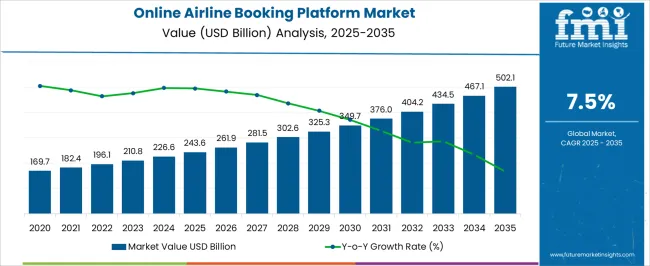

The online airline booking platform market is anticipated to reach USD 243.6 billion in 2025 and projected to reach USD 502.1 billion by 2035, expanding at a CAGR of 7.5%. The widespread shift toward digital channels, increased smartphone penetration, and preference for seamless travel experiences shape growth. From USD 169.7 billion in 2020, the sector climbed to USD 182.4 billion in 2021 and USD 196.1 billion in 2022, highlighting consistent adoption of online booking interfaces.

The rise to USD 210.8 billion in 2023 and USD 226.6 billion in 2024 shows how loyalty programs, personalized promotions, and integrated payment systems have influenced consumer choices. By 2026, the market is expected to be USD 261.9 billion and continue with USD 281.5 billion in 2027, reflecting how low-cost carriers and full-service airlines are enhancing digital platforms to attract global travelers.

In 2028, values are expected to be at USD 302.6 billion and at USD 325.3 billion in 2029, highlighting how artificial intelligence and real-time seat availability optimize customer decisions. By 2030, the market will grow to USD 349.7 billion, accelerating further with USD 376.0 billion in 2031 and USD 404.2 billion in 2032. In the final phase, demand reaches USD 434.5 billion in 2033 and USD 467.1 billion in 2034, before achieving USD 502.1 billion by 2035, underscoring how integration of mobile-first strategies, cross-border ticketing, and hybrid booking models have cemented the global expansion path.

| Metric | Value |

|---|---|

| Online Airline Booking Platform Market Estimated Value in (2025 E) | USD 243.6 billion |

| Online Airline Booking Platform Market Forecast Value in (2035 F) | USD 502.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The online airline booking platform market is influenced by five interconnected parent markets that collectively shape its trajectory and adoption across global travel ecosystems. The largest contributor is the travel and tourism market, holding about a 38% share, as airlines, hotels, and tour operators increasingly depend on digital platforms to capture growing passenger volumes and leisure travelers. The e-commerce market contributes around 25%, reflecting the integration of online booking platforms with digital wallets, loyalty programs, and personalized promotions that enhance customer engagement.

The information technology and software services market holds 15%, driven by the adoption of cloud-based booking systems, AI-enabled dynamic pricing, and data analytics for route optimization. The mobile applications market accounts for nearly a 12% share, powered by smartphone penetration, mobile-first strategies, and app-based ticketing systems that dominate millennial and Gen Z travel choices. The financial services and digital payments market provides 10%, with secure transactions, cross-border payments, and fintech collaborations expanding the reach of booking platforms. These parent markets sustain growth momentum, with travel and tourism and e-commerce forming the backbone while IT services, mobile applications, and financial services diversify the ecosystem, ensuring strong future potential for online airline booking platforms worldwide.

The online airline booking platform market is expanding rapidly as digital transformation reshapes the travel and aviation industries. Growing consumer preference for convenience, real time availability, and competitive pricing is driving widespread adoption of online platforms for flight reservations.

Advancements in mobile technology, secure payment gateways, and personalized AI based recommendation engines have significantly enhanced user experience and booking efficiency. Airlines and travel intermediaries are increasingly investing in seamless omnichannel booking infrastructure to meet evolving traveler expectations and reduce distribution costs.

Additionally, post pandemic recovery in global travel demand has revitalized both domestic and international airline bookings. The future trajectory remains strong as more travelers turn to digital platforms for personalized, dynamic, and loyalty-driven flight booking experiences.

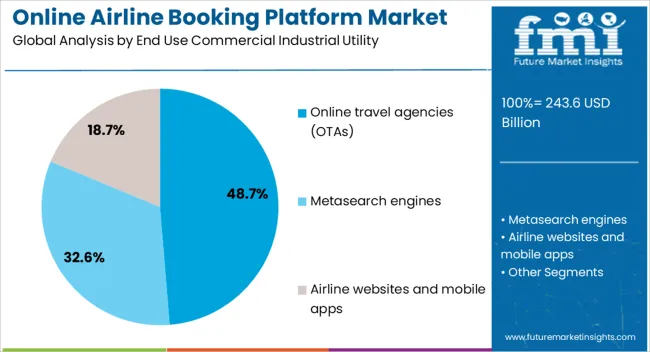

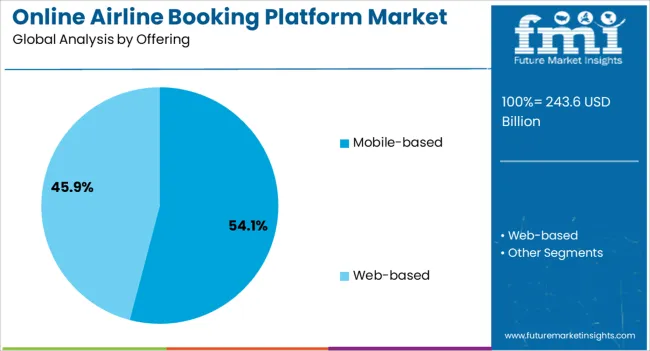

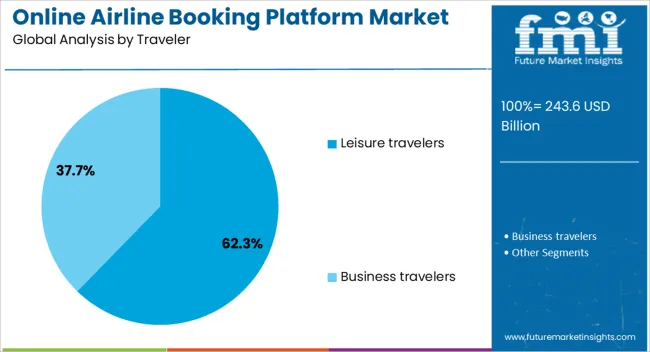

The online airline booking platform market is segmented by end use commercial industrial utility, offering, traveler, application, and geographic regions. By end use commercial industrial utility, online airline booking platform market is divided into Online travel agencies (OTAs), Metasearch engines, and Airline websites and mobile apps. In terms of offering, online airline booking platform market is classified into Mobile-based and Web-based. Based on traveler, online airline booking platform market is segmented into Leisure travelers and Business travelers.

By application, online airline booking platform market is segmented into International booking and Domestic booking. Regionally, the online airline booking platform industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The online travel agencies segment is projected to account for 48.70% of total market revenue by 2025 under the end use category, positioning it as the leading channel. This dominance is driven by their extensive inventory aggregation, price comparison tools, and strong customer service infrastructure.

OTAs offer travelers the flexibility to bundle flights with hotels and other services, providing added value and convenience. Their strategic partnerships with airlines, global marketing capabilities, and reward programs have also reinforced customer loyalty.

The ease of access to international and low cost carriers through OTA platforms has supported their widespread use among price sensitive and international travelers, cementing their role as the preferred booking channel.

The mobile based segment is expected to represent 54.10% of market share by 2025 within the offering category, making it the most dominant interface. This is attributed to the surge in smartphone usage, availability of intuitive booking apps, and real time travel updates that enhance user engagement.

Mobile platforms allow travelers to search, compare, and book flights instantly, while integrating payment and itinerary management tools for a seamless experience. Push notifications, in app deals, and digital boarding passes have improved convenience and retention.

The shift toward mobile first strategies by airlines and OTAs reflects the growing reliance on smartphones for end to end travel planning, ensuring the mobile based segment continues to lead the market.

The leisure travelers segment is projected to contribute 62.30% of total market revenue by 2025 within the traveler category, establishing it as the leading user base. This growth is driven by rising disposable incomes, flexible travel habits, and increased interest in personalized and experiential tourism.

Leisure travelers tend to book directly through user friendly platforms that offer flexible scheduling, curated travel content, and promotional fares. Additionally, seasonal travel peaks and social media influence have intensified demand for spontaneous and remote travel bookings, often facilitated by online platforms.

The focus on affordability, variety, and convenience makes leisure travelers the primary driver of growth in the online airline booking platform market.

The online airline booking platform market is shaped by digital adoption, secure payment integration, AI-driven personalization, and challenges in pricing competition. Its growth is defined by innovation in consumer engagement and strategic partnerships.

The online airline booking platform market is projected to expand due to the increasing preference for digital channels over traditional ticketing systems. Travelers are shifting toward online portals and mobile applications because of their convenience, transparent fare comparison, and the availability of last-minute deals. The growing use of smartphones and high internet penetration in both mature and emerging markets has enhanced the appeal of online bookings.

Personalized offers, flexible payment options, and loyalty integrations are contributing further to this shift. With airlines themselves investing heavily in direct booking platforms, third-party portals, and aggregators are also capturing significant consumer interest, creating a competitive landscape that continues to fuel the sector’s growth trajectory.

A critical factor driving this market is the integration of secure and flexible payment systems into booking platforms. Consumers prefer platforms offering multiple payment options, including credit cards, debit cards, digital wallets, and buy-now-pay-later schemes. Enhanced payment security with multi-factor authentication, encryption, and fraud detection has boosted customer confidence. Fintech collaborations have widened accessibility for global travelers, allowing smooth transactions across currencies and regions. Airlines and booking portals are capitalizing on this trend by combining loyalty rewards with digital payments, thereby increasing customer retention. The growing emphasis on easy refunds and cancellation processes further strengthens trust, positioning payment flexibility as a vital growth catalyst.

Artificial intelligence and data analytics have become integral to online airline booking platforms by driving personalization and efficiency. Algorithms track browsing behavior, past bookings, and spending habits to create tailored recommendations for travelers. Predictive analytics is being used for dynamic pricing, forecasting demand surges, and optimizing seat inventory. This has improved revenue management for airlines and enhanced user experiences by providing better deals and targeted promotions. AI chatbots have become common for customer support, enabling 24/7 assistance and faster issue resolution. Analytics-driven insights are also being deployed to assess route profitability and design marketing strategies, making AI a transformative tool across booking platforms.

Despite growth, the market faces significant challenges related to price sensitivity and high competition. Online booking platforms often operate on thin margins, with consumers consistently seeking the lowest fares and switching between portals to find better deals. This price-driven environment pressures companies to innovate with value-added services, such as bundled packages, insurance, or exclusive offers. Competitive intensity from airline-owned platforms, online travel agencies, and meta-search engines creates constant rivalry. Consumer expectations for transparency on ancillary fees add further strain on profitability.

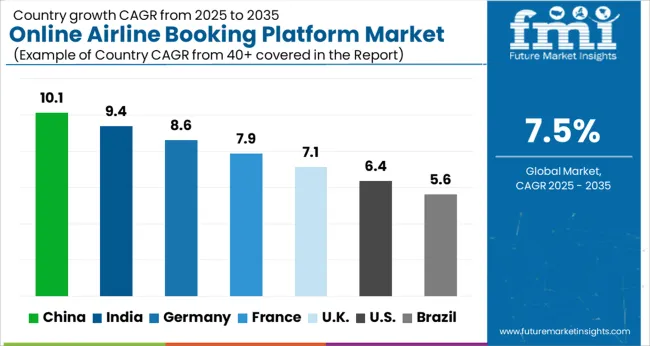

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The global online airline booking platform market is expected to grow at a CAGR of 7.5% between 2025 and 2035. China leads expansion at 10.1%, followed by India at 9.4%, Germany at 8.6%, France at 7.9%, the United Kingdom at 7.1%, and the United States at 6.4%. Asia is driving higher growth through smartphone penetration, rising middle-class travel, and competitive low-cost carrier models integrated with digital platforms. Europe and North America emphasize premium services, loyalty integration, and innovation in dynamic pricing systems that attract both leisure and business travelers. Strong adoption of mobile-first strategies, fintech-backed payments, and AI-enabled personalization defines the global trajectory. Emerging economies are fueling scale, while developed regions enhance user engagement through advanced digital ecosystems. The analysis spans over 40+ countries, with the leading markets shown below.

The online airline booking platform market in China is projected to grow at a CAGR of 10.1% from 2025 to 2035. Travel spending is expected to be channeled through super apps, airline direct channels, and large online travel agencies, with mobile-first journeys preferred across tiers of cities. New Distribution Capability adoption is being prioritized by leading carriers to expand ancillaries and improve fare merchandising. Wallets and QR-based payments have been entrenched, which lowers checkout friction and raises conversion. Cross border routes into Southeast Asia and the Middle East are anticipated to post strong traffic, and platforms are optimizing language, currency, and customer service for these corridors. Partnerships between airlines, hotels, and rail are forming bundled itineraries that increase average order value and retention across repeat travelers.

The online airline booking platform market in India is expected to rise at a CAGR of 9.4% between 2025 and 2035. Penetration of low-cost carriers has encouraged early booking windows and fare alerts, which steer traffic toward online channels. UPI and card-on-file support have simplified checkout and refunds, which improves customer trust. Tier 2 and Tier 3 city travelers are adopting app-based bookings as regional connectivity expands. Airlines are using direct channels to push seats and ancillaries, while marketplaces retain relevance through fare comparison and financing options. Business travel is returning with negotiated fares routed through managed platforms. Content breadth, transparent fee displays, and responsive service are considered decisive in share gains across leisure and corporate travelers through 2035.

The online airline booking platform market in France is projected to advance at a CAGR of 7.9% from 2025 to 2035. Direct airline portals and leading OTAs are strengthening packages that combine seats with rail, hotels, and experiences across domestic and intra EU trips. Strong card acceptance and trusted local wallets are encouraging prepayment and installment plans that lift conversion. Price transparency rules and clear disclosure of surcharges are shaping consumer preference toward platforms with clean workflows. Low cost and full service carriers are sharpening NDC programs to present branded fares and seat attributes, which improves upsell. Leisure demand to Mediterranean and long haul destinations is expected to be captured through targeted offers and loyalty tie ins. Corporate travel tools emphasize duty of care and rebooking speed, supporting steady online usage.

The online airline booking platform market in the United Kingdom is anticipated to expand at a CAGR of 7.1% during 2025 to 2035. Consumers are adopting flexible ticketing, seat selection, and ancillaries through both airline sites and meta led funnels that surface fare families clearly. Open banking payments and strong card networks provide secure checkout and faster refunds, which supports repeat purchases. Short haul European routes and long haul services to North America are promoted with dynamic offers tied to loyalty partnerships. Corporate travel recovery is being managed through online tools that standardize policy, authorizations, and traveler safety features. Price sensitive segments still compare across metas, yet differentiation is being built through customer service, disruption handling, and post booking alerts that keep travelers informed.

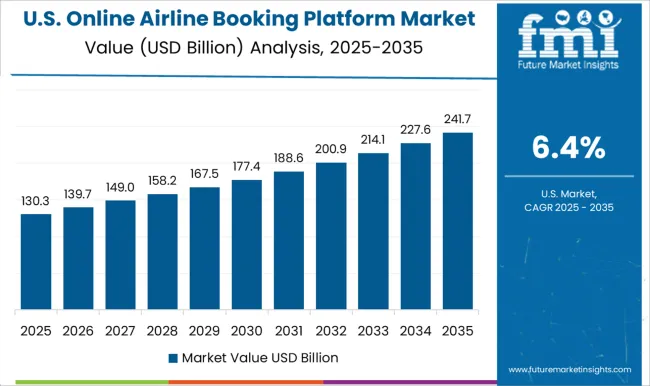

The online airline booking platform market in the United States is expected to grow at a CAGR of 6.4% from 2025 to 2035. Airline direct channels remain influential, yet large OTAs and metas retain share through breadth of content and bundled trip planning. Co branded cards, buy now pay later, and stored credentials have simplified payment, which increases conversion on mobile. Dynamic pricing and fare class merchandising are being used to manage capacity swings across hub and point to point networks. Corporate travel management platforms are prioritizing cost control, unused ticket tracking, and duty of care, which preserves online channel dependence. Customer expectations for transparent fees, rapid customer support, and disruption rebooking are shaping competitive advantages across providers through the period.

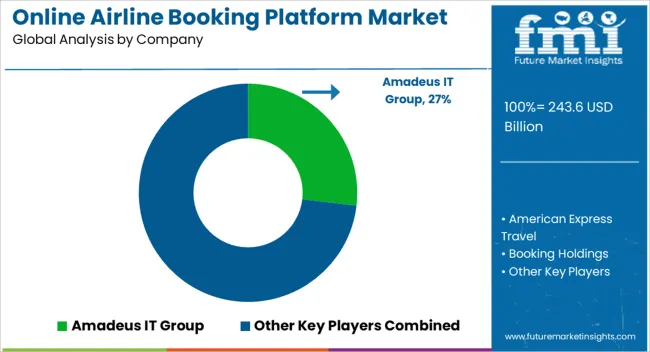

The online airline booking platform market is shaped by global travel technology providers, regional online travel agencies (OTAs), and specialized airline distribution platforms. Leading players such as Expedia Group, Booking Holdings, Amadeus IT Group, and Travelport hold strong positions by offering comprehensive platforms for airline ticket booking, ancillary services, dynamic pricing, and customer support. Competitive differentiation is largely driven by user experience, platform reliability, integration with airline reservation systems, pricing transparency, and loyalty program management. Regional players, particularly in Asia-Pacific, Europe, and North America, compete by offering localized content, language support, and tailored payment solutions to capture domestic and cross-border travel demand.

Strategic partnerships with airlines, hotel chains, and payment providers enhance market reach and customer engagement. Innovation in AI-driven personalized recommendations, mobile booking apps, predictive pricing, and secure payment gateways further strengthens competitive positioning. Companies prioritizing platform scalability, regulatory compliance, and robust customer service are well-positioned to capture significant market share. Overall, firms combining technological innovation, strong airline partnerships, and seamless user experience are expected to benefit from the growing global demand for convenient, efficient, and cost-effective online air travel booking solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 243.6 Billion |

| End Use Commercial Industrial Utility | Online travel agencies (OTAs), Metasearch engines, and Airline websites and mobile apps |

| Offering | Mobile-based and Web-based |

| Traveler | Leisure travelers and Business travelers |

| Application | International booking and Domestic booking |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amadeus IT Group, American Express Travel, Booking Holdings, CheapOair, eTraveli Group, Expedia Group, Kiwi.com, Orbitz, Sabre Corporation, and Trip.com Group |

| Additional Attributes | Dollar sales, share, regional adoption patterns, competitive positioning, consumer booking behavior, mobile penetration, fintech integrations, and future opportunities in leisure and corporate travel. |

The global online airline booking platform market is estimated to be valued at USD 243.6 billion in 2025.

The market size for the online airline booking platform market is projected to reach USD 502.1 billion by 2035.

The online airline booking platform market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in online airline booking platform market are online travel agencies (otas), metasearch engines and airline websites and mobile apps.

In terms of offering, mobile-based segment to command 54.1% share in the online airline booking platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Online Food Delivery and Takeaway Market Size and Share Forecast Outlook 2025 to 2035

Online Clothing Rental Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Online To Offline Commerce Market Size and Share Forecast Outlook 2025 to 2035

Online Travel Market Size and Share Forecast Outlook 2025 to 2035

Online Fitness Market Size and Share Forecast Outlook 2025 to 2035

Online Gambling Market Size and Share Forecast Outlook 2025 to 2035

Online Laundry Services Market Size and Share Forecast Outlook 2025 to 2035

Online Catering Marketplace Size and Share Forecast Outlook 2025 to 2035

Online Powersports Market Size and Share Forecast Outlook 2025 to 2035

Online Paint Editor App Market Size and Share Forecast Outlook 2025 to 2035

Online Grocery Market – Trends, Growth & Forecast 2025 to 2035

Online Home Rental Market Analysis – Trends, Growth & Forecast 2025 to 2035

Online Travel Agencies Market Trends-Growth & Forecast 2025 to 2035

Online Food Delivery Services Market Outlook - Growth, Demand & Forecast 2025 to 2035

Assessing Online Clothing Rental Market Share & Industry Insights

Online Executive Education Program Market Trends – Growth & Forecast 2024-2034

Secure & Seamless Digital Payments – AI-Powered Payment Gateways

Online Advocacy Platform Market

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA