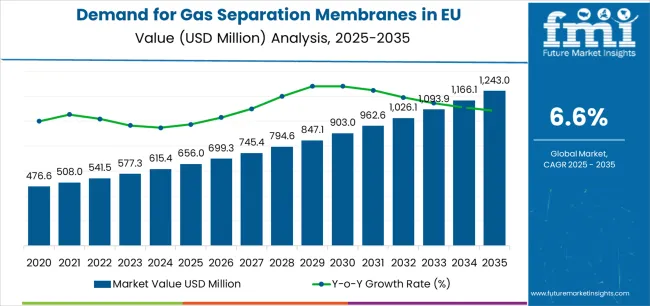

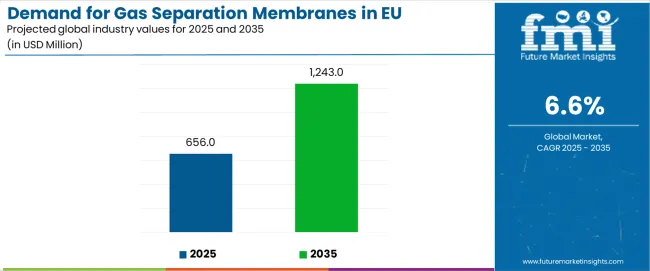

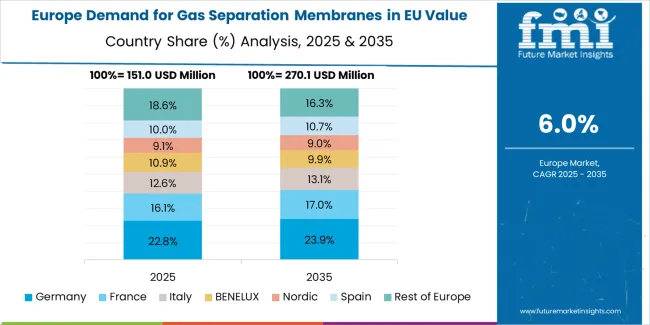

The demand for gas separation membranes in EU is projected to grow from USD 656.0 million in 2025 to USD 1,243.0 million by 2035, at a CAGR of 6.6%. Growth is peojected to be uneven across member states as policy depth, feedstock mix, and industrial clustering vary widely. Faster momentum is expected in Germany, the Netherlands, Denmark, and Italy where biomethane upgrading, blue hydrogen projects, and refinery off-gas recovery have been prioritized. Germany’s large biogas base and strong grid-injection standards are translating into steady orders for CO₂ removal and methane polishing units across midsize plants. The Netherlands has anchored demand with hydrogen and carbon capture initiatives around the North Sea industrial corridor, where membrane trains for CO₂ removal and H₂ recovery are becoming standard in pilot and early commercial phases. Denmark’s high biomethane penetration favors membranes for selective CO₂ separation in upgrading skids, supported by mature EPC integrators and quick permitting. Italy shows a dual engine growth with agricultural feedstock projects in the north drive biogas upgrading, while petrochemical sites in the Po Valley are adopting membranes for nitrogen rejection and hydrogen recovery to debottleneck legacy units.

Moderate but accelerating uptake is anticipated in France and Spain, though each for different reasons. France benefits from clear biomethane targets, yet permitting cadence and rural grid connections can slow project execution, creating a staggered order pipeline. Spain’s momentum is forming around gas processing, LNG infrastructure, and refinery revamps, where membranes are favored for compactness and lower energy intensity in CO₂ and H₂ separations under warm climates and space-constrained brownfields. Belgium’s Antwerp-Bruges cluster and Germany’s Rhine-Ruhr form a contiguous zone for refinery and chemical applications, fostering cross-border service ecosystems that shorten commissioning cycles.

Catch-up dynamics are likely in Poland, Czechia, and Romania as coal-to-gas transitions, fertilizer modernization, and municipal waste-to-gas programs generate practical use cases. Standardized containerized skids and vendor financing could unlock demand despite tighter capex. The Nordics outside Denmark display smaller absolute volumes but high specification requirements for reliability in cold conditions, favoring premium modules with advanced polymer chemistry and tighter cutoffs. Portugal, Greece, and the Baltics present selective opportunities tied to LNG terminals, port decarbonization, and niche industrial gases, creating episodic tenders rather than continuous run-rate.

Across the bloc, the EU ETS and rising CO₂ accountability in chemicals, steel, and fuels are pushing plants to recover hydrogen, reduce flaring, and capture CO₂ with modular membrane steps at the front end of hybrid trains. Service depth, replacement cycles, and module efficiency guarantees will shape share gains. Vendors that localize spare parts in Germany, the Netherlands, and northern Italy, while offering performance-based contracts in Central and Eastern Europe, will benefit most from the country-wise imbalance in growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 656 million |

| Forecast Value in (2035F) | USD 1243 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

Industry expansion is being supported by the rapid increase in CCUS project deployment across European industrial sectors and the corresponding demand for efficient, reliable, and scalable gas separation technologies with proven performance in demanding industrial applications. Modern industrial facilities rely on gas separation membranes as essential separation equipment for CO₂ capture, hydrogen purification, and natural gas processing, driving demand for products that match or exceed traditional separation technologies' performance characteristics, including high selectivity, sufficient permeability, and long-term stability. Even minor separation requirements, such as trace gas removal, product purity specifications, or energy efficiency optimization, can drive comprehensive adoption of gas separation membranes to maintain optimal process economics and support environmental compliance.

The growing awareness of climate change mitigation requirements and increasing recognition of membrane separation's energy efficiency advantages are driving demand for gas separation membranes from certified suppliers with appropriate quality credentials and technical expertise. Regulatory authorities are increasingly establishing clear guidelines for emissions reduction targets, hydrogen purity specifications, and industrial gas quality standards to maintain environmental compliance and ensure product performance. Scientific research studies and engineering analyses are providing evidence supporting membrane separation's advantages over traditional technologies, requiring specialized manufacturing methods and standardized module fabrication protocols for optimal membrane formation, appropriate support structure design, and quality validation, including selectivity testing and permeability characterization.

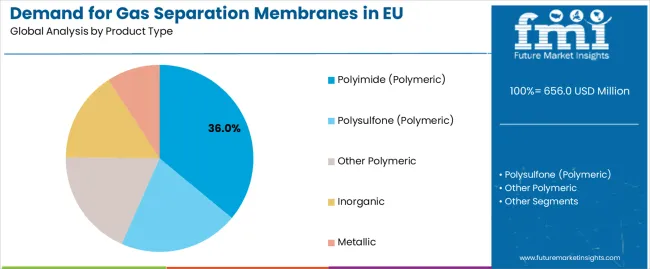

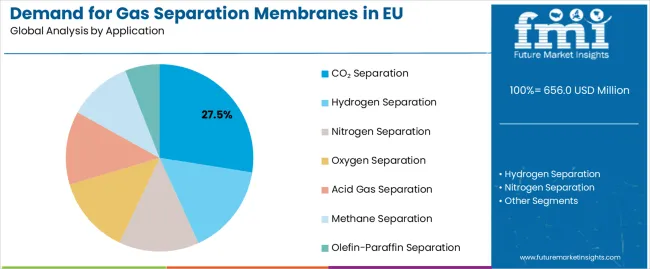

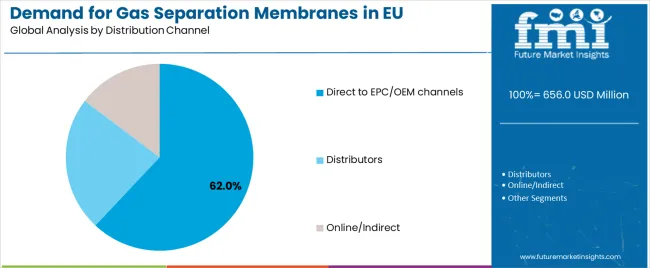

Sales are segmented by product type (material), application (gas type), distribution channel, nature (construction type), and country. By product type, demand is divided into polyimide (polymeric), polysulfone (polymeric), other polymeric, inorganic, and metallic. Based on the application, sales are categorized into CO₂ separation, hydrogen separation, nitrogen separation, oxygen separation, acid gas separation, methane separation, and olefin-paraffin separation. In terms of distribution channel, demand is segmented into direct to EPC/OEM, distributors, and online/indirect. By nature, sales are classified into hollow fiber, spiral wound, and plate & frame. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The polyimide (polymeric) segment is projected to account for 36% of EU gas separation membranes sales in 2025, establishing itself as the dominant material category across European markets. This commanding position is fundamentally supported by polyimide membranes' exceptional chemical stability, comprehensive thermal resistance enabling elevated temperature operation, and superior mechanical properties supporting high-pressure gas separation applications. The polyimide format delivers exceptional reliability, providing gas separation system operators with proven membrane materials that facilitate CO₂ capture, hydrogen purification, and natural gas processing properties essential for demanding industrial separation applications.

This segment benefits from mature polymer chemistry, well-established membrane fabrication methods, and extensive availability from multiple certified membrane manufacturers who maintain rigorous quality standards and performance specifications. Polyimide membranes offer versatility across various module configurations, including hollow fiber modules, spiral wound modules, and flat sheet membranes, supported by proven manufacturing technologies that address traditional challenges in defect-free membrane formation and long-term performance stability.

The polyimide segment is expected to increase slightly to 37.0% share by 2035, demonstrating strengthening positioning as demanding CCUS and hydrogen applications drive adoption of high-performance polymeric membranes throughout the forecast period.

CO₂ separation format is positioned to represent 27.5% of total gas separation membranes demand across European markets in 2025, increasing to 29.0% by 2035, reflecting the segment's dominance as the primary usage format within the industry ecosystem. This substantial share directly demonstrates that CO₂ separation represents the largest single application, with industrial facilities utilizing gas separation membranes for carbon capture from flue gas, biogas upgrading to biomethane, and natural gas sweetening requiring CO₂ removal from methane streams.

Modern CCUS project developers increasingly adopt membrane-based CO₂ separation for industrial decarbonization initiatives, driving demand for membranes optimized for CO₂/N₂ selectivity in flue gas with appropriate permeability, CO₂/CH₄ separation for biogas upgrading, and thermal stability supporting industrial exhaust gas temperatures. The segment benefits from European decarbonization policies driving CCUS deployment, biogas upgrading supporting renewable natural gas production, and natural gas processing requiring acid gas removal.

The segment's expanding share reflects accelerating CCUS project deployment and growing biogas upgrading capacity, with CO₂ separation maintaining dominant positioning as European climate policies intensify throughout the forecast period.

Direct to EPC/OEM channels are strategically estimated to control 62% of total European gas separation membranes sales in 2025, increasing to 65.0% by 2035, reflecting the critical importance of direct relationships between membrane manufacturers and engineering procurement construction (EPC) contractors or original equipment manufacturers (OEM) for driving project specifications, technical collaboration, and supply reliability. European CCUS project developers, hydrogen plant constructors, and industrial gas system integrators consistently demonstrate strong preference for direct supplier relationships, delivering consistent membrane specifications, technical support, and supply security supporting project execution and system commissioning.

The segment provides essential project support through application engineering optimizing membrane system design, technical service supporting system commissioning and troubleshooting, and quality assurance programs addressing specific project requirements and performance guarantees. Major European EPC contractors and OEM system builders systematically establish direct relationships with membrane manufacturers, often conducting extensive technology qualification, pilot testing, and supply agreements ensuring project success and enabling long-term collaboration on multiple projects.

The segment's expanding share reflects increasing importance of technical collaboration and project-specific membrane solutions as CCUS and hydrogen projects become more complex, with direct EPC/OEM channels strengthening dominant positioning as performance requirements drive closer supplier-contractor relationships throughout the forecast period.

EU gas separation membranes sales are advancing steadily due to accelerating CCUS project deployment, growing hydrogen economy development, and increasing industrial decarbonization initiatives. The industry faces challenges, including CCUS policy implementation delays affecting project timing, competition from established pressure swing adsorption and cryogenic separation technologies, and membrane fouling concerns in real-world industrial applications. Continued innovation in membrane materials, module design, and system integration remains central to industry development.

The steadily accelerating deployment of CCUS projects across European industrial facilities is fundamentally transforming gas separation membranes demand from niche applications toward mainstream industrial decarbonization requiring large-scale CO₂ separation systems. Advanced membrane technologies featuring enhanced CO₂/N₂ selectivity, improved permeability enabling compact system designs, and robust materials withstanding flue gas contaminants enable cost-effective carbon capture from cement plants, steel mills, and power generation facilities supporting European climate neutrality targets. These decarbonization initiatives prove particularly transformative for post-combustion carbon capture, including cement plant CO₂ capture from high-concentration flue gas, coal and gas-fired power plant retrofits requiring compact separation systems, and industrial facility point-source capture enabling phased decarbonization implementation.

Modern hydrogen economy development systematically incorporates membrane separation technologies for hydrogen production purification, hydrogen recovery from industrial process streams, and fuel cell grade hydrogen preparation supporting transportation and stationary power applications. Strategic integration of membrane technologies optimized for hydrogen separation enables system designers to position membrane-based purification as energy-efficient alternatives where hydrogen recovery from moderate purity streams directly determines process economics and hydrogen value capture. These hydrogen applications prove essential for steam methane reforming hydrogen plants requiring CO₂ removal and hydrogen purification, ammonia production facilities recovering hydrogen from synthesis purge gas, and refinery hydrogen networks capturing value from off-gas streams.

European biogas producers increasingly prioritize membrane-based upgrading technologies for converting biogas to renewable natural gas meeting pipeline injection specifications and vehicle fuel standards supporting circular economy objectives and renewable energy targets. This biogas trend enables membrane suppliers to provide cost-effective upgrading solutions through single-stage membrane systems for moderate purity biomethane, multi-stage membrane configurations achieving pipeline quality specifications, and hybrid membrane-pressure swing adsorption systems optimizing performance. Membrane positioning proves particularly important for agricultural biogas facilities where simple operation and minimal maintenance determine technology selection, and for landfill gas utilization where compact systems and remote operation capabilities influence project viability.

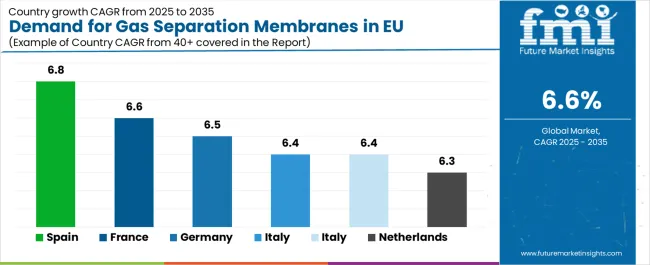

| Country | CAGR % |

|---|---|

| Spain | 6.8% |

| France | 6.6% |

| Germany | 6.5% |

| Italy | 6.4% |

| Rest of Europe | 6.4% |

| Netherlands | 6.3% |

EU gas separation membranes sales demonstrate robust growth across major European economies, with Spain leading expansion at 6.8% CAGR through 2035, driven by CCUS project pipeline and renewable energy integration. Germany maintains leadership through extensive industrial base and hydrogen economy development. France benefits from nuclear-hydrogen synergies and industrial decarbonization initiatives. Italy leverages biogas production leadership and industrial gas requirements. Spain shows strongest growth supported by renewable energy capacity and CCUS project development. Netherlands emphasizes chemical industry applications and hydrogen hub development. Sales show strong regional development reflecting EU-wide decarbonization policies and clean energy transition.

EU gas separation membranes sales are projected to grow from USD 656.0 million in 2025 to USD 1243 million by 2035, registering a CAGR of 6.6% over the forecast period. The Spain region is expected to demonstrate the strongest growth trajectory with a 6.8% CAGR, supported by CCUS project development, hydrogen economy initiatives, and biogas upgrading expansion. France and Germany follow with 6.6% and 6.5% CAGR each, attributed to industrial decarbonization leadership and extensive hydrogen infrastructure development, respectively.

Italy, Rest of Europe, and Netherlands also demonstrate 6.4%, 6.4%, and 6.3% CAGR respectively, supported by steady industrial gas requirements, growing renewable natural gas production, and diversified gas separation applications.

Revenue from gas separation membranes in Germany is projected to exhibit strong growth with a CAGR of 6.5% through 2035, driven by exceptionally well-developed industrial base requiring decarbonization solutions, comprehensive hydrogen economy initiatives, and strong chemical industry presence throughout the country. Germany's sophisticated industrial sector and internationally recognized clean energy leadership are creating substantial demand for gas separation membranes across all separation applications.

Major industrial facilities, including chemical plants, refineries, and steel mills, systematically evaluate membrane-based separation technologies for CCUS deployment, hydrogen purification, and industrial gas generation, often conducting pilot projects and feasibility studies supporting large-scale implementation. German demand benefits from extensive hydrogen infrastructure development including hydrogen pipelines, refueling stations, and Power-to-X facilities naturally supporting gas separation membranes adoption across hydrogen purification and CO₂ separation applications.

Revenue from gas separation membranes in France is expanding at a CAGR of 6.6%, substantially supported by nuclear power integration with electrolytic hydrogen production, industrial decarbonization programs emphasizing heavy industry, and growing biogas upgrading supporting renewable natural gas development. France's unique energy mix and engineering capabilities are systematically driving demand for gas separation membranes across diverse applications.

Major industrial companies and energy sector players strategically incorporate membrane technologies through CCUS project development at industrial sites, hydrogen production supporting low-carbon hydrogen strategy, and biogas upgrading utilizing agricultural and municipal waste streams. French sales particularly benefit from nuclear-powered electrolysis hydrogen production requiring purification membranes, driving clean hydrogen economy development within the gas separation membranes category. Technical collaboration between industrial operators and membrane suppliers significantly enhances technology deployment across traditional and emerging applications.

Revenue from gas separation membranes in Italy is growing at a robust CAGR of 6.4%, fundamentally driven by biogas production leadership supporting renewable natural gas development, steady industrial gas requirements, and growing CCUS awareness across Italian industrial sectors. Italy's substantial agricultural biogas sector and diversified industrial base are systematically incorporating membrane technologies as operators recognize performance advantages and economic opportunities.

Major biogas facility operators, industrial gas consumers, and chemical manufacturers strategically utilize gas separation membranes through biogas upgrading to biomethane injection quality, industrial nitrogen generation replacing liquid nitrogen supply, and hydrogen recovery from refinery and chemical plant streams. Italian sales particularly benefit from leading biogas production in Europe, creating substantial demand for biogas upgrading membranes supporting renewable natural gas targets, combined with industrial gas generation supporting manufacturing sector requirements.

Demand for gas separation membranes in Spain is projected to grow at a CAGR of 6.8%, substantially supported by CCUS project pipeline development, extensive renewable energy capacity supporting Power-to-X initiatives, and biogas upgrading expansion. Spanish energy transition leadership and industrial decarbonization planning position gas separation membranes as valuable technologies supporting climate neutrality targets.

Major industrial facilities, renewable energy developers, and biogas producers systematically evaluate membrane technologies through CCUS project development at cement and refinery facilities, hydrogen production supporting renewable energy storage and transport sector decarbonization, and biogas upgrading utilizing agricultural and wastewater treatment biogas sources. Spain's substantial solar and wind capacity particularly drives interest in Power-to-X hydrogen production requiring membrane purification technologies supporting renewable hydrogen economy development.

Demand for gas separation membranes in Netherlands is expanding at a CAGR of 6.3%, fundamentally driven by extensive chemical industry presence requiring diverse gas separations, Rotterdam hydrogen hub development, and Port of Rotterdam CCUS infrastructure initiatives. Dutch chemical sector sophistication and strategic hydrogen hub positioning create substantial opportunities for gas separation membrane applications.

Netherlands sales significantly benefit from chemical industry cluster in Rotterdam region requiring hydrogen purification, industrial gas generation, and specialty gas separations across petrochemical facilities. The country's hydrogen hub strategy paradoxically coexists with CCUS infrastructure development, as Netherlands leverages port infrastructure and depleted natural gas fields for integrated decarbonization solutions. The Netherlands also serves as energy transition hub for European markets, with successful Dutch CCUS and hydrogen projects potentially expanding to broader European industrial clusters.

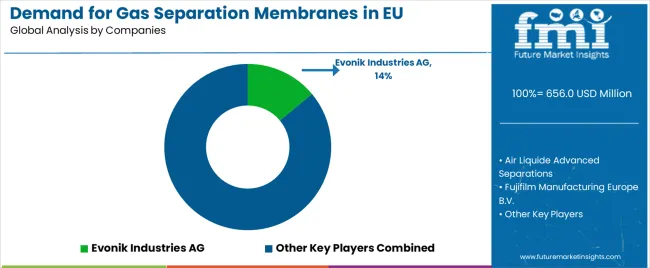

EU gas separation membranes sales are defined by competition among major chemical companies with membrane divisions, specialized membrane manufacturers, and industrial gas companies with membrane technologies. Companies are investing in advanced membrane material development, module design optimization, application engineering services, and technical support to deliver high-performance, cost-effective, and reliable membrane separation solutions. Strategic partnerships with EPC contractors, CCUS project developers, and industrial gas system integrators are central to strengthening competitive position.

Major participants include Evonik Industries AG with an estimated 14.0% share, leveraging its hollow fiber membrane technology, European manufacturing presence, and 2025 SEPURAN membrane launch supporting CO₂ separation and hydrogen applications, ensuring consistent supply to industrial customers across Europe. Evonik benefits from integrated polymer production, membrane manufacturing capabilities, and the ability to provide complete membrane modules with application engineering support, enabling customer process optimization and system design.

Air Liquide Advanced Separations holds approximately 12.0% share, emphasizing MEDAL™ membrane technology presence in European hydrogen projects, established industrial gas company relationships, and technical service capabilities. Air Liquide's success in hydrogen purification applications and integration with industrial gas supply business creates strong competitive positioning in hydrogen economy applications, supported by parent company's gas industry expertise and customer relationships.

Fujifilm Manufacturing Europe B.V. accounts for roughly 7.0% share through its European polymer membrane production footprint, providing flat sheet and module assembly capabilities for gas separation applications. The company benefits from Japanese membrane technology heritage, European manufacturing presence, and established supply relationships supporting industrial gas and specialty separation applications.

Other companies and regional suppliers collectively hold 67.0% share, reflecting the moderately fragmented nature of European gas separation membranes sales, where numerous international membrane manufacturers, specialty chemical companies, industrial gas companies with captive membrane technologies, and emerging technology providers serve specific market segments, regional customers, and niche applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1243 million |

| Product Type (Material) | Polyimide (Polymeric), Polysulfone (Polymeric), Other Polymeric, Inorganic, Metallic |

| Application (Gas Type) | CO₂ Separation, Hydrogen Separation, Nitrogen Separation, Oxygen Separation, Acid Gas Separation, Methane Separation, Olefin-Paraffin Separation |

| Distribution Channel | Direct to EPC/OEM, Distributors, Online/Indirect |

| Nature (Construction Type) | Hollow Fiber, Spiral Wound, Plate & Frame |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Evonik Industries AG, Air Liquide Advanced Separations, Fujifilm Manufacturing Europe B.V., Regional manufacturers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (material), application (gas type), distribution channel, and nature (construction type); regional demand trends across major European markets; competitive landscape analysis with established membrane manufacturers and industrial gas companies; customer preferences for various membrane materials and module configurations; integration with CCUS deployment and hydrogen economy infrastructure; innovations in membrane materials and module design; adoption across industrial decarbonization and clean energy applications; regulatory framework analysis for emissions reduction and hydrogen purity standards; supply chain strategies; and penetration analysis for industrial facilities and EPC contractors across European markets. |

The global demand for gas separation membranes in eu is estimated to be valued at USD 656.0 million in 2025.

The market size for the demand for gas separation membranes in eu is projected to reach USD 1,243.0 million by 2035.

The demand for gas separation membranes in eu is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in demand for gas separation membranes in eu are polyimide (polymeric), polysulfone (polymeric), other polymeric, inorganic and metallic.

In terms of application, co₂ separation segment to command 27.5% share in the demand for gas separation membranes in eu in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Europe Flare Gas Recovery System Market - Growth & Demand 2025 to 2035

Nitrogen Gas Based Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease Therapeutics Market Analysis - Innovations & Forecast 2025 to 2035

Gastrointestinal Stromal Tumor (GIST) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Junction Adenocarcinoma Therapeutics Market by Drug, Diagnosis, Treatment, Distribution Channel, and Region through 2035

Western Europe Bagasse Tableware Market Analysis – Growth & Forecast 2023-2033

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA