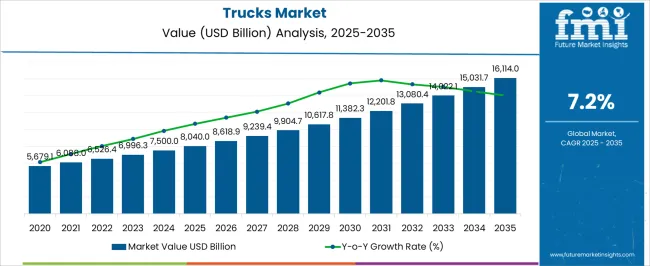

The global trucks market is expected to grow from USD 8,040.0 billion in 2025 to USD 16,114.0 billion by 2035, registering a 7.2% CAGR and generating an absolute dollar opportunity of USD 8,074.0 billion. Growth is driven by expanding logistics, rising industrial activity, and increasing demand for commercial vehicles across freight transport, construction, and mining sectors. Technological advancements, including fuel-efficient engines, electric and hybrid trucks, and smart fleet management systems, enhance operational efficiency and appeal to environmentally conscious markets, supporting adoption globally.

Elasticity of growth versus macroeconomic indicators highlights how the trucks market responds to changes in economic activity, trade volumes, and industrial output. During periods of economic expansion, demand for transportation and logistics increases, directly boosting truck sales in North America, Europe, and the Asia Pacific.

During slowdowns or recessions, industrial production and freight demand decline, temporarily moderating growth. Fuel price fluctuations, trade regulations, and infrastructure investments also influence market elasticity, as variations in operational costs or import-export policies affect purchasing decisions. The USD 8,074.0 billion opportunity illustrates the market’s sensitivity to macroeconomic conditions, showing accelerated growth in regions with strong industrial output and trade activity, while moderating in areas affected by economic uncertainty. Overall, the market demonstrates strong responsiveness to regional and global economic cycles, with technological adoption and infrastructure development acting as stabilizing factors, ensuring long-term expansion between 2025 and 2035.

| Metric | Value |

|---|---|

| Trucks Market Estimated Value in (2025 E) | USD 8040.0 billion |

| Trucks Market Forecast Value in (2035 F) | USD 16114.0 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The trucks market is primarily driven by the freight and logistics sector, which accounts for around 42% of the market share, as transportation of goods over long and short distances relies heavily on heavy-duty and medium-duty trucks. The construction and infrastructure segment contributes about 26%, deploying dump trucks, mixers, and flatbeds for material transport, site logistics, and project execution. The e-commerce and retail distribution sector represents close to 16%, using light- and medium-duty trucks for last-mile delivery and regional transportation.

The agriculture and forestry segment accounts for roughly 10%, where trucks are utilized for crop, timber, and equipment movement. The remaining 6% comes from specialized vehicles for mining, defense, and utility services requiring tailored truck designs and enhanced payload capabilities. The market is evolving with innovations in fuel efficiency, electrification, and connected technologies.

Electric and hybrid trucks are gaining traction to reduce emissions and meet regulatory standards in urban and long-haul transport. Advanced telematics, GPS fleet tracking, and driver assistance systems are improving safety, route optimization, and operational efficiency. Lightweight materials, aerodynamic designs, and modular chassis configurations are being adopted to enhance payload and reduce fuel consumption. Strategic collaborations between truck manufacturers, fleet operators, and technology providers are expanding deployment. Rising demand for efficient logistics, urban deliveries, and sustainable transportation continues to drive global truck market growth.

The trucks market is undergoing a dynamic shift as manufacturers and fleet operators respond to evolving regulatory, environmental, and logistical demands. A growing emphasis on fleet modernization and efficiency, combined with increased freight movement across urban and intercity networks, has reinforced demand for diverse truck classes and propulsion technologies.

The rising need for last-mile delivery solutions, infrastructure expansion, and construction activities across developed and developing regions further contribute to market expansion. Gasoline and alternative fuel trucks are gaining momentum in specific classes due to their lower upfront costs and easier maintenance profiles compared to diesel alternatives.

In the years ahead, demand for technologically enhanced and emission-compliant vehicles is expected to rise, supported by policy incentives and a gradual shift toward fleet electrification. The market’s future trajectory will be shaped by regulatory developments, cost optimization strategies, and the push for more sustainable freight mobility

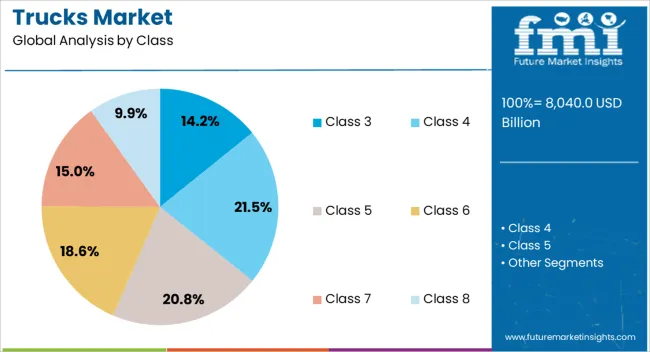

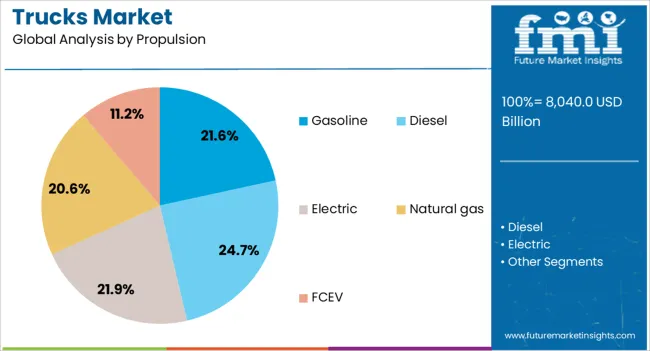

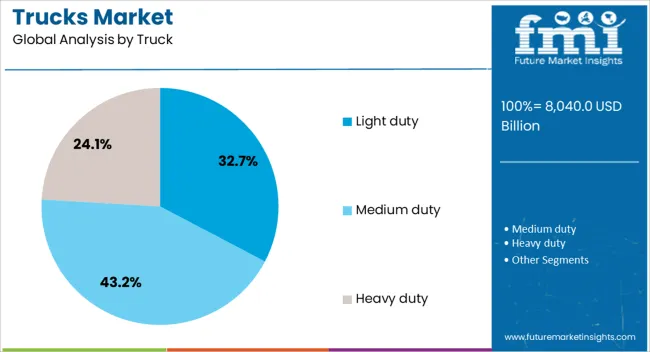

The trucks market is segmented by class, propulsion, truck, application, and geographic regions. By class, trucks market is divided into Class 3, Class 4, Class 5, Class 6, Class 7, and Class 8. In terms of propulsion, trucks market is classified into Gasoline, Diesel, Electric, Natural gas, and FCEV. Based on truck, trucks market is segmented into Light duty, Medium duty, and Heavy duty. By application, trucks market is segmented into Logistics & transportation, Construction & infrastructure, Retail & e-commerce, Mining, and Others. Regionally, the trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Class 3 truck segment holds a 14% market share, driven by its critical role in bridging the gap between light commercial vehicles and heavier-duty fleets. These trucks are widely used for utility, service, and delivery applications where payload flexibility and maneuverability are essential.

The segment’s growth is supported by expanding demand in industries such as telecommunications, maintenance services, and small-scale logistics, which require vehicles capable of handling moderate loads with urban navigation efficiency. Class 3 trucks are also benefiting from an increase in upfitting options and body styles, allowing operators to customize vehicles for specific business functions.

Regulatory developments related to emissions and fleet compliance are prompting the adoption of newer, more efficient Class 3 models. Continued investment in chassis advancements and cab ergonomics is expected to enhance vehicle performance and driver comfort, sustaining demand in this versatile truck category

The gasoline propulsion segment accounts for 22% of the trucks market, reflecting its continued relevance in lighter classes where operating ranges and cost efficiencies align well with gasoline engine characteristics. Gasoline trucks are preferred in applications requiring lower initial investment, reduced engine weight, and ease of refueling.

This segment is particularly prominent in urban and suburban environments where shorter routes and frequent stops are common, making gasoline engines a practical choice. Advancements in fuel efficiency and emissions control technologies have extended the viability of gasoline propulsion, even as stricter environmental standards are introduced.

The ongoing development of hybrid gasoline systems is also enhancing the segment’s competitiveness. As cost-sensitive fleet operators seek a balance between performance and capital expenditure, gasoline-powered trucks are expected to retain a steady share in select regional and application-specific markets

The light duty truck segment leads with a 33% market share, driven by its extensive application in last-mile delivery, e-commerce logistics, municipal services, and personal transport. These vehicles offer optimal fuel efficiency, lower total cost of ownership, and easier handling in congested urban environments.

The growth of online retail and the demand for flexible delivery options have significantly boosted the need for compact and agile trucks, making light duty models the preferred choice among logistics providers and SMEs. Additionally, government initiatives supporting urban freight mobility and small business operations are aiding segment expansion.

Continuous improvements in payload capacity, engine performance, and digital integration features have elevated the functionality of these trucks. With rising interest in electrification and autonomous delivery platforms, the light duty segment is expected to see further innovation, solidifying its lead in addressing short-haul and urban transport demands

The global trucks market is expanding due to increasing demand for commercial transportation, logistics, construction, and mining applications. Heavy-duty and medium-duty trucks dominate fleet composition, while light-duty trucks grow in urban delivery and e-commerce logistics. Asia Pacific accounts for over 40% of global sales driven by industrialization, infrastructure expansion, and rising logistics demand. North America and Europe focus on advanced emission-compliant, fuel-efficient, and electric trucks. Technological innovations in telematics, autonomous driving, and hybrid propulsion are accelerating market adoption. Rising last-mile delivery, e-commerce expansion, and government incentives for cleaner vehicles further support growth.

The primary driver for the trucks market is the growing need for freight and goods transportation across industrial and commercial sectors. Heavy-duty trucks with payload capacities of 20–40 tons are essential for long-haul logistics in mining, construction, and manufacturing. Medium-duty trucks dominate regional transportation for retail, food, and beverage supply chains. Increasing e-commerce demand globally is driving adoption of light-duty trucks for last-mile delivery. Technological improvements in fuel efficiency, safety systems, and telematics reduce operating costs by up to 15%. Infrastructure investments in Asia Pacific, Latin America, and Middle East enhance fleet utilization and route efficiency, supporting overall market growth in commercial and industrial sectors.

Key trends influencing the trucks market include autonomous driving technology, hybrid powertrains, and advanced telematics. Level 2 and 3 autonomous features are increasingly integrated into long-haul trucks to improve safety, reduce driver fatigue, and enhance route efficiency. Hybrid diesel-electric powertrains are gaining traction to reduce emissions and fuel consumption by 15–20%. Adoption of connected truck systems with predictive maintenance, remote diagnostics, and fleet management software improves uptime and cost-efficiency. Lightweight materials such as high-strength steel and aluminum alloys optimize payload and fuel efficiency. Urban delivery trucks with electric propulsion, modular designs, and smart load management are increasingly preferred, reflecting evolving market trends in technology-driven and sustainable transportation.

Electric and hybrid truck adoption is creating measurable opportunities in the trucks market. North America and Europe are implementing government incentives for zero-emission vehicles, encouraging fleet operators to adopt electric medium- and heavy-duty trucks. Asia Pacific, particularly China and India, is witnessing investments in electric trucks for urban logistics and port operations. Smart transportation initiatives integrating IoT, GPS tracking, and telematics enable predictive maintenance, fuel optimization, and real-time fleet monitoring. Expansion of urban last-mile delivery, cold chain logistics, and intercity freight corridors presents further opportunities. Manufacturers investing in battery capacity, fast-charging infrastructure, and lightweight chassis technologies are positioned to capture growing demand in sustainable transportation solutions.

High acquisition costs for electric and advanced diesel trucks, ranging from $70,000 to $150,000 for medium- and heavy-duty models, limit adoption in cost-sensitive regions. Volatility in fuel prices affects operational expenses for diesel and hybrid fleets. Regulatory compliance for emissions, safety, and road taxes varies across countries, creating operational challenges for international fleet operators. Maintenance complexity, limited skilled labor, and infrastructure gaps, such as charging stations for electric trucks, can reduce adoption rates. Competition from rail and inland water transport for bulk goods also impacts market penetration. Manufacturers must focus on cost-efficient, durable, and technologically advanced trucks to overcome these restraints and enable global adoption.

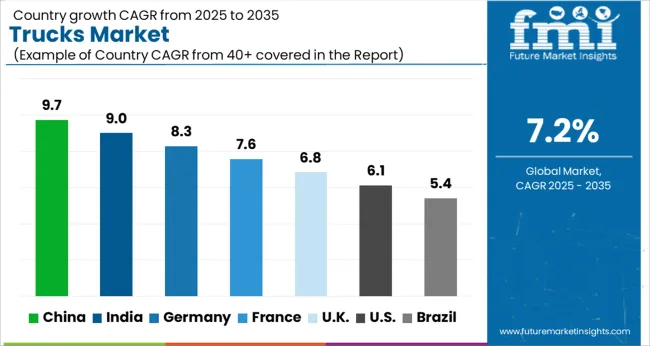

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

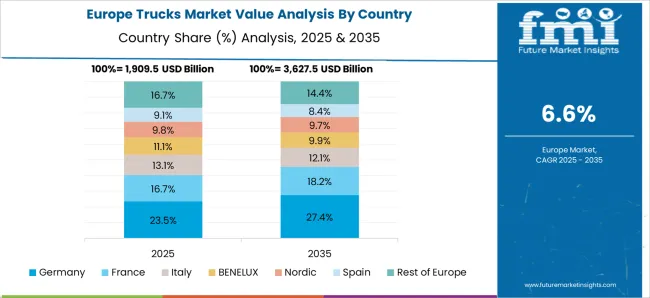

The trucks market is projected to grow at a global CAGR of 7.2% through 2035, driven by increasing logistics demand, industrial transportation needs, and urban infrastructure development. China leads at 9.7%, a 1.35× multiple over the global benchmark, supported by BRICS-driven industrial expansion, e-commerce logistics, and domestic manufacturing. India follows at 9.0%, a 1.25× multiple, reflecting growth in freight transportation, construction, and commercial vehicle adoption. Germany records 8.3%, a 1.15× multiple, shaped by OECD-backed technological innovation, fleet modernization, and efficiency-driven logistics. The United Kingdom posts 6.8%, 0.95× the global rate, with adoption centered on commercial transport and logistics solutions. The United States stands at 6.1%, 0.85× the benchmark, with steady uptake in freight transport, industrial logistics, and long-haul operations. BRICS economies drive most of the market volume, OECD countries emphasize efficiency and innovation, while ASEAN nations contribute through expanding commercial transport and logistics infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The trucks market in China is projected to grow at a CAGR of 9.7%, driven by expanding logistics networks, e-commerce growth, and infrastructure development. Leading manufacturers such as FAW Group, Dongfeng Motor, and Sinotruk are offering heavy-duty and medium-duty trucks with enhanced fuel efficiency, safety features, and advanced telematics. Adoption is concentrated in freight transport, construction, and industrial logistics. Technological trends focus on emission reduction, electric truck adoption, and integration with fleet management systems. Government policies supporting commercial transport, infrastructure expansion, and green logistics reinforce market growth. Rising demand from urban and intercity transportation accelerates market adoption in China.

The trucks market in India is expected to expand at a CAGR of 9.0%, supported by growth in logistics, construction, and e-commerce sectors. Key players such as Tata Motors, Ashok Leyland, and Mahindra Truck and Bus provide medium- and heavy-duty trucks with improved fuel efficiency and telematics integration. Adoption is concentrated in freight transport, industrial supply chains, and construction projects. Technological trends include emission-compliant engines, fleet monitoring systems, and electric truck trials. Government initiatives supporting road infrastructure, logistics modernization, and commercial transport incentives reinforce market growth. Increasing demand for reliable and high-capacity trucks drives adoption across India.

The trucks market in Germany is projected to grow at a CAGR of 8.3%, supported by demand in industrial logistics, construction, and long-haul freight. Leading manufacturers such as Daimler Trucks, MAN, and Volvo Trucks provide fuel-efficient, emission-compliant, and technologically advanced trucks. Adoption is concentrated in urban logistics, industrial transport, and long-distance freight. Technological trends focus on electric and hybrid trucks, telematics integration, and emission reduction technologies. Government regulations supporting environmental compliance, fleet modernization, and industrial transport efficiency reinforce market growth. Rising demand for energy-efficient and technologically advanced trucks accelerates adoption in Germany.

The trucks market in the United Kingdom is projected to grow at a CAGR of 6.8%, driven by demand in logistics, construction, and industrial transport. Companies such as Leyland Trucks, Volvo Trucks, and MAN supply medium- and heavy-duty trucks with telematics and emission-compliant engines. Adoption is concentrated in urban freight, industrial logistics, and construction applications. Technological trends include electric trucks, advanced fleet management systems, and fuel efficiency improvements. Government policies promoting environmental compliance, logistics modernization, and transport infrastructure support market growth. Rising e-commerce and industrial demand reinforce adoption in the United Kingdom.

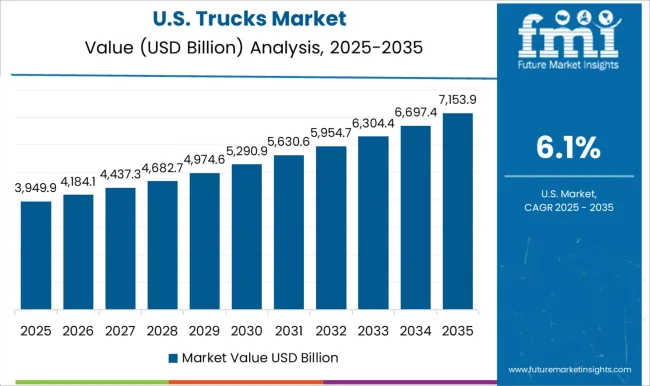

The trucks market in the United States is expected to grow at a CAGR of 6.1%, supported by expansion of logistics networks, construction projects, and e-commerce distribution. Leading manufacturers such as Freightliner, Peterbilt, and Navistar provide heavy- and medium-duty trucks with advanced safety, fuel efficiency, and telematics integration. Adoption is concentrated in industrial transport, urban freight, and long-haul logistics. Technological trends include hybrid and electric trucks, fleet monitoring systems, and emission reduction technologies. Government policies promoting infrastructure development, environmental compliance, and logistics modernization reinforce market adoption. Increasing demand for high-capacity, reliable trucks drives steady growth in the United States.

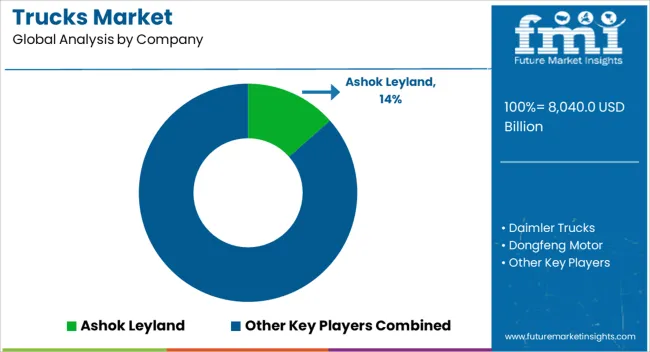

Competition in the trucks industry is being driven by durability, fuel efficiency, and advanced drivetrain technologies, with manufacturers focused on meeting commercial transport demands and regulatory standards. Ashok Leyland and Daimler Trucks are being advanced with medium- and heavy-duty trucks designed for long-haul logistics and urban distribution, offering optimized fuel use and minimal maintenance requirements. Dongfeng Motor and Ford are being positioned with versatile models that cater to regional transportation needs while integrating modern safety and telematics features.

Isuzu and Paccar are being showcased with high-performance trucks engineered for reliability, load capacity, and driver comfort, supporting operations across construction, freight, and industrial sectors. Scania and Tata Motors are being applied with advanced engine technologies and modular chassis solutions that improve operational efficiency and reduce emissions. Toyota and Volvo Group are being highlighted with electric and hybrid truck variants, designed to meet environmental standards and fleet electrification objectives. Product brochures are being structured with technical specifications including payload capacity, engine type, fuel efficiency, emission standards, and drivetrain configuration.

Strategies focus on expanding production capacity, enhancing after-sales support, and providing innovative solutions for commercial transport operators. These companies are shaping global truck supply chains, offering reliable, high-performance vehicles that address both urban and long-distance transportation requirements while supporting industrial and logistical efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 8040.0 Billion |

| Class | Class 3, Class 4, Class 5, Class 6, Class 7, and Class 8 |

| Propulsion | Gasoline, Diesel, Electric, Natural gas, and FCEV |

| Truck | Light duty, Medium duty, and Heavy duty |

| Application | Logistics & transportation, Construction & infrastructure, Retail & e-commerce, Mining, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ashok Leyland, Daimler Trucks, Dongfeng Motor, Ford, Isuzu, Paccar, Scania, Tata Motors, Toyota, and Volvo Group |

| Additional Attributes | Dollar sales by truck type and end use, demand dynamics across logistics, construction, and commercial transport, regional trends in fleet expansion and urbanization, innovation in fuel efficiency, electrification, and safety features, environmental impact of emissions and disposal, and emerging use cases in last-mile delivery, e-mobility, and autonomous trucking. |

The global trucks market is estimated to be valued at USD 8,040.0 billion in 2025.

The market size for the trucks market is projected to reach USD 16,114.0 billion by 2035.

The trucks market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in trucks market are class 3, class 4, class 5, class 6, class 7 and class 8.

In terms of propulsion, gasoline segment to command 21.6% share in the trucks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flatbed Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Wireline Trucks Market

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Rear Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Side Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Aerial Ladder Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA