About The Report

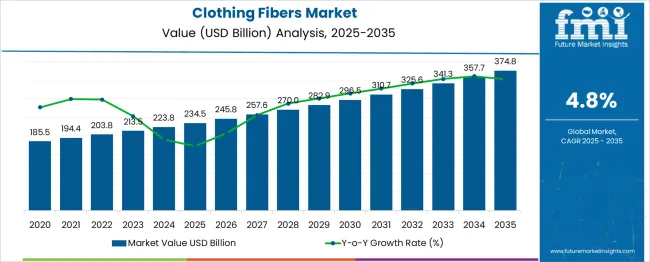

The global clothing fibers market is anticipated to grow from USD 234.5 billion in 2025 to approximately USD 374.8 billion by 2035, recording an absolute increase of USD 140.3 billion over the forecast period. This translates into a total growth of 59.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.6X during the same period, supported by increasing global population, rising disposable incomes in emerging markets, and growing demand for sustainable and high-performance textile materials.

Between 2025 and 2030, the clothing fibers market is projected to expand from USD 234.5 billion to USD 295.6 billion, resulting in a value increase of USD 61.1 billion, which represents 43.5% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating demand for performance fabrics, increasing adoption of recycled and bio-based fibers, and technological advancements in fiber production processes. Textile manufacturers are investing heavily in sustainable production methods and innovative fiber technologies to meet evolving consumer preferences for eco-friendly and functional clothing materials.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 234.5 billion |

| Forecast Value in (2035F) | USD 374.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

From 2030 to 2035, the market is forecast to grow from USD 295.6 billion to USD 374.8 billion, adding another USD 79.2 billion, which constitutes 56.5% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of smart textiles, integration of nanotechnology in fiber production, and development of circular economy models in the textile industry. The growing emphasis on traceability and transparency in supply chains will drive demand for certified sustainable fibers with verified environmental credentials.

Between 2020 and 2025, the clothing fibers market experienced significant transformation, driven by the COVID-19 pandemic's impact on global supply chains and changing consumer behavior. The market evolved as manufacturers recognized the need for resilient supply chains and diversified sourcing strategies. Sustainability concerns gained prominence, with brands and retailers increasingly committing to using recycled and eco-friendly fibers in their products. The rise of athleisure and work-from-home trends also influenced fiber demand patterns, favoring comfort-focused and performance materials.

Market expansion is being supported by the continuous growth in global population and urbanization, which drives fundamental demand for clothing and textiles. Emerging economies, particularly in Asia Pacific and Africa, are experiencing rising middle-class populations with increasing purchasing power, leading to higher per capita fiber consumption. The fashion industry's evolution toward fast fashion and frequent collection cycles continues to drive volume demand, while simultaneously, the counter-trend of sustainable fashion is creating opportunities for premium eco-friendly fibers.

The technological advancement in fiber production is enabling the development of high-performance materials with enhanced properties such as moisture management, temperature regulation, antimicrobial features, and improved durability. Innovation in synthetic fiber production is reducing environmental impact through energy-efficient processes and the use of recycled raw materials. The growing sports and activewear segment is driving demand for technical fibers that offer superior functionality. Additionally, the increasing focus on circular economy principles is encouraging investment in fiber recycling technologies and bio-based alternatives, creating new growth avenues in the sustainable fibers segment.

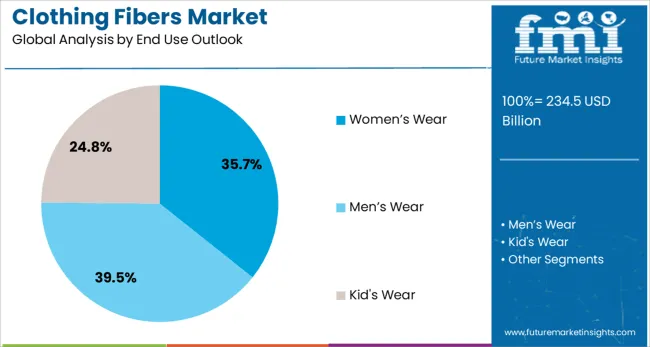

The market is segmented by product type, end use, and region. By product type, the market is divided into synthetic fibers, cotton, animal-based fibers, and others. Based on end use, the market is categorized into women's wear, men's wear, kid's wear, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The synthetic fibers segment is projected to account for 58.9% of the clothing fibers market in 2025, maintaining its position as the dominant fiber category. This leadership position is driven by synthetic fibers' versatility, cost-effectiveness, and performance characteristics that make them suitable for a wide range of applications. Polyester, the largest synthetic fiber category, offers durability, wrinkle resistance, and excellent color retention, making it ideal for both fashion and functional clothing. The ability to engineer synthetic fibers with specific properties such as moisture-wicking, stretch, and thermal regulation has made them indispensable in the growing activewear and performance apparel segments.

Manufacturing efficiency and scalability of synthetic fiber production contribute to their market dominance, offering consistent quality and supply reliability that natural fibers cannot always match. Recent innovations in recycled polyester production from PET bottles and textile waste are addressing environmental concerns while maintaining performance standards. The development of bio-based synthetic fibers using renewable feedstocks is further enhancing the segment's sustainability profile. As textile manufacturers continue to invest in advanced spinning technologies and fiber modification techniques, synthetic fibers are expected to maintain their leading position while evolving to meet sustainability demands and performance requirements.

Men's wear is projected to represent 39.5% of clothing fibers demand in 2025, reflecting the segment's position as the largest end-use category. This dominance is attributed to the expanding global menswear market, rising fashion awareness among male consumers, and increasing emphasis on versatile and durable clothing options. The men's wear segment encompasses a wide range of products from business suits and formal attire to casual wear, sportswear, and outerwear, each requiring distinct fiber blends and performance attributes.

Growing brand consciousness, lifestyle shifts, and the influence of digital platforms on male purchasing behavior continue to drive steady demand for new collections and style updates, supporting sustained fiber consumption. The segment benefits from the expansion of professional workforces and urban middle-class populations, increasing demand for formal and semi-formal wear. Additionally, the rapid growth of men’s athleisure and performance-based apparel has accelerated the need for fibers that deliver comfort, breathability, and functionality. The increasing importance of sustainability in menswear is also shaping fiber choices, with greater adoption of organic cotton, recycled polyester, and eco-friendly performance fabrics in men’s clothing production.

The clothing fibers market is advancing steadily due to global population growth, urbanization trends, and evolving consumer preferences for functional and sustainable textiles. However, the market faces challenges including raw material price volatility, environmental regulations on synthetic fiber production, and competition from alternative materials. Innovation in fiber technology and sustainable production methods continue to influence market development and competitive dynamics.

The rapid expansion of e-commerce platforms is transforming the textile and apparel industry, creating new demand patterns for clothing fibers. Online retail enables faster fashion cycles and direct-to-consumer brands that can quickly respond to trending styles, driving diverse fiber requirements. Digital technologies are also enabling mass customization and on-demand production models that influence fiber selection and inventory management strategies. The growth of digital fashion and virtual try-on technologies is creating new considerations for how fibers perform in digital representations and augmented reality applications.

The textile industry's transition toward circular economy principles is driving significant innovation in fiber recycling and recovery technologies. Chemical recycling processes are being developed to break down used textiles into raw materials for new fiber production, particularly for synthetic materials. Mechanical recycling improvements are enhancing the quality of recycled natural fibers, making them more suitable for high-value applications. Brands are increasingly implementing take-back programs and designing products for recyclability, influencing fiber selection toward materials that can be effectively recovered and reprocessed at end-of-life.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.5% |

| India | 6% |

| Germany | 5.5% |

| France | 5% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

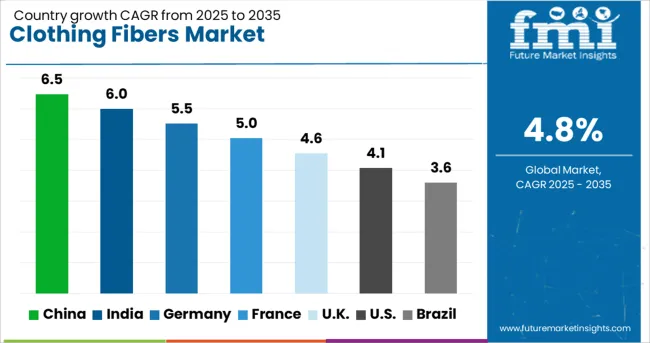

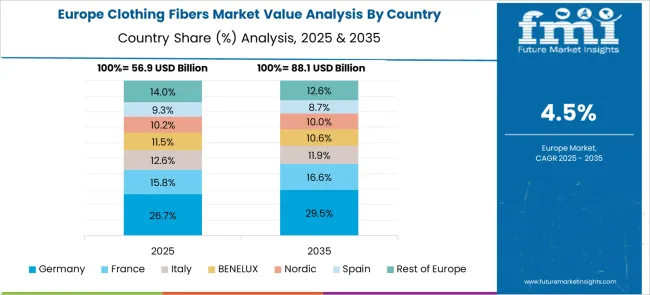

The clothing fibers market is experiencing varied growth rates globally, with China leading at a 6.5% CAGR through 2035, driven by its dominant position in textile manufacturing, massive domestic consumption, and ongoing industrial upgrading. India follows at 6%, supported by its strong cotton production base, growing textile exports, and expanding domestic apparel market. Germany shows steady growth at 5.5%, emphasizing technical textiles and high-performance fibers. France records 5%, focusing on luxury and sustainable fibers. The UK demonstrates 4.6% growth, balancing traditional textile heritage with innovation. The USA shows 4.1% growth, driven by technical textiles and nonwoven applications, while Brazil expands at 3.6%, supported by growing domestic demand and agricultural fiber production. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from clothing fibers in China is projected to exhibit strong growth with a CAGR of 6.5% through 2035, driven by the country's position as the world's largest textile manufacturer and consumer. China's integrated textile supply chain, from fiber production to finished garments, provides unmatched economies of scale and efficiency. The government's focus on industrial upgrading and automation is enhancing productivity while addressing labor cost pressures. Major investments in sustainable fiber technologies and recycling infrastructure are positioning China to meet global demand for eco-friendly textiles.

Revenue from clothing fibers in India is expanding at a CAGR of 6%, supported by the country's position as a major cotton producer and rapidly growing textile manufacturing sector. India's diverse fiber production capabilities, spanning natural and synthetic materials, provide comprehensive supply solutions for global brands. The government's textile policies and production-linked incentive schemes are attracting investments in fiber manufacturing and processing infrastructure.

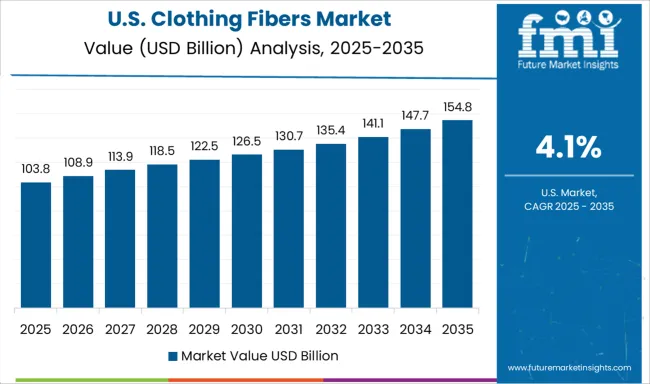

Demand for clothing fibers in the USA is projected to grow at a CAGR of 4.1%, supported by strong demand for technical textiles, nonwovens, and high-performance fibers. American manufacturers are focusing on innovation and specialty products rather than commodity fiber production. The market is characterized by advanced research and development capabilities, particularly in areas such as smart textiles, protective fibers, and sustainable materials.

Revenue from clothing fibers in Germany is projected to grow at a CAGR of 5.5% through 2035, driven by the country's strength in technical textiles and high-performance fiber applications. German manufacturers excel in producing specialized fibers for automotive, medical, and industrial applications, leveraging advanced engineering capabilities and quality standards.

Revenue from clothing fibers in the UK is projected to grow at a CAGR of 4.6% through 2035, supported by the country's heritage in wool and luxury fibers combined with emerging strengths in sustainable textile innovation. British manufacturers are focusing on premium and specialty fibers while developing new capabilities in textile recycling and circular economy solutions.

Revenue from clothing fibers in France is projected to grow at a CAGR of 5% through 2035, supported by the country's luxury fashion industry and increasing focus on sustainable textile production. French manufacturers specialize in high-quality natural fibers and innovative blends that meet the demanding requirements of haute couture and premium ready-to-wear markets.

Revenue from clothing fibers in Brazil is projected to grow at a CAGR of 3.6% through 2035, supported by the country's agricultural fiber production, particularly cotton, and growing synthetic fiber manufacturing capacity. Brazil's large domestic market and expanding textile industry create substantial demand for diverse fiber types.

The clothing fibers market is characterized by competition among large multinational chemical companies, specialized fiber producers, and integrated textile manufacturers. Companies are investing in production capacity expansion, technological innovation, sustainability initiatives, and strategic partnerships to strengthen their market positions. Product differentiation through performance enhancement, sustainable production methods, and customer service excellence are central to competitive strategies.

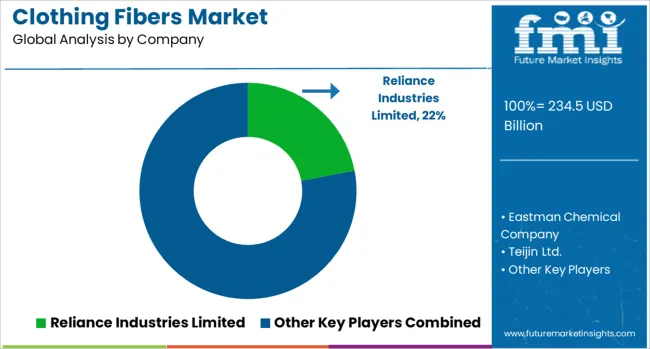

Reliance Industries Limited, India-based, leads the market with 22.0% global value share, offering comprehensive synthetic fiber portfolios with strong positions in polyester and polypropylene. Eastman Chemical Company, USA, provides specialty fibers and sustainable solutions including Naia™ cellulosic fibers. Teijin Ltd., Japan, delivers high-performance fibers for technical and apparel applications with focus on aramid and carbon fibers. Toray Industries Inc., Japan, offers advanced synthetic fibers with leadership in carbon fiber and functional textiles.

Asahi Kasei Corporation, Japan, specializes in high-performance fibers including cupro and spandex for premium applications. The Bombay Dyeing and Manufacturing Co. Ltd., India, provides integrated textile solutions from fiber to finished products. Indorama Ventures Public Company Limited, Thailand, operates as one of the world's largest polyester producers with global manufacturing footprint. Invista, USA, offers branded fibers including Lycra® and Cordura® for performance applications. Hyosung TNC Corporation, South Korea, delivers spandex and polyester solutions with focus on functional textiles. Lenzing AG, Austria, leads in sustainable cellulosic fibers including Tencel™ and Modal for eco-conscious applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 234.5 billion |

| Product Type | Synthetic, Cotton, Animal-based, Others |

| End Use | Women's Wear, Men's Wear, Kid's Wear, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Reliance Industries Limited, Eastman Chemical Company, Teijin Ltd., Toray Industries Inc., Asahi Kasei Corporation, The Bombay Dyeing and Manufacturing Co. Ltd., Indorama Ventures Public Company Limited, Invista, Hyosung TNC Corporation, and Lenzing AG |

| Additional Attributes | Dollar sales by fiber type and application, regional production capacities, competitive landscape analysis, sustainability initiatives and certifications, innovations in recycling technologies, bio-based fiber development, and integration with circular economy principles |

The global clothing fibers market is estimated to be valued at USD 234.5 billion in 2025.

The market size for the clothing fibers market is projected to reach USD 374.8 billion by 2035.

The clothing fibers market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in clothing fibers market are synthetic, cotton, animal-based and others.

In terms of end use outlook, men's wear segment to command 39.5% share in the clothing fibers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clothing Recycling Market Analysis – Growth & Trends 2025 to 2035

Pet Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nano Fibers Market Size and Share Forecast Outlook 2025 to 2035

Vegan Clothing Market Analysis - Size, Share and Forecast 2025 to 2035

Smart Clothing Market – Wearable Tech & Health Insights

Online Clothing Rental Market Forecast and Outlook 2026 to 2036

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Assessing Online Clothing Rental Market Share & Industry Insights

Blended Fibers Market Size and Share Forecast Outlook 2025 to 2035

Braille Clothing Tags Market Size and Share Forecast Outlook 2025 to 2035

Cosplay Clothing Market Trends - Growth & Forecast to 2025 to 2035

Industry Share Analysis for Braille Clothing Tags Companies

Plus Size Clothing Market Size and Share Forecast Outlook 2026 to 2036

Polyimide Fibers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Triathlon Clothing Market Analysis - Trends, Growth & Forecast 2025 to 2035

Lab Safety Clothing Market Forecast and Outlook 2026 to 2036

Protective Clothing Market - Trends, Growth & Forecast 2025 to 2035

Spider Silk Fibers Market Size and Share Forecast Outlook 2025 to 2035

Food Dietary Fibers Market Size and Share Forecast Outlook 2025 to 2035

The Sports Inspired Clothing Market is segmented by Product Type (Athletic Apparel, Athleisure Wear, Performance Footwear, and Sports Accessories), Distribution Channel (Sporting Goods Stores, Online Retail, Department Stores, and Brand Outlets), End User (Men, Women, and Children), and Region. Forecast for 2026 to 2036.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.