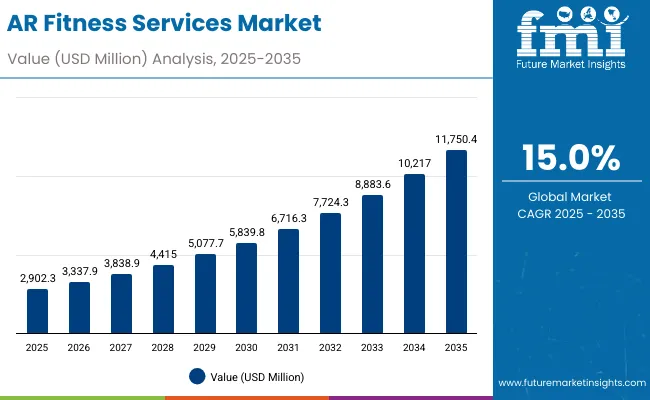

The AR Fitness Services Market is expected to record a valuation of USD 2,902.3 million in 2025 and USD 11,750.4 million in 2035, with an increase of USD 8,848.1 million, which equals a growth of 305% over the decade. The overall expansion represents a CAGR of 15.0% and a nearly 4X increase in market size.

AR Fitness Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 2,902.3 million |

| Market Forecast Value in (2035F) | USD 11,750.4 million |

| Forecast CAGR (2025 to 2035) | 15.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,902.3 million to USD 5,839.8 million, adding USD 2,937.5 million, which accounts for 33.2% of the total decade growth. This phase records steady adoption in home-based AR subscriptions, gym integrations, and wellness apps, driven by the need for gamified and engaging workouts. Smartphone/tablet AR dominates this period as it caters to over 61% of users requiring accessible fitness formats.

The second half from 2030 to 2035 contributes USD 5,910.6 million, equal to 66.8% of total growth, as the market jumps from USD 5,839.8 million to USD 11,750.4 million. This acceleration is powered by widespread deployment of AR headsets, connected fitness mirrors, and corporate wellness platforms in global workplaces. Subscription-based models and corporate packages together capture a larger share above 70% by the end of the decade. Content-led services, immersive AR group classes, and AI-driven personalization add recurring revenue, increasing the subscription share beyond 65% in total value.

From 2020 to 2024, the AR Fitness Services Market grew steadily from a small niche of pilot AR workouts to a consumer-ready segment valued close to USD 2.9 billion by 2025, driven by subscription-based adoption and smartphone-centric AR content. During this period, the competitive landscape was dominated by early innovators and fitness-tech hybrids, with leaders such as Supernatural, FitXR, and Zwift focusing on immersive workout experiences for cardio and group fitness. Competitive differentiation relied on gamification, engaging content, and accessibility via smartphones, while headset adoption remained limited. Corporate wellness and service-based models had minimal traction, contributing less than 15% of the total market value.

Demand for AR-based fitness will expand to USD 11.7 billion by 2035, and the revenue mix will shift as subscription and corporate wellness programs grow to over 70% share. Traditional connected fitness leaders like Peloton face rising competition from AR-first players offering immersive group fitness, real-time motion tracking, and AI-driven personalization. Major players are pivoting to hybrid models, integrating AR headsets, fitness mirrors, and cloud-based analytics to retain relevance. Emerging entrants specializing in corporate AR wellness packages, AR/VR interoperability, and immersive dance/yoga classes are gaining share. The competitive advantage is moving away from hardware and equipment toward ecosystem strength, subscription loyalty, and corporate partnerships.

Advances in AR delivery devices and immersive fitness platforms have improved accessibility and engagement, allowing for more efficient workout delivery across diverse fitness applications. Smartphone/tablet AR has gained popularity due to its affordability, portability, and suitability for interactive workouts. The rise of subscription-based pricing models has contributed to higher user retention and recurring revenue opportunities.

Segments such as home fitness consumers, gyms/studios, and corporate wellness are driving demand for AR fitness services that can seamlessly integrate into existing fitness routines and digital platforms. Expansion of immersive AR group classes, gamified workouts, and wellness tracking has fueled market growth. Innovations in AR headsets, connected fitness mirrors, and AI-driven personalization are expected to open new application areas. Segment growth is expected to be led by home fitness consumers, subscription pricing models, and smartphone/tablet AR devices due to their precision, accessibility, and adaptability.

The market is segmented by workout type, delivery device, pricing model, and user group. Workout types include AR gamified cardio, AR strength training, AR yoga/meditation, and AR dance & group fitness, highlighting the diverse formats driving adoption. Delivery devices cover smartphone/tablet AR, AR headsets/glasses, and connected fitness mirrors, catering to different user preferences. Based on pricing model, the segmentation includes subscription, per-class purchase, and corporate wellness packages. In terms of user groups, categories encompass home fitness consumers, gyms/studios, and corporate wellness clients. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with country-level coverage of the USA, China, India, UK, Germany, and Japan.

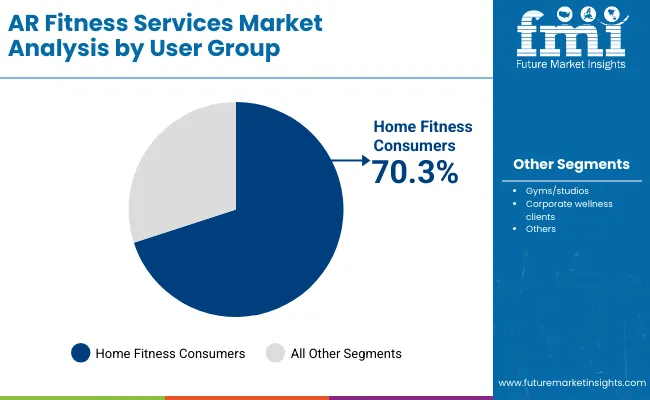

| User Group Segment | Market Value Share, 2025 |

|---|---|

| Home Fitness Consumers | 70.3% |

| Others | 29.7% |

The home fitness consumers segment is projected to contribute 70.3% of the AR Fitness Services Market revenue in 2025, maintaining its lead as the dominant user category. This is driven by ongoing demand for convenient, at-home fitness solutions powered by AR gamification, guided meditation, and interactive cardio sessions. Home users are investing in smartphones, fitness mirrors, and AR headsets to replicate gym-like experiences within their homes. The segment’s growth is also supported by the development of subscription platforms that provide unlimited access to AR fitness content. As immersive content libraries expand and social AR features become more popular, home fitness consumers are expected to retain their position as the backbone of AR fitness demand.

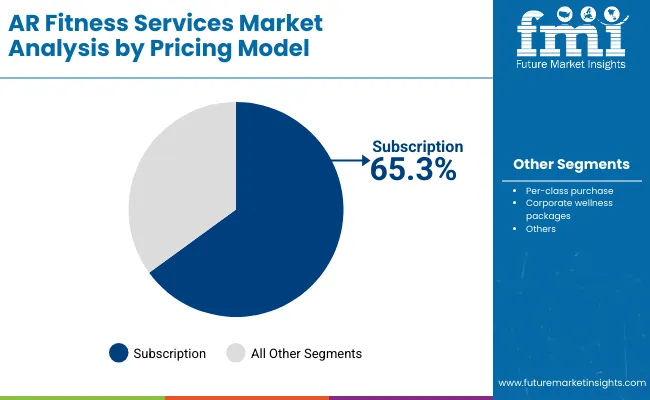

| Pricing Model Segment | Market Value Share, 2025 |

|---|---|

| Subscription | 65.3% |

| Others | 34.7% |

The subscription segment is forecasted to hold 65.3% of the market share in 2025, led by its ability to provide cost-effective, recurring access to fitness content. Subscriptions are favored for their unlimited access to AR cardio, strength, and meditation programs, making them ideal for continuous engagement and consumer retention. Their flexible pricing, bundling options, and compatibility with mobile and wearable devices have facilitated widespread adoption in home and corporate fitness ecosystems. The segment’s growth is bolstered by corporate wellness partnerships and loyalty-driven platforms that integrate AR workouts into broader health initiatives. As demand for recurring and personalized fitness solutions rises, subscription-based models are expected to continue their dominance in the market.

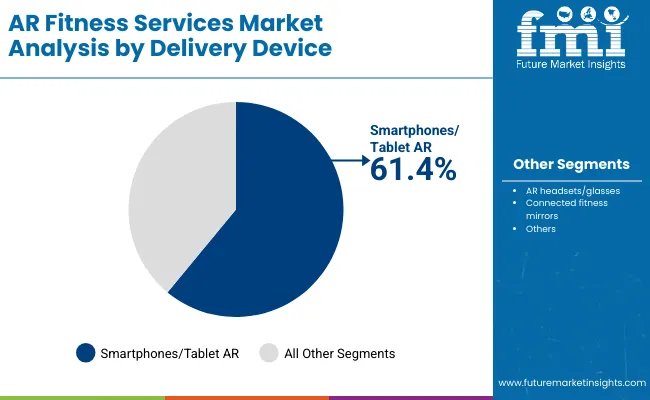

| Delivery Device Segment | Market Value Share, 2025 |

|---|---|

| Smartphones/Tablet AR | 61.4% |

| Others | 38.6% |

The smartphone/tablet AR segment is projected to account for 61.4% of the AR Fitness Services Market revenue in 2025, establishing it as the leading delivery device type. This category is preferred for its ease of access, affordability, and wide compatibility with consumer devices already in use. Its suitability for streaming immersive AR fitness sessions, gamified group workouts, and guided meditation has made it popular across fitness enthusiasts globally. Developments in camera sensors, mobile AR frameworks, and 5G connectivity have enhanced resolution, real-time motion tracking, and engagement, improving the overall AR fitness experience. Given its balance of affordability and scalability, smartphone/tablet AR is expected to maintain its leading role in the AR Fitness Services Market.

Drivers

Rising Adoption of Home-Based Fitness Solutions

One of the most powerful forces driving the growth of the AR fitness services market is the rising adoption of home-based fitness solutions. Consumers increasingly prefer to exercise in the comfort of their homes, where convenience, privacy, and flexibility allow them to build personalized routines without the time and cost commitments of traditional gyms. Augmented reality has elevated this experience by introducing gamification, immersive guidance, and interactive overlays that simulate trainer-led environments.

Cardio workouts, yoga practices, and group dance sessions can now be transformed into engaging and highly motivating digital formats. Another layer fueling this trend is the growing reliance on everyday devices such as smartphones and tablets, which serve as primary entry points into AR fitness ecosystems. By leveraging devices already in consumers’ hands, adoption barriers are minimized, ensuring widespread accessibility. The integration of social features, community-driven competitions, and immersive content further enhances the stickiness of these platforms, making home-based AR fitness not just a substitute for gym sessions but a lifestyle choice. This driver underscores the central role of at-home adoption in ensuring long-term growth for the AR fitness industry.

Subscription-Led Recurring Revenue Models

A second major driver of the market lies in the dominance of subscription-based business models. Subscriptions have transformed the fitness landscape by offering continuous access to diverse workout libraries covering cardio, strength, meditation, and group formats under a single recurring fee. This approach removes the limitations of one-off class purchases and encourages long-term user engagement. Consumers are drawn to platforms that frequently refresh their content, keeping workouts dynamic and preventing fatigue.

From the perspective of providers, subscription revenues offer predictability and stability, enabling continuous reinvestment in content creation, technology upgrades, and customer retention strategies. The model also aligns well with emerging trends in corporate wellness, where organizations purchase bulk subscription access for employees as part of broader well-being initiatives. The ability of subscription models to deliver affordability for users and sustainability for businesses makes them one of the most significant growth drivers shaping the AR fitness services market.

Restraints

High Cost and Limited Penetration of AR Hardware

While smartphones and tablets provide a widely accessible entry point, the adoption of advanced AR hardware such as connected fitness mirrors and AR headsets faces significant challenges. These devices remain relatively expensive, limiting their accessibility to only certain consumer groups. The need for specialized infrastructure and compatible ecosystems further slows down mass adoption. In many markets, especially developing regions, the affordability gap widens the divide between basic AR-enabled mobile solutions and premium immersive hardware.

Another factor limiting penetration is consumer hesitation regarding rapidly evolving technology. Hardware innovation cycles often outpace consumer adoption, creating uncertainty around obsolescence and long-term value. For fitness studios and gyms, the upfront cost of AR integration including devices, content licensing, and staff training can also act as a barrier. This makes the transition to fully hardware-integrated AR fitness environments slower, restraining the market’s ability to achieve broader penetration in the short term.

Content Fragmentation and Engagement Fatigue

The market also faces challenges from content fragmentation and engagement fatigue. With numerous platforms competing for attention, users are often required to juggle multiple subscriptions or apps to access the full range of workout types they desire. This siloed approach leads to inefficiencies and reduces the value proposition of AR fitness for consumers seeking comprehensive solutions. As content quality and variety vary significantly across providers, user experience can be inconsistent, further complicating retention.

In addition, AR fitness heavily relies on novelty and engagement. If platforms fail to refresh their content libraries or provide sufficient personalization, users may lose interest over time. Engagement fatigue can set in when workouts become repetitive or gamification loses its appeal. Subscription fatigue is another risk, as consumers become increasingly selective about the number of recurring services they are willing to maintain. Addressing this restraint requires platforms to focus on interoperability, collaboration, and personalized experiences that keep users motivated and loyal in a crowded marketplace.

Key Trends

Shift Toward Corporate Wellness Integration

A defining trend shaping the AR fitness services market is the growing integration of these platforms into corporate wellness programs. Employers are increasingly recognizing the value of offering fitness and stress-management solutions to their workforce, not only to improve health outcomes but also to enhance productivity and morale. AR platforms lend themselves particularly well to this setting, offering scalable, engaging, and cost-effective wellness benefits that can be accessed remotely by employees working in hybrid or distributed environments.

Corporate wellness applications extend beyond physical exercise to include guided meditation, mindfulness training, and group wellness challenges, all enhanced by AR’s immersive capabilities. By positioning themselves as holistic wellness providers, AR fitness companies are tapping into a large and relatively untapped customer base in the enterprise segment. This trend represents a critical diversification of demand away from consumer-only adoption, opening new long-term revenue streams and deepening the relevance of AR fitness in organizational well-being strategies.

Emergence of AR Headsets and Immersive Group Fitness

Although smartphones currently dominate AR delivery, the next wave of market evolution is being defined by the emergence of AR headsets and immersive group fitness experiences. These technologies offer a more hands-free and fully engaging environment, allowing users to participate in dance classes, strength challenges, and meditation sessions in highly interactive digital spaces. The sense of immersion enhances motivation, replicating the social and community-driven atmosphere of gyms and studios.

Immersive group formats are gaining traction as users increasingly seek experiences that blend fitness with entertainment. By integrating motion tracking, AI-driven coaching, and social interaction features, AR platforms are turning exercise into a shared activity rather than an isolated one. Over the coming decade, AR headsets and fitness mirrors are expected to play a growing role in multi-device ecosystems where consumers switch seamlessly between different platforms. This trend points to a future where AR fitness evolves into a fully immersive, socially connected, and multi-device experience.

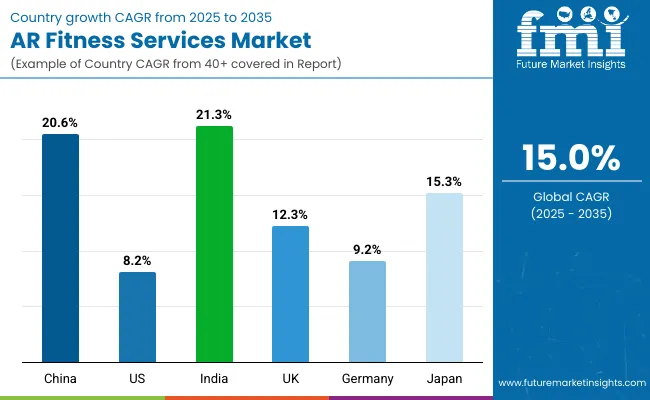

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.6% |

| USA | 8.2% |

| India | 21.3% |

| UK | 12.3% |

| Germany | 9.2% |

| Japan | 15.3% |

The AR Fitness Services Market shows highly uneven growth rates across countries, reflecting differences in digital infrastructure, consumer readiness, and fitness culture. Emerging economies such as China and India are leading with exceptionally high growth prospects, supported by strong smartphone penetration, younger demographics, and a growing appetite for affordable, tech-driven wellness solutions. These markets are adopting AR fitness rapidly as part of a broader digital lifestyle shift, with subscriptions and gamified content becoming mainstream drivers. Japan also stands out with a robust double-digit growth outlook, driven by rising interest in technology-enabled wellness and the cultural emphasis on holistic health.

In contrast, mature markets such as the USA, UK, and Germany exhibit more moderate growth trajectories, as adoption is already established and competition among providers is intense. While the USA remains a large and influential market, its growth pace is slower due to saturation and higher consumer expectations for premium immersive experiences. The UK and Germany also reflect stable, steady growth tied to broader wellness adoption and digital fitness integration into gym and studio ecosystems. Together, these patterns indicate that while developed markets will sustain demand, the fastest momentum for AR fitness services will come from Asia, reshaping the geographic balance of market leadership over the next decade.

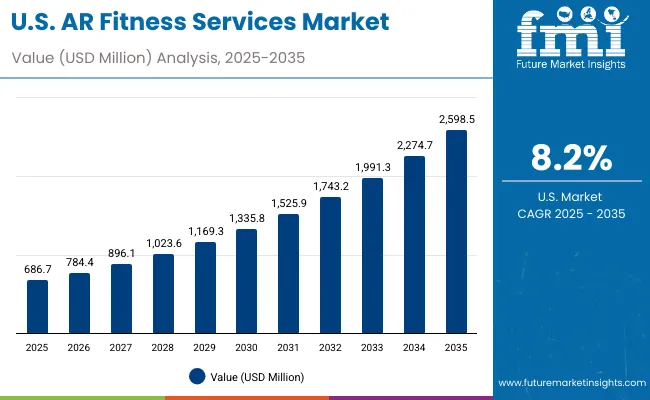

| Year | USA AR Fitness Services Market (USD Million) |

|---|---|

| 2025 | 686.7 |

| 2026 | 784.4 |

| 2027 | 896.1 |

| 2028 | 1023.6 |

| 2029 | 1169.3 |

| 2030 | 1335.8 |

| 2031 | 1525.9 |

| 2032 | 1743.2 |

| 2033 | 1991.3 |

| 2034 | 2274.7 |

| 2035 | 2598.5 |

The AR Fitness Services Market in the United States is projected to expand steadily, reflecting growing demand for home-based immersive workouts and corporate wellness integration. Adoption is being fueled by consumer preference for AR-enhanced cardio, yoga, and group fitness formats accessible via smartphones and tablets. The presence of established players such as Supernatural, FitXR, and Peloton has created strong momentum, particularly among home fitness consumers. Corporate wellness programs are also beginning to integrate AR packages, targeting employee engagement and well-being.

The AR Fitness Services Market in the United Kingdom is expected to grow at a double-digit rate, supported by widespread digital fitness adoption and integration into gyms and studios. Consumers are drawn to gamified cardio and AR-driven group fitness formats, while boutique studios are experimenting with immersive class offerings. The cultural acceptance of hybrid fitness models post-pandemic is reinforcing demand for AR-based wellness tools. Additionally, technology partnerships between local fitness brands and AR developers are accelerating accessibility.

India is witnessing rapid growth in the AR Fitness Services Market, driven by younger demographics, affordability of smartphone-based platforms, and increasing interest in digital fitness experiences. Tier-2 and Tier-3 cities are seeing higher adoption due to improved awareness and cost-effective subscription packages. AR-based yoga and meditation are particularly appealing in the Indian context, combining cultural relevance with immersive digital formats. Educational institutions and corporate wellness programs are also exploring AR fitness integration as awareness spreads.

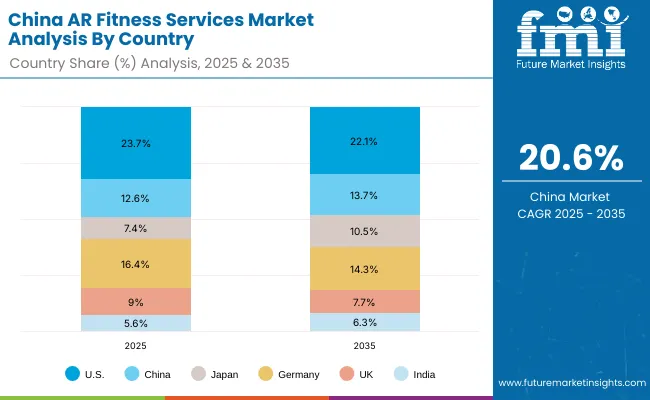

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.7% |

| China | 12.6% |

| Japan | 7.4% |

| Germany | 16.4% |

| UK | 9.0% |

| India | 5.6% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 22.1% |

| China | 13.7% |

| Japan | 10.5% |

| Germany | 14.3% |

| UK | 7.7% |

| India | 6.3% |

The AR Fitness Services Market in China is forecast to record the highest growth rate among leading economies, fueled by strong consumer interest in gamified and immersive wellness platforms. Rapid smartphone penetration and the popularity of AR-enhanced entertainment are directly influencing adoption in the fitness space. Local technology firms are investing in affordable AR fitness applications, making services more accessible to a wider audience. Municipal programs promoting digital wellness and partnerships with domestic gyms are further supporting growth.

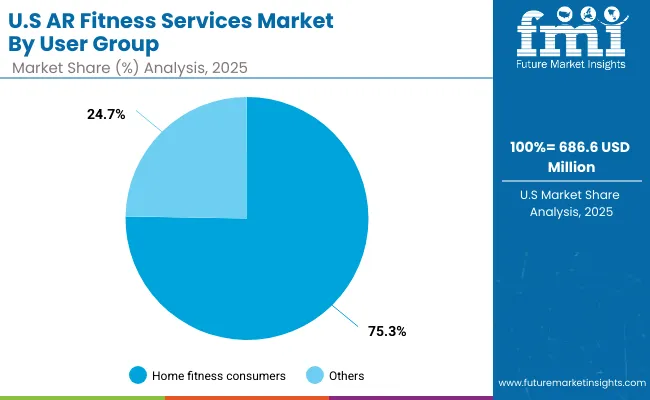

| User Group Segment | Market Value Share, 2025 |

|---|---|

| Home fitness consumers | 75.3% |

| Others | 24.7% |

The AR Fitness Services Market in the United States is valued at USD 686.6 million in 2025, with home fitness consumers leading at 75.3%, while other segments, including gyms/studios and corporate wellness clients, hold a smaller share. The dominance of home-based adoption is closely tied to the country’s strong culture of personal fitness, subscription streaming platforms, and preference for flexible workout formats. Smartphones and fitness mirrors are widely used for AR-enabled workouts, while headsets are gradually penetrating tech-savvy households.

The USA market also benefits from high consumer willingness to pay for premium fitness content, a trend supported by strong brand positioning from early leaders such as Supernatural, FitXR, and Peloton. Corporate wellness adoption, though still emerging, presents a significant opportunity as employers integrate AR-based exercise and meditation programs into broader health benefits. Over time, the corporate segment is expected to contribute more strongly as enterprises prioritize employee well-being in hybrid work environments.

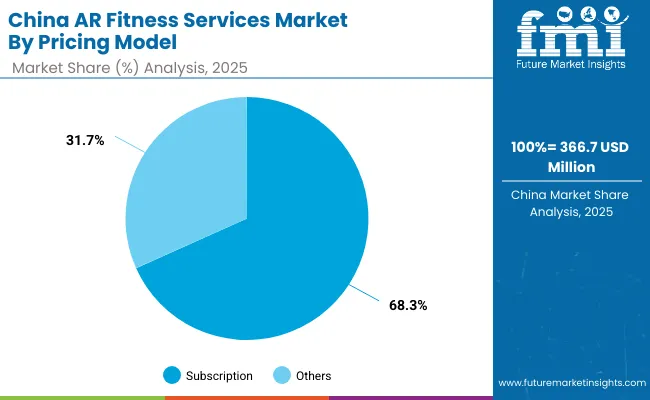

| Pricing Model Segment | Market Value Share, 2025 |

|---|---|

| Subscription | 68.3% |

| Others | 31.7% |

The AR Fitness Services Market in China is valued at USD 366.7 million in 2025, with subscriptions leading at 68.3%, while one-time purchases and corporate packages account for the rest. The strong preference for subscriptions is supported by China’s digital ecosystem, where consumers are accustomed to low-cost, high-volume streaming platforms and recurring app-based payments. Affordable subscription bundles and rapid content refresh cycles have made AR fitness widely appealing to younger demographics and urban populations.

The country’s rapid CAGR outlook reflects not only consumer adoption but also innovation from local tech companies creating AR-driven wellness applications. Smartphone-based AR dominates, though AR headsets are beginning to see traction due to strong domestic manufacturing capabilities. Integration of AR workouts into local gyms, social media platforms, and e-commerce ecosystems ensures that fitness services are accessible and engaging. China’s momentum positions it as a key growth engine for the global market.

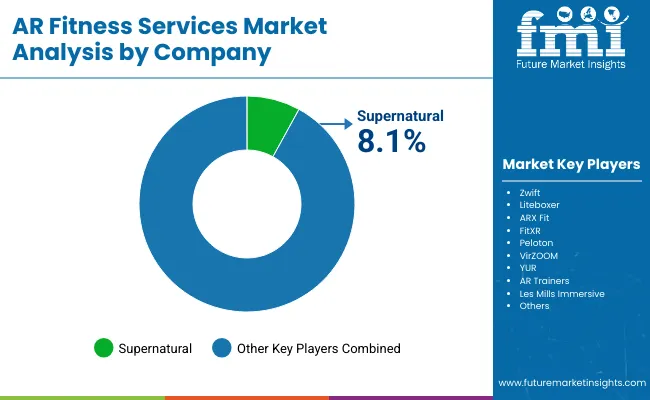

The AR Fitness Services Market is highly fragmented, with a mix of global leaders, mid-sized innovators, and niche-focused specialists. Early pioneers such as Supernatural, FitXR, and Zwift have carved out significant mindshare through immersive cardio, yoga, and group fitness experiences. Supernatural currently leads with the highest individual market share, supported by a strong subscription base and high-quality content integration. Mid-sized challengers including Liteboxer, ARX Fit, and VirZOOM are capturing demand for specialized formats such as boxing, resistance training, and gamified cycling.

Their strength lies in portability, affordability, and the ability to integrate AR workouts into existing consumer ecosystems via smartphones and fitness mirrors. Companies like Peloton and Les Mills Immersive are leveraging brand equity from the traditional fitness space, extending their offerings into AR-driven classes to retain competitiveness. Smaller innovators such as YUR and AR Trainers are driving experimentation in wearable integration, gamification, and niche group workout formats.

Their advantage lies in adaptability, creativity, and the ability to target under-served market niches. Across the landscape, competitive differentiation is shifting away from hardware or workout categories alone and toward ecosystem-driven models that integrate recurring subscriptions, AI-driven personalization, and social engagement. This creates opportunities for players capable of offering holistic, immersive, and loyalty-focused AR fitness ecosystems.

Key Developments in AR Fitness Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,902.3 million |

| Workout Type | AR gamified cardio, AR strength training, AR yoga/meditation, AR dance & group fitness |

| Delivery Device | Smartphone/tablet AR, AR headsets/glasses, Connected fitness mirrors |

| Pricing Model | Subscription, Per-class purchase, Corporate wellness packages |

| User Group | Home fitness consumers, Gyms/studios, Corporate wellness clients |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Supernatural, Zwift, Liteboxer, ARX Fit, FitXR, Peloton, VirZOOM, YUR, AR Trainers, Les Mills Immersive |

| Additional Attributes | Dollar sales by user group and pricing model, adoption trends in home fitness and corporate wellness, rising demand for smartphone/tablet-based AR fitness, segment-specific growth in gamified cardio, yoga/meditation, and group classes, subscription revenue segmentation, integration with AR headsets and connected mirrors, regional growth influenced by digital wellness initiatives, and innovations in AI-driven personalization, gamification, and immersive group fitness formats. |

The AR Fitness Services Market is estimated to be valued at USD 2,902.3 million in 2025.

The market size for the AR Fitness Services Market is projected to reach USD 11,750.4 million by 2035.

The AR Fitness Services Market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key workout types in the AR Fitness Services Market are AR gamified cardio, AR strength training, AR yoga/meditation, and AR dance & group fitness.

In terms of user groups, the home fitness consumers segment is expected to command the largest share in the AR Fitness Services Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Fitness Recovery Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Architectural Metal Coating Market Forecast Outlook 2025 to 2035

Aramid Honeycomb Core Material Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

AR and VR in Training Market Size and Share Forecast Outlook 2025 to 2035

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

AR Coated Film Glass Market Size and Share Forecast Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Art and Office Marker Pen Market Size and Share Forecast Outlook 2025 to 2035

Architectural Membranes Market Size and Share Forecast Outlook 2025 to 2035

Areca Nut Market Size and Share Forecast Outlook 2025 to 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Argan Oil Moisturizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Aromatic Ketone Polymers Market Size and Share Forecast Outlook 2025 to 2035

Aromatic Polyamine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA