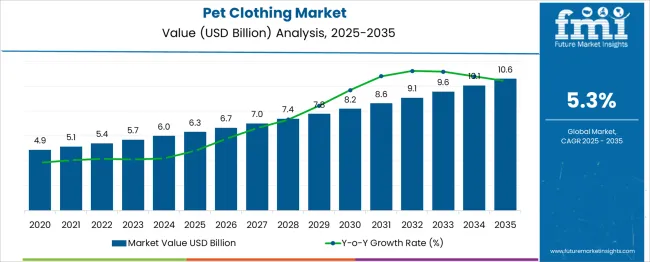

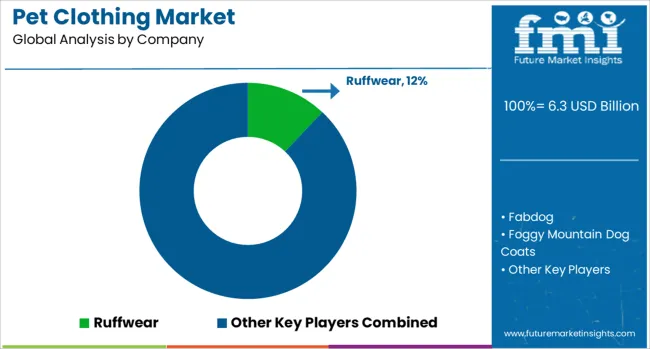

The Pet Clothing Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 10.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. This steady growth reflects a rising global trend toward pet humanization and fashion-conscious pet ownership. However, within this upward trajectory, significant shifts in market share are anticipated across regions and key players.

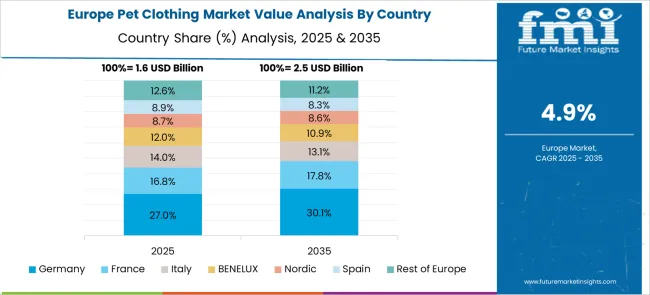

Between 2025 and 2030, established North American brands holding nearly 42% market share may experience moderate erosion as Asian manufacturers, particularly from China and South Korea, gain ground through lower production costs and faster trend responsiveness. Asia-Pacific's share is expected to rise from 26% to 33% by 2030, powered by growing middle-class spending on pets in India and Southeast Asia. From 2030 to 2035, online direct-to-consumer (DTC) platforms and social media-driven boutique labels are projected to disrupt traditional retail channels. E-commerce-led players could increase their share by over 8%, particularly in urban markets, challenging legacy brands reliant on brick-and-mortar sales. Meanwhile, Europe’s market share is expected to stabilize around 21%, with premium and eco-friendly pet clothing segments offsetting price-sensitive losses. The decade ahead suggests a reshuffling of competitive dynamics, favoring agile, digital-native brands with diverse and seasonal offerings.

| Metric | Value |

|---|---|

| Pet Clothing Market Estimated Value in (2025 E) | USD 6.3 billion |

| Pet Clothing Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

Between 2025 and 2035, the pet clothing market is expected to witness shifts in market share as consumer preferences, regional demand, and retail channels evolve. Starting at USD 6.3 billion in 2025 and reaching USD 10.6 billion by 2035, the market will grow steadily at a 5.3% CAGR. However, this growth will not be evenly distributed across players or regions. North America, which holds approximately 42% of the global market share in 2025, is projected to lose 4–5% share by 2030 due to rising competition from Asian and European brands. Asia-Pacific, particularly China, India, and South Korea, is expected to gain share, increasing from 26% in 2025 to nearly 33% by 2035, driven by increased urban pet ownership and affordable manufacturing. E-commerce will be a key catalyst for market share gains. Direct-to-consumer brands and online pet retailers are likely to capture an additional 6–8% market share by 2035, especially in younger, tech-savvy demographics. Conversely, traditional retailers and brands with limited online presence may face erosion. Premium and seasonal pet apparel will also shift shares toward niche, fashion-driven startups. Overall, market share gains will favor agile, digital, and regionally adaptive players.

The pet clothing market is witnessing rapid growth as pet humanization trends drive increased spending on apparel and accessories. Rising awareness around pet comfort, safety, and seasonal protection has shifted consumer preferences toward functional yet fashionable pet wear.

As disposable incomes rise and pets are increasingly viewed as family members, owners are investing in customized, weather-appropriate garments such as coats, sweaters, and rain gear. This trend is further supported by social media influence and seasonal marketing strategies from premium pet brands.

Additionally, product innovations in moisture-wicking fabrics, eco-friendly materials, and temperature-regulating garments are expanding the value proposition of pet clothing. The market is also benefiting from pet fashion events and influencer-driven campaigns, especially in urban markets, where premiumization and pet wellness are key purchase motivators.

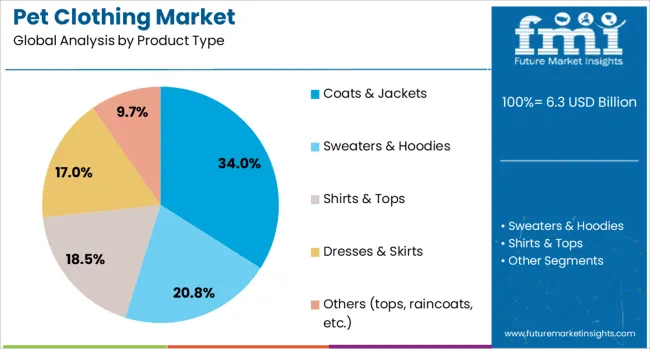

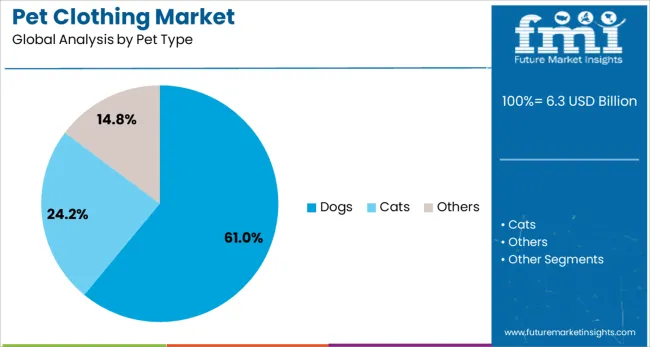

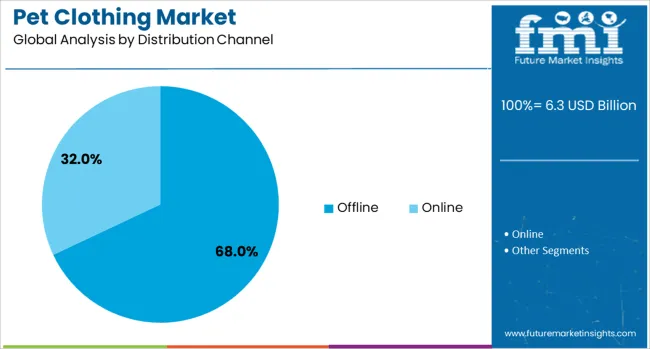

The pet clothing market is segmented by product type, pet type, distribution channel, and geographic regions. The pet clothing market is divided by product type into Coats & Jackets, Sweaters & Hoodies, Shirts & Tops, Dresses & Skirts, and Others (tops, raincoats, etc.). The pet clothing market is classified by pet type into Dogs, Cats, and Others. The distribution channel of the pet clothing market is segmented into Offline and Online. Regionally, the pet clothing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Coats and jackets are projected to account for 34.00% of the pet clothing market revenue in 2025, making them the leading product segment. This dominance stems from their dual functionality providing thermal insulation and stylish appearance.

Pet owners, especially in colder regions, prioritize protective outerwear to shield pets from rain, wind, and low temperatures. These garments are also being tailored for different breeds and sizes, which enhances demand for breed-specific product lines.

Reflective jackets, rainproof materials, and fleece linings are being integrated to boost utility and comfort. As seasonal demand peaks in autumn and winter, coats and jackets remain a staple category with consistent replenishment cycles in retail.

Dogs are expected to represent 61.00% of the total market share in the pet clothing industry by 2025, making them the primary pet type for apparel purchases. This segment's leadership is driven by the global dog population, high owner engagement, and broader suitability for clothing across sizes and breeds.

Owners of small and short-haired breeds, in particular, seek clothing for protection and warmth, while others view fashion as an expression of pet personality. Dogs also participate in outdoor activities and public events more frequently than other pets, necessitating functional apparel.

Increased adoption of designer dog wear and costume-themed clothing for holidays further amplifies demand in this segment.

Offline retail is projected to hold 68.00% of the distribution share in 2025, making it the dominant sales channel in the pet clothing market. This preference is largely due to the need for tactile examination, size fitting, and immediate purchase convenience factors especially important for pet apparel.

Pet owners often prefer in-store consultations with staff regarding fit and fabric, and pet-friendly outlets such as pet boutiques and supermarkets cater to this demand. Additionally, offline retail provides access to exclusive seasonal collections, loyalty programs, and impulse purchases driven by visual merchandising.

As physical retail regains momentum post-pandemic, experiential shopping and premium store formats are reinforcing the strength of this channel.

The pet clothing market is experiencing consistent growth as pet ownership becomes more personalized and fashion-oriented. Owners increasingly view pets as family members, prompting demand for apparel that combines comfort, protection, and style. From casual wear to seasonal and themed garments, pet clothing is now widely available through retail and online platforms. Expansion of pet-friendly social norms and media influence encourages product variety. With rising awareness around pet health and expression, consumers actively seek functional yet stylish pet clothing solutions.

A primary growth driver in the pet clothing market is the increasing humanization of pets, where owners treat animals as integral parts of their families. This emotional bond encourages spending on apparel that mirrors human fashion choices, reflecting personal style and care. Seasonal and weather-based clothing options such as jackets, sweaters, and raincoats are favored for protecting pets from discomfort. Additionally, themed costumes for events, holidays, or photoshoots have gained popularity, especially through online sharing. Retailers and pet boutiques are expanding product lines to include coordinated sets, luxury fabrics, and breed-specific fits. As pets become participants in lifestyle and leisure activities, owners are more willing to purchase clothing that enhances their pet’s appearance and comfort. This ongoing integration of pets into daily routines and cultural expressions supports long-term growth for fashion-forward and functional pet clothing options.

One of the persistent challenges in the pet clothing market involves achieving consistent sizing and ensuring animal comfort. Pets come in a wide range of breeds and body types, making standardized sizes difficult to implement. Ill-fitting garments may restrict movement, cause overheating, or lead to irritation, deterring consumers from repeat purchases. Ensuring that apparel is both functional and comfortable requires deep understanding of animal behavior and movement. Unlike human clothing, pet garments must account for non-verbal cues and physical sensitivity. Moreover, consumers may lack knowledge on how to choose appropriate fabrics or designs, leading to mismatched purchases and dissatisfaction. This challenge becomes more prominent with mass-produced clothing, where limited adjustments are possible. Brands that fail to address these issues risk losing consumer trust. To overcome this, companies must invest in flexible sizing systems, clear measurement guides, and materials that prioritize breathability and ease of wear.

As consumer preferences evolve, the pet clothing market is witnessing opportunity through niche and specialized segments. Products catering to specific weather conditions, medical needs, or lifestyle activities—such as hiking gear or post-surgery outfits—are gaining attention. Fashion-conscious pet owners are also seeking luxury collections and coordinated human-pet clothing sets, adding emotional and aesthetic value. Online marketplaces allow smaller brands to reach targeted audiences with unique offerings, while social media platforms serve as powerful tools for product discovery. Influencer-driven marketing and user-generated content significantly impact purchasing behavior. Moreover, subscription models and limited-edition collections create a sense of exclusivity and regular engagement. Brands that develop tailored collections for different pet sizes, lifestyles, or occasions can capture dedicated customer bases. By leveraging the visual appeal and shareability of stylish pet outfits, companies can build strong communities around their products, increasing retention and word-of-mouth reach across digital channels.

A notable restraint in the pet clothing market is consumer sensitivity to price and the perception that pet apparel is non-essential. While some pet owners are enthusiastic about outfitting their animals, others view clothing as unnecessary, especially in temperate climates or among pets with thick fur. This limits the market's expansion beyond early adopters and fashion-focused buyers. Practical concerns also arise—frequent washing, wear and tear, and pets’ resistance to clothing can reduce usage frequency. In price-sensitive regions, consumers may prioritize essentials such as food, grooming, or healthcare over apparel. Additionally, concerns about pets disliking clothes or appearing unnatural can hinder adoption. Without clear functional benefits, consumers may hesitate to invest in clothing beyond occasional use. Brands must navigate this by balancing affordability with perceived value and utility. Educating pet owners on the protective or therapeutic roles of clothing could help shift perceptions and expand usage across a broader audience.

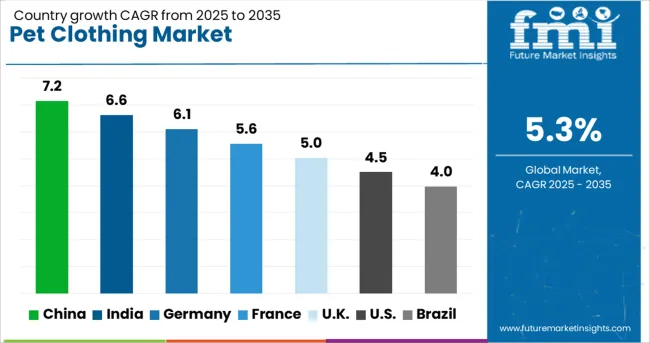

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global pet clothing market is expanding at a CAGR of 5.3%, driven by trends in pet humanization, seasonal demand, and fashion-conscious consumers. China leads with a 7.2% growth rate, supported by large-scale production capabilities and increasing domestic pet ownership. India follows at 6.6%, driven by a rising urban population and growing demand for affordable, stylish pet apparel. Germany posts 6.1% growth, reflecting strong interest in premium, functional, and weather-appropriate garments. The United Kingdom maintains steady momentum at 5.0%, focusing on sustainable materials and tailored pet wear. The United States, with 4.5% growth, remains a mature market shaped by safety standards, brand loyalty, and high customization preferences. Market trends are influenced by material innovation, pet comfort, and seasonal design cycles. This report includes insights on 40+ countries; the top countries are shown here for reference.

In China, the pet clothing market is growing at a strong CAGR of 7.2%, fueled by growing interest in pet styling and increased household pet ownership in major urban centers. Apparel demand has moved beyond winter coats into everyday wear, fashion-forward designs, and costume-style clothing. Pet shops and e-commerce platforms now provide extensive selections, including traditional Chinese motifs and seasonal options. In larger cities, boutique pet salons are offering personalized fittings and designer collections for small dog breeds. Matching outfits for owners and pets are also gaining popularity, especially during festivals and public holidays, creating further demand in this segment.

India is experiencing a pet clothing market CAGR of 6.6%, driven by the rise of nuclear families, urban pet ownership, and greater awareness of animal comfort. Retailers are focusing on breathable, light materials suitable for India’s varied climates. Raincoats and paw protectors are especially common during the monsoon, while sweaters and jackets see increased sales in the north during winter. Social media content featuring pets in festive and occasion-specific outfits is influencing younger pet owners, especially in metro cities. Small businesses are customizing regional outfits for dogs and cats, while veterinary clinics promote protective gear for post-surgical or sensitive pets.

Germany is seeing a 6.1% CAGR in the pet clothing market, centered around performance-driven and cold-weather apparel. Functionality drives most purchases, with jackets, snow booties, and raincoats being top sellers. Many owners use pet apparel for comfort and health rather than aesthetics. Products designed for aging or short-haired breeds are particularly common in colder months. Regional brands are also promoting fleece-lined and water-resistant gear for long walks. Demand has increased from rural households and older pet owners who prioritize warmth and durability. Many German buyers prefer washable and eco-safe fabrics for convenience and environmental safety.

In the United Kingdom, the pet clothing market has posted a CAGR of 5.0%, supported by consumer interest in protective gear and occasion-based clothing. Waterproof jackets, reflective gear, and booties are frequently used during rainy and cold months. Pet retail chains often release themed outfits for national events and holidays, especially for smaller dog breeds. Boutique designers offer coordinated outfits that appeal to fashion-conscious owners. Petwear purchases spike during holiday seasons, with strong uptake in suburban areas. Pet grooming salons and stores are increasingly integrating seasonal collections into their services to enhance foot traffic and sales.

In the United States, the pet clothing market is expanding at a 4.5% CAGR, with emphasis on practicality, comfort, and themed dressing. Owners are shopping for all-season outfits including breathable t-shirts, sweaters, and holiday costumes. Winter gear remains popular in northern states, while coordinated owner-pet outfits are gaining popularity on social media. Retailers have introduced large selections, ranging from character-themed attire to performance gear for outdoor use. Themed pet apparel for holidays like Halloween, Christmas, and Valentine’s Day drives seasonal spikes. Convenience and affordability are key, with many buyers looking for easy-to-clean and ready-to-wear items.

The pet clothing market continues to grow as pet owners increasingly treat their animals as members of the family, fueling demand for apparel that combines comfort, protection, and style. Brands like Ruffwear, Hurtta, and Kurgo are recognized for their focus on functional wear designed for active pets, especially dogs that accompany owners on outdoor adventures. These companies offer items like insulated jackets, raincoats, and cooling vests that are durable and performance-oriented. Fashion-forward pet apparel is also seeing strong interest, with labels such as Fabdog, Mungo & Maud, LAZYBONEZZ, and Ruby Rufus offering seasonal collections that reflect current human fashion trends.

These brands cater to urban pet owners seeking stylish pieces ranging from sweaters and hoodies to costumes and partywear. Pet Life, RC Pet Products, and Ultra Paws provide a broader range, balancing everyday practicality with affordability and variety. Retail chains like Petco and PetSmart play a major role in market accessibility, curating both in-house and external pet apparel lines. Specialty players such as Foggy Mountain Dog Coats, Muttluks, and Pawz are known for weather-specific gear, including waterproof coats and paw protectors, especially in colder regions. This diverse supplier landscape supports a market that ranges from basic utility to high-end pet fashion, serving the full spectrum of pet owners’ preferences.

As officially announced by Authentic Brands Group in January 2025, the company launched the IZOD Pet Collection in collaboration with K9 Wear. The line includes stylish, safety-tested pet apparel and accessories such as raincoats, harnesses, and bandanas, designed by Jeffrey Banks. Products rolled out in Spring 2025 across retail and online platforms. In July 2025, lifestyle brand Life is Good introduced its first pet product line through Chewy, featuring collars, leashes, toys, bowls, and matching human apparel. Inspired by employee pets, the collection reflects the brand’s optimistic ethos and became available exclusively on Chewy.com.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.3 Billion |

| Product Type | Coats & Jackets, Sweaters & Hoodies, Shirts & Tops, Dresses & Skirts, and Others (tops, raincoats, etc.) |

| Pet Type | Dogs, Cats, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ruffwear, Fabdog, Foggy Mountain Dog Coats, Hurtta, Kurgo, LAZYBONEZZ, Mungo & Maud, Muttluks, Pawz, Pet Life, Petco, PetSmart, RC Pet Products, Ruby Rufus, and Ultra Paws |

| Additional Attributes | Dollar sales vary by apparel type and pet species, with dog clothing dominating, while cat attire grows fastest. North America leads revenue, while Asia‑Pacific posts highest growth. Pricing fluctuates with material, customization, and influencer-brand costs. Growth accelerates via sustainable fabrics, smart/seasonal wear, e-commerce, and pet-humanization trend. |

The global pet clothing market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the pet clothing market is projected to reach USD 10.6 billion by 2035.

The pet clothing market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in pet clothing market are coats & jackets, sweaters & hoodies, shirts & tops, dresses & skirts and others (tops, raincoats, etc.).

In terms of pet type, dogs segment to command 61.0% share in the pet clothing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA