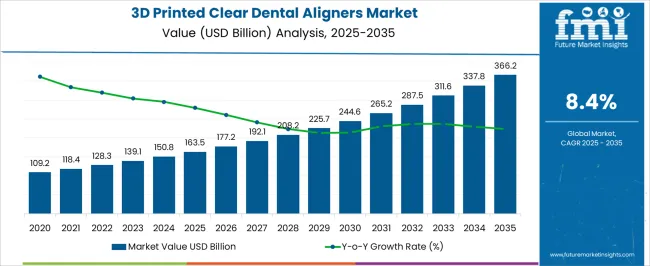

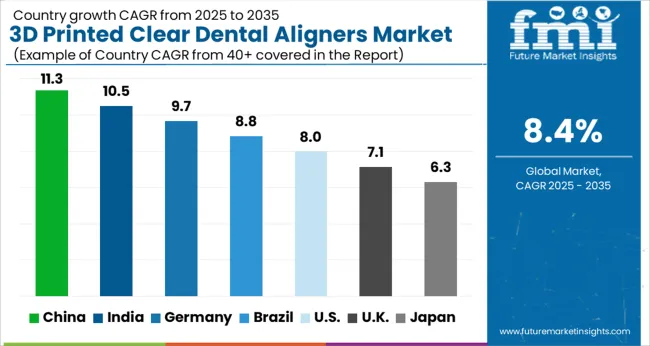

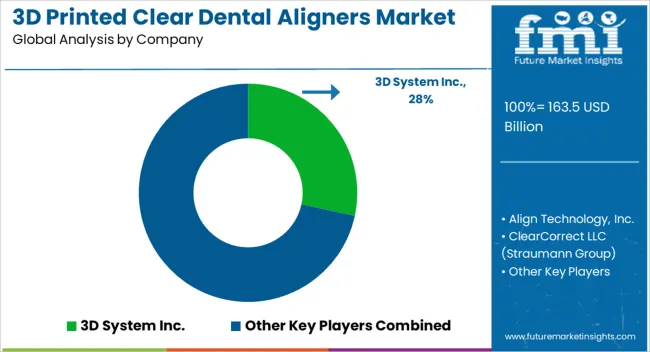

The 3D Printed Clear Dental Aligners Market is estimated to be valued at USD 163.5 billion in 2025 and is projected to reach USD 366.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| 3D Printed Clear Dental Aligners Market Estimated Value in (2025 E) | USD 163.5 billion |

| 3D Printed Clear Dental Aligners Market Forecast Value in (2035 F) | USD 366.2 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The 3D printed clear dental aligners market is experiencing robust growth driven by the rising demand for aesthetic orthodontic solutions, increasing adoption of digital dentistry, and advancements in 3D printing technology. The shift toward minimally invasive treatments and personalized orthodontics has fueled the adoption of clear aligners that combine precision fit with enhanced comfort.

Integration of advanced materials with higher transparency and durability is enabling better clinical outcomes and patient satisfaction. Furthermore, the digitalization of dental workflows, from intraoral scanning to computer aided design and 3D printing, is accelerating production efficiency and reducing chairside time.

Rising dental tourism and increasing awareness about cosmetic dentistry are also influencing adoption rates globally. The market outlook remains strong as more patients and practitioners prioritize treatment effectiveness, aesthetic appeal, and accessibility in orthodontic care.

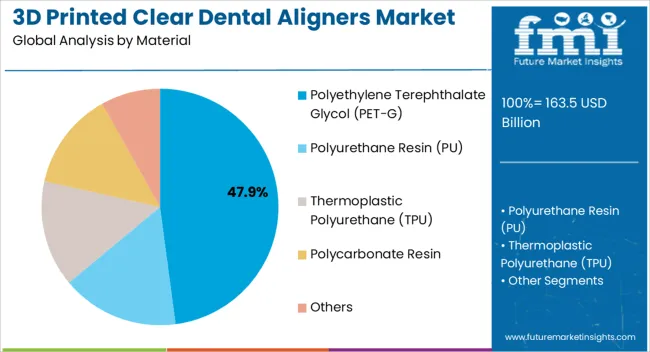

The polyethylene terephthalate glycol material segment is projected to account for 47.90% of total revenue by 2025 within the material category, making it the leading segment. Its dominance is supported by the material’s strength, flexibility, and biocompatibility, which are essential for maintaining comfort while providing effective teeth alignment.

The clarity and resistance to impact also enhance its suitability for long term orthodontic use. Continuous improvements in PET G formulations tailored for medical applications have further strengthened its role in aligner manufacturing.

As dental practitioners emphasize patient safety, performance, and aesthetics, PET G has become the most widely adopted material in this market.

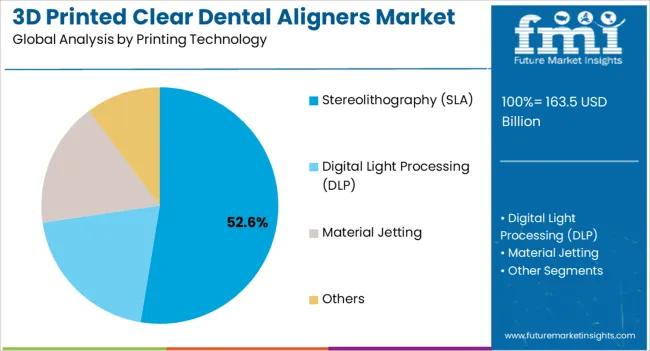

The stereolithography printing technology segment is expected to hold 52.60% of the market share by 2025 within the printing technology category, establishing it as the dominant method. The precision and surface quality offered by SLA printing are critical in creating aligners that provide accurate fit and comfort.

Faster production cycles and the ability to generate detailed geometries have further elevated its adoption in dental laboratories and hospitals. Additionally, compatibility with a wide range of dental resins enhances customization and patient specific treatment options.

As orthodontic practices move toward high efficiency digital workflows, SLA remains the preferred printing technology driving accuracy and consistency in aligner manufacturing.

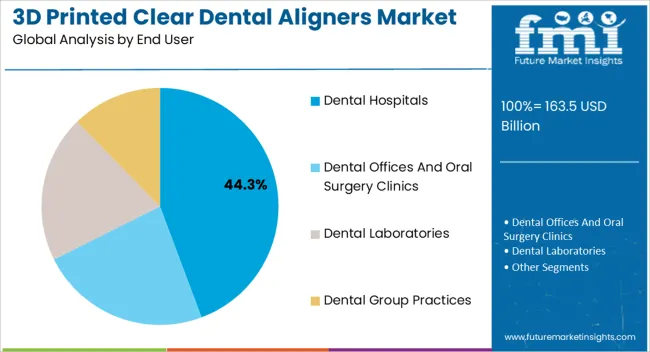

The dental hospitals segment is projected to contribute 44.30% of total revenue by 2025 within the end user category, positioning it as the most significant segment. This is driven by the availability of advanced infrastructure, specialized orthodontists, and the integration of digital dentistry systems within hospital settings.

The ability to manage high patient volumes and offer comprehensive orthodontic care under one roof further strengthens the adoption of 3D printed aligners in hospitals. Moreover, investments in training and research at dental hospitals have facilitated faster adoption of advanced orthodontic technologies.

As a result, dental hospitals continue to play a leading role in driving growth across the clear aligner landscape.

The global sales of the 3D printed clear dental aligners market are anticipated to rise at a CAGR of 8.4% between 2025 and 2035, owing to rising demand for orthodontic treatments and increasing adoption of 3D printing technology, customization options for dental aligners, and growing demand for cosmetic dentistry.

The global 3D printed clear dental aligners market holds around 2.1% share of the overall global orthodontics market with a value of around USD 163.5 Billion, in 2025.

A growing number of dental professionals are using 3D printing technology to produce clear dental aligners as it gets more advanced and affordable. Compared to conventional manufacturing techniques, 3D printing technology provides a more effective and affordable alternative to make personalized aligners.

Patients are increasingly looking for treatment options that are tailored to their specific needs. 3D printing technology enables the production of highly customized clear aligners tailored to a patient's specific needs and preferences. In recent years, a number of businesses have emerged that sell clear aligners to customers directly, eliminating the requirement for an in-person consultation with a dental expert. These businesses often make the aligners using 3D printing technology and provide a more practical and cost-effective orthodontic treatment option.

The market for 3D printed clear dental aligners is expanding beyond North America and Europe. Clear aligners are in high demand in emerging markets such as Asia-Pacific, Latin America, and the Middle East, which is propelling the market forward globally. Owing to the above-mentioned factors, the global market is expected to grow at a prominent pace, and reach a valuation of around USD 366.2 Million during the year 2035.

Treatment for adult patients is a recent development in the 3D printed clear dental aligners sector, which can be attributed to the increasing demand for orthodontic procedures from adults due to increasing awareness and understanding about oral health and dental appearance. Increasing dental disorders and orthodontics problems will lead to growth of the market for 3D printed clear dental aligners. Additionally, cosmetic dentistry is becoming more popular around the world, as more people seek treatments to improve the appearance of their teeth, Clear dental aligners offer a precise and convenient option for teeth straightening

The benefits of orthodontics related to periodontics, temporomandibular disorders, and restorative dentistry have boosted the number of adults undergoing procedures related to orthodontics. Orthodontics for adults is a growing segment in the global dentistry market. Adult patients receiving orthodontic treatments provide the orthodontists with the stimulus to develop effective treatment approaches for non-growing patients. All these factors provide huge opportunities for the players active within this market space.

There are various factors, which might hinder the market growth for 3D printed clear dental aligners. The initial investment required for dental practices to adopt 3D printing technology for producing clear aligners can be substantial, which can be prohibitive for small practices or those with limited resources. Additionally clear dental aligners are subject to regulatory requirements that vary depending on region or country. Compliance with these requirements can be difficult and time-consuming, potentially limiting market growth.

Clear dental aligners also compete with other orthodontic procedures like lingual braces, ceramic braces, and self-ligating braces despite the fact that they provide a discreet and practical option to conventional braces. However, they are not always appropriate for complicated orthodontic cases involving significant tooth movement or jaw realignment. This can render them less appealing to patients who require intensive orthodontic therapy. Further, many dental insurance policies abroad do not cover the cost of these aligners. As a result, patients who cannot afford to pay for them out of pocket find them less available and costly.

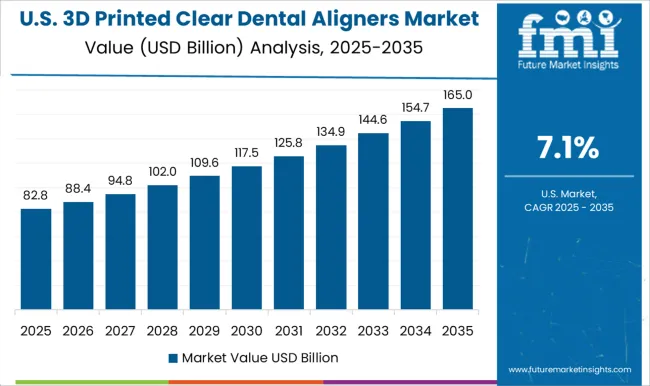

The USA dominates the North American region with a total market share of around 94.7% in 2025.

The USA is a world leader in the development and widespread use of 3D printing technology, which is pushing innovation in the market for 3D printed clear dental aligners. Healthcare in the USA is expensive, and 3D printing technology can produce clear dental aligners more efficiently and affordably than conventional manufacturing methods. This opens up clear dental aligners to a broader variety of patients.

Clear dental aligners, which are nearly invisible and more comfortable to wear than conventional metal braces, are becoming more popular among patients in the USA. Overall, the market expansion is expected to continue to experience the same growth throughout the forecast period due to technological advancement, cost-effective, and growing consumer awareness.

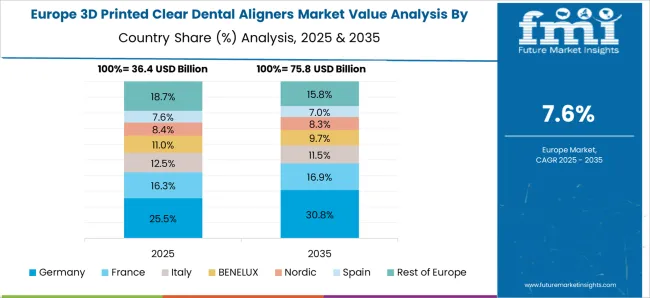

Germany held a market share of 22.3% in 2025 in the European 3D printed clear dental aligners market, owing to the advanced healthcare infrastructure, favorable reimbursement policies, and presence of numerous established key market players.

There are numerous technologically advanced manufacturing companies in Germany that use 3D printed technology. These companies have attributes like innovativeness, operational excellence, simplexity, customer-centricity, and flexibility allowing them to meet consumer demands at lower costs.

Germany has an advanced healthcare infrastructure, allowing for the development and adoption of 3D printing technology for clear dental aligners. The German healthcare system reimburses orthodontic treatments, including clear dental aligners, favorably. This is increasing patient and healthcare provider demand for the technology.

China held a market share of around 57.0% in the East Asia market 2025 and it is set to expand over the forecast period due to prevalence of orthodontic disorders in adults and increasing orthodontic services, government support for research activities.

China has a large adult population; thus the prevalence of orthodontic disorders is increasing, resulting in increasing demand for orthodontic treatments such as clear dental aligners. Because of the rapid growth in the number of adults with minor orthodontic issues who want to straighten their teeth without using traditional brackets and wires, more GPs are now offering 3D printed clear dental aligners.

The Chinese government supports the development and adoption of 3D printing technology and has invested in Research and Development in this area. This is driving market innovation for 3D printed clear dental aligners.

India held a market share of around 4.9% in the global market 2025 owing to the rising demand for orthodontic treatments and cosmetics dentistry, increasing disposable income, and favorable government policies.

India has a substantial and expanding population, and demand for orthodontic procedures like transparent dental aligners is booming. Indians are also more likely to seek out cosmetic dentistry for aesthetic reasons. A significant population in India are able to afford orthodontic treatments like clear dental aligners as disposable incomes rise.

In order to produce clear dental aligners, Indian firms are investing in 3D printing technology. These firms are also creating novel and cost-effective products for the Indian market. The adoption of 3D printing technology is being encouraged by the Indian government, which is spurring innovation in the market for 3D printed clear dental aligners.

Polyurethane Resin (PU) held around 36.1% of the global market share by value in 2025. PU resin is a material that is increasingly being used in the market for 3D printed clear dental aligners due to its numerous benefits.

Polyurethane resin is a biocompatible material that is safe for use in the human body and does not cause any adverse reactions or irritations. PU resin is translucent and can develop nearly invisible aligners, and hence it is well-liked option among patients.

PU resin is a flexible material that can be easily molded and shaped to fit the patient's teeth. PU resin is a material that 3D printing technology can easily process. This enables dental professionals to create clear dental aligners quickly and efficiently, potentially lowering costs and lead times.

Digital Light Processing (DLP) printing technology held a market share of 37.8% in the global market in 2025. DLP printing technology is being used steadily to develop clear dental aligners because of its several advantages and can improve treatment outcomes and patient satisfaction.

DLP printing technology provides a high level of precision in the production of customized clear dental aligners that are tailored to the patient's specific orthodontic needs. DLP printing technology is a quick printing process that can quickly and efficiently produce clear dental aligners. In the production of clear dental aligners, DLP printing technology provides a high level of consistency and nearly identical results.

In comparison to conventional manufacturing techniques, DLP printing technology is a productive printing method that can lower production costs. As a result, a larger spectrum of patients can find clear dental aligners more convenient.

Dental hospitals held a market share of 39.8% in the globally in 2025. Dental hospitals are important end users of 3D printed clear dental aligners. Several factors are influencing dental hospitals for adoption of this technology.

3D printed clear dental aligners are highly customized to the patient's teeth. Dental hospitals are better able to assist their patients, by offering their patients high-quality orthodontic treatments at a lower cost.

Dental hospitals can offer their patients a quicker and more pleasant orthodontic solution with the use of this technology with the use of this technology. This practically invisible 3D printed dental aligners are available from dental offices, boosting patient satisfaction by making it appear as though the patient has real teeth.

Dental hospitals are expected to continue to adopt this technology as a tool to improve patient care and satisfaction as it improves and becomes more widely available.

Leading players within the global market focus to develop and introduce new products either through partnership agreement or through authorized certifications from regulatory bodies. These strategies help them to continue maintaining their position in the global leaderboard.

A few examples of strategies acquired by the key players

Similarly, recent developments related to companies manufacturing 3D printed clear dental aligners have been tracked by the team at Future Market Insights. These are available in the full report.

| Attribute | Details |

|---|---|

| Historical Data Available for | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Market Analysis | USD Million for Value, and 000 Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, the United kingdom, Germany, Italy, Russia, Spain, France, Benelux, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Türkiye, GCC Countries and South Africa |

| Key Market Segments Covered | Material, Printing Technology, End User, and Region |

| Key Companies Profiled | Abbott; 3D System Inc.; Align Technology, Inc.; ClearCorrect LLC (Straumann Group); Dentsply Sirona; DynaFlex, FORESTADENT; Formlabs; Graphy Inc.; Prodways Group; SmileDirectClub; 3M |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global 3D printed clear dental aligners market is estimated to be valued at USD 163.5 billion in 2025.

The market size for the 3D printed clear dental aligners market is projected to reach USD 366.2 billion by 2035.

The 3D printed clear dental aligners market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in 3D printed clear dental aligners market are polyethylene terephthalate glycol (pet-g), polyurethane resin (pu), thermoplastic polyurethane (tpu), polycarbonate resin and others.

In terms of printing technology, stereolithography (sla) segment to command 52.6% share in the 3D printed clear dental aligners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3d-Printed Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Kit Market Analysis Size and Share Forecast Outlook 2025 to 2035

3D Printed Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Medical Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Surgical Models Market Analysis - Size, Share, and Forecast 2025 to 2035

3D Printed Hip and Knee Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Wearable Market - by Product Type, Material Type, Technology, Sales Channel, End-User, Application, and Region - Trends, Growth & Forecast 2025 to 2035

3D Printed Medical Devices Market is segmented by drug type, treatment and distribution channel from 2025 to 2035

Market Share Breakdown of 3D Printed Packaging Manufacturers

Market Share Breakdown of 3D-Printed Stickers & Labels Manufacturers

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

3D-Printed Stickers & Labels Market Growth – Trends & Forecast 2024-2034

3D Printed Brain Model Market Analysis – Trends & Forecast 2024-2034

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Human Tissue Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA