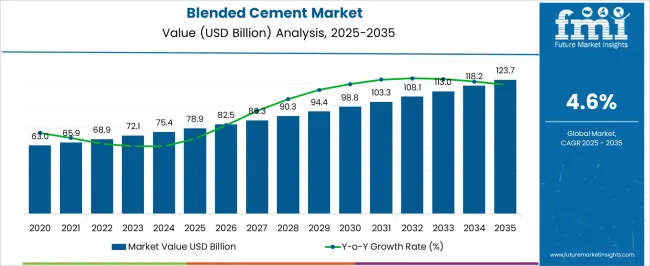

The blended cement market is projected to increase from USD 78.9 billion in 2025 to USD 123.7 billion by 2035, at a CAGR of 4.6%. When the historical and forecast values are examined, the pattern suggests a largely consistent upward progression without sharp fluctuations, which makes seasonality or cyclicality detection relevant. From 2020 to 2025, values rose steadily from USD 63.0 billion to USD 78.9 billion, showing linear progression rather than recurring dips or spikes.

The forecast from 2025 through 2035 demonstrates incremental gains year after year, moving through USD 82.5 billion in 2026, USD 90.3 billion in 2028, USD 98.8 billion in 2030, and surpassing USD 118.2 billion in 2034 before reaching USD 123.7 billion in 2035. The absence of sharp declines, irregular growth bursts, or alternating contraction phases indicates that the blended cement sector is not heavily influenced by seasonality in terms of annual demand. Instead, long-term infrastructure development, urban housing, and industrial projects shape demand in a sustained manner.

| Metric | Value |

|---|---|

| Blended Cement Market Estimated Value in (2025 E) | USD 78.9 billion |

| Blended Cement Market Forecast Value in (2035 F) | USD 123.7 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The blended cement market plays a crucial role across several parent domains, with its share reflecting rising adoption in large-scale construction and infrastructure projects. Within the construction materials market, blended cement accounts for nearly 12 to 14%, positioned alongside aggregates, ready-mix concrete, and other specialty binders. In the cement and concrete market, its share is estimated at 18 to 20%, as it competes directly with ordinary Portland cement but gains traction due to enhanced durability and reduced heat of hydration. The infrastructure development materials market demonstrates stronger reliance, where blended cement contributes around 15 to 16%, particularly in roads, bridges, and dams requiring longevity and crack resistance. Within the residential and commercial building materials market, blended cement holds about 10 to 11%, adopted in housing and commercial complexes for foundations, walls, and flooring where performance balance and cost efficiency are sought.

The industrial construction materials market sees blended cement representing nearly 8 to 9%, used in heavy-duty structures such as factories, power plants, and warehouses where chemical and mechanical resistance are important. These shares illustrate how blended cement, though not replacing ordinary Portland cement entirely, has carved a significant position due to its technical performance across structural, civil, and industrial applications.

The Blended Cement market is experiencing strong expansion, supported by increasing demand for sustainable construction materials and stringent environmental regulations on carbon emissions. The adoption of blended cement has been accelerated by its ability to reduce the clinker factor, thereby lowering greenhouse gas emissions without compromising performance. Urbanization and infrastructure development in emerging economies are driving the consumption of blended cement across both residential and commercial projects.

Advances in production processes and the availability of supplementary cementitious materials have improved product consistency and durability, making blended cement a preferred choice for modern construction. Growing awareness among developers and contractors about lifecycle cost benefits, coupled with government initiatives promoting green building materials, is reinforcing market growth.

Additionally, the integration of blended cement into large-scale infrastructure projects is providing long-term opportunities for manufacturers As the industry shifts toward sustainable practices, blended cement is expected to maintain its upward trajectory, driven by technological innovation, policy support, and market acceptance.

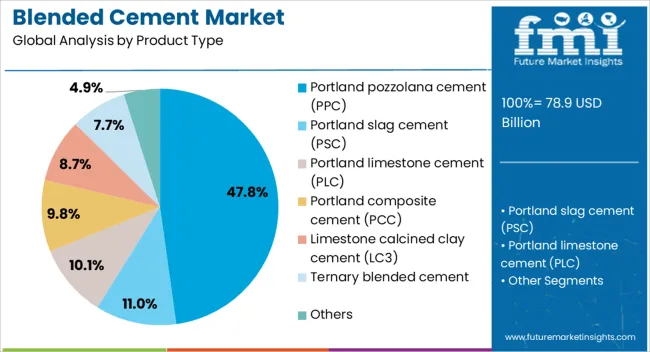

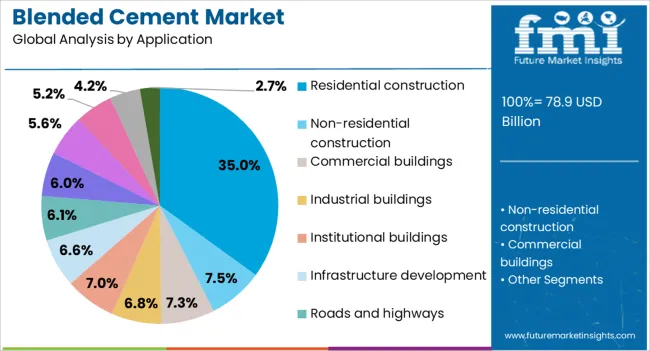

The blended cement market is segmented by product type, application, supplementary cementitious materials (scms), and geographic regions. By product type, blended cement market is divided into Portland pozzolana cement (PPC), Portland slag cement (PSC), Portland limestone cement (PLC), Portland composite cement (PCC), Limestone calcined clay cement (LC3), Ternary blended cement, and Others. In terms of application, blended cement market is classified into Residential construction, Non-residential construction, Commercial buildings, Industrial buildings, Institutional buildings, Infrastructure development, Roads and highways, Bridges and dams, Airports and ports, Other infrastructure, Precast and cast-in-place concrete, and Others. Based on supplementary cementitious materials (scms), blended cement market is segmented into Fly ash, Ground granulated blast furnace slag (GGBFS), Silica fume, Limestone, Calcined clay, and Others. Regionally, the blended cement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Portland pozzolana cement segment is projected to hold 47.80% of the Blended Cement market revenue share in 2025, making it the leading product type. Its growth has been supported by its superior long-term strength, enhanced durability, and cost-effectiveness compared to traditional cement types. The pozzolanic reaction contributes to improved resistance against chemical attacks, making it highly suitable for a wide range of construction environments.

Adoption has been further encouraged by its reduced heat of hydration, which minimizes cracking in large concrete structures. The use of fly ash or natural pozzolana in its production not only improves workability but also significantly reduces the carbon footprint, aligning with global sustainability targets.

Widespread availability and ease of blending with local materials have enhanced its accessibility, particularly in fast-growing construction markets With increasing emphasis on sustainable building practices, Portland pozzolana cement has continued to gain preference among developers, reinforcing its leading market position.

The residential construction segment is expected to account for 35.00% of the Blended Cement market revenue share in 2025, making it the dominant application area. This growth is being driven by rising housing demand in both urban and semi-urban areas, fueled by population growth and government-led affordable housing initiatives.

Blended cement’s superior workability, cost efficiency, and durability make it particularly suitable for residential projects, where consistent quality and long-term performance are critical. Its enhanced resistance to environmental factors such as sulfate attack and moisture ingress ensures structural integrity over time, which appeals to both builders and homeowners.

Adoption in residential projects has also been influenced by its availability in local markets and competitive pricing compared to other cement types As the demand for sustainable and cost-effective building solutions increases, the use of blended cement in housing projects is expected to remain strong, supporting its continued leadership in this segment.

.webp)

The fly ash segment is anticipated to command 37.20% of the Blended Cement market revenue share in 2025, emerging as the leading supplementary cementitious material. Its dominance has been driven by its ability to enhance concrete performance while reducing the reliance on energy-intensive clinker. Fly ash contributes to improved workability, reduced permeability, and increased long-term strength of concrete.

Its pozzolanic properties also improve durability, making it suitable for structures exposed to aggressive environmental conditions. The widespread availability of fly ash as a by-product from thermal power plants has ensured a stable supply, enabling cost-effective production of blended cement.

Moreover, its use supports environmental sustainability by diverting industrial waste from landfills and reducing carbon emissions As construction stakeholders increasingly prioritize eco-friendly materials, fly ash is expected to maintain its leadership within the supplementary cementitious materials category, further reinforcing the overall market shift toward greener building solutions.

Blended cement adoption is supported by performance needs in durability, heat control, and workability across infrastructure, commercial construction, and precast. Constraints arise from variable supply of additions, slower early strength in cool weather, plant changeover complexity, and extended qualification cycles. Opportunity is strong in ternary systems, limestone calcined clay routes, marine and transport projects, precast optimization, and bagged specialty lines. Standards are broadening blend choices while digitalized plants and rigorous documentation improve consistency. Providers that pair regional grinding, verified test data, admixture compatibility, and training support are positioned to capture specifications and repeat orders.

Supplementary constituents such as slag, fly ash, limestone, natural pozzolans, and calcined clays are combined to tune heat of hydration, permeability, and finishability. Mix designers value improved pumpability and extended workability windows that aid placement in warm climates and congested reinforcement. Mass concrete pours benefit from lower thermal gradients, reducing cracking risk. Marine and deicing exposures are addressed through blends that resist chloride ingress and sulfate attack. Performance based specifications are being favored, allowing producers to meet strength and durability targets without prescriptive cement types. Readymix networks are expanding blend portfolios and adjusting particle size distribution to stabilize early strength while protecting later age gains. Public works and private developers are recognizing lifecycle advantages from fewer repairs and tighter in service performance, reinforcing the role of blended binders.

Class specifications for fly ash and slag can be met inconsistently as power generation and steel routes shift, leading to reactivity swings that complicate strength prediction. Import reliance introduces logistics risk and longer lead times for terminals near ports. Early strength development may slow in cool weather, requiring disciplined curing and accelerator strategies that are not always executed on crowded sites. Grinding capacity for finer limestone or calcined clay grades can be limited, creating bottlenecks during peak construction seasons. Silo management and plant changeovers add operational complexity, while contractor familiarity with revised water demand and admixture dosage remains mixed. Qualification cycles for chloride diffusion, sulfate resistance, and alkali silica reaction mitigation extend schedules for major projects. Documentation demands across codes and owner standards increase testing cost, keeping some precasters and small contractors cautious about rapid substitution.

Limestone calcined clay concepts, slag limestone combinations, and pozzolan slag blends are being positioned for bridges, ports, mass foundations, and high exposure pavements. Precast yards can capture cycle time gains by pairing blends with tailored admixture packages and steam regimes, improving surfaces and reducing bugholes. Repair and rehabilitation markets favor sulfate resistant and low heat binders for overlays, grouts, and shotcrete in transport corridors. Bagged products for masonry, screeds, tile beds, and architectural work create retail shelf presence with consistent color control. Data heavy submittals that include heat rise profiles, diffusion metrics, and shrinkage behavior help secure approvals under performance specifications. Partnerships between cement producers, admixture firms, and testing labs enable turnkey mix qualifications. Regional grinding hubs near slag or clay deposits offer scope for localized formulations and faster delivery.

Industry direction points to broader cement classes in leading standards that formalize higher proportions of mineral additions and recognize new blend families. Owners and specifiers are shifting from recipe rules toward measured outcomes for strength development, permeability, and durability indices, which favors competent blending plants. Producers are investing in separate grinding and dosing lines, online analyzers for raw meal and finished cement, and statistical control to stabilize variability across lots. Terminals with dome storage and dedicated silos are being used to segregate additions and support multiple blend recipes. Admixture compatibility programs are expanding, with accelerators, shrinkage reducers, and high range water reducers tuned for specific blends and temperature regimes. Training modules for site crews cover curing discipline, finishing timing, and jointing practices for blended concretes. Long term supply agreements and documented change control are being prioritized by large contractors seeking predictable results on multi year build programs.

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

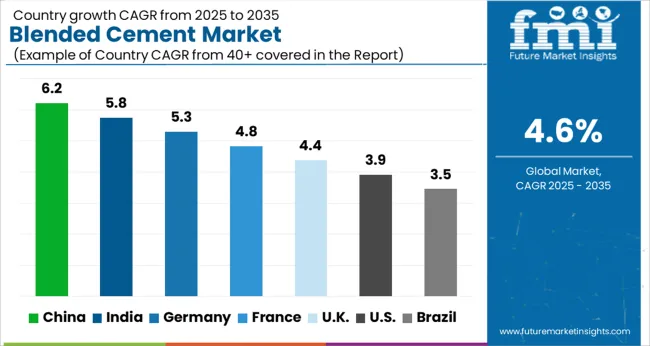

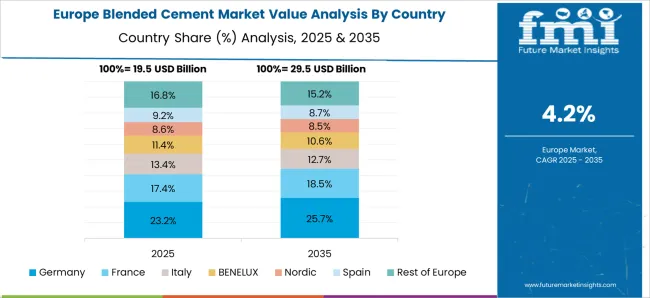

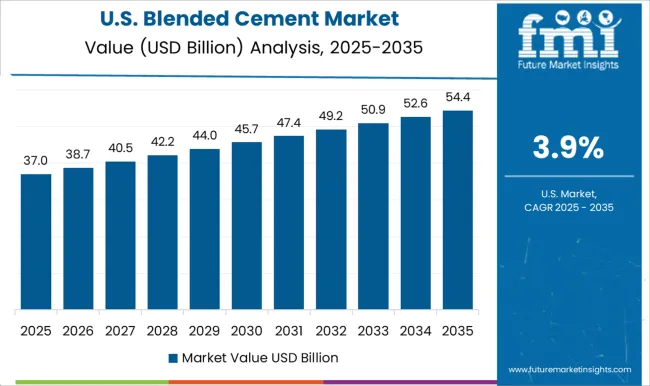

The blended cement market is expected to expand globally at a CAGR of 4.6% from 2025 to 2035. China leads growth with 6.2%, followed by India at 5.8% and Germany at 5.3%, while the UK grows at 4.4% and the USA posts 3.9%. China and India register growth premiums of +1.6% and +1.2% above the global baseline, supported by housing, infrastructure, and cost-efficient construction adoption. Germany benefits from high-quality production standards and European demand, while the UK relies on imports and public sector projects for steady adoption. The USA, though slower in growth, retains high-value demand due to infrastructure upgrades and widespread adoption in commercial and residential segments. The analysis includes over 40+ countries, with the leading markets detailed below.

The blended cement market in China is projected to grow at a CAGR of 6.2% from 2025 to 2035, making it the fastest-expanding region globally. Large-scale construction projects in residential, commercial, and infrastructure segments continue to be major contributors. Government policies emphasizing energy efficiency and reduced clinker usage have encouraged stronger adoption of blended varieties such as fly ash cement, slag cement, and silica fume blends. Domestic cement manufacturers are increasing production capacities to meet demand, while global players are partnering with Chinese firms to strengthen supply chains. Rising investments in rail, highways, and industrial facilities are further supporting growth. Consumer preference for durable, long-lasting, and cost-efficient cement types is creating momentum across both rural and urban projects.

The blended cement market in India is forecast to expand at a CAGR of 5.8% between 2025 and 2035. Growth is supported by rapid expansion in housing, commercial construction, and infrastructure projects. Cement manufacturers are focusing on fly ash-based and slag-based blends due to abundant local availability of raw materials. Major Indian producers are also increasing capacity for blended varieties to capture rising demand from government-backed infrastructure schemes and urban housing programs. Blended cement is gaining recognition for its durability, strength, and ability to reduce overall construction costs. With rising awareness of efficient construction materials, blended cement is gradually replacing traditional Portland cement in large projects.

The blended cement market in Germany is expected to grow at a CAGR of 5.3% from 2025 to 2035. Germany’s construction industry emphasizes high-quality and environmentally compliant building materials, encouraging wider use of blended cement varieties. Demand is driven by infrastructure modernization projects, residential renovations, and commercial building activity. German manufacturers focus on advanced production processes to ensure consistency, durability, and compliance with EU standards. Growing reliance on slag cement and fly ash blends reflects the industry’s move toward reducing clinker usage and improving long-term performance of construction materials. The market also benefits from research partnerships between cement producers and universities that develop innovative blends with enhanced mechanical properties.

The blended cement market in the UK is projected to record a CAGR of 4.4% between 2025 and 2035. Demand is being shaped by steady housing development, renovation projects, and commercial construction activity. Imports play a crucial role, though domestic manufacturers continue to expand offerings to meet local requirements. Blended cement adoption is particularly evident in large-scale infrastructure projects such as transport, schools, and hospitals, where durability and cost efficiency are prioritized. The preference for slag cement and other blended types is increasing as contractors seek materials that perform well under varying weather conditions. With a mature construction industry, growth remains moderate compared to Asia, but steady adoption across both private and public projects ensures a consistent outlook.

The blended cement market in the United States is forecast to grow at a CAGR of 3.9% from 2025 to 2035, marking slower but significant expansion. Adoption is supported by infrastructure upgrades, housing construction, and commercial developments. Blended cement is increasingly recognized for its strength, durability, and resistance to environmental conditions, making it suitable for highways, bridges, and high-rise projects. Domestic producers are focusing on slag and fly ash blends to meet performance requirements, though imports continue to supplement supply. Renovation of aging infrastructure, coupled with growing demand for cost-effective construction solutions, is sustaining steady adoption. While growth rates are slower than in Asia, the USA market remains valuable due to large-scale projects and consistent demand across both private and public sectors.

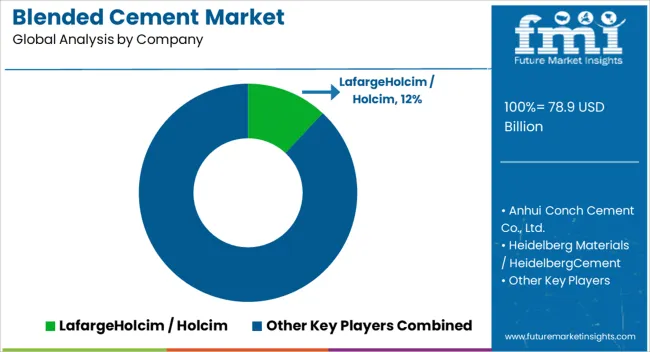

Competition in the blended cement sector has been influenced by clinker substitution expertise, additive integration, and supply chain scale across infrastructure, residential, and industrial construction segments. LafargeHolcim / Holcim has established leadership through diversified blended formulations, combining fly ash, slag, and limestone with clinker to optimize performance, reduce carbon intensity, and ensure consistent setting characteristics for large-scale projects. Anhui Conch Cement Co., Ltd. has focused on regional dominance in China with high-volume production, leveraging vertical integration, cost-efficient operations, and tailored cement blends suitable for high-rise, transport, and industrial constructions. Heidelberg Materials / HeidelbergCement has emphasized technical innovation, developing cements with tailored fineness and admixtures to meet specific structural and durability requirements in European and global markets. Cemex S.A.B. de C.V. has reinforced its position through a broad portfolio of blended cements designed for resilience in diverse climates, offering rapid strength development and workability enhancements. UltraTech Cement Limited has leveraged its large production footprint in India, optimizing kiln operations and additive sourcing to deliver cost-effective, high-performance blended cements for residential and infrastructure projects. Ambuja / ACC and other regional players have maintained competitiveness through local distribution networks, customized blends for specific project requirements, and partnerships with construction conglomerates. Differentiation has been achieved through innovations in clinker replacement materials, controlled particle size distribution, admixture compatibility, hydration optimization, and adherence to ISO 9001 and IS 1489 standards. Companies have also emphasized supply reliability, technical support for contractors, and integration with ready-mix operations to strengthen client retention and regional presence. Product customization, quality consistency, and efficient logistics have collectively shaped competitive positioning in emerging and mature markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 78.9 Billion |

| Product Type | Portland pozzolana cement (PPC), Portland slag cement (PSC), Portland limestone cement (PLC), Portland composite cement (PCC), Limestone calcined clay cement (LC3), Ternary blended cement, and Others |

| Application | Residential construction, Non-residential construction, Commercial buildings, Industrial buildings, Institutional buildings, Infrastructure development, Roads and highways, Bridges and dams, Airports and ports, Other infrastructure, Precast and cast-in-place concrete, and Others |

| Supplementary Cementitious Materials (SCMs) | Fly ash, Ground granulated blast furnace slag (GGBFS), Silica fume, Limestone, Calcined clay, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LafargeHolcim / Holcim, Anhui Conch Cement Co., Ltd., Heidelberg Materials / HeidelbergCement, Cemex S.A.B. de C.V., UltraTech Cement Limited, and Ambuja / ACC / Other major regional players |

| Additional Attributes | Dollar sales by cement type (slag, fly ash, limestone), grade (OPC, PPC, PSC), and end use (residential, commercial, infrastructure, industrial). Demand dynamics are driven by urban and highway construction projects, government infrastructure spending, and high-rise development. Regional trends show strong traction in Asia Pacific with large-scale infrastructure programs, steady demand in Europe supported by renovation and transport projects, and growing adoption in Africa and Latin America for industrial and urban construction initiatives. |

The global blended cement market is estimated to be valued at USD 78.9 billion in 2025.

The market size for the blended cement market is projected to reach USD 123.7 billion by 2035.

The blended cement market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in blended cement market are portland pozzolana cement (ppc), portland slag cement (psc), portland limestone cement (plc), portland composite cement (pcc), limestone calcined clay cement (lc3), ternary blended cement and others.

In terms of application, residential construction segment to command 35.0% share in the blended cement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blended Fibers Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Blended Meat Industry

Dry Blended Products Industry By Application, Type, Nature, Form & Region

Cement Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cement Consistometer Market Size and Share Forecast Outlook 2025 to 2035

Cement Paints Market Size and Share Forecast Outlook 2025 to 2035

Cement Sacks Market Growth – Demand & Forecast 2025 to 2035

Cement Kiln Co-Processing Fuels Market Growth – Trends & Forecast 2024-2034

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Cement Boards Market

Cement and Mortar Testing Equipment Market Growth – Trends & Forecast 2018-2027

Biocement Market Size and Share Forecast Outlook 2025 to 2035

GCC Cement Market Growth – Trends & Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Bone Cement Delivery System Market Trends – Growth & Forecast 2024-2034

Bone Cement Mixers Market

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Fiber Cement Market Analysis by Raw Materials, End User, Application, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA