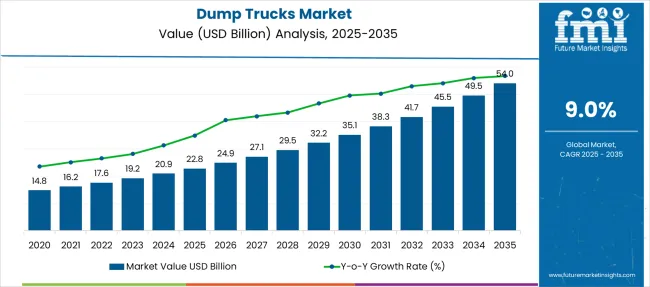

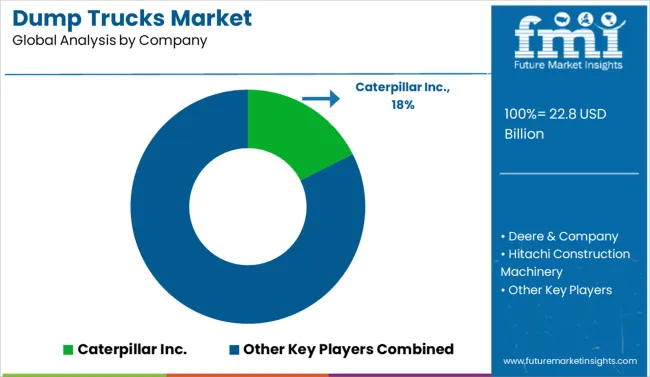

The Dump Trucks Market is estimated to be valued at USD 22.8 billion in 2025 and is projected to reach USD 54.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Dump Trucks Market Estimated Value in (2025 E) | USD 22.8 billion |

| Dump Trucks Market Forecast Value in (2035 F) | USD 54.0 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The dump trucks market is undergoing notable expansion, supported by rising investments in infrastructure development, mining operations, and urban construction projects across developed and emerging regions. Governments are increasing budget allocations for highway expansion, airport modernization, and public transport upgrades, which has driven demand for high-capacity and maneuverable earthmoving equipment. Technological advancements in transmission systems, fuel efficiency, telematics integration, and chassis design are enabling dump trucks to operate efficiently in rugged environments while meeting evolving emission standards.

The growing shift toward electric and hybrid dump trucks in select regions is also enhancing sustainability across job sites. Manufacturers are responding with modular platforms and enhanced payload capacities to support diverse applications from tunneling to aggregate transport.

Demand is being further propelled by rental fleet expansion and dealer network optimization. The future outlook remains strong as smart city projects and renewable energy infrastructure development continue to accelerate equipment procurement cycles, creating new growth avenues for dump truck manufacturers globally.

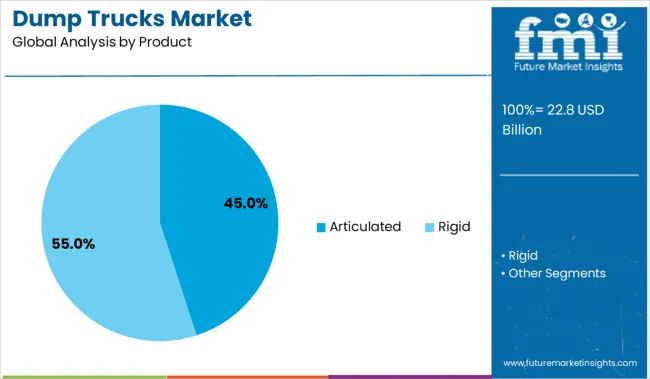

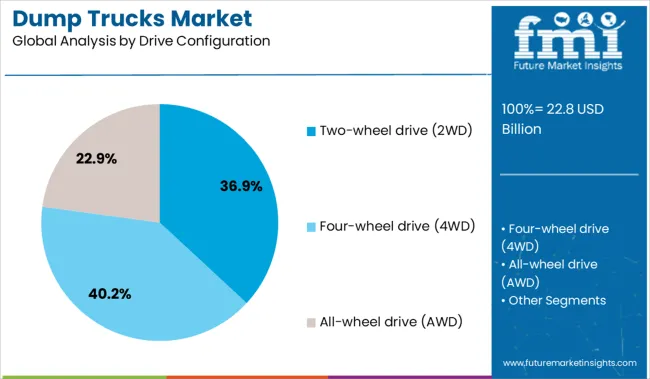

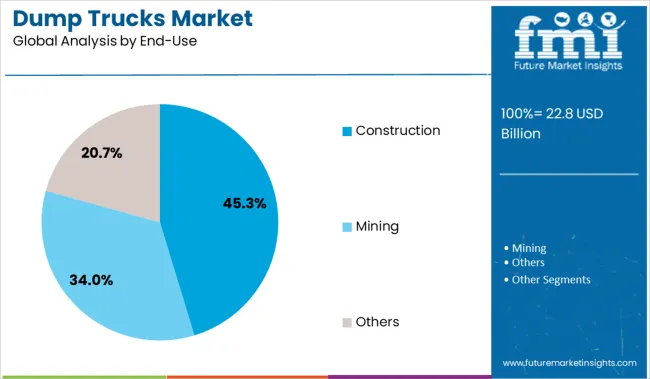

The market is segmented by Product, Drive Configuration, and End-Use and region. By Product, the market is divided into Articulated, Below 50 Metric Tons, 50 Metric Tons and above, Rigid, Below 50 metric tons, 50 to 100 metric tons, 101 - 150 metric tons, 151 - 200 metric tons, 201 - 250 metric tons, 251 - 300 metric tons, and Above 300 metric tons. In terms of Drive Configuration, the market is classified into Two-wheel drive (2WD), Four-wheel drive (4WD), and All-wheel drive (AWD). Based on End-Use, the market is segmented into Construction, Mining, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The articulated product segment is expected to account for 45.0% of the overall dump trucks market revenue in 2025, securing its position as the dominant category. This dominance is driven by the superior flexibility and off-road maneuverability offered by articulated dump trucks, which has made them highly effective in challenging terrains such as mining sites, large-scale construction zones, and oil and gas fields. Their ability to traverse uneven and confined landscapes while maintaining load stability gives them a performance edge over rigid dump trucks.

Furthermore, articulated models are designed to support higher payloads with lower ground pressure, reducing site damage and improving operational efficiency. These benefits are particularly valued in infrastructure and extraction sectors, where project timelines and safety compliance are critical.

Recent enhancements in suspension technology, engine performance, and operator comfort have also contributed to the segment’s growth. As project complexity increases, demand for versatile and durable dump trucks continues to favor the articulated configuration across global markets.

The two-wheel drive configuration segment is projected to capture 36.9% of market revenue in 2025, making it a key contributor within the drive configuration landscape. This segment’s prominence is linked to the cost-effectiveness and operational efficiency that 2WD dump trucks offer, especially in applications that do not require off-road capabilities. Industries such as road maintenance, small to mid-scale construction, and urban waste management are increasingly relying on 2WD dump trucks due to their lower maintenance costs and fuel efficiency.

The simplicity in design and ease of serviceability make these vehicles suitable for fleet-based operations in flat or paved terrains. Additionally, the availability of compact and mid-sized models has made 2WD dump trucks more accessible for contractors and municipalities with budget constraints.

Continuous improvements in drivetrain components and load optimization features have further elevated the performance and reliability of these trucks. As urban infrastructure and light construction activities continue to expand, the demand for 2WD dump trucks is expected to sustain its upward trajectory.

The construction segment is projected to dominate the end-use landscape by accounting for 45.3% of total market revenue in 2025. This leading share is underpinned by the global rise in infrastructure development projects such as residential complexes, highways, commercial centers, and transportation hubs. The demand for material handling and earthmoving equipment in large-scale construction activities has driven strong adoption of dump trucks with high payload capacities and adaptable chassis systems.

Construction contractors prioritize equipment that ensures site productivity, fuel efficiency, and minimal downtime, which has increased reliance on technologically advanced dump trucks. Furthermore, the integration of telematics for real-time fleet monitoring and preventive maintenance has enhanced operational oversight, particularly in high-volume projects.

Governments across Asia, the Middle East, and Africa are introducing public-private partnerships to modernize infrastructure, thereby accelerating procurement of construction vehicles. As smart urbanization and sustainability-linked projects grow, the construction segment is expected to retain its leadership in dump truck demand.

Demand for dump trucks is increasing across mining, construction, and infrastructure segments, driven by haul cycle optimization, regional fleet renewal, and project-linked procurement. Between Q3 2024 and Q2 2025, global dump truck unit shipments rose by 9.2%, with the sharpest increases in Southeast Asia, Latin America, and Sub-Saharan Africa. Mid-tier models in the 35-55 ton range accounted for 62% of global volume. Projects tied to road development, hydropower, and port logistics are contributing to longer fleet deployment cycles. Automation-ready chassis and telematics integration are influencing buyer specifications in both rigid and articulated segments.

Infrastructure expansion and materials movement are driving procurement of high-payload, low-downtime dump truck models. In Q1-Q2 2025, regional public works departments across India, Indonesia, and Nigeria issued fleet tenders totaling over 8,300 units. Haulage contractors report that dual-axle trucks with 38-45 ton capacity now dominate new orders, offering 12-17% higher fill rates compared to legacy models. Fleet operators are adopting engine braking, automatic load distribution, and tire-pressure monitoring as standard features to cut cycle times. Mid-size mining operations in Colombia and Kazakhstan reported payload productivity gains of 18-21% after switching to sensor-assisted dump trucks with adaptive throttle control. OEMs offering locally assembled chassis reduced delivery lead times by 4-6 weeks, helping meet short procurement windows tied to seasonal road-building schedules.

Operational constraints continue to affect dump truck fleet efficiency, particularly in regions with poor haul road quality or delayed site preparation. Data from 47 fleet audits across Sub-Saharan Africa and Central Asia in Q4 2024 showed a 26% increase in unscheduled maintenance due to undercarriage damage from surface irregularities. Fuel cost volatility also impacts usage patterns: contractors in Brazil and South Africa reported an 11-14% increase in per-tonne haul cost during diesel price surges in early 2025. Manufacturers face extended lead times for key parts-drivelines, axles, and hydraulic pumps-pushing average build cycles for rigid dump trucks beyond 9.5 weeks. Import duties on driveline kits in select African and Southeast Asian countries are also raising landed costs, curbing smaller fleet expansion and straining contractor margins.

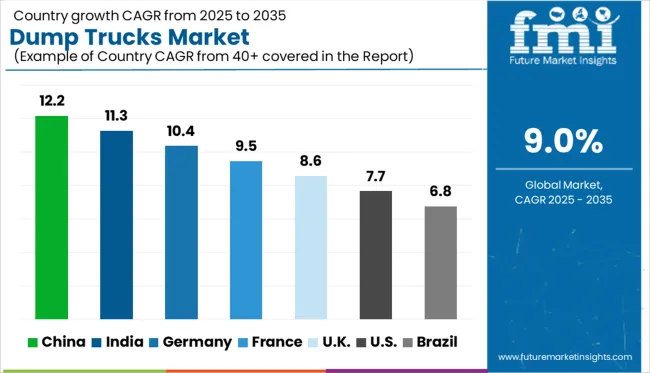

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global market is projected to grow at a CAGR of 9.0% from 2025 to 2035. China (BRICS) leads with a robust 12.2% growth rate, outperforming the global average by 3.2 percentage points, driven by ongoing investment in mining, construction, and large-scale infrastructure projects. Among OECD economies, Germany reports 10.4% (+1.4 pp), supported by its strong commercial vehicle manufacturing base and export focus. France follows with 9.5% (+0.5 pp), reflecting consistent demand across both domestic and regional construction sectors. The UK records 8.6% (–0.4 pp), indicating a stable yet slightly below-average pace of growth. The United States (OECD) posts 7.7%, 1.3 pp below the global average, showing slower growth, possibly due to longer fleet replacement cycles and delayed infrastructure modernization. The report features insights from 40+ countries, with the top five shown below.

China’s dump truck market is forecast to grow at 12.2%, far surpassing the global average of 7.5%. This expansion is fueled by state-backed infrastructure acceleration, particularly in inland provinces. Domestic OEMs are focusing on heavy-duty electric dump trucks designed for mining and intercity material transport. Analysts cite vertical supply chains and rapid model iteration as key factors behind China’s market dominance. Automation integration in quarry and port operations is further boosting demand. Market observers expect China to drive the next generation of energy-efficient dump platforms, with global adoption of its electric drivetrain configurations likely by 2030.

Germany’s dump truck market is growing at 10.4%, well above the global average of 7.5%. This growth is attributed to automation-led mining and smart construction logistics. Tier-1 suppliers are advancing hybrid drivetrain systems suited for off-road terrain and restricted urban zones. Industry analysts note Germany’s precision in axle load balancing and telematics integration as globally competitive. Major OEMs are retrofitting municipal and quarry fleets with low-emission systems to meet EU compliance standards. Experts predict a rapid shift to hydrogen-powered dump platforms over the next decade, especially in regulated freight corridors and high-volume excavation zones.

France is expected to grow its dump truck market at 9.5%, outpacing the global growth average. Demand is rising in civil infrastructure upgrades and sustainable waste management logistics. French manufacturers are investing in mid-capacity models optimized for urban and peri-urban transport. Telematics-linked route mapping and load distribution tracking are being scaled in public fleet tenders. Analysts suggest that France is positioning itself as a supplier of medium-weight, regulation-ready dump trucks suited for metropolitan project cycles. National environmental directives are influencing design mandates, driving innovation in emissions compliance and adaptive engine cooling systems.

United Kingdom’s dump truck market is projected to expand at 8.6%, exceeding the global 7.5% benchmark. Growth is centered on brownfield redevelopment, renewable energy site preparation, and municipal utility projects. UK-based manufacturers are focusing on compact dump platforms with rapid discharge cycles and adaptive hill-start systems. Analysts expect a move toward electrification in inner-city operations, especially with London’s non-road mobile machinery regulations tightening. Investment in battery-swap truck platforms is gaining traction in Scotland and Wales. Fleet managers are prioritizing downtime reduction and autonomous dispatch scheduling as fleet upgrades continue through 2030.

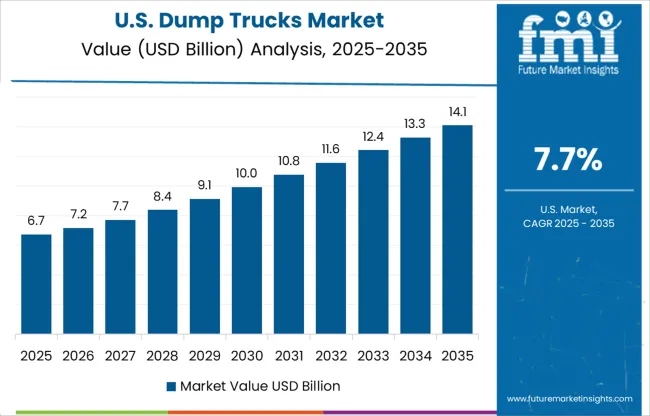

The United States dump truck market is forecast to grow at 7.7%, slightly above the global average of 7.5%. Federal infrastructure stimulus and increased mining permits across western states are key growth levers. US-based OEMs are investing in long-range fuel-efficient dump platforms for cross-county hauling and aggregate transport. Industry insiders highlight growing demand for autonomous-ready dump systems in large-scale quarries. Analysts project increasing adoption of diesel-electric hybrids in government contracts and private fleet renewals. Innovations in telematic diagnostics and anti-roll assist are now expected as baseline in the mid-size fleet segment.

Caterpillar Inc. holds a significant share of the dump trucks market, supported by a broad product range and long-term equipment service contracts. Deere & Company and Hitachi Construction Machinery serve key roles in construction and mining applications with mid-to-heavy-duty models. Liebherr Group offers high-capacity trucks tailored for quarrying and infrastructure work. Volvo Group and Sany Group focus on vehicle durability and operational efficiency across varied terrains, while XCMG Group continues to scale output for large-scale civil projects. Barriers to entry include high capital requirements, compliance with emission and safety regulations, and the need for an established dealer and support network capable of handling long-term maintenance and parts logistics across remote job sites.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.8 Billion |

| Product | Articulated, Below 50 Metric Tons, 50 Metric Tons and above, Rigid, Below 50 metric tons, 50 to 100 metric tons, 101 - 150 metric tons, 151 - 200 metric tons, 201 - 250 metric tons, 251 - 300 metric tons, and Above 300 metric tons |

| Drive Configuration | Two-wheel drive (2WD), Four-wheel drive (4WD), and All-wheel drive (AWD) |

| End-Use | Construction, Mining, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Deere & Company, Hitachi Construction Machinery, Liebherr Group, Sany Group, Volvo Group, and XCMG Group |

| Additional Attributes | Dollar sales by truck class and application segment, growing demand in mining and infrastructure development, stable utilization in municipal services and material transport, advancements in electric and autonomous dump trucks drive operational efficiency and emissions compliance |

The global dump trucks market is estimated to be valued at USD 22.8 billion in 2025.

The market size for the dump trucks market is projected to reach USD 54.0 billion by 2035.

The dump trucks market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in dump trucks market are articulated, below 50 metric tons, 50 metric tons and above, rigid, below 50 metric tons, 50 to 100 metric tons, 101 – 150 metric tons, 151 – 200 metric tons, 201 – 250 metric tons, 251 – 300 metric tons and above 300 metric tons.

In terms of drive configuration, two-wheel drive (2wd) segment to command 36.9% share in the dump trucks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Electric Construction Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Bulk Tote Dumpers Market

Acousto Optical Cavity Dumper Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flatbed Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Wireline Trucks Market

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Rear Loader Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA