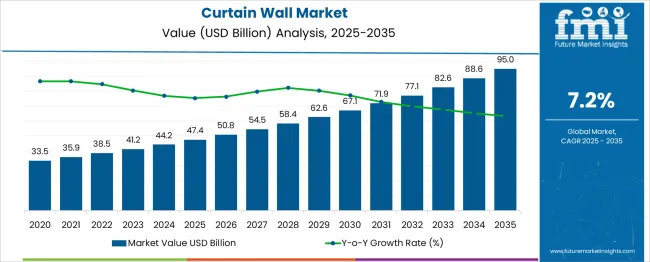

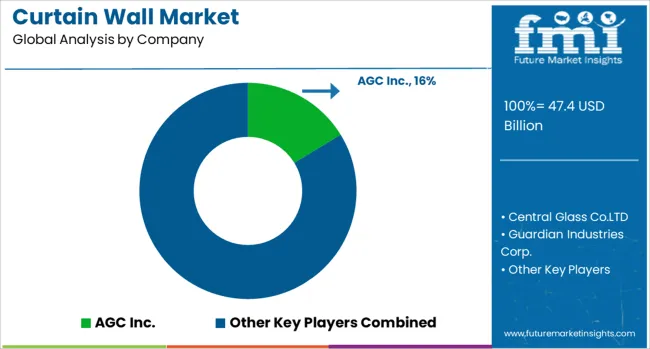

The Curtain Wall Market is estimated to be valued at USD 47.4 billion in 2025 and is projected to reach USD 95.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Curtain Wall Market Estimated Value in (2025 E) | USD 47.4 billion |

| Curtain Wall Market Forecast Value in (2035 F) | USD 95.0 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The curtain wall market is growing steadily due to increasing construction activities in commercial and institutional sectors. Emphasis on energy efficiency and building aesthetics has boosted demand for advanced facade systems. Innovations in material technology and fabrication methods have improved durability and installation speed, making curtain walls more attractive for modern architecture.

Regulatory focus on green buildings and sustainable construction has further propelled market adoption. The rise in urbanization and infrastructural developments globally, especially in emerging markets, is creating numerous opportunities.

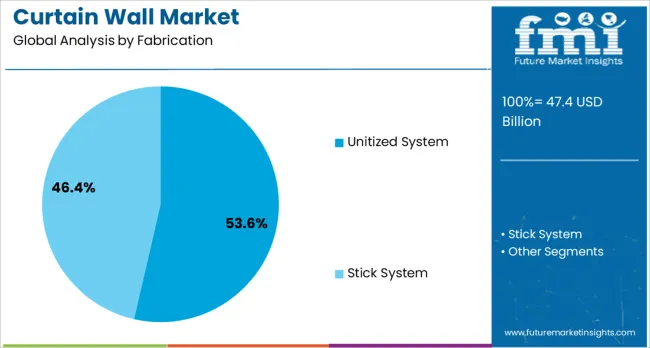

Market growth is anticipated to continue as new construction projects prioritize efficient and visually appealing building envelopes. The segmental growth is expected to be led by the unitized system in fabrication, new construction in construction type, and commercial buildings in application due to their significant contribution to the overall demand.

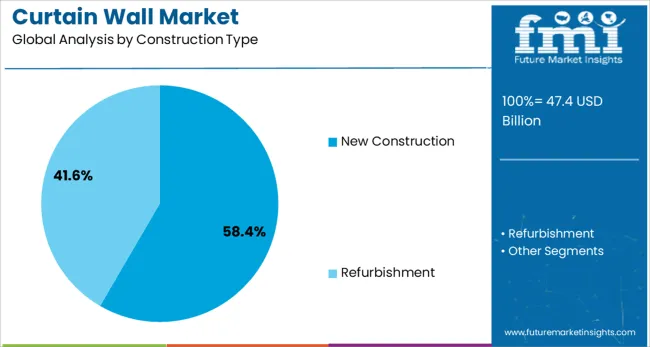

The curtain wall market is segmented by fabrication, construction type, application, and distribution channel and geographic regions. By fabrication of the curtain wall market is divided into Unitized System and Stick System. In terms of construction type of the curtain wall market is classified into New Construction and Refurbishment.

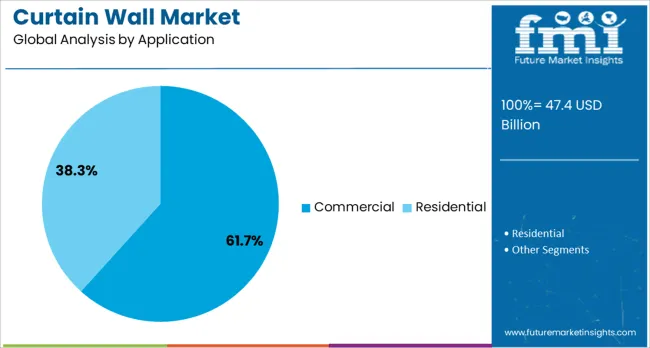

Based on application of the curtain wall market is segmented into Commercial and Residential. By distribution channel of the curtain wall market is segmented into Offline and Online. Regionally, the curtain wall industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The unitized system segment is expected to contribute 53.6% of the curtain wall market revenue in 2025, dominating the fabrication category. This growth is supported by the efficiency of factory-assembled panels that reduce on-site labor and construction time. Unitized systems offer improved quality control and weather tightness as they are pre-assembled and tested before installation.

This fabrication method is preferred in large scale projects where speed and precision are critical. The modular nature of unitized systems allows for customization and easier replacement, enhancing maintenance and lifecycle value.

These advantages have driven their adoption in commercial and high-rise building projects.

The new construction segment is projected to hold 58.4% of the market revenue in 2025, leading the construction type category. This is attributed to the expansion of commercial real estate and institutional buildings where curtain walls are increasingly specified to meet architectural and performance requirements.

New construction projects often integrate curtain walls for their ability to provide natural lighting, thermal insulation, and modern aesthetics. Growing urban development and government infrastructure initiatives have increased the number of new builds, fueling demand for curtain wall systems.

Additionally, building owners and architects favor curtain walls in new developments to achieve green building certifications and energy efficiency goals.

The commercial segment is forecasted to generate 61.7% of the curtain wall market revenue in 2025, representing the largest application sector. This is driven by the widespread use of curtain walls in office buildings, shopping malls, and hotels where facade design plays a key role in branding and occupant comfort.

Commercial buildings require facades that balance aesthetics with functionality, including energy efficiency and weather protection. Increasing investments in commercial infrastructure and renovations to upgrade existing buildings have also contributed to the segment’s growth.

As businesses focus on sustainable design and modern architectural trends, the commercial application will continue to dominate the curtain wall market.

Demand for curtain wall systems is rising steadily, driven by expansion in commercial construction and growing retrofit activities. Sales of unitized glass façade panels and high-performance curtain wall systems surged notably in Asia-Pacific and North America during 2024. This growth aligns with stricter energy codes, increasing aesthetic demands, and the trend toward modular construction, enhancing installation speed and quality control.

Global demand for unitized curtain wall systems increased by approximately 34% in 2024, especially for large-scale commercial and institutional developments. These prefabricated systems now account for about 66% of curtain wall installations worldwide, led by rapid urbanization and green building regulations in Asia-Pacific, which represents over 38% of global volumes. Retrofit projects and new-build commercial towers in North America and Europe experienced a 30% rise in double- and triple-glazed curtain wall panel adoption, reflecting a push for enhanced energy efficiency and façade modernization.

Curtain wall products featuring high-performance glass, Low-E coatings, thermal breaks, and fire-rated panels recorded a 31% year-on-year increase in 2024. These systems reduce HVAC energy consumption by up to 25%, making them highly attractive in commercial segments, which now represent 72% of market demand. Retrofit activities accounted for a 23% increase as aging façades were replaced to meet LEED certifications and local energy regulations. Vendors providing end-to-end design and installation services reported contract growth of 28%.

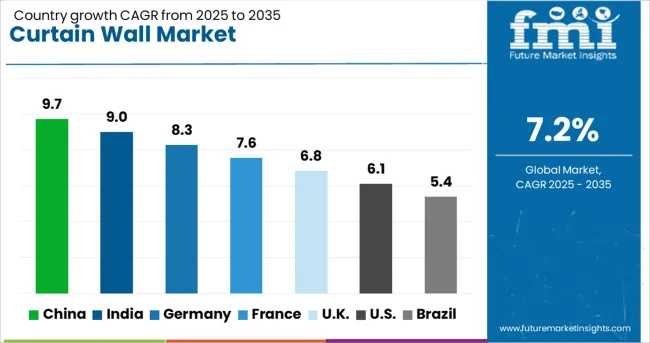

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global market is projected to expand at a CAGR of 7.2% between 2025 and 2035, fueled by smart city investments, green building mandates, and architectural innovation. China, with a CAGR of 9.7%, leads due to high-rise commercial construction in urban clusters, rising LEED-certified buildings, and state-backed infrastructure projects. India is expanding at 9.0%, supported by government schemes like Smart Cities Mission, surging demand for energy-efficient façades, and real estate sector recovery.

Germany, growing at 8.3%, benefits from stringent energy-efficiency regulations (EnEV), sustainable retrofits, and premium glass façade demand. The UK (6.8%) is witnessing increased refurbishment of aged office stock and net-zero architecture targets. The USA, at 6.1%, shows moderate growth with strong commercial demand and growing focus on impact-resistant curtain wall systems. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The curtain wall market in China is expected to grow at a CAGR of 9.7% from 2025 to 2035. Between 2020 and 2024, rapid urbanization and commercial tower projects fueled demand. Moving forward, green building codes, smart façade integrations, and high-rise expansions will drive sales. Developers increasingly favor unitized curtain walls for Tier 1 city skylines, while structural glass systems gain preference in government infrastructure. Sustainability regulations are accelerating solar-integrated curtain wall installations across provinces.

The curtain wall market in India is forecasted to expand at a CAGR of 9.0% through 2035. From 2020 to 2024, growth stemmed from commercial office parks and IT campuses. The coming decade will see accelerated uptake driven by luxury residential towers and smart city initiatives. Aluminium-framed curtain walls are preferred for coastal corrosion resistance, and semi-unitized systems are gaining traction in mid-rise construction. Increasing zoning mandates require energy-efficient façade solutions in metropolitan areas.

The curtain wall market in Germany is projected to grow at a CAGR of 8.3% from 2025 to 2035. Growth from 2020 to 2024 was driven by eco-friendly refurbishments of commercial properties. Upcoming EU regulations and zero-energy building targets will spur the adoption of intelligent curtain walling systems. Triple-glazed curtain walls are becoming standard in public architecture. Passive house design principles influence material choices, while photovoltaic curtain walls are increasingly used in government-funded green campuses.

The UK market is expected to grow at a CAGR of 6.8% during 2025-2035. Demand between 2020 and 2024 focused on airport terminals and retail chains. Future growth will be driven by net-zero carbon building mandates and digitally optimized façade engineering. Frameless glazing curtain walls gain popularity in hotel refurbishments. Retrofit projects targeting Grade A office spaces increase, alongside growing demand for rainscreen cladding in suburban developments.

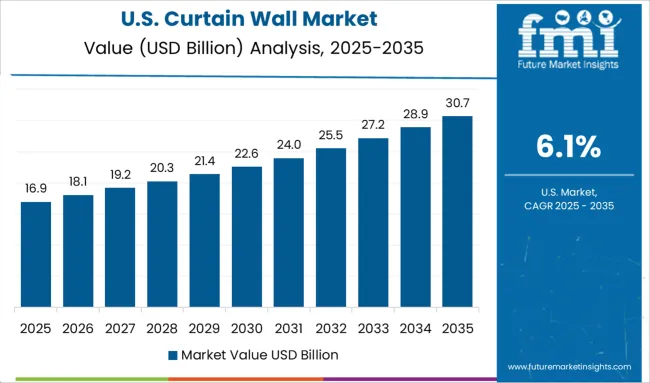

The USA curtain wall market is forecasted to grow at a CAGR of 6.1% between 2025 and 2035. Growth during 2020-2024 was driven by healthcare and university building installations. Over the next decade, demand will rise for curtain walls in energy-efficient commercial complexes and architecturally distinctive skyscrapers.

Smart glass curtain walls offering dynamic thermal control are increasingly specified. Modular unitized systems gain traction for rapid construction in urban areas. Public infrastructure projects create opportunities for fire-rated curtain wall solutions.

AGC Inc. leads the curtain wall industry with a strong share, driven by advanced glass technologies and global distribution. Central Glass Co. LTD and Guardian Industries supply high-performance architectural glass, while Nippon Sheet Glass and Saint-Gobain provide energy-efficient and decorative solutions. Reynaers Group and Schott AG focus on innovative aluminum and glass façade systems tailored for modern designs.

In Asia-Pacific, Xinyi Glass Holdings and Yuanda China Holdings dominate with large-scale production capabilities for high-rise applications. Vitro S.A.B., EFCO Corporation, and Kawneer Company Inc specialize in durable and customizable curtain wall systems, catering to commercial and residential projects. Competition centers on thermal performance, aesthetic versatility, and integration with smart building technologies to meet energy regulations and design flexibility requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 47.4 Billion |

| Fabrication | Unitized System and Stick System |

| Construction Type | New Construction and Refurbishment |

| Application | Commercial and Residential |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AGC Inc., Central Glass Co.LTD, Guardian Industries Corp., Nippon Sheet Glass Co., Ltd, Saint-Gobain group, Elicc Group, EFCO Corporation, EFP International B.V, Reynaers Group, Schott AG, Vitro S.A.B. de C.V., Xinyi Glass Holdings Limited, Yuanda China Holdings Limited, Hainan Development Holdings Nanhai Co., Ltd., Technal, PortaFab Corporation, Kazmi Enterprises, G. James Group, LIXIL Group Corporation, and Kawneer Company Inc |

| Additional Attributes | Dollar sales by system type (unitized, stick‑built, semi-unitized) and material (glass, aluminum, composite, stone veneer), demand dynamics across new construction and refurbishment in commercial vs residential segments, regional growth leading in Asia‑Pacific and Europe, innovation in BIPV, smart glass, double‑skin facades, and environmental impact via energy efficiency and lifecycle emissions. |

The global curtain wall market is estimated to be valued at USD 47.4 billion in 2025.

The market size for the curtain wall market is projected to reach USD 95.0 billion by 2035.

The curtain wall market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in curtain wall market are unitized system and stick system.

In terms of construction type, new construction segment to command 58.4% share in the curtain wall market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA