The Online Gambling Market is estimated to be valued at USD 105.5 billion in 2025 and is projected to reach USD 286.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period.

Analyzing YoY growth from 2020 to 2035 reveals a steady acceleration. Between 2020 (USD 64.1 billion) and 2021 (USD 70.8 billion), the market expanded by 10.4%, followed by 10.4% in 2022, 10.5% in 2023, and 10.5% in 2024, indicating early momentum as digital platforms and global internet penetration strengthened. In 2025, the market reached USD 105.5 billion, and YoY growth maintained a strong pace, increasing by 10.5% to USD 116.6 billion in 2026, 10.6% to USD 128.9 billion in 2027, and 10.5% to USD 142.4 billion in 2028. This trend continues with 10.5% growth in 2029 (USD 157.3 billion), and 10.6% in 2030 (USD 173.9 billion). The upward trajectory remains steady with 10.5% YoY increases through 2035, ultimately reaching USD 286.4 billion. This stable double-digit YoY growth indicates a maturing yet dynamically expanding market, supported by mobile adoption, regulatory shifts, digital payments, and increasing user engagement globally.

| Metric | Value |

|---|---|

| Online Gambling Market Estimated Value in (2025 E) | USD 105.5 billion |

| Online Gambling Market Forecast Value in (2035 F) | USD 286.4 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

Online Gambling Market, a detailed parent market analysis reveals its integration within the expansive Global Digital Entertainment and Gaming Ecosystem, which commands over 22% of the worldwide entertainment industry valued at over USD 2.3 trillion. Within this landscape, the Online Gambling sector accounts for nearly 12.5% of the total digital entertainment spending, making it one of the most lucrative and fastest-growing segments. Online gambling draws from multiple overlapping parent markets. Within the Global iGaming Market, which includes online casinos, sports betting, and poker, online gambling contributes over 68% of total revenue.

It also holds over 45% share of the Digital Betting and Wagering Market, benefiting from rapid tech adoption, live streaming integrations, and real-time analytics. The Fintech sector, specifically digital payments, also influences this market online gambling accounts for nearly 8% of global eWallet transaction volume in the leisure sector. The market is closely tied to the Mobile Applications Market, where gambling apps represent approximately 6% of total consumer spending. Its integration with AI-driven personalization engines and blockchain-backed betting platforms underscores the convergence of entertainment, financial tech, and data science in shaping this fast-expanding digital ecosystem.

The online gambling market is experiencing accelerated growth, driven by widespread internet penetration, evolving regulatory frameworks, and increasing consumer demand for digital entertainment. Favorable changes in online betting legislation across several regions, combined with advancements in secure payment platforms and blockchain verification systems, have enabled wider market participation.

The integration of immersive technologies such as live streaming, real-time odds updates, and virtual reality gaming environments is enhancing user experience and retention. Additionally, rising smartphone adoption and mobile wallet usage are facilitating seamless transactions and on-the-go gaming behavior.

Operators are increasingly investing in responsible gambling tools, AI-based monitoring systems, and personalized platforms to ensure regulatory compliance while improving customer loyalty. As the global shift toward digital leisure continues, the market is expected to maintain high levels of engagement and transaction value across both casual and professional user bases.

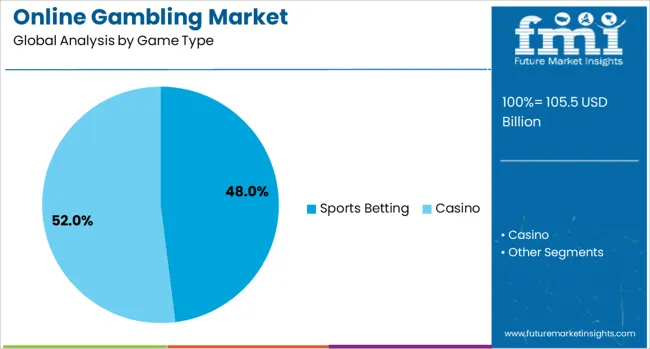

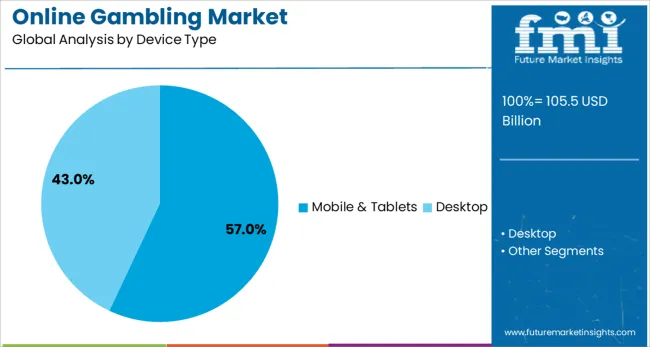

The online gambling market is segmented by game type, device type, and geographic regions. The online gambling market is divided by game type into Sports Betting, Casino, and Lottery. The online gambling market is classified by device type into Mobile & Tablets and Desktop. Regionally, the online gambling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Sports betting is projected to lead the online gambling market with a 48.0% share by 2025, making it the dominant game type. The segment’s growth is being fueled by heightened interest in real-time wagering, fantasy leagues, and international sporting events such as FIFA World Cup and Olympics.

Integration of data analytics and predictive tools has empowered users with enhanced decision-making, while legal reforms in North America, Europe, and parts of Asia-Pacific have significantly expanded market access. Additionally, sportsbook platforms are increasingly incorporating user-friendly interfaces, multi-language support, and eSports betting features, broadening their appeal across different demographic groups.

Partnerships between betting companies and major sports franchises have also increased visibility, contributing to wider adoption across mobile and desktop platforms.

Mobile & tablets are expected to contribute 57.0% of total online gambling market revenues in 2025, positioning them as the leading device type. This dominance is being driven by increased smartphone penetration, availability of high-speed internet, and the popularity of app-based gaming experiences.

Players prefer mobile platforms for their convenience, portability, and integration with biometric authentication and in-app payment options. Operators have optimized their offerings through progressive web apps, location-based services, and seamless cross-platform experiences.

As consumers shift toward mobile-first behavior, especially in emerging markets, gambling operators are responding with mobile-centric loyalty programs, real-time betting notifications, and gamified interfaces. This trend is expected to continue shaping how digital gambling platforms evolve and capture user engagement.

The online gambling market continues to gain traction globally, driven by increasing digital access, mobile-first platforms, and broad interest in interactive entertainment. Users are engaging with diverse formats, including sports betting, online casinos, poker rooms, and virtual games. Platforms are investing in secure, immersive interfaces to appeal to both recreational and seasoned players. With shifting regulatory landscapes and the expansion of legal frameworks in key markets, operators are adapting rapidly to regional compliance while seeking engagement through loyalty programs and live experiences.

One of the primary drivers of the online gambling market is the widespread use of mobile devices and easy access to digital platforms. With smartphones offering seamless connectivity and convenience, users can participate in gambling activities from virtually any location. This ease of entry supports frequent engagement, especially for sports betting and live casino games. Operators are optimizing platforms for intuitive mobile interfaces, faster gameplay, and secure transactions, helping to build user retention. App-based environments provide integrated payment gateways, user tracking, and targeted bonuses, enhancing the customer experience. Many platforms also use personalized dashboards, live updates, and on-demand streaming to encourage repeat visits. The growing appeal of real-time interactions, combined with user familiarity with online entertainment platforms, further strengthens the appeal of online gambling. As audiences seek dynamic and convenient formats, mobile and web-based gambling platforms remain the primary gateway to consistent market expansion across age and interest groups.

Despite growing demand, the online gambling industry faces complex and inconsistent regulatory environments across different regions. Each country, and in some cases individual jurisdictions within countries, maintain distinct rules regarding licensing, taxation, advertising, and user protection. This fragmentation makes it difficult for operators to implement uniform strategies or scale operations internationally. In some regions, ambiguous laws or the absence of clear online gambling frameworks deter platform entry and investment. In other markets, strict compliance protocols and operational caps limit growth potential. These challenges are compounded by ongoing scrutiny around consumer safety, especially concerning underage participation and problem gambling. Operators must invest in legal expertise, data security, and responsible gaming measures to maintain credibility. Without harmonized regulation, platforms may also encounter difficulties in securing banking relationships or digital payment access. These regulatory hurdles create uncertainty in expansion planning, impacting both established providers and emerging entrants seeking to compete across multiple jurisdictions.

As digital infrastructure improves in developing regions, there is notable opportunity for online gambling platforms to enter untapped markets with rising internet penetration and expanding middle-class consumption. In these areas, online gambling represents a modern entertainment alternative, appealing to younger, mobile-first audiences. Platforms that offer local language support, region-specific content, and adaptive payment methods can build early loyalty in these markets. Simultaneously, the rising popularity of esports opens new verticals within gambling. Viewers are increasingly engaging with competitive gaming not only as spectators but also as participants through fantasy leagues, skill-based betting, and live wagering tied to esports events. Integration of esports into gambling offerings allows operators to diversify revenue streams and attract tech-savvy users who are deeply familiar with digital gameplay environments. As interest grows in newer formats, the convergence of traditional gambling and digital entertainment is creating space for innovative offerings that appeal across both core and adjacent user groups.

The online gambling industry is often scrutinized for its potential to contribute to behavioral issues such as addiction, financial distress, and excessive screen time. Public health advocates and watchdog organizations frequently raise concerns about the accessibility and promotion of gambling platforms, especially among younger demographics. The anonymity and ease of digital gambling can lead to impulsive behavior, with fewer friction points compared to physical venues. As a result, regulators and advocacy groups call for stricter oversight around advertising, deposit limits, and self-exclusion tools. In some regions, community resistance and cultural stigmas further limit adoption or push for restrictive legislation. These social concerns also affect brand perception and may reduce partnerships with payment providers or technology firms wary of reputational risks. Platforms are increasingly expected to demonstrate active commitment to user protection, including real-time monitoring, support resources, and clear opt-out systems. Until these expectations are universally met, social and ethical concerns will continue to temper growth.

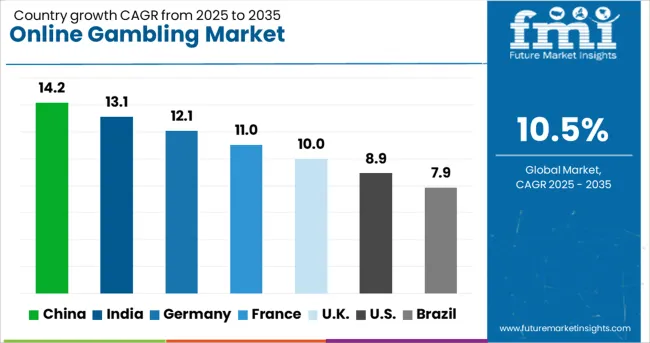

| Country | CAGR |

|---|---|

| China | 14.2% |

| India | 13.1% |

| Germany | 12.1% |

| France | 11.0% |

| UK | 10.0% |

| USA | 8.9% |

| Brazil | 7.9% |

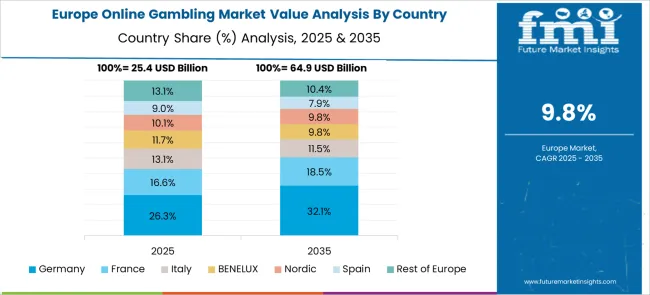

The global online gambling market is projected to grow at a CAGR of 10.5% through 2035, driven by increased digital penetration, evolving regulations, and rising interest in interactive betting platforms. Among BRICS nations, China leads with 14.2% growth, supported by a growing user base for offshore platforms, mobile-first betting interfaces, and expanding access to virtual casinos. India follows at 13.1%, propelled by smartphone penetration, rising disposable income, and increasing popularity of fantasy sports and skill-based games. Within the OECD region, Germany reports 12.1% growth, following the legalization of regulated online gambling and growing demand for secure, compliant platforms. The United Kingdom, growing at 10.0%, remains one of the most mature and regulated online betting markets globally, focusing on responsible gambling and technological innovation. The United States, at 8.9%, shows robust growth as more states legalize digital gambling and sportsbooks. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The online gambling market in China is witnessing rapid growth, marked by a CAGR of 14.2%, as users turn to virtual platforms for sports betting and casino-style games. Despite regulatory restrictions, offshore websites and underground platforms are attracting high traffic through mobile-friendly interfaces and digital wallets. Increasing smartphone penetration in tier-2 and tier-3 cities is contributing to more active user bases. Users are also participating in lottery-based betting through social chat apps and encrypted web browsers, bypassing traditional enforcement methods. Some players are shifting from physical gambling hubs in neighboring regions to online channels for convenience and discretion. Analysts note that demand peaks during major sports tournaments and festivals, prompting operators to enhance their live-streaming features.

In India, the online gambling market is expanding at a CAGR of 13.1%, driven by interest in fantasy sports, card games, and live betting events. States with looser interpretations of skill-based gaming laws have become hotspots for app-based poker, rummy, and cricket-based contests. Regional platforms are leveraging regional languages and local payment apps to deepen engagement. Online casinos offering real-time dealer interactions are growing in popularity among high-value users. The increasing affordability of data and mobile phones has opened access to rural areas as well. Referral programs and competitive leaderboards are being used to retain users and expand organic growth. Several operators are also exploring token-based reward systems to build user loyalty in skill-focused games.

The online gambling market in Germany is growing at a CAGR of 12.1%, underpinned by government regulations that have recently opened the door for licensed betting platforms. The new regulatory framework has brought transparency and legitimacy, allowing domestic and European firms to operate under uniform rules. Most players are focused on licensed sportsbooks and slot-based games, with increased demand seen during football championships and e-sports events. German platforms emphasize age verification and self-exclusion features to align with compliance norms. Several companies are investing in customer support teams and German-language service to build user trust. Online casino games are gaining traction through targeted digital ads and influencer-led campaigns.

In the United Kingdom, the online gambling market is growing at a CAGR of 10.0%, with users showing strong interest in quick-access platforms offering betting, poker, and slots. Mobile-based play dominates the sector, especially among users aged 25 to 40. Live dealer experiences and real-time odds updates are widely adopted by major platforms. Regulatory bodies have enforced strict responsible gambling practices, including deposit limits and self-assessment tools. Promotional strategies like free spins and cashback bonuses are attracting new users, while loyalty programs help retain long-term players. Collaborations between payment providers and gambling platforms are also enhancing the speed and security of transactions.

The United States is experiencing online gambling market growth at a CAGR of 8.9%, as state-level legalization opens up new revenue channels. Key states like New Jersey, Pennsylvania, and Michigan have already established competitive platforms for sports betting and online casinos. Cross-platform play and in-app account linking are popular features that enhance user convenience. Major sportsbook operators are offering integrated experiences across desktop and mobile. Sports seasons create natural peaks in betting activity, especially around football and basketball leagues. Some platforms have introduced exclusive regional content and loyalty perks for users within legalized states. Advertising through podcasts and sports networks is driving significant user traffic.

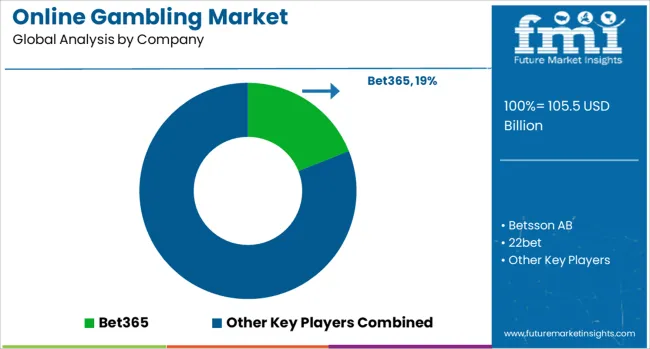

The online gambling market is characterized by a mix of established betting operators and fast-growing digital platforms catering to a global customer base. Industry leaders such as Bet365, 888 Holdings PLC, and William Hill are known for their broad portfolios, covering sports betting, casino games, and poker. Their strong online presence and brand recognition help them attract and retain users across multiple regions, with a focus on user experience, game variety, and real-time betting features. Companies like Flutter Entertainment PLC, Entain PLC, and DraftKings Inc. play a prominent role in the North American and European markets. They focus heavily on licensed operations, partnerships with sports leagues, and regulatory compliance. These companies also benefit from large-scale mergers and acquisitions that expand their reach and product offerings. MGM Resorts International and Super Group (SGHC Limited) bring their physical gaming experience into the online domain, offering users integrated services that blend online and offline gambling. Betsson AB, 22bet, and Kindred Group PLC focus on expanding into regulated and emerging markets, providing multilingual platforms and diverse payment solutions. Their emphasis on regional customization and local market preferences helps them compete with larger brands. With increasing internet access and growing interest in digital entertainment, the online gambling market continues to gain momentum, with leading suppliers investing in marketing, platform reliability, and user engagement strategies to maintain a competitive edge.

ESPN BET, powered by Penn Entertainment, unveiled FanCenter on August 4, 2025. This personalized in-app feature integrates users’ ESPN Fantasy rosters, offering tailored betting markets, a “For You” feed, and a Fantasy Bet Builder. The launch is contingent on regulatory approvals.

| Item | Value |

|---|---|

| Quantitative Units | USD 105.5 Billion |

| Game Type | Sports Betting, Casino, and Lottery |

| Device Type | Mobile & Tablets and Desktop |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bet365, Betsson AB, 22bet, 888 Holdings PLC, Draftkings Inc., Entain PLC, Flutter Entertainment PLC, Kindred Group PLC, Mgm Resorts International, Super Group (sghc Limited), and William Hill |

| Additional Attributes | Dollar sales vary by platform and game type, with sports betting dominating, while online casino and poker segments grow rapidly. Europe leads overall adoption, as Asia-Pacific and North America expand quickly. Pricing fluctuates with tax policies and compliance costs. Growth accelerates via mobile gaming, live dealers, crypto integration, and AI-driven personalization under evolving regulations. |

The global online gambling market is estimated to be valued at USD 105.5 billion in 2025.

The market size for the online gambling market is projected to reach USD 286.4 billion by 2035.

The online gambling market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in online gambling market are sports betting, _football, _horse racing, _tennis, _cricket, _basketball, _other sports, casino, _live casino, _baccarat, _blackjack, _poker, _slots, _others casino games, lottery, _bingo and _others.

In terms of device type, mobile & tablets segment to command 57.0% share in the online gambling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Online Food Delivery and Takeaway Market Size and Share Forecast Outlook 2025 to 2035

Online Clothing Rental Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

Online To Offline Commerce Market Size and Share Forecast Outlook 2025 to 2035

Online Travel Market Size and Share Forecast Outlook 2025 to 2035

Online Fitness Market Size and Share Forecast Outlook 2025 to 2035

Online Laundry Services Market Size and Share Forecast Outlook 2025 to 2035

Online Catering Marketplace Size and Share Forecast Outlook 2025 to 2035

Online Powersports Market Size and Share Forecast Outlook 2025 to 2035

Online Paint Editor App Market Size and Share Forecast Outlook 2025 to 2035

Online Grocery Market – Trends, Growth & Forecast 2025 to 2035

Online Home Rental Market Analysis – Trends, Growth & Forecast 2025 to 2035

Online Travel Agencies Market Trends-Growth & Forecast 2025 to 2035

Online Food Delivery Services Market Outlook - Growth, Demand & Forecast 2025 to 2035

Assessing Online Clothing Rental Market Share & Industry Insights

Online Advocacy Platform Market

Online Executive Education Program Market Trends – Growth & Forecast 2024-2034

Secure & Seamless Digital Payments – AI-Powered Payment Gateways

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA