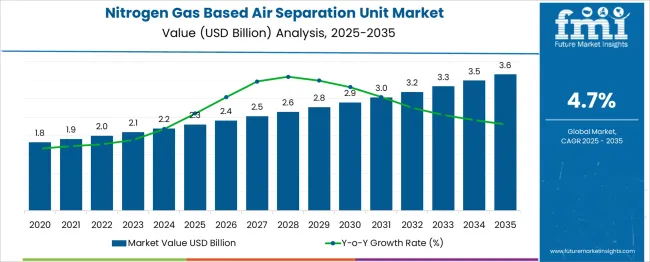

The Nitrogen Gas Based Air Separation Unit Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. The acceleration and deceleration pattern shows a steady, linear trajectory with moderate early growth followed by a gradual slowdown as the market approaches maturity. During 2025–2030, the market increases from USD 2.3 billion to around USD 2.9 billion, contributing USD 0.6 billion or about 41% of total incremental gains, supported by expanding applications in industrial gas supply, electronics, chemical processing, and oil refining, where high-purity nitrogen is critical for inerting and blanketing processes. Year-on-year growth during this period remains in the range of 4.6%–4.8%, indicating consistent momentum.

In the second half (2030–2035), the market advances from USD 2.9 billion to USD 3.76 billion, adding USD 0.86 billion or 59% of cumulative growth, but with a slight deceleration as demand shifts from large-scale installations to replacement units and efficiency upgrades. Vendors focusing on compact modular designs, cryogenic system efficiency improvements, and cost-optimized on-site generation technologies will maintain competitive advantage as industries seek reliability and operational continuity in high-consumption nitrogen applications.

| Metric | Value |

|---|---|

| Nitrogen Gas Based Air Separation Unit Market Estimated Value in (2025 E) | USD 2.3 billion |

| Nitrogen Gas Based Air Separation Unit Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The nitrogen gas based air separation unit market secures a notable position within multiple related domains with varying influence. In the air separation unit market, it accounts for about 35–38%, as nitrogen remains the most produced gas in cryogenic facilities for industrial applications. Within the nitrogen gas market, its share is approximately 7–8%, since nitrogen supply also includes bulk deliveries and membrane-based generators. For the industrial gases equipment market, nitrogen gas based air separation units contribute nearly 4–5%, reflecting their role alongside compressors, vaporizers, and storage systems. In the cryogenic process technology market, the share stands at 20–22%, as large-scale high-purity nitrogen relies heavily on cryogenic separation processes.

Within the on-site gas generation and supply market, nitrogen gas based air separation units hold about 10–12%, serving sectors such as chemicals, healthcare, food packaging, and electronics manufacturing. Growth is driven by consistent demand for ultra-pure nitrogen in semiconductor fabrication, metal processing, and controlled-atmosphere packaging. Additionally, rising investments in industrial clusters and integrated gas supply contracts further strengthen the strategic importance of nitrogen gas based air separation units within the broader industrial gases ecosystem.

The nitrogen gas-based air separation unit market is witnessing stable demand growth, largely driven by its increasing utility in industrial, metallurgical, and electronics applications. Emphasis on high-purity nitrogen generation, supported by the expansion of large-scale infrastructure and continuous processing plants, is contributing to the sustained investment in cryogenic air separation technologies.

Advancements in plant efficiency, modular construction, and integration with energy recovery systems have improved overall operational economics. Growing environmental mandates and focus on inert atmospheres for fire prevention, storage stability, and quality preservation in manufacturing are reinforcing the market’s strategic relevance.

Capital investments across the steel and chemical industries, particularly in developing economies, are expected to boost installations further.

The nitrogen gas based air separation unit market is segmented by process, end use, and geographic regions. By process of the nitrogen gas-based air separation unit, the market is divided into Cryogenic and Non-cryogenic. In terms of end use, the nitrogen gas-based air separation unit market is classified into Iron & Steel, Oil & Gas, Healthcare, Chemicals, and Others. Regionally, the nitrogen gas based air separation unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

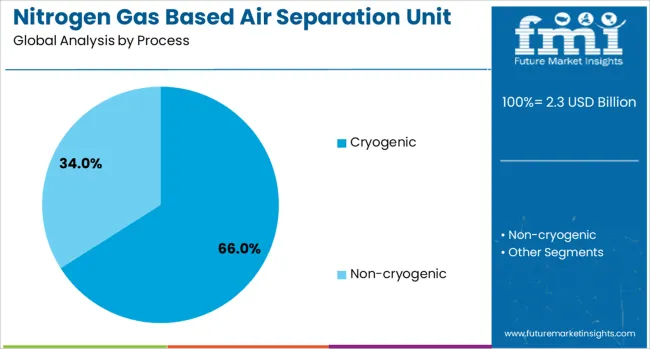

Cryogenic separation is expected to hold 66.0% of the nitrogen gas-based air separation unit market revenue in 2025, making it the dominant process segment. Its leadership is driven by the process’s ability to deliver ultra-high purity nitrogen at scale, essential for industries such as petrochemicals, metallurgy, and electronics.

The cryogenic method is preferred for operations requiring consistent output over long durations, especially where liquid nitrogen is needed for storage or transport. Improved liquefaction technology and integration with low-energy refrigeration cycles have enhanced the commercial viability of this segment.

Additionally, the rise in demand for high-capacity ASUs from industrial gas suppliers is contributing to increased deployment of cryogenic units.

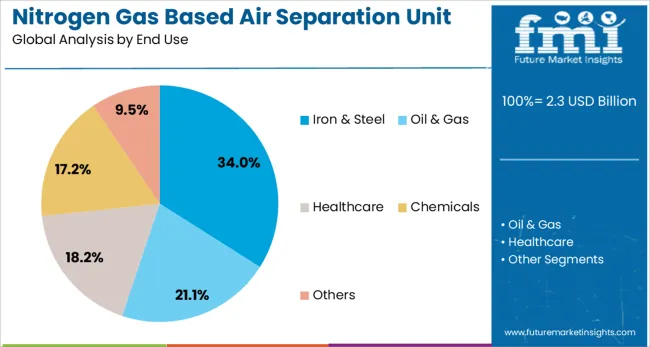

The iron & steel sector is projected to contribute 34.0% of total market revenue in 2025, positioning it as the leading end-use segment. Growth in this segment is being supported by nitrogen’s essential role in processes such as annealing, degassing, and inerting within steel production.

Nitrogen is used extensively to prevent oxidation, improve surface finish, and enhance product quality. Expansion of steel manufacturing capacity, especially in emerging economies, is creating sustained demand for high-volume, continuous nitrogen supply.

The push toward energy efficiency and controlled atmospheres in modern steelmaking practices is also amplifying the adoption of dedicated nitrogen air separation units in this vertical.

Nitrogen gas-based air separation units are widely used to generate high-purity nitrogen for applications in chemicals, food processing, electronics, metal fabrication, and oil and gas sectors. These systems operate on cryogenic or non-cryogenic technologies such as PSA (Pressure Swing Adsorption) and membrane separation. Growth has been influenced by industrial expansion, rising demand for inerting and blanketing operations, and developments in semiconductor and pharmaceutical manufacturing. Manufacturers are investing in modular ASUs and advanced control systems to improve energy efficiency, optimize output, and ensure continuous supply across large-scale and on-site installations.

Adoption of nitrogen gas-based ASUs has been driven by increasing consumption in industries such as chemicals, refining, and petrochemicals for inerting and purging processes. The electronics sector uses high-purity nitrogen for semiconductor and LED manufacturing, reinforcing demand for on-site generation systems. Growth in food and beverage packaging requiring nitrogen flushing to extend product shelf life has contributed significantly to adoption. Rising oil and gas exploration has increased usage for pipeline purging and enhanced recovery techniques. The expansion of pharmaceutical production facilities and reliance on controlled environments has further boosted nitrogen utilization, making ASUs essential for meeting purity and reliability requirements.

Market expansion has faced barriers due to the substantial investment required for installing large-scale cryogenic air separation units and associated infrastructure. Smaller businesses often find the high upfront cost challenging despite long-term benefits. Maintenance-intensive operations, particularly in cryogenic systems, require skilled technicians and advanced monitoring tools, increasing operational complexity. Energy consumption during separation processes adds to production costs, making system optimization critical. Regulatory compliance for safety in storage and handling of nitrogen adds further costs. Limited awareness among small and mid-sized enterprises about modular and portable nitrogen generation solutions has restricted adoption in certain regions.

Significant opportunities exist in developing modular, skid-mounted ASUs for on-site nitrogen generation to reduce logistics and improve supply reliability. Growing demand from sectors such as electronics manufacturing, additive manufacturing, and pharmaceutical production is creating prospects for compact, energy-efficient units. Integration of digital monitoring systems and automation is driving innovation in predictive maintenance and performance optimization. Emerging markets in Asia-Pacific, Middle East, and Africa present opportunities for industrial gas suppliers to set up regional production hubs. Co-development of ASUs tailored for integrated refinery and petrochemical complexes offers scope for strategic partnerships and long-term contracts with large industrial clients.

Recent trends emphasize the adoption of advanced PSA and VPSA technologies for faster cycle times and improved purity control. Hybrid systems combining cryogenic and membrane-based separation are gaining attention for flexibility in variable demand scenarios. Integration of IoT-enabled sensors for real-time process monitoring and fault detection is becoming standard practice in modern ASUs. Energy optimization features, such as variable-speed compressors and smart load management, are increasingly being implemented. Partnerships between industrial gas suppliers and EPC firms are focusing on turnkey ASU projects for large-scale industries. Growth in on-site nitrogen generation systems reflects the rising need for decentralized, continuous gas supply.

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

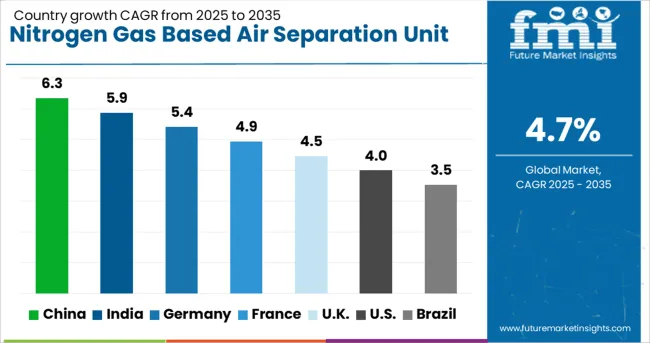

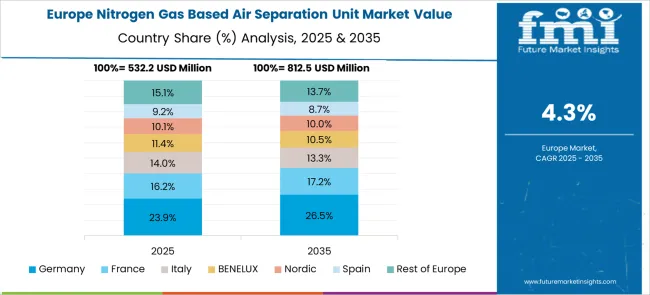

The nitrogen gas-based air separation unit market is forecasted to grow at a CAGR of 4.7% through 2035, driven by increasing demand across industries such as chemicals, food processing, metallurgy, and electronics. China leads at 6.3%, supported by large-scale industrial expansion and infrastructure projects. India follows with 5.9%, benefiting from growth in manufacturing and energy sectors. Among developed regions, France posts 4.9%, with demand fueled by aerospace and pharmaceutical applications, while the United Kingdom records 4.5%, supported by oil & gas and healthcare requirements. The United States grows at 4.0%, with stable demand across industrial gases and electronics production. The analysis includes over 40 countries, with the top five detailed below.

China is projected to grow at a CAGR of 6.3% through 2035, underpinned by massive industrialization and growing nitrogen demand across steelmaking, chemicals, and electronics. State-backed investments in infrastructure and manufacturing hubs are accelerating installations of large-capacity cryogenic air separation units. Chinese manufacturers are introducing modular units to serve diversified industrial requirements, including LNG processing and integrated gas supply systems. Export-oriented chemical and electronics production further amplifies nitrogen consumption. Strategic alliances with global players are facilitating technology upgrades in energy efficiency and operational automation, ensuring competitive positioning in high-volume projects.

India is expected to register a CAGR of 5.9% through 2035, supported by strong growth in metal fabrication, fertilizers, and energy-intensive sectors. Large-scale investments in petrochemical and refinery projects are creating sustained demand for nitrogen gas separation units. Domestic manufacturers are prioritizing cost-efficient, compact ASU designs tailored for localized needs, while international companies are investing in turnkey solutions for large plants. Increasing deployment of nitrogen in food packaging and pharmaceuticals is adding to downstream consumption. Policy-driven initiatives encouraging industrial gas production and infrastructure modernization reinforce market expansion across Indian industrial corridors.

France is forecasted to grow at a CAGR of 4.9% through 2035, with adoption supported by advanced manufacturing ecosystems and stringent quality requirements in aerospace, pharmaceuticals, and specialty chemicals. Demand for ultra-high purity nitrogen gas is rising, creating opportunities for high-performance cryogenic ASUs. French equipment providers are integrating automation, digital monitoring, and energy recovery systems to meet industrial performance standards. Growth in healthcare infrastructure and packaged food industries further adds to demand for nitrogen-based preservation systems. Collaborations with research institutions are advancing membrane and hybrid separation technologies for niche applications.

The United Kingdom is projected to grow at a CAGR of 4.5% through 2035, driven by oil & gas recovery operations, healthcare requirements, and growth in electronics production. Focus on energy efficiency and operational flexibility is pushing adoption of modular ASUs suited for variable demand patterns. Domestic suppliers are working on integrated designs combining air separation with liquefaction systems for enhanced storage capability. The country’s emphasis on optimizing industrial energy consumption reinforces the need for high-efficiency cryogenic solutions. Partnerships with technology firms support the deployment of advanced monitoring tools for predictive maintenance, reducing downtime in mission-critical operations.

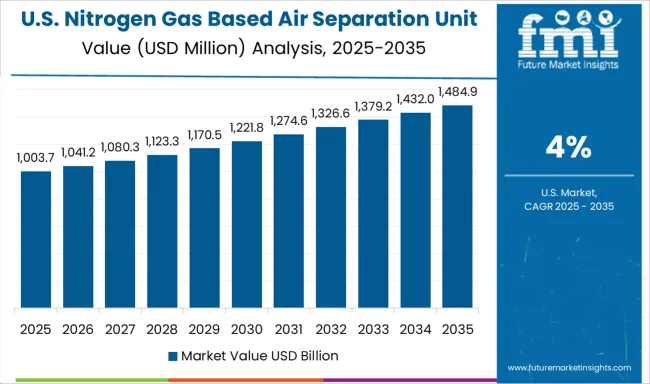

The United States is expected to expand at a CAGR of 4.0% through 2035, led by applications in electronics manufacturing, chemical processing, and industrial gas distribution networks. Growing investments in semiconductor fabrication and data center cooling systems are amplifying demand for high-purity nitrogen. USA manufacturers are focusing on enhancing cryogenic system efficiency, implementing heat integration and advanced control systems for improved energy performance. Long-term supply agreements between industrial gas companies and manufacturing enterprises are shaping stable revenue streams. Strategic developments in digital twin technology for ASU operations are further improving predictive maintenance and process optimization.

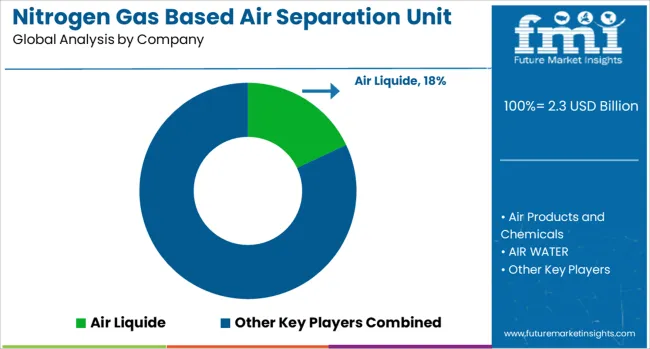

The nitrogen gas-based air separation unit (ASU) market is led by major industrial gas corporations and regional engineering firms supplying large-scale cryogenic systems and on-site generation solutions for industries such as chemicals, metals, electronics, and energy. Air Liquide, Linde plc, and Air Products and Chemicals dominate globally, offering turnkey ASUs with advanced cryogenic distillation technology, optimized energy efficiency, and long-term supply agreements for nitrogen, oxygen, and argon. TAIYO NIPPON SANSO CORPORATION and AIR WATER maintain strong presence in Asia, serving petrochemical and steel industries with customized nitrogen generation plants. Messer and Praxair Technology (now part of Linde) focus on delivering large-capacity ASUs and leveraging global distribution networks to meet industrial demand. Regional players like KaiFeng Air Separation Group, Sichuan Air Separation Plant Group, and Yingde Gases drive cost-competitive installations across Asia, particularly for expanding manufacturing and refining sectors. CRYOTEC, Technex, and Universal Industrial Gases specialize in modular and containerized ASUs for decentralized applications, while Enerflex and Ranch Cryogenics cater to oil and gas sectors with skid-mounted nitrogen generation units.

EuroChem integrates ASUs in fertilizer production facilities, ensuring consistent feedstock supply. Competitive differentiation relies on energy efficiency, plant reliability, automation, and ability to provide end-to-end EPC (engineering, procurement, and construction) solutions. Barriers to entry include high capital investment, cryogenic expertise, and stringent safety standards. Strategic initiatives include developing hybrid ASUs with membrane technology, integrating IoT-based monitoring for predictive maintenance, and expanding high-purity nitrogen offerings for semiconductor and pharmaceutical applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Process | Cryogenic and Non-cryogenic |

| End Use | Iron & Steel, Oil & Gas, Healthcare, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products and Chemicals, AIR WATER, CRYOTEC, Enerflex, EuroChem, KaiFeng Air Separation Group, Linde plc, Messer, Praxair Technology, Ranch Cryogenics, Sichuan Air Separation Plant Group, TAIYO NIPPON SANSO CORPORATION, Technex, Universal Industrial Gases, and Yingde Gases |

| Additional Attributes | Dollar sales by ASU capacity (large-scale cryogenic units, medium modular units, small on-site generators) and end-use sectors (metal processing, chemicals, electronics, oil & gas, food & beverage). Demand dynamics are driven by growing nitrogen consumption in refining, fertilizer production, and electronics manufacturing. Regional trends show Asia-Pacific as the largest market due to rapid industrialization and capacity expansions, while North America and Europe focus on modernization of ASUs with energy-saving technologies. Innovation trends include low-power cryogenic cycles, membrane-cryogenic hybrid systems for flexibility, and AI-driven optimization for oxygen/nitrogen purity control. |

The global nitrogen gas based air separation unit market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the nitrogen gas based air separation unit market is projected to reach USD 3.6 billion by 2035.

The nitrogen gas based air separation unit market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in nitrogen gas based air separation unit market are cryogenic and non-cryogenic.

In terms of end use, iron & steel segment to command 34.0% share in the nitrogen gas based air separation unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Non-Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air-Based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Air-based Remote Weapon Stations Market Size and Share Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nitrogen Gas Springs Market

Air Handling Unit Market Size and Share Forecast Outlook 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

United States Flare Gas Recovery System Market Analysis – Demand, Trends & Forecast 2025-2035

United States Plant-Based Meal Kits Market Analysis by Product Type, Format, Sales Channel - Growth, Trends and Forecast from 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

China Nitrogen Gas Spring Market Report - Trends, Growth & Forecast 2025 to 2035

Leading Providers & Market Share in China Nitrogen Gas Springs

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Hair Salon Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA