The Side Loader Trucks Market is estimated to be valued at USD 11.5 billion in 2025 and is projected to reach USD 18.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 11.5 billion to USD 15.4 billion, driven by the increasing demand for efficient, safe, and versatile material handling solutions in waste management, logistics, and construction industries.

Year-on-year analysis shows steady growth, with values reaching USD 12.0 billion in 2026 and USD 12.6 billion in 2027, supported by growing infrastructure development and urbanization trends. By 2028, the market is forecasted to reach USD 13.3 billion, advancing to USD 13.9 billion in 2029 and USD 14.6 billion by 2030. This growth will be fueled by innovations in side loader truck designs, including enhanced load capacities, fuel efficiency, and automation features.

Increasing demand for side loaders in sectors like waste management and material transport, particularly in urban areas with space constraints, is expected to boost market expansion further. These dynamics position the side loader truck market as a key segment in the material handling equipment industry, offering significant growth opportunities driven by advancements in operational efficiency and environmental sustainability.

| Metric | Value |

|---|---|

| Side Loader Trucks Market Estimated Value in (2025 E) | USD 11.5 billion |

| Side Loader Trucks Market Forecast Value in (2035 F) | USD 18.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The side loader trucks market is expanding steadily due to increased demand for efficient material handling in logistics, construction, and waste management sectors. Urban infrastructure development and the need for compact yet high load capacity vehicles have driven the popularity of side loader configurations.

These trucks are particularly valued for their ability to operate in narrow spaces and provide quick side access for loading and unloading, which enhances operational efficiency. Growing emphasis on fleet productivity, safety compliance, and reduced downtime has prompted investment in robust truck designs with tailored capacity and power configurations.

Technological improvements in lifting mechanisms, maneuverability, and maintenance systems are further contributing to long term adoption. The market outlook remains strong as industries seek cost effective and space optimized solutions for heavy and medium load applications in both municipal and industrial settings.

The side loader trucks market is segmented by technology, fuel type, capacity, end-user, and geographic region. By technology, the side loader trucks market is divided into Manual, Automatic, and Semi-automatic. In terms of fuel, the side loader trucks market is classified into Diesel, Gasoline, and Electric.

Based on capacity, the side loader trucks market is segmented into three categories: up to 10 Tons, 10-20 Tons, and above 20 Tons. By end-user, the side loader trucks market is segmented into Waste management, Construction, Logistics & transportation, and Others. Regionally, the side loader trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual segment is expected to account for 41.30% of the total market revenue by 2025 under the technology category, emerging as the leading segment. This preference is attributed to the simplicity, affordability, and lower maintenance costs associated with manual systems.

In developing regions and cost-sensitive operations, manual side loader trucks offer reliability without the complexity of advanced automation. Operators benefit from greater control during load handling, particularly in non-repetitive tasks or irregular loading environments.

The availability of skilled labor and the lower upfront investment requirement continue to favor manual technology in municipal and construction applications. This combination of economic practicality and proven performance is solidifying manual systems as the top contributor in the technology segment.

Diesel-powered side loader trucks are projected to contribute 54.70% of overall market revenue by 2025, leading the fuel category. The segment's dominance is driven by the high torque, durability, and fuel efficiency offered by diesel engines in heavy load operations.

These trucks are particularly effective in demanding off road and long haul conditions where alternative power sources may not be viable. Extended operating range, lower fuel costs per kilometer, and established refueling infrastructure further support the adoption of diesel variants.

Despite regulatory pressure for cleaner alternatives, diesel remains the most practical solution for many industrial users requiring consistent power and performance. The segment continues to lead due to its operational advantages and wide applicability across industries.

The up to 10 tons segment is anticipated to represent 47.20% of total market revenue by 2025 within the capacity category, making it the dominant segment. This range is preferred for its versatility in handling medium-scale loads across urban and industrial environments.

These models offer the optimal balance between maneuverability and payload, allowing for efficient operations in restricted spaces without compromising carrying capacity. They are widely used in waste collection, warehouse logistics, and small to mid-scale construction tasks where agility and cost effectiveness are critical.

The segment’s growth is further supported by its compatibility with diverse body configurations and ease of maintenance, making it the go-to choice for fleet operators seeking adaptable load solutions.

The side loader trucks market is driven by increasing demand for efficient waste management solutions and opportunities in expanding urban and industrial infrastructure. Emerging trends in electric and autonomous models are reshaping the market, while challenges like high initial costs and operational expenses remain significant. By 2025, overcoming these challenges through cost-effective designs and government support will be key to continued market expansion and widespread adoption of side loader trucks in waste management services.

The side loader trucks market is experiencing growth due to the increasing demand for efficient waste management solutions. These trucks are widely used for waste collection, especially in urban and industrial settings, because they offer better maneuverability, improved safety, and higher payload capacity. Their design allows waste to be loaded from the side, making them ideal for densely populated areas and places with limited access. By 2025, the market is projected to grow further as waste management services and municipal infrastructure investments continue to rise.

Opportunities in the side loader trucks market are growing with the expansion of urban and industrial infrastructure. As cities and industries grow, there is a greater need for waste management solutions that can efficiently handle increasing waste volumes. Side loader trucks are particularly well-suited for areas with narrow streets or congested spaces, where traditional rear loader trucks cannot operate effectively. By 2025, these trucks will see increased adoption as cities and industries invest in modernizing waste collection services to accommodate growing populations and businesses.

Emerging trends in the side loader trucks market include the development of electric and autonomous models. As the demand for environmentally friendly solutions grows, electric side loader trucks are gaining traction as they offer lower emissions and reduced operating costs compared to traditional diesel-powered models. Additionally, autonomous side loader trucks are emerging as a trend, offering increased efficiency and safety by eliminating human error. By 2025, the shift toward these advanced models will drive innovation and further growth in the market, particularly in regions with strong environmental policies.

Despite the market’s growth, challenges such as high initial investment and operational costs persist in the side loader truck market. The purchase price for side loader trucks, especially electric or autonomous models, can be significantly higher than for conventional trucks, making them less accessible for small waste management companies. Additionally, maintenance and fuel costs can add to the overall operational expenses. By 2025, addressing these challenges through government incentives, subsidies, and cost-effective designs will be essential to broadening the adoption of side loader trucks.

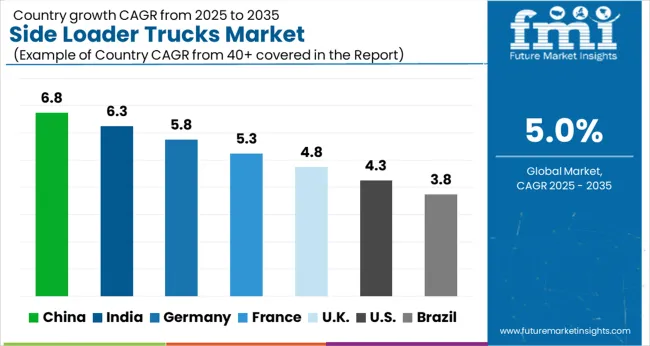

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global side loader trucks market is projected to grow at a 5% CAGR from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and Germany at 5.8%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These varying growth rates are driven by increasing demand for waste management solutions, the need for more efficient logistics in urban environments, and rising infrastructure development. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, urbanization, and growing investments in municipal and commercial waste management, while more mature markets like the USA and the UK see steady growth driven by regulatory frameworks, environmental concerns, and the push towards more efficient, eco-friendly solutions in waste collection and transportation. This report includes insights on 40+ countries; the top markets are shown here for reference.

The side loader trucks market in China is growing rapidly, with a projected CAGR of 6.8%. China’s rapid urbanization and industrialization, combined with the increasing need for efficient waste management and transportation solutions, are fueling the demand for side loader trucks. The country’s focus on improving environmental sustainability and waste collection infrastructure in major cities is further driving market growth. Additionally, China’s growing investments in municipal and commercial waste management, along with the increasing adoption of eco-friendly and efficient waste collection technologies, continue to support the demand for side loader trucks. These factors make China a key player in the global market.

The side loader trucks market in India is projected to grow at a CAGR of 6.3%. India’s growing population and rapid urbanization are driving the demand for waste management solutions, including side loader trucks. The country’s expanding infrastructure, combined with a rising focus on cleanliness and waste collection in urban areas, is contributing to market growth. India’s increasing adoption of waste management technologies in both commercial and municipal sectors further accelerates the demand for side loader trucks. Additionally, the government’s push for better sanitation and waste management systems is expected to contribute to the market’s expansion in the coming years.

The side loader trucks market in Germany is projected to grow at a CAGR of 5.8%. Germany’s strong focus on sustainability, waste management efficiency, and automation in the waste collection process is driving steady market growth. The country’s established infrastructure and regulatory frameworks promoting eco-friendly waste management solutions further boost the adoption of side loader trucks. Additionally, Germany’s commitment to reducing its environmental footprint and improving the efficiency of urban waste management systems contributes to the continued demand for side loader trucks, particularly in cities with a high demand for efficient waste collection solutions.

The side loader trucks market in the United Kingdom is projected to grow at a CAGR of 4.8%. The UK growing focus on improving waste collection efficiency, reducing waste management costs, and adopting eco-friendly solutions is driving steady demand for side loader trucks. The country’s commitment to meeting its environmental targets and reducing carbon emissions is contributing to the growing adoption of energy-efficient waste collection vehicles. Additionally, the UK strong municipal waste management systems and growing interest in automated waste collection technologies further accelerate the demand for side loader trucks.

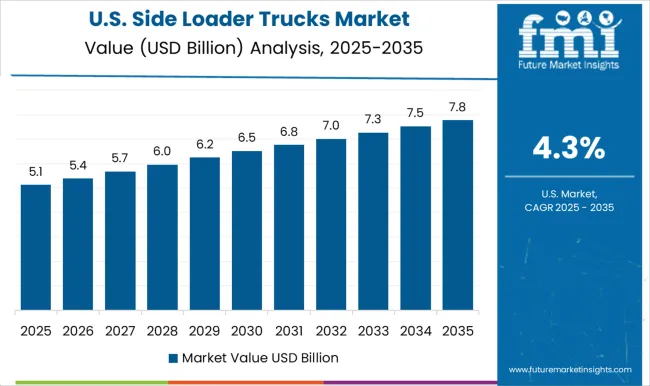

The side loader trucks market in the United States is expected to grow at a CAGR of 4.3%. The USA market is driven by the increasing demand for efficient and eco-friendly waste collection systems in urban and suburban areas. The country’s rising focus on sustainability, waste management regulations, and green technologies is contributing to the adoption of side loader trucks. Additionally, the growing shift towards automation in waste collection processes, along with the demand for improved operational efficiency and reduced carbon footprints in waste management, continues to support the growth of the market in the United States.

The side loader trucks market is dominated by Autocar, LLC, which leads with its robust and durable side loader trucks designed for waste management and construction applications. Autocar’s dominance is supported by its focus on innovation, reliability, and a deep understanding of the specific needs of industries requiring efficient waste collection and handling. Key players such as Mack Trucks (AB Volvo), FAUN Umwelttechnik GmbH & Co. KG, and Dennis Eagle Inc. maintain significant market shares by offering high-performance side loader trucks equipped with advanced technologies that improve operational efficiency, reduce fuel consumption, and enhance driver safety. These companies focus on providing customizable solutions that meet the diverse needs of municipal and commercial waste collection services.

Emerging players, such as Bridgeport Manufacturing, Dongfeng Motor Corporation Ltd., and Labrie Group, are expanding their market presence by offering specialized side loader trucks for niche applications, including large-scale municipal waste management, recycling services, and construction debris handling. Their strategies include improving vehicle durability, enhancing fuel efficiency, and focusing on innovative lifting and tipping systems. Market growth is driven by the increasing demand for efficient waste management solutions, the rise of smart city initiatives, and the growing focus on reducing the environmental impact of waste disposal. Innovations in electrification, automated waste handling, and telematics are expected to continue shaping competitive dynamics and drive further growth in the global side loader trucks market.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.5 Billion |

| Technology | Manual, Automatic, and Semi-automatic |

| Fuel | Diesel, Gasoline, and Electric |

| Capacity | Up to 10 Tons, 10-20 Tons, and Above 20 Tons |

| End-user | Waste management, Construction, Logistics & transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Autocar, LLC, Bridgeport Manufacturing, Dennis Eagle Inc., Dongfeng Motor Corporation Ltd., FAUN Umwelttechnik GmbH & Co. KG, FULONGMA GROUP Co., Ltd., Kirchhoff Group, Labrie Group, Mack Trucks (AB Volvo), and XCMG |

| Additional Attributes | Dollar sales by truck type and application, demand dynamics across waste management, logistics, and industrial sectors, regional trends in side loader truck adoption, innovation in fuel-efficient and automated technologies, impact of regulatory standards on emissions and safety, and emerging use cases in smart waste collection and sustainable urban logistics. |

The global side loader trucks market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the side loader trucks market is projected to reach USD 18.7 billion by 2035.

The side loader trucks market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in side loader trucks market are manual, automatic and semi-automatic.

In terms of fuel, diesel segment to command 54.7% share in the side loader trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sidewinder Machine Market Size and Share Forecast Outlook 2025 to 2035

Side Load Case Packing Machines Market Size and Share Forecast Outlook 2025 to 2035

Side Gusset/Quad Seal Bag Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Side Gusset/Quad Seal Bag Sector

Side Weld Bags Market

Side Sealer Machines Market

Insider Threat Protection Market Analysis Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA