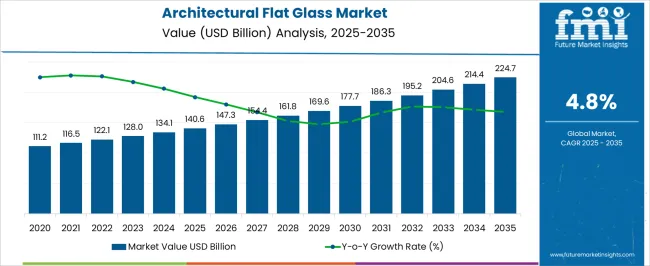

The Architectural Flat Glass Market is estimated to be valued at USD 140.6 billion in 2025 and is projected to reach USD 224.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. The growth curve shows a steady expansion trend, driven by rising demand in commercial construction, residential housing, and infrastructure projects. From 2020 to 2025, the market is expected to increase from USD 111.2 billion to USD 147.3 billion, indicating solid growth supported by urban expansion and the popularity of modern building designs that incorporate glass for aesthetics and energy efficiency.

Between 2026 and 2030, the market advances to nearly USD 169.6 billion, reflecting strong demand for energy-efficient glazing, safety glass, and solar control applications. The curve continues upward post-2030, surpassing USD 200 billion by 2033, before reaching USD 224.7 billion by 2035. The YoY growth rate line suggests a gradual decline after the mid-2020s, consistent with a market that is expanding but moving toward a mature phase. This indicates that while absolute revenues will continue to grow, incremental growth will be slower as adoption levels rise and replacement demand begins to dominate.

| Metric | Value |

|---|---|

| Architectural Flat Glass Market Estimated Value in (2025 E) | USD 140.6 billion |

| Architectural Flat Glass Market Forecast Value in (2035 F) | USD 224.7 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The architectural flat glass market is experiencing sustained growth, driven by expanding urbanization, modernization of building codes, and heightened focus on energy-efficient construction practices. A steady surge in green building certifications and the proliferation of smart city developments have led to greater adoption of high-performance glazing solutions.

Government regulations around thermal insulation, solar control, and safety standards have compelled developers to integrate advanced flat glass technologies into both residential and non-residential projects. Additionally, innovations in coating techniques, nanotechnology integration, and the adoption of low-emissivity (low-E) materials have enabled manufacturers to meet diverse aesthetic and performance requirements.

The ability of architectural flat glass to support daylighting, reduce HVAC load, and improve indoor environmental quality has elevated its strategic value in sustainable construction The market is likely to benefit from rising demand for multifunctional glass solutions that blend safety, design, and energy savings in modern infrastructure developments worldwide.

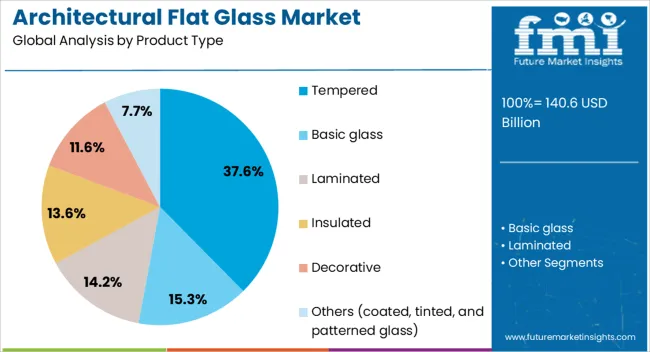

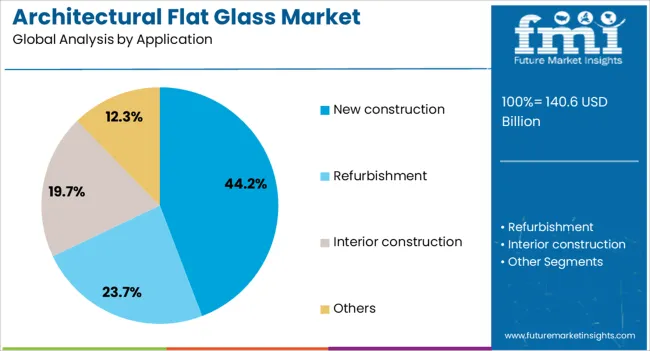

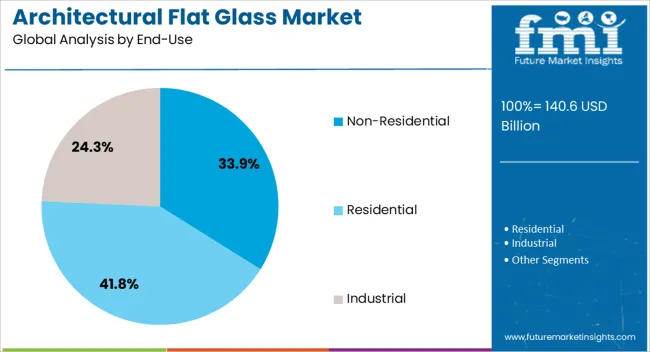

The architectural flat glass market is segmented by product type, application, end-use, distribution channel, and geographic regions. By product type, the architectural flat glass market is divided into Tempered, Basic glass, Laminated, Insulated, Decorative, and Others (coated, tinted, and patterned glass). In terms of application, the architectural flat glass market is classified into New construction, Refurbishment, Interior construction, and Others. Based on end-use, the architectural flat glass market is segmented into Non-Residential, Residential, and Industrial.

By distribution channel, the architectural flat glass market is segmented into Direct and Indirect. Regionally, the architectural flat glass industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tempered glass subsegment is projected to account for 37.6% of the total revenue share in the architectural flat glass market in 2025. Its dominance can be attributed to its superior strength, thermal resistance, and safety profile, which make it highly suitable for both internal and external structural applications. The increased use of large glass panels in commercial facades and residential designs has necessitated the use of glass that can withstand high stress and impact without shattering dangerously.

Tempered glass meets stringent building safety regulations, offering enhanced durability while maintaining visual transparency and design flexibility. Its wide acceptance in curtain walls, partitions, balustrades, and windows has been reinforced by consistent production advancements that allow for customized sizes and finishes.

The ability of tempered glass to undergo post-processing treatments like printing, coating, or lamination without compromising its integrity has further supported its widespread use in contemporary architecture As demand grows for structurally resilient and aesthetically refined glass, this segment is expected to retain its leadership position.

The new construction subsegment is expected to represent 44.2% of the architectural flat glass market revenue in 2025. This substantial share is being driven by an increase in real estate development projects across both developed and emerging economies. Rising investments in residential towers, commercial complexes, and infrastructure upgrades have fueled demand for advanced glazing systems that meet regulatory, aesthetic, and functional benchmarks.

In new construction, architectural flat glass is being extensively utilized for building envelopes, skylights, atriums, and energy-efficient façades. The preference for modern architectural styles that maximize natural lighting and minimize energy consumption has further elevated the use of specialty glass solutions.

Builders and architects are incorporating flat glass that provides solar control, thermal insulation, and acoustic performance to meet evolving environmental standards. Additionally, government-backed initiatives for affordable housing and green buildings have supported sustained consumption of high-performance glass products in the new construction segment, positioning it as a key growth contributor to the overall market.

The non-residential segment is projected to hold 33.9% of the architectural flat glass market share in 2025, reflecting its critical role in the commercial and institutional construction ecosystem. The demand from office buildings, hospitals, airports, educational institutions, and shopping complexes has remained consistently high due to the increased focus on structural aesthetics, occupant comfort, and environmental sustainability.

Architectural flat glass in non-residential applications is being utilized to achieve daylight optimization, energy savings, and enhanced safety, in compliance with evolving green building codes. The trend toward large-scale glass façades and integrated building management systems has further pushed the adoption of advanced flat glass technologies.

Furthermore, corporate initiatives around employee wellness and productivity have increased the deployment of natural lighting solutions, where architectural flat glass plays a pivotal role. With governments and private entities prioritizing urban renewal and smart infrastructure programs, the non-residential segment is expected to maintain a strong growth trajectory in the coming years.

The architectural flat glass market is experiencing significant growth due to its widespread use in the construction and building industry. Architectural flat glass is primarily used in windows, facades, skylights, and other structural elements of buildings, providing both functional and aesthetic benefits. The increasing demand for energy-efficient buildings and modern architectural designs is driving market growth. Innovations in glass technologies, such as laminated, tempered, and coated glass, are expanding its applications in commercial and residential buildings. As urbanization continues to increase globally, the market for architectural flat glass is expected to expand further, particularly in emerging economies.

The architectural flat glass market is primarily driven by the growing demand for energy-efficient building materials. With the increasing focus on reducing energy consumption in buildings, flat glass is being used for its thermal insulation properties. Low-emissivity (Low-E) coatings and other advanced glass technologies allow buildings to maintain temperature control while allowing natural light to enter. As the construction industry embraces green building standards and energy-efficient designs, the demand for architectural flat glass is rising. Architectural glass helps reduce the need for artificial lighting and heating, further driving its adoption in modern construction projects.

The architectural flat glass market faces challenges related to high manufacturing costs and intense market competition. The production of flat glass involves complex processes such as melting and shaping, requiring significant energy inputs, which increases costs. Additionally, the cost of advanced glass technologies, including coatings and treatments, can further raise production expenses. These high costs can limit the market for architectural flat glass, particularly in price-sensitive regions or for low-budget construction projects. Moreover, the market is highly competitive, with numerous players offering similar products, making it difficult for companies to differentiate themselves and maintain profit margins.

The architectural flat glass market presents significant opportunities, particularly with advancements in glass technology and the expanding construction sector. Innovations such as smart glass, which changes transparency in response to light or heat, are gaining traction in both commercial and residential buildings. These technologies offer enhanced energy savings, privacy, and comfort for building occupants. Furthermore, the increasing demand for high-rise buildings, commercial spaces, and modern architecture is driving the need for specialized flat glass products. The growing construction industry, especially in emerging markets where infrastructure development is rapidly advancing, presents a wealth of opportunities for the architectural flat glass market.

A key trend in the architectural flat glass market is the integration of smart glass and innovative glass coatings. Smart glass, also known as switchable glass, allows users to control the amount of light, heat, and privacy in a space by adjusting the transparency of the glass. This trend is particularly prominent in modern offices, homes, and commercial spaces, where energy efficiency and comfort are essential. The development of advanced coatings such as anti-reflective, anti-glare, and self-cleaning coatings is gaining popularity. These coatings enhance the performance of flat glass, making it more durable, energy-efficient, and easier to maintain. As these technologies continue to evolve, they will further drive the growth of the architectural flat glass market.

| Countries | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

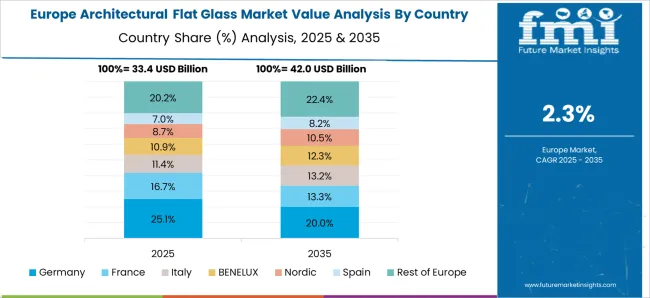

Global architectural flat glass market demand is projected to rise at a 4.8% CAGR from 2025 to 2035. China leads at 6.5%, followed by India at 6.0%, and France at 5.0%, while the United Kingdom records 4.6% and the United States posts 4.1%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: rapid urbanization, infrastructure development, and construction activities in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established markets and stable demand patterns. The analysis spans over 40+ countries, with the leading markets shown below.

Demand for architectural flat glass in China is expanding at a CAGR of 6.5%, driven by the country’s rapid urbanization, infrastructure development, and growth in the construction industry. As one of the largest construction markets in the world, China’s demand for architectural flat glass continues to rise, particularly in residential, commercial, and industrial buildings. The increasing focus on high-rise buildings and modern architectural designs fuels the demand for advanced glass products. The government’s support for infrastructure projects, alongside a growing middle class, is further driving the demand for flat glass used in windows, facades, and other building materials.

The architectural flat glass market in India is projected to grow at a CAGR of 6.0%, supported by the country’s expanding construction and infrastructure sectors. As urbanization continues to increase, the demand for residential and commercial buildings is driving the market for flat glass. India’s growing middle class and rising disposable income also contribute to the demand for modern and energy-efficient building materials. The government’s push for infrastructure development, including smart cities and commercial spaces, is boosting the demand for high-quality architectural glass for facades, windows, and partitions.The focus on improving energy efficiency in buildings is driving the use of advanced glass products.

The United Kingdom’s architectural flat glass market is growing at a CAGR of 4.6%, with demand driven by the country’s construction and renovation sectors. The UK’s focus on residential and commercial building construction, coupled with a growing preference for glass in contemporary architectural designs, is fueling the demand for flat glass. The country’s regulations around energy efficiency in buildings further contribute to the demand for advanced glass products, such as energy-efficient and insulated glass. Additionally, the UK’s real estate market, along with the growing trend of sustainable and modern buildings, continues to drive the adoption of architectural flat glass.

Demand for architectural flat glass in France is growing at a CAGR of 5.0%, driven by the country’s focus on high-quality building materials and modern architectural designs. France’s demand for flat glass is increasing, particularly for residential and commercial buildings, as well as renovation projects. The government’s commitment to improving building standards, combined with the rise in energy-efficient buildings, is pushing for more advanced flat glass solutions, such as low-emissivity (low-E) glass. France’s strong design culture and preference for aesthetics in architecture are contributing to the adoption of flat glass in facades, windows, and other architectural elements.

The USA architectural flat glass market is growing at a CAGR of 4.1%, with steady demand from the construction and renovation sectors. The increasing focus on energy efficiency and sustainability in building design is driving the demand for advanced flat glass solutions, including low-E and insulated glass. The rise in commercial building construction and the expansion of the residential housing market are key factors supporting the market growth. The USA market benefits from strong infrastructure development, with flat glass playing a crucial role in both new buildings and renovation projects. Despite slower growth compared to emerging markets, the USA remains a key market for architectural flat glass.

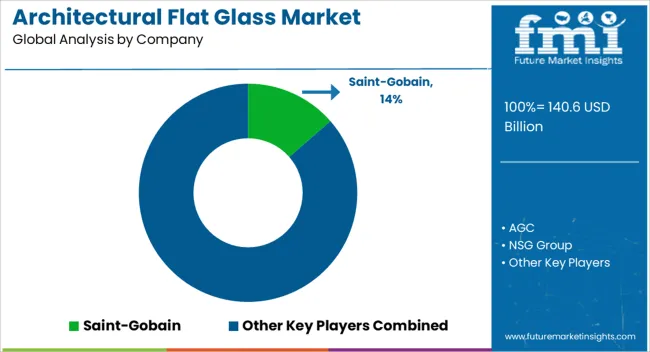

Saint-Gobain stands as a market leader, offering durable, aesthetically appealing glass products known for their energy efficiency, suitable for both residential and commercial projects. AGC (Asahi Glass Company) focuses on innovative, energy-efficient glass for buildings, emphasizing sustainability and high performance. NSG Group is another global leader, providing high-performance architectural flat glass with advanced thermal insulation properties, widely used in construction and automotive industries. Xinyi Glass Holdings offers a broad range of glass products for construction, automotive, and solar applications, with a strong focus on sustainability and energy conservation. Guardian Industries is recognized for its energy-efficient solutions, focusing on both residential and commercial markets, particularly for improved insulation and solar control.

Cardinal Glass Industries specializes in high-quality, energy-efficient architectural glass, catering to the building and construction industry. Asahi India Glass provides durable, energy-efficient glass for residential and commercial applications, ensuring safety and high performance. Vitro Architectural Glass manufactures a wide array of glass products, focusing on strength, design flexibility, and environmental benefits. CSG Holding and China Glass Holdings, both prominent in China, offer high-quality, energy-efficient flat glass products for global markets. Central Glass provides solutions meeting international standards, while Sisecam Group focuses on innovation and sustainability. Taiwan Glass Industry Corporation also provides advanced architectural glass for construction and automotive uses, and Glasfabrik Lamberts specializes in custom solutions for historical buildings.

| Item | Value |

|---|---|

| Quantitative Units | USD 140.6 Billion |

| Product Type | Tempered, Basic glass, Laminated, Insulated, Decorative, and Others (coated, tinted, and patterned glass) |

| Application | New construction, Refurbishment, Interior construction, and Others |

| End-Use | Non-Residential, Residential, and Industrial |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saint-Gobain, AGC, NSG Group, Xinyi Glass Holdings, Guardian Industries, Cardinal Glass Industries, Asahi India Glass, Vitro Architectural Glass, CSG Holding, China Glass Holdings, Central Glass, Sisecam Group, Taiwan Glass Industry Corporation, Guardian Glass, and Glasfabrik Lamberts |

| Additional Attributes | Dollar sales by product type (clear glass, low-emissivity glass, tinted glass, reflective glass) and end-use segments (commercial construction, residential construction, automotive, interior design). Demand is driven by the rise in energy-efficient building solutions, sustainable construction practices, and technological innovations. Strong growth is expected in North America, Europe, and Asia-Pacific, driven by increasing demand for high-performance, energy-efficient glass solutions. |

The global architectural flat glass market is estimated to be valued at USD 140.6 billion in 2025.

The market size for the architectural flat glass market is projected to reach USD 224.7 billion by 2035.

The architectural flat glass market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in architectural flat glass market are tempered, basic glass, laminated, insulated, decorative and others (coated, tinted, and patterned glass).

In terms of application, new construction segment to command 44.2% share in the architectural flat glass market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Architectural Membranes Market Size and Share Forecast Outlook 2025 to 2035

Architectural Metal Coating Market Growth – Trends & Forecast 2024-2034

Architectural Lighting Market

Flat Rack Containers Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Die Cutters Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Antenna Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Trucks Market Size and Share Forecast Outlook 2025 to 2035

Flat Valve Caps And Closures Market Size and Share Forecast Outlook 2025 to 2035

Flat Bottom Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flat Bottom Bags Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Display Market Analysis by Technology, Application, and Region through 2025 to 2035

Flatware Market Analysis - Growth & Demand Forecast 2025 to 2035

Flat Panel X-Ray Detectors Market Analysis by Application, Product, and Region Forecast Through 2035

Analyzing Flatback Tape Market Share & Industry Leaders

Leading Providers & Market Share in Flat Bottom Pouch Manufacturing

Flat Steel Market Growth – Trends & Forecast 2024-2034

Flatback Tape Market by Rubber, Silicon & Other Adhesives Forecast 2024 to 2034

Flatware Holders and Organizers Market

Flat Glass Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA