The air separation unit market is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The production process involves significant upfront investment in cryogenic distillation technology, compressors, and high-pressure equipment, which account for a large portion of fixed costs. Energy consumption is a dominant operating expense since air separation units are highly power-intensive, making electricity prices a critical factor in determining profitability and competitiveness. The value chain begins with raw material inputs, primarily industrial gases such as nitrogen, oxygen, and argon, extracted through separation processes. Equipment suppliers provide compressors, heat exchangers, and control systems, which form the technological backbone of operations.

Manufacturers then optimize plant design, ensuring efficiency and scalability, while service providers add value through installation, maintenance, and digital monitoring. Distribution channels include direct supply to end users in steel, healthcare, chemical, and electronics industries, where demand is steady and contract-based. Margins are shaped by energy efficiency improvements and economies of scale, with larger plants often achieving lower per-unit production costs. The value chain exhibits strong interdependence between technology providers, operators, and end-use industries, making innovation in energy-saving designs a key competitive differentiator.

| Metric | Value |

|---|---|

| Air Separation Unit Market Estimated Value in (2025 E) | USD 6.4 billion |

| Air Separation Unit Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The air separation unit market is a critical segment within the industrial gases and process equipment industry, supporting applications across steel, energy, chemical, and healthcare sectors. Within the global industrial gas production sector, it contributes about 6.1%, highlighting its essential role in supplying oxygen, nitrogen, and argon. In the broader cryogenic equipment market, its share is around 4.8%, driven by demand for large scale liquefaction and separation technologies.

Across the energy and power generation industry, air separation units hold 3.7%, supporting cleaner combustion processes and integration with gasification plants. Within the healthcare and medical gases segment, it represents about 2.9%, providing reliable oxygen supply for hospitals and emergency services. In the metallurgy and steelmaking ecosystem, the share is calculated at 5.3%, emphasizing the importance of oxygen in blast furnace operations and refining processes. Recent developments in the air separation unit market have been shaped by efficiency, scalability, and integration with emerging energy technologies. Groundbreaking trends include deployment of large capacity cryogenic ASUs for steel and petrochemical plants, alongside modular and skid mounted units for distributed applications.

Key players are investing in advanced energy efficient designs that reduce power consumption in air compression and liquefaction processes. Integration with hydrogen production and carbon capture projects is gaining momentum, positioning ASUs as enablers of low carbon industrial operations. Strategic partnerships between gas suppliers, equipment manufacturers, and energy companies are accelerating adoption. The digital monitoring systems and AI-driven predictive maintenance are being introduced to ensure reliability and cost effectiveness. These advancements show how energy efficiency and industrial innovation are guiding the future of the air separation unit market.

The air separation unit market is registering steady expansion, driven by rising industrial gas consumption across manufacturing, metallurgy, and energy sectors. The current scenario reflects strong demand from large-scale industries requiring continuous gas supply for operational efficiency and quality control. Cryogenic air separation remains the primary method for producing high-purity gases, particularly in applications where consistency and scalability are critical.

Increasing investments in infrastructure, along with advancements in process optimization, have improved production capacity and reduced energy consumption, enhancing market competitiveness. Regulatory measures promoting cleaner industrial processes are further increasing the adoption of oxygen, nitrogen, and argon in various end-use industries.

The future outlook is anchored in the growing integration of air separation units with industrial clusters, refineries, and steel plants, ensuring operational synergies and cost benefits. With continuous advancements in energy-efficient systems and the rising role of industrial gases in decarbonization initiatives, the market is poised for sustainable growth over the forecast horizon.

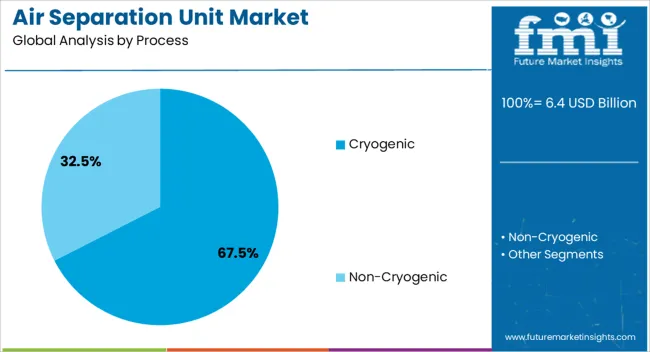

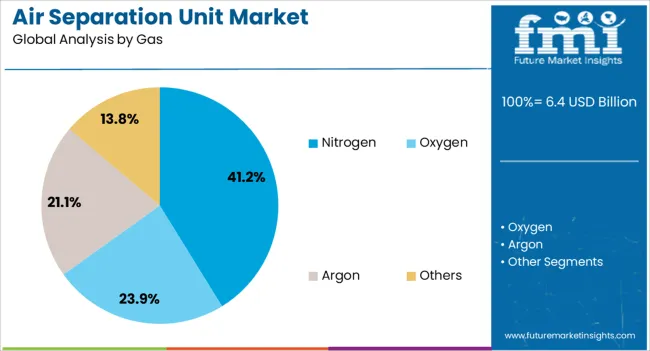

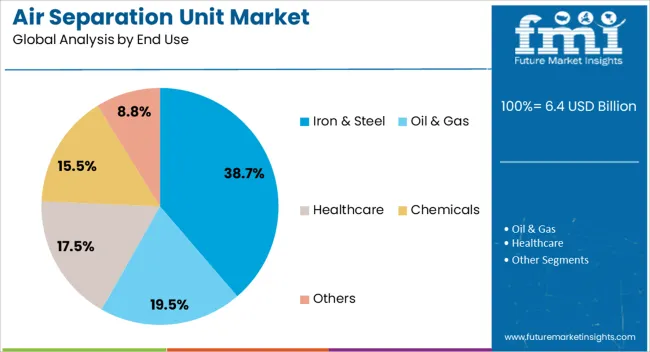

The air separation unit market is segmented by process, gas, end use, and geographic regions. By process, air separation unit market is divided into cryogenic and non-cryogenic. In terms of gas, air separation unit market is classified into nitrogen, oxygen, argon, and others. Based on end use, air separation unit market is segmented into iron & steel, oil & gas, healthcare, chemicals, and others. Regionally, the air separation unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cryogenic process segment dominates the air separation unit market, accounting for approximately 67.5% of the share. This dominance is maintained due to its ability to produce high-purity gases at large volumes, meeting the stringent quality demands of heavy industries. The process operates through fractional distillation of liquefied air, making it suitable for continuous and large-scale applications where high production efficiency is required.

Its prevalence is further supported by the growing demand from integrated steel plants, petrochemical complexes, and large-scale manufacturing facilities, where reliability and scalability are critical. Technological improvements have reduced energy consumption in cryogenic systems, increasing their operational feasibility in cost-sensitive markets.

Furthermore, the cryogenic process remains the preferred choice for applications requiring simultaneous production of multiple gases in varied purity grades. With sustained industrial expansion and the rising role of high-purity gases in advanced manufacturing, this segment is expected to retain its leadership position in the forecast period.

The nitrogen segment leads the air separation unit market by gas type, capturing approximately 41.2% of the share. This segment’s dominance is reinforced by nitrogen’s critical role as an inert gas across industries such as metallurgy, chemicals, and electronics. In the iron and steel sector, nitrogen is extensively utilized for purging, blanketing, and controlling oxidation during production processes.

The growing adoption of nitrogen in food packaging, pharmaceuticals, and semiconductor manufacturing has also contributed to sustained demand. Production through cryogenic separation enables supply of high-purity nitrogen at scale, supporting long-term industrial contracts.

The cost-effectiveness and availability of nitrogen further strengthen its market presence, while ongoing capacity expansions in major manufacturing hubs continue to drive uptake. The increasing use of nitrogen in emerging applications such as energy storage and additive manufacturing is anticipated to reinforce the segment’s growth momentum over the coming years.

The iron and steel industry holds the largest share among end uses in the air separation unit market, representing approximately 38.7% of the total. This dominance is primarily attributed to the industry’s extensive reliance on oxygen and nitrogen for core production processes, including blast furnace operation, basic oxygen steelmaking, and ladle metallurgy.

Oxygen injection enhances combustion efficiency, reduces coke consumption, and improves overall productivity, while nitrogen is employed for purging and cooling operations. The integration of on-site air separation units within steel plants ensures uninterrupted gas supply, enabling operational stability and cost savings.

Expanding steel production in emerging economies, alongside modernization of existing facilities in developed markets, has further boosted demand for dedicated ASU installations. With the iron and steel sector remaining a cornerstone of industrial development and infrastructure growth, the segment is expected to continue as a primary demand driver for the air separation unit market in the forecast period.

The market has been positioned as a fundamental part of industrial gas supply, supporting steelmaking, petrochemicals, healthcare, energy, and electronics. These units separate atmospheric air into oxygen, nitrogen, and argon, which serve as critical inputs across multiple industries. Rising demand for high-purity gases, coupled with expansion in infrastructure and energy-intensive industries, has been accelerating adoption. Advancements in cryogenic and non-cryogenic separation technologies have been enhancing operational efficiency and lowering energy costs. The air separation units have been increasingly integrated into hydrogen and liquefied natural gas value chains.

The steel and metallurgy sectors have remained among the largest consumers of oxygen generated by air separation units. Oxygen is widely used in blast furnace operations, basic oxygen furnaces, and direct reduced iron processes, making it indispensable in steel production. Increasing infrastructure projects and demand for structural steel have been sustaining the need for large-capacity ASUs. Additionally, nitrogen finds application in protective atmospheres during metal processing, while argon is used in welding and refining. Energy-efficient and large-scale ASUs have been installed near integrated steel plants to meet rising consumption. The continued expansion of steel production in Asia and the Middle East has been reinforcing the strategic role of air separation units, making the metallurgical industry a primary growth driver for this market.

The healthcare sector has been another critical driver of the air separation unit market. Oxygen production for medical use gained heightened importance during the COVID-19 pandemic, where the supply of medical-grade oxygen became a global priority. Hospitals, clinics, and healthcare facilities rely on ASUs to meet oxygen demand for critical care and surgical applications. Portable and modular ASUs have been deployed in regions with limited infrastructure to provide reliable oxygen supply. Growing healthcare spending, increasing life expectancy, and rising demand for advanced medical facilities have been sustaining oxygen consumption. The emphasis on building resilient healthcare systems has been leading to greater investments in ASU installations. Medical-grade nitrogen and oxygen also play important roles in pharmaceutical manufacturing, supporting long-term demand from this sector.

Air separation units have been increasingly integrated into projects linked with the global energy transition. Large volumes of oxygen are required for gasification, coal-to-chemicals, and blue hydrogen production through steam methane reforming with carbon capture. Similarly, nitrogen finds application in enhanced oil recovery and liquefied natural gas operations. The expansion of renewable hydrogen projects has highlighted the importance of ASUs in supplying oxygen for water electrolysis and nitrogen for storage and transport processes. Companies have been investing in energy-efficient cryogenic units to reduce power consumption in line with decarbonization targets. As industrial gases remain critical enablers for low-carbon technologies, ASUs are gaining prominence in global energy transition strategies, reinforcing their strategic importance for the future energy landscape.

Continuous technological improvements have been shaping the competitiveness of the air separation unit market. Cryogenic ASUs dominate large-scale applications due to their ability to produce gases at high purity and volume, but innovations in non-cryogenic technologies such as pressure swing adsorption and membrane separation are providing energy-efficient alternatives for small- and medium-scale uses. Automation, process optimization, and digital monitoring have been improving reliability and lowering operating costs of ASUs. Hybrid designs that combine cryogenic and non-cryogenic methods are being adopted to balance efficiency with flexibility. Equipment manufacturers are focusing on reducing power consumption, which accounts for a significant portion of ASU operational costs. With growing emphasis on sustainability and operational excellence, efficiency gains in ASUs are set to be a decisive factor for future market competitiveness.

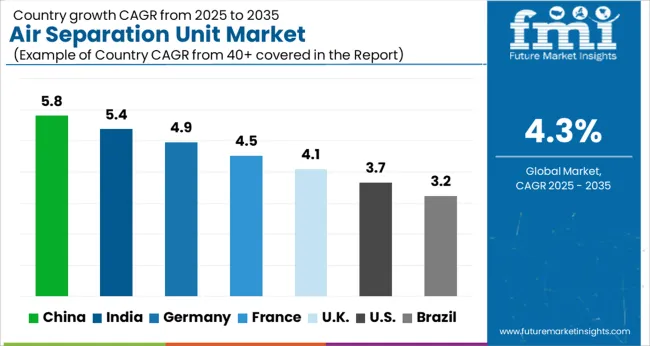

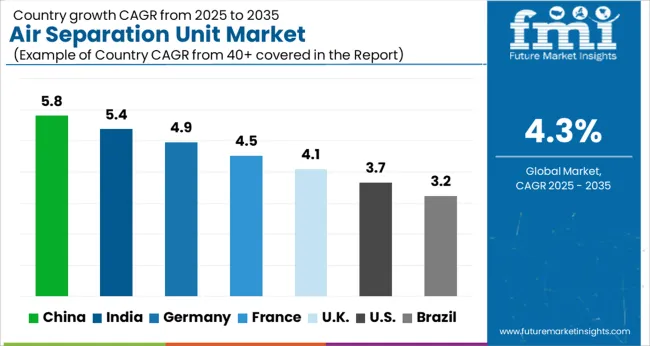

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The market is projected to expand at a CAGR of 4.3% from 2025 to 2035, driven by rising industrial gas demand across energy, healthcare, and manufacturing. China holds the leading position at 5.8%, supported by continuous industrialization and investment in steel and chemical facilities. India follows at 5.4%, where capacity expansion in refining and power generation is strengthening demand. Germany, at 4.9%, benefits from technological expertise and deployment of efficient cryogenic systems. The UK secures 4.1%, backed by industrial upgrades and consistent demand for oxygen and nitrogen. The USA records 3.7%, where steady adoption is encouraged by healthcare and electronics industries. The market is expected to remain steady as global industries emphasize efficiency, reliability, and on-site gas production capabilities. This report includes insights on 40+ countries; the top markets are shown here for reference.

China advanced at a 5.8% CAGR, supported by expansion in steel production, refining, and chemical manufacturing. Large capacity air separation units were commissioned to meet oxygen, nitrogen, and argon requirements across industrial clusters. Domestic engineering companies collaborated with global technology providers to introduce energy efficient cryogenic systems. The government’s push for modernization of industrial gases infrastructure encouraged investment in automation and digital monitoring. Supply security was also prioritized by steel majors and petrochemical firms through long term contracts with gas suppliers. Local players were actively pursuing modular unit installations in remote industrial zones, while international participants invested in large onsite projects near integrated industrial complexes to secure continuous demand and long term operational efficiency.

India recorded a 5.4% CAGR, fueled by demand from refining, power generation, and industrial gases consumption. Expansion of fertilizer production facilities and steel plants increased the requirement for large oxygen and nitrogen supply systems. Indian companies prioritized modular mid-sized units to serve regional clusters, while global firms invested in joint ventures to deploy high capacity cryogenic plants. Local engineering capabilities were enhanced with technology transfers from international partners, ensuring efficiency and reduced energy costs. The government’s emphasis on strengthening domestic steel and petrochemical capacity supported continuous orders for new air separation projects. Strong competition was evident between multinational players and local engineering firms, with differentiation achieved through lower energy consumption and long term service contracts.

Germany maintained a 4.9% CAGR, with growth influenced by advanced industrial gas demand from automotive, electronics, and high precision manufacturing sectors. German industry emphasized high purity gases, which required sophisticated cryogenic air separation technologies. Investment was concentrated on energy efficient plants integrated with digital process controls, ensuring compliance with stringent emission regulations. Engineering firms prioritized projects near chemical parks and automotive supply hubs to optimize logistics. Renewable energy integration into gas production was explored to reduce carbon intensity. Competitive advantage was sought through innovation in cryogenic design, reliability of long term operation, and integration of process automation that allowed predictive maintenance and minimized downtime in critical applications.

The United Kingdom progressed at a 4.1% CAGR, influenced by stable demand from healthcare, refining, and chemical industries. Hospitals and medical infrastructure expansions required consistent oxygen supply, encouraging new air separation projects with integrated backup systems. Refining and chemical companies invested in mid-sized units positioned close to production hubs to ensure supply security. The market was shaped by strong regulatory requirements for safety and emissions, pushing suppliers to deploy energy efficient and environmentally compliant technologies. Local partnerships between engineering contractors and multinational gas companies were strengthened to deliver turnkey projects. Service based models including build own operate agreements gained prominence, as industries sought long term reliability and predictable pricing for industrial gases supply.

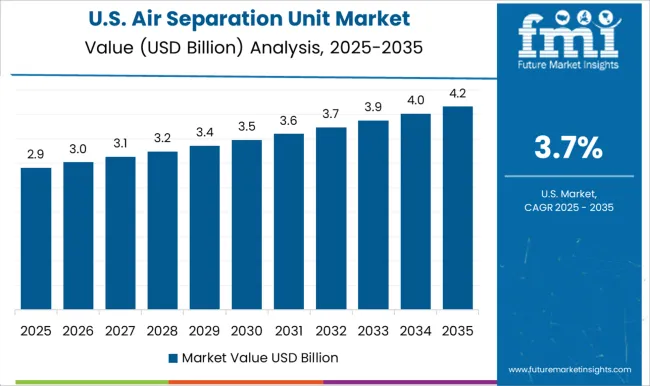

The United States grew at a 3.7% CAGR, with demand shaped by industrial gas consumption in refining, electronics, and liquefied natural gas sectors. Large scale ASUs were installed close to petrochemical hubs and integrated industrial zones, supporting bulk oxygen and nitrogen requirements. The market emphasized operational efficiency and energy cost reduction, leading to investments in advanced cryogenic designs. Multinational firms expanded capacity through greenfield and brownfield projects, while merchant gas suppliers strengthened logistics networks to serve dispersed clients. Onsite ASUs became the preferred model for large steel and refining companies requiring continuous high volume supply. Strategic differentiation was seen through integration of digital monitoring, predictive analytics, and advanced controls to ensure optimized long term performance.

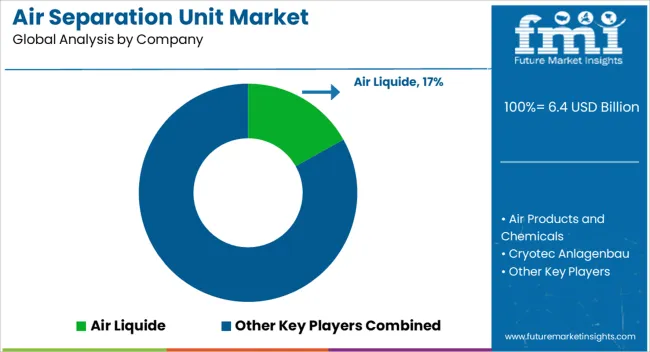

The market has been defined by a mix of global corporations and specialized regional players. Linde, Air Liquide, and Air Products and Chemicals have expanded their dominance through large scale projects and advanced cryogenic technologies. Their strategies have centered on efficiency improvements, cost effective gas supply, and integration with downstream industries. Messer and Praxair Technology have concentrated on process optimization and modular solutions, allowing faster installation and adaptability for varying customer requirements.

Companies such as Taiyo Nippon Sanso and Yingde Gases have built strong positions in Asia by scaling production and ensuring competitive supply contracts. Regional specialists including Cryotec Anlagenbau, Kaifeng Air Separation Group, Sichuan Air Separation Plant Group, Universal Industrial Gases, and Ranch Cryogenics have differentiated by focusing on tailor made units. Their product brochures highlight compact layouts, energy saving compressors, and automated controls for smaller to mid-sized industries. Emphasis is placed on reliability of oxygen, nitrogen, and argon generation while minimizing operational interruptions. Larger companies promote integration with industrial clusters, while smaller firms showcase flexibility in design and cost efficiency.

Competition has moved into the space of performance branding. Air Liquide and Linde showcase advanced digital monitoring features. Air Products emphasizes global supply reliability. Messer communicates compact plant design advantages. Universal Industrial Gases and Ranch Cryogenics highlight modular engineering. Product literature consistently underscores safety, low power consumption, and adaptability across petrochemicals, metallurgy, and electronics. This brochure driven strategy has created a competitive environment where credibility, technology positioning, and service assurance are projected as key differentiators.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.4 billion |

| Process | Cryogenic and Non-Cryogenic |

| Gas | Nitrogen, Oxygen, Argon, and Others |

| End Use | Iron & Steel, Oil & Gas, Healthcare, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, Air Products and Chemicals, Cryotec Anlagenbau, Kaifeng Air Separation Group, Linde, Messer, Praxair Technology, Ranch Cryogenics, Sichuan Air Separation Plant Group, Taiyo Nippon Sanso, Universal Industrial Gases, and Yingde Gases |

| Additional Attributes | Dollar sales by unit type and application, demand dynamics across industrial gases, healthcare, and metallurgy sectors, regional trends in oxygen, nitrogen, and argon adoption, innovation in cryogenic distillation, energy efficiency, and modular systems, environmental impact of high energy consumption and gas venting, and emerging use cases in renewable hydrogen production, semiconductor manufacturing, and carbon capture processes. |

The global air separation unit market is estimated to be valued at USD 6.4 billion in 2025.

The market size for the air separation unit market is projected to reach USD 9.7 billion by 2035.

The air separation unit market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in air separation unit market are cryogenic and non-cryogenic.

In terms of gas, nitrogen segment to command 41.2% share in the air separation unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Non-Cryogenic Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Nitrogen Gas Based Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA