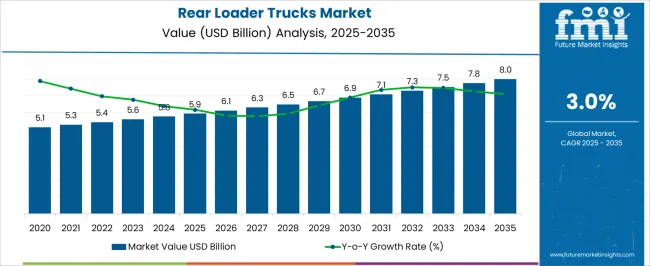

The rear loader trucks market is estimated to be valued at USD 5.9 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

The global rear loader trucks market is projected to increase from 5.9 USD billion in 2025 to 8.0 USD billion by 2035, recording a CAGR of 3.0%. Examination of the growth rate volatility index indicates a low to moderate fluctuation in annual growth rates, suggesting a market characterized by steady demand with minor variations caused by regulatory changes, fuel price shifts, and fleet replacement cycles. During the early forecast period, from 2025 to 2028, incremental gains are modest, reflecting cautious investment in municipal and commercial waste management fleets, as well as gradual adoption of efficiency-focused rear loader models.

Mid-period trends from 2029 to 2032 show slightly higher growth, influenced by technological improvements such as automation, hydraulic efficiency, and compliance with emissions standards, which encourage fleet modernization. Minor deceleration is observed in 2033–2034 due to market saturation in mature regions and extended service life of existing vehicles, yet demand remains resilient as urban waste management requirements expand. By 2035, market growth stabilizes, supported by infrastructure development, emerging market fleet expansions, and public-private partnerships aimed at improving collection efficiency. The yearly increments from 5.9 USD billion to 8.0 USD billion demonstrate a relatively stable trajectory, with limited volatility in growth rates, highlighting that rear loader trucks remain essential for efficient solid waste management solutions.

| Metric | Value |

|---|---|

| Rear Loader Trucks Market Estimated Value in (2025 E) | USD 5.9 billion |

| Rear Loader Trucks Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The rear loader trucks market is strongly influenced by interrelated parent segments, each contributing uniquely to overall demand and growth. The waste collection sector holds the largest share at 44%, as municipalities and private service providers increasingly rely on manual-loading vehicles to manage residential and urban waste efficiently. The construction and demolition (C&D) sector contributes 25%, with rear loader trucks essential for transporting debris and materials from construction sites to disposal or recycling facilities.

The street cleaning segment accounts for 15%, where these trucks support the maintenance of clean roadways, public spaces, and commercial areas. The recycling sector holds 10%, driven by the collection and transport of recyclable materials in urban environments, enhancing circular economy initiatives. Finally, the municipal services segment represents 5%, encompassing diverse public sector applications that require reliable and durable waste collection solutions. Collectively, waste collection, C&D, and street cleaning sectors account for 84% of overall demand, highlighting that urban sanitation, infrastructure development, and public cleanliness remain the primary growth drivers, while recycling and municipal services provide steady, complementary demand across regions globally.

The rear loader trucks market is witnessing significant growth due to increasing demand for efficient waste collection and transportation solutions across urban, municipal, and industrial environments. Rising urbanization and the expansion of smart city initiatives are driving investments in modern waste management infrastructure, which favors trucks with enhanced operational efficiency and adaptability. Growing focus on reducing fuel consumption, improving fleet productivity, and complying with stricter emission and safety standards is shaping the market landscape.

Technological advancements in truck automation, telematics, and real-time monitoring systems are further enhancing performance, reliability, and cost efficiency. The integration of advanced drivetrains and high-capacity loading mechanisms is enabling operators to handle larger volumes while maintaining fuel efficiency.

As municipalities and private waste management companies seek solutions that optimize operational costs and service coverage, rear loader trucks are increasingly preferred due to their versatility, compact maneuverability in urban areas, and compatibility with emerging waste management strategies The market is expected to maintain strong growth as environmental regulations tighten and fleet modernization becomes a strategic priority globally.

The rear loader trucks market is segmented by fuel, technology, capacity, end-user industry, and geographic regions. By fuel, rear loader trucks market is divided into diesel, electric, and gasoline. In terms of technology, rear loader trucks market is classified into automatic, manual, and semi-automatic. Based on capacity, rear loader trucks market is segmented into 10-20 tons, below 10 tons, and above 20 tons. By end-user industry, rear loader trucks market is segmented into municipal corporations, private waste management companies, construction companies, recycling companies, and others. Regionally, the rear loader trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

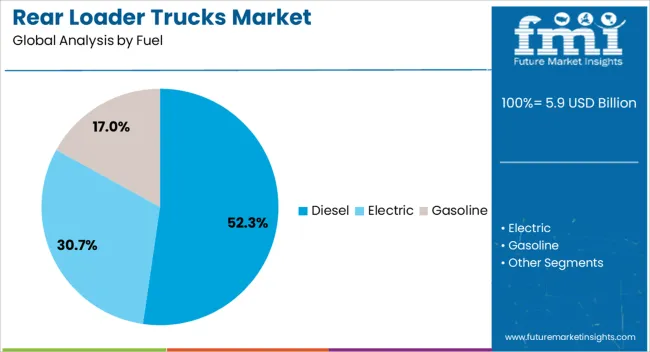

The diesel fuel segment is projected to account for 52.3% of the rear loader trucks market revenue share in 2025, making it the leading fuel type. Diesel engines are being preferred due to their superior torque, durability, and fuel efficiency in heavy-duty applications, particularly in waste collection scenarios that involve frequent stop-start cycles and variable load conditions.

The widespread availability of diesel fuel and the established refueling infrastructure further support the dominance of this segment. Diesel-powered rear loader trucks are being chosen for their reliability under high operational stress and ability to sustain extended routes without frequent refueling.

Improvements in engine technologies, such as low-emission diesel engines compliant with stringent environmental regulations, are enhancing performance while reducing carbon footprint The combination of cost efficiency, operational reliability, and adherence to regulatory standards is reinforcing diesel as the fuel of choice, maintaining its leading position in the rear loader trucks market.

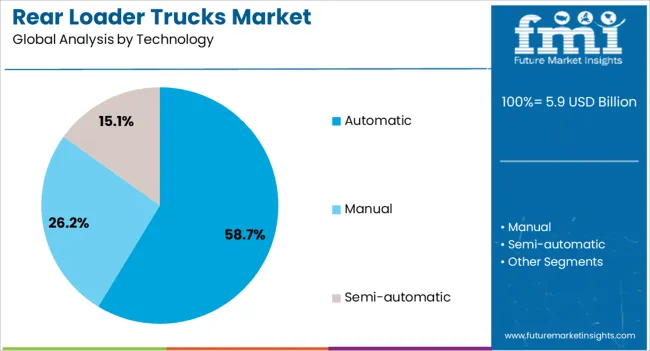

The automatic transmission segment is expected to capture 58.7% of the rear loader trucks market revenue share in 2025, establishing it as the dominant technology category. The growth of this segment is being driven by operational efficiency, reduced driver fatigue, and improved fuel optimization offered by automatic drivetrains in stop-and-go urban waste collection operations.

Automatic transmissions allow smoother gear shifts, enabling drivers to focus on safety and maneuverability in congested streets while minimizing mechanical wear and maintenance costs. The adoption of automatic technology is further reinforced by fleet operators’ preference for vehicles that enhance productivity and reduce long-term operational costs.

In addition, advancements in automated transmission systems have improved reliability and performance, making them compatible with heavy loads and challenging operational conditions These benefits are driving widespread integration in rear loader trucks, positioning automatic technology as the leading choice among municipalities and private waste management companies seeking efficiency, safety, and ease of operation.

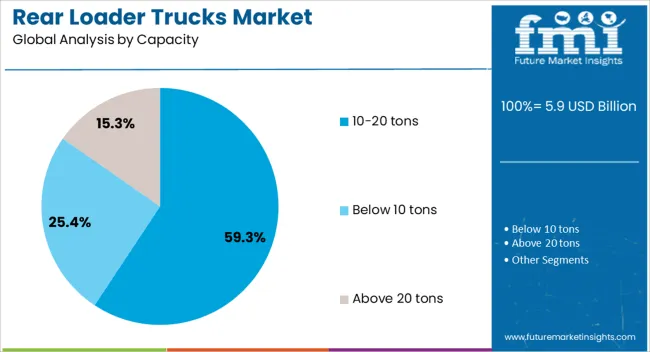

The 10-20 tons capacity segment is anticipated to hold 59.3% of the rear loader trucks market revenue share in 2025, making it the leading capacity category. This dominance is being driven by the balance it provides between maneuverability, payload efficiency, and operational versatility. Trucks within this capacity range are suitable for urban and suburban waste collection, offering sufficient load volume to minimize trips while remaining compact enough for narrow streets and restricted-access areas.

Fleet operators prefer this segment because it optimizes fuel consumption and reduces wear and tear compared to larger trucks while handling substantial waste loads efficiently. Increasing urban population density and rising commercial waste generation are further strengthening demand for medium-capacity vehicles.

The availability of high-performance engines, advanced suspension systems, and durable chassis designs within this capacity category enhances operational reliability and reduces downtime These factors collectively contribute to the sustained growth and leadership of the 10-20 tons capacity segment in the rear loader trucks market.

The rear loader trucks market is growing steadily due to the rising need for efficient and safe waste collection solutions. Regulatory compliance, emission standards, and government incentives drive adoption of modern, eco-friendly trucks. Technological advancements in hydraulics, automation, and vehicle monitoring enhance operational efficiency, reliability, and safety. Expansion in urban infrastructure, residential development, and industrial areas further supports demand. Manufacturers are focusing on durable, high-capacity, and low-maintenance trucks to meet evolving municipal and commercial requirement

The rear loader trucks market is experiencing growth due to increasing demand for efficient municipal solid waste collection solutions. Urban municipalities, private waste management companies, and commercial establishments are adopting these trucks to enhance operational efficiency and safety. Rear loader trucks are favored for their ability to handle diverse waste types, including residential, commercial, and industrial refuse. Features such as automated lifting systems, compact designs, and high payload capacity improve collection speed and reduce labor costs. Growing awareness about proper waste disposal, sanitation, and hygiene standards in cities is driving investments in modern fleet upgrades, particularly in regions with expanding urban populations and waste generation.

Market growth is shaped by stringent environmental regulations, emission norms, and safety standards. Municipal authorities and waste management companies must comply with local and national guidelines regarding vehicle emissions, noise levels, and hydraulic system safety. Compliance ensures lower environmental impact, reduced fuel consumption, and adherence to occupational safety standards. Government initiatives promoting eco-friendly waste collection vehicles and fleet modernization programs support adoption of rear loader trucks with cleaner engines and advanced compaction systems. Regulatory pressure encourages manufacturers to integrate fuel-efficient, low-emission powertrains and durable components to meet performance, reliability, and sustainability requirements.

Technological improvements in hydraulics, automation, and vehicle design are key drivers for market expansion. Rear loader trucks increasingly feature automated loading systems, GPS-enabled route optimization, telematics for fleet monitoring, and enhanced safety mechanisms for operators. Innovations in chassis design and compact body configurations allow operation in narrow streets and densely populated areas. Payload optimization, corrosion-resistant materials, and low-maintenance components reduce operational costs. Manufacturers are focusing on reliability, durability, and ease of maintenance to ensure consistent performance in high-volume collection scenarios. These advancements increase productivity, reduce downtime, and improve overall operational efficiency for waste management companies.

The market is fueled by ongoing urban development, industrial growth, and public infrastructure investments. Municipal authorities and private contractors are modernizing waste management fleets to address rising waste volumes and improve city cleanliness. Expansion of residential complexes, commercial centers, and industrial zones drives the need for rear loader trucks with high capacity and efficient compaction systems. Public-private partnerships and government contracts for city sanitation projects are creating stable demand. Investment in fleet upgrades and replacement programs ensures adoption of advanced trucks, enabling municipalities to meet evolving waste management and public health requirements effectively.

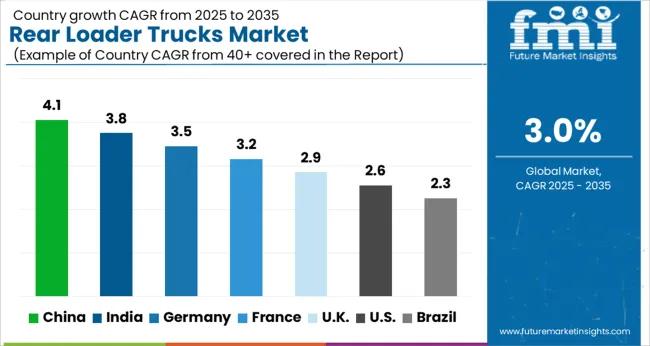

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| U.K. | 2.9% |

| U.S. | 2.6% |

| Brazil | 2.3% |

The global rear loader trucks market is projected to grow at a CAGR of 3.0% from 2025 to 2035. China leads expansion at 4.1%, followed by India at 3.8%, Germany at 3.5%, the U.K. at 2.9%, and the U.S. at 2.6%. Growth is supported by rising urban waste management requirements, increasing municipal fleet modernization, and stricter environmental regulations targeting efficient waste collection. China and India are driving production and adoption due to expanding urban populations and infrastructure development, while Germany, the U.K., and the U.S. emphasize high-efficiency, low-emission vehicles and advanced hydraulic and compaction technologies for optimized operations. The analysis covers over 40 countries, with the leading markets detailed below.

The rear loader trucks market in China is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by expanding urban sanitation infrastructure and government initiatives to modernize waste collection fleets. Municipalities are increasingly investing in high-capacity, fuel-efficient rear loader trucks to optimize collection routes, reduce operational costs, and comply with stricter emission regulations. Innovations in hydraulic systems, automated loading mechanisms, and telematics are enhancing operational efficiency, reliability, and safety. Domestic truck manufacturers are collaborating with global suppliers to integrate advanced control systems and durable body designs. The growing emphasis on sustainable waste management practices and smart city projects is further encouraging fleet upgrades and adoption across municipal and commercial waste collection services.

The rear loader trucks market in India is expected to grow at a CAGR of 3.8% from 2025 to 2035, driven by urbanization, increased municipal solid waste generation, and government mandates for improved waste management. High-capacity, rear loader trucks are increasingly adopted for residential, commercial, and industrial waste collection. Manufacturers are offering vehicles with fuel-efficient engines, hydraulic automation, and GPS-enabled telematics for route optimization and operational tracking. Investment in solid waste management infrastructure, smart city initiatives, and waste-to-energy projects is supporting market growth. Local manufacturers are collaborating with international technology providers to enhance product quality, meet emission norms, and improve vehicle lifecycle performance.

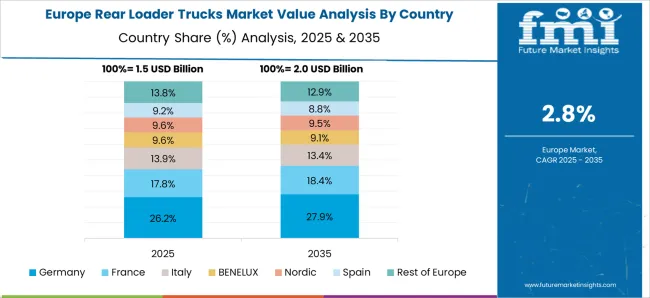

Germany’s rear loader trucks market is projected to grow at a CAGR of 3.5% from 2025 to 2035, supported by stringent environmental regulations and demand for energy-efficient, low-emission waste collection vehicles. Municipalities and private waste management companies are investing in trucks with hybrid or electric powertrains, automated loading systems, and durable chassis designs. Technological innovations in telematics, route optimization software, and hydraulic efficiency are enhancing operational productivity while reducing emissions. Collaborations between German manufacturers and international suppliers allow integration of advanced safety systems, lightweight materials, and compliance with EU standards. The market is also driven by modernization projects in urban centers and increasing adoption of sustainable waste management practices.

The rear loader trucks market in the UK is expected to grow at a CAGR of 2.9% from 2025 to 2035, influenced by increasing municipal solid waste collection demands and sustainability initiatives. Public and private waste management operators are deploying rear loader trucks with automated loading systems, telematics for route optimization, and hybrid or electric powertrains. Replacement of aging fleets and government subsidies for low-emission vehicles are boosting adoption. Manufacturers are developing durable chassis designs, noise reduction solutions, and operator-friendly cabins to meet urban operational requirements. Partnerships with local authorities and technology providers are ensuring adherence to regulatory and safety standards, while smart city programs drive modernization of waste management infrastructure.

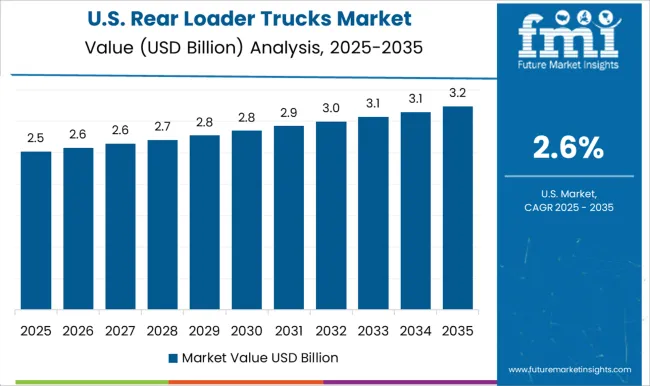

The U.S. rear loader trucks market is projected to grow at a CAGR of 2.6% from 2025 to 2035, shaped by modernization of municipal waste management fleets and adoption of environmentally friendly vehicles. Increasing regulations on emissions and waste collection efficiency are promoting the use of hybrid and electric rear loader trucks equipped with advanced hydraulic systems and automated loading mechanisms. Manufacturers are introducing trucks with telematics, route optimization software, and enhanced safety features to reduce operational costs and improve reliability. Investments in infrastructure for residential and commercial waste collection, along with partnerships between domestic OEMs and international technology providers, are driving market penetration and fleet upgrades.

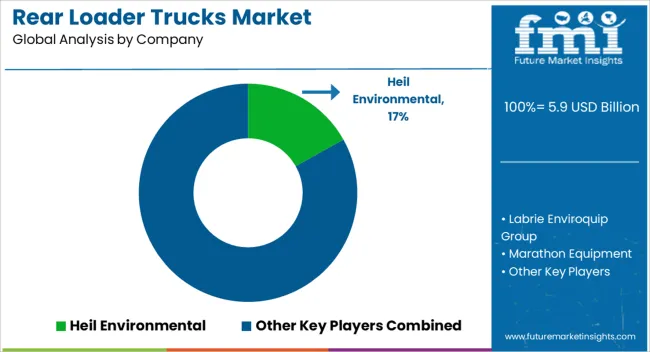

Competition in the rear loader trucks market is shaped by payload capacity, durability, and operational efficiency. Leading manufacturers such as Heil Environmental Industries, McNeilus Truck and Manufacturing, and Labrie Environmental Group offer a range of rear loader trucks designed for both residential and commercial waste collection. These trucks emphasize features like high compaction ratios, ease of maintenance, and adaptability to various waste types. For instance, Heil's DuraPack® 5000 and McNeilus' Rear Loader models are known for their robust build and efficient waste handling capabilities. Regional players also contribute to the market by offering specialized solutions tailored to local needs.

In North America, companies like Amrep and New Way Trucks provide rear loader trucks that cater to both urban and rural waste collection requirements. These trucks often feature customizable options to meet specific municipal regulations and operational demands. Strategies in the market focus on enhancing fuel efficiency, integrating advanced technologies for route optimization, and improving driver ergonomics. Manufacturers are increasingly adopting alternative fuel options, such as compressed natural gas (CNG) and electric-powered systems, to meet environmental standards and reduce operational costs.

Additionally, the integration of telematics and GPS systems allows for real-time monitoring and efficient fleet management. Product brochures typically highlight specifications on payload capacity, compaction force, hopper size, and compatibility with various waste containers. Safety features, such as backup cameras, automated arm systems, and ergonomic controls, are also emphasized to ensure operator safety and ease of use.

| Items | Values |

|---|---|

| Quantitative Units | USD 5.9 billion |

| Fuel | Diesel, Electric, and Gasoline |

| Technology | Automatic, Manual, and Semi-automatic |

| Capacity | 10-20 tons, Below 10 tons, and Above 20 tons |

| End-User Industry | Municipal corporations, Private waste management companies, Construction companies, Recycling companies, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Heil Environmental, Labrie Enviroquip Group, Marathon Equipment, McNeilus Truck & Manufacturing, New Way Trucks, Petersen Industries, Precision Truck Bodies, Scrapper Industries, Thrust Products, and Wastequip |

| Additional Attributes | Dollar sales by truck capacity and fuel type, share by application (municipal, commercial, industrial) and region, growth trends, emission regulations, operational efficiency, emerging technologies, and competitive positioning. |

The global rear loader trucks market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the rear loader trucks market is projected to reach USD 8.0 billion by 2035.

The rear loader trucks market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in rear loader trucks market are diesel, electric and gasoline.

In terms of technology, automatic segment to command 58.7% share in the rear loader trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rear Spoiler Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Firearm Lubricants Market Demand & Growth 2025 to 2035

Automotive Rear Cross Traffic Alert Market Size and Share Forecast Outlook 2025 to 2035

Automotive Rear Seat Reinforcement Market Growth – Trends & Forecast 2024-2034

Automotive Rear View Mirror Market

Automotive Front and Rear Phygital Shield Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electrochromic Rearview Modules Market Size and Share Forecast Outlook 2025 to 2035

Loader Bucket Market Size and Share Forecast Outlook 2025 to 2035

Loader Bucket Attachments Market Size and Share Forecast Outlook 2025 to 2035

Tray Loader Market

Side Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Train Loaders Market Size and Share Forecast Outlook 2025 to 2035

Hopper Loader Market

Global Loaders Market

Compact Loader Market Size and Share Forecast Outlook 2025 to 2035

Railcar Unloader Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA