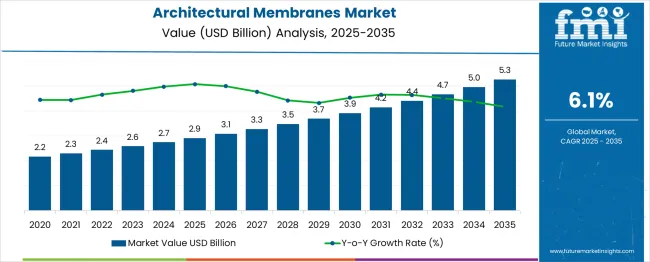

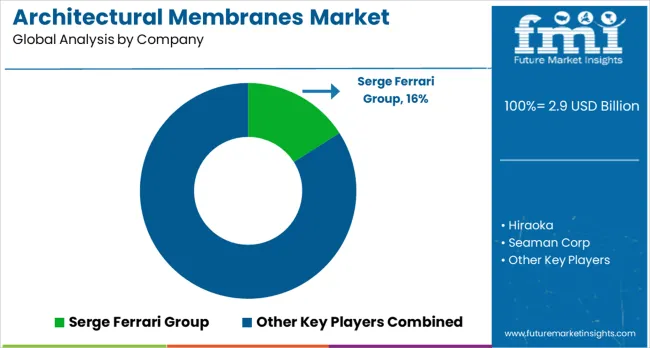

The architectural membranes market is valued at USD 2.9 billion in 2025 and is anticipated to reach USD 5.3 billion by 2035, registering a CAGR of 6%. The demand for energy-efficient building solutions and durable construction materials drives this growth, as architectural membranes offer insulation and longevity in both commercial and residential applications. These membranes are increasingly preferred for their functionality and aesthetic appeal in modern architecture.

Growth is driven by increased adoption in large-scale commercial and residential projects, where architectural membranes are valued for their versatile applications in facades, roofing, and interior design. As the market continues to expand, technological advancements improve performance, further accelerating market growth. By 2035, the market will reach USD 5.3 billion, driven by continued product innovation and broader application in the construction sector, with enhanced material properties supporting higher market penetration.

| Metric | Value |

|---|---|

| Architectural Membranes Market Value (2025) | USD 2.9 billion |

| Architectural Membranes Market Forecast Value (2035) | USD 5.3 billion |

| Architectural Membranes Market Forecast CAGR | 6% |

The primary risks in the architectural membranes market are largely driven by the volatility in raw material prices, especially for essential polymers like PVC and PTFE. Any disruption in global supply chains caused by geopolitical instability, trade restrictions, or natural disasters can lead to significant fluctuations in the cost of these materials. As raw materials account for a substantial portion of production costs, price increases can squeeze profit margins for manufacturers. With the growing focus on environmental responsibility, there is increased pressure on manufacturers to use eco-friendly materials, which, coupled with fluctuating resource availability, can further drive up costs.

The market is also vulnerable to economic cycles, particularly fluctuations in the construction industry. Architectural membranes are primarily used in commercial and residential building projects; therefore, any downturn in the construction sector, driven by economic recessions, reduced investments, or shifting demand, could directly affect market growth. The cyclical nature of construction projects and dependency on large-scale infrastructure developments make the market particularly sensitive to these economic shifts. Tightening building codes and regulatory changes related to environmental standards may result in higher compliance costs for manufacturers, particularly in regions with stringent environmental regulations.

Market expansion is being supported by the increasing demand for lightweight, durable, and aesthetically pleasing construction materials that can cover large spans without intermediate supports. Architectural membranes offer unique advantages including excellent weather resistance, translucency for natural lighting, and the ability to create complex geometric forms that are difficult to achieve with traditional materials. The growing emphasis on construction and energy-efficient building designs is driving adoption of membrane solutions that reduce material usage and improve building performance.

The expansion of sports and recreational facilities worldwide is creating substantial demand for architectural membranes that can provide weather protection while maintaining aesthetic appeal. Infrastructure modernization programs and the development of iconic architectural projects are increasing the use of membrane structures for airports, convention centers, and transportation hubs. The versatility of modern membrane materials and advancing installation techniques is making these solutions more accessible for diverse construction applications.

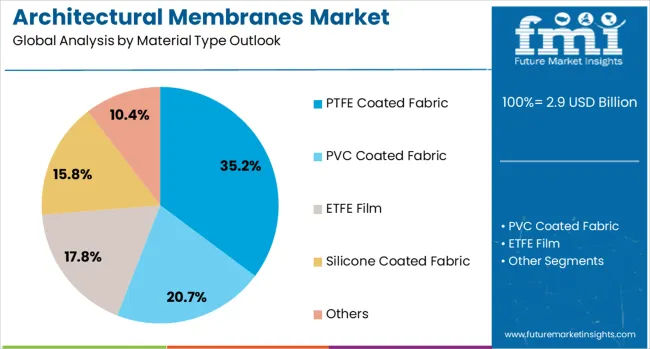

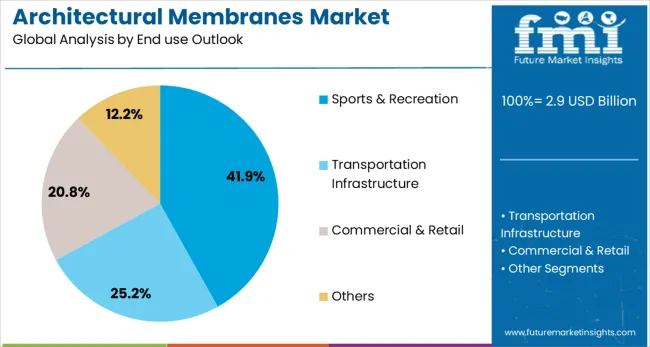

The market is segmented by material type, end use, and region. By material type, the market is divided into PTFE coated fabric, PVC coated fabric, ETFE film, silicone coated fabric, and others. Based on end use, the market is categorized into sports and recreation, transportation infrastructure, commercial and retail, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

PTFE coated fabric is projected to account for 35% of the Architectural Membranes market in 2025. This leading share is supported by the superior performance characteristics of PTFE materials including excellent weather resistance, non-stick properties, and long-term durability under harsh environmental conditions. PTFE coated fabrics offer exceptional UV resistance, chemical stability, and maintain their structural integrity over extended periods. The material's ability to provide translucency while maintaining strength makes it ideal for applications requiring natural lighting and weather protection. The segment benefits from established manufacturing processes and widespread acceptance in premium architectural applications.

Sports and recreation applications are expected to represent 42% of architectural membrane usage in 2025. This dominant share reflects the extensive use of membrane structures for stadiums, sports complexes, swimming pools, and recreational facilities that require large-span coverage with minimal structural support. Membrane structures provide cost-effective solutions for sports venues by reducing construction time, lowering maintenance requirements, and offering design flexibility. The segment benefits from growing investment in sports infrastructure, increasing popularity of outdoor recreational activities, and the need for weather-protected venues that can accommodate large crowds while maintaining optimal environmental conditions.

Transportation infrastructure represents a significant portion of the architectural membranes market, encompassing applications in airports, railway stations, bus terminals, and parking facilities. These applications require membrane solutions that can span large areas, provide weather protection, and create distinctive architectural landmarks. Transportation hubs increasingly utilize membrane structures to create welcoming environments that combine functionality with aesthetic appeal while managing construction costs and timeframes.

Commercial and retail applications include shopping centers, exhibition halls, warehouses, and mixed-use developments that utilize architectural membranes for both functional and aesthetic purposes. These applications benefit from the rapid installation capabilities of membrane systems, their ability to create column-free spaces, and the potential for incorporating branded colors and designs that enhance commercial appeal.

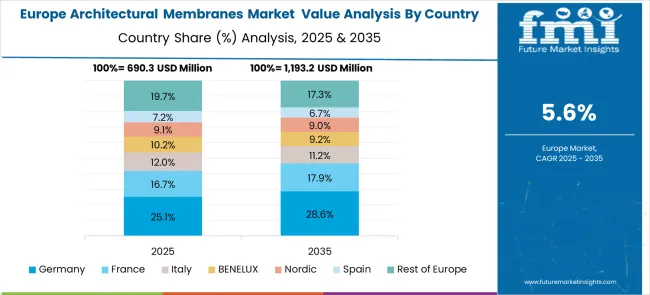

The architectural membranes market in Europe exhibits mature growth across key economies. Germany holds a strong presence, driven by its advanced construction sector and demand for high-performance materials such as PTFE and ETFE, supported by innovations that enhance durability, energy efficiency in architectural designs. France is a significant market, propelled by its focus on eco-friendly and aesthetic building solutions, with leading manufacturers blending technical membrane properties with French design excellence for iconic constructions. The UK shows growth through increased adoption of lightweight, green roofing solutions in modern infrastructure projects. Italy and Spain demonstrate rising demand for architectural membranes in sports and commercial venues, emphasizing innovative and weather-resistant materials. BENELUX countries contribute to growth with emphasis on urban development and green building standards, while Eastern Europe and Nordic regions present growing opportunities driven by infrastructure modernization and climate-responsive architecture.

The Architectural Membranes market is advancing steadily due to growing demand for innovative construction solutions and green building materials. However, the market faces challenges including higher initial costs compared to traditional materials, limited awareness among some architects and contractors, and technical requirements for specialized installation expertise. Technological advancements in material science and expanding applications continue to drive market growth and adoption patterns.

The integration of smart technologies into architectural membranes is creating opportunities for responsive building skins that can adapt to environmental conditions. Advanced membrane materials are incorporating sensors, lighting systems, and environmental controls that enable dynamic responses to weather conditions, occupancy levels, and energy management requirements. These smart membrane systems provide enhanced building performance, improved occupant comfort, and operational efficiency while maintaining the aesthetic and structural benefits of traditional membrane architecture.

Modern architectural membrane development is focusing on eco-friendly solutions through recyclable materials, reduced environmental impact manufacturing processes, and enhanced energy performance characteristics. New membrane formulations are incorporating bio-based materials, improved recycling capabilities, and manufacturing processes that reduce carbon footprint while maintaining performance standards. These environmentally responsible solutions are appealing to environmentally conscious architects and building owners while meeting increasingly stringent environmental regulations and green building certification requirements.

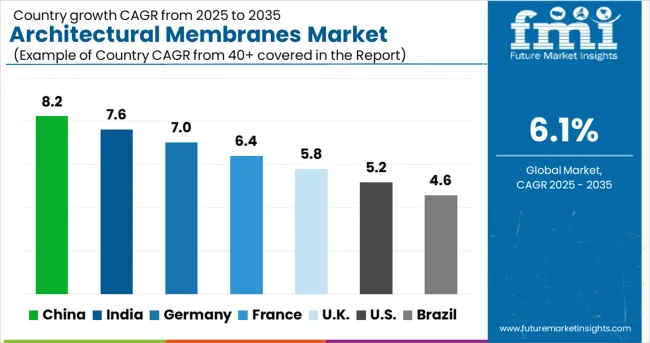

| Country | CAGR (2025–2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7% |

| France | 6.4% |

| United Kingdom | 5.8% |

| United States | 5.2% |

| Brazil | 4.6% |

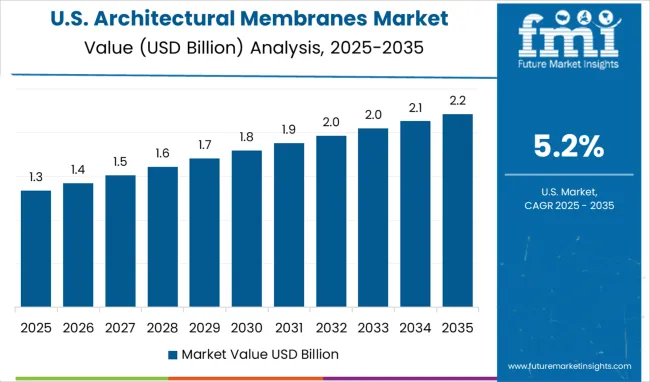

The architectural membranes market is growing steadily, with China leading at an 8.2% CAGR through 2035, driven by massive infrastructure development and increasing adoption of modern construction technologies. India follows at 7.6%, supported by expanding urbanization and growing sports infrastructure investments. Germany grows at 7.0%, emphasizing high-quality membrane solutions and advanced architectural applications. France records 6.4%, focusing on iconic architectural projects and transportation infrastructure development. The United Kingdom and United States show growth rates of 5.8% and 5.2% respectively, with mature construction markets and ongoing facility modernization programs. Brazil is expected to grow at a CAGR of approximately 4.6% between 2025 and 2035, driven by rapid urbanization, infrastructure development, and increasing adoption of architectural membranes in commercial, sports, and transportation sectors.

The report covers an in-depth analysis of 40+ countries seven top-performing OECD countries are highlighted below.

The architectural membranes market in China is projected to grow at a CAGR of 8.2% from 2025 to 2035. The market’s growth is primarily driven by rapid urbanization and ongoing infrastructure development across the country. With increasing demand for energy-efficient, durable, and weather-resistant building materials, architectural membranes are becoming a preferred choice for commercial and residential constructions. The government’s investments in infrastructure projects, such as smart cities and public buildings, are fueling this growth. As the construction sector prioritizes energy savings and long-lasting materials, architectural membranes are playing a key role in building design. The demand for high-performance materials like these continues to rise, especially as new construction projects seek to meet modern requirements for insulation, weather protection, and aesthetics.

The architectural membranes market in India is expected to expand at a CAGR of 7.6% from 2025 to 2035. This growth is fueled by the expanding construction industry and the increasing demand for modern building materials. With rapid urbanization and growing investments in infrastructure, the demand for high-performance materials such as architectural membranes is rising. The government’s focus on large-scale projects, including commercial buildings and public infrastructure, is contributing to the market’s expansion. The membranes offer advantages like weather resistance, durability, and improved insulation, making them a popular choice for commercial and residential buildings. As the construction sector modernizes, there is a shift towards using advanced materials to meet the growing demand for efficient and long-lasting building components.

Germany is expected to experience a CAGR of 7% in the architectural membranes market from 2025 to 2035. The country’s construction industry is driven by high demand for high-performance, durable materials. With Germany’s strong focus on energy-efficient building practices and increasingly strict regulations, architectural membranes are in demand for commercial buildings and public infrastructure projects. The country’s commitment to improving building performance and efficiency is reflected in the growing use of advanced materials like architectural membranes, which offer benefits such as thermal insulation and weather protection. Germany’s leadership in technological innovation continues to drive the development of advanced membranes, contributing to market growth. As the construction sector grows, both residential and commercial buildings increasingly demand these high-quality materials to meet modern building codes.

In France, the architectural membranes market is projected to grow at a CAGR of 6.4% from 2025 to 2035. The market’s growth is primarily driven by the country’s focus on improving building performance through the use of high-quality materials. France’s growing demand for public infrastructure, commercial complexes, and residential buildings that are designed for efficiency and durability is contributing to the widespread use of architectural membranes. The membranes’ ability to provide superior insulation, weather resistance, and aesthetic value has made them a popular choice among architects and builders. Additionally, France’s emphasis on energy conservation in building design and ongoing urban development projects further supports the demand for these high-performance materials. With the growing trend of upgrading older buildings and modernizing urban spaces, the market for architectural membranes continues to expand.

The United Kingdom is expected to witness a CAGR of 5.8% in the architectural membranes market from 2025 to 2035. The market is driven by increasing demand for advanced building materials that offer enhanced energy efficiency, weather resistance, and durability. The UK government’s initiatives to improve building performance, reduce energy consumption, and meet regulatory requirements are contributing to the demand for architectural membranes. As commercial and residential building projects seek to meet high standards for energy efficiency and low maintenance, membranes are becoming a popular solution. The use of membranes in modern building designs, including facades and roofs, continues to rise due to their versatility and aesthetic appeal. The construction sector in the UK is placing greater emphasis on using materials that improve the long-term performance of buildings, further boosting the market for architectural membranes.

The USA architectural membranes market is projected to grow at a CAGR of 5.2% from 2025 to 2035. The market is influenced by the increasing construction of high-performance buildings, particularly in commercial sectors, where energy efficiency and weather resistance are crucial. Architectural membranes are gaining popularity due to their ability to enhance building insulation, provide protection from extreme weather conditions, and reduce energy costs. The rising trend of using advanced materials that improve both the aesthetics and functionality of buildings is driving the adoption of architectural membranes in construction. As the USA construction industry focuses on meeting regulatory standards for energy efficiency, the demand for architectural membranes is expected to continue to grow.

The architectural membranes market is expected to grow at a CAGR of 4.6% from 2025 to 2035. This growth is driven by Brazil’s expanding construction industry, with a significant focus on urbanization and commercial projects. As demand for modern buildings increases, so does the need for high-performance materials such as architectural membranes. These membranes are valued for their weather resistance, thermal insulation, and ease of installation. Furthermore, Brazil’s government has initiated several large-scale infrastructure projects, providing a boost to the market. The growing awareness of building performance, along with increased construction of public facilities and commercial buildings, will contribute to the market’s growth in the country.

The architectural membranes market is characterized by competition among specialized membrane manufacturers, chemical companies, and architectural solution providers. Companies are investing in advanced material technologies, innovative coating formulations, comprehensive installation services, and strategic partnerships with architects and contractors to deliver high-performance membrane solutions. Product innovation, technical expertise, and project execution capabilities are central to establishing competitive advantages in this specialized construction materials market.

Serge Ferrari Group, France-based, leads the market with comprehensive membrane solutions, advanced coating technologies, and extensive global project experience across diverse architectural applications. Hiraoka, Japan, provides high-quality membrane materials with emphasis on precision manufacturing and technical performance for demanding architectural projects. Seaman Corp, United States, offers specialized coated fabrics with focus on durability and weather resistance for long-term architectural applications. Saint-Gobain, France, delivers advanced material solutions with emphasis on green construction and energy-efficient building performance.

Chukoh Chem, Japan, provides specialized coating technologies and membrane materials for premium architectural applications. Obei Kan, Sika, Atex Membrane, Taconic-AFD, and Kobond offer specialized membrane solutions, technical expertise, and comprehensive support services across global and regional markets. These companies focus on material innovation, installation support, and project-specific solutions that meet diverse architectural requirements and performance standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 billion |

| Material Type Outlook | PTFE Coated Fabric, PVC Coated Fabric, ETFE Film, Silicone Coated Fabric, Others |

| End Use Outlook | Sports & Recreation, Transportation Infrastructure, Commercial & Retail, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | Serge Ferrari Group, Hiraoka, Seaman Corp, Saint-Gobain, Chukoh Chem, Obei Kan, Sika, Atex Membrane, Taconic-AFD, Kobond |

| Additional Attributes | Revenue analysis by material type and end use segments, regional demand patterns across major construction markets, competitive positioning with specialized membrane manufacturers and material suppliers, architect and contractor preferences for different membrane technologies, integration with green construction practices and green building certification programs, innovations in smart membrane technologies and responsive building skin applications, and adoption of advanced coating formulations with enhanced durability and performance characteristics. |

The global architectural membranes market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the architectural membranes market is projected to reach USD 5.3 billion by 2035.

The architectural membranes market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in architectural membranes market are ptfe coated fabric, pvc coated fabric, etfe film, silicone coated fabric and others.

In terms of end use outlook, sports & recreation segment to command 41.9% share in the architectural membranes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Architectural Metal Coating Market Forecast Outlook 2025 to 2035

Architectural Flat Glass Market Size and Share Forecast Outlook 2025 to 2035

Architectural Lighting Market

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Hollow Fiber Membranes Market Size and Share Forecast Outlook 2025 to 2035

Ultrafiltration Membranes Market Analysis by Material Type, End-Use, and Region through 2025 to 2035

Hollow Fiber Ceramic Membranes Market Analysis by Application, End Use, and Region Forecast Through 2035

Demand for Gas Separation Membranes in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA