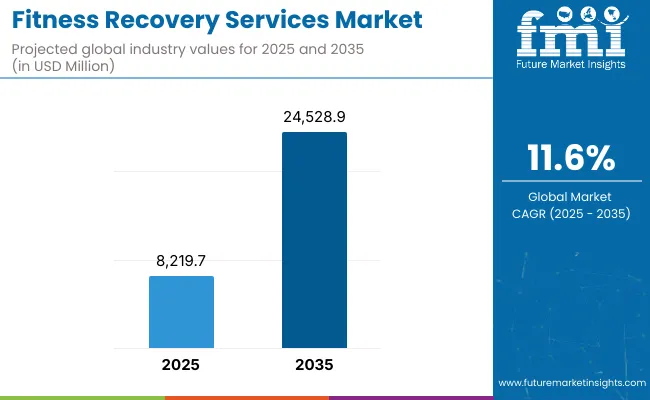

The Global Fitness Recovery Services Market is expected to record a valuation of USD 8,219.7 million in 2025 and USD 24,528.9 million in 2035, with an increase of USD 16,309.2 million, which equals a growth of ~198% over the decade. The overall expansion represents a CAGR of 11.6% and a 3X increase in market size.

Global Fitness Recovery Services Market Key Takeaways

| Metric | Value |

| Market Estimated Value in (2025E) | USD 8,219.7 million |

| Market Forecast Value in (2035F) | USD 24,528.9 million |

| Forecast CAGR (2025 to 2035) | 11.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 8,219.7 million to USD 14,199.3 million, adding USD 5,979.6 million, which accounts for 37% of the total decade growth. This phase records steady adoption in wellness spas, fitness clubs, and sports clinics, driven by the need for general wellness recovery. Massage therapy & assisted stretch dominates this period as it caters to over one-third of global demand in 2025.

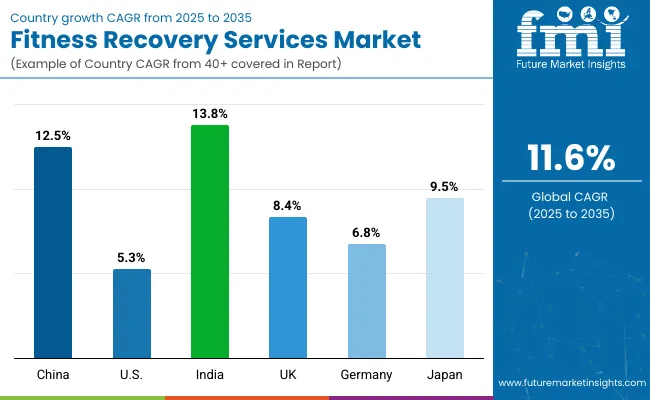

The second half from 2030 to 2035 contributes USD 10,329.6 million, equal to 63% of total growth, as the market jumps from USD 14,199.3 million to USD 24,528.9 million. This acceleration is powered by widespread adoption in India (13.8% CAGR), China (12.5% CAGR), and Japan (9.5% CAGR), alongside corporate wellness programs, in-home/on-demand recovery, and digital-first booking platforms. Membership and subscription models increase recurring revenue, expanding their share in total value.

From 2020 to 2024, the Global Fitness Recovery Services Market grew from smaller adoption levels to early mainstreaming, driven by wellness studios and recovery spas. During this period, the competitive landscape was dominated by service-based operators controlling nearly 70% of revenue, with leaders such as Restore Hyper Wellness and StretchLab focusing on premium memberships and assisted stretch modalities. Competitive differentiation relied on location density, practitioner expertise, and recovery program variety, while corporate wellness and mobile recovery services had minimal traction, contributing less than 15% of the total market value.

Demand for fitness recovery services will expand to USD 8,219.7 million in 2025, and the revenue mix will shift as app/web booking platforms (63.2% | USD 5,194.8 million) and subscription-based recovery programs rise. Traditional players face competition from digital-first recovery startups offering AI-enabled wellness tracking, cryotherapy pods, and bundled recovery memberships. Major service providers are pivoting to hybrid models, integrating in-home sessions and corporate tie-ups to retain relevance. Emerging entrants specializing in infrared therapy, percussive recovery, and compression therapy equipment are gaining share. The competitive advantage is moving away from location-only strategies toward ecosystem strength, digital integration, and recurring memberships.

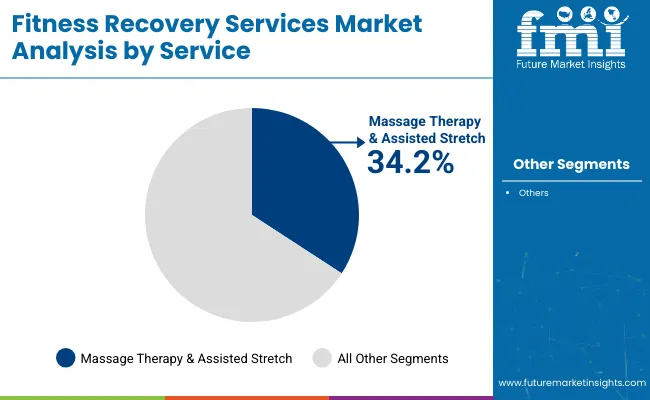

Advances in recovery modalities such as cryotherapy, infrared therapy, and percussive therapy have improved efficiency and broadened adoption across consumer groups. Massage therapy & assisted stretch remains the most widely accepted, accounting for 34.2% share in 2025 (USD 2,811.1 million), due to its suitability for both general wellness and athlete recovery. The rise of digital booking platforms has further accelerated adoption, as app/web bookings account for 63.2% of market value in 2025 (USD 5,194.8 million). Expansion of corporate wellness programs, boutique studios, and on-demand recovery is fueling long-term growth. New offerings such as infrared saunas, compression therapy boots, and AI-based coaching apps are opening additional use cases. Segment growth is expected to be led by massage therapy & assisted stretch, app-based booking channels, and subscription pricing models, ensuring strong scalability and recurring revenue streams.

The market is segmented by service type (modality), end user, booking channel, delivery setting, session type, and pricing model. Service types include massage therapy & assisted stretch, cryotherapy/cold plunge & contrast therapy, compression therapy, infrared sauna & red-light therapy, myofascial/percussive & mobility sessions, and other recovery methods (PEMF, float, breathwork). End users encompass general wellness consumers, recreational athletes, professional & elite athletes/teams, and corporate wellness participants.

Booking channels include app/web booking and walk-in/phone, reflecting evolving consumer preferences. Delivery settings span boutique recovery studios/wellness spas, fitness clubs & premium gyms, sports medicine/physiotherapy clinics, and in-home/on-demand mobile recovery. Session types cover self-serve equipment sessions and therapist-guided/practitioner-led formats. Pricing models include membership/subscription, packs (multi-session), and pay-per-session. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Massage Therapy & Assisted Stretch | 34.2% |

| Others | 65.8% |

The massage therapy & assisted stretch segment is projected to contribute 34.2% of the Global Fitness Recovery Services Market revenue in 2025, valued at USD 2,811.1 million, making it the leading modality. Its dominance is driven by strong consumer demand across both wellness enthusiasts and athletes, who seek personalized recovery programs that combine relaxation with mobility improvement. The segment benefits from scalability within boutique studios, fitness clubs, and dedicated recovery franchises, enabling consistent revenue growth. This segment is expected to retain leadership as recovery services become more mainstream, with operators bundling massage and stretch sessions into subscription packages. Assisted stretching, in particular, has gained momentum due to its accessibility and proven benefits in injury prevention and flexibility improvement, ensuring its position as the backbone of recovery modalities.

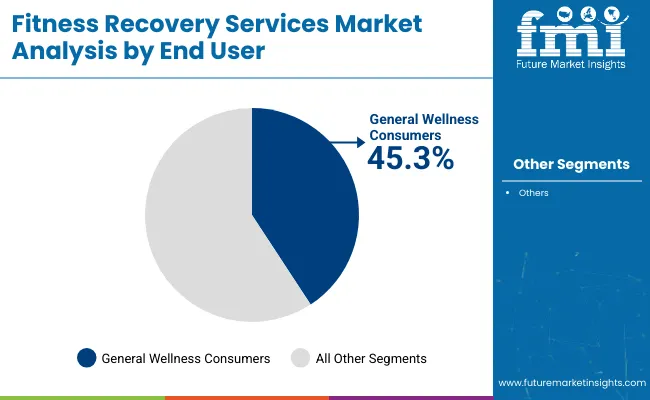

| End User Segment | Market Value Share, 2025 |

|---|---|

| General Wellness Consumers | 45.3% |

| Others | 65.8% |

The general wellness consumer segment is forecasted to hold 45.3% of market share in 2025, valued at USD 3,723.5 million, making it the single largest user group. Rising health awareness, increased stress management needs, and the pursuit of holistic well-being are fueling participation from everyday consumers beyond professional athletes. This broad demographic ensures recurring demand through both memberships and on-demand sessions.The segment’s growth is reinforced by its accessibility via app-based booking platforms, as consumers are drawn to flexible and affordable service packs. With more people adopting fitness and recovery as part of preventive healthcare, this segment is expected to remain the largest driver of global market value throughout the forecast period.

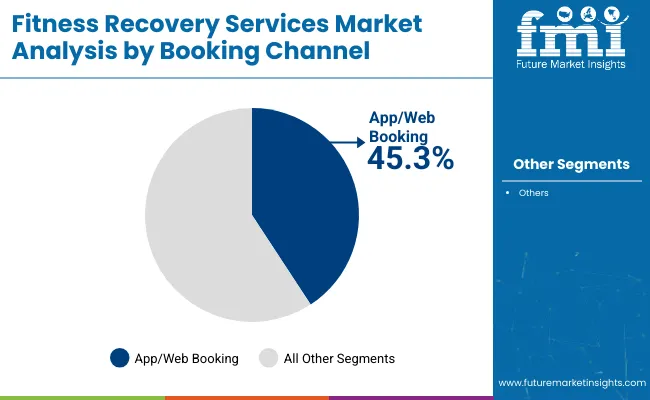

| Booking Channel Segment | Market Value Share, 2025 |

|---|---|

| App/Web Booking | 45.3% |

| Others | 65.8% |

The app/web booking channel is projected to capture 63.2% of market share in 2025, valued at USD 5,194.8 million, making it the dominant booking method. This trend reflects the industry’s shift toward digital-first engagement, with recovery service providers adopting platforms that simplify scheduling, payments, and subscription management. The segment’s rise is fueled by consumer preference for convenience and operators’ push for operational efficiency through digital channels. Integration with loyalty programs, AI-driven personalization, and seamless subscription billing further enhances adoption. As on-demand wellness services continue to scale globally, app/web booking is expected to strengthen its dominance, displacing traditional walk-in and phone-based scheduling.

Drivers

Rising Health & Wellness Awareness Among Consumers

The single largest driver for the Global Fitness Recovery Services Market is the rising awareness of preventive health and holistic wellness among consumers. Over the last decade, fitness and wellness trends have evolved beyond traditional gym workouts and sports performance, shifting toward recovery, mobility, and stress management as integral aspects of an active lifestyle. This shift is evident in the fact that general wellness consumers already contribute 45.3% of the market in 2025, equivalent to USD 3,723.5 million, making them the dominant end-user group ahead of recreational or professional athletes. What makes this driver particularly strong is the broad demographic base fueling demand.

Unlike niche services that appeal only to elite athletes, recovery modalities such as massage therapy, assisted stretching, and mobility sessions are increasingly being adopted by everyday consumers seeking stress relief, better sleep, and injury prevention. Post-pandemic wellness behaviors have also intensified demand for recovery services, with consumers actively investing in personal health as part of preventive care. This driver is reinforced by the accessibility of recovery services across delivery settings from boutique wellness spas and fitness clubs to in-home mobile services.

Operators are capitalizing on this trend by offering flexible programs through subscription packs, memberships, and on-demand digital bookings, which reduce barriers to entry for new users. As recovery services continue to be positioned as “essential wellness” rather than “luxury treatments,” the mass-market appeal of these offerings ensures strong, sustained growth over the forecast period.

Digital Transformation Through App/Web Platforms

The adoption of digital-first booking and service delivery is another major driver of market growth. In 2025, app/web bookings already account for 63.2% of global market revenue, valued at USD 5,194.8 million, highlighting how technology has become the default interface for consumers. This shift is not merely about convenience it is structurally reshaping how recovery services are accessed, consumed, and monetized. Digital platforms simplify scheduling, payments, and subscription management, while also allowing for seamless integration with wellness apps, wearable data, and personalized programs.

For operators, app/web systems reduce operational inefficiencies, increase customer retention, and open the door to recurring revenue models that replace one-time transactional sales. Memberships and packs are increasingly managed through digital platforms, enabling operators to offer loyalty-based discounts and AI-driven recommendations. The digital transformation is also breaking geographical barriers, allowing recovery providers to scale quickly into new markets.

For example, boutique studios in the USA are leveraging digital platforms to expand into Asia-Pacific through franchising models supported by centralized booking systems. The growth of digital-first recovery startups some offering exclusively app-based mobility and breathwork sessions demonstrates how this driver extends beyond physical service delivery into hybrid and virtual wellness ecosystems. With the majority of consumers now expecting app-based convenience, this driver is likely to remain one of the most powerful enablers of market expansion through 2035.

Restraints

High Cost of Specialized Recovery Modalities

One of the biggest challenges restraining wider adoption is the cost associated with specialized recovery services. While massage therapy and assisted stretching remain relatively accessible, modalities such as cryotherapy chambers, infrared saunas, and PEMF treatments require heavy capital investments in equipment and infrastructure. This cost burden limits affordability for end consumers and creates barriers for small or independent operators, particularly in emerging economies. Even when available, advanced recovery services are often priced at a premium under pay-per-session or boutique membership models.

This creates a perception of recovery as a luxury rather than a necessity, restricting its penetration among middle-income consumers who represent the largest growth opportunity. Although subscription packs reduce the upfront cost, many advanced modalities remain out of reach for price-sensitive markets. The high cost also hampers geographic expansion, as recovery brands struggle to justify investments in countries where disposable incomes are lower. Without scalable low-cost models or financing options for operators, the diffusion of advanced recovery technologies may remain limited to North America, parts of Europe, and select Asian cities with affluent populations. This restraint risks slowing down the otherwise rapid adoption trajectory predicted for the sector.

Fragmented Market with Limited Standardization

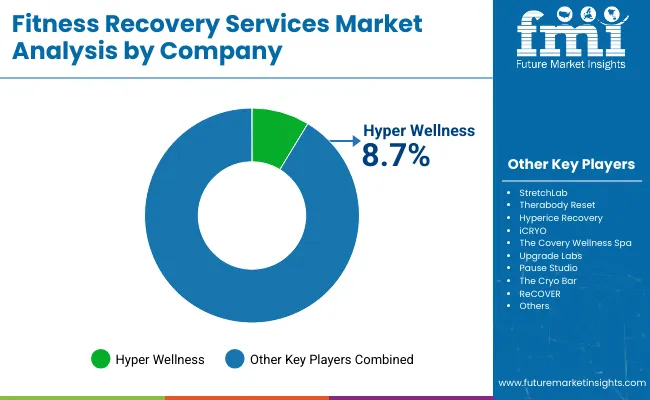

Another major restraint is the highly fragmented nature of the Global Fitness Recovery Services Market. Unlike the fitness club industry, which has consolidated under a few global brands, recovery services remain dominated by small boutique studios, wellness spas, and localized operators. Even leading players such as Restore Hyper Wellness, which holds an 8.7% global market share in 2025, account for only a small fraction of the overall market. This fragmentation results in a lack of standardization in pricing, practitioner training, and service quality. Consumers may experience significant variations in service outcomes depending on location and operator, which can undermine trust in recovery services as a consistent wellness solution.

Safety standards for modalities such as cryotherapy or infrared saunas also vary widely, increasing risks for both consumers and operators. The lack of standardization is particularly challenging for corporate wellness programs, which require reliable, uniform service delivery across multiple geographies. Without industry-wide certifications or global operating standards, many corporates hesitate to integrate recovery services at scale, restricting one of the most promising growth opportunities for the sector. This restraint will need to be addressed through regulation, franchise consolidation, or the emergence of strong global brands that can enforce service quality consistency.

Key Trends

Shift Toward Hybrid and Subscription-Based Models

A defining trend in the market is the rapid transition toward subscription and hybrid pricing models. In contrast to pay-per-session recovery services, subscription models provide predictable recurring revenue for operators and more affordable access for consumers. Bundled packs that combine multiple modalities such as massage, compression therapy, and cryotherapy are increasingly marketed as holistic recovery programs, encouraging repeat visits and long-term customer engagement. Hybrid models that combine physical recovery services with digital coaching or app-based mobility sessions are also gaining traction. Consumers value the flexibility of being able to access certain recovery tools at home while visiting studios for higher-end modalities.

This trend is particularly strong in urban markets where digital convenience complements premium in-person experiences. The expansion of subscription models not only boosts customer retention but also aligns recovery services with broader consumer trends in wellness and fitness, where subscriptions for gyms, yoga apps, and meditation platforms have already become mainstream. As recovery integrates further into preventive healthcare, the hybrid subscription trend is expected to define the future business model of the industry.

Asia-Pacific Emergence as a Growth Hub

A second defining trend is the rise of Asia-Pacific as the fastest-growing hub for recovery services. Countries like India (13.8% CAGR) and China (12.5% CAGR) are outpacing traditional markets such as the USA (5.3% CAGR) and Germany (6.8% CAGR). With growing disposable incomes, urbanization, and lifestyle shifts toward fitness and wellness, demand for recovery modalities is accelerating across the region. Operators are increasingly prioritizing Asia-Pacific for expansion, leveraging franchising models supported by digital booking platforms to reduce setup costs. Mobile and on-demand recovery services are also proving popular in Asia, where consumers value affordability and convenience.

Unlike Western markets where recovery is often positioned as a premium offering, in Asia-Pacific it is being localized into mainstream wellness routines, ensuring broader adoption. This trend signals a geographic rebalancing of the industry. While the USA will remain the largest single market by absolute value, its global share is projected to decline from 27.8% in 2025 to 23.4% in 2035, as Asia-Pacific strengthens its contribution. By the end of the decade, Asia-Pacific is expected to emerge not only as a demand hub but also as a key center for innovation, with localized adaptations of recovery services designed for price-sensitive yet health-conscious consumers.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.5% |

| USA | 5.3% |

| India | 13.8% |

| UK | 8.4% |

| Germany | 6.8% |

| Japan | 9.5% |

The global Fitness Recovery Services Market shows a pronounced regional disparity in adoption speed, strongly influenced by wellness penetration, digital booking usage, and the maturity of premium studio ecosystems. Asia-Pacific emerges as the fastest-growing region, anchored by China at 12.5% CAGR and India at 13.8%. This acceleration is driven by rapid urban wellness adoption, franchised recovery studio rollouts, and app-led memberships that lower access friction.

China’s growth is further supported by large fitness club networks adding cryotherapy, infrared, and compression zones, while India’s trajectory reflects rising participation from general wellness consumers and corporate wellness tie-ups. Europe maintains a strong growth profile, led by Germany (6.8%) and the UK (8.4%), supported by premium boutique studios, physiotherapy integration, and employer-backed wellness benefits. High digital booking penetration and packaged memberships keep Europe ahead of North America in subscription mix and hybrid (in-studio + at-home) models. North America shows moderate expansion, with the USA at 5.3% CAGR, reflecting a more mature landscape and increasing emphasis on recurring memberships, therapist-assisted stretch formats, and app/web bookings (already dominant globally at 63.2% in 2025). Growth in North America is increasingly service- and subscription-driven, with stronger adoption of bundled modalities and therapist-guided programs rather than pure pay-per-session models.

| Year | USA Fitness Recovery Services Market |

|---|---|

| 2025 | 2285.06 |

| 2026 | 2505.52 |

| 2027 | 2747.24 |

| 2028 | 3012.29 |

| 2029 | 3302.91 |

| 2030 | 3621.56 |

| 2031 | 3970.96 |

| 2032 | 4354.07 |

| 2033 | 4774.14 |

| 2034 | 5234.73 |

| 2035 | 5739.76 |

The Fitness Recovery Services Market in the United States is projected to grow at a 5.3% CAGR. Growth is led by expanded assisted stretch and massage programs (the leading global modality at 34.2% share in 2025), deepening subscription/membership adoption, and the dominance of app/web booking channels aligned with consumer preference for flexible scheduling and packs. Assisted stretch & massage remain core draws for recurring memberships and upsell bundles. Corporate wellness partnerships expand access, especially for general wellness employees seeking preventive recovery. Digital-first experiences (app/web booking, loyalty, and personalization) increase retention and raise spend per member.

The Fitness Recovery Services Market in the United Kingdom is expected to grow at a CAGR of 8.4%, supported by premium recovery studios, physiotherapy-linked clinics, and fitness club add-ons. Operators are widening packs-based and subscription pricing, pairing compression, infrared, and cryo with therapist-led stretch to lift ARPU and visit frequency. Digital bookings continue to streamline discovery and scheduling, with bundled memberships gaining traction in metropolitan areas. Fitness clubs and boutique studios integrate recovery zones to boost member lifetime value. Physio and sports clinics cross-sell recovery protocols for injury prevention and return-to-activity plans. Subscription and packs drive predictable revenue while enabling multi-modality experimentation by consumers.

India is witnessing rapid growth in the Fitness Recovery Services Market, forecast to expand at a CAGR of 13.8% through 2035. Penetration is rising beyond Tier-1 cities as app/web booking normalizes access and price-tiered packs improve affordability. General wellness consumers are the largest base, while recreational athletes add volume through event-season peaks. Franchised studios and physiotherapy clinics increasingly offer infrared, compression, and mobility alongside massage and assisted stretch. Tier-2 city expansion accelerates via franchising and lower-CAPEX fit-outs focused on high-turnover modalities. General wellness adoption fuels recurring memberships; seasonal athletes supplement demand. Corporate wellness pilots broaden access and awareness among urban professionals.

| Countries | 2025 Share (%) |

|---|---|

| USA | 27.8% |

| China | 8.6% |

| Japan | 6.5% |

| Germany | 11.4% |

| UK | 7.8% |

| India | 3.9% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 23.4% |

| China | 9.5% |

| Japan | 6.6% |

| Germany | 10.0% |

| UK | 7.1% |

| India | 5.5% |

The Fitness Recovery Services Market in China is expected to grow at a CAGR of 12.5%, the highest among leading economies listed. Momentum is driven by fitness club recovery add-ons, boutique recovery chains, and strong consumer uptake of app/web booking. General wellness consumers form the demand backbone, with rapid growth in compression, infrared, and mobility/percussive sessions complementing massage and assisted stretch. Large club ecosystems add cryo/infrared/compression corners to standard memberships. Boutique franchises scale across Tier-1/2 cities using digital subscriptions and packs. App-centric engagement boosts utilization, personalization, and cross-modality bundling.

The Global Fitness Recovery Services Market demonstrates clear regional contrasts, with developed markets like the USA and Germany showing maturity, while emerging economies such as India and China are rapidly expanding. In 2025, the USA leads with 27.8% share (USD 2,285.1 million) but is set to decline to 23.4% by 2035 as growth stabilizes at a moderate CAGR of 5.3%. Similarly, Germany and the U.K. retain strong positions in Europe, though their shares will fall slightly to 10.0% and 7.1%, respectively, as other regions outpace them. These declines reflect the saturation of premium recovery ecosystems and steady but slower adoption of advanced modalities compared to Asia-Pacific.

On the other hand, Asia-Pacific markets are emerging as global growth hubs. India’s share is projected to rise from 3.9% in 2025 to 5.5% in 2035, supported by the fastest CAGR of 13.8%, driven by digital-first booking adoption and urban middle-class wellness demand. China is also expanding from 8.6% to 9.5% share, with recovery integration into fitness clubs and strong general wellness participation fueling growth at 12.5% CAGR. Japan’s steady rise to 6.6% share reflects demand from aging demographics and preventive healthcare trends. Overall, the market is shifting toward Asia-Pacific dominance, with India and China capturing global share from the USA and Europe over the decade.

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Mas sage therapy & assisted stretch | 33.5% |

| Others | 66.5% |

The Fitness Recovery Services Market in the United States is valued at USD 2,285.06 million in 2025, with massage therapy & assisted stretch leading at 33.5% of service mix. The USA accounts for ~27.8% of global market value in 2025, reflecting a mature ecosystem of assisted-stretch franchises, wellness studios, and recovery add-ons in premium gyms. Leadership of massage/assisted stretch stems from wide consumer acceptance, clear outcomes in flexibility and pain relief, and scalable staffing/training models for multi-location operators. Subscription and packs are deepening recurring revenue, while app/web booking is the dominant access channel, streamlining scheduling, payments, and loyalty.

| End User Segment | Market Value Share, 2025 |

|---|---|

| General wellness consumers | 43.6% |

| Others | 56.4% |

The Fitness Recovery Services Market in China is valued at ~USD 706.89 million in 2025 (based on 8.6% global share), with general wellness consumers leading at 43.6%. Growth is propelled by rapid urban adoption, fitness club chains adding recovery corners (cryotherapy, infrared, compression), and app-centric memberships that lower access friction. General wellness demand reflects stress management, preventive health, and lifestyle-led recovery routines, with multi-modality packs encouraging experimentation and upsell.

The Global Fitness Recovery Services Market is moderately fragmented, with leading franchise operators, mid-sized innovators, and boutique specialists competing across diverse service modalities. Global leaders such as Restore Hyper Wellness hold a notable share, driven by large franchise networks, multi-modality offerings (massage/stretch, cryotherapy, compression, infrared), and strong integration with digital booking platforms. Their strategies increasingly emphasize subscription memberships, app-based scheduling, and corporate wellness partnerships to deepen recurring revenue streams and scale across geographies. Established mid-sized players, including StretchLab, Therabody Reset, and Hyperice Recovery, cater to the demand for targeted recovery experiences through assisted stretching, percussive therapy, and mobility sessions.

These companies accelerate adoption by combining therapist-led programs with self-serve equipment solutions, making them relevant to both wellness consumers and recreational athletes. Their hybrid approach allows for scalable expansion in fitness clubs and premium wellness studios. Specialized providers such as iCRYO, The Covery Wellness Spa, Upgrade Labs, Pause Studio, The Cryo Bar, and ReCOVER focus on niche experiences like cryotherapy, infrared therapy, and float/breathwork modalities. Their strength lies in tailoring experiences for local markets, leveraging strong brand identities, and offering customizable packs and memberships rather than global scale. Competitive differentiation is shifting away from location-based presence alone toward ecosystem strength that blends multi-modality recovery menus, digital-first engagement, and subscription-based service models. Players that successfully integrate therapist expertise with app/web booking platforms, loyalty programs, and flexible memberships are expected to gain market share through 2035.

Key Developments in Global Fitness Recovery Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 8,219.7 Million |

| Service Type (Modality) | Massage therapy & assisted stretch, Cryotherapy / cold plunge & contrast therapy, Compression therapy (boots/sleeves), Infrared sauna & red-light therapy, Myofascial/percussive & mobility sessions, Other recovery (PEMF, float, breathwork) |

| Delivery Setting | Boutique recovery studios / wellness spas, Fitness clubs & premium gyms, Sports medicine / physiotherapy clinics, In-home / on-demand mobile |

| Technology | General wellness consumers, Recreational athletes, Professional & elite athletes / teams, Corporate wellness participants |

| End User | Laser scanners, Handheld, Stationary, Mobile, Structured light scanners, Optical scanners, Contact scanners, and Non-contact scanners |

| Session Type | Self-serve equipment session, Therapist-guided / practitioner-led |

| Pricing Model | Membership / subscription, Packs (multi-session), Pay-per-session (à la carte) |

| Booking Channel | App / web booking, Walk-in / phone |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Restore Hyper Wellness, StretchLab, Therabody Reset, Hyperice Recovery, iCRYO, The Covery Wellness Spa, Upgrade Labs, Pause Studio, The Cryo Bar, ReCOVER |

| Additional Attributes | Dollar sales by service type, end user, and booking channel; subscription vs pay-per-session adoption trends; growth of app/web booking channels; demand shifts between wellness consumers and athletes; corporate wellness program integration; regional shifts led by Asia-Pacific growth (India and China); innovations in cryotherapy, infrared, and compression modalities. |

The Global Fitness Recovery Services Market is estimated to be valued at USD 8,219.7 million in 2025.

The market size for the Global Fitness Recovery Services Market is projected to reach USD 24,528.9 million by 2035.

The Global Fitness Recovery Services Market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key service types in the market are massage therapy & assisted stretch, cryotherapy, compression therapy, infrared/red-light therapy, myofascial/percussive & mobility sessions, and other recovery modalities.

In terms of booking channel, app/web booking is projected to command 63.2% share in 2025 (USD 5,194.8 million).

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AR Fitness Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fitness Apps Market Report - Trends & Forecast 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Pet Fitness Care Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Pet Fitness Trackers Market Growth & Trends 2025-2035

Heat Recovery System Generator Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

Heat Recovery Steam Generator Market Growth – Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Smart Fitness Mirror Market Size and Share Forecast Outlook 2025 to 2035

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Smart Fitness Market Analysis – Demand, Growth & Forecast 2025 to 2035

Vapour Recovery Units Market Size and Share Forecast Outlook 2025 to 2035

Online Fitness Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Vapour Recovery Unit Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA