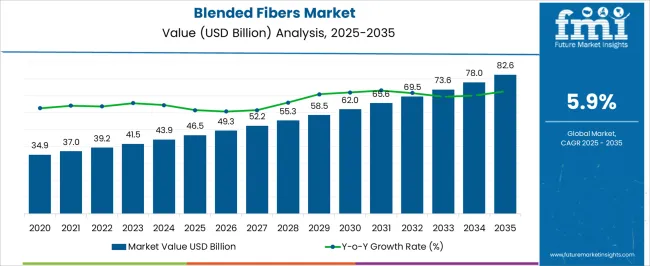

The blended fibers market is estimated to be valued at USD 46.5 billion in 2025 and is projected to reach USD 82.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The global blended fibers market is anticipated to expand from 46.5 USD billion in 2025 to 82.6 USD billion by 2035, registering a CAGR of 5.9%. A breakpoint analysis highlights periods where market growth undergoes distinct acceleration or moderation, reflecting shifts in consumer demand, textile innovation, and regional production dynamics. In the initial phase, from 2025 to 2028, growth progresses steadily, supported by rising demand for performance fabrics, cost-effective fiber blends, and expansion of the apparel and home textile sectors.

The first notable breakpoint occurs around 2029–2030, where accelerated growth is observed due to increased adoption of technical and sustainable fiber blends, expanding e-commerce penetration, and evolving fashion trends favoring mixed-material products. A second breakpoint is seen during 2032–2033, where the growth curve slightly moderates, influenced by price fluctuations in raw materials and temporary capacity constraints in certain production regions. Growth momentum resumes in the later years, driven by innovation in high-performance blends, regional industrialization, and rising demand in emerging economies for durable and functional textile products. The yearly market progression from 46.5 USD billion in 2025 to 82.6 USD billion in 2035 illustrates distinct breakpoints that signify periods of accelerated adoption, temporary moderation, and renewed expansion.

| Metric | Value |

|---|---|

| Blended Fibers Market Estimated Value in (2025 E) | USD 46.5 billion |

| Blended Fibers Market Forecast Value in (2035 F) | USD 82.6 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

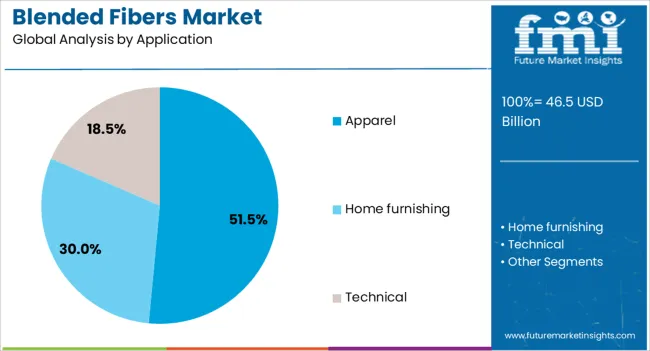

The blended fibers market is strongly influenced by interconnected parent segments, each contributing uniquely to overall demand and growth. The apparel sector holds the largest share at 45%, driven by widespread use of blended fibers such as cotton/polyester and cotton/polyester/cellulose in everyday clothing, offering an optimal balance of comfort, durability, and cost-effectiveness, while meeting consumer preferences for wrinkle resistance, shape retention, and low maintenance. The home furnishing segment contributes 30%, reflecting increased adoption in bed linens, upholstery, curtains, and decorative textiles, where blended fibers provide aesthetic appeal, color retention, durability, and easy cleaning, appealing to both residential and hospitality sectors.

The technical applications segment accounts for 25%, covering specialized uses across automotive, healthcare, aerospace, and industrial manufacturing, where performance attributes such as tensile strength, flame resistance, moisture management, thermal stability, and chemical durability are critical. Collectively, the apparel and home furnishing sectors account for 75% of overall demand, highlighting that consumer-driven applications in clothing and interior textiles remain the primary growth drivers, while technical and industrial applications provide steady, complementary demand globally, supported by ongoing innovations in fiber blends and evolving performance requirements.

The blended fibers market is experiencing strong growth, driven by increasing demand for high-performance and versatile textile materials across apparel and industrial applications. The market expansion is being supported by the growing need for fabrics that combine the natural comfort of cotton with the durability, wrinkle resistance, and easy-care properties of synthetic fibers such as polyester. Rising consumer awareness regarding comfort, style, and longevity of textiles is influencing manufacturers to adopt blended fiber solutions in product lines.

Technological advancements in fiber processing and fabric finishing are enabling the production of lightweight, breathable, and moisture-wicking materials that enhance wearer comfort and performance. Increasing investments in textile manufacturing infrastructure, particularly in emerging economies, are further facilitating the adoption of blended fibers in both mass-market and premium apparel segments.

Sustainability trends, including the development of recycled polyester and eco-friendly cotton blends, are creating new growth opportunities As fashion and lifestyle sectors continue to evolve, the demand for innovative, multi-functional blended fabrics is expected to remain a primary driver for market growth over the coming decade.

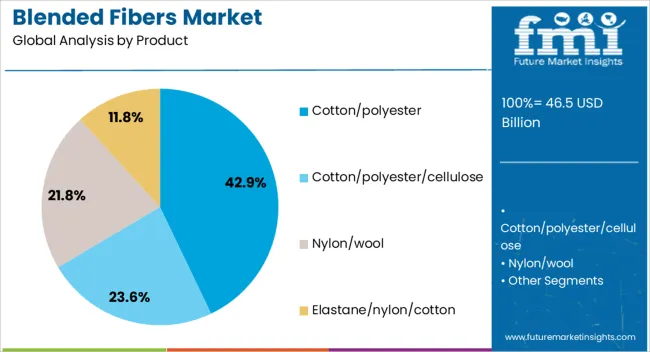

The blended fibers market is segmented by product, application, and geographic regions. By product, blended fibers market is divided into cotton/polyester, cotton/polyester/cellulose, nylon/wool, and elastane/nylon/cotton. In terms of application, blended fibers market is classified into apparel, home furnishing, and technical. Regionally, the blended fibers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cotton/polyester segment is projected to hold 42.9% of the blended fibers market revenue share in 2025, making it the leading product type. This dominance is being driven by the complementary properties of the fibers, where cotton provides softness, breathability, and natural comfort, while polyester adds strength, durability, and shape retention. The combination of these characteristics results in fabrics that are suitable for a wide range of apparel applications, including casual wear, sportswear, and uniforms, where performance and longevity are critical.

This segment is also benefiting from cost-effectiveness, as blending allows manufacturers to produce high-quality fabrics at competitive prices. Technological advancements in spinning, weaving, and finishing processes are enabling uniform blends that meet specific performance and aesthetic requirements.

Furthermore, the ability of cotton/polyester blends to reduce shrinkage, maintain colorfastness, and provide easy-care benefits has strengthened adoption across global apparel markets The segment’s versatility, consistent quality, and economic advantage are reinforcing its leadership position in the blended fibers market.

The apparel application segment is expected to capture 51.5% of the blended fibers market revenue share in 2025, establishing itself as the leading end-use area. Growth in this segment is being driven by the increasing demand for comfortable, durable, and stylish clothing that meets diverse consumer needs. Cotton/polyester blends are widely utilized for their ability to combine comfort with resilience, supporting apparel categories that range from casual clothing to activewear.

Rising global disposable incomes and fashion-conscious consumer behavior are further accelerating the adoption of blended fabrics. Additionally, manufacturers are leveraging blended fibers to develop innovative textiles with improved moisture management, wrinkle resistance, and longevity, enhancing product appeal in competitive markets.

The segment is also benefiting from trends in fast fashion and mass customization, where rapid production of high-quality fabrics with consistent performance is required As a result, apparel applications are expected to remain the primary revenue contributor within the blended fibers market, supported by ongoing technological innovations and evolving consumer preferences.

The blended fibers market is growing due to rising demand for versatile, durable, and aesthetically appealing fabrics across apparel, home textiles, and technical applications. Regulatory standards and compliance requirements ensure safe, high-quality products, boosting consumer confidence and trade opportunities. Technological innovations in fiber mixing, fabric processing, and functional finishes enhance performance, durability, and comfort, enabling differentiation and targeted applications. Strong demand from fashion, sportswear, workwear, and technical textile sectors, combined with e-commerce growth and global distribution improvements, drives market expansion.

The blended fibers market is experiencing steady growth due to rising demand for fabrics that combine the strengths of multiple fibers. Blends of natural and synthetic fibers, such as cotton-polyester, wool-nylon, and rayon-spandex, offer enhanced durability, elasticity, comfort, and aesthetic appeal. These fabrics are widely used in apparel, home textiles, industrial fabrics, and technical textiles. The need for low-maintenance, wrinkle-resistant, and long-lasting fabrics is driving adoption. Fashion trends, performance wear, and functional textiles contribute to growth. Manufacturers and brands prefer blended fibers to achieve cost efficiency while maintaining high quality, appealing to both premium and mass-market segments.

The blended fibers market is influenced by regulations on product safety, labeling, and environmental compliance. Authorities enforce standards regarding chemical treatments, dyeing processes, flammability, and allergen control. Compliance ensures safe, durable, and consumer-friendly fabrics. Certifications such as OEKO-TEX and ISO standards enhance product credibility. Regulatory pressure encourages manufacturers to optimize fiber blends, reduce harmful chemicals, and adopt quality testing procedures. Meeting international trade requirements is crucial for export-oriented manufacturers, driving investment in sustainable sourcing, traceable supply chains, and production transparency. Adhering to these standards enhances market acceptance, especially in developed and highly regulated regions.

Technological advancements in fiber blending and fabric processing are shaping market dynamics. Modern machinery and software allow precise fiber mixing, consistent quality, and optimized texture. Functional finishes such as moisture-wicking, antimicrobial, UV protection, and anti-odor properties are increasingly incorporated in blended fabrics. Innovations in spinning, weaving, and knitting techniques enable customization for specific end-use applications such as sportswear, workwear, and luxury apparel. Research into new fiber combinations, lightweight composites, and eco-friendly alternatives is driving product differentiation. These technological developments improve performance, durability, and comfort, meeting evolving consumer expectations and competitive demands in the textile sector.

The blended fibers market is propelled by strong demand from apparel, industrial, and technical textile sectors. Fashion brands, sportswear manufacturers, and workwear producers increasingly prefer blends for functionality, comfort, and design flexibility. Technical textiles for automotive, construction, medical, and protective applications benefit from enhanced mechanical strength, thermal resistance, and durability offered by blended fibers. Urbanization, rising disposable incomes, and lifestyle changes are increasing demand for versatile and fashionable fabrics. Retail expansion, e-commerce, and global supply chain improvements further support market penetration. Manufacturers are focusing on high-quality, multi-functional, and aesthetically appealing fabrics to capture growing end-user interest.

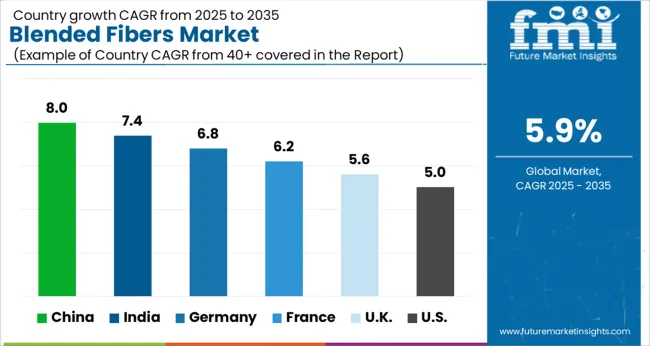

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| U.K. | 5.6% |

| U.S. | 5.0% |

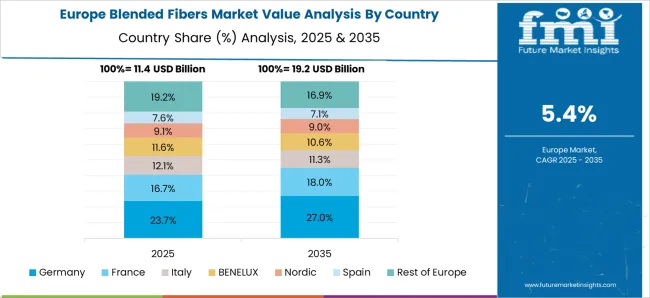

The global blended fibers market is projected to grow at a CAGR of 5.9% from 2025 to 2035. China leads expansion at 8.0%, followed by India at 7.4%, Germany at 6.8%, the U.K. at 5.6%, and the U.S. at 5.0%. Growth is driven by increasing demand for high-performance textiles, apparel, and industrial fabrics, along with rising consumer preference for mixed-material durability and comfort. China and India dominate production and adoption due to large-scale textile manufacturing and expanding domestic consumption, while Germany, the U.K., and the U.S. focus on premium blends, innovative fabric applications, and specialized end-use markets to cater to evolving textile requirements. The analysis includes over 40 countries, with the leading markets detailed below.

The blended fibers market in China is projected to grow at a CAGR of 8.0% from 2025 to 2035, driven by increasing demand from textile, apparel, and technical textile applications. Rapid industrialization, rising disposable income, and growing fashion consciousness are boosting consumer demand for high-performance, durable, and comfortable blended fabrics. Manufacturers are innovating with synthetic-natural fiber combinations, moisture-wicking properties, and wrinkle-resistant finishes to meet diverse consumer needs. The expansion of e-commerce and organized retail channels is facilitating wider product availability. Collaborations between domestic and international fiber producers are supporting R&D for eco-friendly, high-quality blends. Demand from automotive, healthcare, and home textile sectors further contributes to market growth, while investments in fiber processing and finishing technology enhance product differentiation and scalability.

The blended fibers market in India is expected to grow at a CAGR of 7.4% from 2025 to 2035, supported by rapid growth in the textile and apparel sectors, increasing disposable incomes, and evolving consumer preferences. Adoption of blended fabrics with cotton-polyester, wool-synthetic, and other combinations is rising due to their durability, ease of care, and versatility. Manufacturers are investing in advanced spinning, weaving, and finishing technologies to produce high-quality fabrics tailored to fashion, sportswear, and home textile applications. Growth in e-commerce, organized retail, and export-oriented textile units is increasing market penetration. Partnerships with international fiber suppliers enable access to high-performance fibers, eco-friendly blends, and innovative finishing techniques, fueling competitiveness and market expansion.

Germany’s blended fibers market is projected to grow at a CAGR of 6.8% from 2025 to 2035, driven by strong demand from technical textiles, automotive, sportswear, and industrial applications. Consumers and industries increasingly prefer blends combining natural and synthetic fibers for enhanced strength, durability, moisture management, and thermal regulation. Manufacturers are focusing on high-performance blends and functional fabrics, including flame-retardant, antimicrobial, and eco-conscious fibers. Collaborations with European fiber suppliers support innovation, sustainable production, and compliance with stringent environmental regulations. Industrial and fashion sectors continue to drive adoption, with advanced weaving, knitting, and finishing technologies ensuring superior product quality and efficiency. The market is further reinforced by increasing investments in research and development of specialty blended fibers.

The UK blended fibers market is expected to grow at a CAGR of 5.6% from 2025 to 2035, influenced by rising demand in apparel, home textiles, and technical applications. Consumers and industries are increasingly seeking fabrics that combine performance, comfort, and sustainability. Adoption of cotton-synthetic, wool-synthetic, and specialty performance blends is accelerating, driven by fashion trends and functional textile requirements. Manufacturers are leveraging advanced fiber processing, spinning, and finishing technologies to produce high-quality fabrics with enhanced durability and aesthetic appeal. Partnerships with European and global fiber suppliers support innovation in eco-friendly and performance-oriented blends. Growth in e-commerce, organized retail, and niche textile applications such as protective clothing further bolsters market expansion.

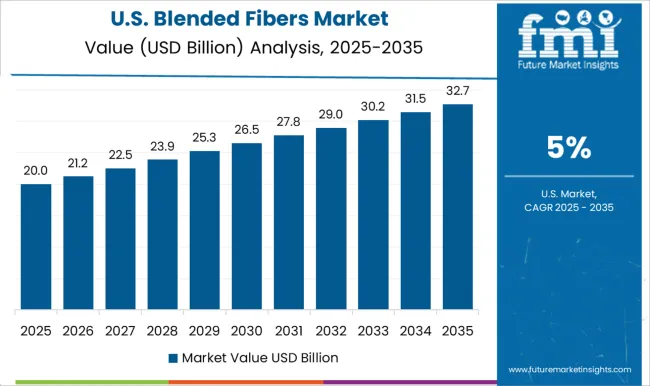

The U.S. blended fibers market is projected to grow at a CAGR of 5.0% from 2025 to 2035, driven by demand from apparel, industrial textiles, automotive interiors, and home furnishings. Consumers increasingly prefer fabrics combining natural and synthetic fibers for comfort, durability, moisture management, and easy maintenance. Manufacturers are investing in innovative fiber blends, functional finishes, and high-performance textiles for sportswear, protective clothing, and industrial applications. Collaborations with global fiber producers and technology providers facilitate access to advanced materials, sustainable fibers, and high-efficiency manufacturing processes. Growth is further supported by e-commerce penetration, retail expansion, and government emphasis on sustainable textiles. The market reflects a shift toward eco-conscious, durable, and high-quality blended fabrics to meet diverse consumer and industrial needs.

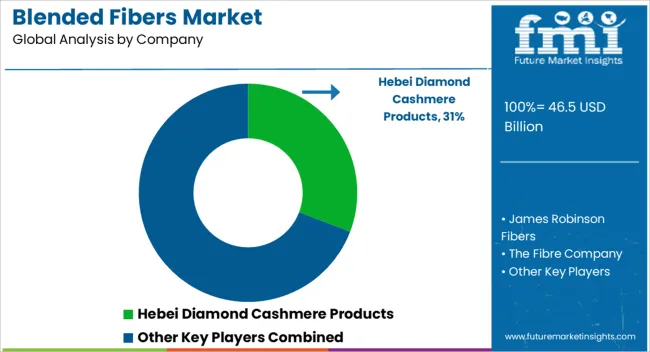

Competition in the blended fibers market is shaped by fiber quality, blend consistency, and application versatility. Hebei Diamond Cashmere Products leads with premium cashmere blends, focusing on softness, durability, and luxury apparel applications. James Robinson Fibers competes with high-quality wool and synthetic fiber blends for fashion, upholstery, and industrial textiles, emphasizing consistent fiber properties and enhanced wear resistance. The Fibre Company differentiates through ethically sourced wool-cotton and wool-silk blends, targeting high-end clothing and home textiles, with a focus on traceability and sustainable practices.

The Natural Fibre Company offers a diverse range of natural-synthetic fiber blends, providing functional properties such as moisture-wicking, thermal insulation, and elasticity for sportswear, casual wear, and technical textiles. Mid-sized and regional players provide customized fiber blends for niche applications, including eco-friendly textiles, performance fabrics, and specialty industrial uses. Strategies emphasize optimized fiber ratios, quality control, and flexibility in blending techniques to meet client-specific requirements. Research and development focuses on enhancing durability, texture, color retention, and functional properties, enabling differentiation in fashion, home, and industrial textile segments.

Collaborations with apparel brands, designers, and textile converters support rapid adoption and market penetration. Product brochure content is detailed and informative. Fiber blends are offered in carded, combed, or spun formats, with specifications on fiber composition, staple length, tensile strength, and elasticity. Guidance on applications in garments, upholstery, and technical textiles is provided. Packaging formats, storage recommendations, and quality assurance protocols are described. Testing for shrinkage, pilling, dye uptake, and abrasion resistance is highlighted, reflecting a market focused on blend performance, versatility, and textile industry compatibility.

| Items | Values |

|---|---|

| Quantitative Units | USD 46.5 bllion |

| Product | Cotton/polyester, Cotton/polyester/cellulose, Nylon/wool, and Elastane/nylon/cotton |

| Application | Apparel, Home furnishing, and Technical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hebei Diamond Cashmere Products, James Robinson Fibers, The Fibre Company, and The Natural Fibre Company |

| Additional Attributes | Dollar sales by fiber type and blend ratio, share by end-use segment (apparel, home textiles, industrial), growth trends, consumer preferences, sustainability regulations, emerging fiber technologies, and competitive positioning. |

The global blended fibers market is estimated to be valued at USD 46.5 billion in 2025.

The market size for the blended fibers market is projected to reach USD 82.6 billion by 2035.

The blended fibers market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in blended fibers market are cotton/polyester, cotton/polyester/cellulose, nylon/wool and elastane/nylon/cotton.

In terms of application, apparel segment to command 51.5% share in the blended fibers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blended Cement Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Blended Meat Industry

Dry Blended Products Industry By Application, Type, Nature, Form & Region

Nano Fibers Market Size and Share Forecast Outlook 2025 to 2035

Citrus Fiber Market Trends - Functional Applications & Growth 2025 to 2035

Clothing Fibers Market Size and Share Forecast Outlook 2025 to 2035

Polyimide Fibers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spider Silk Fibers Market Size and Share Forecast Outlook 2025 to 2035

Food Dietary Fibers Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fibers for Defense Market Report – Demand, Trends & Industry Forecast 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Thermal Insulation Materials for Optical Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA