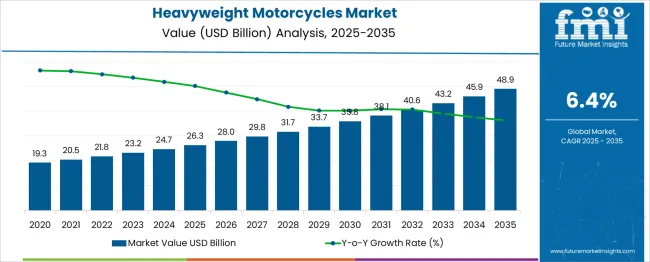

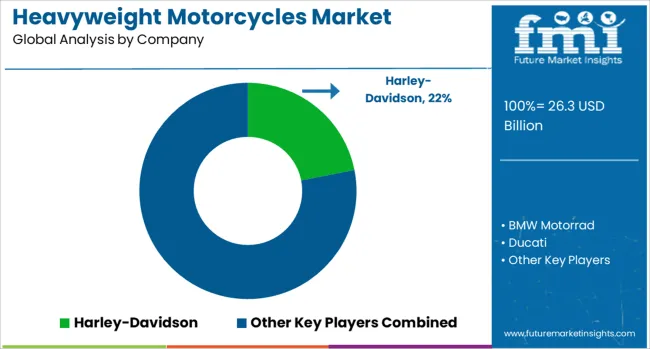

The Heavyweight Motorcycles Market is estimated to be valued at USD 26.3 billion in 2025 and is projected to reach USD 48.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Heavyweight Motorcycles Market Estimated Value in (2025 E) | USD 26.3 billion |

| Heavyweight Motorcycles Market Forecast Value in (2035 F) | USD 48.9 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The heavyweight motorcycles market is experiencing stable demand, bolstered by a loyal rider base, rising disposable incomes, and lifestyle-oriented consumer preferences. This segment appeals to enthusiasts seeking high engine performance, premium aesthetics, and long-distance touring capabilities.

Market expansion is further supported by the resurgence of motorcycling culture in developed economies and the growing presence of heavyweight models in emerging regions through targeted brand outreach. Technological upgrades such as electronic rider aids, improved safety systems, and advanced suspension setups are enhancing product value propositions.

Additionally, the trend toward customization and performance enhancement continues to drive accessory sales and aftermarket activity. The long-term outlook remains positive as consumers prioritize comfort, engine output, and brand prestige, while OEMs introduce refined engines, sustainable material integrations, and hybrid capabilities to align with evolving regulatory frameworks and environmental standards.

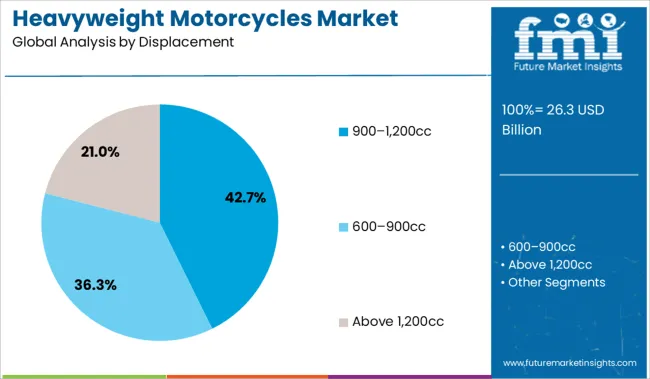

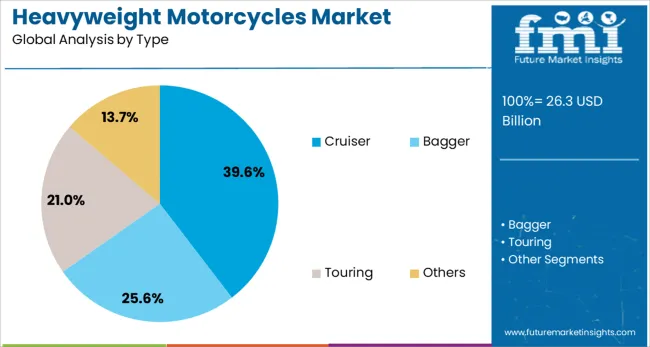

The heavyweight motorcycles market is segmented by displacement and type, and geographic regions. The heavyweight motorcycles market is divided into 900–1,200cc, 600–900cc, and above 1,200cc. In terms of the type of the heavyweight motorcycles market, it is classified into Cruiser, Bagger, Touring, and Others. Regionally, the heavyweight motorcycles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 900–1,200cc segment accounts for 42.7% of the heavyweight motorcycles market, marking it as the preferred engine displacement range among riders seeking a balance between power, maneuverability, and ride comfort. This displacement bracket offers sufficient torque for both urban commuting and highway cruising, making it highly versatile across rider profiles.

The segment has gained traction through competitive offerings from established brands that emphasize reliability, fuel efficiency, and affordability without compromising on performance. Manufacturers are also leveraging this range to target new entrants into the heavyweight category who seek manageable handling characteristics.

Product availability across standard, sport, and touring formats has further enhanced market penetration. As OEMs integrate modern features such as ride modes, infotainment, and emissions compliance technologies within this displacement range, its appeal is expected to persist among both seasoned and aspiring riders.

Cruisers lead the heavyweight motorcycle market by type with a 39.6% share, driven by their iconic design, low-end torque, and comfortable long-distance riding ergonomics. This segment continues to resonate with mature consumers and touring enthusiasts who value relaxed riding positions and custom styling.

Market growth is influenced by strong brand loyalty, heritage-inspired model lineups, and the consistent demand for motorcycles that embody a classic aesthetic with modern performance features. Manufacturers have responded by offering advanced rider assistance systems, infotainment dashboards, and improved chassis dynamics while maintaining the core identity of cruiser models.

The segment’s prominence is further reinforced by a thriving customization culture, where riders invest in aftermarket upgrades for personalization and performance tuning. As lifestyle marketing and experiential ownership programs expand, the cruiser segment is expected to retain its leadership through sustained consumer engagement and product innovation tailored to the touring and leisure riding community.

Demand for heavyweight motorcycles is rising as tour riding and premium performance models gain traction. Sales of high-displacement cruisers and electric heavyweight bikes are growing in North America and Europe. Growth is supported by rising interest in adventure riding and customization trends, especially in mid-size and upper displacement classes.

Demand for heavyweight motorcycles with advanced touring capabilities surged in 2025, especially among riders seeking comfort for cross-country and leisure travel. Models in the 900 to 1200 cc range now represent over half of total segment volume. Riders prioritize extended fuel range, ergonomic seating, and built-in luggage capacity. Adventure-cruiser designs with trunk and pannier setups are enabling versatile deployment across varied terrains and long-distance routes. OEMs are responding by offering integrated ride modes and longer wheelbases to support multi-day performance riding styles.

Sales of premium heavyweight motorcycles saw strong growth in 2025, driven by lifestyle buyers and expanding electric options. Customizable and limited-edition variants featuring smart connectivity, traction control, and advanced styling are capturing a larger share of unit revenue. Electric heavyweight bikes with equivalent 900 cc output offer silent torque and urban-friendly dynamics, appealing to eco-conscious commuters and urban riding clubs. Dealerships report longer resale cycles and greater aftermarket demand for high-spec models. As electric variants become more widely available, they are contributing more to overall heavyweight sales while strengthening premium positioning and meeting emissions requirements.

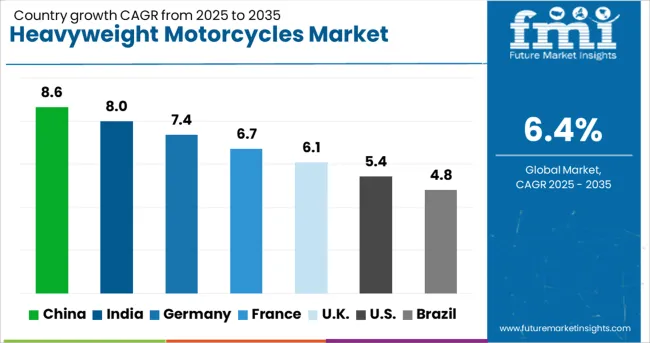

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

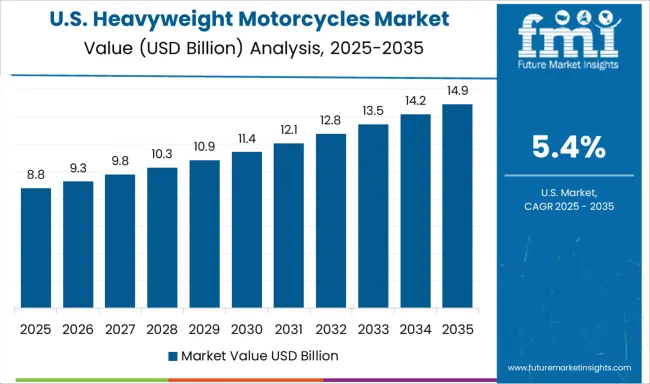

| USA | 5.4% |

| Brazil | 4.8% |

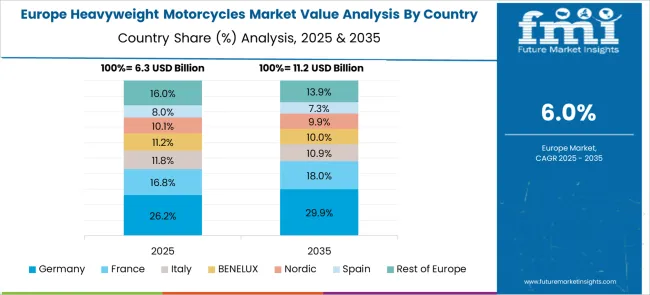

The global market is projected to grow at a CAGR of 6.4% between 2025 and 2035. Key growth drivers include rising demand for premium models, expanding motorcycle tourism, and increasing discretionary incomes in emerging economies. China leads with a forecast CAGR of 8.6%, backed by a surge in luxury motorcycle imports, rider community expansion, and domestic brand upgrades. India follows at 8.0%, supported by improving road networks and the aspirational rise of cruiser and touring bike demand.

Germany is projected at 7.4%, with strong interest in adventure and electric heavyweight models. The United Kingdom is expected to grow at 6.1%, fueled by mid-displacement sales and advanced safety features. In the United States, growth will average 5.4%, with demand shifting toward tech-enabled touring and electric variants. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 8.6% CAGR, driven by a surge in luxury motorcycle imports and the rapid expansion of rider communities in metropolitan cities. Demand for heavyweight cruisers, sport-tourers, and premium adventure bikes is increasing as rising disposable income supports lifestyle-oriented purchases. Domestic manufacturers are upgrading portfolios with advanced electronics, connected features, and Euro-5-compliant engines to compete with global brands. Government policies in Tier 1 cities now allow registered heavyweight motorcycles in select urban zones, improving accessibility. Digital retail platforms and rider clubs are influencing purchase decisions, while financing solutions make premium models more affordable..

India is forecast to grow at a 8.0% CAGR, supported by aspirational demand for cruisers and touring bikes. Expanding highway networks and state-led tourism initiatives have boosted long-distance riding culture. Global brands such as Harley-Davidson and Triumph are partnering with local firms for CKD (Completely Knocked Down) assembly to reduce pricing. Domestic OEMs like Royal Enfield are introducing advanced 650cc and 750cc models to strengthen their presence in mid-displacement touring. The emergence of premium motorcycle financing, combined with improved aftersales infrastructure, is broadening market reach. Growing adoption of electric heavyweight prototypes is notable in Tier 1 cities.

Germany is expected to grow at a 7.4% CAGR, fueled by strong consumer preference for adventure-touring and electric heavyweight motorcycles. Premium brands like BMW Motorrad dominate, leveraging advanced safety systems, connectivity features, and integrated navigation tools. Incentives under EU emission standards are pushing the adoption of zero-emission motorcycles, particularly in urban mobility programs. Adventure bikes designed for cross-border touring and rugged terrains remain a key segment for domestic and international riders. German engineering capabilities drive continuous innovation in ABS, traction control, and adaptive cruise systems. Demand from luxury rental services is also rising, creating additional growth channels.

The United Kingdom is projected to grow at a 6.1% CAGR, driven by increasing adoption of mid-displacement and tech-enabled heavyweight bikes. Rising popularity of advanced safety features such as blind-spot monitoring and adaptive headlights has elevated premium touring demand. Urban buyers are showing interest in electric cruisers, supported by low-emission zones and tax benefits for zero-emission vehicles. The growth of online motorcycle sales platforms, coupled with OEM-backed financing schemes, is improving accessibility to high-value models. Riding schools and experiential marketing programs are enhancing awareness of premium segments among younger consumers, boosting adoption rates in regional markets.

The United States is expected to grow at a 5.4% CAGR, with demand shifting toward touring motorcycles equipped with connectivity and rider-assist technologies. Brands like Harley-Davidson are introducing electric heavyweight models under aggressive electrification strategies. Rising interest in adventure touring motorcycles is creating demand among younger demographics seeking versatile performance. OEMs are focusing on advanced infotainment, adaptive suspension systems, and high-efficiency engines to retain leadership in the heavyweight segment. Expansion of dealership networks and subscription-based motorcycle ownership models is improving customer accessibility. Long-distance riding events and motorcycle tourism continue to reinforce demand for premium touring variants.

Harley-Davidson remains the global leader with a significant market share in 2025, backed by strong USA brand loyalty and the expansion of its LiveWire electric lineup. BMW Motorrad continues to grow in North America and Europe through its adventure-touring models such as the R 1250 GS. Ducati is gaining ground in the premium performance space with new launches focused on Asia-Pacific and race-derived technology. Eicher Motors, via Royal Enfield, is expanding its international footprint with 650cc and 750cc bikes in the UK and Southeast Asia. Honda, Yamaha, and Suzuki maintain competitive positions through their diversified cruiser and sport-touring portfolios. Kawasaki and Polaris are focusing on tech-forward models, while Sena Technologies supplies aftermarket communication systems tailored to heavyweight users.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.3 Billion |

| Displacement | 900–1,200cc, 600–900cc, and Above 1,200cc |

| Type | Cruiser, Bagger, Touring, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Harley-Davidson, BMW Motorrad, Ducati, Eicher Motors, Honda Motor, Kawasaki Motors, Polaris, Sena Technologies, Suzuki Motor, and Yamaha Motor |

| Additional Attributes | Dollar sales by engine-displacement (600‑900cc, 1001‑1600cc, above 1600cc) and motorcycle type (cruiser, touring, adventure/ADV), demand dynamics across tourism, premium lifestyle, and customization segments, regional leadership in Asia‑Pacific and North America, innovation in semi‑automatic transmissions, ADAS, connectivity and lightweight materials, and environmental impact from emissions compliance and electrification trends. |

The global heavyweight motorcycles market is estimated to be valued at USD 26.3 billion in 2025.

The market size for the heavyweight motorcycles market is projected to reach USD 48.9 billion by 2035.

The heavyweight motorcycles market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in heavyweight motorcycles market are 900–1,200cc, 600–900cc and above 1,200cc.

In terms of type, cruiser segment to command 39.6% share in the heavyweight motorcycles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Motorcycles And Scooters Market Size and Share Forecast Outlook 2025 to 2035

Conventional Motorcycles & Scooters Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA