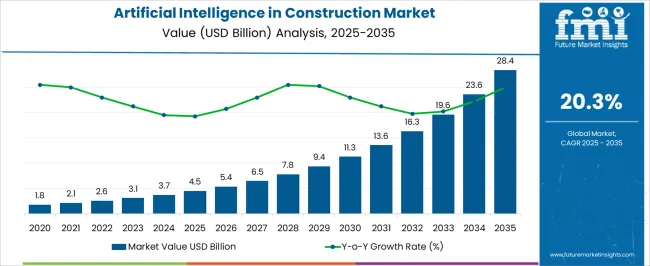

The artificial intelligence in construction market is projected to grow from USD 4.5 billion in 2025 to USD 28.4 billion in 2035, reflecting a CAGR of 20.3%. During the early adoption phase (2020–2024), the market expanded slowly from USD 1.8 billion to USD 4.5 billion as construction firms began experimenting with AI-driven planning, project monitoring, and safety tools. This phase focused on pilot projects, proving return on investment, and addressing operational challenges.

By 2025, the market will reach a pivotal size, signaling readiness for broader adoption and more extensive integration across construction projects, setting the stage for rapid market scaling. From 2025 to 2035, the market moves through scaling (2025–2030) and consolidation (2030–2035). By 2030, the market will surpass USD 9.4 billion, driven by the widespread deployment of AI solutions in project management, resource allocation, and predictive maintenance.

During consolidation, growth accelerates toward USD 28.4 billion by 2035 as leading providers dominate the space and smaller players align with established ecosystems. The 20.3% CAGR highlights the consistent expansion, reflecting a shift from experimental use to standard practice, with construction projects increasingly relying on AI for efficiency, accuracy, and decision-making across operations.

| Metric | Value |

|---|---|

| Artificial Intelligence in Construction Market Estimated Value in (2025 E) | USD 4.5 billion |

| Artificial Intelligence in Construction Market Forecast Value in (2035 F) | USD 28.4 billion |

| Forecast CAGR (2025 to 2035) | 20.3% |

The artificial intelligence in construction market is influenced by multiple parent markets, each contributing differently to overall growth. The construction industry itself drives roughly 30%, as adoption of AI tools depends on the scale and complexity of ongoing projects. Software solutions and project management platforms account for 20%, providing the digital backbone for AI-powered planning, scheduling, and monitoring. Data analytics and cloud computing contribute 15%, enabling real-time insights and performance tracking across construction sites. Robotics and automation in construction influence about 10%, facilitating AI integration in machinery and on-site operations. Building materials and prefabrication account for 8%, supporting optimized resource use and modular construction.

Equipment leasing and maintenance services contribute 7%, ensuring operational efficiency for AI-enabled tools. Energy and utilities management represent 5%, as AI helps monitor consumption and optimize systems. Lastly, digital platforms and mobile applications make up 5%, allowing stakeholders to track progress, manage assets, and coordinate teams.

The Artificial Intelligence in Construction market is experiencing robust expansion due to the increasing demand for automation, enhanced project management, and safety improvements within the construction industry. The current market environment is characterized by growing adoption of AI-driven solutions that optimize planning, resource allocation, risk management, and field operations.

The shift toward digital transformation in construction is accelerating investments in smart technologies, including AI-powered software platforms, cloud computing, and integrated analytics. Rising pressure to improve efficiency, reduce costs, and ensure project deadlines are met is driving the incorporation of AI-based tools that enable real-time decision-making and predictive maintenance.

The future outlook remains highly positive as construction firms prioritize scalable, flexible AI solutions that can be deployed across multiple projects and geographies Increasing integration with cloud infrastructure and large enterprise adoption further support market growth, offering opportunities for innovative AI applications that enhance productivity and safety while minimizing delays and errors.

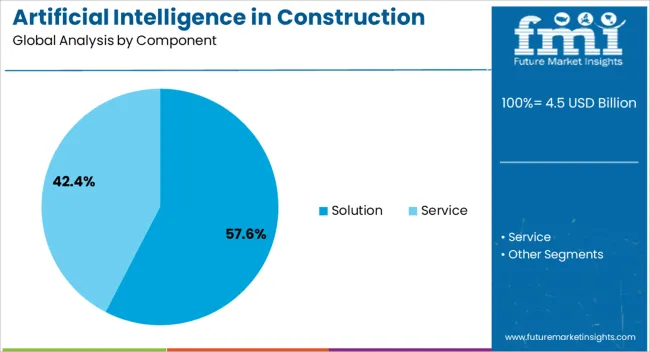

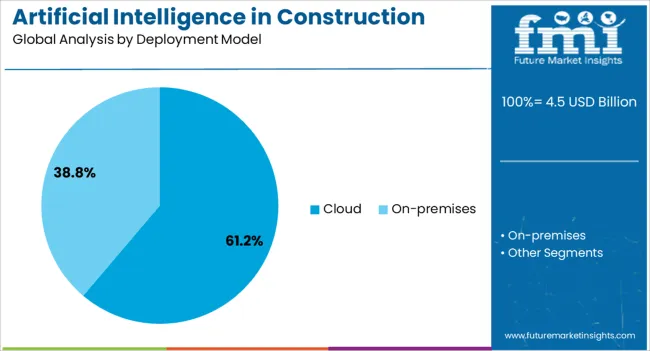

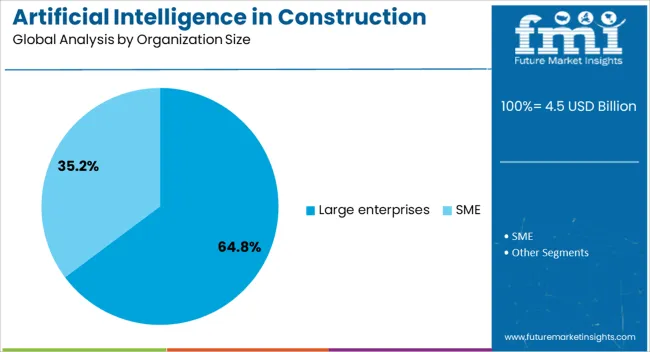

The artificial intelligence in construction market is segmented by component, deployment model, organization size, application, end user, and geographic regions. By component, artificial intelligence in construction market is divided into Solution and Service. In terms of deployment model, artificial intelligence in construction market is classified into Cloud and On-premises. Based on organization size, artificial intelligence in construction market is segmented into Large enterprises and SME. By application, artificial intelligence in construction market is segmented into Project management, Field management, Risk management, and Asset management. By end user, artificial intelligence in construction market is segmented into Commercial, Residential, Industrial, and Public infrastructure. Regionally, the artificial intelligence in construction industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution component segment is projected to hold 57.6% of the Artificial Intelligence in Construction market revenue share in 2025, making it the leading component category. This position is attributed to the widespread deployment of AI software platforms designed to support project management, risk assessment, and predictive analytics. Solutions offer construction firms a comprehensive toolset that can be tailored to specific workflows and integrated with existing enterprise systems.

The ability to deliver actionable insights through machine learning algorithms and data visualization tools has increased their appeal. As construction projects grow in complexity and scale, the demand for intelligent software that can automate routine tasks and identify potential issues in advance has surged.

Moreover, solution components enable remote collaboration and real-time monitoring, which are critical factors in maintaining project timelines and budgets The software-centric nature of this segment allows rapid innovation and frequent updates, sustaining its leadership position.

The cloud deployment model segment holds a dominant 61.2% revenue share in the Artificial Intelligence in Construction market in 2025. This dominance results from the cloud’s ability to provide scalable, secure, and accessible AI platforms without requiring extensive on-premise infrastructure. Cloud deployment supports seamless collaboration among geographically dispersed teams, enabling real-time data access and updates, which are essential in complex construction projects.

The reduced need for upfront capital expenditure on hardware and IT maintenance makes cloud-based AI solutions attractive, particularly for large enterprises managing multiple projects. Furthermore, cloud infrastructure facilitates integration with other digital tools such as BIM and IoT devices, creating an ecosystem that enhances overall project efficiency.

The flexibility to scale resources up or down based on project demands supports cost optimization and faster deployment of AI applications As cybersecurity measures improve, confidence in cloud-based solutions is expected to increase, reinforcing this segment’s market dominance.

Large enterprises are estimated to capture 64.8% of the Artificial Intelligence in Construction market revenue share in 2025, positioning them as the leading end-user segment. The preference for AI adoption within large organizations is driven by their capacity to invest in advanced technologies and the complexity of their projects requiring sophisticated AI-driven solutions. Large construction firms benefit from AI applications that streamline project management, improve safety compliance, and enable predictive maintenance at scale.

The ability to integrate AI tools across various departments and sites enhances operational efficiency and risk mitigation. Additionally, large enterprises often have established digital transformation roadmaps that prioritize AI implementation, supported by dedicated IT and data science teams.

This scale allows for customized AI solutions that address specific business needs, creating competitive advantages in cost control and project delivery As regulatory scrutiny and sustainability standards increase, large enterprises are likely to continue leading AI adoption to maintain market leadership and operational excellence.

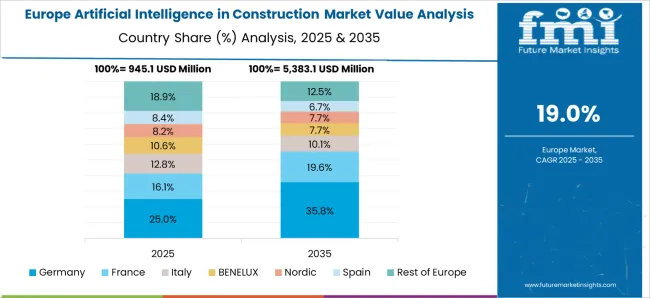

The artificial intelligence (AI) in construction market is expanding due to rising demand for automation, predictive analytics, and digitalization in building projects. North America and Europe lead adoption, integrating AI for project planning, safety monitoring, and resource optimization. Asia-Pacific shows rapid growth driven by urbanization, large-scale infrastructure projects, and government smart city initiatives. Providers differentiate through machine learning algorithms, computer vision, predictive maintenance tools, and integration with Building Information Modeling (BIM). Regional variations in technological readiness, labor availability, and regulatory frameworks shape adoption, implementation strategies, and competitive positioning.

AI adoption in construction is primarily driven by enhanced project planning and predictive analytics capabilities. North America and Europe focus on AI-powered scheduling, cost estimation, and risk assessment tools to optimize project timelines, reduce delays, and minimize cost overruns in commercial and infrastructure projects. Asia-Pacific markets increasingly implement AI for large-scale construction projects, balancing automation benefits with budget constraints and workforce adaptation. Differences in predictive capabilities influence decision-making efficiency, resource allocation, and project risk management. Leading suppliers provide AI solutions with robust predictive algorithms integrated with BIM platforms for high-value projects, while regional vendors offer simplified tools for standard planning. Analytics capability contrasts directly affect adoption, operational efficiency, and competitiveness across construction sectors globally.

AI technologies are increasingly used for on-site safety monitoring and hazard detection. Europe and North America emphasize AI-driven computer vision, sensor integration, and real-time monitoring systems to identify safety risks, track personnel, and prevent accidents in complex construction environments. Asia-Pacific adoption is growing, though smaller projects often rely on manual safety management or limited AI monitoring. Differences in safety implementation affect compliance, insurance costs, and workforce protection. Providers offering AI platforms that integrate real-time alerts and predictive risk modeling gain higher adoption rates, while regional players focus on basic monitoring solutions. Safety-focused AI contrasts shape project reliability, regulatory compliance, and market competitiveness in global construction projects.

AI enhances construction efficiency through equipment monitoring, material tracking, and energy optimization. North America and Europe implement AI-driven resource management to reduce downtime, optimize machinery utilization, and streamline supply chain operations in large-scale projects. In Asia-Pacific, AI adoption focuses on maximizing labor productivity and material usage, often constrained by cost considerations. Differences in resource optimization capabilities impact project costs, operational efficiency, and overall sustainability. Leading suppliers offer AI platforms integrating IoT and predictive analytics for proactive resource management, while regional vendors provide simpler solutions for monitoring key metrics. Resource management contrasts shape adoption, operational performance, and long-term competitiveness in construction markets globally.

AI in construction must align with regulatory standards, building codes, and digital infrastructure compatibility. North America and Europe enforce strict compliance for safety, quality, and environmental regulations, encouraging integration of AI tools with BIM, CAD, and project management software. Asia-Pacific exhibits variable adoption, with advanced urban projects leveraging full integration while smaller projects implement standalone AI solutions. Differences in compliance and digital infrastructure affect deployment timelines, project approvals, and ROI. Suppliers offering regulation-compliant, interoperable AI solutions gain market credibility and adoption, while regional providers focus on cost-efficient, modular systems. Regulatory and digital integration contrasts shape global market accessibility, adoption rates, and competitive positioning across construction projects.

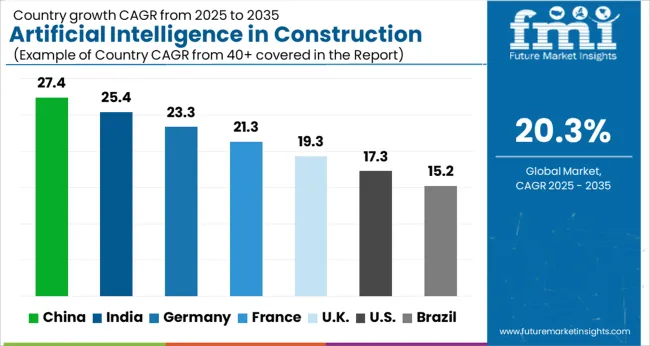

| Country | CAGR |

|---|---|

| China | 27.4% |

| India | 25.4% |

| Germany | 23.3% |

| France | 21.3% |

| UK | 19.3% |

| USA | 17.3% |

| Brazil | 15.2% |

The global artificial intelligence in construction market was projected to grow at a 20.3% CAGR through 2035, driven by demand in project management, design automation, and construction monitoring applications. Among BRICS nations, China recorded 27.4% growth as large-scale AI integration and deployment facilities were commissioned and compliance with construction and safety standards was enforced, while India at 25.4% growth saw expansion of AI-powered operations to meet rising regional construction demand. In the OECD region, Germany at 23.3% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 19.3% relied on moderate-scale AI adoption for project planning and monitoring applications. The USA, expanding at 17.3%, remained a mature market with steady demand across commercial and infrastructure projects, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The artificial intelligence in construction market in China is growing at a CAGR of 27.4% driven by increasing adoption of smart construction technologies and digital solutions. Construction companies are leveraging AI for project planning, predictive maintenance, resource management, and safety monitoring. The integration of AI tools with building information modeling and automated machinery is improving efficiency and reducing costs. Government support for smart city projects and urban infrastructure development is further fueling demand. AI enabled software platforms, drones, and sensors are being widely adopted across commercial and residential projects. Contractors and developers prioritize accuracy, operational efficiency, and risk reduction when implementing AI technologies. The China market is emerging as a global leader in construction AI adoption due to strong investment in infrastructure and growing interest in intelligent building solutions.

Artificial intelligence in construction market in India is expanding at a CAGR of 25.4% supported by increasing infrastructure development and adoption of digital tools in construction projects. Companies are implementing AI for project planning, monitoring, predictive analytics, and safety compliance. AI enabled drones, software platforms, and sensors are being integrated into commercial, residential, and industrial construction projects. Government initiatives promoting smart cities and digital infrastructure are fueling demand for AI solutions. Contractors and project managers are prioritizing efficiency, risk mitigation, and accurate resource allocation through AI technologies. The Indian market is seeing growth due to rising urbanization, large scale construction projects, and demand for faster, safer, and cost effective building solutions.

Artificial intelligence in construction market in Germany is advancing at a CAGR of 23.3% driven by high technology adoption and the demand for precision and efficiency in construction projects. AI is being used for predictive maintenance, project management, site safety monitoring, and workflow optimization. Integration of AI with building information modeling and automated machinery is enhancing productivity and reducing errors. Contractors and construction firms prioritize advanced AI tools for cost reduction and timely project completion. Germany is witnessing growth in commercial and industrial construction projects utilizing AI technologies. Digital platforms, robotics, and smart sensors are widely implemented. The market benefits from skilled labor, strong technology infrastructure, and high awareness about innovative construction practices.

The United Kingdom market is growing at a CAGR of 19.3% with construction companies adopting AI solutions to optimize project planning, resource management, and safety. AI enabled tools, including predictive software, sensors, and drones, are increasingly integrated into residential, commercial, and infrastructure projects. The use of AI enhances operational efficiency, reduces errors, and improves risk management on construction sites. Government initiatives promoting smart city and digital infrastructure projects are supporting market adoption. Contractors are focusing on faster completion times, cost savings, and improved project accuracy through AI integration. The United Kingdom continues to see consistent growth in AI adoption due to rising awareness and technological support in the construction sector.

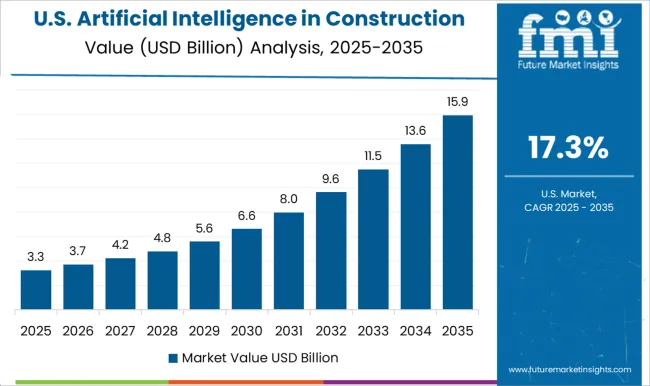

The United States market is expanding at a CAGR of 17.3% driven by increasing deployment of AI technologies in construction projects. Companies are using AI for project management, predictive maintenance, workflow optimization, and safety monitoring. Integration of AI with building information modeling and automated machinery enhances efficiency, reduces errors, and lowers operational costs. Commercial, residential, and infrastructure projects are leveraging AI enabled software, drones, and sensors. Contractors and developers prioritize precision, timeliness, and resource optimization in their projects. Government and private investments in smart infrastructure and technology adoption further support market growth. The United States remains a significant market for AI in construction due to high technological readiness and demand for innovative, efficient, and safer construction practices.

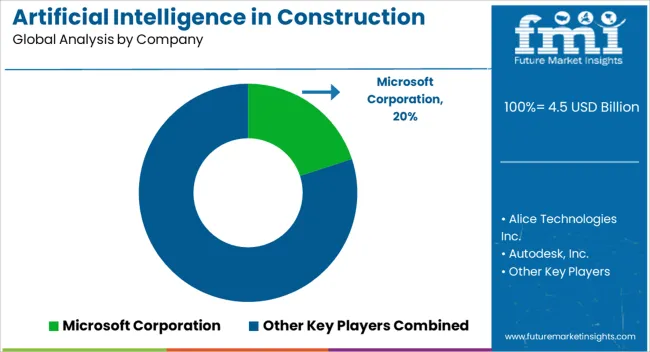

The artificial intelligence (AI) in construction market is growing rapidly as companies increasingly leverage AI to enhance productivity, reduce costs, improve safety, and streamline project management. Key suppliers driving innovation in this space include Microsoft Corporation, Alice Technologies Inc., Autodesk, Inc., Bentley Systems Inc., Dassault Systèmes SE, IBM Corporation, NVIDIA Corporation, Oracle Corporation, Predii, PTC Inc., SAP SE, and Smartvid.io Inc. These companies offer integrated AI solutions that span design, project planning, predictive analytics, quality control, and risk management, providing construction firms with tools to optimize workflow and decision-making. Microsoft Corporation delivers AI-powered construction management tools through platforms such as Azure AI and Dynamics 365, enabling data-driven project insights, predictive maintenance, and real-time collaboration. Autodesk and Bentley Systems focus on design automation, virtual modeling, and project simulations, while Dassault Systèmes SE integrates AI with 3D modeling and digital twin technologies to enhance design efficiency and reduce errors. Companies like IBM and NVIDIA provide AI frameworks, machine learning algorithms, and high-performance computing solutions that enable predictive analytics, risk assessment, and equipment optimization across large construction projects. Software platforms from Oracle, SAP SE, and PTC Inc. offer AI-driven project management, resource allocation, and cost estimation capabilities, allowing construction managers to make proactive decisions and reduce operational inefficiencies. Emerging startups such as Alice Technologies Inc., Predii, and Smartvid.io Inc. are bringing innovation in construction scheduling, safety monitoring, and automated inspection, integrating computer vision and deep learning technologies to minimize onsite risks and maximize efficiency. AI solutions also enhance workforce productivity by predicting labor needs, identifying potential bottlenecks, and providing real-time insights to improve project delivery. The growing adoption of AI in construction is being fueled by smart city initiatives, the increasing use of digital twins, and rising demand for predictive and prescriptive analytics. By integrating AI into planning, monitoring, and execution, these leading suppliers are enabling construction companies to reduce delays, optimize resource usage, improve safety standards, and deliver projects more efficiently. As AI continues to transform the construction industry, these suppliers are shaping a technology-driven ecosystem that enhances operational efficiency, ensures project accuracy, and drives sustainable growth across global construction projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Component | Solution and Service |

| Deployment Model | Cloud and On-premises |

| Organization Size | Large enterprises and SME |

| Application | Project management, Field management, Risk management, and Asset management |

| End User | Commercial, Residential, Industrial, and Public infrastructure |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Microsoft Corporation, Alice Technologies Inc., Autodesk, Inc., Bentley Systems Inc., Dassault Systemes SE, IBM Corporation, NVIDIA Corporation, Oracle Corporation, Predii, PTC Inc., SAP SE, and Smartvid.io Inc. |

| Additional Attributes | Dollar sales vary by AI technology, including machine learning, computer vision, and natural language processing; by application, such as project planning, safety monitoring, predictive maintenance, and quality control; by end-use, spanning commercial, residential, and infrastructure construction; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising digitalization, demand for productivity enhancement, and safety improvements in construction projects. |

The global artificial intelligence in construction market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the artificial intelligence in construction market is projected to reach USD 28.4 billion by 2035.

The artificial intelligence in construction market is expected to grow at a 20.3% CAGR between 2025 and 2035.

The key product types in artificial intelligence in construction market are solution and service.

In terms of deployment model, cloud segment to command 61.2% share in the artificial intelligence in construction market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Ear Simulator Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Ventilation and Anaesthesia Masks Market Size and Share Forecast Outlook 2025 to 2035

Artificial Pancreas Device Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Analysis and Growth Projections for Artificial Sweetener Business

Artificial Turf Market Growth & Trends 2024-2034

Artificial Plants Market

Artificial Wood Beams Market

Artificial Airway Holders Market

Artificial Cartilage Implant Market

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Bowling Surface Market

Artificial Hair Integration Market Growth - Trends & Forecast 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA