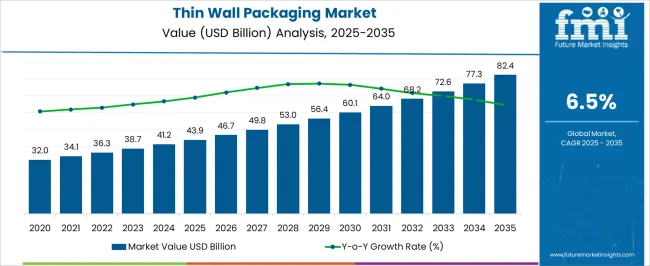

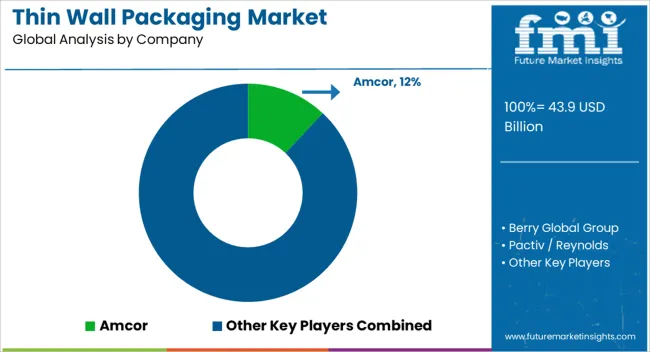

The thin wall packaging market, valued at USD 43.9 billion in 2025 and expected to reach USD 82.4 billion by 2035 with a CAGR of 6.5%, demonstrates a cost structure shaped by raw material dependency, energy-intensive production, and logistics dynamics. Raw materials, particularly polypropylene and polyethylene, form the largest cost segment, accounting for nearly half of total expenditure.

Fluctuations in crude oil prices directly impact resin costs, making procurement strategies critical for cost management. Manufacturing processes such as injection molding and thermoforming also require significant energy, adding to overhead expenses, particularly in regions with higher energy tariffs. The value chain begins with resin suppliers, moving to converters and packaging manufacturers who develop lightweight, durable containers. These products are then supplied to food and beverage companies, household goods producers, and retailers. Value addition is achieved through customization, barrier property enhancement, and recyclable content integration. Distribution efficiency, especially in high-volume applications, plays a pivotal role in ensuring competitiveness.

Downstream, retailers and brand owners exert significant influence by demanding cost-efficient yet sustainable packaging, forcing suppliers to innovate in material reduction without compromising performance. The overall chain is increasingly being reshaped by circular economy practices, where recycling and reprocessing feed back into production, lowering long-term raw material cost dependency.

| Metric | Value |

|---|---|

| Thin Wall Packaging Market Estimated Value in (2025 E) | USD 43.9 billion |

| Thin Wall Packaging Market Forecast Value in (2035 F) | USD 82.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The thin wall packaging market is viewed as a high volume, performance driven segment across its parent industries. It is estimated at 9.3% within rigid plastic packaging, supported by lightweight containers for high speed filling lines. In food and beverage packaging, a 6.6% share is assessed, led by dairy cups, yogurt tubs, ice cream containers, and ready meal trays. Thermoformed and injection molded formats account for 7.8%, where downgauged polypropylene, polyethylene, and PET are favored for cycle time and stiffness. Fast moving consumer goods add 5.2%, covering household and personal care packs. In e commerce and retail ready packaging, a 3.9% share is observed, driven by stackable formats and protection in transit. Recent trends have been shaped by downgauging, design for recycling, and barrier enhancement.

Groundbreaking moves include mono material PP and PET systems with in mold labeling for full body decoration, rPET and recycled PP adoption, and high flow resins that allow thinner walls without loss of top load. Key players have pursued partnerships with resin suppliers for food contact compliant recyclate, while converters invest in high cavitation molds, stack molds, and in mold automation to lift throughput. Oxygen and moisture barriers using EVOH, SiOx, and AlOx coatings have been introduced for shelf life gains. Easy peel lidding, tethered lids, and digital printing for short runs have been emphasized, positioning thin wall packaging as a cost efficient, brandable, and recycling ready solution.

Increasing focus on sustainability and the reduction of raw material usage is encouraging manufacturers to adopt innovative designs and advanced production processes that deliver strength while minimizing environmental impact.

Technological advancements in molding and material engineering are enabling higher production efficiency, faster cycle times, and improved barrier properties. The demand is being further supported by the growth of ready-to-eat and on-the-go food consumption, which requires packaging that maintains product integrity while offering convenience.

Regulatory emphasis on recyclable and reusable packaging materials is influencing product development strategies, with polypropylene and other sustainable materials gaining prominence. As brand owners seek solutions that enhance shelf appeal and performance, thin-wall packaging is expected to remain a preferred choice, supported by ongoing innovations in material science, manufacturing, and product customization.

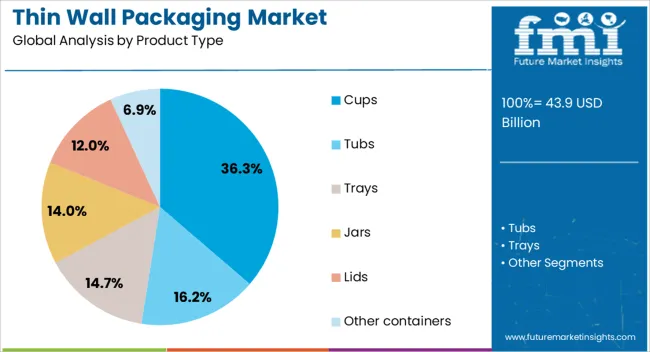

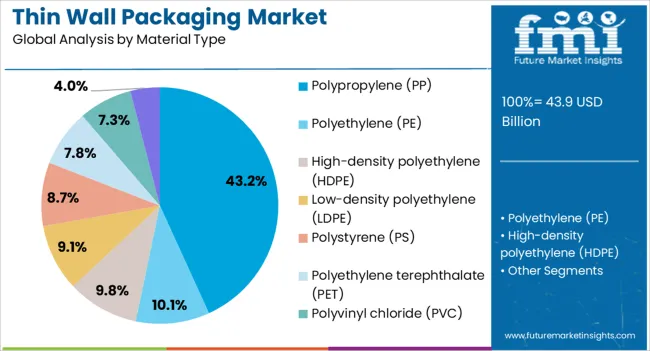

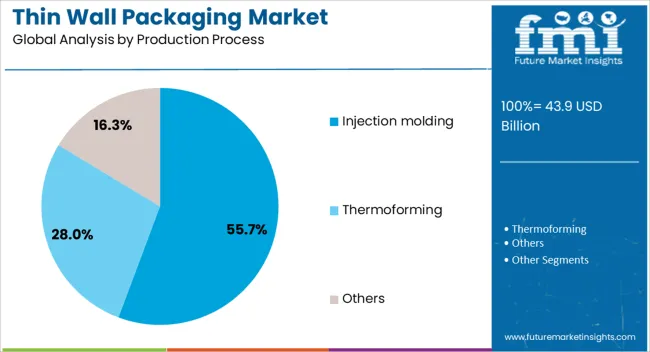

The thin wall packaging market is segmented by product type, material type, production process, application, and geographic regions. By product type, thin wall packaging market is divided into Cups, Tubs, Trays, Jars, Lids, and Other containers.

In terms of material type, thin wall packaging market is classified into Polypropylene (PP), Polyethylene (PE), High-density polyethylene (HDPE), Low-density polyethylene (LDPE), Polystyrene (PS), Polyethylene terephthalate (PET), Polyvinyl chloride (PVC), and Others. Based on production process, thin wall packaging market is segmented into Injection molding, Thermoforming, and Others. By application, thin wall packaging market is segmented into Food, Dairy products, Ready-to-eat meals, Bakery & confectionery, Meat, poultry & seafood, Beverages, Personal care & cosmetics, Household products, Electrical & electronics, Pharmaceuticals & nutraceuticals, and Industrial. Regionally, the thin wall packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cups product type segment is projected to hold 36.30% of the market revenue share in 2025, making it the leading product type. Growth in this segment has been driven by strong demand from the dairy, beverage, and ready-to-eat food industries, where portion control, product safety, and convenience are critical. Cups offer superior stacking, storage, and transportation efficiency, making them ideal for high-volume distribution.

Their adaptability to various designs, printing methods, and branding requirements has increased their appeal to manufacturers and retailers. Enhanced production capabilities and the ability to integrate lightweight yet durable structures have further reinforced the segment's dominance.

With the rise in single-serve and takeaway packaging trends, the cups category continues to benefit from consumer preference for functional and aesthetically appealing packaging formats. The segment’s resilience is further strengthened by its compatibility with sustainable materials, which aligns with global shifts toward environmentally responsible packaging practices.

The polypropylene material type segment is anticipated to account for 43.20% of the market revenue share in 2025, establishing it as the leading material type. Its dominance has been driven by a combination of durability, lightweight characteristics, and cost-effectiveness, making it ideal for high-volume production. Polypropylene offers excellent moisture and chemical resistance, which preserves product freshness and quality.

Its recyclability has positioned it as a preferred choice amid increasing environmental regulations and consumer demand for sustainable materials. Additionally, polypropylene’s versatility allows it to be molded into various shapes and sizes without compromising structural integrity. Manufacturers have leveraged their ability to accommodate advanced printing and labeling techniques, enhancing shelf appeal and brand visibility. The material’s thermal resistance and suitability for microwaveable packaging further support its adoption across multiple applications.

The injection molding production process segment is expected to capture 55.70% of the Thin Wall Packaging market revenue share in 2025, making it the dominant production process. The segment’s leadership has been attributed to its ability to produce precise, high-quality components at scale, with reduced cycle times and consistent performance. Injection molding supports complex shapes, intricate designs, and thin-wall structures without compromising strength or durability.

Its efficiency in large-scale manufacturing has allowed producers to meet growing market demands while maintaining cost competitiveness. The process is also compatible with a wide range of materials, including polypropylene, enabling customization and innovation in product development.

Automation integration in injection molding facilities has improved productivity, minimized waste, and ensured consistent quality. As consumer goods and food packaging markets expand, the ability to deliver high-speed production with design flexibility continues to strengthen injection molding’s role as the preferred manufacturing process for thin wall packaging.

Thin wall packaging has been adopted broadly across food, beverage, household, and personal care applications due to its light weight, high stiffness, and formability. Injection molded and thermoformed formats have been used to deliver stackable cups, tubs, trays, and lids with reduced material usage and faster cycle times. Polypropylene, polystyrene, polyethylene, and PET have been favored for clarity, impact strength, and barrier upgrades. Demand has been reinforced by retail ready packaging needs, branding through in mold labeling, and cost control targets across fillers, converters, and brand owners worldwide.

Retail and quick service channels have favored thin wall containers for portion controlled yogurts, spreads, ready meals, ice cream, salads, and confectionery. Shelf efficiencies have been improved through uniform dimensions, nesting, and tamper evidence, while in mold labeling has delivered high resolution graphics that endure cold chain and moisture. High stiffness to weight ratios have enabled downgauging without deformation under top load or lidding stress. Rapid tool change capability in high cavitation molds has supported frequent promotions and seasonal ranges. Returnable crate logistics and automated case packing have been aided by consistent flange design and snap fit lids. As private label penetration and convenience focused formats expand, thin wall packaging adoption has been strengthened across supermarkets, C stores, and foodservice operators seeking predictable performance and attractive merchandising.

Advancements in nucleated polypropylene, impact copolymers, tie layer modifiers, and clarified resins have been used to achieve higher flow, faster crystallization, and improved transparency at reduced wall thicknesses. Gas assisted and cascade injection have minimized sink and warpage in deep cavities, while stack molds and in mold labeling automation have lifted output per press. Thermoforming of PET, polypropylene, and high impact polystyrene sheets with plug assist design has delivered crisp corners and uniform distribution for shallow trays. Barrier needs have been addressed through multilayer structures, silicon oxide or aluminum oxide coatings, and peel reseal lidding films. Predictive mold cooling, hot runner balancing, and cavity pressure monitoring have reduced scrap and improved repeatability. These innovations have increased line speeds, protected visual quality, and lowered unit costs, allowing converters to serve high volume contracts under tight service level expectations.

Demand for recyclable and material efficient formats has encouraged mono material solutions, label and closure compatibility, and improved sortability in optical recycling. Polypropylene tubs with in mold labels and lids designed from the same polymer have been promoted to reduce separation losses at material recovery facilities. Near infrared detectable masterbatches, washable adhesive systems, and de inkable label options have improved bale quality. Mechanical recycling of clear polypropylene and PET streams has been aided by consistent color management and controlled barrier use. Recycled content incorporation targets have been addressed through deodorization, additive packages, and cascade applications where direct food contact is limited. Lightweighting combined with transport efficiency has reduced upstream impacts in distribution networks. As deposit return trials and extended producer responsibility schemes expand across regions, thin wall packaging formats designed for collection and high yield recovery have been prioritized by retailers and brand owners.

Price fluctuations in polypropylene, polystyrene, polyethylene, and PET feedstocks have required agile sourcing, hedging practices, and resin substitution studies to protect margins. Converter differentiation has been pursued through proprietary mold design, fast changeover capability, and integrated decoration lines that reduce total applied cost for brand owners. Regional trade dynamics, energy prices, and logistics constraints have influenced plant footprint decisions, with near shoring considered to stabilize lead times for large retailers. Competition from paper based tubs, aluminum trays, and rigid glass jars has intensified in premium segments, prompting functional upgrades such as snap secure closures, microwave suitability, and anti-fog lids. Regulatory moves on single use formats and extended producer responsibility fees have been monitored closely, leading to proactive design revisions and lifecycle data sharing with customers. These competitive and regulatory forces have guided investment toward high efficiency assets and versatile product families.

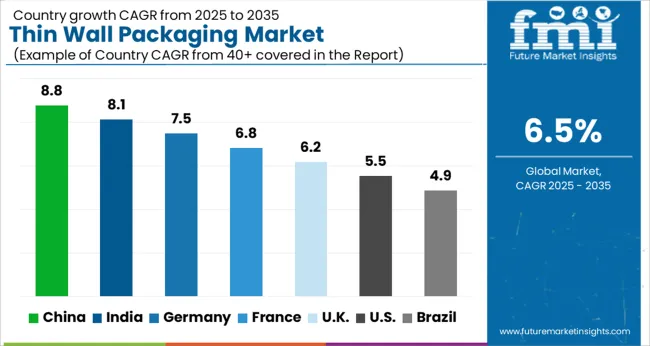

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

China led the market with a forecast growth rate of 8.8%, supported by expanding consumption of convenience food and strong manufacturing capabilities in injection molded packaging. India followed with 8.1%, where rising adoption of lightweight and cost-effective packaging solutions drove consistent momentum across food and beverage applications. Germany reached 7.5%, supported by increased focus on recyclable packaging formats and demand from dairy and fresh produce sectors. The United Kingdom registered 6.2%, with growing preference for portable and sustainable packaging boosting demand. The United States recorded 5.5%, where demand for shelf-ready packaging in retail and food service maintained market presence. Together, these countries highlight the importance of efficiency, sustainability, and consumer-driven innovation in shaping the global thin wall packaging market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is advancing with a CAGR of 8.8% in the market, supported by large-scale demand from food and beverage industries and increasing adoption of lightweight packaging. Consumer preference for ready-to-eat meals, dairy products, and frozen food is driving rapid uptake of thin wall packaging solutions. Local producers are innovating with recyclable polymers and lightweight designs to address environmental concerns and regulatory requirements. Expansion of e-commerce grocery deliveries and changing consumption patterns are further boosting demand. Global packaging firms are also strengthening their presence in China through partnerships and manufacturing investments. With rising emphasis on speed, safety, and sustainability, the market in China is expected to maintain strong growth momentum in the forecast years.

India is witnessing a CAGR of 8.1% in the market, fueled by higher consumption of packaged dairy products, snacks, and beverages. The rapid expansion of food delivery services and quick commerce platforms is generating significant opportunities for thin wall packaging solutions. Domestic manufacturers are increasingly adopting advanced molding technologies to improve efficiency and product quality. Rising consumer interest in hygienic and safe packaging is supporting market expansion, while government regulations are steering companies toward recyclable and eco-friendly alternatives. Global players are entering strategic partnerships with Indian packaging companies to strengthen their market reach. With convenience and affordability being major purchasing drivers, thin wall packaging demand in India is set to rise steadily.

Germany is recording a CAGR of 7.5% in the market, with sustainability requirements and regulatory compliance shaping product development. Consumers in Germany prioritize eco-friendly, recyclable, and lightweight packaging solutions that align with environmental commitments. Leading packaging manufacturers are investing in advanced injection molding processes to produce higher quality thin wall products. Retailers are promoting eco-conscious packaging for frozen foods, dairy, and ready meals. Demand from the food processing industry remains robust, supported by innovation in packaging safety and extended shelf life. As consumers seek reliable yet sustainable solutions, Germany continues to play a leading role in Europe’s thin wall packaging segment.

The United Kingdom is progressing with a CAGR of 6.2% in the market, driven by strong adoption in supermarkets and growing use in online grocery distribution. Consumer interest in packaged ready-to-cook and ready-to-heat meals is encouraging demand for thin wall containers. Companies are focusing on the use of lightweight plastics and recyclable alternatives to meet environmental concerns. Packaging firms are also collaborating with foodservice brands to enhance the quality and safety of thin wall solutions. With retail competition intensifying and consumer lifestyles evolving toward faster meal preparation, the UK market is anticipated to experience steady expansion in the coming years.

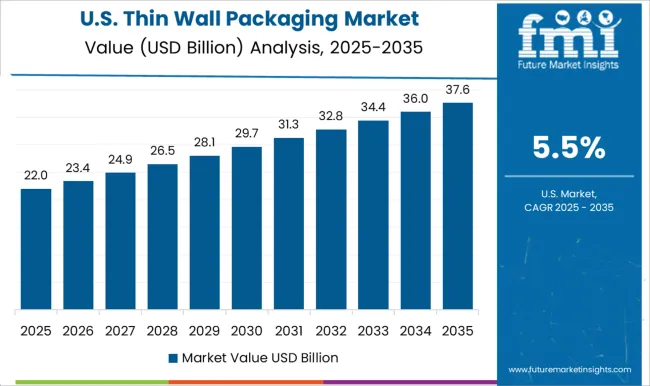

The United States is expanding at a CAGR of 5.5% in the market, supported by high demand from the frozen food and dairy industries. Rising popularity of single-serve meal solutions and takeaway services has increased reliance on thin wall packaging. Manufacturers are introducing sustainable product lines that focus on recycling and lightweight efficiency. The competitive retail environment is also encouraging packaging innovation to improve product safety and shelf appeal. Strategic investments by multinational packaging companies are strengthening domestic production capabilities. With the growing influence of consumer demand for convenience and sustainability, the US thin wall packaging market is poised for consistent development.

The market is influenced by major global packaging leaders that focus on lightweight, durable, and cost-efficient solutions for food and consumer goods. Amcor has built a strong reputation by developing thin wall containers that combine functionality with reduced material usage, supporting efficiency in production and transport. Berry Global Group stands out with its diverse product portfolio in rigid packaging, providing injection molded and thermoformed containers widely used in dairy, ready meals, and beverages.

Pactiv Reynolds plays a vital role in the North American market, supplying a wide range of thin wall packaging options tailored to both retail and foodservice needs. Huhtamaki expands its impact with fiber and polymer-based thin wall containers that address consumer demand for convenience, while also investing in innovation for sustainability-driven packaging. Silgan, along with other regional players, enhances competition through its specialization in rigid packaging solutions that support high-volume applications for food and household products. Together, these companies drive the advancement of thin wall packaging by focusing on efficiency, safety, and consumer appeal, ensuring wide adoption across retail, foodservice, and fast-moving consumer goods sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 43.9 Billion |

| Product Type | Cups, Tubs, Trays, Jars, Lids, and Other containers |

| Material Type | Polypropylene (PP), Polyethylene (PE), High-density polyethylene (HDPE), Low-density polyethylene (LDPE), Polystyrene (PS), Polyethylene terephthalate (PET), Polyvinyl chloride (PVC), and Others |

| Production Process | Injection molding, Thermoforming, and Others |

| Application | Food, Dairy products, Ready-to-eat meals, Bakery & confectionery, Meat, poultry & seafood, Beverages, Personal care & cosmetics, Household products, Electrical & electronics, Pharmaceuticals & nutraceuticals, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Berry Global Group, Pactiv / Reynolds, Huhtamaki, and Silgan / Others |

| Additional Attributes | Dollar sales by packaging type and end-use sector, demand dynamics across food, beverage, and consumer goods industries, regional trends in lightweight packaging adoption, innovation in durability, barrier properties, and design, environmental impact of plastic usage and recycling, and emerging use cases in sustainable packaging and ready-to-eat products. |

The global thin wall packaging market is estimated to be valued at USD 43.9 billion in 2025.

The market size for the thin wall packaging market is projected to reach USD 82.4 billion by 2035.

The thin wall packaging market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in thin wall packaging market are cups, tubs, trays, jars, lids and other containers.

In terms of material type, polypropylene (pp) segment to command 43.2% share in the thin wall packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar Cells Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaics Market Size and Share Forecast Outlook 2025 to 2035

Thin Wafer Processing and Dicing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar PV Backsheet Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Encapsulation TFE Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Battery Market Size and Share Forecast Outlook 2025 to 2035

Thinned Starch Market Size, Growth, and Forecast for 2025 to 2035

Thin Film and Printed Batteries Market Trends - Growth & Forecast 2025 to 2035

Thin Wafers Market Analysis - Size, Demand & Growth 2025 to 2035

Thin Client Market

Thin Paper Market

Thin Film Photovoltaic Modules Market

Thin Wall Plastic Container Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Breakdown of Thin Wall Plastic Container Providers

Thin Wall Mould Market

Thin Wall Glass Container Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA