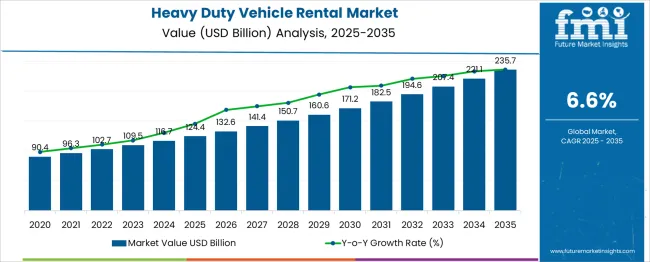

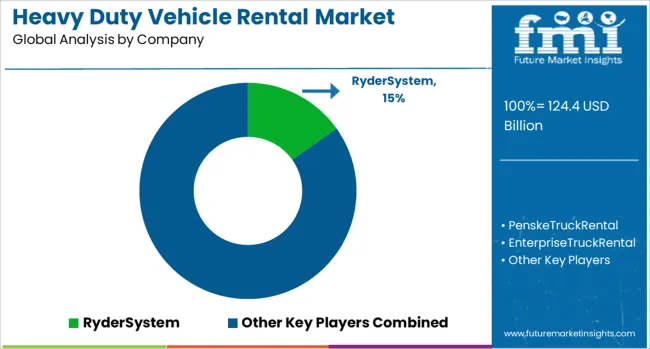

The Heavy Duty Vehicle Rental Market is estimated to be valued at USD 124.4 billion in 2025 and is projected to reach USD 235.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period. A market share erosion or gain analysis indicates a steady increase in market share over the forecast period, driven by both volume growth and increasing demand for rental services. Between 2025 and 2030, the market grows from USD 124.4 billion to USD 171.2 billion, contributing USD 46.8 billion in growth, with a CAGR of 6.5%. This early-stage growth is driven by rising demand for flexible and cost-effective transportation solutions in industries such as construction, logistics, and mining.

The shift toward rental services is fueled by the need to minimize fleet ownership costs and improve operational efficiency. The market experiences significant share gain during this period as businesses increasingly recognize the benefits of renting heavy-duty vehicles rather than purchasing them outright. From 2030 to 2035, the market continues to expand from USD 171.2 billion to USD 235.7 billion, contributing USD 64.5 billion in growth, with a slightly higher CAGR of 7.3%. This phase reflects continued market share gain, driven by increasing demand from emerging markets, along with technological advancements in fleet management and vehicle tracking.

| Metric | Value |

|---|---|

| Heavy Duty Vehicle Rental Market Estimated Value in (2025 E) | USD 124.4 billion |

| Heavy Duty Vehicle Rental Market Forecast Value in (2035 F) | USD 235.7 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The heavy duty vehicle rental market is experiencing robust growth driven by rising infrastructure development, expanding logistics networks, and the increasing need for cost-effective fleet management solutions. The demand for rental services is being fueled by fluctuating freight volumes, seasonal project requirements, and the high capital costs associated with vehicle ownership.

Innovations in telematics, vehicle tracking, and predictive maintenance have enhanced fleet utilization rates, making rental options more attractive to businesses seeking operational flexibility. Additionally, sustainability initiatives and tightening emission norms have encouraged the integration of advanced propulsion technologies, prompting rental providers to update their fleets accordingly.

The rise of third-party rental service providers offering tailored contracts, maintenance, and insurance has further expanded market accessibility. Looking forward, the market is expected to benefit from digital platform adoption, which streamlines booking and fleet management processes, as well as from increasing infrastructure projects in emerging economies.

The heavy duty vehicle rental market is segmented by vehicle, propulsion, service provider, rental type, end use, and geographic regions. By vehicle, the heavy-duty vehicle rental market is divided into Trucks, Buses, Trailers, and others. In terms of propulsion, the heavy-duty vehicle rental market is classified into Diesel, Natural gas, Electric, Hybrid electric, and others. The heavy-duty vehicle rental market is segmented into 3rd companies and OEMs. By rental type, the heavy-duty vehicle rental market is segmented into long-term and short-term. The end use of the heavy-duty vehicle rental market is segmented into Logistics and transportation, Construction, Mining, Oil and gas, Agriculture, and others. Regionally, the heavy duty vehicle rental industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

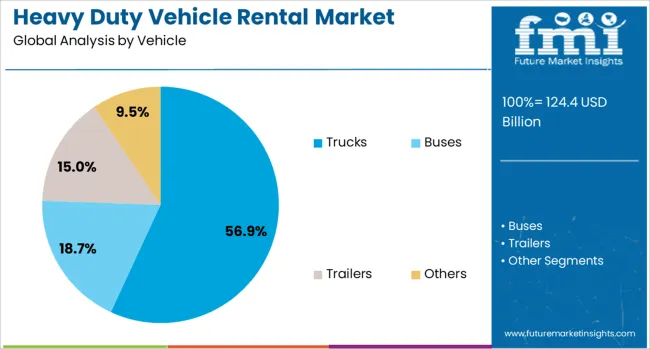

The trucks segment is projected to capture 56.9% of the heavy duty vehicle rental market revenue share by 2025, positioning it as the dominant vehicle category. This prominence is attributed to trucks’ critical role in freight transportation and logistics operations, which require reliable and scalable vehicle availability.

The segment’s growth has been supported by the expansion of e-commerce, retail distribution networks, and intercity cargo movement. Trucks offered through rental models provide businesses with flexibility to manage fluctuating demand without incurring ownership costs or maintenance liabilities.

Furthermore, the integration of advanced telematics and GPS tracking within rented trucks has improved route optimization and asset management, enhancing operational efficiency. The versatility of truck types available on rental platforms has also enabled customization based on cargo size, distance, and regulatory compliance, contributing to the segment’s sustained leadership.

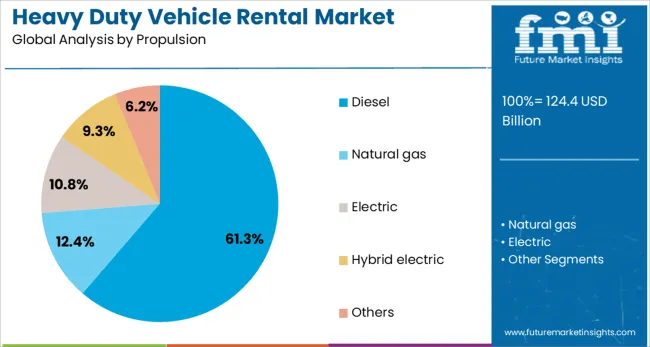

Diesel-powered vehicles are expected to hold 61.3% of the market revenue share in the heavy duty vehicle rental market by 2025, reflecting their continued dominance as the primary propulsion choice. This segment’s growth is supported by diesel engines’ proven fuel efficiency, torque output, and established fueling infrastructure, which collectively meet the rigorous demands of heavy transportation tasks.

Despite growing interest in alternative fuels, diesel remains preferred for long-haul and heavy payload operations due to reliability and operational cost advantages. Rental fleet operators have focused on upgrading diesel vehicles to comply with evolving emission standards, including Euro VI and Bharat Stage VI norms, ensuring continued market acceptance.

The segment’s stability is also driven by the availability of skilled maintenance services and widespread refueling networks, which reduce downtime and enhance vehicle readiness for rental customers.

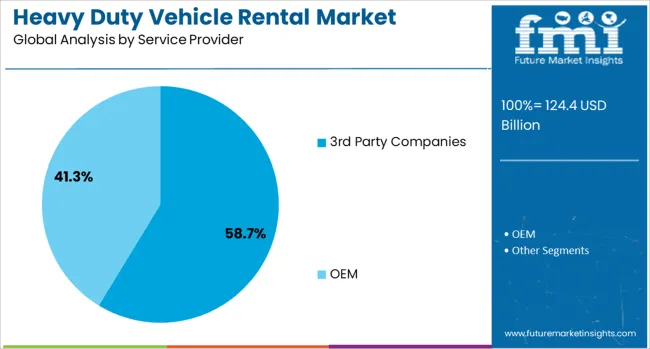

Third-party companies are anticipated to secure 58.7% of the revenue share in the service provider segment of the heavy duty vehicle rental market by 2025. The segment’s expansion is primarily driven by the demand for specialized fleet management, maintenance services, and flexible rental agreements offered by independent operators.

These providers offer cost-effective solutions by leveraging economies of scale, advanced logistics management, and technology-enabled platforms that simplify vehicle booking and utilization tracking. The ability to provide customized rental packages, including short-term leases and pay-per-use models, has attracted a diverse customer base across construction, mining, and transportation sectors.

Third-party providers have also benefited from increasing partnerships with OEMs and financing firms, enabling fleet modernization and risk mitigation. Their operational agility and focus on customer service have been critical in meeting the dynamic requirements of end-users, supporting this segment’s leadership in the market.

The heavy duty vehicle rental market is experiencing growth due to increasing demand for flexible transportation solutions across industries such as construction, logistics, and agriculture. Rental services offer cost-effective alternatives to owning expensive heavy vehicles, especially for businesses that require heavy-duty equipment for short-term projects or seasonal demands. These vehicles are essential for large-scale operations, including hauling, construction, and infrastructure development. Despite challenges like high maintenance costs and regulatory hurdles, opportunities are growing in emerging markets and through technological innovations that improve fleet management and customer service.

The primary driver of the heavy duty vehicle rental market is the growing need for cost-effective and flexible transportation solutions, particularly among small and medium-sized businesses. Owning heavy-duty vehicles requires significant capital investment, ongoing maintenance, and storage costs, which can be a financial burden for companies with limited budgets or temporary requirements. Renting heavy-duty vehicles offers businesses a more affordable alternative, allowing them to access high-quality equipment for short-term projects, seasonal demands, or fluctuating workloads. As industries like construction, logistics, and mining continue to grow, the demand for rental vehicles that can handle demanding tasks and adapt to varying needs is driving the market forward.

The tea processing machine market faces challenges related to the high initial investment required for acquiring advanced processing equipment. These machines, especially those that offer automation and precision control, require significant financial outlay. Additionally, ongoing maintenance costs for these complex machines can add to operational expenses. As the machines are often used in large-scale production, maintaining equipment performance and reducing downtime is crucial. The need for skilled personnel to operate and maintain these machines adds another layer of complexity, particularly for smaller manufacturers with limited resources. These factors can deter small-scale producers from adopting modern tea processing technologies, hindering wider market adoption.

The heavy duty vehicle rental market presents significant opportunities for growth, especially in emerging markets where infrastructure development and industrial activities are on the rise. As businesses in these regions expand, the demand for reliable and cost-effective transportation solutions continues to increase, creating a growing market for rental services. Advancements in fleet management technology, including GPS tracking, telematics, and predictive maintenance, present opportunities to improve operational efficiency, reduce costs, and enhance customer satisfaction. By leveraging these technologies, rental companies can offer more flexible, transparent, and efficient services, attracting new customers and increasing market share in competitive environments.

A notable trend in the heavy duty vehicle rental market is the growing adoption of technology to improve fleet management, reduce operational costs, and enhance customer experience. Telematics systems and GPS tracking are being widely used to monitor vehicle performance, optimize routes, and schedule maintenance, increasing operational efficiency. There is a growing trend towards environmentally friendly solutions, with rental companies adopting green fleets by offering electric or hybrid heavy-duty vehicles. These vehicles are becoming more popular as industries seek to reduce their carbon footprint and comply with stricter environmental regulations. The combination of technological advancements and eco-consciousness is shaping the future of the heavy-duty vehicle rental industry.

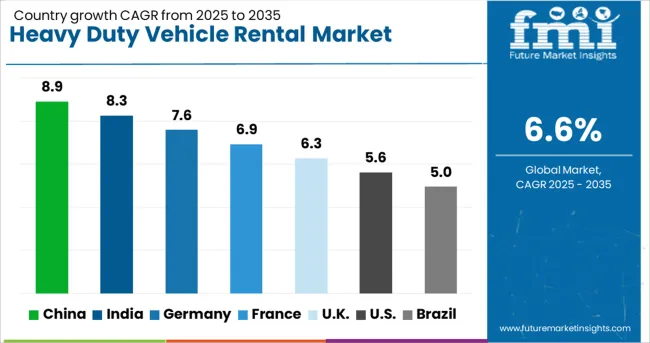

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global heavy-duty vehicle rental market is set to grow at a steady CAGR of 6.6% from 2025 to 2035. China leads the market with an impressive growth rate of 8.9%, fueled by booming infrastructure development and the increasing demand for rental solutions in the construction, mining, and logistics sectors. India follows closely with a CAGR of 8.3%, driven by similar industry growth, particularly in construction and e-commerce logistics. Germany is also witnessing strong growth at 7.6%, supported by its well-established industrial base and demand for specialized vehicles. The UK shows a moderate growth rate of 6.3%, as rental solutions continue to be adopted for large-scale infrastructure projects. The United States, with the slowest growth at 5.6%, remains a key player, though the market’s maturity and widespread fleet ownership contribute to slower expansion

China is projected to grow at a CAGR of 8.9% through 2035 in the heavy duty vehicle rental market. This growth is driven by China’s rapid industrialization, expanding transportation needs, and the increasing demand for heavy-duty vehicles in sectors like construction, mining, and logistics. The rental market is gaining traction due to the rising need for flexible fleet management solutions that reduce capital expenditure. With rapid infrastructure development and urbanization, Chinese industries are increasingly opting for rented vehicles to minimize maintenance costs and enhance operational efficiency.

India is expected to grow at a CAGR of 8.3% through 2035 in the heavy duty vehicle rental market. As the country’s infrastructure and industrial sectors grow, the demand for heavy-duty vehicles is increasing, especially in construction, mining, and logistics. Renting heavy-duty vehicles offers cost efficiency, especially for companies that only need vehicles for specific projects. India’s growing e-commerce sector also increases the demand for rental vehicles for transportation and last-mile delivery. The government’s push for infrastructure development, along with rising construction activities, is fueling demand for rented vehicles.

Germany is projected to grow at a CAGR of 7.6% through 2035 in the heavy duty vehicle rental market. The demand for rental vehicles is supported by Germany’s strong manufacturing and logistics sectors, where rented vehicles are essential for optimizing fleet management. With industries like construction, automotive, and manufacturing growing rapidly, renting heavy-duty vehicles offers flexibility, especially during periods of peak demand. Germany’s transportation and logistics companies are increasingly seeking cost-effective and fuel-efficient rental options to meet operational needs

The United Kingdom is projected to grow at a CAGR of 6.3% through 2035 in the heavy duty vehicle rental market. The UK’s construction and logistics sectors are the primary drivers for the demand for heavy-duty vehicle rentals. Rental services provide flexibility and cost efficiency, especially for companies that need temporary access to heavy-duty trucks and machinery for specific projects. The growing focus on green technologies and the need for environmentally friendly transport solutions are contributing to the growth of rental fleets with energy-efficient vehicles.

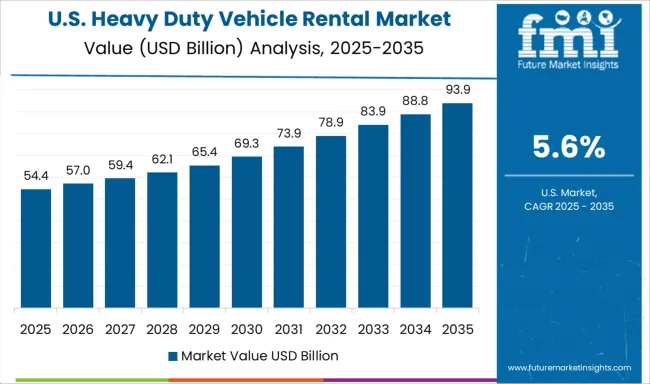

The United States is projected to grow at a CAGR of 5.6% through 2035 in the heavy duty vehicle rental market. The increasing demand for flexible and cost-effective fleet management solutions in the construction, logistics, and transportation sectors is driving the growth of the market. With the rising construction of infrastructure, the demand for rented heavy-duty vehicles has surged, particularly for specialized machinery. The logistics and transportation sectors are increasingly adopting rental fleets to meet short-term needs without the upfront costs associated with owning the vehicles. As the USA economy focuses on improving infrastructure, the need for heavy-duty vehicle rentals is set to grow.

The heavy-duty vehicle rental market is structured around a value chain that highlights where competitive power truly resides: fleet acquisition, operations, customer interface, and aftermarket services. At the upstream stage, vehicle OEMs such as Volvo, Daimler, and Caterpillar exert strong influence. Rental companies depend on their production cycles, financing terms, and technology integration. While OEMs set the baseline for fleet capabilities, they have little direct role in rentals, creating a dependency that pushes operators to negotiate aggressively for bulk purchase discounts, leasing agreements, and maintenance packages.

The midstream stage — fleet operations — is where competitive differentiation emerges. Large global rental providers focus on utilization optimization, predictive maintenance, and digital fleet management platforms. Their ability to maximize uptime and extend vehicle lifecycles determines profitability. Smaller regional firms compete with flexibility, offering niche vehicles, tailored contracts, and faster delivery for local projects. The edge here lies in balancing fleet breadth with service agility. Telematics and data-driven maintenance scheduling are increasingly decisive, shifting competition from asset volume to asset intelligence.

Customer interface represents another leverage point. Multinational construction, mining, and logistics firms demand standardized service, transparent pricing, and compliance with safety regulations. Larger rental groups capture advantage by offering cross-border consistency and bundled contracts that cover insurance, servicing, and even operator training. Regional players differentiate through personal service and adaptability, often embedding staff on-site to manage rented fleets.

| Item | Value |

|---|---|

| Quantitative Units | USD 124.4 Billion |

| Vehicle | Trucks, Buses, Trailers, and Others |

| Propulsion | Diesel, Natural gas, Electric, Hybrid electric, and Others |

| Service Provider | 3rd Party Companies and OEM |

| Rental Type | Long Term and Short Term |

| End Use | Logistics and transportation, Construction, Mining, Oil and gas, Agriculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | RyderSystem, PenskeTruckRental, EnterpriseTruckRental, U-HaulInternational, AvisBudget, HercRental, PACCAR, SixtSE, Toyota, and ScaniaRents |

| Additional Attributes | Dollar sales by vehicle type (trucks, trailers, buses, specialized vehicles) and end-use segments (logistics, transportation, construction, industrial). Demand dynamics are influenced by the growing demand for logistics and transportation services, the need for temporary fleet solutions, and increasing construction activity. Regional trends show strong growth in North America and Europe due to expanding infrastructure projects and growing e-commerce, while Asia-Pacific is seeing rising demand driven by rapid industrialization. |

The global heavy duty vehicle rental market is estimated to be valued at USD 124.4 billion in 2025.

The market size for the heavy duty vehicle rental market is projected to reach USD 235.7 billion by 2035.

The heavy duty vehicle rental market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in heavy duty vehicle rental market are trucks, buses, trailers and others.

In terms of propulsion, diesel segment to command 61.3% share in the heavy duty vehicle rental market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Heavy Duty Band Sealer Machine Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of the Heavy Duty Corrugated Packaging Market

Heavy Duty Bag and Sack Market from 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA