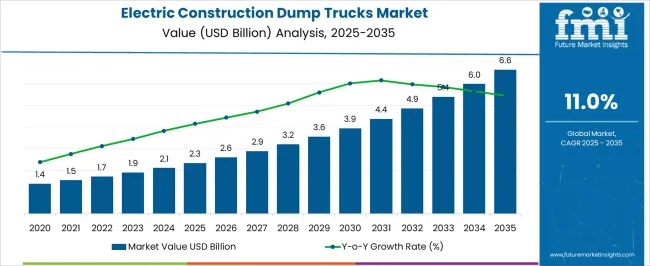

The electric construction dump trucks market is projected to reach USD 2.3 billion in 2025 and USD 6.6 billion in 2035, reflecting a CAGR of 11.0% between 2025 and 2035. During the early adoption phase from 2020 to 2024, demand was driven by pilot deployments in select construction and mining projects where operators tested vehicle efficiency, durability, and performance in heavy-duty environments.

As the scaling phase begins in 2025, adoption accelerates across infrastructure development, mining, and large-scale construction projects. Manufacturers expand production capacity, refine vehicle design, and establish stronger dealer and service networks, fueling broader market penetration. Between 2030 and 2035, the market moves into the consolidation phase, with revenues projected at USD 6.6 billion by 2035 while maintaining a CAGR of 11.0%.

During this stage, leading manufacturers strengthen their presence through fleet contracts, long-term service agreements, and entry into high-demand regions. Smaller players focus on niche applications or exit the market. Adoption stabilizes as most major operators integrate electric dump trucks into their fleets, and the market shifts toward efficiency, cost competitiveness, and lifecycle support. By 2035, the industry will demonstrate predictable growth, strong competition, and well-structured operational practices.

| Metric | Value |

|---|---|

| Electric Construction Dump Trucks Market Estimated Value in (2025 E) | USD 2.3 billion |

| Electric Construction Dump Trucks Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

The electric construction dump trucks market is shaped by several end-use sectors that collectively drive adoption. Construction and Infrastructure Projects dominate with about 30% of the market, where dump trucks are integral for transporting heavy loads in urban and rural developments. Mining Operations contribute 25%, as large fleets of dump trucks are required for hauling ore and overburden in demanding environments.

Quarrying and Aggregates account for 12%, deploying trucks for stone, sand, and gravel extraction. Industrial Facilities and Heavy Manufacturing Sites represent 10%, using dump trucks for bulk material handling within plant premises. Energy Projects, including hydropower and large-scale grid installations, hold around 8% share, requiring reliable material movement. Waste Management and Recycling contributes 7%, where trucks handle heavy refuse, debris, and scrap transport. Ports and Logistics Hubs represent 5%, using electric dump trucks for bulk handling in short-haul operations.

Smaller segments, including Military Engineering Units and Research-led Pilot Projects, account for the remaining 3%. Revenue distribution mirrors sector reliance, with the market expanding from 1.4 billion dollars in 2020 to 2.3 billion in 2025 and projected to reach 6.6 billion by 2035, at a CAGR of 11.0%. Construction and mining remain core demand drivers, while waste management and energy projects provide incremental long-term growth.

The electric construction dump trucks market is experiencing accelerated growth due to increasing environmental regulations, the transition toward low emission construction equipment, and advancements in battery technology. Rising fuel costs and stricter carbon emission targets are encouraging construction companies to shift from diesel powered vehicles to electric alternatives.

Improvements in load handling efficiency, battery charging infrastructure, and vehicle durability have enhanced adoption rates across large scale construction and mining operations. Government incentives, subsidies, and funding for green construction machinery are also contributing to market expansion.

With the added benefits of lower maintenance costs, reduced noise levels, and improved operator comfort, electric construction dump trucks are becoming a preferred choice for both urban and remote construction projects. The outlook remains strong as technological innovation continues to improve payload efficiency and operational range, further strengthening the case for electric adoption in heavy duty applications.

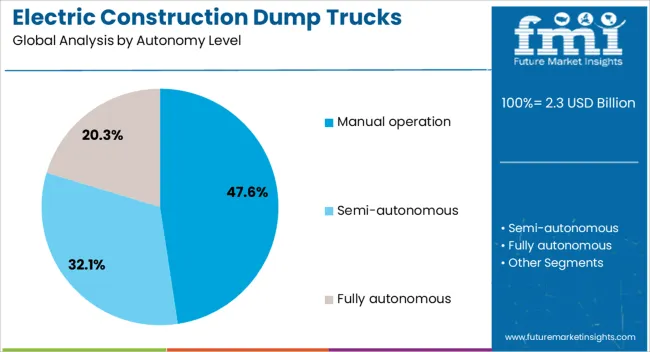

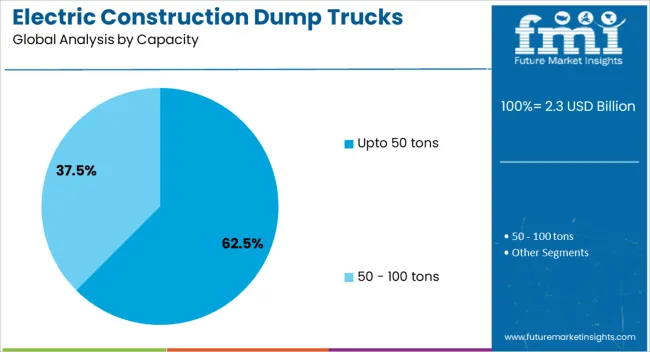

The electric construction dump trucks market is segmented by autonomy level, battery type, capacity, and geographic regions. By autonomy level, electric construction dump trucks market is divided into Manual operation, Semi-autonomous, and Fully autonomous. In terms of battery type, electric construction dump trucks market is classified into Lithium-ion, Sodium-ion, and Solid-state.

Based on capacity, electric construction dump trucks market is segmented into Upto 50 tons and 50 - 100 tons. Regionally, the electric construction dump trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual operation segment is anticipated to hold 47.60% of the total market revenue by 2025 within the autonomy level category, making it the leading segment. Its dominance is supported by operational familiarity, lower upfront costs, and the ability to deploy without significant retraining of operators.

Manual models continue to be preferred in regions where automation infrastructure is limited or where highly variable site conditions demand direct human control.

Their adaptability to diverse project requirements and immediate operational readiness have reinforced their continued prominence despite the gradual rise of autonomous alternatives.

The upto 50 tons capacity segment is expected to represent 62.50% of the total market revenue by 2025 within the capacity category, positioning it as the most significant segment. Its popularity is attributed to its versatility, suitability for a broad range of construction projects, and balance between payload capacity and operational efficiency.

Trucks in this range can navigate diverse terrain while maintaining optimal energy consumption, making them ideal for both urban and off highway environments.

This combination of operational flexibility and cost effectiveness continues to drive the strong preference for this capacity class..

The electric construction dump trucks market is expanding as industries prioritize cleaner operations, reduced emissions, and cost efficiency in heavy-duty construction. North America and Europe lead with early adoption of battery-powered dump trucks supported by sustainability goals and stricter emission standards. Asia-Pacific shows rapid growth due to large-scale infrastructure projects and rising government incentives for electrification. Manufacturers differentiate through payload capacity, battery range, and charging flexibility. Regional differences in fuel costs, construction intensity, and regulatory frameworks strongly shape adoption and competitiveness globally.

Adoption of electric construction dump trucks is driven by the global push to reduce greenhouse gas emissions and achieve clean construction goals. North America and Europe prioritize fully electric dump trucks to comply with emission caps and urban air-quality regulations, particularly in city-based infrastructure projects. Asia-Pacific markets emphasize hybrid or semi-electric models as cost-effective solutions for balancing productivity with sustainability. Differences in regulatory enforcement, public funding, and operational mandates affect adoption speed and fleet electrification strategies. Leading suppliers develop high-capacity trucks with long-life batteries and regenerative braking systems, while regional manufacturers deliver practical solutions optimized for affordability. Emission-reduction contrasts shape adoption, fleet modernization, and competitiveness in the global electric construction dump trucks market.

Battery range, charging speed, and flexibility significantly influence electric dump truck adoption. North America and Europe demand high-capacity batteries capable of sustaining extended shifts in large construction and mining projects, supported by fast-charging infrastructure. Asia-Pacific markets prioritize cost-effective batteries with moderate range, supported by portable charging or battery-swapping solutions for sites with limited grid access. Differences in battery chemistry, energy density, and charging networks affect operational uptime, fleet productivity, and investment returns. Leading suppliers invest in high-density lithium-ion and solid-state batteries with rapid charging capabilities, while regional players focus on modular, replaceable battery packs. Battery and charging contrasts shape adoption, operational reliability, and competitiveness globally.

Payload capability and operational efficiency are critical for adoption in heavy construction. North America and Europe emphasize high-payload trucks capable of operating in large-scale infrastructure, mining, and industrial projects without compromising performance. Asia-Pacific markets adopt mid-range payload trucks designed for urban projects, housing developments, and medium-sized construction sites. Differences in payload requirements, terrain adaptability, and duty cycles affect vehicle design, drivetrain configuration, and durability. Leading manufacturers focus on optimizing truck power-to-weight ratios, torque delivery, and hydraulic performance, while regional players emphasize rugged, practical trucks tailored to localized site conditions. Payload capacity contrasts shape adoption, deployment strategies, and competitive positioning in the global market.

Government regulations, incentives, and supporting infrastructure strongly influence the electric construction dump truck market. North America and Europe provide subsidies, tax incentives, and infrastructure development for EV adoption, creating favorable conditions for deployment. Asia-Pacific markets vary, with developed economies offering structured policies while emerging regions focus on targeted pilot programs and localized incentives. Differences in policy frameworks, charging infrastructure readiness, and financial support directly impact procurement, fleet investment decisions, and adoption pace. Leading suppliers align products with government electrification goals and charging compatibility, while regional manufacturers adapt cost-effective trucks to local conditions. Regulatory and infrastructure contrasts shape adoption, market penetration, and competitiveness globally.

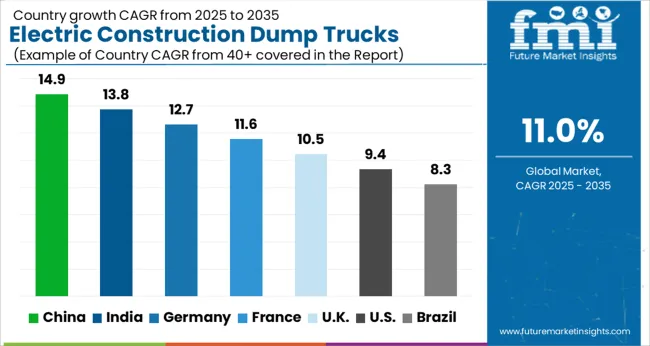

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

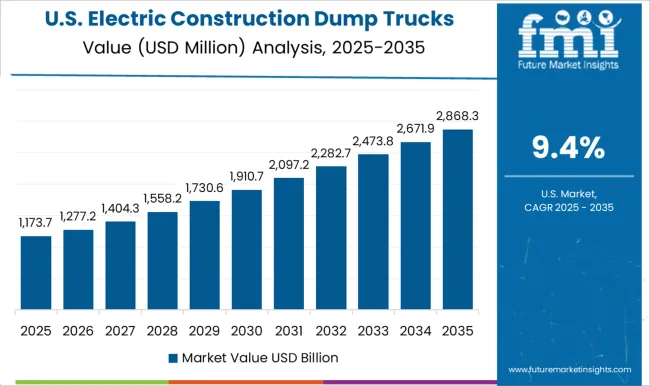

| USA | 9.4% |

| Brazil | 8.3% |

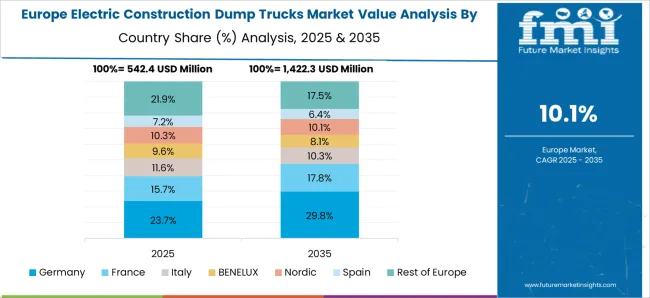

The global electric construction dump trucks market is projected to grow at an 11.0% CAGR through 2035, driven by rising adoption in construction, mining, and infrastructure projects. Among BRICS nations, China led with 14.9% growth as large-scale manufacturing and deployment across construction sites were carried out, while India at 13.8% growth expanded fleet utilization to meet increasing industrial demand. In the OECD region, Germany at 12.7% maintained steady adoption supported by stringent safety and operational regulations, while the United Kingdom at 10.5% integrated these vehicles into commercial and civil infrastructure projects. The USA, growing at 9.4%, advanced deployment across industrial and construction sectors under regulated frameworks for performance and reliability. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The electric construction dump trucks market in China is projected to grow at a CAGR of 14.9%, driven by increasing adoption of eco friendly construction equipment and expansion of infrastructure projects. Adoption is being encouraged by trucks that provide zero emissions, high load capacity, and enhanced operational efficiency. Manufacturers are being urged to supply reliable, durable, and energy efficient vehicles suitable for large scale construction sites. Distribution is being strengthened through partnerships with construction firms, equipment rental companies, and government infrastructure projects. Research in battery life optimization, fast charging systems, and lightweight materials is being conducted. Rising demand for sustainable construction, urban development, and government incentives for electric vehicles are considered key factors supporting the electric construction dump trucks market in China.

The electric construction dump trucks market in India is expected to grow at a CAGR of 13.8%, driven by the modernization of construction fleets and government support for green technology. Adoption is being strengthened by vehicles that provide high efficiency, reduced carbon emissions, and lower operating costs. Manufacturers are being encouraged to deliver cost effective, robust, and reliable trucks suitable for Indian construction conditions. Distribution through construction contractors, rental services, and industrial equipment suppliers is being expanded. Awareness campaigns and training programs are being conducted to promote adoption and proper usage. Rapid urbanization, expansion of infrastructure projects, and increasing environmental regulations are recognized as primary drivers of the electric construction dump trucks market in India.

Germany is witnessing steady growth in the electric construction dump trucks market at a CAGR of 12.7%, supported by adoption in construction and mining operations aiming to reduce emissions. Adoption is being encouraged by trucks that provide high reliability, low maintenance requirements, and energy efficiency. Manufacturers are being urged to supply vehicles that meet stringent European environmental standards. Distribution through equipment rental companies, construction contractors, and industrial suppliers is being maintained. Research in battery technology, weight reduction, and vehicle automation is being pursued. Emphasis on green construction practices, industrial sustainability goals, and efficiency improvement are considered key factors driving the electric construction dump trucks market in Germany.

The electric construction dump trucks market in the United Kingdom is projected to grow at a CAGR of 10.5% due to increasing demand for low emission construction equipment and energy efficient vehicles. Adoption is being emphasized for trucks that provide high payload capacity, reliable performance, and reduced environmental impact. Manufacturers are being encouraged to supply advanced, durable, and safe vehicles. Distribution through construction firms, equipment rental services, and industrial suppliers is being strengthened. Demonstrations and awareness programs are being conducted to increase acceptance among contractors. Expansion of public infrastructure projects, environmental compliance requirements, and energy cost reduction are recognized as major contributors to the electric construction dump trucks market in the United Kingdom.

The electric construction dump trucks market in the United States is projected to grow at a CAGR of 9.4%, supported by demand for green construction equipment and modernization of heavy duty fleets. Adoption is being encouraged by trucks that provide zero emissions, high efficiency, and enhanced safety features. Manufacturers are being urged to deliver reliable, high performance, and environmentally friendly vehicles. Distribution through construction companies, equipment rental providers, and industrial suppliers is being maintained. Research in battery efficiency, fast charging technology, and vehicle automation is being pursued. Expansion of infrastructure projects, environmental regulations, and energy saving initiatives are considered key factors driving the electric construction dump trucks market in the United States.

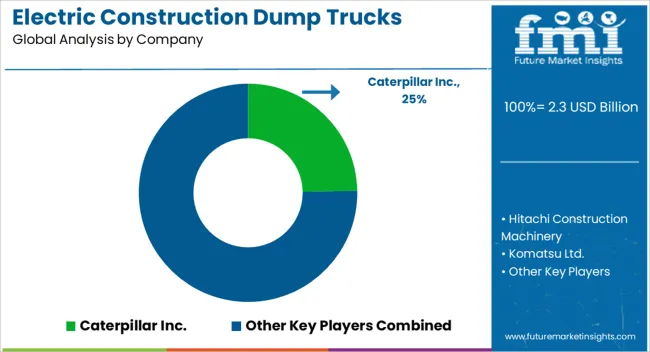

The electric construction dump trucks market is shaped by a mix of global heavy equipment manufacturers, regional construction vehicle producers, and emerging electric mobility solution providers. Leading players such as Caterpillar, Komatsu, Volvo Construction Equipment, and Hitachi Construction Machinery hold strong positions by offering diversified portfolios of electric and hybrid dump trucks for mining, quarrying, and large-scale construction projects.

Competitive differentiation is driven by battery capacity, haulage efficiency, operational reliability, reduced emissions, and integration with fleet management systems. Regional manufacturers, particularly in Asia-Pacific and Europe, compete by providing cost-effective solutions and localized support tailored to infrastructure and industrial applications. Strategic partnerships with mining operators, construction firms, and equipment rental companies enhance market penetration and after-sales service capabilities. Innovation in battery technology, regenerative braking systems, and electric powertrain optimization further strengthens competitive positioning. Companies prioritizing regulatory compliance, safety standards, and robust service networks are well-positioned to capture significant market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Autonomy Level | Manual operation, Semi-autonomous, and Fully autonomous |

| Battery Type | Lithium-ion, Sodium-ion, and Solid-state |

| Capacity | Upto 50 tons and 50 - 100 tons |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Hitachi Construction Machinery, Komatsu Ltd., Liebherr Group, Sany Group, Terex Corporation, and XCMG Group |

| Additional Attributes | Dollar sales vary by truck type, including rigid, articulated, and hybrid electric dump trucks; by capacity, spanning small, medium, and large loads; by application, such as mining, road construction, and infrastructure projects; by end-use, covering construction firms, mining operators, and government projects; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by sustainability goals, fuel cost savings, and stricter emission regulations. |

The global electric construction dump trucks market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the electric construction dump trucks market is projected to reach USD 6.6 billion by 2035.

The electric construction dump trucks market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in electric construction dump trucks market are manual operation, semi-autonomous and fully autonomous.

In terms of battery type, lithium-ion segment to command 58.3% share in the electric construction dump trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA