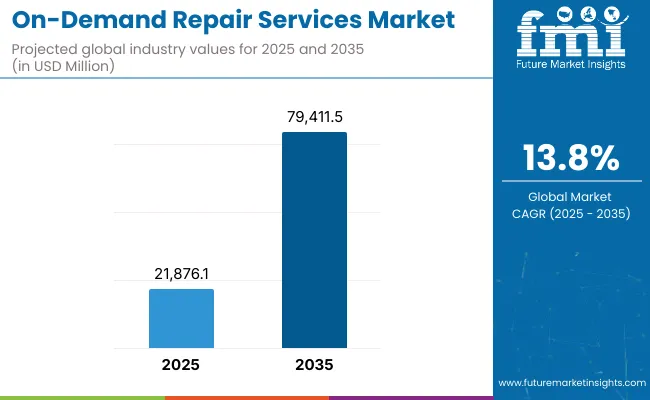

The Global On-Demand Repair Services Market is expected to record a valuation of USD 21,876.1 million in 2025 and USD 79,411.5 million in 2035, with an increase of USD 57,535.5 million, which equals a growth of 263% over the decade. The overall expansion represents a CAGR of 13.8% and a 3.6X increase in market size.

Global On-Demand Repairs Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 21876.1 million |

| Market Forecast Value in (2035F) | USD 79,411.5 million |

| Forecast CAGR (2025 to 2035) | 13.8 % |

During the first five-year period from 2025 to 2030, the market increases from USD 21,876.1 million to USD 41,679.8 million, adding USD 19,803.8 million, which accounts for 34.4% of the total decade growth. This phase records steady adoption across smartphones and tablets, laptops and desktops, and consumer electronics, supported by consumer preference for convenience and rapid booking. Same-day fulfills high-urgency jobs, while platform-managed technicians gain traction for quality control in B2C use cases.

The second half from 2030 to 2035 contributes USD 37,731.7 million, equal to 65.6% of total growth, as the market jumps from USD 41,679.8 million to USD 79,411.5 million. This acceleration is powered by B2B expansion with SMBs and property managers, deeper OEM-authorized partnerships, and add-on subscription or protection plans. Pickup and return plus remote diagnosis broaden coverage for major home appliances and vehicles, while subscription add-ons increase recurring revenue and lifetime value.

From 2020 to 2024, on-demand repair platforms scaled primarily through smartphones and small electronics, with marketplace and platform-managed technician models expanding city coverage and response times. Competitive differentiation focused on speed, geographic density, technician quality, and transparent pricing. Service plans and subscriptions remained emerging, contributing a modest share to revenue compared with one-off repairs.

Demand for on-demand repairs reaches USD 21,876.1 million in 2025, and the revenue mix begins to shift as subscription or protection plan add-ons increase share alongside time and materials and fixed upfront price models. Traditional home services aggregators face rising competition from digital-first platforms specializing in electronics and appliance repairs with remote diagnostics, standardized SKUs, and OEM tie-ups. Competitive advantage is moving from pure lead aggregation to end-to-end service orchestration, technician enablement, and recurring plan economics.

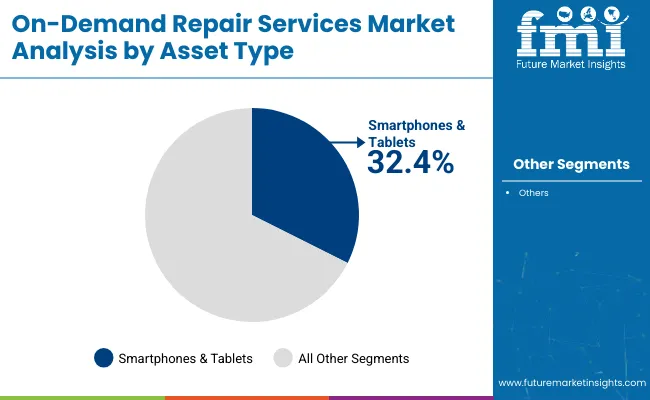

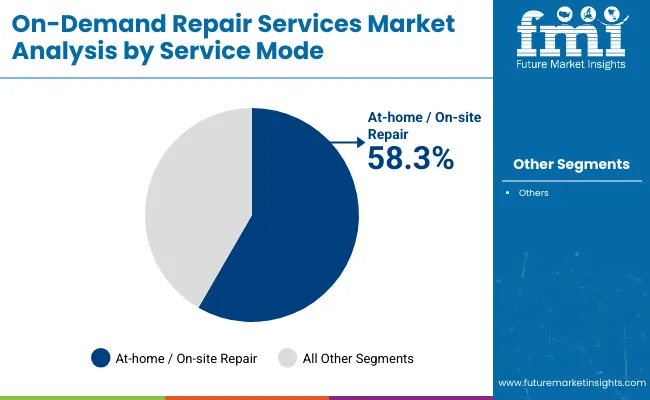

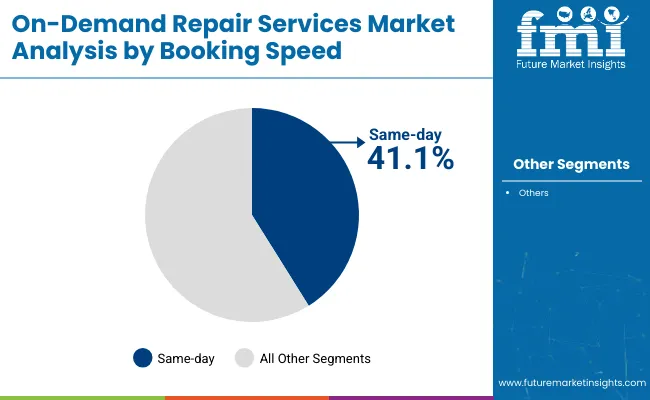

Consumer preference for convenience and faster turnaround has boosted same-day and next-day bookings. Proliferation of connected devices and larger installed bases of major home appliances have increased repairable incidents post warranty. Digital platforms improve discovery, pricing transparency, and technician utilization, while remote diagnosis reduces no-fault visits and speeds parts readiness. B2B demand from SMBs, property managers, and fleets is rising for multi-asset maintenance with SLAs. OEM-authorized networks and platform-managed models expand quality assurance, and subscription or protection plan add-ons enhance predictability and retention. Segment growth in 2025 is led by at-home / on-site repair (58.3%), same-day bookings (41.1%), and smartphones and tablets (32.4%) within asset type.

The market is segmented by asset type, service mode, provider type, booking speed, customer type, pricing model, and region. Asset type includes smartphones & tablets, laptops & desktops, consumer electronics (TV/audio), major home appliances, home fixtures (plumbing/electrical/HVAC), and passenger cars & two-wheelers, highlighting the core categories driving adoption. Service mode classification covers at-home / on-site repair, pickup & return, and remote diagnosis / assist to cater to different customer requirements. Based on provider type, the segmentation includes platform-managed technicians, marketplace/aggregator freelancers, and OEM-authorized service networks.

In terms of booking speed, categories encompass same-day, next-day, and 3+ days. Customer type includes B2C (households) and B2B (SMBs, property managers, fleets). Pricing model segmentation covers fixed upfront price, time & materials, and subscription/protection plan add-ons. Regionally, the scope spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa, with key country-level insights highlighting growth in India, China, Japan, the USA, Germany, and the UK.

| Asset Type Segment | Market Value Share, 2025 |

|---|---|

| Smartphones & Tablets | 32.4% |

| Others | 67.6% |

The smartphones & tablets segment is projected to contribute 32.4% of the Global On-Demand Repair Services Market revenue in 2025, maintaining its lead as the dominant asset category. This is driven by the sheer scale of mobile device ownership worldwide and the high frequency of screen, battery, and performance-related issues that require repair. Users prioritize immediate and cost-effective repairs, making smartphones & tablets the most consistent demand generator for on-demand platforms. The segment’s growth is also supported by the rising cost of new devices, which encourages consumers to extend device lifecycles through repair instead of replacement. With OEM-authorized networks and third-party platforms expanding global coverage, smartphones & tablets are expected to remain at the core of demand. The asset type continues to be the entry point for customer acquisition in on-demand repair ecosystems.

| Service Mode Segment | Market Value Share, 2025 |

|---|---|

| At-home / On-site Repair | 58.3% |

| Others | 41.6% |

The at-home / on-site repair segment is forecasted to hold 58.3% of the market share in 2025, led by consumer demand for convenience and faster turnaround times. This model allows technicians to provide same-day solutions for electronics, appliances, and home systems without requiring device transportation, making it highly preferred in urban areas. Its strong adoption is supported by platform-managed technician networks that ensure quality control, safety, and reliability. The segment’s growth is further bolstered by the integration of digital scheduling, technician tracking, and transparent pricing models. As more B2C households and small businesses opt for hassle-free repairs, at-home / on-site repair is expected to remain the dominant service delivery mode across global markets.

| Booking Speed Segment | Market Value Share, 2025 |

|---|---|

| Same-day | 41.1% |

| Others | 58.9% |

The same-day booking segment is projected to account for 41.1% of the Global On-Demand Repair Services Market revenue in 2025, making it a defining feature of consumer expectations. Same-day repair addresses urgent needs such as broken smartphones, malfunctioning appliances, or plumbing failures, where delays can significantly impact daily routines. Its popularity is supported by the rise of gig-based repair platforms and marketplace aggregators, which can dispatch technicians quickly by leveraging real-time availability and location-based scheduling. The segment benefits from consumer willingness to pay a premium for speed, particularly in urban and densely populated markets. As competition intensifies, same-day repair is expected to retain its critical role in driving differentiation and customer loyalty within the on-demand repair ecosystem.

Drivers

Rising Device and Appliance Penetration Leading to Higher Repair Incidences

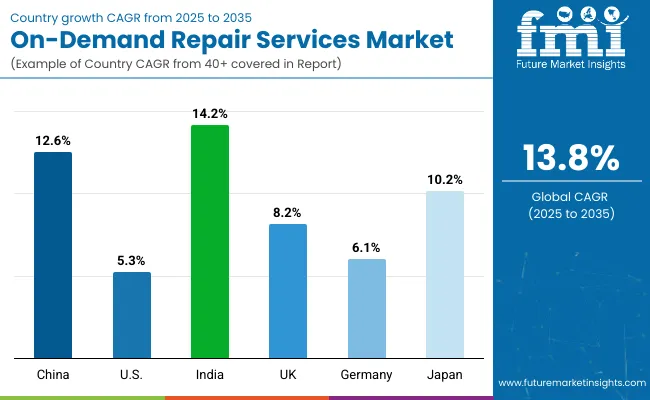

The global installed base of smartphones, laptops, consumer electronics, and home appliances is growing rapidly, especially in emerging economies. In 2025, smartphones & tablets alone account for 32.4% of on-demand repair demand (USD 7,087.82 million), underlining their centrality to the market. As the cost of new devices rises, consumers increasingly prefer repairing existing assets to extend their lifecycle, creating repeat demand. The surge of connected devices, smart appliances, and electric vehicles will only multiply repair needs across categories, ensuring consistent revenue opportunities for service providers. This trend is particularly pronounced in Asia-Pacific, where India (14.2% CAGR) and China (12.6% CAGR) are expanding faster than global averages.

Consumer Preference for Convenience and Speed

The dominance of at-home/on-site repair (58.3% share in 2025) and same-day booking (41.1%) reflects a clear global consumer preference for rapid, hassle-free solutions. Customers increasingly expect services to come directly to them, reducing downtime and eliminating the inconvenience of visiting service centers. Platforms that offer technician tracking, transparent pricing, and instant scheduling are tapping into this behavioral shift. For businesses, same-day and next-day models also minimize asset downtime, supporting B2B adoption among fleets, property managers, and SMBs. This demand for speed and accessibility is one of the strongest long-term growth drivers in the market.

Restraints

High Fragmentation and Informal Competition

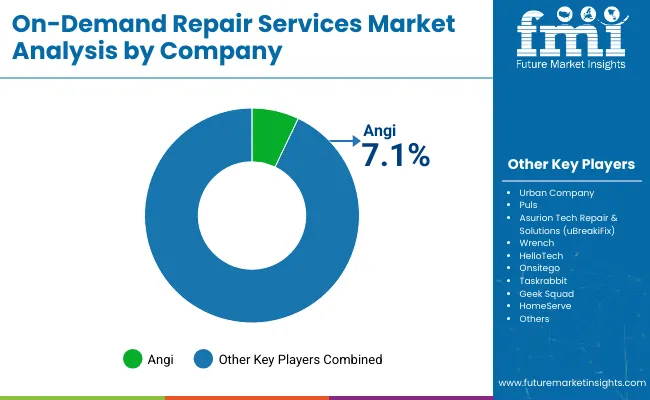

The competitive landscape is highly fragmented, with Angi holding just 7.1% global share in 2025 and the rest spread across numerous regional and specialized players. Informal and unorganized technicians often compete on lower price points, especially in emerging markets, which reduces the profitability of structured platforms. This fragmentation makes it difficult for providers to establish strong global or even regional dominance, slows down standardization, and increases quality variance across geographies.

Skill Gaps and Supply-Side Constraints

The quality and availability of skilled technicians remain a limiting factor in scaling operations. Rapid expansion of categories such as major appliances, home fixtures, and electric vehicles requires technicians with specialized training. However, certification standards differ across regions, leading to inconsistency in service quality. For OEM-authorized networks, the challenge is maintaining brand-aligned repair quality at scale, while for platforms, the issue lies in ensuring reliability and consumer trust when relying on freelance or marketplace models. These gaps can slow adoption in critical categories and reduce repeat usage if customer expectations are not met.

Trends

Expansion of B2B Contracts and Protection Plans

While B2C households currently dominate volumes, B2B demand is expanding rapidly, especially from SMBs, property managers, and fleet operators. Businesses are increasingly outsourcing repair contracts to reduce downtime and operational risks. At the same time, subscription and protection plan add-ons are gaining traction as recurring revenue models, offering predictability for providers and peace of mind for customers. This transition toward contractual relationships rather than ad-hoc repairs is reshaping the industry’s revenue mix and increasing the share of long-term, recurring income streams.

Integration of Remote Diagnosis and Digital Platforms

Although at-home repair dominates today (58.3%), remote diagnosis and virtual assist are emerging as complementary modes, particularly in markets like China where they already represent 75.2% share in 2025. Digital-first platforms are leveraging AI and IoT to pre-diagnose issues, enabling technicians to arrive with the right tools or spare parts, thereby reducing wasted trips. Remote support also appeals to consumers for minor issues and lowers costs for providers. Over the next decade, this trend is expected to integrate tightly with subscription plans, OEM ecosystems, and connected-device monitoring, making digital orchestration as important as physical repair execution.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.6% |

| USA | 5.3% |

| India | 14.2% |

| UK | 8.2% |

| Germany | 6.1% |

| Japan | 10.2% |

The market is segmented by asset type, service mode, provider type, booking speed, customer type, pricing model, and region. Asset type includes smartphones & tablets, laptops & desktops, consumer electronics (TV/audio), major home appliances, home fixtures (plumbing/electrical/HVAC), and passenger cars & two-wheelers, highlighting the core categories driving adoption. Service mode classification covers at-home / on-site repair, pickup & return, and remote diagnosis / assist to cater to different customer requirements.

Based on provider type, the segmentation includes platform-managed technicians, marketplace/aggregator freelancers, and OEM-authorized service networks. In terms of booking speed, categories encompass same-day, next-day, and 3+ days. Customer type includes B2C (households) and B2B (SMBs, property managers, fleets). Pricing model segmentation covers fixed upfront price, time & materials, and subscription/protection plan add-ons. Regionally, the scope spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa, with key country-level insights highlighting growth in India, China, Japan, the USA, Germany, and the UK.

| Year | USA On-Demand Repairs Services Market |

|---|---|

| 2025 | 5022.0 |

| 2026 | 5651.9 |

| 2027 | 6360.7 |

| 2028 | 7158.4 |

| 2029 | 8056.2 |

| 2030 | 9066.6 |

| 2031 | 10203.7 |

| 2032 | 11483.4 |

| 2033 | 12923.6 |

| 2034 | 14544.4 |

| 2035 | 16368.5 |

The USA On-Demand Repair Services Market is projected to grow at a CAGR of 5.3%, led by steady consumer adoption across electronics, home appliances, and household services. The segment mix in 2025 shows smartphones & tablets at 33.7% share (USD 1,692.43 million), demonstrating the country’s dependence on mobile devices. Growth is also supported by expanding subscription/protection plans and B2B service outsourcing among property managers and fleets. Smartphones & tablets repairs dominate early adoption. Subscription add-ons are emerging as a key growth lever. Technician quality and response times remain competitive differentiators.

The On-Demand Repair Services Market in the UK is expected to grow at a CAGR of 8.2%, supported by applications in electronics, home fixtures, and appliance servicing. Right-to-Repair regulations and environmental awareness are fueling longer device lifecycles, boosting repair demand. Growth is also supported by platform-managed technicians that emphasize trust and reliability.

India is witnessing the fastest growth globally, with the market forecast to expand at a CAGR of 14.2% through 2035. Rising smartphone adoption, cost-conscious consumers, and increasing awareness of sustainability are driving high repair demand. B2C households dominate, but B2B contracts are emerging, especially in property and fleet management. Growth is particularly strong in Tier-2 and Tier-3 cities where platform-managed technician models are scaling rapidly.

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.0% |

| China | 11.7% |

| Japan | 6.8% |

| Germany | 15.1% |

| UK | 8.0% |

| India | 4.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 8.3% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

The On-Demand Repair Services Market in China is expected to grow at a CAGR of 12.6%, one of the highest among leading economies. Unlike the USA, China’s market leans heavily on pickup & return and remote diagnosis models (75.2% share in 2025), reflecting strong digital integration and consumer trust in platform-based ecosystems. Local players benefit from scale, cost efficiency, and government policies favoring sustainability and repair adoption.

In 2025, the USA leads the Global On-Demand Repair Services Market with a 23.0% share, reflecting its mature consumer base, established platforms, and strong demand for device and appliance repairs. However, its share is projected to decline to 20.6% by 2035, as growth in emerging regions accelerates. Similarly, mature European markets such as Germany (15.1% → 13.3%) and the UK (8.0% → 7.2%) are expected to lose some share, largely due to slower growth rates and already high service penetration. These markets remain significant in value terms but face stagnation as adoption reaches maturity and new growth shifts elsewhere.

In contrast, Asia-Pacific markets are gaining ground, led by India (4.8% → 5.9%), China (11.7% → 12.8%), and Japan (6.8% → 8.3%). India’s share expansion reflects its rapid CAGR of 14.2%, driven by cost-conscious consumers and increasing adoption of smartphone and appliance repair services across Tier-2 and Tier-3 cities. China, already a major market, grows steadily on the back of digital-first service models like pickup & return and remote diagnosis, while Japan benefits from rising demand in consumer electronics and urban household services. Together, these shifts illustrate the transition of market weight from North America and Europe toward Asia-Pacific, marking the next decade as one of emerging-market dominance in on-demand repair services.

| Asset Type Segment | Market Value Share, 2025 |

|---|---|

| smartphones & tablets | 33.7% |

| Others | 66.3% |

The USA On-Demand Repair Services Market is valued at USD 5,022.04 million in 2025, with smartphones & tablets leading at 33.7% (USD 1,692.43 million), followed by other repair categories at 66.3% (USD 3,329.61 million). The dominance of smartphone and tablet repair reflects the USA consumer ecosystem, where high device penetration and elevated replacement costs drive sustained repair demand. Electronics and appliances continue to anchor household-level adoption, with growing demand for protection plans and subscription-based repair services. The maturity of the USA market positions smartphones & tablets as the primary entry point for customers, with same-day repair models differentiating platforms on speed and convenience. Subscription add-ons and OEM-authorized networks are expanding, aligning with consumer trust in quality and transparency. While major appliances and vehicles represent stable growth categories, mobile devices remain the most dynamic driver of on-demand repair service revenues.

| Service Mode Segment | Market Value Share, 2025 |

|---|---|

| At-home / On-site Repair | 24.8% |

| Others | 75.2% |

The China On-Demand Repair Services Market is valued at USD 2,566.82 million in 2025, with pickup & return and remote diagnosis dominating at 75.2% (USD 1,930.25 million), compared to at-home/on-site repair at 24.8% (USD 636.57 million). The dominance of remote-first solutions reflects China’s highly digitalized service culture, where super-app ecosystems and integrated e-commerce platforms enable seamless repair bookings. Consumers show strong trust in logistics-driven models, where devices are collected, repaired in centralized facilities, and returned with guaranteed quality checks.

This advantage positions China as a leader in scaling remote diagnostics and centralized service hubs. Pickup models also benefit from lower costs and faster turnaround for high-volume categories such as smartphones, laptops, and consumer electronics. As digital-first ecosystems expand, AI-powered diagnostics combined with logistics optimization will remain critical in reducing downtime and enhancing consumer trust.

The Global On-Demand Repair Services Market is highly fragmented, with global platforms, regional leaders, and niche-focused specialists competing across multiple repair categories. Angi holds the largest single share at 7.1%, leveraging its strong USA presence and broad household repair network. However, the majority of the market remains dispersed among regional innovators and service aggregators. Global digital-first leaders such as Urban Company, Puls, and Asurion Tech Repair & Solutions (uBreakiFix) are driving adoption through technician-enabled mobile repairs, device protection plans, and OEM partnerships. Their strategies emphasize convenience, speed, and integration with warranty ecosystems.

Established service aggregators like HelloTech, TaskRabbit, and Geek Squad cater to household demand for appliances, consumer electronics, and IT support. These companies are accelerating adoption through bundled services, in-home technician networks, and subscription offerings. Specialized providers such as On site go, Wrench, and HomeServe focus on application-specific niches from vehicle maintenance to protection plans for consumer appliances.

Their strength lies in customization and customer loyalty in local markets rather than global scale. Competitive differentiation is shifting away from pure lead aggregation toward integrated ecosystems that include subscription models, OEM tie-ups, remote diagnostics, and technician enablement platforms. Platforms that succeed in combining speed, trust, and recurring revenue streams are expected to consolidate greater market share through 2035.

Key Developments in Global On-Demand Repairs Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 21,876.1 million |

| Asset Type | Smartphones & tablets; Laptops & desktops; Consumer electronics (TV/audio); Major home appliances; Home fixtures (plumbing/electrical/HVAC); Passenger cars & two-wheelers |

| Service Mode | At-home / on-site repair; Pickup & return; Remote diagnosis / assist |

| Provider Type | Platform-managed technicians; Marketplace/aggregator freelancers; OEM-authorized service networks |

| Booking Speed | Same-day; Next-day; 3+ days |

| Customer Type | B2C (households); B2B (SMBs, property managers, fleets) |

| Pricing Model | Fixed upfront price; Time & materials; Subscription/protection plan add-ons |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Angi ; Urban Company; Puls ; Asurion Tech Repair & Solutions (uBreakiFix); Wrench; HelloTech ; Onsitego ; Taskrabbit ; Geek Squad; HomeServe |

| Additional Attributes | Dollar sales by asset type, service mode, and booking speed; adoption trends in same-day and next-day repairs; growth of subscription/protection plan add-ons; OEM-authorized network expansion; platform-managed vs. marketplace technician models; regional dynamics driven by smartphone/appliance penetration; integration of remote diagnosis; B2B contract growth across property and fleet maintenance. |

The global market is estimated at USD 21,876.0 million in 2025.

The market is projected to reach USD 79,411.5 million by 2035.

The market is expected to grow at a 13.8% CAGR between 2025 and 2035.

Asset type, service mode, provider type, booking speed, customer type, and pricing model.

At-home / on-site repair leads within service mode with a 58.3% share in 2025 (USD 12,753.71 million).

Smartphones & tablets account for 32.4% in 2025 (USD 7,087.82 million).

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foundation Repair Services Market Outlook from 2025 to 2035

Automotive Repair & Maintenance Services Market Growth - Trends & Forecast 2025 to 2035

United States & Canada Foundation Repair Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Nerve Repair Market Growth - Trends, Demand & Innovations 2025 to 2035

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Hernia Repair Devices Market Insights - Trends & Forecast 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA