The flatback tape market is showing consistent growth, driven by rising demand in packaging, splicing, labeling, and masking applications across various industries. Known for its smooth backing and strong adhesion, flatback tape is widely utilized in industrial and commercial settings requiring clean removal and reliable performance.

The market benefits from increasing automation in packaging operations and growing preference for eco-friendly paper-based tapes. Advancements in adhesive chemistry have enhanced temperature resistance, tensile strength, and surface compatibility, expanding its application range.

Moreover, the shift toward recyclable and biodegradable materials aligns with sustainability goals, further supporting demand. With expanding logistics and e-commerce activities, coupled with continuous product innovation, the market is expected to maintain steady growth globally..

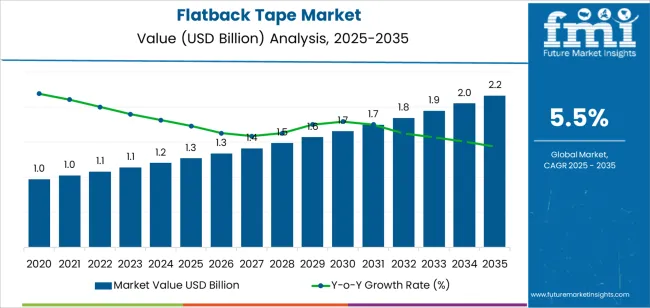

| Metric | Value |

|---|---|

| Flatback Tape Market Estimated Value in (2025 E) | USD 1.3 billion |

| Flatback Tape Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

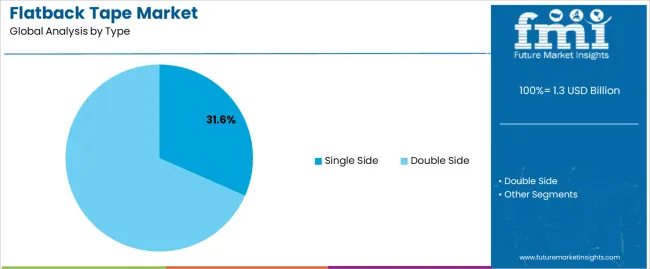

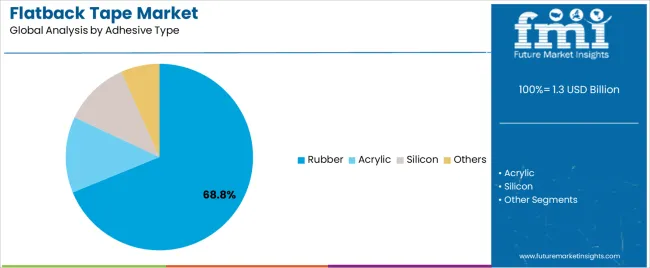

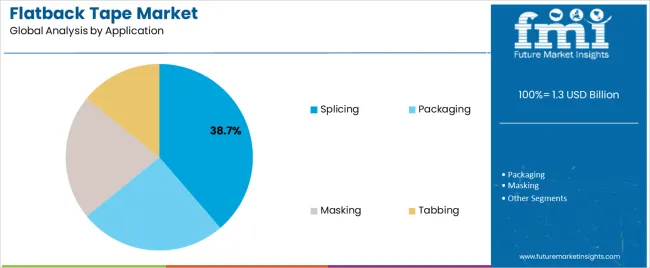

The market is segmented by Type, Adhesive Type, Application, and Thickness and region. By Type, the market is divided into Single Side and Double Side. In terms of Adhesive Type, the market is classified into Rubber, Acrylic, Silicon, and Others. Based on Application, the market is segmented into Splicing, Packaging, Masking, and Tabbing. By Thickness, the market is divided into 5 To 10, <5, and >10. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single side segment leads the type category, representing approximately 31.60% share of the flatback tape market. This segment’s dominance is attributed to its wide application in packaging, splicing, and general-purpose industrial uses where high adhesion and easy removal are required.

Single side flatback tapes offer better compatibility with automated dispensers and provide consistent performance across diverse substrates. The segment benefits from extensive adoption in manufacturing and printing industries due to its clean tearing and high-temperature stability.

With continued investment in sustainable tape formulations and the growth of industrial automation, the single side segment is anticipated to maintain its leading market share..

The rubber segment dominates the adhesive type category with approximately 68.80% share, supported by its superior tack and quick adhesion to various surfaces. Rubber-based adhesives provide excellent initial bond strength, making them suitable for high-speed packaging and masking operations.

The segment’s growth is reinforced by cost efficiency and the ability to perform well in both high and low temperatures. Continuous improvements in synthetic rubber formulations have enhanced durability and resistance to aging, further strengthening demand.

With the packaging and paper industries expanding globally, rubber adhesive flatback tapes are expected to sustain strong market traction..

The splicing segment holds approximately 38.70% share within the application category, owing to its extensive use in paper mills, printing, and film processing industries. The need for reliable, high-performance tapes that provide secure and residue-free splicing drives segment growth.

Flatback tapes used in splicing applications offer strong adhesion, dimensional stability, and clean removability under varying temperature and pressure conditions. The segment’s prominence is also linked to increasing automation in converting and manufacturing processes, which demand consistent bonding quality.

With continued emphasis on operational efficiency and reduced downtime, the splicing segment is expected to retain a major share throughout the forecast period..

Surging Supply Chain Digitalization Presents Opportunities in the Market

There is a transformational potential in using digital technologies, like blockchain or digital platforms, to improve the transparency of supply chains and traceability. End-to-end supply chain transparency can be achieved by businesses offering flatback tapes with inbuilt digital tracking features.

In addition to satisfying the rising demand for data-driven decision-making in logistics, this presents companies as progressive partners for customers looking to streamline their supply chain processes. The digitization of the supply chain gives businesses a competitive edge in sectors where traceability and transparency are critical, as well as improved operational efficiency and compliance with regulations.

Elastic and Stretchable Tapes Witness Increased Demand in the Market

Stretchable and elastic flatback tapes are growing more popular to implement environmentally friendly packaging techniques. Due to their strength and flexibility, these tapes enable firms to improve their packaging operations by allowing for variances in package sizes without sacrificing security.

The trend is consistent with the industry's larger drive for resource efficiency and waste minimization. Employing elastic and flexible flatback tapes demonstrates a company's dedication to economical, eco-friendly operations and its understanding of sustainable packaging.

Rise in Online Grocery Shopping Fuels Sales in the Market

The advent of online grocery shopping, fueled by convenience, time savings, and shifting lifestyle preferences, signifies a profound paradigm change in consumer behavior.

As more people choose to buy their groceries online, there is a corresponding rise in the need for packing materials like flatback paper tapes that can efficiently protect perishable foods while they are being transported and stored.

Strong adhesive, moisture-resistant, and temperature-resistant packaging tapes are crucial for sealing food packages, preventing contamination, and guaranteeing the freshness and quality of goods that are delivered to customers' doorsteps.

Businesses must invest in suitable packaging solutions to satisfy the particular needs of this quickly expanding market sector and take advantage of its potential for revenue development and market expansion as online grocery shopping continues to gain popularity.

| Attribute | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Challenges |

|

| Segment | Rubber (Adhesive Type) |

|---|---|

| Value Share (2025) | 68.8% |

Based on adhesive type, the rubber segment holds 68.8% of the flatback tape market shares in 2025.

| Segment | Splicing (Application) |

|---|---|

| Value Share (2025) | 38.7% |

Based on application, the splicing segment captured 38.7% of the flatback tape market shares in 2025.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

| United Kingdom | 5.4% |

| China | 7.1% |

| Japan | 4.4% |

| India | 7.6% |

The demand for flatback tapes in the United States is projected to rise at a 4.1% CAGR through 2035.

The flatback tape sales in the United Kingdom are expected to surge at a 5.4% CAGR through 2035.

The flatback tape market growth in China is estimated at a 7.1% CAGR through 2035.

The demand for flatback tape in Japan is anticipated to increase at a 4.4% CAGR through 2035.

The sales of flatback tapes in India are projected to surge at a 7.6% CAGR through 2035.

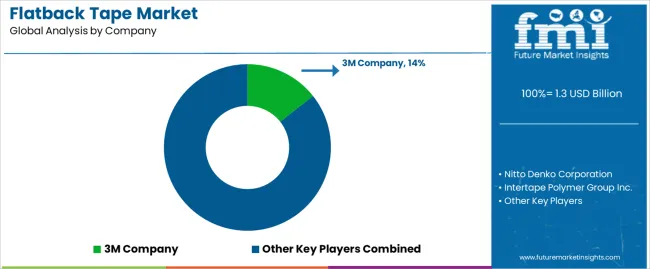

The flatback tape market is competitive, with established industry giants, new firms, and regional rivals battling for market share and positioning. Key international firms, such as 3M Company, Nitto Denko Corporation, and Tesa SE, lead the market due to their diverse product portfolios, global presence, and strategic partnerships.

These industrial behemoths use economies of scale and extensive distribution networks to retain a strong market position, continually investing in R&D to deliver novel solutions that meet changing client requirements.

Recent Developments

The global flatback tape market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the flatback tape market is projected to reach USD 2.2 billion by 2035.

The flatback tape market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in flatback tape market are single side and double side.

In terms of adhesive type, rubber segment to command 68.8% share in the flatback tape market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Flatback Tape Market Share & Industry Leaders

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape & Label Adhesives Market

Tape Applicator Machines Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA