The Wall Covering Product market is experiencing notable growth driven by increasing consumer demand for aesthetically appealing and durable interior design solutions. The market outlook is shaped by rising investments in residential and commercial construction, along with a growing preference for home personalization and premium interior décor. Continuous innovations in materials, patterns, and textures are enhancing the appeal of wall coverings while improving their durability, stain resistance, and ease of maintenance.

Sustainability trends and the adoption of eco-friendly materials are also influencing purchasing decisions, expanding opportunities for manufacturers offering green solutions. The shift towards organized retail and e-commerce channels has further enabled greater accessibility, allowing consumers to explore a wider variety of wall covering products.

Additionally, growing awareness about interior aesthetics, coupled with increased disposable income, supports higher adoption in residential spaces As construction activities and interior design modernization continue globally, the Wall Covering Product market is expected to witness sustained growth across diverse regions and consumer segments.

| Metric | Value |

|---|---|

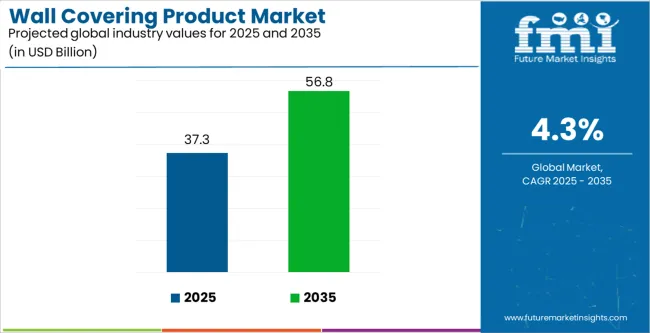

| Wall Covering Product Market Estimated Value in (2025 E) | USD 37.3 billion |

| Wall Covering Product Market Forecast Value in (2035 F) | USD 56.8 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

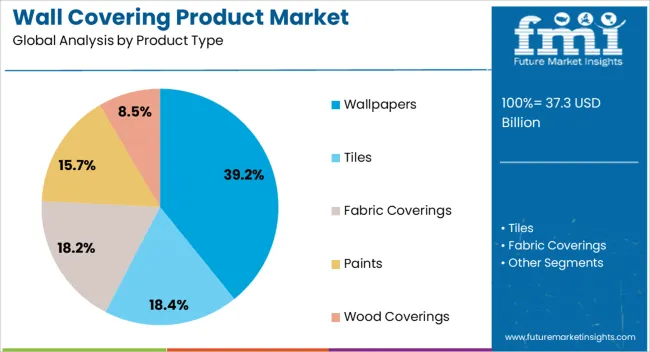

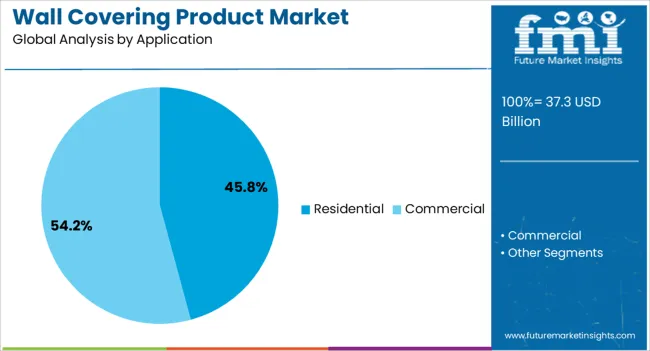

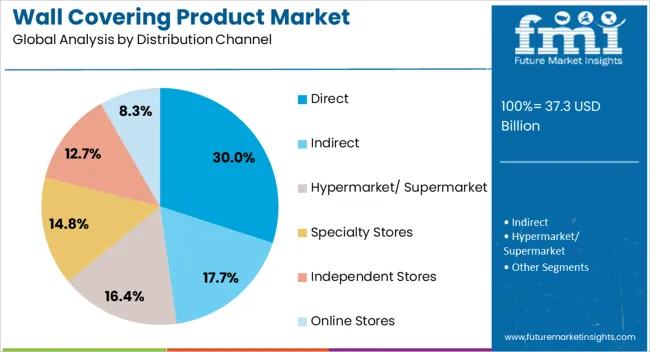

The market is segmented by Product Type, Application, and Distribution Channel and region. By Product Type, the market is divided into Wallpapers, Tiles, Fabric Coverings, Paints, and Wood Coverings. In terms of Application, the market is classified into Residential and Commercial. Based on Distribution Channel, the market is segmented into Direct, Indirect, Hypermarket/ Supermarket, Specialty Stores, Independent Stores, and Online Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wallpapers product type segment is projected to hold 39.20% of the Wall Covering Product market revenue share in 2025, making it the leading product type. This dominance is driven by the versatility of wallpapers in transforming interior spaces with a wide range of colors, textures, and patterns. Wallpapers offer easy application and replacement, allowing homeowners and designers to customize spaces without major renovation.

The growing preference for premium and decorative wall finishes has reinforced the adoption of wallpaper solutions. Additionally, advancements in materials and printing technology have improved durability, resistance to moisture, and aesthetic appeal, making wallpapers a preferred choice in modern interiors.

The segment’s growth is further supported by increasing awareness of interior design trends, higher disposable income, and rising investments in residential and commercial décor projects Robust availability through multiple sales channels, coupled with the ability to cater to diverse consumer preferences, underpins the leading position of wallpapers in the market.

The residential application segment is expected to capture 45.80% of the Wall Covering Product market revenue share in 2025, making it the leading application. The growth of this segment is influenced by rising demand for personalized and stylish home interiors that enhance aesthetic appeal and comfort. Increasing investments in home renovation and remodeling projects have created opportunities for diverse wall covering products.

Residential consumers are seeking durable, easy-to-maintain, and visually appealing solutions, which has driven the adoption of wallpapers and other decorative finishes. Additionally, the rise of interior design awareness, social media influence, and digital platforms showcasing design trends has contributed to higher acceptance in residential spaces.

The segment is further supported by the expansion of organized retail, direct sales, and e-commerce channels, which improve accessibility and convenience for consumers As residential modernization continues globally, this segment remains a critical driver of market revenue.

The direct distribution channel segment is anticipated to hold 30.00% of the Wall Covering Product market revenue share in 2025, establishing it as a leading channel. Growth in this segment is driven by manufacturers’ strategies to engage directly with end consumers, allowing better control over pricing, customization, and brand experience.

Direct sales channels provide opportunities for showcasing premium and innovative wall covering products while enhancing customer service and support. The segment also benefits from growing consumer preference for personalized consultation and tailored product offerings.

Additionally, the expansion of online direct-to-consumer platforms has further boosted the reach and convenience of purchasing wall coverings This approach reduces dependency on intermediaries and strengthens brand loyalty, making the direct distribution channel an attractive and high-performing segment in the market.

Sustainable Developments Making the Wall Covering Industry Greener

Eco-friendliness and sustainability are key trends that impact the wall covering product industry. Consumers are constantly searching for eco-friendly products, to which manufacturers are responding with sustainable wall coverings developed from natural fibers, recycled materials, and low-VOC (volatile organic compounds) paints. Surging demand for sustainable wall-covering options is fueling product development and innovation.

Manufacturers Deploying Digital Tools to Assist Customers While Making Decisions

Manufacturers increased their dependence on digital platforms during the coronavirus outbreak. This reliance has continued well into the future, with players enjoying the bounty of digital platforms with features like online visualization tools, virtual design consultations, and augmented reality applications.

These tools and applications assist customers in discovering and visualizing various wall covering options before their purchase. Manufacturers and retailers implementing digital tools may enjoy a competitive edge in reaching and engaging with customers.

Paints to Pick up Pace Over the Forecast Period

The paints segment is significantly expanding over the forecast period. Demand for paints is increasing as it provides a versatile option for wall decoration, giving customers the freedom to easily change the finish and color of their walls.

Paints can be applied on a range of surfaces, such as ceilings, walls, and trim, offering a cohesive look. Paints’ versatility makes them popular with various customers, particularly those who prefer a more contemporary or minimalistic aesthetic.

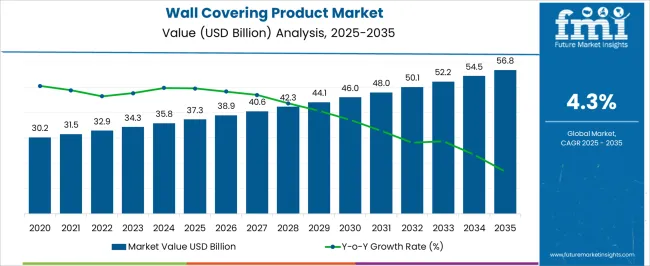

Global wall covering product sales rose at a CAGR of 4% from 2020 to 2025. Over the forecast period, the industry is projected to expand at a 4.3% CAGR.

Demand for wall cladding is influenced by a surging tendency to decorate homes, an emerging desire for aesthetics and durability, and increasing real estate investment. Growing curiosity about smart wallpapers and projects like home DIY and ensuring thermal insulation are expanding the market’s horizon.

The millennial population is fond of the latest and techno-savvy things. Consequently, this has led to constant evolutions in terms of products and components in the global market. This demographic segment has a liking for new-age home designs and interiors, which is further stirring the sector’s growth.

The wall covering product industry has had quite an evolutionary phase. Initially, wall coverings came in a paint-like format, which later progressed into a sticker-like format.

Presently, the wall coverings have taken the form of stick and remove format, which can be reused several times. This constant evolution in wall coverings is creating an extensive range of opportunities for wall covering product manufacturers.

The table below provides qualitative information about the product’s performance across key countries. Germany and the United States are expected to have slow growth over the forecast period.

In contrast, India, China, and Australia are projected to offer business opportunities to players to increase their revenues. The future of wall covering product industry in these countries is driven by surged investments in commercial buildings.

| Countries | CAGR 2025 to 2035 |

|---|---|

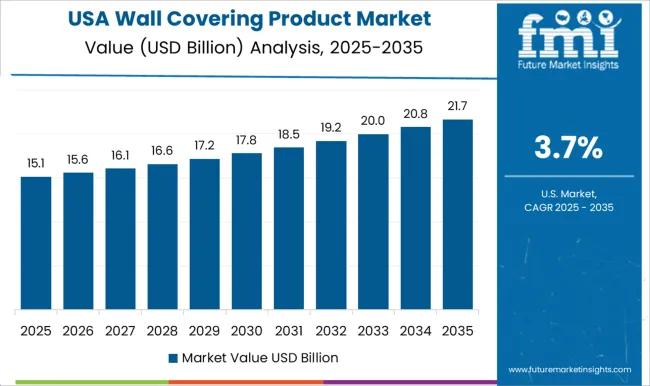

| The United States | 2.5% |

| Germany | 2.9% |

| China | 5.7% |

| India | 6.2% |

| Australia | 4.2% |

The sales of wall cladding products are expected to experience a 2.5% rise in the United States. The sluggish growth graph in the country indicates that the market is starting to mature over here. Despite nearing maturity, the industry is projected to expand due to increasing construction activities.

Leading players in the country are adopting advanced technologies to enhance the wall covering products quality. Some of these technologies include additive manufacturing and nanotechnology. Companies are also introducing an extensive range of wallpapers and wall panels, in addition to sustainable interior paints.

The market demand for wall covering products in Germany is projected to increase at a CAGR of 2.9% through 2035. The increasing count of residential structures is encouraging the sales of wall covering products.

Likewise, increasing commercial applications of wall coverings in sectors like retail, healthcare, hospitality, and office spaces are increasing opportunities for players.

Players are also raising the competitiveness of Germany by introducing many innovations in wall covering designs. Additionally, 3D textures, digital printing, and customizable solutions are other options available to players to enhance their offerings.

India promises an optimistic growth outlook over the forecast period. The country is estimated to expand at a 6.2% CAGR over the forecast period.

Robust efforts in urban development, rich decorative arts heritage, and inflating disposable incomes are primary market drivers. Further, the expanding real estate sector is driving demand for wall coverings.

A strong manufacturing base in India offers an extensive variety of wall covering products at affordable prices. Additionally, the regional cultural focus on bright and stylish interiors and the rapidly growing demand for inventive and sustainable materials play a critical role in market dynamics.

These wall coverings appeal to the young generation of homeowners seeking to create unique, stylish, and comfortable living spaces.

According to the latest statistics and forecasts, India is predicted to be a lucrative place for prospective players.

This section is dedicated to the top players in the wall covering product industry. Presently, wallpapers in the type category are gaining broader appeal, registering a share of 39.2% in 2025.

Under the application category, the residential segment is expected to enjoy dominance over the estimated period. In 2025, this segment is predicted to obtain a 45.8% share.

| Segment | Wallpapers (Type) |

|---|---|

| Value Share (2025) | 39.2% |

The wallpaper segment holds significant appeal among customers. They come in a variety of materials like non-woven wallpaper, fabric wallpaper, vinyl, and paper-based wallpaper, giving customers the flexibility to opt for a design.

Wallpapers are simple to use and can be quickly installed on walls without the need for any external gums or chemicals. This convenience is projected to fuel product demand. The rising use of digitally printed wallpapers composed of paper or non-woven materials is due to their environment friendliness.

As a result, demand for these wallpapers is surging in many industries. For instance, increasing demand for affordable digitally printed wall coverings in the upcoming construction building sector is enhancing segment growth.

| Segment | Residential (Application) |

|---|---|

| Value Share (2025) | 45.8% |

The residential application segment is significantly influencing the market dynamics. The rising requirement for comfort and individualization in home environments is prompting homeowners to demonstrate their personalities and unique tastes through the wall coverings that they choose.

Increasing interest in home improvement and renovation is intensifying consumers' focus on making living spaces more functional and attractive. The plenitude of textures, materials, and designs allows extensive customization of interiors.

Rising health and eco-consciousness are contributing to the increasing popularity of wall coverings that are produced from non-toxic or nature-safe environmentally appropriate materials. Surging sustainable home décor trend is further impacting the residential sector.

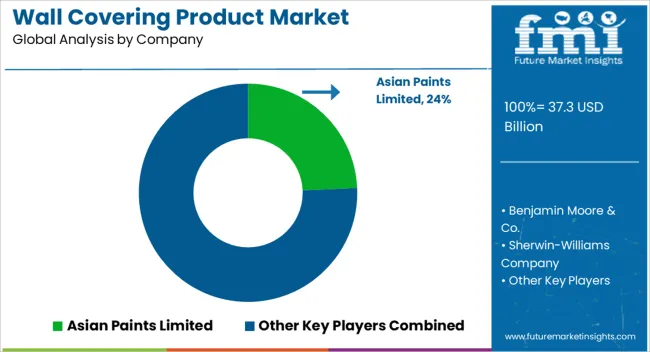

Competitive landscape of the wall covering product industry is fragmented, with many players populating the market space. Participants are actively responding to changing consumer interests and demands by engaging in varied strategic initiatives.

They are significantly investing in research and development activities to introduce high-quality, innovative, and sustainable products in this lucrative sector.

Growing demand for smart wall coverings has further propelled manufacturers to integrate IoT-enabled features, latest technology, and interactive surfaces.

Players are also expanding their product portfolio by getting into creative agreements with innovators, artists, and technologists. They are developing and advertising unique and custom solutions for various customer groups.

Industry participants further stretch their geographical scope, delve into new business areas, and boost distribution through key strategies like acquisitions and collaborations.

Industry Updates

Based on product type, the sector is divided into tiles, fabric coverings, wallpapers, paints, and wood coverings.

By application, the market is bifurcated into residential and commercial.

Wall covering products are accessible to customers through various distribution channels, including indirect, direct, hypermarket/ supermarket, specialty stores, independent stores, online stores, among others.

The wall cladding is sold across North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The global wall covering product market is estimated to be valued at USD 37.3 billion in 2025.

The market size for the wall covering product market is projected to reach USD 56.8 billion by 2035.

The wall covering product market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in wall covering product market are wallpapers, tiles, fabric coverings, paints and wood coverings.

In terms of application, residential segment to command 45.8% share in the wall covering product market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Wall Covering Product Manufacturers

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Wall Mounted Manifolds Market Size and Share Forecast Outlook 2025 to 2035

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Wall Art Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Wall Mounted Paper Napkin Dispensers Market Growth - Demand & Forecast 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Wall Decor Market Insights – Growth & Demand 2025–2035

Market Leaders & Share in the Wallets & Little Cases Industry

Product Information Management Market Growth – Trends & Forecast 2024-2034

Product Dispensing Machinery Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA