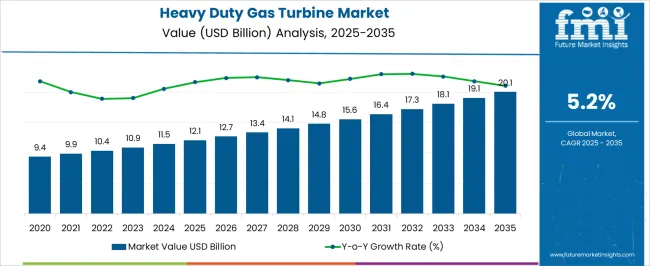

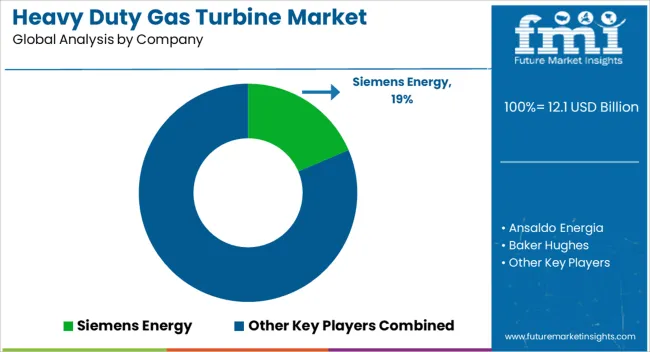

The Heavy Duty Gas Turbine Market is estimated to be valued at USD 12.1 billion in 2025 and is projected to reach USD 20.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. Year-over-year growth from 2025 to 2030 shows moderate increments: from USD 12.1 billion in 2025 to USD 12.7 billion in 2026, representing approximately 5.0% growth. The market continues its upward trend with similar annual increases of around 4.7% to 5.2% each year, reaching USD 14.8 billion by 2030.

This consistent growth reflects steady demand in power generation and industrial applications. From 2031 to 2035, the market accelerates slightly, with yearly growth rates ranging from 4.8% to 5.7%. The market expands from USD 15.6 billion in 2031 to USD 20.1 billion in 2035. This reflects increasing adoption of gas turbines for efficient and reliable energy production in multiple sectors. The steady year-over-year rise underscores the sector’s expanding role in meeting global energy needs through a decade marked by incremental capacity additions and modernization of existing infrastructure.

| Metric | Value |

|---|---|

| Heavy Duty Gas Turbine Market Estimated Value in (2025 E) | USD 12.1 billion |

| Heavy Duty Gas Turbine Market Forecast Value in (2035 F) | USD 20.1 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The heavy duty gas turbine market is experiencing steady advancement, underpinned by growing global electricity demand, the need for grid stability, and increasing integration of renewables. As utilities aim to reduce carbon emissions without compromising base-load reliability, modern gas turbines have emerged as a transitional technology due to their high thermal efficiency and flexible operation.

Technological progress in combustion systems, advanced materials, and digital performance optimization is extending operational life and improving output across diverse geographies. Strategic investments in combined cycle configurations and the repowering of aging coal plants with gas-fired systems are reinforcing market expansion.

In regions facing energy security concerns, gas turbines are playing a critical role in diversifying generation portfolios while ensuring compliance with evolving emission standards. Looking ahead, hybrid models incorporating hydrogen co-firing and predictive maintenance solutions are expected to shape the next phase of innovation and adoption.

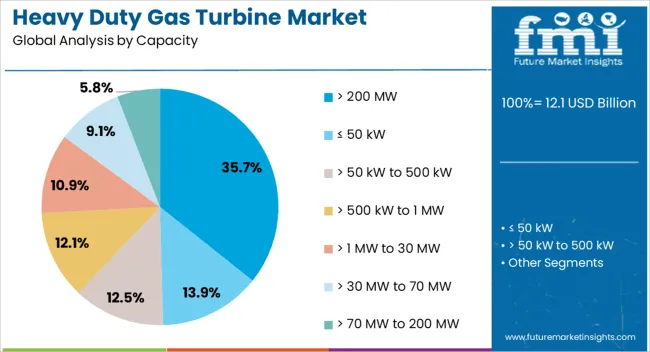

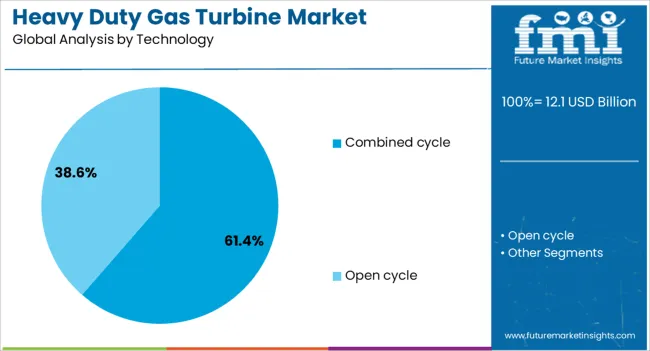

The heavy-duty gas turbine market is segmented by capacity, technology application, and geographic regions. The heavy-duty gas turbine market is divided into > 200 MW, ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 MW to 30 MW, > 30 MW to 70 MW, and > 70 MW to 200 MW. In terms of technology, the heavy-duty gas turbine market is classified into combined cycle and Open cycle.

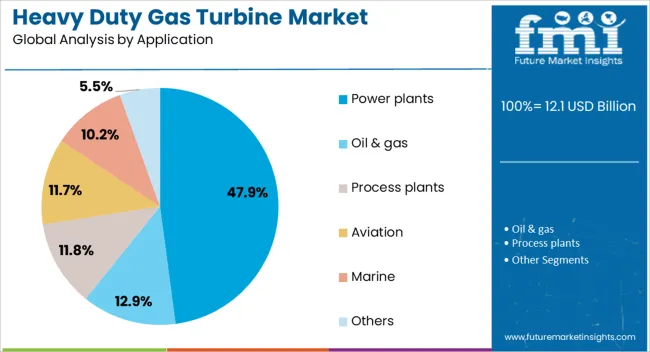

The heavy-duty gas turbine market is segmented into Power plants, Oil & gas, Process plants, Aviation, Marine, and Others. Regionally, the heavy duty gas turbine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Gas turbines with a capacity of over 200 MW are projected to account for 35.70% of the total market revenue by 2025, establishing this as the leading capacity segment. This dominance is being driven by the demand for large-scale base-load power generation, especially in industrialized and rapidly urbanizing economies.

Turbines in this class are well-suited for utility-scale deployment, offering superior output with fewer installation sites and reduced operational complexity. Their compatibility with combined cycle systems enhances thermal efficiency, making them cost-effective over longer project lifecycles.

Increased investments in upgrading national grids and transitioning from coal to cleaner alternatives have further accelerated the adoption of high-capacity gas turbines. Their performance reliability and longer maintenance intervals also contribute to favorable economics in continuous duty operations.

Combined cycle technology is anticipated to hold 61.40% of the market revenue in 2025, positioning it as the dominant technology segment. This leadership stems from its superior efficiency profile, as it utilizes both gas and steam turbines to convert fuel into electricity.

Combined cycle systems can achieve efficiency rates above 60%, significantly reducing fuel costs and emissions per megawatt generated. Their adaptability to various fuel types and operational scalability has made them ideal for both grid support and baseload generation.

As global emphasis intensifies on decarbonizing the power sector without compromising generation capacity, combined cycle configurations are being prioritized in both greenfield and repowering projects. The reduced environmental impact and faster ramp-up capability further reinforce their strategic relevance in today's energy transition framework.

Power plants are expected to contribute 47.90% of the total revenue in the heavy duty gas turbine market by 2025, ranking them as the largest application segment. This segment’s growth is being driven by global demand for continuous, scalable, and dispatchable energy sources amid increasing electrification and renewable intermittency.

Gas turbines provide a reliable and quick-start alternative to coal and diesel in modern power infrastructure. National energy strategies focused on improving air quality and modernizing thermal fleets have supported the deployment of advanced turbine systems in utility-scale power plants.

Furthermore, the ability to integrate with carbon capture technologies and the emergence of hydrogen-ready turbines are aligning gas turbines with long-term decarbonization goals. These factors are collectively sustaining their prominence in new and retrofitted power generation assets worldwide.

The heavy duty gas turbine market is advancing steadily as industries seek reliable, efficient power generation solutions amid rising energy demands. These turbines are favored for their high power output, fuel flexibility, and operational efficiency, making them essential in power plants, oil and gas facilities, and industrial sectors. Emphasis on reducing emissions and enhancing performance drives ongoing upgrades and innovations. Market growth is influenced by expanding infrastructure projects, regulatory policies targeting cleaner energy, and investments in modernizing aging power grids. However, high capital expenditure and maintenance complexities pose challenges. Strategic collaborations and technological refinements aim to address these barriers and unlock broader adoption globally.

Heavy duty gas turbines are central to large-scale power generation, providing stable and efficient electricity supply for utilities and industrial operations. The increasing need for uninterrupted power, especially in emerging economies with expanding industrial bases, is fueling demand. These turbines’ ability to operate on diverse fuels, including natural gas and liquid fuels, supports energy security and cost management. Infrastructure investments in power plants, coupled with retirements of older, less efficient units, create replacement and expansion opportunities. Additionally, their role in cogeneration and combined cycle power plants enhances overall efficiency, appealing to industries aiming to reduce operational costs and carbon footprints.

Advances in materials, cooling techniques, and aerodynamic designs are enhancing the thermal efficiency and reliability of heavy duty gas turbines. Innovations such as improved blade coatings and advanced combustion systems reduce emissions of nitrogen oxides and other pollutants, helping operators meet stringent environmental standards. Digital monitoring and predictive maintenance technologies are also integrated to minimize downtime and optimize performance. These improvements extend turbine lifespan, lower fuel consumption, and reduce operational costs. Manufacturers are focusing on modular designs that facilitate upgrades and customization, enabling operators to adapt to evolving regulatory landscapes and fuel availability while maintaining high output.

The adoption of heavy duty gas turbines requires substantial upfront capital for equipment purchase, installation, and commissioning. Additionally, operational complexities including skilled workforce requirements, maintenance demands, and supply chain dependencies can increase total cost of ownership. In regions with volatile fuel prices or infrastructure challenges, these factors may hinder market penetration. Smaller power producers and developing markets often face financing constraints and lack technical expertise, delaying turbine deployment. To overcome these challenges, manufacturers and service providers offer financing solutions, extended warranties, and comprehensive training programs. Efforts to simplify operation through automation and remote diagnostics are also underway to reduce operational burdens and make turbines more accessible.

Emerging economies in Asia-Pacific, Latin America, and Africa are key growth drivers for the heavy duty gas turbine market, propelled by increasing electricity demand and grid expansion projects. Governments prioritize reliable power infrastructure to support industrial growth and urbanization, creating demand for efficient, scalable power generation technologies. Modernization initiatives targeting grid resilience and integration of renewable energy sources complement turbine deployment in flexible combined cycle configurations. Additionally, replacement of aging thermal power plants with modern gas turbines presents a significant opportunity. Strategic investments and partnerships by turbine manufacturers in these regions aim to establish local presence and adapt offerings to regional fuel and regulatory requirements.

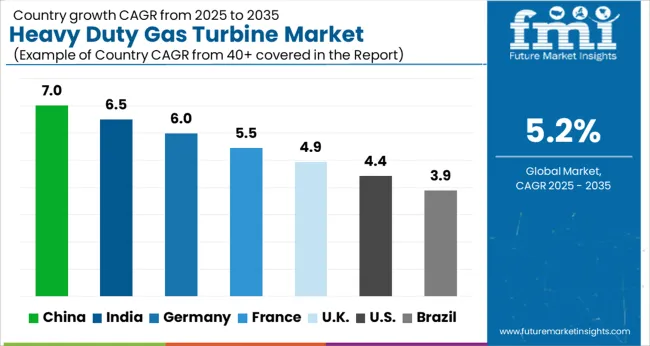

The market is expanding at a 5.2% CAGR, driven by increasing demand for efficient power generation and industrial applications. Among BRICS nations, China leads with 7.0% growth, supported by extensive energy infrastructure projects. India follows at 6.5%, fueled by rising power generation needs and modernization efforts. In the OECD region, Germany records 6.0% growth, reflecting strong regulatory standards and technological innovation.

The United Kingdom grows at 4.9%, driven by investments in energy efficiency and emissions reduction. The United States, a mature market, shows 4.4% growth, shaped by established energy policies and ongoing equipment upgrades. These countries collectively influence market trends through advancements in turbine technology, regulatory compliance, and sustainability initiatives. This report includes insights on 40+ countries; the top countries are shown here for reference.

China heavy duty gas turbine market is advancing at a 7.0% CAGR, fueled by rapid industrialization and expanding power generation capacity. The government’s focus on cleaner energy sources and upgrading aging power plants drives demand for efficient, high-capacity gas turbines. Compared to Western countries, China benefits from large-scale infrastructure projects and investments in natural gas-based power generation. Growing urbanization and industrial growth require reliable, low-emission turbines to meet increasing electricity demand. Domestic manufacturers are collaborating with global technology providers to enhance turbine performance and reduce operational costs. The shift toward gas as a transitional fuel supports market growth, alongside renewables integration. The need for flexible, efficient power solutions in industrial sectors positions China as a leading market for heavy duty gas turbines.

India heavy duty gas turbine market is growing steadily at a 6.5% CAGR, driven by expanding power infrastructure and rising energy demand. India’s push for cleaner fuel alternatives and reduction of coal dependency encourages adoption of gas turbines for thermal power plants. Compared to China, India’s market growth is supported by a mix of government incentives and private sector investments. The increasing role of natural gas in the energy mix promotes demand for high-efficiency turbines that reduce emissions. Power generation companies seek turbines with enhanced flexibility to complement renewable sources like solar and wind. Local manufacturing and technology transfer agreements help reduce costs and improve accessibility. Overall, India’s energy transition and infrastructure development provide a strong growth foundation for heavy duty gas turbines.

Germany heavy duty gas turbine market is progressing at a 6.0% CAGR, driven by the Energiewende initiative focusing on renewable integration and reduced carbon footprint. Germany uses gas turbines to provide flexible backup power and stabilize the grid amid growing renewable penetration. Compared to Asian markets, Germany emphasizes advanced turbine technology with low emissions and high operational efficiency. Industrial demand and combined heat and power (CHP) applications further support turbine adoption. Strict regulatory standards require manufacturers to innovate environmentally friendly designs. Germany’s mature energy market prioritizes reliability and emissions compliance, driving incremental turbine upgrades and replacements. Collaboration between energy firms and research institutions fosters continuous technological improvements in turbine performance and sustainability.

United Kingdom heavy duty gas turbine market is expanding at a 4.9% CAGR, influenced by a transition to lower-carbon energy sources and grid modernization efforts. The UK increasingly relies on gas turbines for flexible and efficient power generation to complement intermittent renewables like wind. Compared to Germany, the UK market growth is slightly slower but steady, supported by investments in upgrading aging thermal plants. The power sector’s demand for rapid start-up and load-following turbines drives interest in advanced models with enhanced flexibility. Policies encouraging emissions reduction and energy efficiency promote adoption of cutting-edge turbine technologies. Integration of digital monitoring and predictive maintenance solutions improves operational reliability. The UK market reflects a balanced growth trajectory shaped by regulatory and environmental priorities.

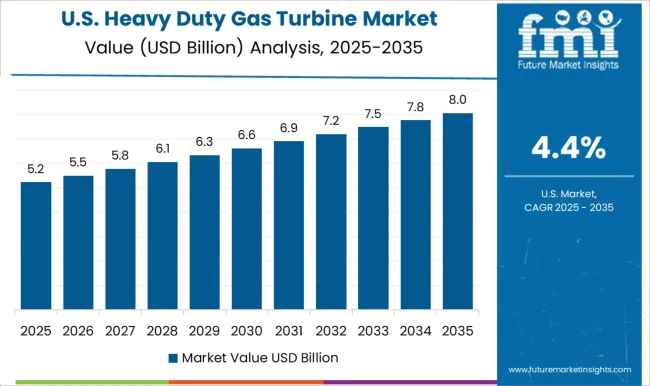

United States heavy duty gas turbine market is growing at a 4.4% CAGR, driven by the country’s large and diverse power generation infrastructure. Gas turbines are central to the USA energy transition, offering cleaner alternatives to coal and supporting renewable integration. Compared to European markets, the USA market emphasizes high-capacity turbines with robust performance and flexibility. Utilities and independent power producers invest in advanced turbines that enable fast ramp-up and efficient combined cycle operation. Environmental regulations encourage the use of low-emission turbine models. Technological advancements such as digital controls and predictive maintenance are increasingly adopted to optimize performance and reduce downtime. The United States market remains competitive, supported by innovation and strong demand for reliable power solutions.

Competitive dynamics in the heavy duty gas turbine market are governed by high capital barriers, long asset lifecycles, and limited global suppliers, making Porter’s Five Forces a useful lens. Rivalry among incumbents is intense but highly concentrated. General Electric, Siemens Energy, Mitsubishi Power, and Ansaldo Energia dominate, with Rolls-Royce and regional suppliers occupying smaller positions. Competition is not purely about unit sales; it is about lifecycle contracts, performance guarantees, and the ability to integrate turbines into combined-cycle plants. Once specified, turbines are rarely displaced, so rivalry manifests in winning tenders for new plants and capturing lucrative aftermarket service agreements.

The threat of new entrants is minimal. Gas turbines require decades of combustion R&D, advanced materials expertise, and global certification pathways. The capital requirements for manufacturing and testing are prohibitive, and customer trust is tied to proven performance records exceeding 100,000 operating hours. Any new entrant faces immense barriers not only in technology but also in bankability for project financing.

Supplier power is significant but not overwhelming. Nickel-based superalloys, high-precision blades, and control systems rely on specialized suppliers, giving them leverage during shortages. However, turbine OEMs vertically integrate critical components or lock in long-term supply contracts to mitigate exposure. Supply risk remains elevated when geopolitical tensions affect rare alloy flows.

Buyer power is concentrated among utilities, independent power producers, and government-backed projects. While each project is large, buyers have limited alternatives beyond the same three or four OEMs. They exert influence through demanding performance guarantees, efficiency levels above 60 percent in combined-cycle mode, and long service warranties. In some markets, state procurement policies increase pressure by favoring domestic players. The threat of substitutes is rising. Utility-scale renewables with storage and grid-scale batteries challenge new gas turbine demand, especially in developed economies. Yet in regions prioritizing baseload stability, turbines retain a role, particularly as hydrogen-ready models position themselves as transitional assets in decarbonization.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.1 Billion |

| Capacity | > 200 MW, ≤ 50 kW, > 50 kW to 500 kW, > 500 kW to 1 MW, > 1 MW to 30 MW, > 30 MW to 70 MW, and > 70 MW to 200 MW |

| Technology | Combined cycle and Open cycle |

| Application | Power plants, Oil & gas, Process plants, Aviation, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, Ansaldo Energia, Baker Hughes, Bharat Heavy Electricals, Capstone Green Energy, Doosan, Flex Energy Solutions, GE Vernova, Harbin Electric, Kawasaki Heavy Industries, MAN Energy Solutions, Mitsubishi Heavy Industries, Nanjing Turbine and Electric Machinery, Destinus Energy, Rolls Royce, Solar Turbines, Vericor, and Wartsila |

| Additional Attributes | Dollar sales in the Heavy Duty Gas Turbine Market vary by application (power generation, oil & gas, marine), type (simple cycle, combined cycle), fuel type (natural gas, diesel), and region (North America, Europe, Asia-Pacific). Growth is driven by rising energy demand, industrialization, and focus on cleaner power solutions. |

The global heavy duty gas turbine market is estimated to be valued at USD 12.1 billion in 2025.

The market size for the heavy duty gas turbine market is projected to reach USD 20.1 billion by 2035.

The heavy duty gas turbine market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in heavy duty gas turbine market are > 200 mw, ≤ 50 kw, > 50 kw to 500 kw, > 500 kw to 1 mw, > 1 mw to 30 mw, > 30 mw to 70 mw and > 70 mw to 200 mw.

In terms of technology, combined cycle segment to command 61.4% share in the heavy duty gas turbine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Market - Size, Share, and Forecast 2025 to 2035

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Heavy Duty Band Sealer Machine Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA