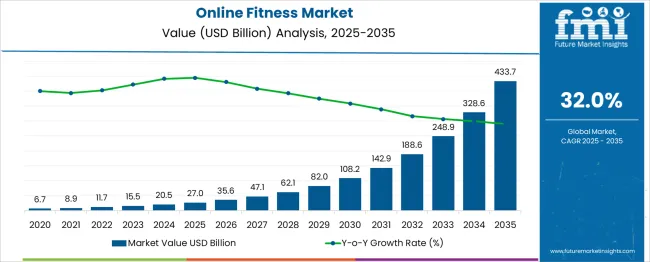

The Online Fitness Market is estimated to be valued at USD 27.0 billion in 2025 and is projected to reach USD 433.7 billion by 2035, registering a compound annual growth rate (CAGR) of 32.0% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 27.0 billion to USD 108.2 billion, driven by increasing consumer preference for flexible and accessible fitness solutions and the growth of digital fitness platforms.

Year-on-year analysis shows rapid expansion, with values reaching USD 35.6 billion in 2026 and USD 47.1 billion in 2027, supported by advancements in live streaming classes, on-demand content, and personalized fitness programs. By 2028, the market is forecasted to hit USD 62.1 billion, advancing to USD 82.0 billion in 2029 and USD 108.2 billion by 2030.

Growth is expected to be fueled by innovations in virtual reality workouts, AI-driven personalized fitness plans, and partnerships with wearable technology brands. The expansion of social fitness networks and the gamification of fitness content will further boost engagement. These dynamics position online fitness as a dominant segment in the global health and wellness industry, offering significant opportunities for growth and innovation.

| Metric | Value |

|---|---|

| Online Fitness Market Estimated Value in (2025 E) | USD 27.0 billion |

| Online Fitness Market Forecast Value in (2035 F) | USD 433.7 billion |

| Forecast CAGR (2025 to 2035) | 32.0% |

The Online Fitness market is advancing steadily, fueled by rising consumer awareness about health and convenience-driven workout solutions. The current scenario reflects an increasing preference for digital platforms that deliver personalized, engaging, and accessible fitness experiences at home or on the go, as evidenced by company press releases, industry news, and investor presentations.

This momentum is being reinforced by the growing penetration of smartphones and high-speed internet, enabling seamless access to fitness content globally. The future outlook remains positive, supported by technological advancements in streaming quality, integration of AI-driven coaching, and gamification strategies that enhance user motivation and adherence.

Statements from fitness platform providers also highlight an expanding focus on mental wellness and holistic health programs, widening the user base beyond traditional gym-goers. With the convergence of wearable technology, social features, and data analytics, the market is expected to continue growing as consumers prioritize flexibility and customization in their fitness routines.

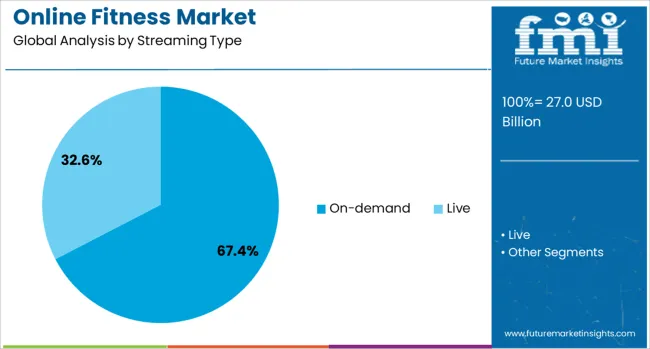

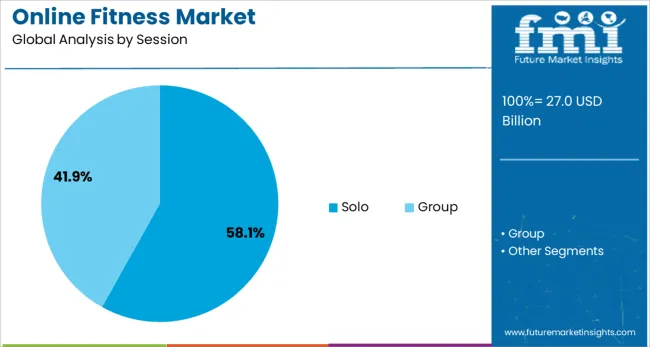

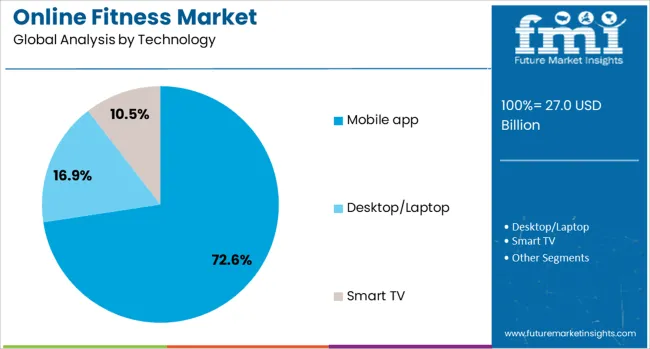

The online fitness market is segmented by streaming type, session, technology, subscription model, end use, and geographic regions. The online fitness market is divided into two types: On-demand and Live. In terms of the online fitness market, it is classified into SoloGroup. The online fitness market is segmented into Mobile apps, Desktop/Laptop, and Smart TV.

The online fitness market is segmented into Monthly subscription, pay-per-class, and Annual subscription. The end use of the online fitness market is segmented into Individuals, Professional gyms, Educational & sports institutes, and others. Regionally, the online fitness industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on-demand streaming type is projected to account for 67.4% of the Online Fitness market revenue share in 2025, securing its position as the leading streaming type segment. This dominance is being attributed to its unmatched flexibility and convenience, allowing users to access workout sessions at their convenience.

Industry updates and company announcements have highlighted that on-demand platforms cater to diverse fitness levels and preferences, offering a vast library of content that keeps users engaged. The ability to choose workouts without time constraints has resonated strongly with busy professionals and individuals seeking autonomy in their fitness journey.

Furthermore, on-demand content is frequently updated, incorporating trending fitness modalities and ensuring ongoing relevance. This segment’s growth has also been encouraged by the affordability and scalability of on-demand solutions, which have become appealing to both individual users and corporate wellness programs seeking to support remote employees effectively.

The solo session segment is anticipated to hold 58.1% of the Online Fitness market revenue share in 2025, making it the dominant session type segment. This prominence has been driven by users’ desire for privacy, control, and self-paced progress in their fitness routines. Company statements and industry analyses have noted that solo sessions empower individuals to tailor their workouts without the social pressures of group settings, fostering greater confidence and consistency.

This segment has also benefited from the integration of performance tracking and personalized feedback features, which enhance the solo user experience. Reports from platform providers indicate that solo formats attract a wider demographic, including beginners who prefer to build fitness foundations independently.

Additionally, the pandemic-induced shift toward home-based fitness has strengthened the appeal of solo sessions, as users have become accustomed to exercising alone in safe and familiar environments. These advantages have sustained the segment’s leading position in the market landscape.

The mobile app technology segment is forecasted to command 72.6% of the Online Fitness market revenue share in 2025, retaining its leadership within the technology segment. This growth has been propelled by the widespread adoption of smartphones and the ease of accessing fitness programs through dedicated apps.

Investor briefings and technology news have emphasized that mobile apps offer intuitive interfaces, seamless streaming, and integration with wearable devices, enhancing the user experience significantly. The segment has also been strengthened by the ability of apps to deliver real-time progress tracking, reminders, and community engagement features, which drive higher retention rates.

Companies have focused on continuous innovation within apps, adding functionalities such as live coaching, AI-driven recommendations, and immersive experiences through augmented reality. The accessibility, portability, and affordability of mobile apps have made them the preferred choice for users seeking comprehensive fitness solutions on their personal devices, solidifying the segment’s dominant share in the market.

The online fitness market is growing, driven by the increasing demand for flexible home-based workout solutions and the expansion of live fitness classes. Opportunities are rising in integrating fitness with wellness services, creating a more holistic approach to health. However, challenges such as market saturation and subscription fatigue may hinder long-term growth. By 2025, innovative strategies to retain customers and offer differentiated services will be essential for continued market expansion.

The online fitness market is growing rapidly, driven by the rising demand for convenient, at-home fitness solutions. With busy lifestyles and the closure of gyms during the pandemic, consumers are increasingly turning to online fitness platforms for flexibility and accessibility. This shift has been further accelerated by the growing trend of remote working, with more people seeking home-based workout options. By 2025, the market is expected to continue benefiting from the demand for affordable, on-demand fitness content available at consumers’ convenience.

Opportunities in the online fitness market are rising with the expansion of virtual and live fitness classes. These formats allow users to engage with fitness instructors in real-time, offering a more interactive experience compared to pre-recorded content. The growing number of users seeking personalized training and community-based experiences presents significant growth potential. By 2025, the demand for live-streamed fitness sessions will likely increase, particularly among individuals looking for personalized attention without attending physical gyms.

Emerging trends in the online fitness market point toward the integration of fitness and wellness services. Platforms are expanding to offer not only workout classes but also personalized nutrition plans, mental health resources, and wellness coaching. The shift towards holistic health services provides users with a comprehensive wellness experience. By 2025, these integrated offerings are expected to dominate, as consumers increasingly seek well-rounded fitness solutions that encompass both physical and mental health.

Despite the market’s growth, challenges related to market saturation and subscription fatigue may limit future expansion. With an influx of fitness apps and platforms, consumers may struggle to differentiate between services, leading to subscription cancellations. Additionally, high subscription costs or the lack of long-term value could deter user retention. By 2025, addressing these concerns through unique offerings and maintaining customer loyalty will be crucial for online fitness platforms aiming to sustain growth.

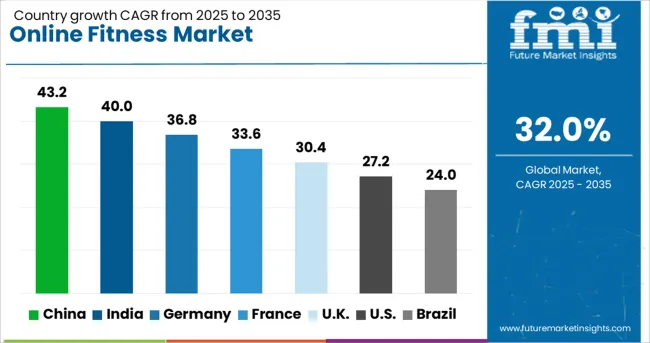

| Country | CAGR |

|---|---|

| China | 43.2% |

| India | 40.0% |

| Germany | 36.8% |

| France | 33.6% |

| UK | 30.4% |

| USA | 27.2% |

| Brazil | 24.0% |

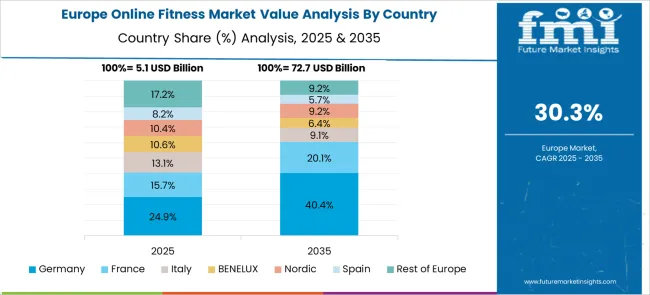

The global online fitness market is projected to grow at a remarkable 32% CAGR from 2025 to 2035. China leads with an extraordinary growth rate of 43.2%, followed by India at 40%, and France at 33.6%. The United Kingdom records a growth rate of 30.4%, while the United States shows the slowest growth among the profiled markets at 27.2%. These varying growth rates are driven by factors such as increasing health awareness, rising disposable incomes, and the widespread adoption of digital platforms for fitness services. Emerging markets like China and India are seeing explosive growth due to increased internet penetration, evolving fitness habits, and expanding consumer demand for convenient and accessible fitness solutions, while more mature markets like the USA and the UK show steady growth driven by established fitness culture and a high level of digital fitness adoption. This report includes insights on 40+ countries; the top markets are shown here for reference.

he online fitness market in China is growing at an exceptional pace, with a projected CAGR of 43.2%. The country’s increasing health awareness, growing interest in personal wellness, and rising disposable incomes are key factors driving this rapid growth. China’s massive internet user base and the increasing availability of affordable smartphones and digital devices contribute to the expansion of online fitness platforms. Additionally, the government’s focus on improving public health and wellness, along with the popularity of online fitness classes, virtual trainers, and wellness apps, further accelerates the market's growth.

The online fitness market in India is projected to grow at a CAGR of 40%. As one of the fastest-growing markets in digital fitness, India’s rising awareness of health and wellness, along with the growing penetration of smartphones and internet access, contributes significantly to market growth. The increasing adoption of digital fitness solutions, including virtual fitness classes, yoga sessions, and customized workout plans, is rapidly gaining traction among Indian consumers. Moreover, the rise of fitness influencers, online wellness platforms, and affordable fitness apps further drives the demand for online fitness services in the country.

The online fitness market in France is projected to grow at a CAGR of 33.6%. France has a strong culture of fitness and wellness, with a growing shift toward digital fitness solutions as consumers seek more flexible workout options. The increasing demand for virtual fitness classes, wellness apps, and online personal trainers is driving the market’s growth. France’s growing awareness of mental health and wellness, combined with the rise in virtual fitness platforms offering personalized solutions, further accelerates the adoption of online fitness services. The market also benefits from the increasing interest in at-home fitness solutions following the pandemic.

The online fitness market in the United Kingdom is projected to grow at a CAGR of 30.4%. The UK has seen a significant shift toward online fitness services, driven by rising health awareness and an increased focus on flexible, convenient fitness options. The widespread adoption of online workout platforms, including streaming services, personalized fitness plans, and virtual classes, is contributing to this growth. Additionally, the increasing popularity of fitness wearables and digital health tools further boosts demand for online fitness services in the UK The market also benefits from post-pandemic behavioral changes, with many individuals preferring home-based fitness solutions.

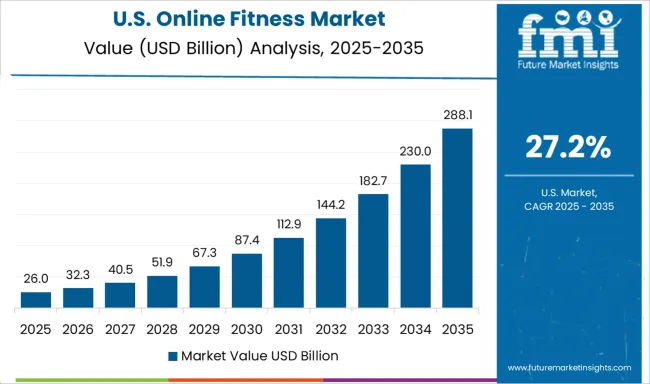

The online fitness market in the United States is expected to grow at a CAGR of 27.2%. The USA market is mature but continues to see steady demand driven by the increasing popularity of virtual fitness classes, on-demand workouts, and personalized fitness solutions. The growing trend of fitness tracking and health optimization, along with the adoption of wearable technology, fuels the demand for digital fitness platforms. Additionally, the increasing preference for home workouts and remote training services, coupled with the proliferation of fitness apps and subscription-based models, supports the steady expansion of the online fitness market.

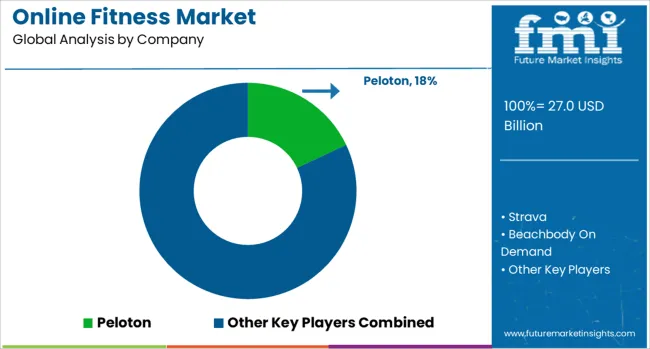

The online fitness market is dominated by Peloton, which leads with its subscription-based, interactive fitness platform offering live and on-demand cycling, strength, and yoga classes. Peloton’s dominance is reinforced by its strong brand presence, high-quality equipment, and engaging virtual community that attracts both fitness enthusiasts and beginners.

Key players such as Strava, Beachbody On Demand, and Nike Training Club maintain significant market shares by offering diverse fitness programs, from running and cycling tracking to strength training and guided workout plans. These companies focus on delivering personalized fitness experiences with features like progress tracking, gamification, and expert-led coaching to meet the growing demand for accessible and flexible fitness solutions.

Emerging players like MyFitnessPal, Fitbit Premium, Fitness Blender, and Obé Fitness are expanding their market presence by providing specialized fitness content and mobile-friendly platforms, targeting niche markets such as nutrition tracking, at-home workouts, and bodyweight exercises. Their strategies include improving integration with wearable fitness devices, enhancing user experience, and offering affordable subscription plans.

Market growth is driven by the increasing popularity of at-home workouts, rising health consciousness, and the convenience of on-demand fitness programs. Innovations in virtual coaching, personalized workout routines, and integration with wearable fitness trackers are expected to shape competitive dynamics and foster further growth in the online fitness market.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.0 Billion |

| Streaming Type | On-demand and Live |

| Session | Solo and Group |

| Technology | Mobile app, Desktop/Laptop, and Smart TV |

| Subscription Model | Monthly subscription, Pay-per class, and Annual subscription |

| End Use | Individuals, Professional gyms, Educational & sports institutes, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Peloton, Strava, Beachbody On Demand, Nike Training Club, MyFitnessPal, Fitbit Premium, Fitness Blender, Daily Burn, Obé Fitness, Tone It Up, Freeletics, Centr (Chris Hemsworth's app), and Apple Fitness+ |

| Additional Attributes | Dollar sales by subscription model and application, demand dynamics across fitness enthusiasts, wellness programs, and corporate sectors, regional trends in online fitness adoption, innovation in virtual training platforms and wearable integrations, impact of regulatory standards on data privacy and health claims, and emerging use cases in personalized fitness coaching and virtual fitness communities. |

The global online fitness market is estimated to be valued at USD 27.0 billion in 2025.

The market size for the online fitness market is projected to reach USD 433.7 billion by 2035.

The online fitness market is expected to grow at a 32.0% CAGR between 2025 and 2035.

The key product types in online fitness market are on-demand and live.

In terms of session, solo segment to command 58.1% share in the online fitness market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Online Sweepstakes Platform Market Size and Share Forecast Outlook 2025 to 2035

Online Food Delivery and Takeaway Market Size and Share Forecast Outlook 2025 to 2035

Online Clothing Rental Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

Online To Offline Commerce Market Size and Share Forecast Outlook 2025 to 2035

Online Travel Market Size and Share Forecast Outlook 2025 to 2035

Global Fitness Recovery Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Online Gambling Market Size and Share Forecast Outlook 2025 to 2035

Online Laundry Services Market Size and Share Forecast Outlook 2025 to 2035

Online Catering Marketplace Size and Share Forecast Outlook 2025 to 2035

Online Powersports Market Size and Share Forecast Outlook 2025 to 2035

Online Paint Editor App Market Size and Share Forecast Outlook 2025 to 2035

Online Grocery Market – Trends, Growth & Forecast 2025 to 2035

Online Home Rental Market Analysis – Trends, Growth & Forecast 2025 to 2035

Online Travel Agencies Market Trends-Growth & Forecast 2025 to 2035

Online Food Delivery Services Market Outlook - Growth, Demand & Forecast 2025 to 2035

Assessing Online Clothing Rental Market Share & Industry Insights

Fitness Apps Market Report - Trends & Forecast 2025 to 2035

Online Advocacy Platform Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA