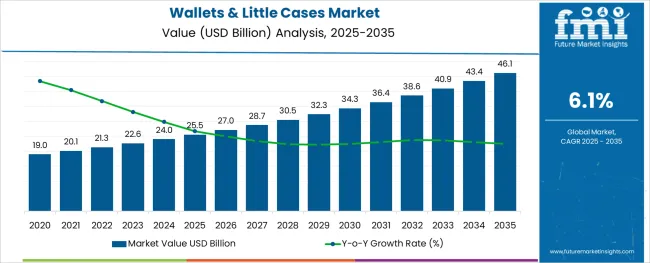

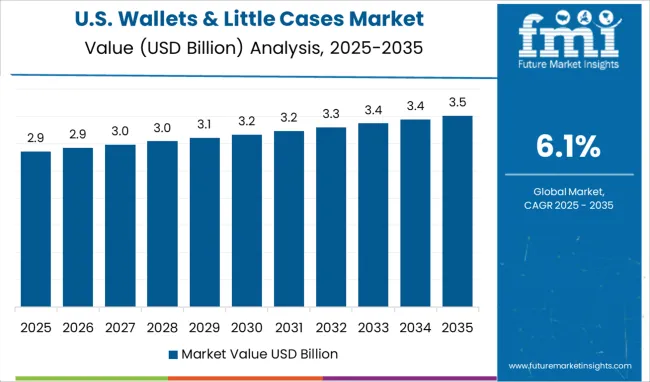

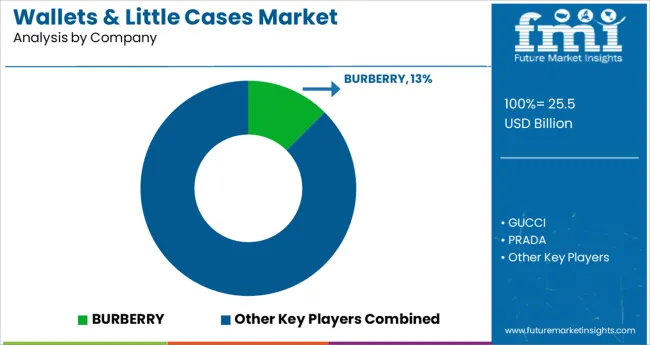

The Wallets & Little Cases Market is estimated to be valued at USD 25.5 billion in 2025 and is projected to reach USD 46.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The wallets and little cases market is experiencing sustained growth driven by evolving consumer preferences, fashion-forward design innovation, and increased adoption across niche commercial applications. Rising demand for slim, compact storage solutions has prompted brands to focus on minimalistic designs that align with mobile lifestyles. Materials innovation, including plant-based leathers and recycled synthetics, is enabling sustainable options that appeal to environmentally conscious consumers.

Additionally, the market is seeing momentum from retail partnerships and promotional merchandising, where customized little cases serve dual functions of brand visibility and practical utility. Advancements in RFID-blocking technologies and multipurpose configurations are also enhancing value perception across both personal and commercial use.

As global urbanization and retail activity intensify, the market is expected to benefit from expanded usage in food and beverage, hospitality, and event-driven promotions. Future growth will likely stem from personalization technologies, digitally connected accessories, and eco-certification-driven product development.

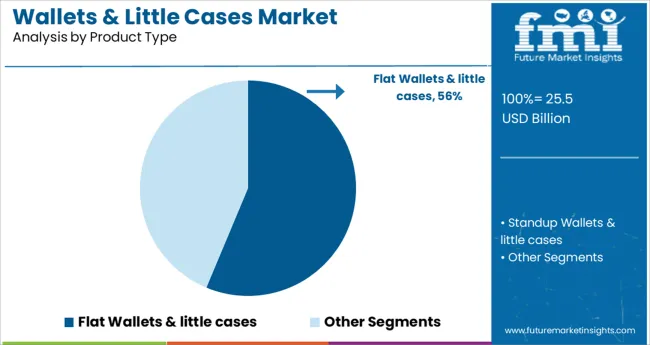

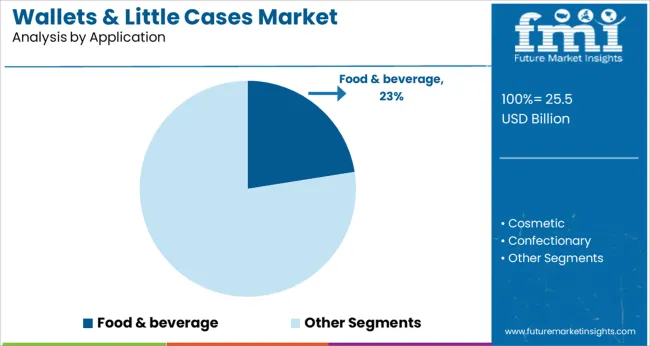

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Flat Wallets & little cases and Standup Wallets & little cases. In terms of Application, the market is classified into Food & beverage, Cosmetic, Confectionary, Grocery, Packed food, Baked food, Pre-cook food, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Flat Wallets & little cases and Standup Wallets & little cases. In terms of Application, the market is classified into Food & beverage, Cosmetic, Confectionary, Grocery, Packed food, Baked food, Pre-cook food, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flat wallets and little cases segment is projected to command 56.3% of the total market revenue in 2025, marking it as the leading product category. This dominance has been enabled by growing consumer demand for slim, lightweight, and versatile storage options that cater to cashless transactions and compact everyday carry.

The flat form factor allows for easy integration into pockets, bags, or uniforms, making it especially suitable for urban professionals, travelers, and hospitality staff. Manufacturers have responded with innovations in minimalistic designs, premium finishes, and sustainable materials that blend functionality with fashion.

Additionally, the compatibility of flat wallets with contactless payment solutions and digital card holders has reinforced their relevance in an increasingly digital economy. Custom branding and corporate gifting applications have further expanded their appeal, cementing this product type’s lead in both consumer and institutional segments.

The food and beverage segment is anticipated to contribute 22.5% of the total market revenue in 2025, establishing it as the leading application within this market. This position has been driven by the rising integration of branded wallets and compact cases into food delivery, restaurant, and hospitality operations.

Their usage as functional accessories for staff-such as bill holders, token cases, and ID wallets-has increased due to operational needs and uniformity in customer-facing roles. Businesses in the food service sector are also leveraging custom-designed wallets and cases for promotional campaigns, loyalty programs, and limited-edition merchandising.

Additionally, the durability, portability, and aesthetic flexibility of little cases have made them a preferred choice for establishments seeking to enhance customer experience and reinforce brand identity. With the expansion of quick-service and casual dining formats, the demand for compact, reusable, and presentable accessories is expected to continue supporting the segment’s market leadership.

End-use companies' increased demand for sustainable packaging solutions, as a result of rising regulatory pressure and consumer awareness about sustainability, is likely to boost the demand for wallets & little cases in the future years.

Wallets & little cases production takes less material, energy, and water. Furthermore, such items contribute to the reduction of landfills after disposal, which improves their sustainability profile.

Standup wallets & little cases are used as a marketing technique since they have a larger surface area on which visuals can be printed to attract customers, especially in supermarkets where customers make a quicker purchasing choice. This factor has also enticed end-user enterprises to utilize such package format, boosting the sales of wallets & little cases throughout the forecast period.

The trend toward convenient, easy transportation and single-use products is driving the wallets & little cases market growth. In recent years, the number of retail markets such as superstores, hypermarkets, and supermarkets has increased significantly.

When compared to rigid packaging solutions, wallets & little cases are a more convenient and efficient packaging solution. However, the sales of wallets & little cases are anticipated to decline as many manufacturers in the end-use industries find it difficult to make the transition as it requires them to change many aspects of the manufacturing process and costs a significant amount of money.

On the other hand, high costs associated with Research and Development capabilities, inadequate infrastructural facilities, and inconsistent high product costs, are projected to stymie wallets & little cases of market expansion. Rising import duties and high taxation, as well as the supply of counterfeit goods and a lack of appropriate infrastructure in low- and middle-income countries, are expected to pose challenges to the wallets & little cases market during the forecast period of 2025 to 2035.

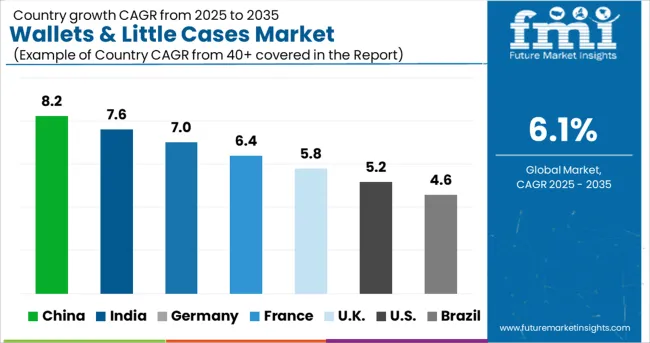

Europe is projected to dominate the global wallets & little cases market with a share of 28% during the forecast period. Factors such as rising product demand due to its low cost and great visual appeal on retail shelves, as well as the region's rapid growth of the organized retail sector, are likely to drive the wallets & little cases market share. Furthermore, rising packaged beverage consumption and a preference for small-sized packs due to their low cost and ease of use are likely to drive demand for wallets & little cases in the region.

North America is projected to witness significant growth in the wallets & little cases market with a share of 18.0% during the forecast period. The growing preference for wallets & little cases among manufacturers due to marketing benefits is likely to boost the demand for wallets & little cases in the region. Furthermore, rising consumer preference for wallets & little cases due to their portability and ease of use is expected to drive regional wallets & little cases market expansion.

The demand for wallets & little cases is expected to gain pace in Europe due to increased Research and Development spending and expanding acceptance of the technology in a variety of industrial applications such as photovoltaic, lighting, and RFID devices. During the predicted period, the region is expected to capture 26.2% of the overall market share.

The increasing acceptance of novel technologies in the European region, as well as the expanding popularity of electronics items, are both contributing considerably to the expansion of the wallets & little cases market in Europe.

Startups in the wallets & little cases market are focused on innovation in the use of materials as well as product design, which has contributed to the consumer's interest in printed packaging.

For example, the inclusion of smart features like wallet tracking and biometric identification in smart-connected wallets aids in the tracking of these wallets in the event of loss or theft. During the forecast period, such applications of smart-connected wallets are anticipated to drive the wallets & little cases market share.

Bellroy Pty Ltd. - The company offers a wide selection of wallets in the wallet segment, including Zip Wallets, Card Holders, Billfolds, and others. Travel Folio, Card Sleeve, Note Sleeve, and other popular goods are available.

Some of the key market participants in the wallets & little cases market are Amcor Limited, Bemis Company, Inc., Sealed Air Corporation, Huhtamaki Oyj, Mondi Group, S. C. JOHNSON & SON, INC., and Maco PKG. Maco Bag Corporation.

Due to the existence of both domestic and global players, the wallets & little cases market is highly fragmented. Key industry players primarily provide customized packaging products and use techniques such as mergers and acquisitions and new product development to acquire a competitive advantage over others.

Some of the recent developments in the wallets & little cases are

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.1% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | By Product, By Application, By Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; The Asia Pacific excluding Japan; Japan; The Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled | Amcor Limited; Bemis Company, Inc.; Sealed Air Corporation; Huhtamaki Oyj; Mondi Group; S. C. JOHNSON & Sons, INC.; and Maco PKG. Maco Bag Corporation. |

| Customization | Available Upon Request |

The global wallets & little cases market is estimated to be valued at USD 25.5 USD billion in 2025.

It is projected to reach USD 46.1 USD billion by 2035.

The market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types are flat wallets & little cases and standup wallets & little cases.

food & beverage segment is expected to dominate with a 22.5% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Wallets & Little Cases Industry

Crypto Wallets Market Size and Share Forecast Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

USA & Canada Cat Litter Market Growth, Demand, and Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

USA & Canada Portable Air Conditioner Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA