The air handling unit (AHU) market is projected to expand steadily from USD 14.9 billion in 2025 to approximately USD 23.9 billion by 2035, reflecting a CAGR of 4.8%. A peak-to-trough analysis of the market reveals a consistent upward trend with periods of moderate fluctuations. Between 2020 and 2025, the market increases from USD 14.9 billion to USD 14.3 billion before steadily rising to USD 15.7 billion by 2026. This early phase shows an incremental gain, driven by growing demand for energy-efficient HVAC solutions and regulatory pressures on indoor air quality across commercial and industrial sectors.

The market reaches a peak in 2029, where the value hits USD 18.9 billion, reflecting heightened investments in infrastructure development, technological advancements in energy efficiency, and increasing urbanization trends. This phase benefits from innovations such as variable speed fans, smart sensors, and enhanced filtration systems, contributing to improved operational performance and energy savings.

From 2030 to 2035, the market continues to rise gradually from USD 19.8 billion to USD 23.9 billion, demonstrating sustained growth and recovery post-peak. This period is characterized by widespread adoption of AHUs in emerging economies, fueled by rising industrial and residential construction and growing awareness of air quality standards. The air handling unit market demonstrates steady growth with minor fluctuations, reflecting market maturation, technological progress, and consistent demand across a range of industries.

Building construction operations encounter installation challenges as air handling unit deployment requires coordination between structural engineering, electrical infrastructure, and mechanical systems while managing crane access, equipment sequencing, and building envelope integration. Project managers work with HVAC contractors to establish installation schedules while coordinating with other trades about space allocation and utility connections that must accommodate both equipment placement and maintenance access throughout the building lifecycle.

Cross-functional coordination between facility management teams and energy optimization specialists creates ongoing dialogue about operational efficiency versus capital investment requirements. Building engineers work with utility management departments to evaluate variable frequency drive applications and control system integration while managing tenant comfort requirements and energy cost allocation across different building zones and usage patterns that may affect both system sizing and operational strategies.

Manufacturing facilities producing air handling units encounter assembly complexity as modular construction requires coordination between component fabrication, quality testing procedures, and custom configuration management while maintaining performance specifications and regulatory compliance. Production teams coordinate with engineering departments to establish testing protocols for airflow performance, energy efficiency ratings, and filtration effectiveness while managing quality control procedures that verify both individual component performance and integrated system functionality.

| Metric | Value |

|---|---|

| Air Handling Unit Market Estimated Value in (2025 E) | USD 14.9 billion |

| Air Handling Unit Market Forecast Value in (2035 F) | USD 23.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The air handling unit market is witnessing consistent growth, driven by the increasing demand for energy-efficient HVAC solutions in commercial, industrial, and residential sectors. Rising focus on indoor air quality, coupled with stricter building energy codes and environmental regulations, is pushing adoption of advanced air handling systems. The integration of smart controls, variable speed drives, and high-efficiency filtration technologies is enhancing system performance while reducing operational costs.

Growing investments in infrastructure development and refurbishment of existing buildings, particularly in urban areas, are further supporting demand. The healthcare, pharmaceutical, and data center industries are increasingly relying on air handling units for precise temperature, humidity, and particulate control, boosting market potential.

With heightened awareness of airborne contaminants, demand for systems capable of incorporating advanced filtration and air purification features is on the rise Continuous innovations in modular and compact designs, along with expanding applications in green building projects, are expected to sustain market growth in the coming years.

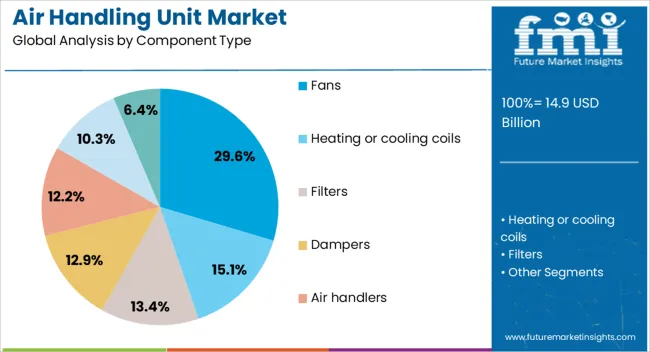

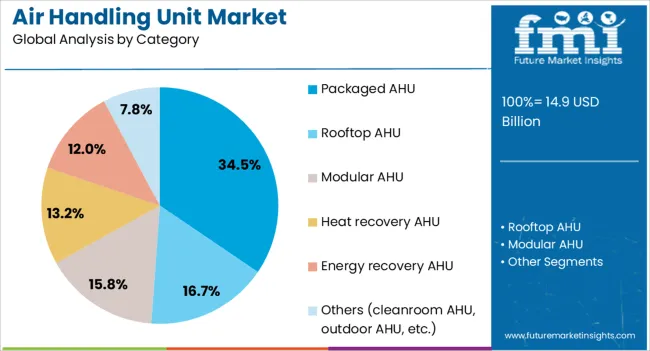

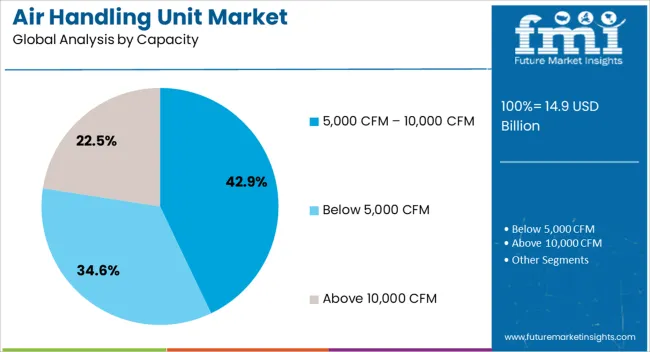

The air handling unit market is segmented by component type, category, capacity, application, distribution channel, and geographic regions. By component type, air handling unit market is divided into Fans, Heating or cooling coils, Filters, Dampers, Air handlers, Blowers, and Others (humidifiers/dehumidifiers, isolators, etc.). In terms of category, air handling unit market is classified into Packaged AHU, Rooftop AHU, Modular AHU, Heat recovery AHU, Energy recovery AHU, and Others (cleanroom AHU, outdoor AHU, etc.). Based on capacity, air handling unit market is segmented into 5,000 CFM – 10,000 CFM, Below 5,000 CFM, and Above 10,000 CFM. By application, air handling unit market is segmented into Commercial, Residential, and Industrial. By distribution channel, air handling unit market is segmented into Direct, Online, and Indirect. Regionally, the air handling unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fans segment is projected to hold 29.6% of the air handling unit market revenue share in 2025, making it the leading component type. This dominance is supported by their critical role in ensuring optimal airflow and maintaining the performance of the entire system. The efficiency and reliability of fans directly influence the energy consumption and operational effectiveness of air handling units.

Technological advancements such as electronically commutated motors and aerodynamic blade designs are reducing power consumption and improving noise control, making fans more effective and sustainable. The segment is benefiting from increasing demand for high-performance ventilation systems in sectors such as healthcare, manufacturing, and commercial real estate.

Easy integration with control systems and adaptability to varying airflow requirements are reinforcing their adoption As the focus on reducing operational costs and meeting energy efficiency standards intensifies, the role of advanced fan technologies is expected to remain central to the continued dominance of this component type.

The packaged AHU category is anticipated to account for 34.5% of the air handling unit market revenue share in 2025, positioning it as the leading category. This leadership is being driven by the convenience and cost-effectiveness of factory-assembled, ready-to-install units that reduce on-site labor and installation time.

The compact and integrated design of packaged units allows for efficient use of space while delivering consistent performance in controlling temperature, humidity, and air quality. Their growing popularity in commercial buildings, retail spaces, and healthcare facilities is supported by the ease of maintenance and customization options available from manufacturers.

The segment is also benefiting from the increasing adoption of energy recovery systems and smart control integration, which enhance operational efficiency As demand for turnkey HVAC solutions grows, packaged AHUs are expected to maintain their market leadership, supported by their versatility, shorter deployment timelines, and ability to meet diverse performance requirements across multiple end-use sectors.

The 5,000 CFM to 10,000 CFM capacity segment is expected to capture 42.9% of the air handling unit market revenue share in 2025, making it the dominant capacity range. This preference is being driven by its suitability for a wide range of medium to large-scale applications, including office complexes, educational institutions, shopping centers, and healthcare facilities.

Units within this capacity range offer a balance between airflow performance and energy efficiency, meeting the requirements of both comfort and process cooling applications. The segment benefits from flexibility in configuration, allowing integration with advanced filtration systems, energy recovery modules, and smart controls for optimized operation.

Growing investments in infrastructure projects and retrofitting initiatives are increasing the demand for AHUs that can efficiently serve medium to large spaces while maintaining compliance with energy regulations The ability of this capacity range to deliver consistent performance, combined with lower lifecycle costs, is reinforcing its leadership position in the global market.

The air handling unit (AHU) play a crucial role in regulating and circulating air within buildings, ensuring optimal indoor air quality and comfort. The market is characterized by technological advancements, including the integration of energy-efficient components and smart controls, enhancing the performance and adaptability of AHUs. Stringent building codes and regulations are prompting the adoption of advanced HVAC solutions, further propelling market expansion. The Asia Pacific region leads the market, driven by rapid urbanization and industrialization, while North America and Europe also exhibit significant demand due to ongoing infrastructure development and modernization projects.

High initial investment costs for advanced AHU systems can deter small and medium-sized enterprises from upgrading their HVAC infrastructure. The complexity of installation and maintenance of these systems requires skilled labor, which may be scarce in certain regions. The integration of AHUs with existing building structures can also pose technical challenges, especially in retrofitting scenarios. Furthermore, while advancements in AHU technology offer improved efficiency, they also necessitate regular maintenance and monitoring to ensure optimal performance, leading to increased operational costs. Addressing these challenges requires ongoing innovation, workforce training, and supportive policies to facilitate the widespread adoption of advanced AHU systems.

The growth of the AHU market is primarily driven by the increasing demand for energy-efficient HVAC systems in commercial, residential, and industrial buildings. Rising urbanization and infrastructure development, particularly in emerging economies, are contributing to the demand for advanced HVAC solutions. Technological advancements, such as the integration of variable air volume (VAV) systems, heat recovery mechanisms, and smart controls, are enhancing the efficiency and functionality of AHUs. Growing awareness of indoor air quality and the need for precise climate control are prompting the adoption of advanced AHU systems. Regulatory mandates and building codes emphasizing energy efficiency and indoor environmental quality are further accelerating market growth.

The AHU market presents numerous opportunities for expansion, particularly in the development of energy-efficient and smart HVAC solutions. The integration of Internet of Things (IoT) technology allows for real-time monitoring and predictive maintenance, enhancing the performance and lifespan of AHU systems. Advancements in materials and design are enabling the production of more compact and quieter AHUs, catering to the needs of modern buildings with space constraints. The growing trend of smart cities and the increasing adoption of Building Management Systems (BMS) are creating demand for AHUs that can seamlessly integrate with other building systems. Additionally, the expansion of healthcare, educational, and commercial sectors in emerging markets presents significant growth opportunities for AHU manufacturers.

The increasing emphasis on energy efficiency is driving the development of AHUs with advanced features such as heat recovery, variable speed drives, and smart controls. The integration of artificial intelligence (AI) and machine learning algorithms is enabling predictive maintenance and optimized performance of AHU systems. There is also a growing focus on improving indoor air quality through the incorporation of advanced filtration systems and UV-C light technology. The trend towards modular and customizable AHU designs allows for greater flexibility and scalability in meeting the specific needs of various applications. These trends indicate a shift towards more intelligent, efficient, and adaptable AHU systems in the coming years.

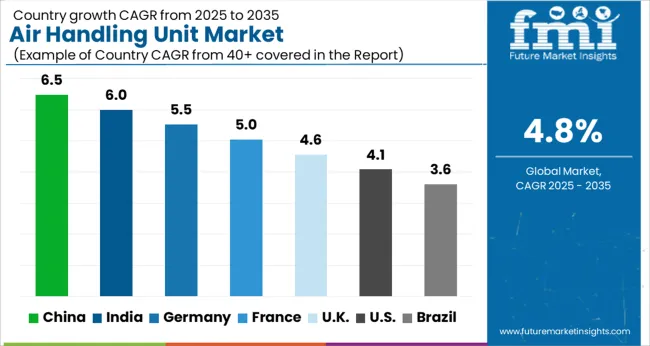

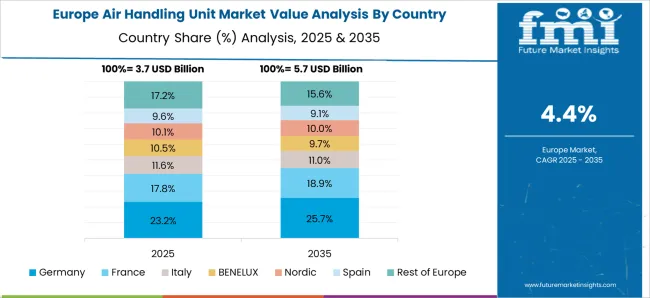

The global air handling unit market is projected to grow at a CAGR of 4.8% from 2025 to 2035. Among the key markets, China leads with a growth rate of 6.5%, followed by India at 6.0%, and France at 5.0%. The United Kingdom and the United States show more moderate growth rates of 4.6% and 4.1%, respectively. The growth is driven by increasing demand for energy-efficient HVAC systems across sectors such as residential, commercial, and industrial. Factors like urbanization, stricter environmental regulations, and rising concerns over indoor air quality are key contributors to the market’s expansion. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the global air handling unit market, growing at a projected CAGR of 6.5% from 2025 to 2035. The rapid urbanization, industrialization, and expansion of infrastructure projects are key drivers of market growth. As the construction and commercial real estate sectors continue to thrive, there is a growing demand for energy-efficient air handling systems that enhance indoor air quality and optimize energy consumption. The government’s increasing focus on environmental regulations and building codes that promote energy-efficient HVAC systems is fueling the demand for air handling units in both residential and commercial buildings.

The air handling unit market is expected to grow at a CAGR of 6.0% from 2025 to 2035. The rapid urbanization, along with the expansion of the construction and real estate sectors, is fueling the demand for efficient air handling units. India’s increasing focus on energy conservation and improving indoor air quality in commercial, residential, and industrial sectors is contributing to market growth. Additionally, as the country expands its commercial and institutional spaces, including shopping malls, hospitals, and hotels, the demand for advanced HVAC solutions is rising, further driving the air handling unit market.

The air handling unit market in France is anticipated to grow at a CAGR of 5.0% from 2025 to 2035. The market is driven by the increasing demand for energy-efficient HVAC solutions across residential, commercial, and industrial sectors. The country’s focus on reducing carbon emissions and meeting stringent environmental standards is fueling the adoption of air handling units that enhance energy efficiency and improve air quality. The growing demand for air handling units in France is also supported by the development of new commercial buildings and the need for high-performance ventilation systems in various sectors like hospitality, healthcare, and retail.

The air handling unit market in the United Kingdom is projected to grow at a CAGR of 4.6% from 2025 to 2035. The market’s growth is driven by the increasing adoption of energy-efficient HVAC systems in response to stricter environmental regulations and growing concerns over indoor air quality. The commercial construction sector, along with new developments in the industrial and residential sectors, is contributing to the demand for air handling units. The UK’s focus on achieving sustainability and reducing energy consumption in buildings further boosts the need for advanced, high-performance air handling solutions.

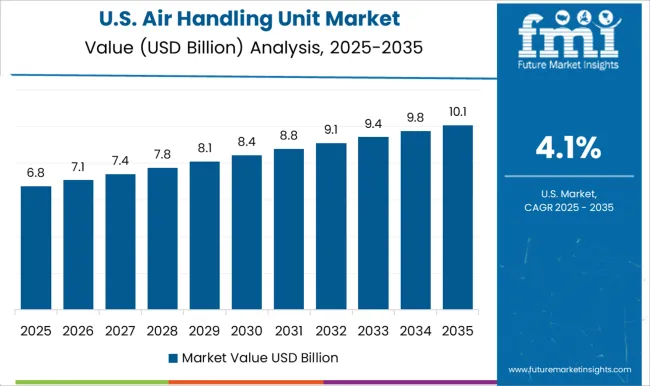

The air handling unit market in the United States is projected to grow at a CAGR of 4.1% from 2025 to 2035. The growth is supported by the increasing demand for energy-efficient HVAC systems across residential, commercial, and industrial sectors. The USA is witnessing a surge in commercial construction, particularly in the retail, healthcare, and office sectors, which is driving the demand for air handling units. Additionally, rising concerns about indoor air quality, coupled with the need for energy conservation, are encouraging the adoption of high-performance air handling solutions across various industries.

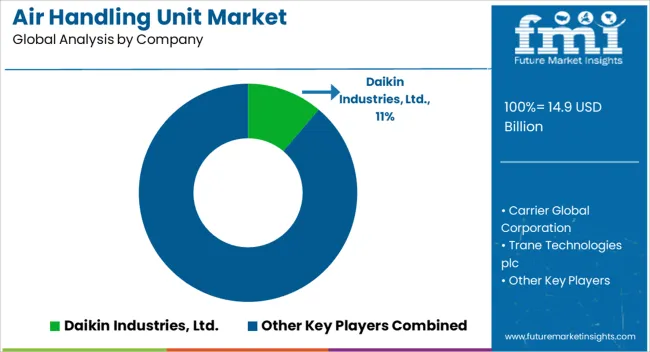

The air handling unit (AHU) market is expanding rapidly, fueled by the global emphasis on energy efficiency, indoor air quality, and sustainable HVAC solutions across residential, commercial, and industrial sectors. The market is moderately consolidated, with leading manufacturers leveraging technological innovation, automation, and smart building integration to strengthen their competitive positions.

Daikin Industries Ltd. remains the market leader, offering high-efficiency AHUs designed for maximum energy savings, low noise operation, and climate adaptability. Carrier Global Corporation delivers a wide range of AHU systems recognized for their advanced control capabilities and robust performance in large-scale commercial and industrial environments. Trane Technologies plc and Johnson Controls International PLC emphasize sustainability and intelligent system integration, developing AHUs that align with evolving environmental standards and green building certifications.

Systemair AB, Mitsubishi Electric Corporation, and Bosch Thermotechnology GmbH are notable for their eco-friendly and modular designs, providing flexibility and reduced lifecycle costs. Lennox International Inc. focuses on smart HVAC connectivity, enabling real-time monitoring and optimization of air quality. Munters Group AB and TROX GmbH lead in humidity control, filtration precision, and customized industrial solutions, supporting critical environments such as data centers and pharmaceutical facilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.9 Billion |

| Component Type | Fans, Heating or cooling coils, Filters, Dampers, Air handlers, Blowers, and Others (humidifiers/dehumidifiers, isolators, etc.) |

| Category | Packaged AHU, Rooftop AHU, Modular AHU, Heat recovery AHU, Energy recovery AHU, and Others (cleanroom AHU, outdoor AHU, etc.) |

| Capacity | 5,000 CFM – 10,000 CFM, Below 5,000 CFM, and Above 10,000 CFM |

| Application | Commercial, Residential, and Industrial |

| Distribution Channel | Direct, Online, and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin Industries Ltd., Carrier Global Corporation, Trane Technologies plc, Johnson Controls International PLC, Systemair AB, Mitsubishi Electric Corporation, Bosch Thermotechnology GmbH, Lennox International Inc., Munters Group AB, TROX GmbH. |

| Additional Attributes | Dollar sales by application (residential, commercial, industrial), airflow capacity (low, medium, high), and system type (modular, central, split). Demand dynamics are driven by a focus on energy-efficient solutions, the increasing adoption of smart HVAC systems, and the push for improved air quality in indoor environments. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, with increasing investments in sustainable building technologies and government incentives promoting energy efficiency. |

The global air handling unit market is estimated to be valued at USD 14.9 billion in 2025.

The market size for the air handling unit market is projected to reach USD 23.9 billion by 2035.

The air handling unit market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in air handling unit market are fans, heating or cooling coils, filters, dampers, air handlers, blowers and others (humidifiers/dehumidifiers, isolators, etc.).

In terms of category, packaged ahu segment to command 34.5% share in the air handling unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Aircraft Cargo Handling Equipment Market

United States & Canada Hair Salon Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Aircraft air conditioning units Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

United States Continuous Positive Airway Pressure (CPAP) Market Report – Trends, Demand & Forecast 2025-2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

UVC Upper Air Disinfection Unit Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Foundation Repair Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbag Controller Unit Market Size and Share Forecast Outlook 2025 to 2035

Non-Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Nitrogen Gas Based Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Ultra-low Temperature Air Source Heat Pump Units Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA