The Online Travel Market is estimated to be valued at USD 0.7 billion in 2025 and is projected to reach USD 1.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. This growth follows a steady maturity curve shaped by evolving consumer behavior, digital adoption, and platform innovation. During the early adoption phase (2020–2024), the market hovered between USD 0.5–0.6 billion, with growth constrained by pandemic-related disruptions and reliance on traditional travel booking channels. However, this period laid the groundwork for digital transformation, as online platforms enhanced personalization, mobile integration, and payment security to attract users. The scaling phase (2025–2030) begins with the market value at USD 0.7 billion, driven by rising smartphone penetration, shifting consumer preference toward online bookings, and competitive pricing strategies.

Platforms diversify offerings by integrating hotel reservations, transport, and curated experiences, helping the market climb toward USD 1.0 billion by 2030. Moving into consolidation (2030–2035), the industry matures with the market expanding to USD 1.4 billion. Growth stabilizes as leading players focus on loyalty programs, AI-driven recommendations, and partnerships with airlines and hospitality chains. By 2035, online travel will become a standardized, seamless part of the consumer journey, with strong regional adoption and higher booking volumes.

| Metric | Value |

|---|---|

| Online Travel Market Estimated Value in (2025 E) | USD 0.7 billion |

| Online Travel Market Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The online travel market is expanding rapidly as consumers increasingly prefer the convenience and variety offered by digital platforms for planning and booking trips. The transportation segment leads demand due to growing mobility needs across leisure and business travel.

Advances in internet connectivity and mobile technology have driven a shift from traditional travel agencies to online travel agencies that provide seamless booking experiences. Consumers are drawn to the ease of comparing options, securing deals, and managing itineraries all in one place.

The rise in smartphone penetration has accelerated mobile-based bookings, offering travelers access anytime and anywhere. Increased digital literacy and the growth of budget travel options have further fueled market adoption. Industry stakeholders continue to innovate by integrating AI-driven recommendations and personalized offers to enhance user engagement. Segmental growth is expected to be driven by transportation services, with online travel agencies serving as the primary booking mode, and mobile-based platforms dominating the digital travel experience.

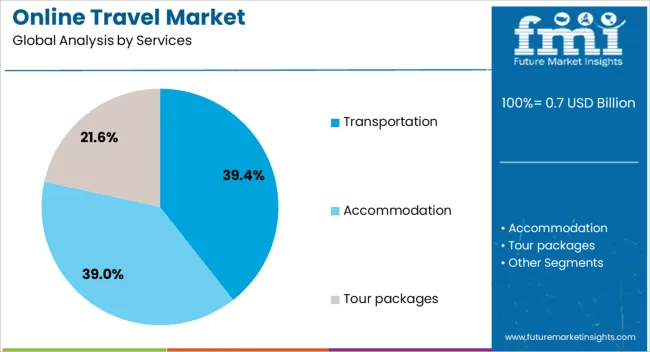

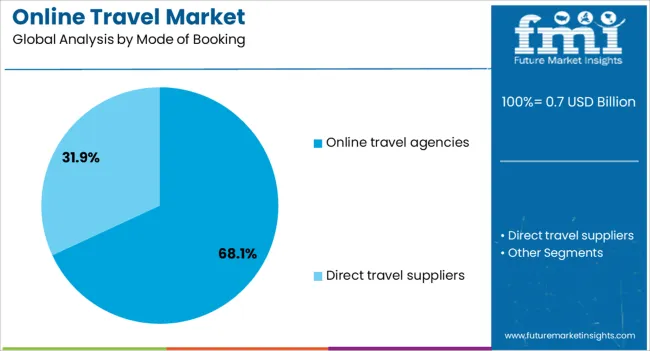

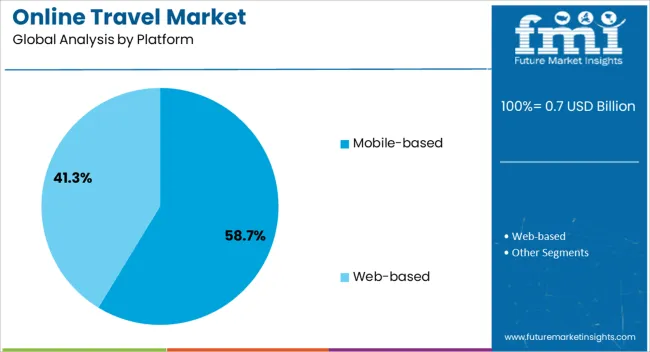

The online travel market is segmented by services, mode of booking, platform, traveler, application, and geographic regions. By services, the online travel market is divided into Transportation, Accommodation, and Tour packages. In terms of mode of booking, the online travel market is classified into Online travel agencies and Direct travel suppliers. Based on platform of the online travel market is segmented into Mobile-based and Web-based. The online travel market is segmented by traveler type into Leisure and Business. By application, the online travel market is segmented into International booking and Domestic booking. Regionally, the online travel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transportation segment is projected to account for 39.4% of the online travel market revenue in 2025, maintaining its leading position. This growth is primarily driven by the high frequency and necessity of travel across air, rail, and road modes.

Consumers seek efficient and cost-effective transportation booking solutions that can be easily accessed via online platforms. The rise of low-cost carriers and integrated multimodal travel options has boosted transportation bookings through digital channels.

Furthermore, enhanced scheduling flexibility and real-time updates have improved the attractiveness of online transportation services. As travel demand rebounds and diversifies, transportation remains a critical segment sustaining the online travel market.

The online travel agencies segment is expected to hold 68.1% of the market revenue in 2025, reflecting their dominance as the preferred booking method. Online travel agencies offer comprehensive travel solutions including flights, hotels, and packages, attracting users with their convenience and competitive pricing.

Their platforms provide extensive search and filtering options that empower consumers to customize travel plans easily. Partnerships with service providers and integrated payment systems enhance user confidence and transaction security.

The ability to bundle services and access customer reviews further solidifies the position of online travel agencies. Growing trust in these platforms and marketing efforts have reinforced their central role in the online travel ecosystem.

The mobile-based platform segment is projected to contribute 58.7% of the online travel market revenue in 2025, emerging as the dominant digital channel. Growth in this segment is supported by widespread smartphone usage and improvements in mobile internet speed and reliability.

Mobile apps provide personalized experiences, instant notifications, and simplified booking processes that cater to on-the-go travelers. Features such as mobile check-in, real-time itinerary updates, and location-based services have increased user engagement.

Additionally, mobile platforms offer seamless integration with digital wallets and loyalty programs, enhancing convenience. As mobile technology evolves, mobile-based platforms are expected further to strengthen their hold on the online travel market.

The online travel market is expanding rapidly as travelers increasingly rely on digital platforms for booking flights, hotels, and experiences. The rise of mobile applications, personalized recommendations, and secure payment systems enhances convenience and accessibility for consumers. Growing internet penetration and rising disposable incomes in emerging economies further accelerate adoption. Competition among global booking platforms and regional players is intensifying, with customer loyalty hinging on pricing, convenience, and user experience. Shifts in travel patterns and regulations also shape industry performance.

Online travel platforms benefit significantly from growing internet access, smartphone usage, and digital literacy worldwide. Travelers increasingly prefer mobile applications and web portals for booking flights, accommodation, and tour packages due to the ease of price comparisons and instant confirmations. Secure payment gateways and wallet integration enhance transaction confidence. The demand for personalized digital experiences, such as tailored offers and real-time updates, is also driving growth. As digital adoption accelerates, online platforms are steadily replacing traditional travel agencies as the dominant booking channels globally.

Emerging markets present significant growth opportunities for online travel companies. Rising disposable incomes, expanding middle-class populations, and increased leisure spending encourage more people to explore domestic and international travel. Governments in Asia-Pacific, Latin America, and the Middle East are also investing in tourism promotion, boosting demand for online booking services. Localized platforms and multilingual applications attract first-time digital users in these regions. The growing acceptance of online payments and the availability of low-cost travel options make emerging economies a critical driver of future market expansion.

Customer experience has become a decisive factor in the online travel market. Platforms that provide intuitive interfaces, transparent pricing, responsive customer support, and seamless booking processes retain stronger customer loyalty. Personalization through AI-based recommendations, predictive pricing, and customized offers enhances user engagement. Features like flexible cancellation policies, loyalty rewards, and real-time updates further strengthen satisfaction levels. As customer expectations evolve, companies prioritizing seamless experiences and tailored services are likely to gain a competitive advantage in this highly dynamic and competitive industry.

The online travel market faces strong competitive pressure as established global players compete with regional platforms and direct bookings through airline and hotel websites. Price sensitivity among travelers leads to narrow margins, making differentiation through service quality and loyalty programs essential. Additionally, regulatory frameworks concerning consumer protection, data privacy, and cross-border transactions pose operational challenges. Regional taxation policies and travel restrictions further affect market growth. Companies navigating these complexities effectively while offering reliable services and transparent pricing will remain resilient in a competitive landscape.

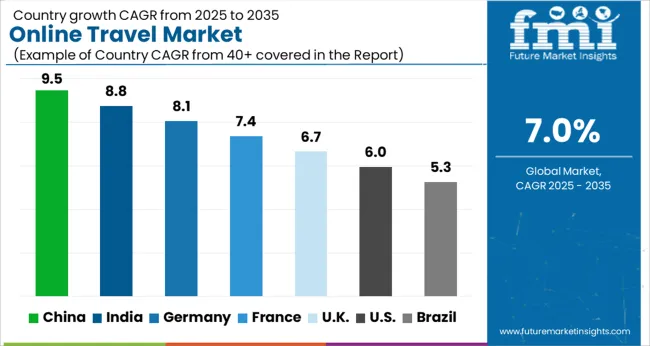

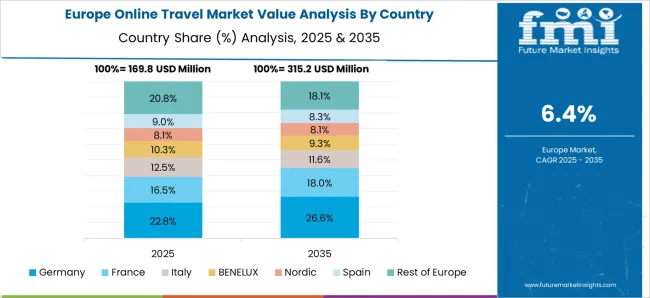

The global online travel market is projected to grow at a CAGR of 7.0%, fueled by rising internet penetration, increasing mobile bookings, and consumer preference for digital platforms. China leads the market with a 9.5% growth rate, supported by a surge in domestic tourism and rapid adoption of online booking platforms. India follows closely at 8.8%, driven by expanding middle-class travel demand and digital transformation in the tourism sector. Germany shows steady progress at 8.1%, reflecting strong consumer reliance on online platforms for both leisure and business travel. The UK records a 6.7% growth rate, supported by a mature digital booking ecosystem, while the USA sees growth of 6.0%, driven by sustained demand for online travel services across diverse segments. This report includes insights on 40+ countries; the top countries are shown here for reference.

China dominates the Online Travel Market with a CAGR of 9.5%, supported by its fast-growing digital ecosystem, rising disposable incomes, and a strong preference for mobile-first travel bookings. The country’s booming domestic tourism industry and rapid expansion of international travel further boost online platforms. Companies like Ctrip and Fliggy are transforming the sector with user-friendly apps, integrated payment solutions, and personalized travel recommendations. Government initiatives to enhance digital infrastructure, combined with widespread smartphone adoption, enable seamless customer experiences. Additionally, the growth of high-speed rail and low-cost airlines stimulates affordable travel options, driving more users toward online platforms. China’s tech-savvy population and increased reliance on AI-driven booking systems ensure consistent demand. With digital wallets and super-app integrations, the country is well-positioned to remain a global leader in the online travel industry.

Online travel market in India is expanding at 8.8%, supported by rapid digital adoption, affordable internet access, and a growing middle-class population eager to travel. Online platforms such as MakeMyTrip, Yatra, and Cleartrip dominate the market, offering affordable flight, hotel, and holiday package bookings. Increasing smartphone penetration and government focus on boosting tourism infrastructure significantly enhance adoption. Growth in budget airlines and improved connectivity between tier-2 and tier-3 cities contribute to rising demand. Travelers increasingly prefer online platforms for transparency, discounts, and convenient digital payment options. The market also benefits from the surge in domestic tourism post-pandemic, where travelers rely on mobile applications for safe and hassle-free bookings. Integration of AI and data analytics for customized travel packages ensures further growth, making India a key growth hub for the online travel industry.

Online travel market in Germany grows steadily at 8.1%, supported by the country’s highly organized tourism industry and demand for digital convenience in booking processes. German travelers value reliability, transparency, and seamless integration of accommodation, transport, and travel services. Leading platforms such as Booking.com and Expedia dominate the market with user-centric experiences. Growth is also fueled by increasing international tourism, as Germany is a top outbound travel market in Europe. Mobile booking adoption continues to rise as travelers prefer app-based solutions for convenience. Sustainability plays a vital role, with eco-friendly travel options gaining traction. Moreover, the country’s strong technological infrastructure ensures high adoption rates of digital services. The combination of cultural tourism, business travel, and sustainable travel preferences makes Germany a robust contributor to global online travel growth.

The UK market for online travel expands at 6.7%, influenced by growing demand for international tourism, package holidays, and digital-first booking platforms. British travelers increasingly rely on websites and mobile applications for flights, hotels, and customized experiences. Companies such as Skyscanner and Expedia provide competitive options and personalized deals, boosting adoption. Growth is also supported by an increase in short-haul European travel and demand for flexible travel plans. The UK’s strong e-commerce ecosystem complements the expansion of online travel platforms, ensuring trust and secure transactions. Rising demand for eco-conscious and sustainable travel packages adds further growth opportunities. With international tourism bouncing back and digital habits solidifying, the UK remains a mature yet steadily growing market for online travel platforms.

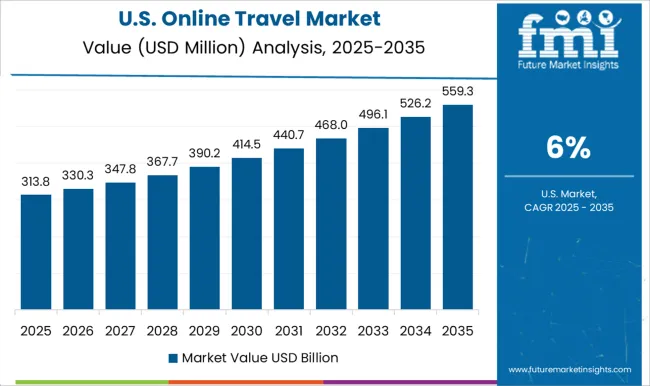

The USA Online Travel Market records a CAGR of 6.0%, driven by high smartphone usage, strong internet penetration, and demand for both domestic and international travel. Leading players such as Expedia, Airbnb, and Booking Holdings dominate the landscape with comprehensive booking options. American consumers increasingly demand flexibility, transparency, and customizable packages that integrate flights, hotels, and car rentals. Growth in leisure travel and “workcation” trends contributes to market expansion, as hybrid work models encourage longer stays. The rise of last-minute bookings and mobile-first platforms ensures rapid adoption among younger demographics. Sustainability is also gaining importance, with eco-friendly travel options becoming mainstream. Government investments in tourism recovery and strong private sector innovation will further strengthen the USA online travel industry.

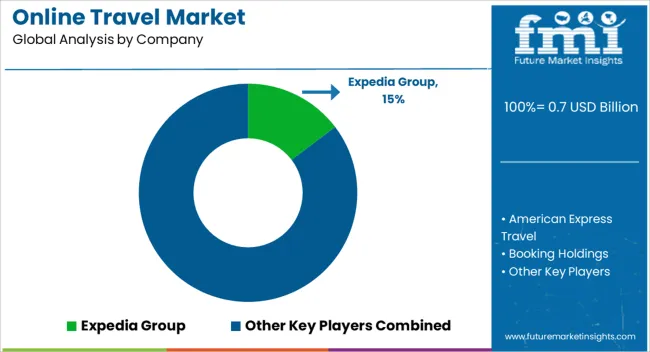

Expedia Group and Booking Holdings are dominant players in the market, offering comprehensive platforms with vast inventories of hotels, flights, and travel experiences. Trip.com Group, based in China, is expanding its global footprint, serving as a leading online travel provider in Asia-Pacific. American Express Travel combines premium travel services with loyalty programs, catering to high-end travelers. Platforms like Orbitz and CheapOair specialize in competitive pricing and user-friendly booking options, attracting budget-conscious travelers. EaseMyTrip and Webjet Limited are strengthening their presence in emerging markets, particularly in the Asia-Pacific region, by offering localized and cost-effective travel solutions. Kiwi.com has built a strong reputation with its advanced flight-search technology and unique virtual interlining capabilities, while eTraveli Group enhances the market with innovative flight distribution services. Sabre Corporation, a leading travel technology provider, supports OTAs and travel agencies with advanced booking, distribution, and analytics platforms, playing a crucial role in backend solutions. With increasing smartphone adoption, AI-driven personalization, and digital payment integration, the online travel market is set to expand rapidly, reshaping how consumers plan and book travel worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.7 Billion |

| Services | Transportation, Accommodation, and Tour packages |

| Mode of Booking | Online travel agencies and Direct travel suppliers |

| Platform | Mobile-based and Web-based |

| Traveler | Leisure and Business |

| Application | International booking and Domestic booking |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Expedia Group, American Express Travel, Booking Holdings, CheapOair, EaseMyTrip, eTraveli Group, Kiwi.com, Orbitz, Sabre Corporation, Trip.com Group, and Webjet Limited |

| Additional Attributes | Dollar sales by service type including transportation booking, accommodation booking, and vacation packages, device type such as desktop and mobile, application across leisure and business travel, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising internet penetration, increasing mobile-based bookings, and demand for convenient travel planning solutions. |

The global online travel market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the online travel market is projected to reach USD 1.4 billion by 2035.

The online travel market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in online travel market are transportation, _airline, _car rental, _rail, _cruise, _bus, accommodation and tour packages.

In terms of mode of booking, online travel agencies segment to command 68.1% share in the online travel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Online Travel Agencies Market Trends-Growth & Forecast 2025 to 2035

Online Leadership Development Program Market Size and Share Forecast Outlook 2025 to 2035

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

Online To Offline Commerce Market Size and Share Forecast Outlook 2025 to 2035

Online Fitness Market Size and Share Forecast Outlook 2025 to 2035

Online Gambling Market Size and Share Forecast Outlook 2025 to 2035

Online Laundry Services Market Size and Share Forecast Outlook 2025 to 2035

Online Catering Marketplace Size and Share Forecast Outlook 2025 to 2035

Online Powersports Market Size and Share Forecast Outlook 2025 to 2035

Online Clothing Rental Market Size, Growth, and Forecast 2025 to 2035

Online Paint Editor App Market Size and Share Forecast Outlook 2025 to 2035

Online Home Rental Market Analysis – Trends, Growth & Forecast 2025 to 2035

Online Grocery Market – Trends, Growth & Forecast 2025 to 2035

Online Food Delivery Services Market Outlook - Growth, Demand & Forecast 2025 to 2035

Assessing Online Clothing Rental Market Share & Industry Insights

Online Advocacy Platform Market

Online Executive Education Program Market Trends – Growth & Forecast 2024-2034

Secure & Seamless Digital Payments – AI-Powered Payment Gateways

Online Food Delivery Market Analysis – Trends & Forecast 2024-2034

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA