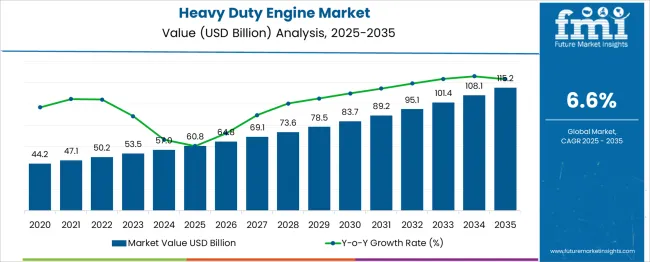

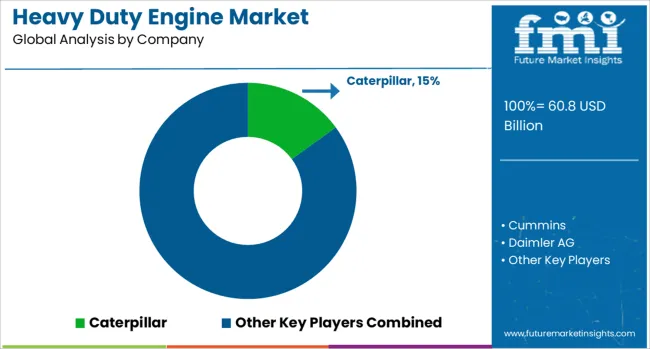

The Heavy Duty Engine Market is estimated to be valued at USD 60.8 billion in 2025 and is projected to reach USD 115.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period. An acceleration and deceleration pattern analysis shows notable growth dynamics across the forecast period. Between 2025 and 2030, the market expands from USD 60.8 billion to USD 83.7 billion, contributing USD 22.9 billion in growth, with a CAGR of 7.6%. This early-phase acceleration is driven by increasing demand for more powerful, efficient, and environmentally compliant heavy-duty engines across industries like transportation, construction, and mining. The rising global demand for goods, expanding infrastructure projects, and stricter emission standards all contribute to this robust growth.

The first peak occurs in 2030 at USD 83.7 billion, followed by a slight deceleration between 2030 and 2032, where the market moves from USD 83.7 billion to USD 89.2 billion, reflecting a growth of USD 5.5 billion with a slightly lower CAGR of 3.3%. This slowdown indicates the market is nearing maturity, where the adoption rate begins to stabilize. From 2032 to 2035, the market picks up again, growing from USD 89.2 billion to USD 115.2 billion, contributing USD 26 billion in growth, with a CAGR of 8.5%. The later-phase acceleration is driven by new technological innovations, increased demand from emerging markets, and the shift toward electrification in heavy-duty engines, marking the second peak in market growth.

| Metric | Value |

|---|---|

| Heavy Duty Engine Market Estimated Value in (2025 E) | USD 60.8 billion |

| Heavy Duty Engine Market Forecast Value in (2035 F) | USD 115.2 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The heavy duty engine market is experiencing robust growth as industries worldwide demand more powerful and efficient engines to support increasing transportation and infrastructure needs. The current landscape is shaped by technological advancements in engine design, stricter emissions regulations, and the need for higher fuel efficiency, as highlighted in industry publications, corporate press releases, and investor presentations.

Future outlook remains positive as manufacturers continue to invest in cleaner technologies, hybrid powertrains, and digital monitoring systems to enhance performance and meet environmental standards. Statements from leading companies emphasize the growing demand from logistics, construction, and mining sectors, which is driving innovation in high-horsepower engines.

The market is also benefiting from the expansion of global trade routes and e-commerce, which have increased the requirement for heavy duty vehicles. These developments collectively create a favorable environment for the sustained growth of the market, ensuring relevance in both traditional and emerging economies.

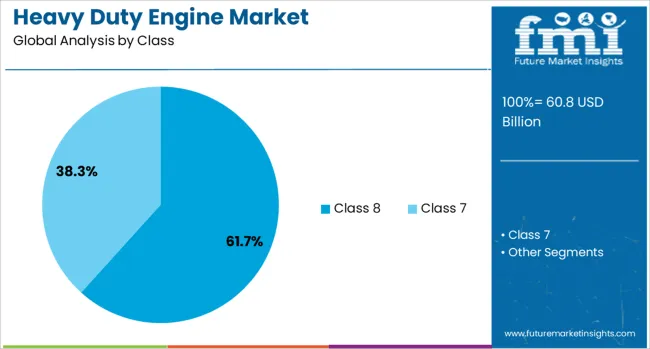

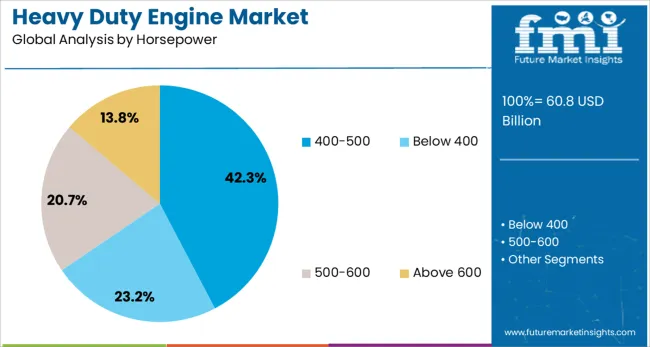

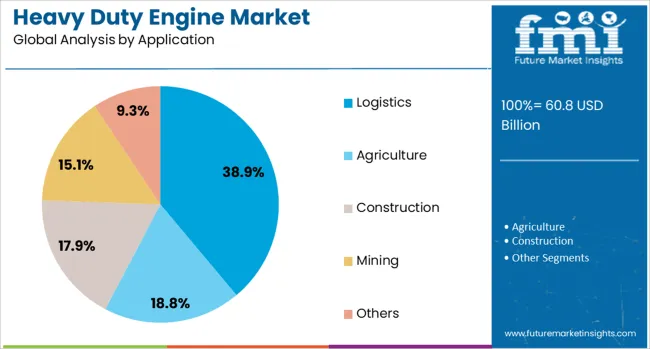

The heavy duty engine market is segmented by class, horsepower, application, distribution channel, and geographic regions. The heavy-duty engine market is divided into Class 8 and Class 7. In terms of horsepower, the heavy-duty engine market is classified into 400-500, Below 400, 500-600, and Above 600. Based on the application, the heavy-duty engine market is segmented into Logistics, Agriculture, Construction, Mining, and Others. The distribution channel of the heavy-duty engine market is segmented into Direct and Indirect. Regionally, the heavy duty engine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Class 8 segment is projected to account for 61.7% of the Heavy Duty Engine market revenue share in 2025, making it the most dominant class. This prominence is being attributed to its capability to deliver superior hauling capacity and durability for long-distance transportation needs, as noted in technical publications and corporate updates.

Class 8 engines are being preferred in freight and logistics operations due to their ability to handle higher payloads and comply with stringent operational standards. Manufacturers have increasingly focused on enhancing fuel efficiency and reducing emissions within this class, aligning with regulatory mandates and corporate sustainability goals.

Furthermore, the segment’s leadership has been driven by its wide adoption in key industries such as logistics, construction, and mining, which require high performance under demanding conditions. These factors, coupled with ongoing improvements in engine reliability and lower total cost of ownership, have strengthened the position of Class 8 engines in the market.

The 400-500 horsepower segment is anticipated to hold 42.3% of the Heavy Duty Engine market revenue share in 2025, retaining its position as the leading horsepower range. This leadership is being reinforced by its ability to provide an optimal balance between power output and fuel efficiency, which is critical for long haul transportation, as discussed in technical reports and company disclosures.

Engines in this range are being adopted widely because they meet the diverse requirements of heavy duty trucks operating in various terrains and load conditions. The segment’s growth has also been supported by innovations in engine control technologies that improve performance while maintaining compliance with emissions standards.

Additionally, the 400-500 horsepower engines offer sufficient versatility to serve multiple applications, which has been recognized by fleet operators seeking operational flexibility. The sustained preference for this range is further strengthened by its proven reliability, lower maintenance costs, and adaptability to evolving regulatory and environmental demands.

The logistics application segment is expected to account for 38.9% of the Heavy Duty Engine market revenue share in 2025, maintaining its leadership among applications. This dominance is being driven by the rapid growth of global trade, e-commerce, and just in time delivery models, as highlighted in industry news and corporate presentations. Logistics operations increasingly rely on heavy duty engines to ensure efficient transportation of goods across vast distances while adhering to time-sensitive schedules.

The segment has been favored due to its ability to leverage high capacity engines that enhance operational productivity and reduce downtime. Companies have been investing in modern fleets powered by heavy duty engines to meet customer expectations and regulatory requirements for efficiency and emissions.

Furthermore, the focus on reducing operational costs while maximizing load capacities has propelled demand within this segment. These factors have collectively supported the continued dominance of the logistics application in the Heavy Duty Engine market in 2025.

The demand for heavy duty engines is rising as industries such as construction, mining, agriculture, and transportation require powerful, reliable, and fuel-efficient engines for their heavy machinery and equipment. These engines are crucial for ensuring high performance and durability in harsh operational conditions. With growing urbanization, infrastructure development, and the need for efficient transportation, the market for heavy-duty engines is expanding. Despite challenges such as environmental regulations and the high cost of advanced technology, there are significant opportunities driven by technological advancements and the demand for cleaner and more efficient engines.

The radar simulators market is driven by the growing need for advanced testing and training solutions, particularly in the defense and aerospace industries. Radar simulators offer realistic training environments for military personnel and air traffic controllers, enabling them to simulate various radar scenarios without the need for costly and time-consuming field tests. As defense spending increases, particularly in developed nations, there is a heightened need for radar systems that can perform under diverse conditions. Radar simulators provide a cost-effective and efficient way to evaluate radar performance and conduct scenario-based training, driving the adoption of these simulators in defense and aerospace sectors. The growing integration of radar technology in commercial applications, such as autonomous vehicles and drones, contributes to this demand.

A major challenge in the heavy-duty engine market is the stringent emission regulations imposed by governments to reduce the environmental impact of heavy machinery and transportation vehicles. These regulations require manufacturers to develop engines that comply with increasingly strict emission standards, which can raise production costs and complicate engine design. Additionally, while newer engine technologies offer improved fuel efficiency and lower emissions, they often come with higher upfront costs, which can be a barrier, particularly for smaller operators or companies with limited budgets. These factors can lead to increased operational expenses, including maintenance and repair costs, particularly with newer, more complex engine designs.

There are significant opportunities in the heavy-duty engine market driven by advancements in engine efficiency and emission control technologies. Manufacturers are investing in research and development to produce engines that offer improved fuel efficiency, lower emissions, and higher power outputs. The development of electric and hybrid engines is also gaining traction, offering a more environmentally friendly alternative to traditional diesel engines. Additionally, advancements in engine management systems, predictive maintenance, and IoT integration are making engines more efficient and cost-effective by reducing downtime and enhancing operational performance. As demand for greener technologies increases, the transition to cleaner, more efficient engines presents long-term growth potential for the market.

A key trend in the heavy-duty engine market is the shift toward electrification and hybrid powertrain solutions. With increasing pressure to reduce carbon emissions and improve fuel efficiency, many manufacturers are exploring electric and hybrid engine options for heavy-duty machinery and transportation. Hybrid engines, which combine traditional internal combustion engines with electric motors, offer improved fuel efficiency and reduced emissions, making them an attractive option for industries looking to balance performance and environmental impact. Additionally, as electric vehicle infrastructure develops, the adoption of fully electric engines in certain sectors, such as logistics and mining, is gaining momentum. These trends reflect the broader shift towards more sustainable and efficient power solutions in the heavy-duty engine market.

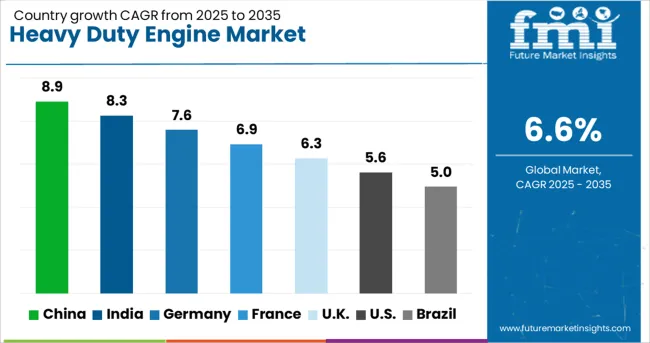

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global heavy duty engine market is expected to grow at a CAGR of 6.6%, with substantial contributions from China, India, France, the UK, and the USA China leads the market with a growth rate of 8.9%, followed by India at 8.3%. France records a growth rate of 6.9%, while the UK and USA show growth rates of 6.3% and 5.6%, respectively. The rising demand for efficient, powerful engines in sectors such as construction, transportation, and agriculture is driving market growth. Both emerging markets and developed economies are seeing increased investments in heavy-duty vehicles and machinery, pushing the adoption of advanced engine technologies The analysis covers over 40 countries, with the leading markets highlighted below.

China is projected to lead the heavy duty engine market with a CAGR of 8.9% through 2035. The rapid industrialization in China, combined with its booming construction, agriculture, and transportation sectors, significantly drives the demand for high-performance and fuel-efficient heavy-duty engines. China’s strong focus on infrastructure development and urbanization, along with government investments in modernizing heavy machinery, has spurred the growth of the market.The increasing need for fuel-efficient engines, due to stringent environmental standards, has fueled the demand for advanced engine designs and manufacturing technologies. China's push toward clean energy solutions and technological innovation in engine design will continue to drive the market forward.

India is expected to grow at a CAGR of 8.3% through 2035 in the heavy duty engine market. The country’s growing transportation and construction sectors are key drivers for the increasing demand for powerful, fuel-efficient engines. As India continues to modernize its infrastructure and expand its industrial base, the need for heavy-duty vehicles and machinery rises, further contributing to the market’s expansion. The increasing demand for efficient engines in the agricultural sector, particularly for tractors and other farming machinery, is another factor supporting market growth.

France is expected to grow at a CAGR of 6.9% through 2035 in the heavy duty engine market. The demand for advanced and efficient heavy-duty engines in France is driven by the expansion of key sectors, including transportation, construction, and logistics. The French government’s push for greener and more fuel-efficient vehicles, along with tightening emission regulations, supports the adoption of advanced engine technologies. In the construction and transportation industries, heavy-duty engines are crucial for driving machinery such as trucks, cranes, and excavators. The rise in demand for environmentally conscious vehicles in France also contributes to the development of cleaner engine technologies.

The United Kingdom is projected to grow at a CAGR of 6.3% through 2035 in the heavy duty engine market. The demand for powerful and fuel-efficient engines is rising due to the expansion of the transportation and construction sectors. The UK’s increasing focus on sustainable transportation solutions and green construction practices drives the adoption of advanced engine technologies in heavy-duty vehicles and machinery. The demand for trucks, construction equipment, and agricultural vehicles is expected to rise, fueling the market for heavy-duty engines. Furthermore, the UK government’s initiatives to improve transportation infrastructure and reduce emissions are encouraging manufacturers to develop cleaner, more efficient engines.

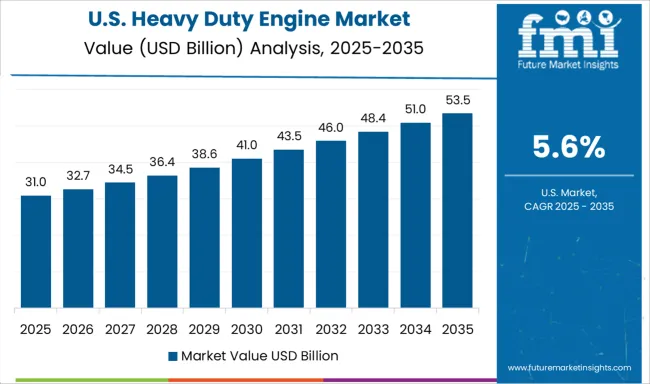

The United States is projected to grow at a CAGR of 5.6% through 2035 in the heavy duty engine market. The demand for heavy-duty engines in the USA is driven by the growth of the transportation, logistics, and construction sectors, where fuel-efficient, durable engines are crucial. As the USA continues to modernize its fleet of trucks, cranes, and machinery, the need for high-performance engines with lower emissions increases. The growing focus on clean energy solutions and strict government regulations aimed at reducing vehicle emissions are encouraging the development of more sustainable and efficient engines. The need for advanced engine systems in the military and defense sector also contributes to the growing demand for high-performance engines.

The heat sealing machine market is driven by key players providing reliable and efficient solutions for sealing packaging materials in industries such as food and beverage, pharmaceuticals, and consumer goods. Bosch Packaging Technology is a market leader, offering advanced heat sealing machines that combine high performance with energy efficiency for a wide range of packaging applications. Barry-Wehmiller Companies and ProMach Inc. also contribute significantly, providing high-quality heat sealing machines designed for diverse industries, with a focus on automation and cost efficiency. Krones AG is a major player known for offering integrated packaging solutions, including heat sealing machines that ensure precise sealing and high productivity. Illinois Tool Works Inc. and GEA Group specialize in offering heat sealing technology for industrial packaging systems, emphasizing product quality, operational efficiency, and compliance with regulatory standards.

Omron Corporation and Audion Elektro provide advanced control systems and sealing machines, with a focus on optimizing performance and minimizing operational downtime. Sonoco Products Company and PAC Machinery Group also contribute with high-performance heat sealing machines designed for food packaging, medical devices, and industrial applications, focusing on flexibility, durability, and precision. Hayssen Flexible Systems and Tokyo Automatic Machinery Works Ltd. offer automated heat sealing solutions that improve production speed while maintaining high levels of quality and consistency. Starview Packaging Machinery and Wenzhou Ruizhi Packaging Machinery offer specialized heat sealing machines for custom packaging needs, targeting both small businesses and large-scale industrial clients. Packrite provides reliable heat sealing machines catering to small and medium-sized enterprises, focusing on user-friendly designs and affordability.

| Item | Value |

|---|---|

| Quantitative Units | USD 60.8 Billion |

| Class | Class 8 and Class 7 |

| Horsepower | 400-500, Below 400, 500-600, and Above 600 |

| Application | Logistics, Agriculture, Construction, Mining, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Cummins, Daimler AG, Detroit Diesel, Deutz AG, HYDI, Isuzu Motors Limited, Kubota Corporation, Mack, Navistar, PACCAR, Rolls-Royce Power Systems AG, Volvo Group, Weichai Power Co., Ltd., and Yanmar Holdings Co., Ltd. |

| Additional Attributes | Dollar sales by machine type (vertical form-fill-seal machines, horizontal form-fill-seal machines, rotary sealing machines) and end-use segments (food and beverage, pharmaceuticals, consumer goods, industrial applications). Demand dynamics are driven by the increasing adoption of automated packaging solutions, the growing demand for sustainable packaging, and the need for high-quality sealing in industries such as food and pharmaceuticals. |

The global heavy duty engine market is estimated to be valued at USD 60.8 billion in 2025.

The market size for the heavy duty engine market is projected to reach USD 115.2 billion by 2035.

The heavy duty engine market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in heavy duty engine market are class 8 and class 7.

In terms of horsepower, 400-500 segment to command 42.3% share in the heavy duty engine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Heavy Duty Band Sealer Machine Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of the Heavy Duty Corrugated Packaging Market

Heavy Duty Bag and Sack Market from 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Korea Heavy-Duty Corrugated Packaging Industry Analysis by Product Type, Board Type, Capacity, End-Use Verticals and Region: A Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA