advanced algorithms and machine learning models, these systems can automatically assess patient symptoms, prioritize high-risk cases, and recommend appropriate care pathways. This reduces the burden on medical staff, minimizes delays in patient evaluation, and optimizes resource allocation.

Hospitals, outpatient clinics, and telehealth platforms are increasingly deploying AI triage solutions to streamline operations while maintaining quality of care. Industry analysts note that these technologies not only enhance operational efficiency but also support better clinical decision-making by providing standardized, evidence-based guidance. As healthcare demand continues to rise globally, the adoption of AI-based triage tools is expected to accelerate, positioning them as a critical component in modern healthcare delivery and digital transformation strategies.

Shift to cloud- and mobile-enabled triage platforms for 24/7 accessCloud deployment offers centralized storage, real-time AI model updates, and seamless integration with electronic health records (EHRs) and telehealth systems, reducing reliance on local IT infrastructure. This enables healthcare providers to scale services efficiently across multiple sites while maintaining data consistency and accessibility.

Mobile-enabled triage solutions further enhance patient engagement by providing 24/7 access to symptom assessment tools through smartphones, tablets, and web applications. Patients in remote or underserved regions can receive timely guidance, reducing unnecessary hospital visits and improving overall care accessibility.

Additionally, cloud-based platforms facilitate data analytics and predictive insights, enabling providers to identify high-risk populations and manage care proactively. Experts suggest that this shift not only expands the reach of AI-based triage solutions but also supports integration with other digital health services, including telemedicine consultations and remote monitoring. As a result, cloud and mobile adoption is becoming a defining factor in the competitive positioning of vendors and the overall growth trajectory of the market.

Integration challenges with hospital IT systems and data privacy compliance.

Integrating AI triage systems with existing hospital IT infrastructure, including electronic health records (EHRs) and patient management platforms, often requires significant customization and workflow alignment. Legacy systems in many healthcare facilities may lack interoperability, creating additional barriers for seamless deployment. In addition, strict regulatory frameworks governing patient data privacy and security, such as HIPAA in the United States and GDPR in Europe, necessitate robust safeguards to protect sensitive health information.

Non-compliance can lead to substantial legal and financial repercussions, deterring smaller hospitals and clinics from adopting these solutions. Moreover, ongoing maintenance, software updates, and training of medical personnel are required to ensure accurate use and interpretation of AI-generated outputs.

Analysts highlight that these integration and compliance challenges may slow market penetration, particularly in resource-limited settings. Consequently, while AI-based triage tools offer significant potential for improving efficiency and patient outcomes, overcoming these technical and regulatory barriers remains critical for realizing their full adoption across global healthcare systems.

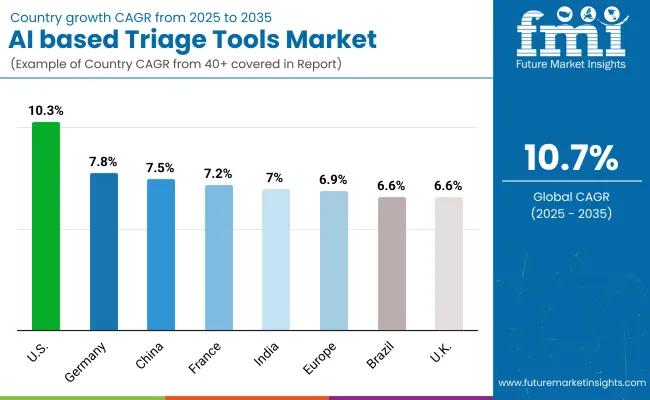

| Country | CAGR |

|---|---|

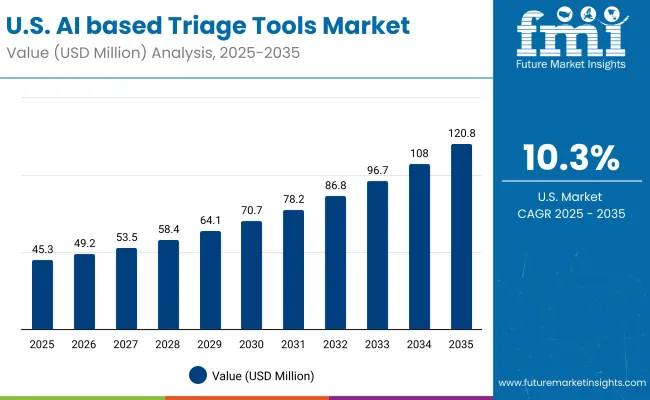

| USA | 10.3% |

| Brazil | 6.6% |

| China | 7.5% |

| India | 7.0% |

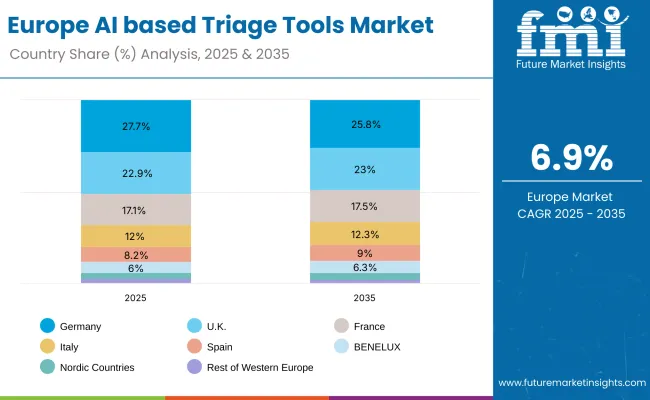

| Europe | 6.9% |

| Germany | 7.8% |

| France | 7.2% |

| UK | 6.6% |

The adoption and growth patterns of AI-based triage tools vary across regions, shaped by healthcare infrastructure maturity, regulatory frameworks, and the prevalence of digital health initiatives.

In the United States, the market is driven by a combination of high patient volumes, advanced hospital networks, and widespread adoption of electronic health records (EHRs). Hospitals and emergency departments are increasingly integrating AI-based triage systems to optimize patient flow, reduce wait times, and enhance critical decision-making.

Telemedicine providers and virtual care platforms are also accelerating adoption, supported by favorable reimbursement policies and regulatory support for digital health solutions. The USA market benefits from significant investments in AI healthcare technologies, a robust vendor ecosystem, and early adoption by leading academic medical centers. The market is projected to grow at a CAGR of 10.3%.

In Europe, countries such as Germany, France, and the UK are leading the adoption of AI-based triage tools, driven by advanced healthcare infrastructure, supportive government initiatives, and the growing integration of digital health solutions. Hospitals and emergency departments are increasingly deploying AI-driven triage systems to optimize patient flow, improve care prioritization, and enhance operational efficiency. Telemedicine and cloud-based platforms further support market expansion, particularly in remote and outpatient care settings.

The market is projected to account for 8.2% in Germany, 7.6% in France, and 6.9% in the UK, reflecting both the maturity of healthcare systems and the cautious yet steady adoption of AI technologies. Regulatory support, strategic funding, and investments in healthcare digitization continue to foster growth, while considerations around data security, staff training, and workflow integration moderate the pace of adoption.

Overall, the AI-based triage tools market in Europe reflects a careful balance between technological innovation, policy support, and institutional readiness, highlighting the key role that regional healthcare priorities and infrastructure play in shaping adoption trajectories.

The AI-based triage tools market in the United States is projected to grow at a CAGR of 10.3% between 2025 and 2035. The USA remains the most mature and research-intensive market for AI-enabled triage, with wide integration into hospital emergency departments, large health systems, and telemedicine networks. Academic medical centers such as Mayo Clinic, Cleveland Clinic, and Johns Hopkins Hospital have been pivotal in demonstrating the clinical value of AI triage in emergency care and inpatient workflows.

The global AI-based triage tools market in India is expected to grow at a CAGR of 7.0% between 2025 and 2035, driven by rising healthcare digitization and increased adoption of telemedicine. Hospitals and health networks in Delhi, Mumbai, and Bangalore are pioneering AI-enabled triage implementations, but widespread deployment remains limited due to infrastructure gaps and uneven digital literacy.

China’s global AI-based triage tools market is projected to expand at a CAGR of 7.5% from 2025 to 2035. Growth is driven by government investment in smart hospital infrastructure, large-scale telehealth platforms, and AI-powered patient management systems. Tsinghua University has officially launched Agent Hospital, the world’s first fully AI-powered virtual hospital.

This facility employs autonomous AI agents to simulate the entire patient care cycle, including triage. Powered by the MedAgent-Zero framework developed by Tsinghua’s Institute for AI Industry Research (AIR), Agent Hospital enables AI agents to self-evolve by interacting with simulated patients.

| Europe Country | 2025 |

|---|---|

| Germany | 27.7% |

| UK | 22.9% |

| France | 17.1% |

| Italy | 12.0% |

| Spain | 8.2% |

| BENELUX | 6.0% |

| Nordic Countries | 3.4% |

| Rest of Western Europe | 2.7% |

| Europe Country | 2035 |

|---|---|

| Germany | 25.8% |

| UK | 23.0% |

| France | 17.5% |

| Italy | 12.3% |

| Spain | 9.0% |

| BENELUX | 6.3% |

| Nordic Countries | 4.1% |

| Rest of Western Europe | 2.0% |

The AI-based triage tools market in the United Kingdom is projected to grow at a CAGR of 6.6% between 2025 and 2035. The market is supported by advanced hospital networks, national digital health initiatives, and growing interest in AI-enabled patient triage. NHS institutions are actively piloting AI-based triage systems to enhance patient care. For instance, King's College Hospital and Guy's and St Thomas' NHS Foundation Trusts are collaborating with King's College London and UCL to develop and test AI tools that predict medical events and support clinical decision-making.

The AI-based triage tools market in Germany is expected to grow at a CAGR of 7.8% between 2025 and 2035. Germany’s strong healthcare infrastructure, emphasis on hospital digitization, and academic research programs are driving interest in AI triage solutionsCharité’s AI Hub and the Charité Lab for Artificial Intelligence in Medicine (CLAIM) develop and validate machine learning models, including predictive algorithms relevant to emergency and outpatient triage.

Real-world testing provides insights into accuracy, reliability, and usability, supporting both local adoption and global applications. These initiatives contribute directly to the growth and deployment of AI-based triage tools in the international healthcare market.

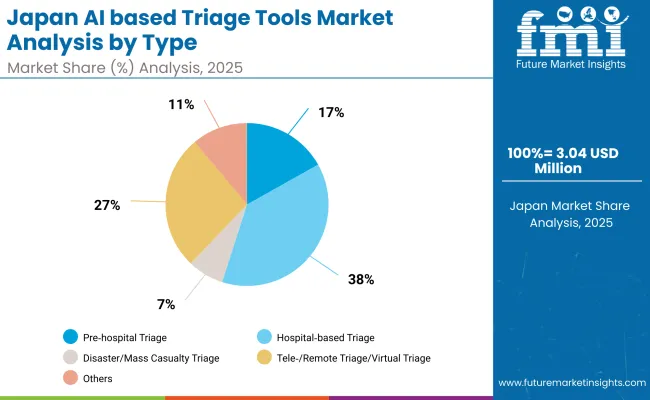

| Type | Market Value Share, 2025 |

|---|---|

| Pre hospital Triage | 16.9% |

| Hospital based Triage | 38.1% |

| Disaster/Mass Casualty Triage | 7.2% |

| Tele /Remote Triage/Virtual Triage | 26.8% |

| Others | 11.1% |

The AI-based triage tools market in Japan has been projected to reach USD 3.0 million by 2025 with hospital-based triage leading the landscape at 38.1%, followed by tele-/remote triage at 26.8%. The market is shaped by Japan’s strong emphasis on digital healthcare, emergency medicine, and telehealth innovation.

Hospitals and healthcare institutions, including University of Tokyo Hospital, Keio University Hospital, and Osaka University Hospital, are increasingly piloting AI-driven triage systems to improve patient prioritization, optimize workflow, and extend care access to both urban and rural areas.

Many institutions are implementing AI platforms that integrate predictive algorithms, electronic health record (EHR) interoperability, and remote monitoring, enabling real-time triage decisions across pre-hospital, in-hospital, and virtual care settings. This multi-modal approach allows clinicians to respond more effectively to high-acuity cases, monitor chronic patients remotely, and manage patient flow during emergencies.

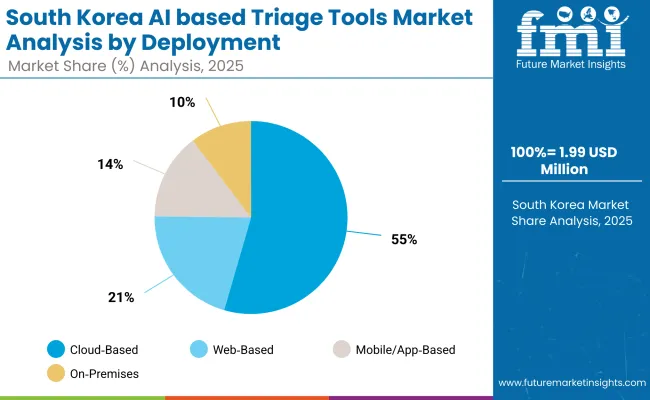

| Deployment | Market Value Share, 2025 |

|---|---|

| On premises | 10.3% |

| Cloud based | 54.5% |

| Web based | 20.7% |

| Mobile/App based | 14.5% |

The AI-based triage tools market in South Korea has been projected to reach USD 1.99 million in 2025 with cloud-based deployment leading the segment at 54.5%, followed by web-based platforms at 20.7%. South Korea’s market is evolving from pilot projects in major hospitals toward broader national adoption across emergency care, telemedicine, and digital health services.

Leading institutions such as Seoul National University Hospital, Samsung Medical Center, and Asan Medical Center are actively testing AI triage platforms to optimize patient flow, improve early warning systems, and integrate remote monitoring with in-hospital workflows.

Many hospitals are deploying cloud-enabled AI platforms that combine predictive algorithms, electronic health record (EHR) interoperability, and real-time patient monitoring, enabling rapid triage decisions across multiple care settings. This approach allows clinicians to prioritize high-acuity cases efficiently, support telemedicine consultations, and extend triage capabilities to regional and rural healthcare centers.

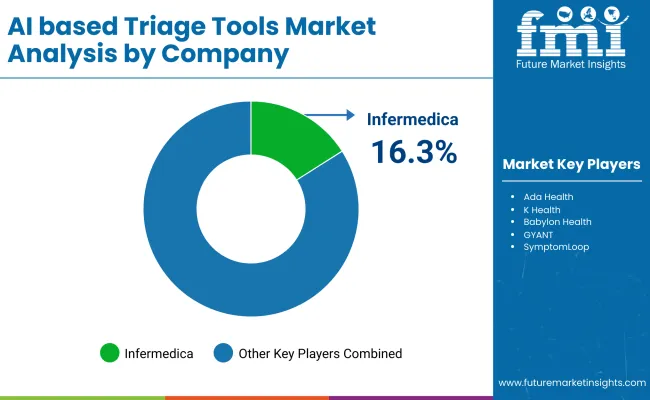

| Company | Global Value Share 2024 |

|---|---|

| Infermedica | 16.3% |

| Others | 83.7% |

The AI-based triage tools market is moderately concentrated, with Infermedica holding a leading global position due to its advanced AI symptom checker, clinical decision support algorithms, and seamless integration with electronic health record (EHR) systems.

The company’s dominance is rooted in its platform approach offering cloud-based and mobile-compatible solutions, predictive triage analytics, and workflow optimization tools. Infermedica also provides robust support for multi-language deployment and telemedicine integration, positioning itself as a go-to vendor for AI-assisted patient triage across hospitals, clinics, and virtual care networks.

Other key players include Ada Health, K Health, Babylon Health, GYANT, Rapid Health, SymptomLoop, Sully.ai, Predictmedix, aiTriage, Aidoc, Mediktor, Buoy Health, Sensely, HealthTap, TriageLogic, and eConsult Health, each addressing different segments of the AI triage ecosystem.

Key Developments in Global AI based Triage Tools Market

| Item | Value |

|---|---|

| Quantitative Units | USD 104.97 million |

| By Type | Pre hospital triage, hospital based triage, disaster/mass casualty triage, tele /remote triage/virtual triage, others |

| Component | Software, hardware, services, wearables / IoT integration, others |

| Deployment | On premises, cloud based, web based, mobile/app based |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | Infermedica , Ada Health, K Health, Babylon Health, GYANT, Rapid Health, SymptomLoop , Sully.ai, Predictmedix , aiTriage , Aidoc , Mediktor , Buoy Health, Sensely , HealthTap , TriageLogic , eConsult Health and others |

The global AI based triage tools market is estimated to be valued at USD 104.97 million in 2025.

The market size for the global AI based triage tools market is projected to reach approximately USD 290.10 million by 2035.

The global AI based triage tools market is expected to grow at a CAGR of 10.7% between 2025 and 2035.

The key product formats in the global AI based triage tools market include Pre hospital triage, hospital based triage, disaster/mass casualty triage, tele /remote triage/virtual triage and others.

In terms of Component, Software is projected to command the highest share at 43.9% in the global AI based triage tools market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-powered In-car Assistant Market Forecast and Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

AI-defined Vehicle Market Forecast and Outlook 2025 to 2035

AI in Oil and Gas Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA