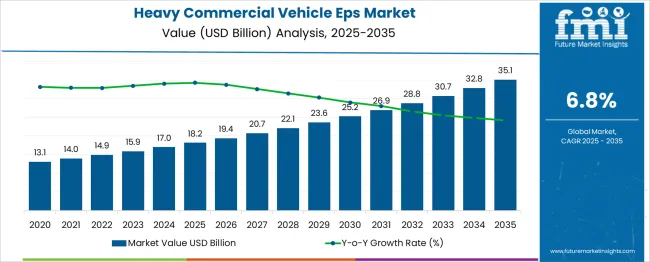

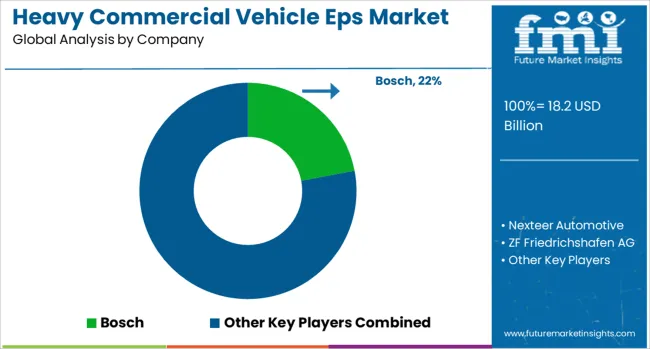

The Heavy Commercial Vehicle Eps Market is estimated to be valued at USD 18.2 billion in 2025 and is projected to reach USD 35.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. The 10-year growth trajectory reveals a steady upward trend, with values reaching USD 14.0 billion in 2021, USD 14.9 billion in 2022, USD 15.9 billion in 2023, USD 17.0 billion in 2024, and USD 18.2 billion in 2025, contributing USD 5.1 billion in the first half, which accounts for about 23% of total growth.

The second half of the forecast period (2025-2030) delivers USD 10.7 billion, or 49% of the overall increase, as the market advances through USD 19.4 billion in 2026, USD 20.7 billion in 2027, USD 22.1 billion in 2028, USD 23.6 billion in 2029, and USD 25.2 billion in 2030, confirming a moderately back-weighted growth pattern.

The decade multiplier stands at approximately 2.68x, with the first half registering around 1.39x and the latter half showing a multiplier near 1.44x, indicating consistent momentum throughout the forecast period. This growth is driven by rising demand for enhanced vehicle control, fuel efficiency, and safety in commercial vehicles, alongside increasing adoption of advanced EPS systems that reduce steering effort and improve driver comfort. Manufacturers focusing on technological innovation, integration with autonomous vehicle systems, and compliance with evolving safety regulations are expected to capture significant market share in this expanding segment.

| Metric | Value |

|---|---|

| Heavy Commercial Vehicle Eps Market Estimated Value in (2025 E) | USD 18.2 billion |

| Heavy Commercial Vehicle Eps Market Forecast Value in (2035 F) | USD 35.1 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The heavy commercial vehicle EPS (Electric Power Steering) market holds a vital role in the evolving automotive steering system landscape, contributing significantly to enhanced vehicle control, fuel efficiency, and reduced maintenance compared to traditional hydraulic systems. Within the overall electric power steering market, the heavy commercial vehicle segment accounts for approximately 18–20%, indicating its growing influence as adoption accelerates in long-haul trucks and heavy-duty fleets. In the broader commercial vehicle steering systems category, this segment represents about 24–26%, supported by OEM initiatives to improve maneuverability, driver comfort, and compliance with energy efficiency regulations.

In the advanced driver assistance systems (ADAS)-enabled steering solutions market, heavy commercial vehicle EPS contributes nearly 14–16%, owing to its integration with lane-keeping assistance, adaptive cruise control, and emerging autonomous driving platforms. Within the electric and hybrid heavy commercial vehicle segment, its share is close to 12–14%, driven by demand for low-energy steering mechanisms that complement electrified powertrains. Growth in this sector is propelled by rising global freight activity, stringent regulatory norms to reduce emissions, and the increasing penetration of mechatronic systems in the heavy-duty vehicle category. Key developments include the integration of EPS with real-time telematics, predictive maintenance analytics, and torque overlay functionality to enhance safety. Manufacturers are focusing on scalability and system redundancy to meet performance expectations in both on-highway and off-highway operations, positioning EPS as a critical enabler of advanced mobility solutions in heavy commercial transportation.

Growth is being supported by rising demand for fuel-efficient vehicles, stringent emissions regulations, and increased safety expectations across global markets. Electric Power Steering (EPS) systems are gradually replacing hydraulic systems due to their reduced energy consumption, better integration with ADAS technologies, and enhanced steering precision.

With advancements in sensor technologies and control algorithms, EPS solutions are being tailored for the heavier torque demands of commercial vehicles. The transition toward electrification in heavy-duty transport and the development of autonomous freight technologies are further accelerating EPS integration.

Market growth is being reinforced by OEM collaborations and platform-level investments focused on modular EPS solutions that support scalable architecture. As fleet operators and manufacturers increasingly prioritize performance, reliability, and regulatory compliance, EPS adoption is expected to rise steadily, paving the way for long-term expansion in the heavy commercial vehicle segment..

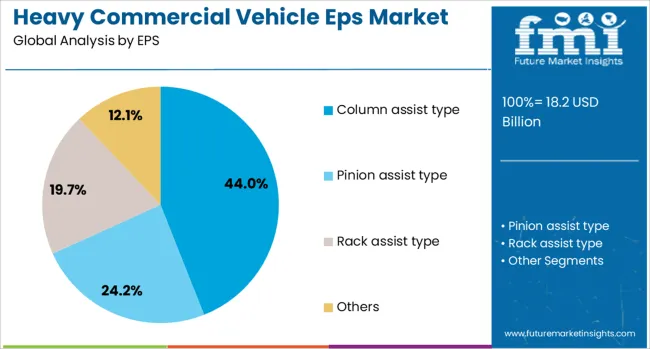

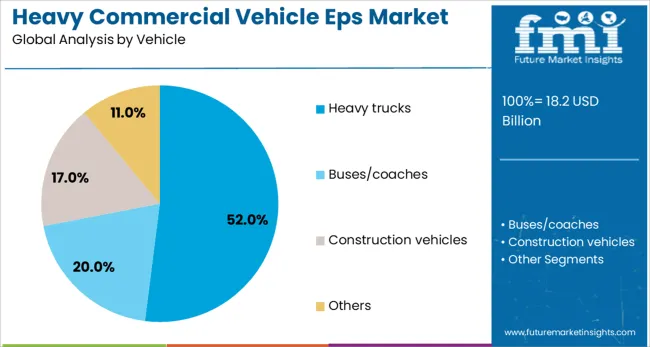

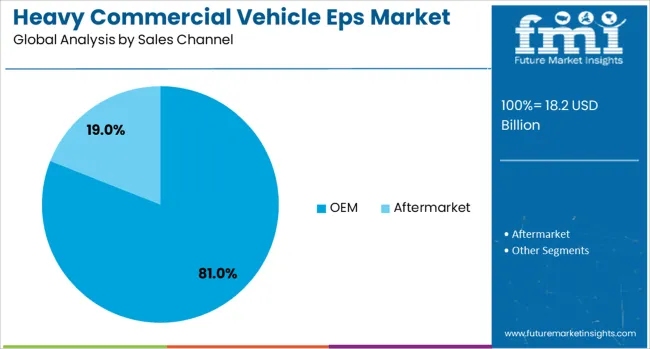

The heavy commercial vehicle eps market is segmented by eps, vehicle, sales channel, component, and geographic regions. By eps of the heavy commercial vehicle eps market is divided into Column assist type, Pinion assist type, Rack assist type, and Others. In terms of vehicles, the heavy commercial vehicle eps market is classified into Heavy trucks, Buses/coaches, Construction vehicles, and Others. Based on the sales channel, the heavy commercial vehicle eps market is segmented into OEM and Aftermarket. The heavy commercial vehicle EPS market is segmented by component into Electronic Control Unit (ECU), Steering Column, Electric Motor, Sensors, Software and Algorithms, and Others. Regionally, the heavy commercial vehicle eps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The column assist type segment is expected to account for 44% of the EPS market revenue share in 2025, making it the dominant EPS configuration. Its growth has been primarily driven by its compact design, simplified integration, and cost-effectiveness in steering applications suited for heavy commercial vehicles. This configuration has been adopted widely due to its ability to reduce mechanical complexity while offering precise steering control.

Enhanced by electronic control units and torque sensors, column assist EPS systems have proven efficient in reducing driver fatigue and improving vehicle handling. Manufacturers have favored this segment for its compatibility with existing chassis designs, reducing the need for extensive structural modifications.

Additionally, column assist systems support modular development, enabling easier incorporation of safety features and diagnostics. As vehicle platforms evolve to support advanced driver assistance systems and electrification, the column assist EPS configuration has been positioned as a reliable and future-ready solution in the market..

The heavy trucks segment is projected to hold 52% of the EPS market revenue share in 2025, representing the leading vehicle category. This dominance has been influenced by increasing demand for efficient steering systems that can handle high axle loads while maintaining driver comfort and control. The deployment of EPS in heavy trucks has been encouraged by improvements in actuator strength, steering torque management, and software adaptability.

OEMs have prioritized EPS in heavy-duty applications to enhance vehicle responsiveness and to meet evolving safety and emission standards. EPS systems in heavy trucks have enabled better integration with automated driving functions, such as lane keeping and adaptive steering, which are increasingly required in long-haul logistics operations.

The reduction in hydraulic components has contributed to lower maintenance requirements and operational cost savings for fleet operators. As demand grows for digitalized, connected truck platforms, the heavy trucks segment is expected to remain central to EPS technology adoption.

The OEM segment is forecasted to capture 81% of the EPS market revenue share in 2025, maintaining its status as the primary sales channel. This leading position has been driven by the strategic integration of EPS technologies into new vehicle platforms at the manufacturing stage. OEMs have increasingly collaborated with technology suppliers to embed advanced EPS systems that comply with global regulatory standards and enable future upgrades.

The growth of this segment has been supported by OEM-led innovation in electric and hybrid commercial vehicles, where EPS plays a key role in energy efficiency and system interoperability. OEM channels offer significant advantages in calibration, warranty support, and compatibility assurance, prompting fleet buyers to favor factory-fitted EPS solutions.

Additionally, global manufacturing programs aimed at reducing carbon emissions have resulted in the standardization of EPS across commercial vehicle models. This trend is expected to solidify OEMs as the preferred distribution and deployment channel in the market..

Heavy commercial vehicle EPS demand is rising due to the shift from hydraulic systems, ADAS integration, and electrification trends. Strategic partnerships and component-level advancements are ensuring performance, reliability, and cost optimization for future deployments.

The transition from hydraulic steering to electric power steering (EPS) is a major driver for heavy commercial vehicles. This shift is encouraged by the need for improved fuel efficiency, reduced component complexity, and lower maintenance costs. EPS eliminates the hydraulic pump load, reducing energy consumption, which benefits fleet operators managing high operational expenses. OEMs are increasingly adopting EPS to meet emissions targets while improving steering response and precision in heavy-duty trucks. This evolution supports advanced functionalities like torque overlay for stability on highways. As fleets seek better performance and efficiency, the shift toward EPS is accelerating, shaping future steering architecture for heavy commercial transportation.

The rising adoption of ADAS in heavy commercial vehicles is amplifying demand for EPS systems. Unlike hydraulic solutions, EPS enables seamless integration with driver assistance features such as lane-keeping support, collision avoidance, and adaptive cruise control. EPS systems deliver precise steering inputs required for semi-autonomous and driver-assist functionalities, improving safety in long-haul and high-load scenarios. Fleet operators and manufacturers are prioritizing steering systems that can interface with sensors and controllers for enhanced functionality. This trend highlights EPS as an essential component for achieving the reliability and precision needed for advanced electronic control systems in heavy-duty vehicle platforms.

Electrification in heavy commercial vehicles, driven by regulatory mandates and OEM initiatives, is a key factor favoring EPS adoption. Unlike hydraulic steering, EPS draws power only when needed, reducing energy losses and improving overall vehicle efficiency. This feature aligns with electrified powertrains, where energy optimization is critical for extended range and compliance with emissions standards. Electric buses, delivery trucks, and construction vehicles are increasingly adopting EPS due to its compatibility with hybrid and fully electric platforms. Manufacturers are designing high-torque EPS units tailored for heavy-duty applications, ensuring robust performance while meeting global targets for fuel economy and emissions reduction.

Collaborations between EPS manufacturers, automotive OEMs, and technology providers are accelerating innovation in steering systems for heavy vehicles. Key players are investing in high-output electric motors, integrated sensors, and advanced controllers to improve steering accuracy under varying load conditions. Strategic partnerships are also emerging to develop EPS systems that are scalable across multiple vehicle classes, reducing production costs and enhancing platform flexibility. Suppliers are focusing on integrating real-time telematics and diagnostic capabilities into EPS modules for predictive maintenance, increasing vehicle uptime. These collaborative initiatives underscore a competitive market environment where innovation and cost-efficiency determine future adoption rates.

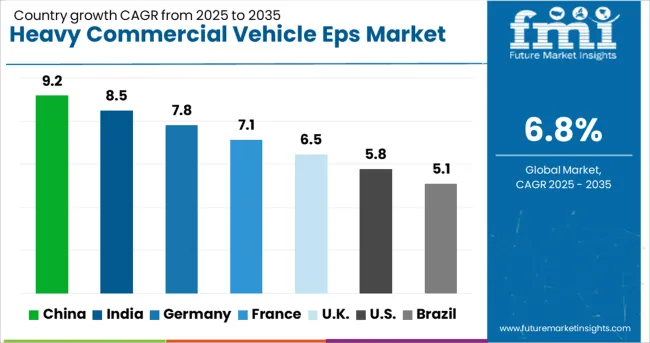

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

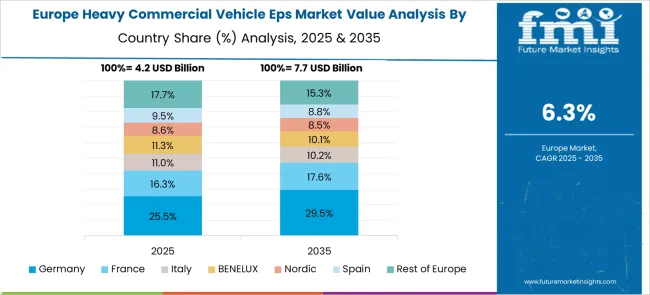

The heavy commercial vehicle electric power steering (EPS) market is projected to grow at a global CAGR of 6.8% from 2025 to 2035, driven by the need for energy-efficient steering systems, advanced driver assistance integration, and compatibility with electric and hybrid platforms. China leads with a CAGR of 9.2%, supported by rapid electrification of heavy-duty fleets, government-backed autonomous mobility programs, and expansion of domestic EPS manufacturing capabilities. India follows at 8.5%, driven by the modernization of logistics fleets, infrastructure growth, and rising adoption of ADAS-enabled vehicles in long-haul and construction segments. France records a CAGR of 7.1%, propelled by increased investment in connected truck technologies and strong aftermarket demand. The United Kingdom grows at 6.5%, reflecting steady integration of EPS in telematics-equipped fleets and compliance-driven vehicle safety upgrades, while the United States records 5.8%, shaped by stable demand in heavy-haul trucking and renewed focus on energy-efficient steering technologies for long-distance applications. The report evaluates more than 40 countries, with these markets serving as primary benchmarks for global EPS deployment strategies and investment opportunities across heavy commercial vehicle segments.

China demonstrated a CAGR of nearly 6.1% during 2020–2024, which rose sharply to 9.2% in the 2025–2035 period, supported by rapid electrification of heavy-duty fleets and large-scale integration of ADAS functionalities in commercial vehicles. The initial phase saw adoption primarily in premium and export-oriented truck segments, driven by the need for energy efficiency and compliance with tightening emission norms. In the following decade, accelerated rollout of autonomous trucking pilots, 5G-enabled connectivity solutions, and government-backed incentives for electric trucks created a surge in EPS adoption. Strategic collaborations with domestic steering component suppliers and digital platform providers enhanced performance standards.

India posted a CAGR of 5.5% between 2020–2024, which jumped significantly to 8.5% during 2025–2035, reflecting strong transformation in commercial mobility solutions. Early adoption was gradual due to cost sensitivity and limited awareness of electric power steering benefits. However, growing demand for precision steering in congested routes and increasing sales of electric and hybrid trucks fueled EPS adoption post-2025. Government-led vehicle modernization programs and incentives for fleet electrification accelerated this shift. Collaboration between Indian OEMs and global EPS technology leaders enhanced the affordability of advanced systems, fostering higher penetration rates across freight and construction vehicles.

France recorded a CAGR of 4.9% from 2020–2024, which climbed to 7.1% for 2025–2035, indicating a robust transition to advanced steering systems. Early growth was constrained by higher system costs and reliance on hydraulic steering solutions. The next decade, however, witnessed significant integration of EPS into connected truck ecosystems, driven by regulatory frameworks promoting advanced driver safety systems. The trend toward smart logistics networks further boosted EPS adoption in freight and distribution sectors. OEM investment in modular steering systems for electric buses and long-haul trucks provided additional momentum for market growth.

The CAGR for the United Kingdom moved from approximately 4.2% during 2020–2024 to 6.5% in 2025–2035, highlighting a significant leap driven by safety regulations and digital connectivity adoption. Initial growth was modest due to reliance on legacy hydraulic systems in regional fleets. The subsequent surge reflects the country’s strategic emphasis on connected mobility corridors, telematics-enabled fleet solutions, and regulatory mandates for driver-assist integration. Adoption of EPS became critical for improving fuel efficiency and enhancing vehicle control under heavy load conditions, particularly in electric trucks and logistics operations. Partnerships between UK-based OEMs and steering solution providers facilitated this transformation.

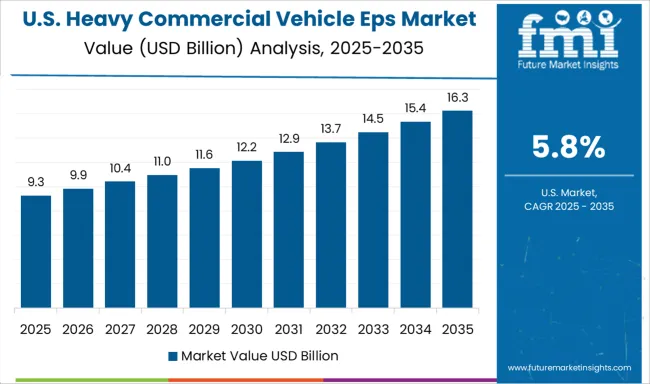

The United States exhibited a CAGR of 3.9% during 2020–2024, which improved to 5.8% for the 2025–2035 timeline, reflecting a steady but measured pace of transition toward EPS solutions. Early adoption remained concentrated among premium trucks and specialized fleet operators prioritizing fuel savings and driver comfort. Growth during the next phase is supported by integration of ADAS in Class 8 trucks, electrification incentives for heavy-duty fleets, and partnerships with EPS technology innovators for redundancy-based steering systems. Adoption is also rising in construction and mining vehicles, driven by operational efficiency and compliance requirements for low-emission technologies.

The heavy commercial vehicle EPS market is dominated by leading automotive component manufacturers who deliver advanced steering technologies optimized for high-load applications and integration with electronic control systems. Bosch maintains a prominent position through its robust portfolio of electric steering systems that offer high precision and compatibility with ADAS features, focusing on energy efficiency and reliability for long-haul fleets. Nexteer Automotive emphasizes advanced EPS architectures with torque overlay and integrated diagnostic capabilities, strengthening its partnerships with global OEMs in both premium and mid-segment trucks. ZF Friedrichshafen AG leads in steering solutions tailored for autonomous and semi-autonomous vehicles, offering scalable EPS modules with high torque performance and seamless connectivity.

JTEKT Corporation delivers innovative steering systems incorporating real-time feedback control, supporting improved maneuverability and enhanced driver comfort in heavy-duty applications. NSK Ltd. specializes in producing compact yet high-capacity EPS units with improved durability and noise reduction, targeting electric and hybrid heavy commercial vehicles. Competitive strategies among these companies include the development of sensor-integrated EPS systems, leveraging advanced motor technology for improved steering response, and investing in cloud-based predictive maintenance platforms to enhance vehicle uptime. The market is also witnessing increased collaboration between steering component suppliers and telematics solution providers to integrate real-time monitoring capabilities. Future growth will be shaped by the adoption of autonomous driving technologies, electrification trends in heavy trucks, and stringent regulatory frameworks requiring improved steering safety standards globally. These dynamics position the leading players to drive innovation and cost optimization in the next wave of EPS adoption for heavy-duty vehicles.

Key strategies for 2024 and 2025 in the heavy commercial vehicle EPS market include expanding integration with ADAS platforms to meet rising safety mandates, enhancing EPS torque capacity for long-haul and heavy-load applications, and developing scalable architectures for electric and hybrid trucks.

Manufacturers are focusing on cost optimization through modular design and sensor fusion, while partnerships with telematics providers enable predictive maintenance and remote diagnostics. Market drivers include regulatory pressure for energy efficiency, fleet modernization initiatives, and OEM adoption of connected mobility solutions to improve operational performance and reduce lifetime vehicle costs in global freight and logistics sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.2 Billion |

| EPS | Column assist type, Pinion assist type, Rack assist type, and Others |

| Vehicle | Heavy trucks, Buses/coaches, Construction vehicles, and Others |

| Sales Channel | OEM and Aftermarket |

| Component | Electronic Control Unit (ECU), Steering Column, Electric Motor, Sensors, Software and Algorithms, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Nexteer Automotive, ZF Friedrichshafen AG, JTEKT Corporation, and NSK Ltd. |

The global heavy commercial vehicle eps market is estimated to be valued at USD 18.2 billion in 2025.

The market size for the heavy commercial vehicle eps market is projected to reach USD 35.1 billion by 2035.

The heavy commercial vehicle eps market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in heavy commercial vehicle eps market are column assist type, pinion assist type, rack assist type and others.

In terms of vehicle, heavy trucks segment to command 52.0% share in the heavy commercial vehicle eps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Haul Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA