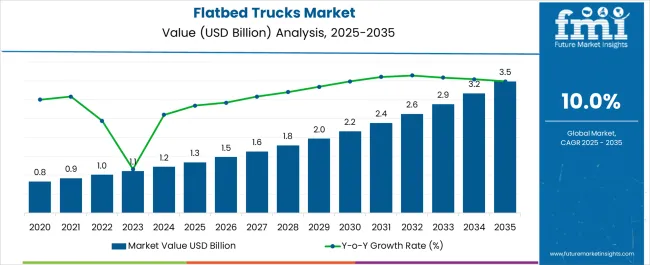

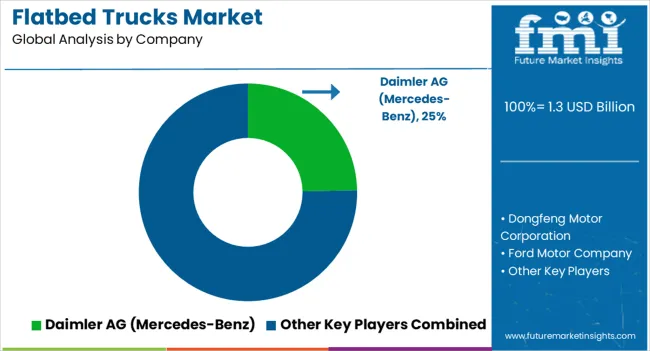

The Flatbed Trucks Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. Regulatory frameworks are poised to significantly influence this market trajectory, shaping both production standards and adoption patterns. Safety regulations, emission norms, and vehicle weight limits established by authorities such as the USA Department of Transportation, European Union vehicle directives, and regional transport ministries are compelling manufacturers to integrate advanced braking systems, load stabilization technologies, and emission-compliant engines into flatbed truck designs. Compliance with these standards directly impacts the total cost of ownership, influencing procurement decisions by fleet operators.

Emission-related mandates, particularly stringent in Europe and North America, are accelerating the adoption of cleaner powertrains, including hybrid and electric variants, which are increasingly integrated into new flatbed models. The occupational safety regulations governing cargo handling and vehicle operation enforce design modifications that enhance operator protection and minimize accident risks. Such regulatory pressures also encourage telematics and advanced driver assistance systems to improve compliance monitoring, fleet efficiency, and insurance assessments. By 2035, adherence to evolving regulatory standards is expected to be a key driver of technological upgrades, shaping product differentiation and competitive positioning. Regions with more stringent regulatory oversight, including Europe and North America, may experience higher incremental costs but benefit from safer, cleaner, and more reliable flatbed truck fleets, while emerging markets balance cost and compliance to maximize market penetration.

| Metric | Value |

|---|---|

| Flatbed Trucks Market Estimated Value in (2025 E) | USD 1.3 billion |

| Flatbed Trucks Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The flatbed trucks market is witnessing substantial growth as industries prioritize flexible freight movement, infrastructure expansion, and construction activity across both developed and emerging economies. These vehicles offer unmatched utility for transporting oversized loads, heavy equipment, and irregularly shaped goods, making them essential in sectors like logistics, manufacturing, and agriculture.

Technological advancements in vehicle telematics, safety integration, and fuel efficiency have further enhanced operational productivity and fleet management. Demand for versatile transportation solutions that can handle dynamic payload conditions is reinforcing the adoption of flatbed trucks across varied terrain and distance requirements.

As global investments in road infrastructure and supply chain upgrades increase, the market is expected to benefit from rising demand for durable, high performance trucks that can operate efficiently under diverse load constraints and regulatory environments.

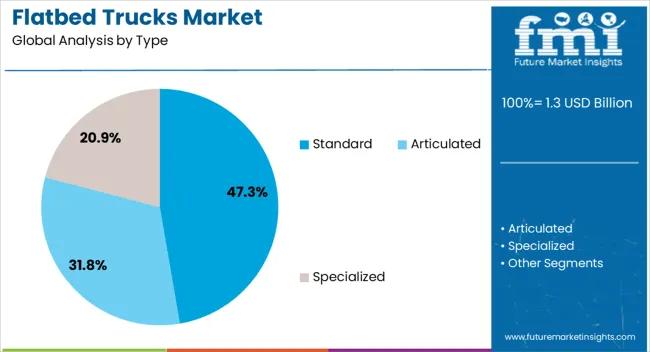

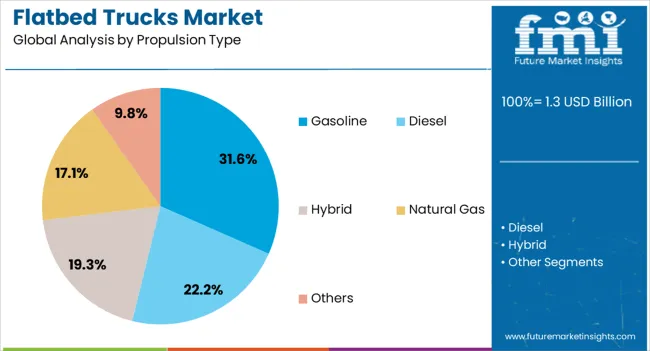

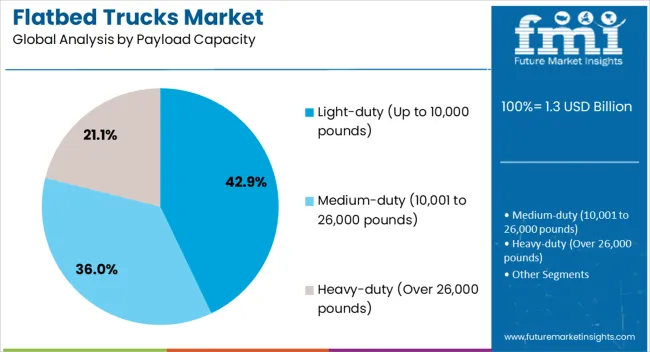

The flatbed trucks market is segmented by type, propulsion type, payload capacityapplication, and geographic regions. By type of the flatbed trucks market is divided into Standard, Articulated, and Specialized. In terms of propulsion type of the flatbed trucks market is classified into Gasoline, Diesel, Hybrid, Natural Gas, and Others. Based on payload capacity of the flatbed trucks market is segmented into Light-duty (Up to 10,000 pounds), Medium-duty (10,001 to 26,000 pounds), and Heavy-duty (Over 26,000 pounds). By application of the flatbed trucks market is segmented into Industrial and Commercial. Regionally, the flatbed trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The standard segment is projected to hold 47.30% of total revenue by 2025 within the type category, making it the dominant product configuration. This preference is driven by the segment’s structural simplicity, wide usability, and cost effectiveness across general freight and non specialized hauling.

The standard flatbed truck is widely utilized due to its straightforward design which accommodates a variety of cargo types without complex loading mechanisms. Its adaptability across multiple industries and minimal maintenance requirements have enhanced operational reliability.

As demand for short to medium distance transport grows, this configuration remains a preferred choice due to its practicality, lower capital cost, and broad market availability.

Within the propulsion category, gasoline powered flatbed trucks are expected to account for 31.60% of market revenue by 2025. This is due to their affordability, availability, and suitability for urban and short haul logistics operations.

Gasoline engines offer quick start capabilities, reduced noise levels, and are less expensive to maintain in lower duty cycles. Their dominance is further supported by a stable refueling infrastructure and lower upfront costs compared to diesel or electric alternatives.

Fleets operating in metropolitan and suburban regions have shown continued preference for gasoline propulsion due to its favorable balance of performance, emissions compliance, and operational simplicity. As fuel efficiency and emissions standards continue to evolve, gasoline variants are likely to retain a notable share, particularly in light to medium load applications.

The light duty flatbed truck segment, defined by payload capacity up to 10000 pounds, is anticipated to contribute 42.90% of the market revenue by 2025, making it the leading payload category. This growth is being driven by demand for last mile delivery, residential construction, and small business logistics where flexibility and maneuverability are critical.

Light duty flatbeds offer ease of navigation in congested urban environments, lower fuel consumption, and reduced operational costs. Their increasing use among small and medium enterprises, service providers, and municipal operations further underscores their widespread acceptance.

As the need for quick turnaround and frequent delivery increases, the utility of light duty flatbeds in fulfilling these operational requirements supports their continued market dominance.

The market has expanded as demand for versatile cargo transportation solutions has increased across construction, manufacturing, and logistics sectors. These trucks, characterized by open and level cargo beds, have been widely used for transporting oversized or irregularly shaped loads that cannot fit in enclosed vehicles. Manufacturers have focused on enhancing load capacity, safety features, and vehicle durability while improving fuel efficiency and operational flexibility. The market has benefited from industrial growth, infrastructure development, and rising demand for efficient, multi-purpose trucks in both urban and long-haul operations.

Flatbed trucks have been increasingly adopted across construction, mining, and heavy industries due to their ability to transport large, bulky, or irregularly shaped materials. Steel beams, construction equipment, pipes, and pre-fabricated materials have been commonly carried on flatbed trucks, where standard enclosed trucks are unsuitable. The ease of loading and unloading has reduced operational time and labor requirements, which has encouraged their use in large-scale industrial projects. Infrastructure development projects, including highway construction, port expansion, and urban development, have further contributed to fleet upgrades and increased orders for flatbed trucks. Commercial operators have relied on these vehicles to maintain supply chain efficiency and ensure timely delivery of critical materials. With industrial sectors continuing to expand globally, flatbed trucks have remained essential for transporting materials that require versatility and heavy-duty support.

The flatbed trucks market has been influenced by continuous improvements in payload capacity, chassis strength, and overall vehicle design. Reinforced frames and high-strength steel beds have been incorporated to handle heavier loads while maintaining structural integrity. Suspension systems have been upgraded to reduce vibration and load shifting during transit, protecting both cargo and vehicle components. Modifications such as extendable beds, removable side panels, and adjustable deck heights have allowed for greater versatility in carrying oversized equipment or materials. Engine efficiency has been optimized to handle heavier loads without compromising fuel economy, while safety standards have been maintained through advanced braking and stability systems. These design and performance enhancements have strengthened the suitability of flatbed trucks for diverse industrial applications, ensuring that operational efficiency, reliability, and cargo safety are consistently achieved across demanding transportation tasks.

Safety and operational efficiency have become central to flatbed truck adoption, driven by regulatory standards and commercial requirements. Trucks have been equipped with advanced braking systems, load monitoring sensors, and electronic stability control to prevent accidents and cargo damage. Telematics integration has allowed fleet managers to monitor driver behavior, optimize routes, and schedule preventive maintenance, reducing downtime and operational costs. Rear-view cameras, load securing alerts, and automated alerts for overloading have further increased safety compliance. Connected dashboards have enabled real-time reporting and predictive analytics, ensuring that both vehicles and drivers operate within safe and efficient parameters. These technological innovations have elevated flatbed trucks beyond traditional transport vehicles, providing fleet operators with intelligence-driven solutions that enhance reliability, reduce costs, and improve overall supply chain performance.

Infrastructure expansion and economic growth have directly influenced demand for flatbed trucks. Construction projects, industrial facility development, and manufacturing growth have created a need for vehicles capable of carrying heavy and irregular loads over long distances. Urban expansion and road network improvements have allowed increased deployment of flatbed trucks for efficient material transportation. Seasonal demand in agricultural and industrial sectors has further supported adoption, particularly for transporting machinery, raw materials, and bulk items. Fleet operators have increasingly relied on flatbed trucks to maintain supply chain efficiency, ensuring timely delivery across regions. Emerging markets with growing industrial and construction activities have contributed to robust demand, while developed regions continue to prioritize fleet modernization and efficiency improvements. Consequently, economic activity and infrastructure development have remained major drivers of flatbed truck adoption globally.

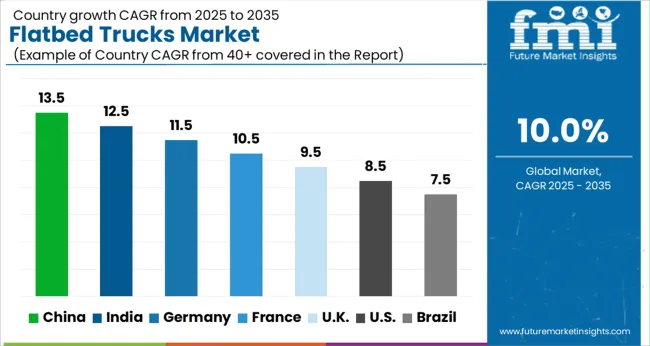

The market is expected to grow at a CAGR of 10.0% from 2025 to 2035, driven by rising demand for versatile cargo transport, construction applications, and logistics optimization. China leads with a 13.5% CAGR, deploying large-scale commercial fleets and advancing manufacturing capabilities. India follows at 12.5%, expanding through urban and intercity transport adoption. Germany grows at 11.5%, supported by technological enhancements and fleet modernization initiatives. The UK, at 9.5%, focuses on efficiency improvements in transport operations. The USA, at 8.5%, witnesses steady growth driven by demand in construction, industrial, and logistics sectors. This report covers 40+ countries, with the top markets highlighted here for reference.

The market in China is projected to expand at a CAGR of 13.5% from 2025 to 2035, driven by rising industrial transportation, construction activities, and logistics demand. Manufacturers are focusing on enhancing payload capacity, fuel efficiency, and safety features to meet regulatory requirements. Increasing urban and regional freight movements, coupled with the need for versatile vehicles for material handling, are further boosting market adoption. Strategic collaborations between domestic and international truck manufacturers, along with government support for modern commercial vehicles, are enhancing growth. Demand for multipurpose vehicles capable of transporting construction materials, machinery, and goods efficiently is expected to sustain market momentum.

India is expected to witness a CAGR of 12.5% in the market over the next decade, fueled by growth in small and medium enterprises, regional construction, and rural logistics. Manufacturers are introducing fuel-efficient engines, enhanced load capacities, and robust designs to cater to diverse terrains. Expansion of industrial clusters and demand for versatile transport solutions is driving market adoption. Government initiatives promoting cleaner and safer vehicles, combined with rising demand for fleet modernization in logistics and construction sectors, are further supporting market growth. Consumer preference for multifunctional vehicles for both commercial and business needs is contributing to increasing market traction.

Germany’s market is forecasted to grow at a CAGR of 11.5% between 2025 and 2035, influenced by rising construction, industrial logistics, and material transport requirements. Manufacturers are focusing on electric and hybrid powertrains, lightweight materials, and connected vehicle technologies to comply with stringent European emission and safety standards. Demand for multipurpose commercial vehicles capable of efficient cargo transport is increasing. Strategic alliances between domestic and international truck makers, along with strong dealership networks and aftersales support, are fostering adoption. The market is benefiting from government initiatives promoting cleaner, more efficient commercial vehicles and fleet modernization programs.

The United Kingdom market is anticipated to expand at a CAGR of 9.5% from 2025 to 2035, driven by urban logistics, light industrial transport, and construction operations. Manufacturers are investing in hybrid vehicles, enhanced payload efficiency, and safety systems to meet regulatory and environmental standards. Increasing demand for versatile vehicles for both commercial operations and small business logistics is fostering growth. Fleet modernization programs and the expansion of last-mile delivery networks are further driving market adoption. Strategic partnerships between domestic and global manufacturers, along with incentives for cleaner vehicles, are supporting market penetration.

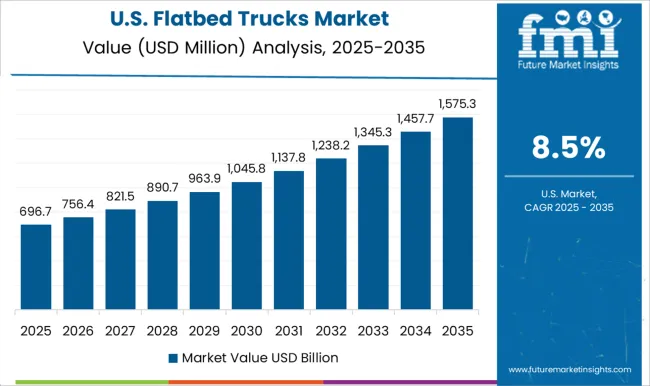

The market in the United States is projected to grow at a CAGR of 8.5% over the next decade, supported by industrial transport, small-scale construction, and fleet modernization. Manufacturers are introducing electric and hybrid models, connected vehicle features, and lightweight designs to meet environmental regulations and enhance efficiency. Demand for multipurpose commercial vehicles suitable for transporting materials, machinery, and goods across urban and regional areas is increasing. Expansion of logistics networks, small and medium enterprise operations, and strategic partnerships between domestic and international players are further strengthening market growth.

Daimler AG (Mercedes-Benz) and Volvo Group provide technologically advanced flatbed trucks known for durability, fuel efficiency, and safety features. Ford Motor Company and Paccar Inc., including its Kenworth and Peterbilt brands, supply models with high payload capacity, reliability, and low operational costs, addressing the needs of the logistics and construction industries.

Toyota Motor Corporation and Isuzu Motors focus on mid-size flatbed trucks with efficiency and ease of maintenance, catering to small and medium enterprises. Hino Motors, Ltd. and Navistar International Corporation emphasize vehicle longevity, driver comfort, and integration of telematics to optimize fleet performance. Emerging market players and regional manufacturers play an important role in expanding market coverage. Tata Motors and Dongfeng Motor Corporation target cost-effective flatbed trucks for South Asian and Chinese markets, balancing performance, payload, and local regulatory compliance. Key strategies among these providers include continuous product development, enhancements in engine performance, and the integration of advanced safety systems.

Manufacturers are increasingly investing in R&D to introduce eco-friendly powertrains and smart fleet management solutions, ensuring competitiveness while meeting evolving customer demands. The strategic collaborations, innovative offerings, and focus on operational efficiency remain central to growth in the flatbed trucks market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Type | Standard, Articulated, and Specialized |

| Propulsion Type | Gasoline, Diesel, Hybrid, Natural Gas, and Others |

| Payload Capacity | Light-duty (Up to 10,000 pounds), Medium-duty (10,001 to 26,000 pounds), and Heavy-duty (Over 26,000 pounds) |

| Application | Industrial and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler Truck Holding AG (Mercedes-Benz Trucks), Dongfeng Motor Corporation, Ford Motor Company, Hino Motors, Ltd., Isuzu Motors Ltd., Navistar, Inc., PACCAR Inc, Tata Motors Limited, Toyota Motor Corporation, Volvo Group |

| Additional Attributes | Dollar sales by truck size and payload capacity, demand dynamics across construction and logistics sectors, regional trends in infrastructure development, innovation in load management and safety systems, environmental impact of fuel consumption, and emerging use cases in specialized transport and modular cargo solutions. |

The global flatbed trucks market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the flatbed trucks market is projected to reach USD 3.5 billion by 2035.

The flatbed trucks market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in flatbed trucks market are standard, articulated and specialized.

In terms of propulsion type, gasoline segment to command 31.6% share in the flatbed trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flatbed Die Cutters Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Wireline Trucks Market

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Rear Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Side Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA