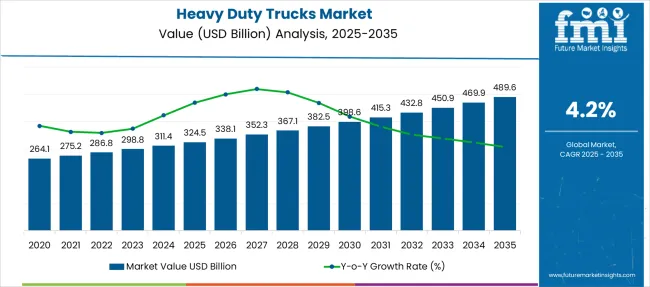

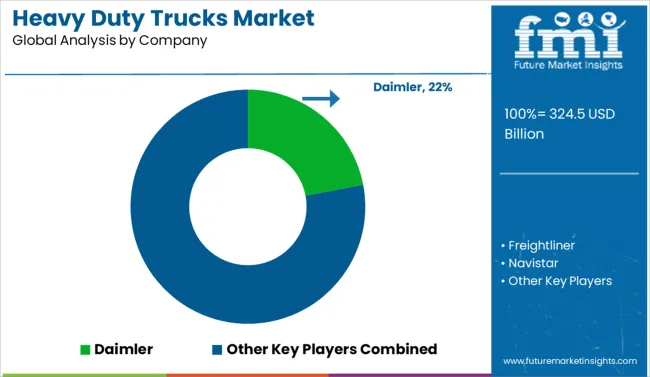

The Heavy Duty Trucks Market is estimated to be valued at USD 324.5 billion in 2025 and is projected to reach USD 489.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period. As per our analysis, the elasticity analysis links growth to infrastructure and industrial freight demand. From 2025-2028, the market adds USD 42.6 billion at an annualized elasticity of 0.9, driven by fleet modernization in North America and China.

The next phase, 2028-2031, registers a demand-sensitive elasticity of 1.1, coinciding with emission regulation-driven upgrades, as revenue climbs from 367.1 to 415.3 billion. Final phase 2031-2035 sees slower elasticity at 0.7, reflecting stabilizing replacement cycles and alternative fuel penetration. Annual increments reduce from USD 18.5 billion (2028-2029) to USD 13.7 billion (2034-2035), signaling deceleration. Key volatility emerges between 2027-2029, aligning with regulatory peaks, where YoY growth hovers above 4.5% before softening below 3.5% in later years, confirming declining marginal gains in a capital-heavy segment.

The market growth curve shows a steady upward trend with a moderate incline, reflecting stable demand driven by industrial logistics, construction, and long-haul transportation. The expansion is supported by fleet modernization, regulatory compliance on emissions, and the gradual introduction of electric and alternative-fuel trucks.

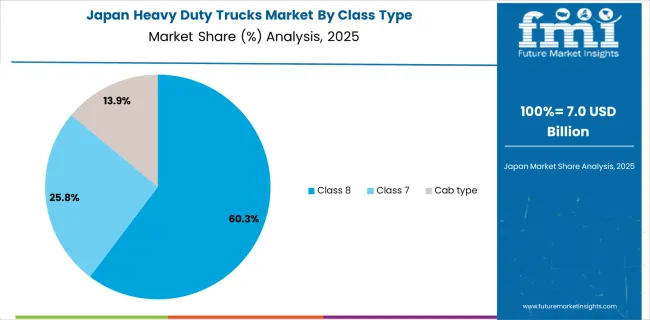

Class 8 trucks dominate the market with a 61.0% share in 2025, driven by high-capacity freight movement requirements in logistics and e-commerce supply chains. North America leads due to strong freight networks and infrastructure investment, while Asia-Pacific demonstrates the fastest growth, fueled by large-scale manufacturing hubs and increased cross-border trade. Europe maintains solid adoption under stringent emissions mandates and green transport initiatives.

The market’s growth trajectory is expected to accelerate post-2029 as battery-electric and hydrogen-powered heavy-duty trucks gain commercial viability. Digital integration with telematics, predictive maintenance, and connected fleet solutions will further enhance operational efficiency. Partnerships among OEMs and energy providers will be critical in enabling charging and refueling infrastructure, shaping the future competitive landscape of heavy-duty freight mobility.

| Metric | Value |

|---|---|

| Heavy Duty Trucks Market Estimated Value in (2025 E) | USD 324.5 billion |

| Heavy Duty Trucks Market Forecast Value in (2035 F) | USD 489.6 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The heavy-duty trucks market is undergoing structural shifts, supported by rising infrastructure investment, evolving logistics requirements, and emission regulatory compliance. Increased freight movement driven by e-commerce and industrial output has created demand for high-performance trucking solutions.

OEMs are enhancing truck powertrain efficiency and integrating advanced driver assistance systems (ADAS), reflecting the industry’s shift toward safety, fuel economy, and uptime optimization. Government-led mandates on fuel emissions and alternative energy integration are accelerating technology innovation, while the growth of long-haul and cross-border logistics is encouraging fleet expansion in emerging economies.

Further momentum is expected as autonomous trials and connected fleet platforms become commercially viable. The transition toward modular platforms and alternative drivetrains will be central to long-term market evolution.

The heavy duty trucks market is segmented by class type, fuel type, horsepower range, application type, ownership type, and region. By class type, it includes Class 8, Class 7, and cab type configurations to serve various load capacities and operational requirements. In terms of fuel type, the segmentation comprises diesel, natural gas, hybrid electric, and gasoline-powered trucks, reflecting the shift toward alternative fuels.

Based on horsepower range, the market is categorized into below 300 HP, 300 HP-400 HP, 400 HP-500 HP, and above 500 HP, supporting a wide range of performance needs. By application type, it spans freight delivery, utility services, construction and mining, and other specialized uses. Ownership type segmentation includes fleet operators and independent operators. Regionally, the market covers North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Class 8 trucks are anticipated to contribute 61.0% of the total market revenue in 2025, making it the leading segment by class type. This dominance is being attributed to their critical role in long-haul freight operations and ability to support heavier payload capacities over longer distances.

These vehicles offer advanced transmission systems, enhanced torque output, and compatibility with sleeper cab configurations-essential for interstate logistics and mining applications. Regulatory compliance with emission standards and increasing adoption of telematics have further positioned Class 8 trucks as the preferred choice among fleet operators seeking operational efficiency and performance reliability. With the expansion of highway infrastructure and the rise in full-truckload demand, their relevance is projected to remain unmatched in the foreseeable future.

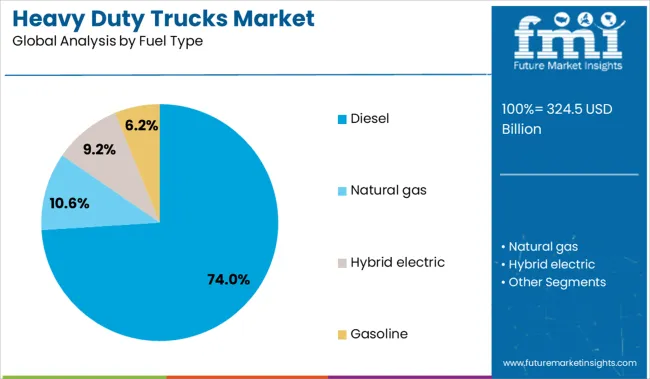

Diesel-powered trucks are expected to account for 74.0% of the market revenue in 2025, maintaining their dominance in the fuel type category. This segment’s continued lead is being driven by diesel’s superior energy density, torque generation, and fuel economy under heavy load conditions.

Diesel engines remain the backbone of long-haul and off-road transportation due to their durability and longer service intervals, which translate into reduced downtime and lifecycle cost savings. Technological advancements in diesel aftertreatment systems and exhaust gas recirculation have enabled compliance with stringent emission standards without compromising power output.

As refueling infrastructure remains more developed for diesel compared to emerging fuel alternatives, fleet operators continue to prefer diesel engines for operational continuity, especially in rural and high-demand corridors.

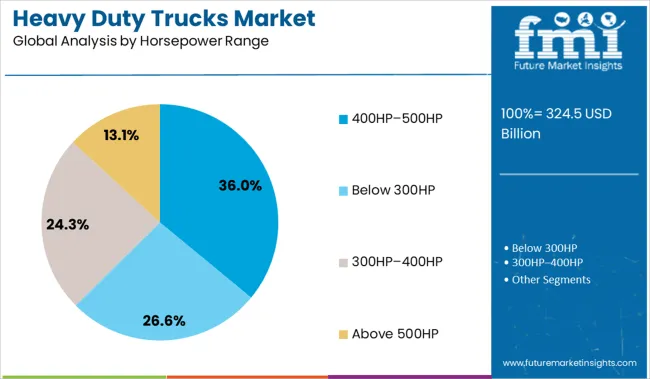

The 400HP-500HP range is forecast to represent 36.0% of the market share by 2025, emerging as the most utilized horsepower category for heavy duty trucks. This segment’s growth is supported by its suitability for a wide range of logistics applications, including regional haul, refrigerated transport, and intermodal operations.

Engines within this horsepower band offer a strategic balance between performance and fuel efficiency, making them ideal for both flat terrains and moderate inclines. OEMs are focusing on this range to optimize vehicle weight-to-power ratios, enhance aerodynamics, and improve driver comfort without escalating operational costs. As route complexity increases and logistics networks diversify, this horsepower range is seen as the most reliable and flexible for general freight movement across varying geographies.

Freight realignment and growing cross-border trade are reshaping heavy-duty truck demand, favoring high-capacity, terrain-resilient models. Stricter emissions norms are accelerating fleet upgrades, with both new and retrofitted trucks gaining traction.

Demand for heavy-duty trucks is being significantly influenced by changes in freight movement, regional logistics integration, and the expanding cross-border trade networks. Freight corridors under regional blocs such as NAFTA, ASEAN, and BRICS are being strengthened, leading to increased vehicle utilization. Truck fleets are being adjusted to suit route density, fuel capacity, and cargo payloads, making Class 7 and Class 8 trucks more relevant across long-haul operations. Supply chains in e-commerce, agriculture, and raw material distribution are being recalibrated to support last-mile and first-mile connectivity. Opinions in the logistics sector suggest that resilient truck platforms are now being favored due to their ability to navigate variable terrains and endure regulatory compliance in cross-border applications.

Stricter emission compliance norms across Europe, North America, and parts of Asia-Pacific are compelling fleet operators to transition from older diesel trucks to cleaner, regulation-compliant models. OEMs are focusing on delivering trucks that meet Euro VI, EPA 2027, and similar global standards. This regulatory shift is being seen not only as a compliance issue but also as a strategic investment by fleet managers aiming to reduce long-term operating costs. Analysts believe that fleet modernization is being influenced by lifecycle cost assessments, component reliability, and vehicle downtime. Retrofitting and upcycling trends are being observed as interim solutions in price-sensitive markets, driving an interesting duality in demand for both new and reconditioned heavy-duty truck platforms.

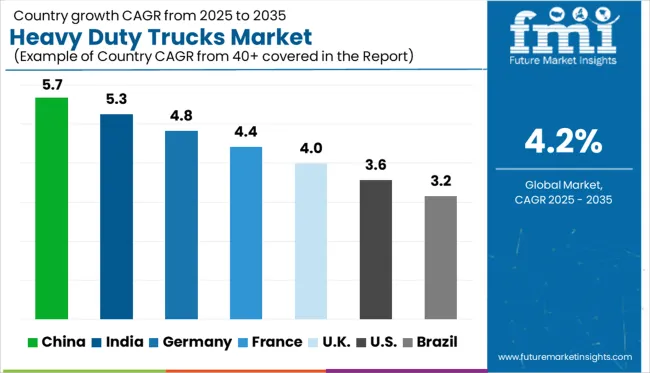

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

The global heavy duty trucks market is expanding at a CAGR of 4.2% from 2025 to 2035, but several key economies, especially within BRICS and select OECD regions, are surpassing this average. China leads with a CAGR of 5.7%, propelled by aggressive freight electrification, infrastructure stimulus, and an expanding logistics footprint. India follows at 5.3%, supported by high-volume demand in construction, mining, and rural transportation, coupled with localized manufacturing scale-ups and ASEAN trade corridor integration.

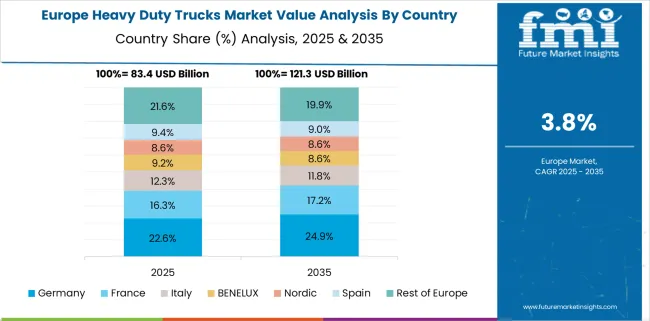

Germany, a core OECD economy, grows at 4.8%, underpinned by next-gen diesel hybrids, hydrogen-powered prototypes, and regulatory frameworks favoring low-emission logistics. France advances at 4.4%, reflecting its investments in fleet electrification and defense logistics.

In contrast, the UK and USA trail the global average with 4.0% and 3.6% respectively, impacted by slower fleet renewal cycles and infrastructure bottlenecks. This contrast illustrates the shift of momentum toward BRICS and Asian economies. The report covers 40+ countries in detail; the top five are highlighted here.

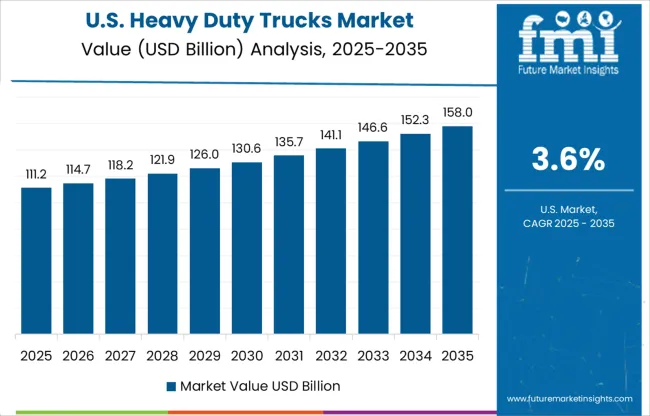

The CAGR of the heavy duty trucks market in the United States increased from around 3.1% during 2020 to 2024 to 3.6% during 2025 to 2035, driven by stricter compliance with federal GHG Phase 2 standards and accelerated fleet renewals across the logistics and long-haul sector.

Fleet electrification mandates across California and New York led to early adoption of next-gen truck platforms. Growth in e-commerce-related intermodal freight also supported demand for heavy-duty truck chassis tailored to large-scale warehouse-to-hub operations. OEMs in North America increased investments in autonomous-ready models and fuel-efficient Class 8 configurations tailored for long-distance corridors.

The CAGR in the United Kingdom climbed from nearly 3.4% during 2020 to 2024 to 4.0% during 2025 to 2035, following recovery from post-Brexit freight inefficiencies and a reorientation of intra-Europe trade routes. Demand rebounded on the back of targeted infrastructure upgrades and carbon-zone logistics standards being rolled out in Greater London, Manchester, and Birmingham.

The market observed an uptick in sales for trucks with Euro VI-E certification and hybrid retrofit compatibility. Fleet managers began aligning replacement cycles with regulatory incentives that favored low-emission commercial transport. Industry sentiment suggests a strategic recalibration around payload optimization and zero-emission transition timetables.

Germany’s heavy duty trucks market posted a CAGR of 4.1% from 2020 to 2024, which is projected to rise to 4.8% from 2025 to 2035, supported by freight modernization under the Bundesverkehrswegeplan (Federal Transport Infrastructure Plan). Strong demand was seen for high-torque trucks configured for autobahn logistics and cross-border trade into Austria, Poland, and France.

The national electrification program for commercial fleets, particularly in cities like Hamburg and Stuttgart, spurred early adoption of low-emission heavy trucks. German OEMs continued leading in modular chassis innovation to support industry-specific configurations in mining, construction, and container freight.

Electric heavy truck sales rose by 39.1% YoY between 2024 and 2027. By 2028, over 64% of trucks on key autobahn corridors were fleet-owned. Heavy trucks with digital freight management tools reached 57.8% adoption by 2029.

China’s CAGR for heavy duty trucks increased from 5.1% in 2020 to 2024 to 5.7% during 2025 to 2035, driven by regional freight growth under the Belt and Road Initiative and upgrades in provincial highway networks. Investments in intelligent freight logistics in Guangdong, Shandong, and Jiangsu facilitated high-mileage truck deployments.

National guidelines for diesel scrappage created a surge in replacement cycles, with OEMs delivering connected, driver-optimized trucks with intelligent navigation and payload distribution systems. Government-backed financial incentives on new heavy trucks improved fleet affordability across Tier 2 and Tier 3 markets.

India’s heavy duty trucks market witnessed a CAGR of 4.5% during 2020 to 2024, which is forecast to rise to 5.3% during 2025 to 2035, supported by infrastructure mega-projects like Bharatmala and Gati Shakti. Highway expansions and multi-modal logistics parks improved vehicle efficiency, especially for long-haul goods transport.

Replacement demand surged from the mining, cement, and cold chain sectors. Domestic OEMs expanded capacity for BS-VI truck variants with higher torque, durability, and fuel optimization. Fleet digitization in organized logistics further accelerated new purchases across key freight corridors connecting Delhi, Mumbai, Chennai, and Kolkata.

Major players in the heavy duty trucks market are optimizing powertrain technologies, axle configurations, and driver-assist systems to meet evolving freight needs and emission standards. Daimler, Freightliner, Navistar, and Isuzu Motors are leading OEMs, offering models tailored for long-haul, construction, and cross-border logistics.

Their strategies include modular chassis design, smart fleet management integration, and hydrogen fuel compatibility. Established North American brands like Kenworth, Mack Trucks, MAN, and Peterbilt continue to strengthen their presence through advanced torque management and connected-vehicle platforms.

European stalwarts Scania AB and Volvo Trucks are focusing on battery-electric and hybrid variants, aligning with zero-emission freight corridors and fleet electrification mandates across the EU and Nordic markets.

In June 2025, the 30 Mercedes-Benz eActros 600 trucks will complement DHL's sustainable fleet, which already includes 16 electric trucks and 450 CNG trucks in transport, as well as 32,400 electric vans for last-mile delivery.

| Item | Value |

|---|---|

| Quantitative Units | USD 324.5 Billion |

| Class Type | Class 8, Class 7, and Cab type |

| Fuel Type | Diesel, Natural gas, Hybrid electric, and Gasoline |

| Horsepower Range | 400HP-500HP, Below 300HP, 300HP-400HP, and Above 500HP |

| Application Type | Freight delivery, Utility services, Construction & mining, and Others |

| Ownership Type | Fleet operator and Independent operator |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler, Freightliner, Navistar, Isuzu Motors, Kenworth, Mack Trucks, MAN, Peterbilt, Scania AB, and Volvo Trucks |

| Additional Attributes | Dollar sales, share by class and axle type, regional demand shifts, fleet replacement trends, emission regulations, EV adoption rates, OEM positioning, and channel preferences. |

The global heavy duty trucks market is estimated to be valued at USD 324.5 billion in 2025.

The market size for the heavy duty trucks market is projected to reach USD 489.6 billion by 2035.

The heavy duty trucks market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in heavy duty trucks market are class 8, class 7 and cab type.

In terms of fuel type, diesel segment to command 74.0% share in the heavy duty trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Haul Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA