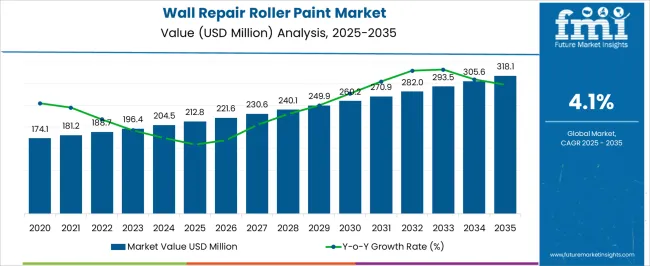

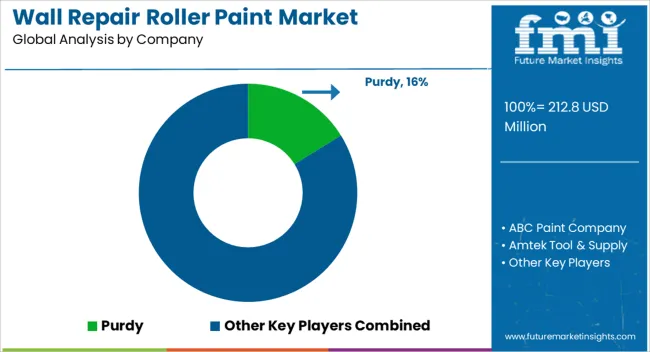

The wall repair roller paint market, with an estimated value of USD 212.8 million in 2025 and a projected value of USD 318.1 million by 2035, growing at a modest CAGR of 4.1%, exhibits a cost structure heavily influenced by raw material procurement, manufacturing processes, and distribution logistics. Raw materials, including polymers, pigments, solvents, and additives, constitute a significant portion of the production cost, as the quality and formulation of these inputs directly impact product performance, application efficiency, and durability.

Procurement strategies, such as bulk sourcing and long-term supplier contracts, are critical for managing costs and ensuring consistency in product quality. The manufacturing stage involves blending, mixing, and coating processes, where operational efficiency, labor costs, and energy consumption influence overall profitability. Facilities optimized for small-scale and large-scale production offer flexibility, but variations in production efficiency can affect the per-unit cost of the roller paint. Packaging and secondary materials, including rollers, trays, and containers, further add to the value chain, with design and material choices affecting both cost and customer perception. Distribution and logistics play a pivotal role, as timely delivery to retail outlets, hardware stores, and direct-to-consumer channels impacts market reach.

Marketing, sales, and after-sales support contribute to the final market value, shaping adoption and repeat purchase rates. The value chain emphasizes material quality, production efficiency, and distribution effectiveness, with incremental improvements across each stage essential to sustaining profitability and competitiveness in a market with moderate growth dynamics.

| Metric | Value |

|---|---|

| Wall Repair Roller Paint Market Estimated Value in (2025 E) | USD 212.8 million |

| Wall Repair Roller Paint Market Forecast Value in (2035 F) | USD 318.1 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The wall repair roller paint market is regarded as a niche but growing segment within the decorative coatings and building maintenance industries. It is estimated to hold 6.2% of the decorative paints and coatings market, driven by demand for fast and convenient wall repair solutions. Within construction and building materials, a 3.8% share is observed, reflecting integration into new construction and renovation projects. The DIY and home improvement products sector contributes 4.5%, supported by consumer preference for easy-to-use repair tools.

Commercial painting services account for 2.7%, while specialty coatings represent 1.9%, highlighting use in textured and functional surfaces. Recent industry trends have been shaped by innovation in repair-ready formulations, quick-drying paints, and roller-integrated repair kits. Groundbreaking developments include self-leveling compounds, low VOC and odorless formulations, and color-matching technologies for seamless wall touch-ups.

Key players are investing in user-friendly packaging and promoting kits that combine primers, fillers, and rollers for convenience. Strategies also include partnerships with home improvement retailers and e-commerce platforms to expand distribution and visibility. Consumer education campaigns and DIY demonstration videos have increased adoption, while eco-friendly formulations and improved durability continue to strengthen the market.

The wall repair roller paint market is witnessing consistent growth, driven by heightened demand for quick-application coatings that cater to both residential and commercial renovation needs. The current market structure is influenced by the increasing adoption of easy-to-use products that reduce labor time while delivering durable finishes. Product innovation has been a key growth driver, with manufacturers focusing on enhancing drying speed, coverage efficiency, and environmental compliance.

Water-based technologies are gaining traction due to lower VOC emissions, safety benefits, and ease of cleanup, aligning with tightening environmental regulations. In application trends, indoor use dominates, supported by a surge in home improvement activities and commercial refurbishments.

Price segmentation reveals growing consumer interest in cost-effective options without compromising performance, especially in emerging markets. Looking ahead, market expansion will be fueled by evolving consumer preferences, sustainable formulations, and wider distribution networks, ensuring competitive advantage for brands that balance affordability, functionality, and regulatory adherence.

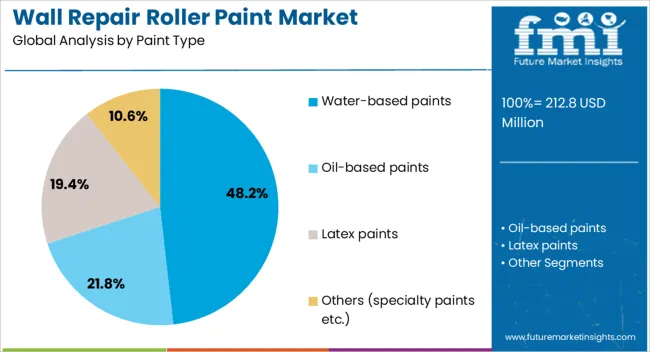

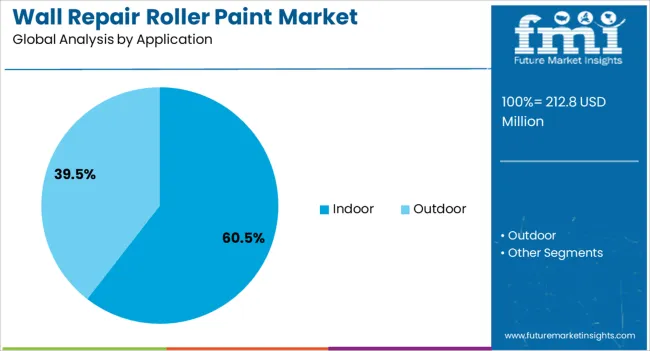

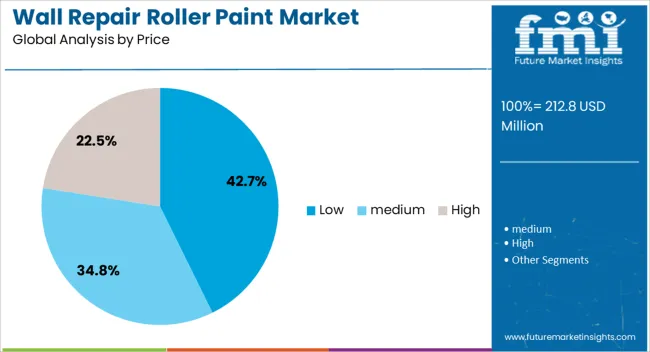

The wall repair roller paint market is segmented by paint type, application, price, end use, distribution channel, and geographic regions. By paint type, the wall repair roller paint market is divided into Water-based paints, Oil-based paints, Latex paints, and Others (specialty paints, etc.). In terms of application, wall repair roller paint market is classified into Indoor and Outdoor. Based on price, wall repair roller paint market is segmented into Low, medium, and High.

By end use, wall repair roller paint market is segmented into Professional and Individual/DIY. By distribution channel, wall repair roller paint market is segmented into Offline and Online. Regionally, the wall repair roller paint industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Water-based paints, holding 48.20% of the paint type category, are leading the segment due to their favorable environmental profile, low odor, and ease of application. Their adoption has been bolstered by compliance with stringent emission regulations, which has increased acceptance in both residential and commercial projects.

Technological advancements in formulation have improved durability, washability, and color retention, making these paints highly competitive against solvent-based alternatives. Supply chain efficiencies, coupled with increased production capacities, have reduced costs, allowing broader accessibility across market tiers.

Consumer inclination towards health-conscious products has further supported the shift toward water-based options, particularly in regions with heightened environmental awareness. As infrastructure development and renovation activities continue to expand, this segment is expected to sustain growth through innovation in finishes and specialized coatings tailored for diverse wall repair applications.

The indoor application segment, representing 60.50% of the application category, has retained its dominance through sustained demand in residential refurbishments, office renovations, and hospitality projects. The growth trajectory has been supported by consumer investment in aesthetic upgrades, enhanced living spaces, and maintenance of property value.

Indoor paints for wall repair roller applications are being preferred for their controlled drying times, minimal odor, and compatibility with various substrates. Market penetration has been furthered by the availability of a wide range of finishes, colors, and textures that cater to diverse consumer preferences.

The segment’s leadership is underpinned by ongoing urban housing projects and commercial space refurbishments, which continue to create high-volume consumption opportunities. Manufacturers are increasingly aligning product portfolios with low-VOC and eco-friendly certifications, strengthening market positioning in regulatory-compliant regions and supporting steady expansion across global markets.

The low-price segment, accounting for 42.70% of the price category, has maintained its lead through affordability and high accessibility across a wide consumer base. This segment appeals strongly to budget-conscious buyers in both developed and developing markets, where price sensitivity significantly influences purchase decisions.

Large-scale production efficiencies and simplified packaging have enabled manufacturers to offer competitive pricing without severely compromising quality standards. Retail distribution through hardware stores, supermarkets, and e-commerce platforms has broadened accessibility, further reinforcing segment growth.

The sustained adoption of low-priced wall repair roller paints is also attributed to large-scale renovation projects where cost management is a priority. Future prospects will be influenced by strategic positioning in high-volume markets, bundled offerings with essential painting tools, and targeted marketing campaigns that emphasize value for money, ensuring the segment retains its leadership in the pricing structure of the market.

The market has gained traction due to the growing demand for efficient home improvement and commercial maintenance solutions. These products allow smooth application over patched or repaired wall surfaces, improving coverage and finish quality while reducing labor time. Market growth is driven by the expansion of residential renovation activities, commercial refurbishments, and DIY trends, supported by easy-to-use roller systems and compatible repair paints. Construction activity, interior design trends, and the adoption of durable, eco-friendly coatings influence regional demand.

Residential renovation projects and DIY home improvement trends have significantly fueled demand for wall repair roller paints. Homeowners prefer products that combine patching and painting in a single application, reducing labor and material requirements. The increase in property remodeling, interior design upgrades, and aesthetic renovations has created a steady market for user-friendly repair solutions. DIY enthusiasts favor roller systems due to their ease of use, even for beginners, and compatibility with multiple wall surfaces such as drywall, plaster, and concrete. Retail channels and e-commerce platforms have also increased accessibility, supporting wider adoption across urban and suburban areas.

Advancements in roller materials, paint formulations, and coating technologies have enhanced product performance and ease of use. High-quality synthetic and micro-fiber rollers provide even paint distribution and reduced splatter, while fast-drying and low-odor formulations improve indoor usability. Products designed for multiple surface types and repair applications allow broader versatility, reducing the need for multiple tools. Anti-drip roller designs and ergonomic handles further increase user comfort and efficiency. Manufacturers are also developing eco-friendly and low volatile organic compound (VOC) paints to meet regulatory and consumer demands. These technological enhancements have expanded the market by offering professional-quality finishes for both commercial and residential users.

Commercial spaces, offices, educational institutions, and healthcare facilities require regular maintenance and refurbishments, creating a stable demand for wall repair roller paints. Facilities managers seek solutions that reduce downtime, ensure aesthetic consistency, and minimize labor costs. Quick-drying formulations and specialized rollers enable efficient touch-ups and surface restoration in high-traffic areas. Large-scale refurbishment projects benefit from bulk purchasing of compatible repair paints and rollers, encouraging partnerships with professional distributors. The institutional segment continues to drive demand for products that combine durability, ease of application, and minimal maintenance requirements, ensuring long-term market stability alongside residential consumption.

Companies in the market are increasingly leveraging innovation and marketing strategies to differentiate products. Brand positioning emphasizes ease of use, quality finish, environmental safety, and multi-surface compatibility. Retailer partnerships, online distribution, and DIY education campaigns enhance consumer awareness and adoption. Manufacturers are also focusing on product bundles combining rollers, repair paints, and accessories to provide end-to-end solutions. Strategic investments in R&D, product demonstrations, and customer service support have strengthened market competitiveness, driving loyalty among professional contractors and DIY consumers alike. Innovation and targeted marketing are becoming essential to capture market share in a growing, yet highly competitive, segment.

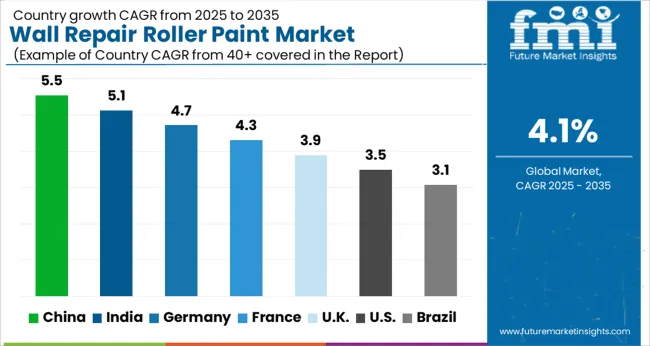

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

China leads the market with a forecast CAGR of 5.5%, driven by large-scale residential and commercial construction projects and rising adoption of efficient wall finishing solutions. India follows at 5.1%, supported by expanding urban infrastructure, home renovation trends, and growing DIY painting activities. Germany records 4.7%, fueled by advanced construction techniques and demand for high-quality paint products in both commercial and residential segments. The United Kingdom posts 3.9%, where innovation in durable and easy-to-apply coatings sustains steady development. The United States registers 3.5%, influenced by consistent housing renovations and preference for premium repair paints. Together, these countries represent a combination of production, adoption, and technological advancement shaping the global wall repair roller paint market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 5.5% in the market, driven by increasing construction and renovation activities in residential and commercial sectors. Urban development initiatives, along with rising awareness of durable and eco-friendly wall coatings, boost demand for advanced roller paints. Technological improvements in paint formulation enhance ease of application, coverage, and finish quality. Adoption of water-based and low-VOC products is increasing, reflecting environmental and health considerations. Industrial collaborations and innovative packaging solutions, such as wall repair rollers with integrated paint reservoirs, further support market expansion. China’s growing middle-class population and increasing DIY home improvement culture contribute to steady growth across the country.

India is projected to expand at a CAGR of 5.1% in the market, fueled by increasing urban construction and infrastructure development. Rising awareness of efficient wall coatings and protective paints encourages the adoption of roller-based repair solutions. DIY home improvement trends, combined with innovative packaging and easy-to-use roller designs, drive market penetration. Demand for durable and environmentally friendly paints, including low-odor and water-based variants, is on the rise. Industrial partnerships and collaborations with paint manufacturers facilitate distribution of advanced roller systems. India’s expanding middle-class housing projects and renovation activities across urban centers ensure steady growth in the wall repair roller paint segment.

Germany is anticipated to grow at a CAGR of 4.7% in the market, supported by rising demand for high-quality interior coatings and refurbishment projects. Consumers and commercial entities increasingly prefer low-VOC and environmentally compliant paints. Technological advancements in roller design, such as ergonomic handles and high-efficiency paint rollers, enhance user experience and application speed. Industrial collaborations with leading paint manufacturers promote innovative product development and distribution. Demand for DIY renovation solutions and refurbishment of older buildings contributes to steady adoption of wall repair roller paints. Germany’s strong regulatory focus on sustainable building materials and eco-friendly coatings further strengthens market growth.

The United Kingdom is projected to expand at a CAGR of 3.9% in the market, supported by a focus on residential renovations and commercial property refurbishments. Rising interest in sustainable and low-odor paint products drives demand for modern roller-based repair solutions. Advanced designs, including rollers that minimize dripping and provide uniform application, enhance efficiency. Partnerships between paint manufacturers and retailers ensure accessibility and variety of products for professional and DIY applications. The growing trend of home improvement projects and environmentally conscious consumers contributes to steady growth in wall repair roller paints across the UK.

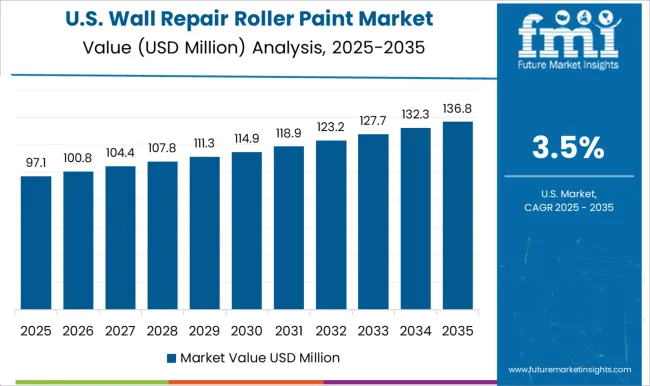

The United States is forecasted to grow at a CAGR of 3.5% in the market, with rising demand from residential remodeling and commercial renovation projects. DIY home improvement culture, combined with an emphasis on eco-friendly and water-based paints, supports product adoption. Technological innovations, including ergonomic and high-efficiency roller designs, facilitate faster and uniform application. Collaborations between paint manufacturers and retailers ensure widespread availability of advanced roller paint systems. Increasing interest in sustainable coatings and low-VOC formulations reflects consumer priorities for safety and environmental compliance, supporting steady expansion of the market across the United States.

The market is driven by manufacturers and suppliers delivering specialized roller solutions for painting, patching, and surface finishing across residential, commercial, and industrial applications. Purdy and Wooster are recognized for their premium quality rollers that ensure uniform paint application and long-term durability, offering a wide range of sizes and materials suited for different wall surfaces. ABC Paint Company and Beorol provide versatile roller systems designed to improve efficiency during wall repair and painting projects, emphasizing ergonomic design and consistent coverage. Amtek Tool & Supply, Dunham Rubber & Belting, and Harwood Rubber Products focus on high-performance roller cores and covers, engineered to optimize paint pick-up and release for smooth finishes.

Gordon Brush, Meiji, and Miyako Roller Industry supply rollers with innovative materials suitable for textured and repaired wall surfaces, enhancing application quality and user convenience. Nexllent, Premier Paint Roller, Wharton Hardware and Supply, Work Tools International, and Yange offer cost-effective and durable solutions catering to both professional painters and DIY enthusiasts. Collectively, these providers advance roller paint technology, ensuring efficiency, consistency, and high-quality wall repair outcomes.

| Item | Value |

|---|---|

| Quantitative Units | USD 212.8 Million |

| Paint Type | Water-based paints, Oil-based paints, Latex paints, and Others (specialty paints etc.) |

| Application | Indoor and Outdoor |

| Price | Low, medium, and High |

| End Use | Professional and Individual/DIY |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Purdy, ABC Paint Company, Amtek Tool & Supply, Beorol, Dunham Rubber & Belting, Gordon Brush, Harwood Rubber Products, Meiji, Miyako Roller Industry, Nexllent, Premier Paint Roller, Wharton Hardware and Supply, Wooster, Work Tools International, and Yange |

| Additional Attributes | Dollar sales by roller type and paint formulation, demand dynamics across residential, commercial, and DIY segments, regional trends in home improvement and renovation adoption, innovation in coverage efficiency, durability, and ergonomic design, environmental impact of paint chemicals and disposal, and emerging use cases in textured finishes and rapid wall repair solutions. |

The global wall repair roller paint market is estimated to be valued at USD 212.8 million in 2025.

The market size for the wall repair roller paint market is projected to reach USD 318.1 million by 2035.

The wall repair roller paint market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in wall repair roller paint market are water-based paints, oil-based paints, latex paints and others (specialty paints etc.).

In terms of application, indoor segment to command 60.5% share in the wall repair roller paint market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Wall Art Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Wall Mounted Paper Napkin Dispensers Market Growth - Demand & Forecast 2025 to 2035

Wall Decor Market Insights – Growth & Demand 2025–2035

Market Leaders & Share in the Wallets & Little Cases Industry

Market Share Distribution Among Wall Covering Product Manufacturers

In-Wall Bottle Filling Station Market Size and Share Forecast Outlook 2025 to 2035

Firewall as a Service Market

Thin Wall Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Multiwall Bags Market Trends - Growth & Demand 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Wall Mould Market

Thin Wall Glass Container Market

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Korea Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Japan Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA