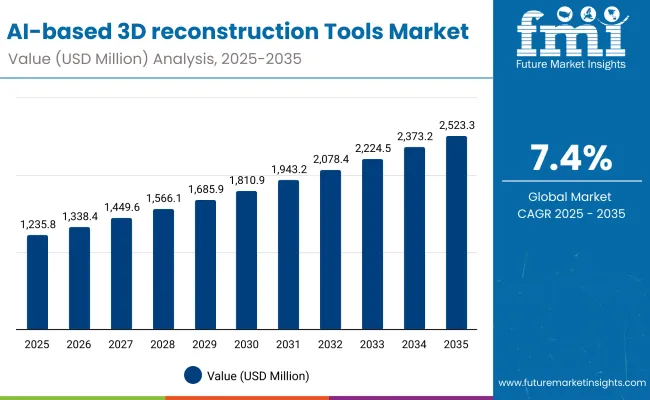

The Global AI-based 3D reconstruction Tools Market has been forecasted to attain a valuation of USD 1,235.8 million in 2025, rising to USD 2,523.43 million by 2035, resulting in an incremental gain of USD 1,287.63 million, which reflects a 49% increase over the forecast decade. A compound annual growth rate (CAGR) of 7.4% is expected to be recorded, indicating a rapid expansion trajectory for the Global AI-based 3D reconstruction Tools Market.

Global AI-based 3D reconstruction Tools Market Key Takeaways

| Metric | Value |

|---|---|

| Global AI-based 3D reconstruction Tools Market Estimated Value in (2025E) | USD 1,235.8 million |

| Global AI-based 3D reconstruction Tools Market Forecast Value in (2035F) | USD 2,523.43 million |

| Forecast CAGR (2025 to 2035) | 7.4 % |

Between 2025 and 2030, AI-based 3D reconstruction tools will see broader adoption across industries such as architecture, gaming, healthcare, and manufacturing, as organizations increasingly leverage AI-driven automation for precise 3D modeling, virtual simulations, and digital twin creation.

It will grow upto USD 530.1 million in that period from USD 1,235.8million in 2025 to USD 1,765.9 million in 2030, driven by the convergence of advanced AI algorithms with user-friendly software platforms, cloud-based processing, and real-time collaboration tools making 3D reconstruction more accessible.

Between 2030 and 2035, the market is projected to expand further by USD 757.5million, fueled by advances in deep learning, multi-modal data integration, and real-time 3D reconstruction capabilities. Demand will rise from emerging applications in medical imaging, heritage preservation, autonomous systems, and digital twins for industrial operations. Continuous innovation in AI model accuracy, GPU/edge computing, and multi-sensor fusion will define the next generation of 3D reconstruction tools.

From 2020 to 2024, the Global AI-based 3D reconstruction Tools Market, expanded from USD 869.0 million to USD 1,165.4 million, aturing through the proliferation of cloud-based platforms, open-source software, and cross-industry adoption. During this period, software developers collaborated with hardware vendors and research institutions to streamline processing pipelines, optimize 3D reconstruction workflows, and improve user experience laying the foundation for its adoption.

Going forward, the AI-based 3D reconstruction ecosystem is likely to evolve to incorporate AI-powered error correction, hybrid modeling with photogrammetry and LiDAR, and real-time integration with AR/VR platforms. These innovations aim to reduce the learning curve, improve throughput, and expand interdisciplinary usability making AI-driven 3D reconstruction an essential tool for industrial design, entertainment, and scientific research.

The growth of the Global AI-Based 3D Reconstruction Tools Market is reinforced by the unique ability of these tools to generate highly accurate, automated 3D models from 2D images, video streams, or sensor data critical for industries ranging from architecture and construction to healthcare and entertainment. Unlike traditional 3D modeling techniques, AI-driven reconstruction provides faster processing, real-time error correction, and scalability, enabling organizations to visualize complex objects, environments, or structures with unprecedented precision.

Over the last decade, the scope of AI-based 3D reconstruction has expanded beyond specialized research applications. It is now widely used in virtual and augmented reality, digital twin creation, reverse engineering, and autonomous vehicle mapping. As industries increasingly rely on precise spatial data for simulation, predictive analysis, and immersive experiences, AI-based 3D reconstruction tools have become essential for both R&D and commercial deployment.

Another factor driving adoption is the integration of AI algorithms with accessible, cloud-enabled software platforms. Vendors now offer turnkey solutions that combine deep learning, multi-sensor fusion, and GPU acceleration, allowing organizations to deploy high-accuracy 3D reconstruction without extensive expertise or expensive hardware. This democratization is transforming the accessibility of these tools, particularly in emerging markets and mid-tier enterprises.

Moreover, increasing demand from interdisciplinary applications including healthcare imaging, urban planning, cultural heritage preservation, and industrial inspection is fostering the development of specialized AI-based reconstruction workflows. These systems cater to the growing need for real-time modeling, multi-modal data integration, and automated quality assessment across diverse sectors.

Collectively, these technological and industry drivers are positioning the AI-based 3D reconstruction tools market for sustained expansion, fueled by its essential role in accelerating design, analysis, and visualization in the digital economy.

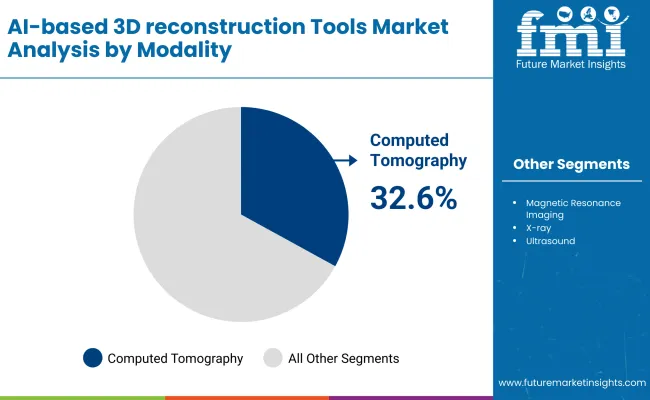

The market is segmented by modality, technology models, deployment type, clinical application, and end user. By modality, the market includes computed tomography (CT), magnetic resonance imaging (MRI), X-ray, ultrasound, and PET/SPECT. In terms of technology models, the segmentation covers AI algorithms, reconstruction models, self-/semi-supervised learning, multi-modal learning, and cloud/edge deployment.

Based on deployment type, solutions are classified as on-premise, cloud-based, or hybrid. By clinical application, the market serves radiology, surgical planning, oncology, orthopedics, cardiology, dentistry/maxillofacial, and digital pathology.

Based on end users, the market caters to hospitals, imaging centers, medical device companies, and research institutions.Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Modality | Market Value Share, 2025 |

|---|---|

| Computed Tomography | 32.6% |

| Magnetic Resonance Imaging | 24.1% |

| X-ray | 20.0% |

| Ultrasound | 14.9% |

| PET/SPECT | 8.4% |

Computed Tomography (CT) systems are projected to lead the modality segment with a 32.6% market share in 2025, and are expected to maintain this position due to their ability to deliver high-resolution, rapid volumetric imaging across a wide range of clinical applications. Unlike other imaging modalities, CT combines speed, spatial resolution, and quantitative capability, enabling accurate assessment of complex anatomical structures, trauma evaluation, and advanced diagnostic procedures such as vascular imaging and oncology staging.

Recent advances in multi-detector CT, iterative reconstruction algorithms, and low-dose imaging technology have significantly enhanced image quality while minimizing patient exposure. Moreover, integration with AI-powered post-processing software allows automated segmentation, lesion detection, and 3D visualization, boosting diagnostic efficiency and supporting precision medicine initiatives.

A key factor behind CT’s dominance is its widespread adoption across hospitals, diagnostic imaging centers, and specialized clinics. With vendors now offering scalable systems ranging from compact mobile units to high-end multi-slice scanners, CT has become accessible to both urban tertiary care centers and mid-sized healthcare facilities. Its relatively high throughput, broad clinical utility, and ability to serve as a backbone for multi-modal imaging workflows further reinforce its leading position.

As demand for advanced diagnostics, personalized medicine, and rapid intervention continues to grow, the ease of use, versatility, and resolution superiority of CT systems ensure they remain the preferred modality, driving sustained adoption and shaping the future of medical imaging across global markets.

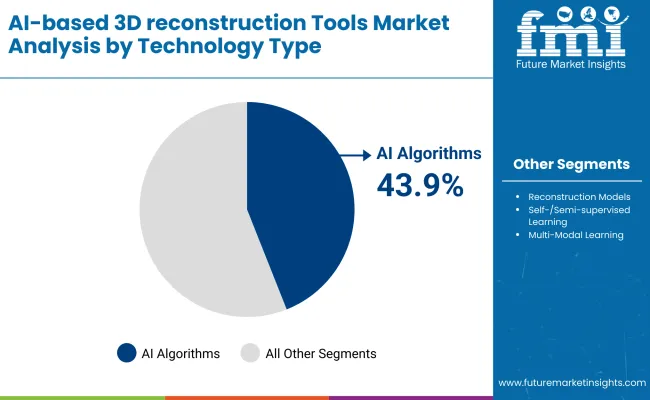

| Technology Type | Market Value Share, 2025 |

|---|---|

| AI Algorithms | 43.9% |

| Reconstruction Models | 24.3% |

| Self-/Semi-supervised Learning | 15.6% |

| Multi-Modal Learning | 9.2% |

| Cloud / Edge Deployment | 7.0% |

AI algorithms continue to dominate the technology segment, accounting for 43.9% of total market value in 2025. These algorithms form the backbone of 3D reconstruction workflows, enabling rapid conversion of 2D images or sensor data into accurate 3D models with high precision and minimal manual intervention. As the primary driver of reconstruction accuracy, AI algorithms are essential for applications ranging from industrial inspection and autonomous navigation to medical imaging and digital twin creation.

What makes AI algorithms irreplaceable is their versatility, adaptability, and mature development ecosystem. Many software platforms have integrated deep learning, convolutional neural networks, and other AI approaches into scalable pipelines, creating a rich framework for real-time, high-fidelity reconstruction. These algorithms are particularly effective in handling noisy data, occlusions, and complex geometries, ensuring reliable output across diverse industry applications.

Recent advances in model architecture, training datasets, and GPU/edge acceleration have further enhanced the speed, accuracy, and usability of AI algorithms. Moreover, ongoing academic research, industry collaborations, and open-source initiatives continue to expand capabilities, ensuring a sustained pipeline of innovation and adoption.

While other technologies such as reconstruction models, self-supervised learning, and multi-modal learning are gaining traction for specialized tasks, AI algorithms remain the mainstay of the global market due to their broad applicability, scalability, and proven effectiveness across multiple sectors and deployment environments.

The adoption of AI-based 3D reconstruction tools is accelerating across multiple industries as advances in artificial intelligence, computer vision, and sensor integration converge to enable highly accurate and automated 3D modeling. While momentum is strong, the market also faces structural limitations related to computational complexity, data quality requirements, and integration challenges with existing industrial or research workflows.

Growing Role in Industrial and Research Applications AI-based 3D reconstruction has become essential in architecture, industrial design, healthcare imaging, autonomous vehicle mapping, and digital twin development.

These tools provide rapid, high-fidelity modeling from 2D images or multi-sensor input, allowing organizations to visualize complex structures, simulate real-world conditions, and perform predictive analysis in ways conventional 3D modeling cannot achieve. As demand for automation, precision, and real-time analysis rises, AI-driven reconstruction is becoming a standard tool in product development, quality assurance, and research validation workflows.

Shift Toward Accessible Platforms The market is expanding as more companies and labs adopt cloud-enabled, turnkey 3D reconstruction solutions. These platforms combine advanced AI algorithms with simplified interfaces and multi-modal sensor integration, making them usable even by operators with limited technical expertise.

GPU acceleration, edge computing, and cloud processing allow high-end reconstruction without the need for large on-site computational infrastructure. Organizations investing in in-house capabilities are increasingly equipping research labs and design centers with these tools, extending the market beyond traditional high-tech adopters.

Computational, Data, and Expertise Constraints AI-based 3D reconstruction requires significant computational resources, high-quality input data, and expertise in AI model selection and evaluation. Complex multi-sensor setups and integration with legacy systems can slow adoption, while data privacy and standardization concerns create additional operational constraints.

Smaller enterprises or field operations may struggle to fully leverage the capabilities of advanced reconstruction tools without proper infrastructure and trained personnel. These factors remain key restraints in expanding adoption beyond specialized research centers and leading industrial users.

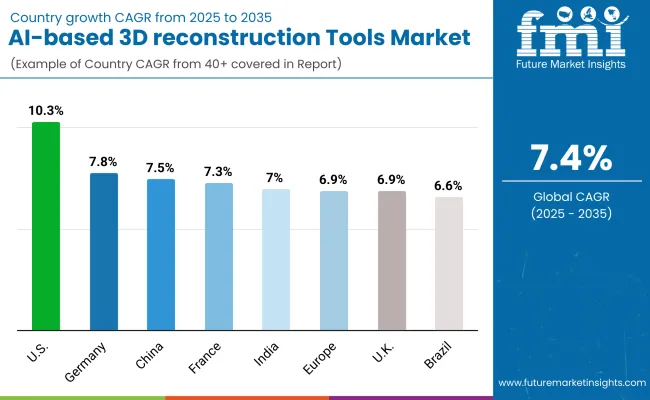

| Country | CAGR |

|---|---|

| USA | 10.3% |

| Brazil | 6.6% |

| China | 7.5% |

| India | 7.0% |

| Europe | 6.9% |

| Germany | 7.8% |

| France | 7.3% |

| UK | 6.9% |

The adoption and growth patterns of AI-based 3D reconstruction tools vary significantly across regions, shaped by the maturity of digital infrastructure, government and private investment in AI technologies, and industry-specific application demand.

In the United States, the market is marked by strong expansion, supported by a well-established ecosystem of tech companies, research institutions, and industrial adopters in sectors such as autonomous vehicles, healthcare imaging, architecture, and industrial design.

The widespread availability of high-performance computing resources, cloud platforms, and AI frameworks enables rapid deployment and integration of 3D reconstruction tools. Demand is particularly strong in advanced manufacturing and R&D environments, where precise digital twins, simulation models, and real-time reconstruction capabilities are critical. The USA market is projected to grow at a CAGR of 10.3%

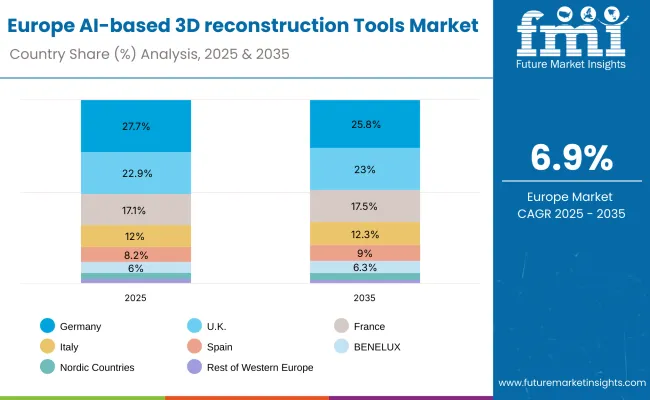

In Europe, countries such as Germany, France, and the UK are leading the adoption of AI-based 3D reconstruction tools, with a growing emphasis on integrating these technologies into smart manufacturing, urban planning, and research-driven innovation initiatives.

Government-backed programs, public-private partnerships, and investments in AI infrastructure have simplified collaboration between universities, industrial firms, and technology startups, enabling the deployment of advanced reconstruction workflows for applications such as digital twins, immersive simulations, and precision design.

Regulatory support for AI deployment, strategic funding for R&D, and cloud computing incentives foster sustained market growth, although adoption remains measured as organizations evaluate integration challenges and data standardization requirements. The market in Germany is expected to expand at a CAGR of 7.8%, France at 7.3%, and the UK at 6.9%.

Overall, the global AI-based 3D reconstruction tools market reflects a strategic blend of technological innovation, digital transformation priorities, and institutional investment, which collectively govern the pace and scale of adoption across different regions. This dynamic interplay underscores the central role that regional policies, computational infrastructure, and technical expertise play in shaping the trajectory of this rapidly evolving technology market.

The Global AI-based 3D Reconstruction Tools Market in the United States has been forecasted to expand at a CAGR of 10.3% between 2025 and 2035. The United States remains the most mature and research-intensive market for AI-based 3D reconstruction, with long-standing integration into healthcare imaging, automotive prototyping, architecture, and entertainment applications.

Universities such as MIT, Stanford, and Carnegie Mellon, alongside institutions like the National Institute of Standards and Technology (NIST), have been pivotal in setting global benchmarks for AI-driven 3D reconstruction workflows. The USA also hosts several of the world’s most advanced medical imaging centers, autonomous vehicle test facilities, and digital infrastructure labs, providing routine access to high-resolution datasets and computing resources.

The AI-based 3D reconstruction tools market in India is expected to grow at a CAGR of 7.0% between 2025 and 2035, driven by increasing demand from sectors such as healthcare, urban planning, education, and e-commerce. Although the market is still in its nascent stages, academic and industrial interest is rising, with leading institutions making significant strides in integrating AI for 3D modeling and spatial analysis.

The adoption of AI-based 3D reconstruction is particularly focused in high-tech cities and top-tier research institutions, while broader commercial deployment remains limited due to infrastructure gaps.

China’s AI-based 3D reconstruction tools market is projected to expand at a CAGR of 7.5% from 2025 to 2035, driven by rapid advancements in AI research, high investment in infrastructure, and strong demand from sectors like autonomous vehicles, urban planning, robotics, and smart manufacturing. With significant investments in AI and deep learning, China is increasingly adopting AI-driven 3D modeling for a variety of applications, from digital twins in smart cities to real-time modeling in robotics. Major institutions and industries are integrating these tools into both R&D and commercial projects, strengthening China’s leadership in the global 3D reconstruction market.

| Europe Country | 2025 |

|---|---|

| Germany | 27.7% |

| UK | 22.9% |

| France | 17.1% |

| Italy | 12.0% |

| Spain | 8.2% |

| BENELUX | 6.0% |

| Nordic Countries | 3.4% |

| Rest of Western Europe | 2.7% |

| Europe Country | 2035 |

|---|---|

| Germany | 25.8% |

| UK | 23.0% |

| France | 17.5% |

| Italy | 12.3% |

| Spain | 9.0% |

| BENELUX | 6.3% |

| Nordic Countries | 4.1% |

| Rest of Western Europe | 2.0% |

The AI-based 3D reconstruction tools market in the United Kingdom is projected to grow at a CAGR of 6.9% between 2025 and 2035, driven by strong demand from industries such as healthcare, automotive, urban planning, and entertainment. The UK has a well-established track record in AI research and development, with major universities and research institutions playing a pivotal role in advancing 3D modeling technologies.

Leading institutions like the University of Oxford, University of Cambridge, and Imperial College London are at the forefront of applying AI techniques to enhance the speed and accuracy of 3D reconstructions for both academic research and commercial applications.

The Global AI-based 3D Reconstruction Tools Market in Germany is anticipated to grow at a CAGR of 7.8% between 2025 and 2035. Germany is positioning itself as a key industrial hub for high-precision AI-based 3D reconstruction applications, particularly in medical imaging, automotive prototyping, and industrial design.

While academic research remains strong, much of the current growth is fueled by collaborations between technical universities, research institutes, and commercial software and hardware developers. German firms are playing a strategic role in developing AI-powered reconstruction subsystems-including advanced imaging sensors, high-performance computing pipelines, and real-time processing algorithms-which are now being integrated into global platforms.

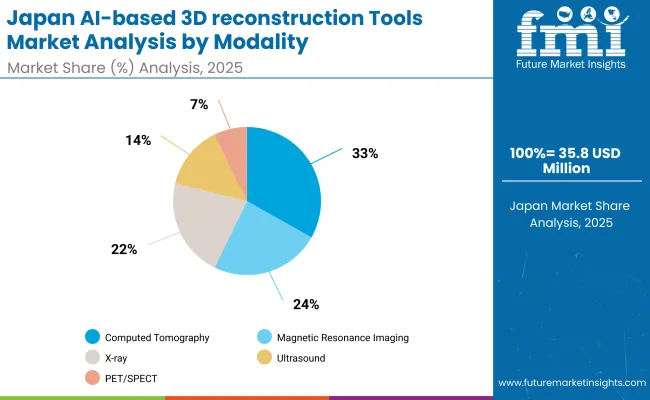

| Modality | Market Value Share, 2025 |

|---|---|

| Computed Tomography | 33.2% |

| Magnetic Resonance Imaging | 24.0% |

| X-ray | 21.7% |

| Ultrasound | 13.8% |

| PET/SPECT | 7.3% |

The Global AI-based 3D Reconstruction Tools Market in Japan has been projected to reach USD 320 million by 2025. Computed Tomography (CT)-based reconstruction will lead the modality landscape with a 33.2% share, followed by Magnetic Resonance Imaging (MRI) at 24.0%. The Japanese market is shaped by a strong tradition of medical imaging, robotics, and industrial design research.

Universities and research institutes such as the University of Tokyo, RIKEN, and Osaka University have made AI-driven 3D reconstruction central to applications ranging from surgical planning and diagnostic workflows to precision manufacturing and autonomous system simulation. Many institutions operate both AI-enhanced software platforms and in-lab imaging setups, enabling diverse experimentation from real-time model generation to multi-modality integration.

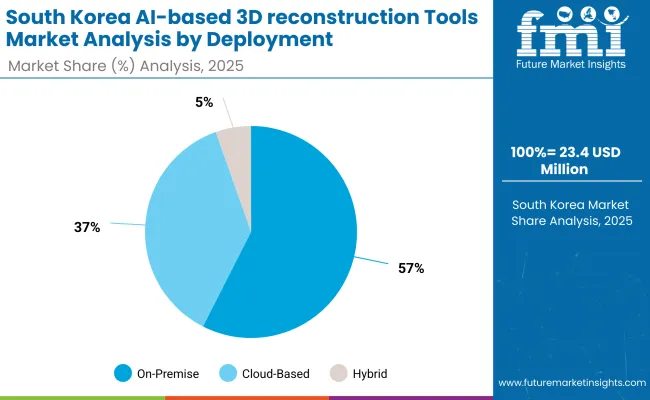

| Deployment Type | Market Value Share, 2025 |

|---|---|

| On-Premise | 57.5% |

| Cloud-Based | 37.1% |

| Hybrid | 5.4% |

The Global AI-based 3D Reconstruction Tools Market in South Korea has been projected to reach USD 150 million in 2025. On-premise deployment is expected to lead with a 57.5% share, followed by cloud-based solutions at 37.1%. South Korea’s market is evolving from academic research toward industrial-grade and commercial applications, particularly in healthcare imaging, automotive prototyping, and precision manufacturing.

National institutes such as the Korea Institute of Science and Technology (KIST) and POSTECH are spearheading advanced AI-based 3D reconstruction research, focusing on high-fidelity model generation, real-time processing, and integration with robotics and sensor networks. A key differentiator for South Korea is the early-stage adoption of AI-driven 3D reconstruction in industrial R&D, supporting rapid prototyping, digital twin creation, and quality inspection workflows.

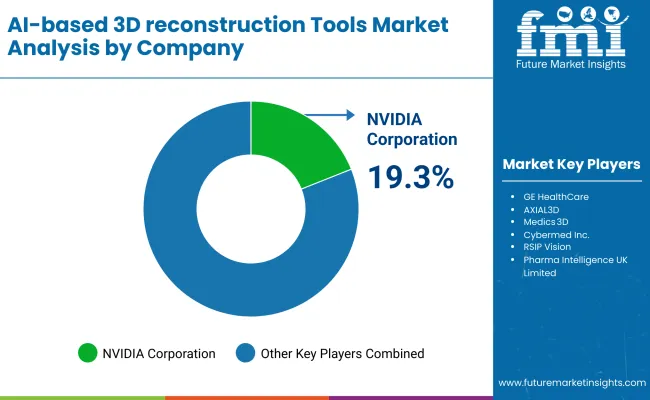

| Company | Global Value Share 2025 |

|---|---|

| NVIDIA Corporation | 19.3% |

| Others | 80.7% |

The AI-based 3D reconstruction tools market is moderately concentrated, with NVIDIA Corporation holding a leading global position due to its specialization in AI hardware, GPU-accelerated computation, and AI-driven 3D modeling frameworks.

NVIDIA’s dominance is rooted in its integrated ecosystem approach offering GPU platforms, optimized AI toolkits, and software frameworks that accelerate real-time 3D reconstruction across medical, industrial, and simulation applications. The company also provides robust support for cloud- and on-premise deployments, positioning itself as the preferred vendor for high-performance reconstruction workflows.

Other key players include XPlan.ai, GE HealthCare, AXIAL3D, Medics 3D, Cybermed Inc., RSIP Vision, Pharma Intelligence UK Limited, Infervision, iSchemaView, Materialise, and Pareidolia Systems LLP, each addressing specific segments of the market.

XPlan.ai and AXIAL3D are particularly strong in medical imaging workflows and surgical planning, while GE HealthCare and Medics 3D focus on clinical applications. Together, these players, along with smaller vendors, account for 80.7% of the market outside NVIDIA’s 19.3% share, reflecting a competitive landscape.

Key Developments in Global AI-based 3D reconstruction Tools Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,235.8 million |

| Modality | Computed Tomography, Magnetic Resonance Imaging, X-ray, Ultrasound, PET/SPECT |

| Technology Models | AI Algorithms, Reconstruction Models, Self-/Semi-Supervised Learning, Multi-Modal Learning, Cloud/Edge Deployment |

| End User | Hospitals, Imaging Centers, Medical Device Companies, Research Institutions |

| Deployment Type | On-Premise, Cloud-Based, Hybrid |

| Clinical Application | Radiology, Surgical Planning, Oncology, Orthopedics, Cardiology, Dentistry/Maxillofacial, Pathology (Digital) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | NVIDIA Corporation, XPlan.ai, GE HealthCare, AXIAL3D, Medics 3D, Cybermed Inc., RSIP Vision, Pharma Intelligence UK Limited, Infervision , iSchemaView , Inc., Materialise , Pareidolia Systems LLP and others |

The global Global AI-based 3D reconstruction Tools Market is estimated to be valued at USD 1,235.8 million in 2025.

The market size for the Global AI-based 3D reconstruction Tools Market is projected to reach approximately USD 2,523.43 million by 2035.

The Global AI-based 3D reconstruction Tools Market is expected to grow at a CAGR of 7.4% between 2025 and 2035.

The key Modality formats in the Global AI-based 3D reconstruction Tools Market include Computed Tomography, Magnetic Resonance Imaging, X-ray, Ultrasound, PET/SPECT.

In terms of technology, AI Algorithms segment is projected to command the highest share at 43.9% in the Global AI-based 3D reconstruction Tools Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA