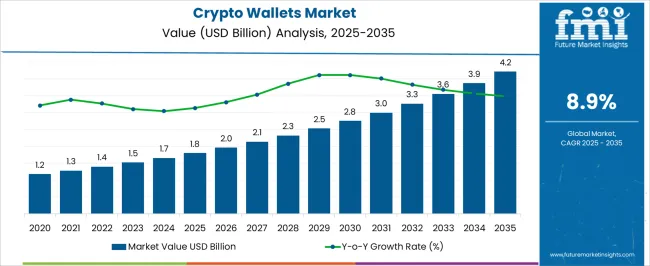

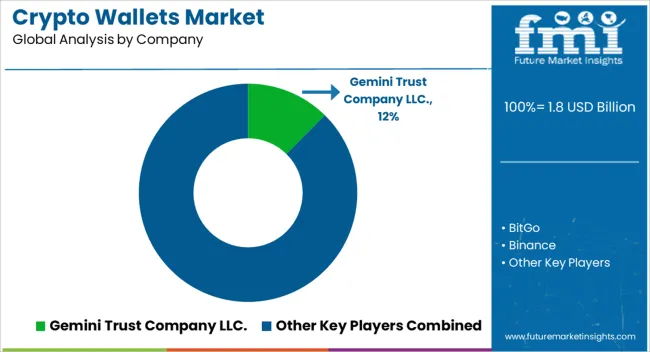

The Crypto Wallets Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| Crypto Wallets Market Estimated Value in (2025 E) | USD 1.8 billion |

| Crypto Wallets Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The crypto wallets market is expanding rapidly, supported by the accelerating adoption of digital assets and the growing need for secure storage and transaction solutions. Industry publications and company disclosures have emphasized the increasing participation of both retail and institutional investors in cryptocurrency markets, which has driven demand for user-friendly and highly secure wallets.

Technological innovations, such as integration of biometric authentication, multi-signature security, and decentralized identity features, have strengthened wallet capabilities and enhanced user confidence. Additionally, regulatory updates in key financial hubs are shaping wallet development by promoting compliance while ensuring consumer protection.

Press releases from fintech firms have highlighted ongoing investments into hardware and software wallet infrastructure, signaling strong growth potential. Looking ahead, wider integration of crypto wallets into payment platforms, banking systems, and decentralized finance (DeFi) ecosystems is expected to fuel adoption. Market momentum is projected to be concentrated in hot wallets for everyday use, trading applications where speed is critical, and BFSI industry adoption, where security and scalability are primary concerns.

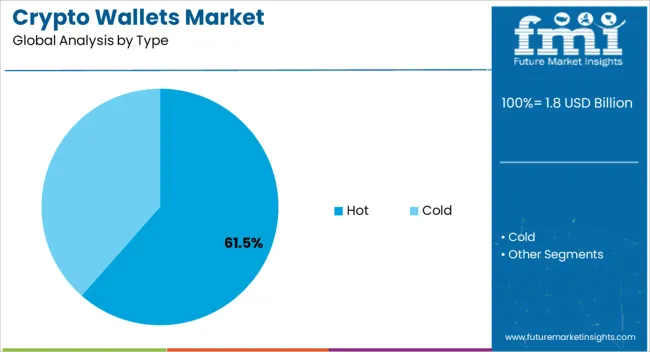

The Hot wallet segment is projected to account for 61.50% of the crypto wallets market revenue in 2025, maintaining its dominance due to widespread accessibility and convenience for active users. Growth has been driven by the ability of hot wallets to provide instant connectivity to the internet, enabling rapid execution of trades and transfers.

Industry commentary has underlined that hot wallets are particularly favored by retail investors who prioritize usability and integration with exchanges. Continuous updates in software architecture, such as encrypted cloud backups and enhanced private key management, have further secured user adoption.

Mobile-based hot wallets, which support multi-asset storage and payment functions, have extended access to broader demographics globally. Despite ongoing concerns about cybersecurity risks, ongoing improvements in encryption standards and two-factor authentication have reinforced user trust. As crypto adoption widens and transaction volumes rise, the hot wallet segment is expected to sustain its leadership in the market.

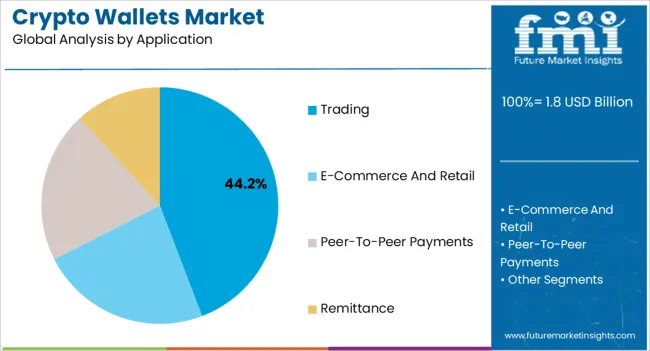

The Trading segment is expected to hold 44.20% of the crypto wallets market revenue in 2025, solidifying its position as the leading application. Growth of this segment has been fueled by increasing cryptocurrency transaction volumes on exchanges and rising participation in day trading and derivatives markets.

Crypto wallets designed for trading have been developed with advanced functionalities, including instant transaction signing, real-time balance tracking, and integration with decentralized exchanges. Industry reports have noted that traders require wallets capable of supporting quick access and interoperability across multiple blockchains.

Furthermore, the volatility of cryptocurrency markets has heightened the reliance on wallets that enable users to execute trades swiftly and securely. Market demand has also been supported by partnerships between exchanges and wallet providers to streamline user onboarding and compliance. With global retail and institutional trading activity continuing to surge, the trading application segment is anticipated to remain the dominant area of wallet usage.

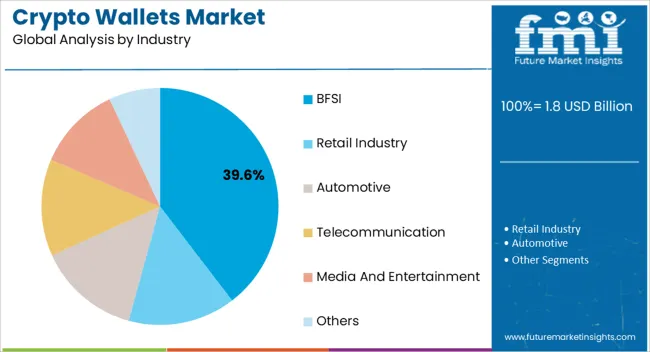

The BFSI segment is projected to contribute 39.60% of the crypto wallets market revenue in 2025, reflecting its central role in institutionalizing digital asset adoption. Growth has been driven by financial institutions integrating wallet solutions to support custody, trading, and investment services for cryptocurrencies.

Banks and payment providers have increasingly sought to incorporate wallet technologies to align with growing consumer interest in digital assets. Annual reports and investor briefings from fintech and banking companies have outlined strategic partnerships aimed at offering secure custody and wallet services to institutional clients.

Enhanced regulatory clarity in multiple jurisdictions has also encouraged BFSI players to expand into digital asset services, requiring robust and compliant wallet infrastructure. Moreover, the demand for multi-signature solutions and cold-hot hybrid models within BFSI has been emphasized to ensure both security and operational efficiency. As digital assets become an integral part of financial ecosystems, the BFSI industry segment is expected to sustain its leadership in wallet adoption.

The global crypto wallet market is expected to increase at 9.3% CAGR between 2025 and 2035 in comparison with the 7.2% CAGR registered from 2020 to 2025. When it comes to financing and holding a user’s virtual currencies, one of the main advantages of using a known cryptocurrency wallet is that users have a lot of currency substitutes to choose from. Those who are capable of buying a variety of coins will be able to effectively spread their financial assets while lowering risk and expanding the total earning potential.

Crypto wallets help to secure confidential keys, making cryptocurrencies safe and easily available. In short, it is a safe place to store users’ evidence of ownership. It also allows users to receive, deliver, and spend cryptocurrencies like Ethereum and Bitcoin.

The cold wallet segment by type is set to grow at a steady CAGR of around 10.6% during the forecast period. Stealing from a cold wallet would require access to or physical possession of the wallet, as well as any related PINs or passwords that have to be utilized to access the funds.

Rising Acceptance of Crypto among Retailers

Increasing adoption of cryptocurrency and rising acceptance of crypto payments by retailers can be prime differentiator in the highly competitive digital payment world. Crypto wallets are thus gradually obtaining customer familiarity with acceptance from retailers.

By integrating crypto wallets, the route of industries will change as they offer benefits like modern payment options. These wallets also provide a chance for virtual partnerships with retailers by eliminating currency barriers and raising the value of member data. Looking at consumers’ eagerness to adopt modern technologies, retailers may record the success and get an actual hold on crypto.

Innovation of Safety and Privacy Features

The presence of several account and privacy features in crypto wallets would make them an extremely secure sign-in method. They also require users to enter an encrypted login ID, which would ensure complete safety. A digital wallet keeps track of the blockchain location where a specific asset is held, in addition to the data encryption required to electronically authenticate transactions.

| Country | 2025 Value share in Global Market |

|---|---|

| Germany | 8.4% |

As per FMI’s study, Germany is estimated to create an absolute $ opportunity of USD 4.2 million by the end of 2035. Technological advancements in the crypto world are one of the major factors creating high revenues in Germany. A large number of crypto wallets are obtainable in Germany such as BitGo, ZenGo, and eToro owing to their various excellent usage. Thus, rapid digitization in the field of crypto wallets is driving the German market.

In March 2025, for instance, German fintech Naga (N4G) which provides investment in crypto and stock via its mobile app, announced that its new crypto trading platform will begin operating on March 7. The social trading platform named Nagax is set to focus on cryptocurrencies and feature a crypto exchange, as well as a crypto wallet with more than 50 assets. The launch of similar unique platforms by start-up firms in Germany is anticipated to boost growth.

| Country | 2025 Value share in Global Market |

|---|---|

| United States | 18.4% |

The presence of major vendors in the country such as Gemini Trust Company, LLC, BitGo, and BitPay among others is one of the significant factors driving the market. The entry of various new companies in the field of cryptocurrency is another vital factor that would spur growth in the USA.

In September 2024, for instance, Robinhood, a USA-based financial services company, debuted a feature that would deliver traders more control over digital tokens in its new expansion in the cryptocurrency space. The newly public brokerage announced that it is testing crypto wallets with select clients. The novel wallet would enable investors to receive, send, and trade digital currencies, as well as move them in and out of the company’s app.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| India | 12.3% |

India is anticipated to grow at an impressive rate of around 12.3% CAGR between 2025 and 2035. Growing technological advancement has led to the development of new crypto wallets in India. The ability of these wallets to secure users’ assets in one place would further lead to market expansion. In May 2025, for instance, Wirex announced the expansion of its range of top-up methods on its non-custodial wallet for Indian users. It has added the popular payment option for purchasing crypto to make the digital economy more accessible for more than 1 billion people in India.

| Segment | 2025 Value share in Global Market |

|---|---|

| Hot Crypto Wallets | 68.7% |

| Trading Application | 38.7% |

The hot wallet segment is expected to showcase the highest market share in the upcoming decade. The segment held a market share of nearly 68.7% in 2025, says FMI. Hot wallets are simple to use and their storage is completely based online. Therefore, switching between online and offline is not necessary to complete a cryptocurrency transaction. Many people use mobile hot wallets to exchange or buy cryptocurrencies. Cold wallets, on the other hand, are not suitable for initiating transactions. Thus, various advantages offered by hot wallets over cold wallets are driving the segment.

The trading segment is anticipated to grow by 2.0x during the forecast period. Many trading applications offer a broad selection of cryptocurrencies for trading, including both well-established coins like Bitcoin and Ethereum, as well as numerous altcoins. This variety can appeal to traders looking to diversify their holdings. Many trading platforms are available across different devices, including web browsers and mobile applications. This makes it convenient for users to access and trade cryptocurrencies on the go. Top trading applications continuously innovate and upgrade their services to stay ahead of the competition and meet the evolving needs of the market. These benefits offered by the peer-to-peer payment methods are driving the segment.

The BFSI sector is estimated to grow by 2.1x during the forecast period, finds FMI. The sector uses crypto wallets and public blockchains comprising stablecoins to speed up their payment procedures. Blockchain technology offers a quicker and more inexpensive substitute for clearing houses when processing transactions. Settlements and clearing could happen at a much quicker rate if banks use blockchain technology. Thus, increasing the use of crypto wallets to make transactions safe and simple is driving the segment.

Key businesses in the global crypto wallets market are focusing on strategic partnerships with other vendors to develop technologically advanced wallets to serve their customers. A few other key players are engaging in mergers and acquisitions with local companies worldwide to co-develop new applications equipped with unique features.

For instance

Gemini, BitGo, and Binance Are Pioneering Full-blown Crypto Wallets to Transform the Way People Transact

Gemini, BitGo, and Binance are expected to remain at the forefront in the field of cryptocurrency. Gemini announced the introduction of Gemini Staking, which allows clients to collect staking benefits in their Gemini accounts. The platform provides a smooth approach to further discovering the world of cryptocurrency while also assisting in the security and validation of blockchain transactions, with yield earned by crypto incentives given out to validators.

With Gemini Earn, the company collaborates with accredited and thoroughly screened third-party borrowers to provide its customers with yields created by the payment of interest on lent assets. For instance, in March 2024, the company collaborated with Itiviti to enable cryptocurrency holders to trade on Itviti's NYFIX.

BitGo, on the other hand, is progressing at a fast pace in the crypto wallets space by providing new security features. The company is planning to secure wallets on certain blockchains using a technology called Threshold Signature Scheme (TSS) in order to support new coins and reduce transaction fees.

BitGo is the first company to bring a Travel Rule solution to the market for its custodial clients. The company’s application programming interface (API) network will allow clients with both cold and hot wallets to attach the additional data necessary by the new regulation. For instance, in April 2024, BitGo purchased Lumina, which is a supplier of software solutions that provides digital asset dealers with a financial platform to promote mass adoption by bridging the gap between traditional finance and crypto.

Similarly, Binance, a leading firm that provides API services, is committed to ensuring the global crypto ecosystem's secure and sustainable growth. Its services include combating various types of ransomware and fraud. The company has developed a new API service to enable customers to quickly track their cryptocurrency operations and help them to meet their country's regulatory standards. For instance, in August 2025, Binance announced its plans to launch Binance Account Bound (BAB), which is the first Soulbound Token (SBT) created on the BNB Chain. BAB will be first offered as a prototype project and will only be available via the Binance mobile app.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.8 billion |

| Projected Market Valuation (2035) | USD 4.2 billion |

| Value-based CAGR (2025 to 2035) | 8.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD million) |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, North Africa and South Africa |

| Key Segments Covered | Type, Application, Industry, Region |

| Key Companies Profiled | Gemini Trust Company LLC.; BitGo; Binance; BitMEX; Breadwinner AG (BRD); Trezor; BitPay; Ledger SAS; Bittrex Global; Exodus; ARCHOS; BitLox; Coinkite Inc.; OPOLO SARL; ZenGo Ltd |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global crypto wallets market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the crypto wallets market is projected to reach USD 4.2 billion by 2035.

The crypto wallets market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in crypto wallets market are hot, _desktop, _web, _mobile, cold, _hardware and _paper.

In terms of application, trading segment to command 44.2% share in the crypto wallets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cryptogenic Stroke Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cryptocurrency Market Size and Share Forecast Outlook 2025 to 2035

Crypto Trading Platform Market Size and Share Forecast Outlook 2025 to 2035

Cryptojacking Solution Market Analysis by Component, Deployment Mode, Industry and Region Through 2035

Crypto APIs Market Trends - Growth, Demand & Outlook 2025 to 2035

Crypto Payment Gateways Market Insights - Trends & Growth 2025 to 2035

Crypto Security Market Trends - Growth, Demand & Outlook 2025 to 2035

The Cryptococcal Antigen Lateral Flow Assay Test Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Crypto Authentication ICs Market Growth – Trends & Forecast through 2034

Crypto Tax Software Market Trends – Growth & Forecast 2024-2034

Crypto Asset Management Market

Quantum Cryptography Market Insights - Growth & Forecast 2025 to 2035

Post-Quantum Cryptography (PQC) Migration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Wallets & Little Cases Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA