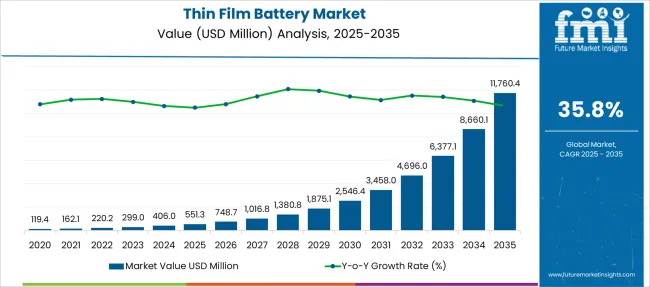

The Thin Film Battery Market is estimated to be valued at USD 551.3 million in 2025 and is projected to reach USD 11760.4 million by 2035, registering a compound annual growth rate (CAGR) of 35.8% over the forecast period.

| Metric | Value |

|---|---|

| Thin Film Battery Market Estimated Value in (2025 E) | USD 551.3 million |

| Thin Film Battery Market Forecast Value in (2035 F) | USD 11760.4 million |

| Forecast CAGR (2025 to 2035) | 35.8% |

The thin film battery market is experiencing steady growth, driven by rising demand for compact, flexible, and efficient power sources across various electronic applications. Technological advancements have enabled the production of rechargeable thin film batteries that offer high energy density and long cycle life while maintaining a slim profile.

The increasing adoption of wearable devices such as fitness trackers, smartwatches, and medical monitors has significantly boosted demand for thin-film batteries, which are ideal due to their lightweight and flexible design. Additionally, trends toward miniaturization in consumer electronics and the Internet of Things (IoT) have expanded the market.

Industry emphasis on longer battery life and fast charging capabilities continues to influence product development. Growth is expected to be fueled by innovation in battery chemistry and integration with flexible electronics. The rechargeable battery segment and wearable devices application are expected to lead this market expansion.

The thin film battery market is segmented by product, application, and geographic regions. The product of the thin film battery market is divided into Rechargeable and Non-Rechargeable. The thin film battery market is classified into Wearable Devices, Medical, Smart Cards, Consumer Products, and Others. Regionally, the thin film battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

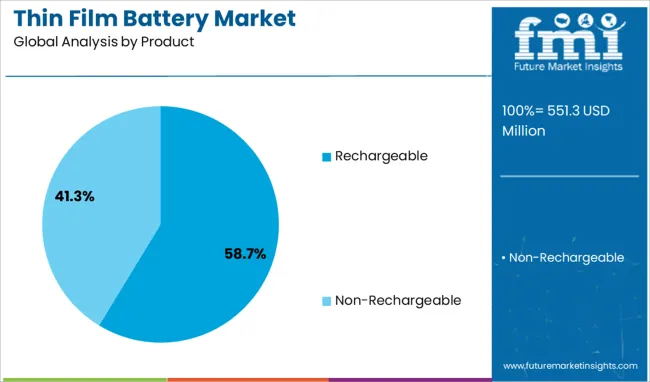

The rechargeable segment is anticipated to contribute 58.7% of the thin film battery market revenue in 2025, reflecting its dominant position among product types. Rechargeable thin film batteries have been preferred for their ability to support multiple charge-discharge cycles, extending the lifespan of portable devices. Their suitability for applications requiring frequent recharging has driven adoption, especially in wearable technology where battery replacement is challenging.

Continuous improvements in rechargeability and energy density have enhanced user convenience and device performance. Furthermore, rechargeable batteries contribute to sustainability by reducing electronic waste.

As demand for durable and efficient power sources rises, the rechargeable segment is poised to maintain its lead in the thin film battery market.

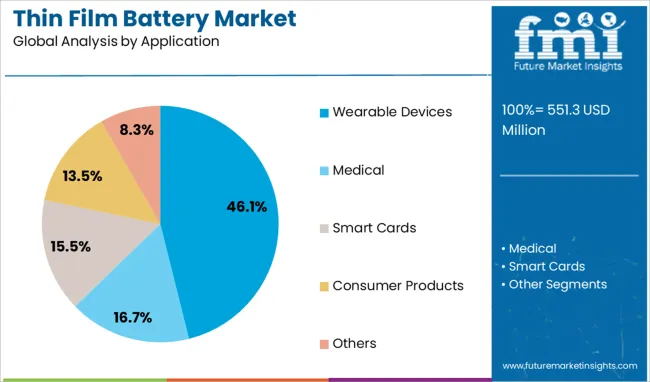

The wearable devices segment is projected to hold 46.1% of the thin film battery market revenue in 2025, establishing itself as the primary application area. This growth has been propelled by the rapid expansion of the wearable technology industry, with increasing consumer adoption of health monitoring and fitness tracking devices.

Thin film batteries offer the flexibility, thinness, and safety features required for seamless integration into wearable form factors. The need for long-lasting, lightweight batteries that do not compromise device comfort has made thin film batteries the preferred choice in this segment.

Additionally, advancements in flexible electronics and miniaturized device design continue to support market expansion. As the wearable devices market grows and diversifies, demand for thin film batteries is expected to increase correspondingly.

The thin film battery market is being driven by rising demand for ultra-thin, flexible power sources used in wearables, medical patches, smart cards, RFID tags and IoT sensors. Key growth from 2024 to 2025 has been observed in North America, Europe and Asia‑Pacific due to extensive product development and consumer electronics deployment. Emerging opportunities have been identified in interactive packaging and energy-harvesting applications. Trends include printed fabrication techniques and solid-state electrolyte integration. However, limited energy density, high integration cost, and production scalability challenges have restrained adoption. The outlook suggests rapid expansion across portable electronics and connected device ecosystems.

The growing need for compact power solutions in connected devices has been a major factor in driving thin film battery adoption. In 2024 and 2025, wearables such as smartwatches, fitness trackers, and medical monitoring patches integrated thin film batteries due to their thinness and design flexibility. Smart cards and IoT-based sensors also contributed to this upward demand trajectory. North America led advancements in R&D and commercialization, while Asia-Pacific showed strong manufacturing dominance. The combination of miniaturization requirements and high-performance energy storage capability positions thin film batteries as essential for next-generation portable electronics.

Significant opportunities have been identified in the integration of thin film batteries with smart packaging, medical labels, and asset-tracking devices. In 2025, thin film battery-powered smart packaging systems gained prominence for interactive retail and logistics solutions. Healthcare applications such as diagnostic patches and patient monitoring devices have increased the adoption of these lightweight batteries. Energy harvesting technologies combining printed solar cells with thin film batteries also emerged as a viable solution for low-power, long-life applications. These developments are signaling strong potential for market expansion into healthcare, packaging, and industrial IoT ecosystems.

The market has seen a rise in advanced manufacturing techniques like roll-to-roll printing and solid-state electrolyte integration. In 2025, printed thin film batteries were introduced for mass production, offering higher scalability for consumer and medical electronics. Solid electrolytes are being incorporated to enhance cycle life, improve safety, and support ultra-thin form factors for flexible devices. Micro-battery designs and ultra-low-profile cells are enabling integration into compact systems like smart cards, RFID tags, and wearable electronics. These developments indicate a trend toward energy solutions that prioritize miniaturization, performance, and design flexibility.

Despite strong adoption in niche applications, the market faces challenges related to low energy density and manufacturing complexity. Thin film batteries are suitable for low-drain devices but cannot replace conventional lithium-ion cells in high-energy applications. Production scalability remains constrained due to specialized manufacturing environments and cost-intensive processes, which hinder widespread adoption. Manufacturers are under pressure to optimize fabrication methods and reduce costs while maintaining performance and safety standards. Overcoming these limitations will be essential to unlock broader market potential across diverse applications in the coming years.

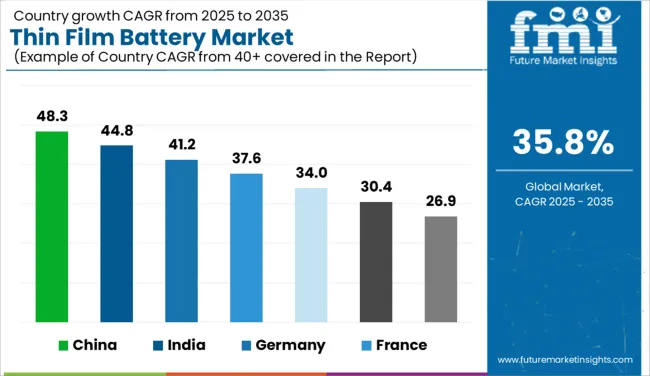

| Country | CAGR |

|---|---|

| China | 48.3% |

| India | 44.8% |

| Germany | 41.2% |

| France | 37.6% |

| UK | 34.0% |

| USA | 30.4% |

| Brazil | 26.9% |

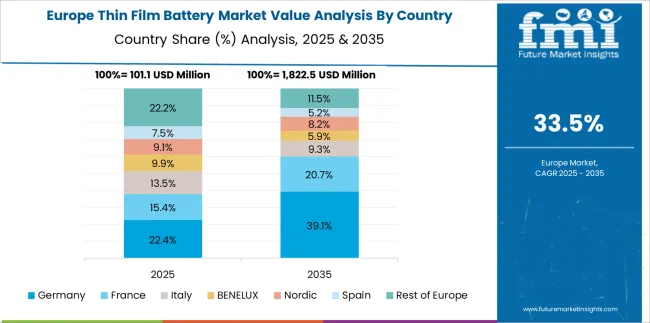

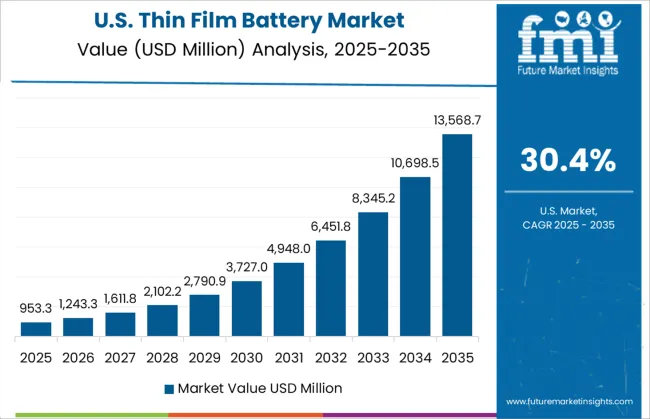

The global thin film battery market is projected to grow at an exceptional 35.85% CAGR between 2025 and 2035. China leads with 48.3% CAGR, driven by strong investments in micro-energy storage for IoT devices, medical implants, and electric wearables. India follows at 44.8%, supported by government-backed electronics manufacturing clusters and renewable energy integration. Germany records 41.2% CAGR, with rapid adoption in automotive electronics, medical devices, and industrial IoT applications. The UK posts 34.0% CAGR, while the United States grows at 30.4%, reflecting mature but expanding demand for energy-dense, ultra-thin batteries in consumer electronics and defense applications. Asia-Pacific dominates due to cost-competitive production and high R&D spending, while Europe and the US emphasize advanced chemistries and solid-state battery integration.

China is the undisputed leader in thin film battery adoption, expected to surge at 48.3% CAGR through 2035. Growth is fueled by robust investments in next-generation electronics, IoT devices, and implantable medical sensors. Domestic players, along with government-supported R&D programs, accelerate large-scale production of solid-state and flexible batteries for wearables and smart packaging. The EV ecosystem further promotes innovation in energy-dense micro-battery solutions for onboard electronics and BMS (Battery Management Systems). Strategic collaborations between universities, startups, and established firms are expanding advanced materials research for ultra-thin, solid-state chemistries, ensuring China’s competitive advantage.

India’s thin film battery market is projected to register 44.8% CAGR, driven by strong demand from consumer electronics, healthcare devices, and smart grid applications. Government initiatives such as “Make in India” and the Production Linked Incentive (PLI) scheme for electronics manufacturing boost domestic thin film battery production. Indian companies are partnering with global battery technology providers to scale up local assembly and ensure competitive pricing for high-growth markets like medical diagnostics, RFID tags, and wearable tech. Additionally, the surge in IoT adoption for industrial automation and supply chain tracking strengthens demand for energy-efficient storage solutions.

Germany is forecasted to grow at 41.2% CAGR, supported by strong industrial automation, medical electronics, and EV component markets. Thin film batteries are gaining traction in automotive electronics for real-time sensor systems and BMS modules, complementing the country’s advanced EV strategy. German firms lead in R&D for high-purity electrode materials and all-solid-state architectures, targeting ultra-thin form factors with higher energy density. EU regulations promoting sustainable energy solutions further support the commercialization of recyclable and eco-compliant thin film battery chemistries. Partnerships between automotive OEMs and material science companies reinforce Germany’s position as a key innovation hub.

The UK market is projected to post 34.0% CAGR, driven by advanced adoption in wearables, medical sensors, and defense-grade electronics. Research collaborations under government innovation programs emphasize scaling thin film battery prototypes into mass production for consumer and military applications. The healthcare sector’s focus on implantable and portable diagnostic devices supports consistent demand. Additionally, the UK’s push toward sustainable packaging solutions with embedded smart tags is driving innovation in flexible thin film designs. Domestic R&D centers are increasingly investing in alternative chemistries, such as lithium-free systems, for enhanced safety.

The United States records 30.4% CAGR, reflecting substantial investments in advanced chemistries for high-performance applications in aerospace, defense, and consumer electronics. The country emphasizes solid-state thin film batteries for implantable medical devices, military-grade sensors, and EV components requiring compact energy storage. Major firms focus on developing flexible and ultra-safe designs aligned with stringent regulatory standards. High-profile partnerships between tech giants and energy startups accelerate commercialization of scalable thin film solutions. Federal funding for next-generation battery R&D further enhances innovation pipelines for long-lasting, low-profile battery systems.

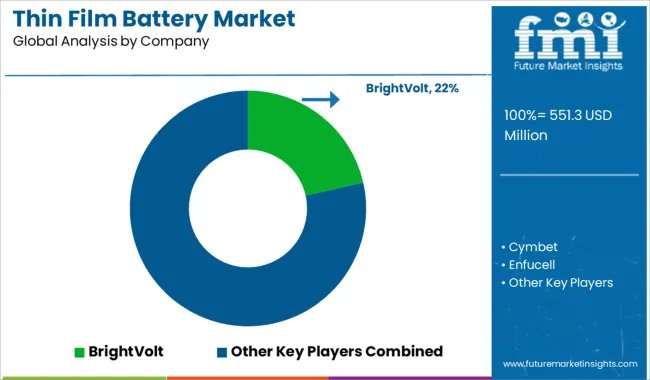

The thin film battery market is moderately fragmented, with BrightVolt recognized as a leading player due to its advanced solid-state battery technology and expertise in ultra-thin, flexible power solutions for wearables, IoT devices, and smart cards. The company’s focus on safety, high energy density, and scalability makes it a dominant supplier in this segment. Key players include Cymbet, Enfucell, Ilika, Imprint Energy, Ion Storage Systems, ITEN, Jenax, Johnson Energy Storage, Molex, Prieto Battery, and STMicroelectronics.

These companies develop thin film batteries designed for microelectronics, medical implants, wireless sensors, and energy-harvesting applications, emphasizing properties such as flexibility, low weight, and long cycle life. Market growth is driven by the rapid adoption of wearable electronics, increasing demand for compact energy storage in medical and IoT devices, and the transition toward solid-state battery technologies offering improved safety and performance.

Leading manufacturers are investing in innovative deposition processes like sputtering and evaporation, alongside exploring next-generation chemistries such as lithium solid-state and polymer electrolytes. Emerging trends include integration of flexible thin film batteries into smart packaging, self-powered sensors, and energy-harvesting systems. Asia-Pacific is projected to dominate production due to strong electronics manufacturing, while North America and Europe lead in R&D for advanced solid-state energy storage solutions.

In January 2024, LionVolt purchased AMTE Power’s battery cell production line in Thurso, Scotland. This acquisition enables pilot-scale production of 3D solid-state thin-film batteries, strengthening LionVolt’s manufacturing capabilities and strategic position in the fast-growing solid-state energy storage market focused on advanced performance and compact designs.

| Item | Value |

|---|---|

| Quantitative Units | USD 551.3 Million |

| Product | Rechargeable and Non-Rechargeable |

| Application | Wearable Devices, Medical, Smart Cards, Consumer Products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BrightVolt, Cymbet, Enfucell, Ilika, Imprint Energy, Ion Storage Systems, ITEN, Jenax, Johnson Energy Storage, Molex, Prieto Battery, and STMicroelectronics |

| Additional Attributes | Dollar sales by battery type (rechargeable vs non-rechargeable including printed thin film) and technology (thin-film lithium/polymer, zinc-based). North America led in 2024, while Asia-Pacific shows the fastest growth. Buyers demand ultra-thin, flexible power for wearables, medical devices, and IoT sensors. Innovations include solid-state architectures, roll-to-roll manufacturing, and enhanced energy density solutions. |

The global thin film battery market is estimated to be valued at USD 551.3 million in 2025.

The market size for the thin film battery market is projected to reach USD 11,760.4 million by 2035.

The thin film battery market is expected to grow at a 35.8% CAGR between 2025 and 2035.

The key product types in thin film battery market are rechargeable and non-rechargeable.

In terms of application, wearable devices segment to command 46.1% share in the thin film battery market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA